Is Citibank Korea safe?

Pros

Cons

Is Citibank A Scam?

Introduction

Citibank, a prominent player in the global financial landscape, has established itself as a significant entity in the forex market. With a legacy dating back to 1812, it offers a wide range of financial services, including forex trading, investment banking, and personal banking. However, as the forex market is rife with potential risks and scams, traders must exercise caution when choosing a broker. The importance of evaluating the credibility and safety of a broker cannot be understated, as it directly impacts the security of traders' investments. In this article, we will conduct a thorough investigation into Citibank's legitimacy, focusing on its regulatory status, company background, trading conditions, customer safety measures, and user experiences. Our assessment will be guided by data collected from various reputable sources, ensuring an objective analysis of whether Citibank is safe or a potential scam.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining the safety of any trading platform. Regulatory bodies impose strict standards that brokers must adhere to, ensuring a level of protection for traders. Citibank claims to be regulated, but the specifics surrounding its regulatory status require careful examination.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CFTC | N/A | United States | Verified |

| FCA | N/A | United Kingdom | Not Verified |

| ASIC | N/A | Australia | Not Verified |

While Citibank has a long history in the financial sector, its regulatory status appears inconsistent across different regions. The lack of a clear license number and verification status from major regulatory bodies raises concerns about its legitimacy. Additionally, the quality of regulation is paramount; brokers under the oversight of top-tier regulators, such as the SEC or FCA, offer more robust protections compared to those regulated by lesser-known entities. Citibank's historical compliance is also a point of concern, as any past infractions could indicate potential risks for traders.

Company Background Investigation

Citibank's history is extensive, with over two centuries of operation. Originally founded as the City Bank of New York, it has evolved into a global financial institution with operations in numerous countries. The ownership structure is straightforward, with Citibank being a subsidiary of Citigroup Inc., a publicly traded company.

The management team at Citibank is composed of experienced professionals with backgrounds in finance and banking. However, transparency regarding the company's operations and decision-making processes is crucial. Citibank has made strides in providing information to its clients, yet the availability of comprehensive details about its management and operational strategies remains limited. This lack of transparency could be a red flag for potential traders evaluating whether Citibank is safe for their investments.

Trading Conditions Analysis

When assessing a broker, understanding its fee structure and trading conditions is essential. Citibank offers a variety of trading options, but the overall cost structure can significantly impact profitability.

| Fee Type | Citibank | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Structure | Commission-free | Varies |

| Overnight Interest Range | 0.5% - 1% | 0.3% - 0.8% |

Citibank's commission-free trading model is appealing, but the spreads on major currency pairs tend to be higher than the industry average, which could affect trading profitability. Furthermore, the overnight interest rates can vary, and traders should be aware of how these fees can accumulate over time. The lack of transparency regarding additional fees could lead to unexpected costs, which is a critical consideration for those wondering if Citibank is safe for trading.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. Citibank claims to implement several measures to protect customer deposits, including segregated accounts and investor protection schemes. However, the effectiveness of these measures warrants scrutiny.

Citibank maintains that customer funds are held in segregated accounts, ensuring that they are not used for operational purposes. Additionally, the bank is a member of the FDIC, which provides insurance for deposits up to $250,000 per account holder. However, historical issues regarding fund security have been reported, including delays in withdrawals and difficulties in accessing funds. These incidents raise questions about the reliability of Citibank's safety measures and whether traders can trust that their investments are secure. Prospective users should carefully consider these factors when determining if Citibank is safe for their trading activities.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Analyzing user reviews and common complaints can provide insights into the overall customer experience with Citibank.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Suspension | Medium | Inconsistent |

| Customer Service Issues | High | Limited support |

Common complaints about Citibank include withdrawal delays and account suspensions, which can significantly impact traders' experiences. The company's response to these issues has been criticized for being slow and inconsistent, leading to frustration among users. For example, some traders have reported being unable to access their funds for extended periods, raising concerns about the bank's operational efficiency. These issues are critical for anyone evaluating whether Citibank is safe to trade with, as they reflect the company's ability to provide reliable and timely service.

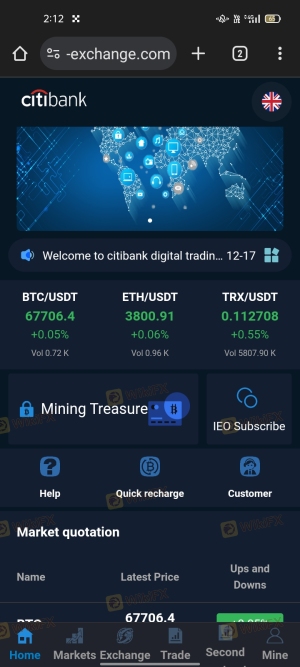

Platform and Trade Execution

The performance and reliability of a trading platform play a vital role in a trader's success. Citibank offers a digital platform for trading, but its performance and user experience need examination.

The Citibank trading platform is user-friendly, but some users have reported issues related to stability and execution quality. Instances of slippage, where the execution price differs from the intended price, have been noted, which can adversely affect trading outcomes. Additionally, traders have expressed concerns over the rejection of orders during high volatility periods, raising questions about the platform's robustness. These factors are crucial for determining if Citibank is safe as a trading option, particularly for those who rely on timely execution for their trading strategies.

Risk Assessment

Every trading platform carries inherent risks, and understanding these risks is essential for traders. The following risk assessment summarizes key areas of concern related to Citibank.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risks | High | Lack of clear regulatory oversight |

| Operational Risks | Medium | Reports of withdrawal delays and account issues |

| Market Risks | High | Exposure to high volatility in forex markets |

The overall risk associated with trading with Citibank is significant, particularly due to regulatory concerns and operational inefficiencies. Traders should be aware of these risks and consider implementing strategies to mitigate them, such as diversifying their investments and maintaining a cautious approach to trading with Citibank.

Conclusion and Recommendations

In conclusion, while Citibank has a longstanding reputation in the financial industry, potential traders should approach with caution. The analysis indicates that there are several areas of concern regarding Citibank's regulatory status, customer experience, and operational reliability. For those wondering if Citibank is safe, the evidence suggests that traders should be vigilant and consider alternative options that offer more robust regulatory protections and better customer service.

For traders seeking a more reliable trading experience, it may be advisable to explore other brokers that are well-regulated and have a proven track record of customer satisfaction. Options such as brokers regulated by the FCA or ASIC may provide a more secure trading environment. Ultimately, careful consideration of all these factors is essential for making informed trading decisions.

Is Citibank Korea a scam, or is it legit?

The latest exposure and evaluation content of Citibank Korea brokers.

Citibank Korea Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Citibank Korea latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.