Is IMF safe?

Business

License

Is IMF Safe or Scam?

Introduction

IMF, or IMF Capital Limited, is a forex broker that has positioned itself in the competitive landscape of foreign exchange trading since its establishment in 2019. Operating primarily from the United Kingdom, it offers a range of trading instruments, including major and emerging market currencies, commodities, and share indices. However, as the forex market continues to grow, so does the complexity of finding a reliable broker. Traders must exercise caution and conduct thorough evaluations of brokers to avoid potential scams and ensure their investments are secure. This article aims to assess the legitimacy of IMF by examining its regulatory status, company background, trading conditions, customer experiences, and overall risks associated with trading with this broker.

Regulatory and Legitimacy

Regulation is a crucial factor in determining the safety and reliability of a forex broker. A regulated broker is typically required to adhere to strict guidelines that protect traders' interests, ensuring fair trading practices and the security of client funds. Unfortunately, IMF is not regulated by any recognized financial authority, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0524299 | United States | Unauthorized |

The absence of valid regulatory oversight means that IMF does not have to comply with any regulatory standards, leaving traders vulnerable to potential fraud or mismanagement of funds. The NFA has flagged IMF as unauthorized, which indicates a serious lack of oversight and raises red flags for potential investors. This lack of regulation is a critical factor in assessing whether IMF is safe for trading.

Company Background Investigation

IMF Capital Limited was founded in 2019, and while it presents itself as a legitimate trading platform, its history and ownership structure warrant scrutiny. The company claims to operate under various registrations, including with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA). However, investigations reveal that these claims do not hold up, as neither FINTRAC nor SVG FSA regulates forex activities, and IMF's registration does not equate to authorization to provide financial services.

The management team behind IMF has not been extensively detailed in available reports, which raises questions about their qualifications and experience in the financial industry. A lack of transparency regarding the company's ownership and operational history further complicates the trustworthiness of IMF. Given these factors, potential traders must be cautious, as the absence of a solid background can indicate a higher risk of fraudulent activities.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is essential. IMF offers various trading instruments and claims competitive spreads; however, the absence of regulatory oversight raises concerns about the transparency of these claims.

| Fee Type | IMF | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.2 - 0.5 pips | 0.1 - 0.3 pips |

| Commission Structure | $1 per lot | $5 per lot |

| Overnight Interest Range | Not specified | Varies widely |

The trading costs associated with IMF appear to be competitive, but the lack of clarity regarding overnight interest and potential hidden fees is troubling. Traders should be wary of any unusual or undisclosed fees that can significantly impact overall profitability. The overall fee structure should be transparent and in line with industry standards for a broker to be considered trustworthy.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. IMF's lack of regulatory oversight means that there are no mandated protections in place for client funds. This absence of investor protection measures, such as segregated accounts and negative balance protection, poses a significant risk for traders. Without these safeguards, traders may find themselves at risk of losing their entire investment if the broker encounters financial difficulties or engages in fraudulent practices.

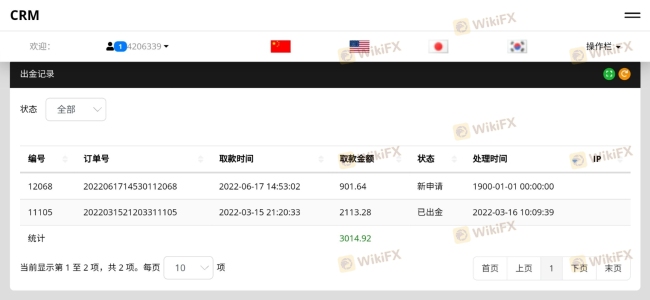

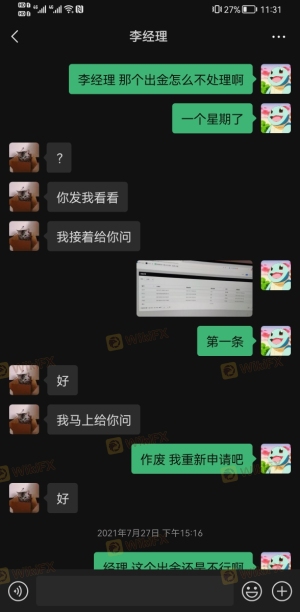

Historically, there have been complaints regarding difficulties in fund withdrawals and issues with account accessibility. Such incidents suggest that IMF is not safe when it comes to securing customer funds, and potential traders should be cautious about entrusting their money to this broker.

Customer Experience and Complaints

Customer reviews and experiences provide valuable insights into the reliability of a forex broker. A review of user feedback for IMF reveals a concerning pattern of complaints, particularly regarding withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Delays | Medium | Inadequate support |

| Platform Accessibility | High | No resolution |

Many users have reported being unable to access their funds or facing excessive delays in processing withdrawal requests. These complaints highlight a serious issue with IMF's operational integrity and customer support. When traders are unable to access their funds or receive timely assistance, it raises significant concerns about the broker's overall reliability and safety.

Platform and Trade Execution

The trading platform offered by IMF is based on the widely-used MetaTrader 4 (MT4) software, which is known for its robust features and user-friendly interface. However, the performance and stability of the platform must be assessed to determine whether it meets traders' needs. Reports of order execution issues, including slippage and rejected orders, have been noted by users, indicating potential manipulation or inefficiencies in trade execution.

Traders must be cautious of platforms that exhibit signs of manipulation, as this can lead to significant financial losses. A reliable broker should provide a stable trading environment with minimal disruptions to ensure that traders can execute their strategies effectively.

Risk Assessment

Engaging with IMF poses several risks that potential traders should consider carefully. The absence of regulatory oversight, combined with a pattern of customer complaints and withdrawal issues, indicates a high-risk environment for trading.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Security | High | Lack of investor protections |

| Customer Support | Medium | Poor response times to complaints |

To mitigate these risks, traders are advised to conduct thorough research before engaging with IMF. It may be prudent to start with a small deposit or consider alternative, more reputable brokers with established regulatory frameworks and positive customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that IMF is not safe for trading. The broker's lack of regulation, combined with numerous customer complaints and issues surrounding fund withdrawals, raises serious concerns about its legitimacy. Traders should be vigilant and consider alternative options that provide a higher level of security and customer support.

For those seeking reliable forex brokers, it is advisable to explore options that are well-regulated, have a proven track record of customer satisfaction, and demonstrate transparency in their operations. By doing so, traders can protect their investments and engage in a safer trading environment.

Is IMF a scam, or is it legit?

The latest exposure and evaluation content of IMF brokers.

IMF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IMF latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.