Olymp Trade 2025 Review: Everything You Need to Know

Summary

This detailed Olymp trade review looks at one of the online trading platforms that has been working since 2014. Olymp Trade calls itself an easy-to-use broker that offers many types of assets like forex, stocks, commodities, and indices. The platform gets attention because it only needs a $10 minimum deposit, which makes it great for new traders and people who want to start trading without risking much money.

Based on what we know, Olymp Trade has more than 25,000 active traders. It works under FinaCom rules and is registered in Vanuatu. The broker gives you FTT (Fixed Time Trades), CFD, and crypto trading choices, so users have many different trading tools to pick from.

But user feedback shows some worrying problems, especially with verification delays that go past 14 days. These delays make users complain because they sent in the right papers but had to wait too long to get their accounts verified. Even though it has a low starting cost and learning materials, these problems make people question how well the platform helps its customers.

The platform mainly targets beginner traders and people who want to start trading with less financial risk. However, the verification delays might hurt the user experience a lot.

Important Notice

Regional Entity Differences: Olymp Trade works under different rules in different places. Users should know that the platform is registered in Vanuatu and regulated by FinaCom (Financial Commission). The rules and services you can get might change based on where you live and your local financial laws.

Review Methodology: This review uses public information, user feedback from many sources, and stories from traders who have used the platform. Our goal is to give potential users a fair look at Olymp Trade's services, features, and how it works. All information here shows what we know now based on data and user reports from 2025.

Rating Framework

Broker Overview

Company Background and Establishment

Olymp Trade started in the online trading market in 2014. The company focuses on giving easy trading solutions to regular investors. It's based in Vanuatu and works under FinaCom rules, and the company has built a user base of more than 25,000 active traders over ten years. The platform became well-known through big sponsorships, including deals with retired Brazilian soccer player Ronaldinho, which helped more people notice it in the busy online trading world.

The broker's business plan centers on offering many asset types through one platform. It mainly targets new traders and people looking for entry-level trading chances. Olymp Trade focuses on being easy to use through low minimum deposits and learning materials that help new traders understand markets and trading strategies.

Platform Types and Asset Coverage

Olymp Trade gives you three main trading platform types: Fixed Time Trades (FTT), Contract for Difference (CFD), and cryptocurrency trading options. This Olymp trade review finds that the platform covers major asset types including foreign exchange pairs, individual stocks, commodities like gold and oil, and major market indices. Having many different instruments lets traders explore different markets and create varied trading strategies in one platform.

FinaCom provides the regulatory oversight, which gives dispute resolution services for traders. But this regulatory framework might not work as well as more established financial authorities in major trading areas.

Regulatory Environment

Olymp Trade works under FinaCom regulation with its registration in Vanuatu. This regulatory framework gives basic oversight but might not offer the same investor protection as regulators in major financial centers.

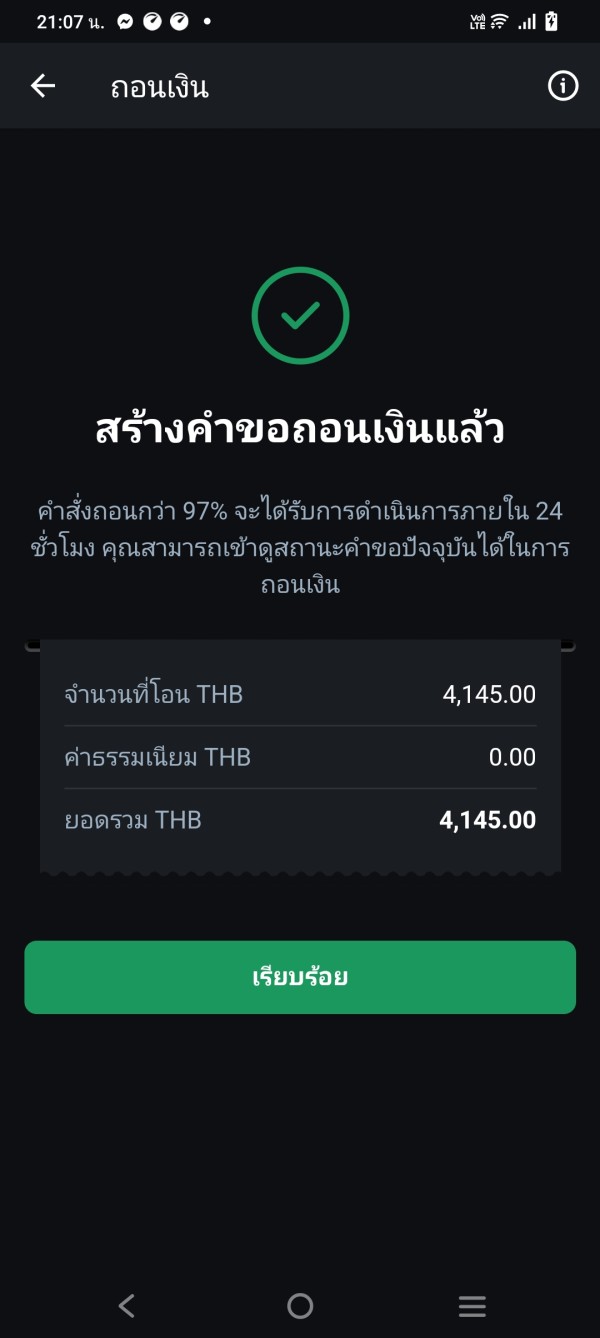

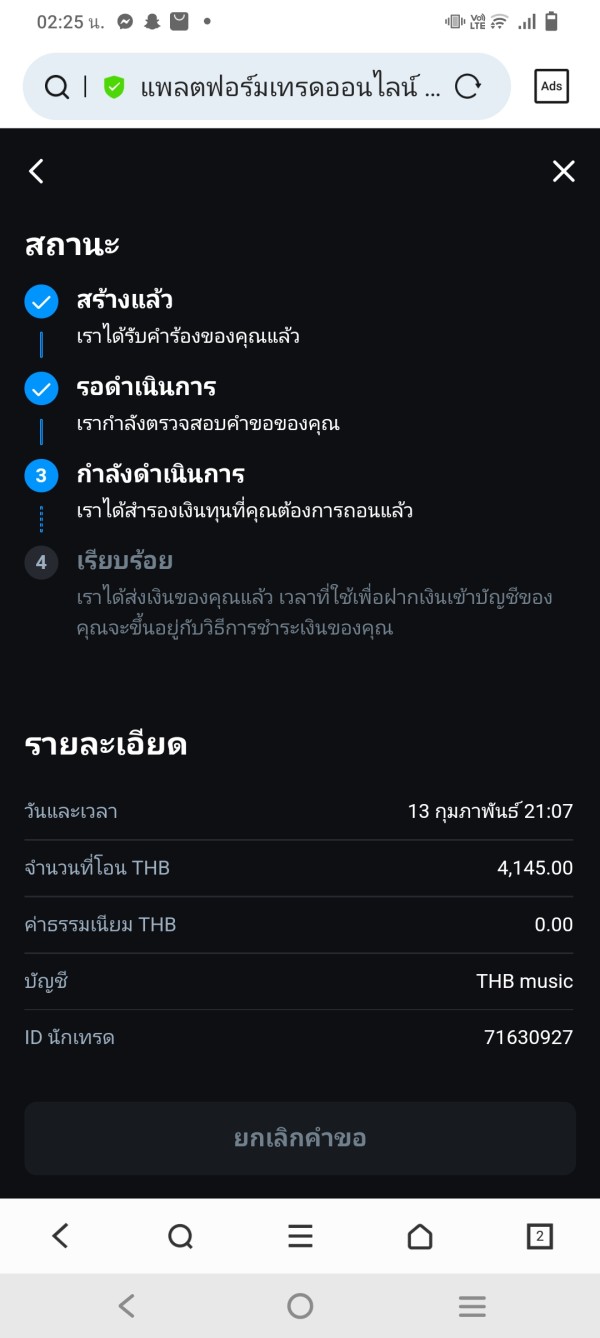

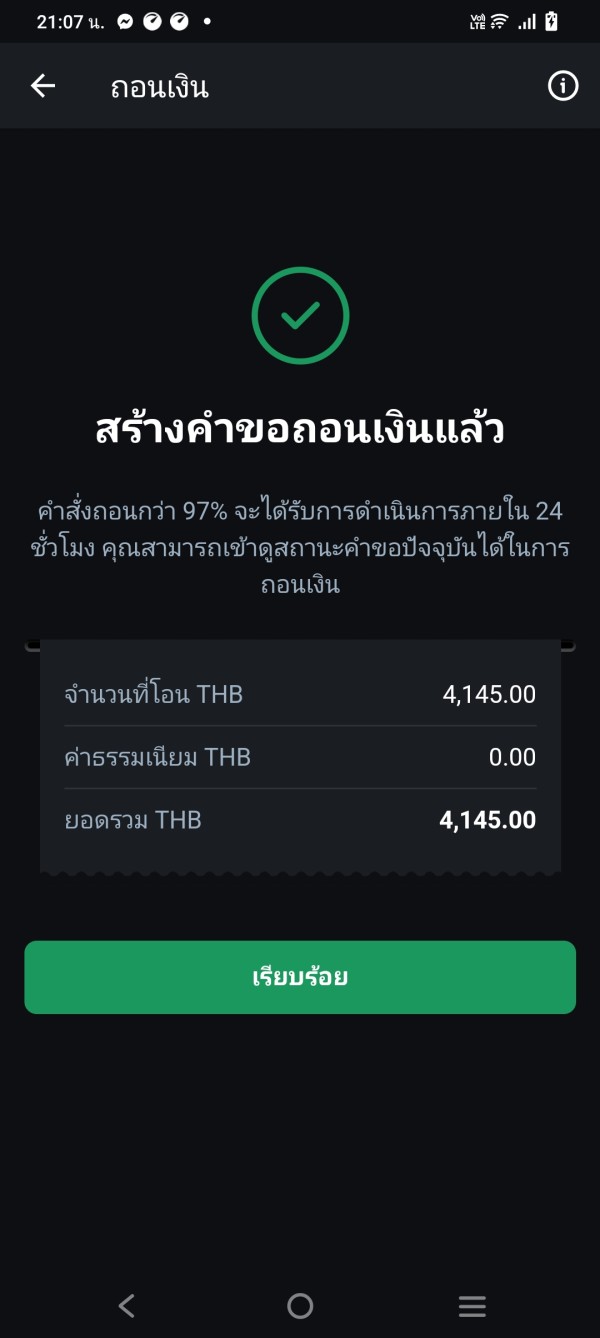

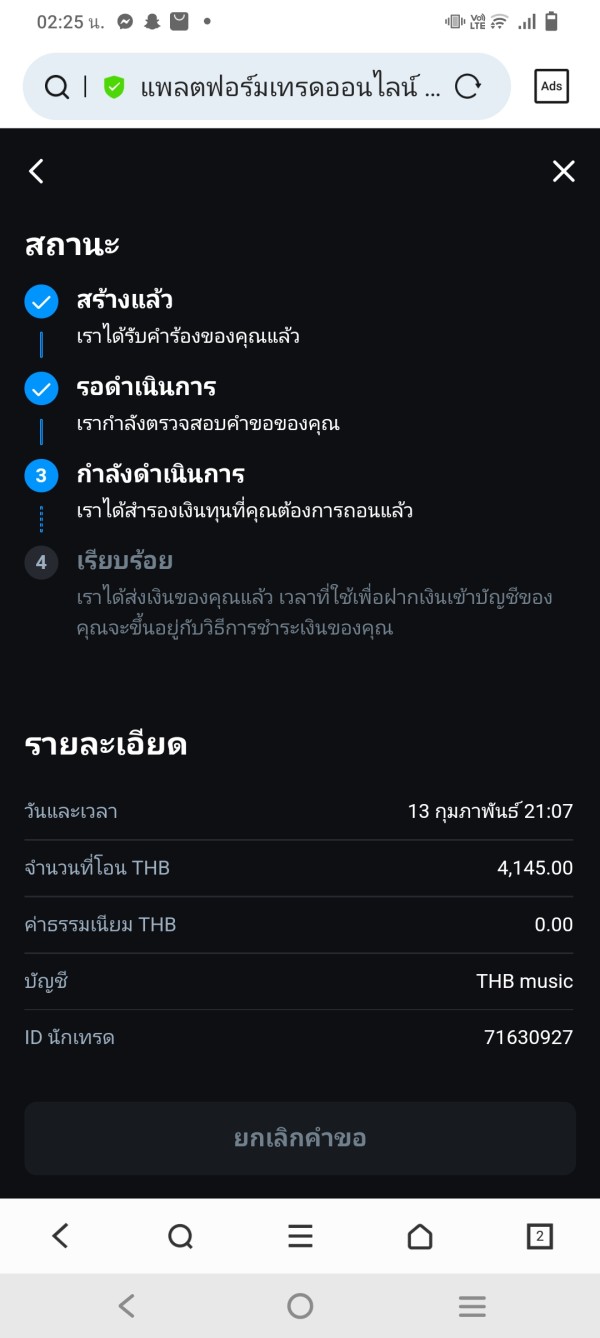

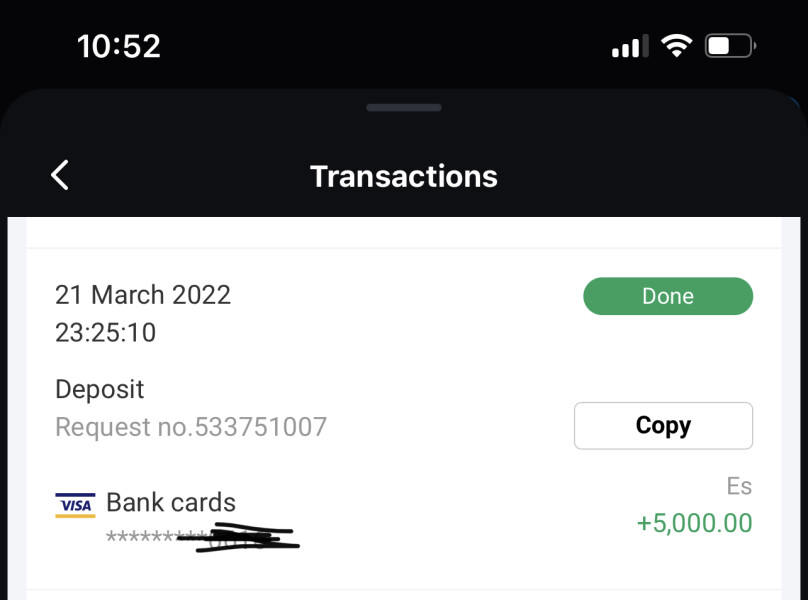

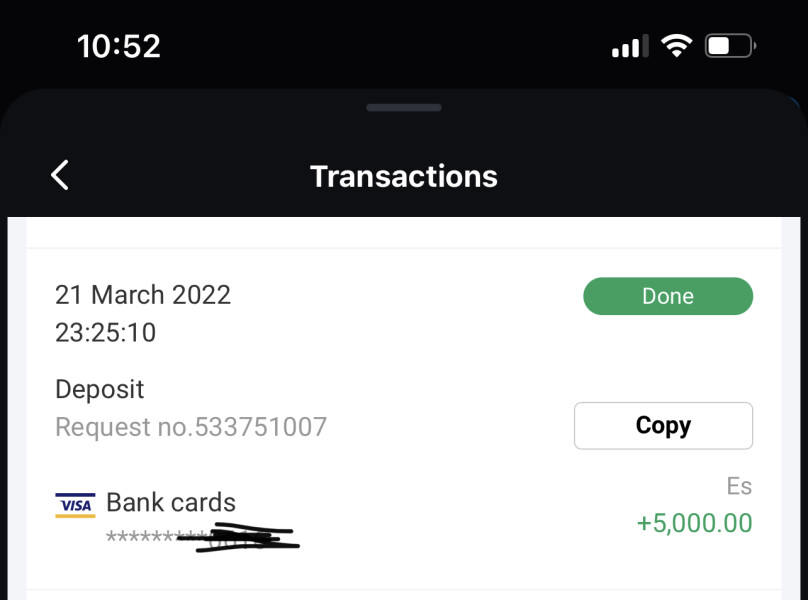

Deposit and Withdrawal Methods

We don't have specific information about available deposit and withdrawal methods, so potential users need to check these options directly with the platform.

Minimum Deposit Requirements

The platform sets its minimum deposit at $10. This makes it one of the easier options for beginning traders who want to start with very little money.

Bonus and Promotional Offers

We don't have details about current bonus structures and promotional campaigns in available documents, so users should ask directly about any available incentives.

Available Trading Assets

The asset selection includes foreign exchange currency pairs, individual company stocks, commodity instruments, and major market indices. This gives reasonable variety for retail trading activities.

Cost Structure Analysis

Commission rates and spread information weren't detailed in available sources. This is a big information gap for potential users who want to evaluate total trading costs.

Leverage Ratios

We don't have specific leverage information in the available documents, so you need to check directly with the platform.

Platform Options

Olymp Trade offers FTT, CFD, and cryptocurrency trading platforms. These accommodate different trading preferences and strategies within their system.

Regional Restrictions

We don't have details about specific geographical limitations in available sources.

Customer Service Languages

Information about supported languages for customer service wasn't specified in available documents.

This Olymp trade review notes that several key operational details need direct verification with the platform because of limited publicly available information.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Account Types and Features

While we don't have specific account tier information in available sources, Olymp Trade's account structure seems designed for accessibility rather than complexity. The platform's approach favors simplicity, which fits with its target of beginning traders who might find complicated account hierarchies confusing or scary.

Minimum Deposit Assessment

The $10 minimum deposit requirement stands as one of Olymp Trade's strongest features. This earns significant points in this Olymp trade review. This low barrier makes the platform accessible to people who want to try trading without putting in a lot of money. Compared to industry standards where minimum deposits often range from $100 to $500, this represents exceptional accessibility.

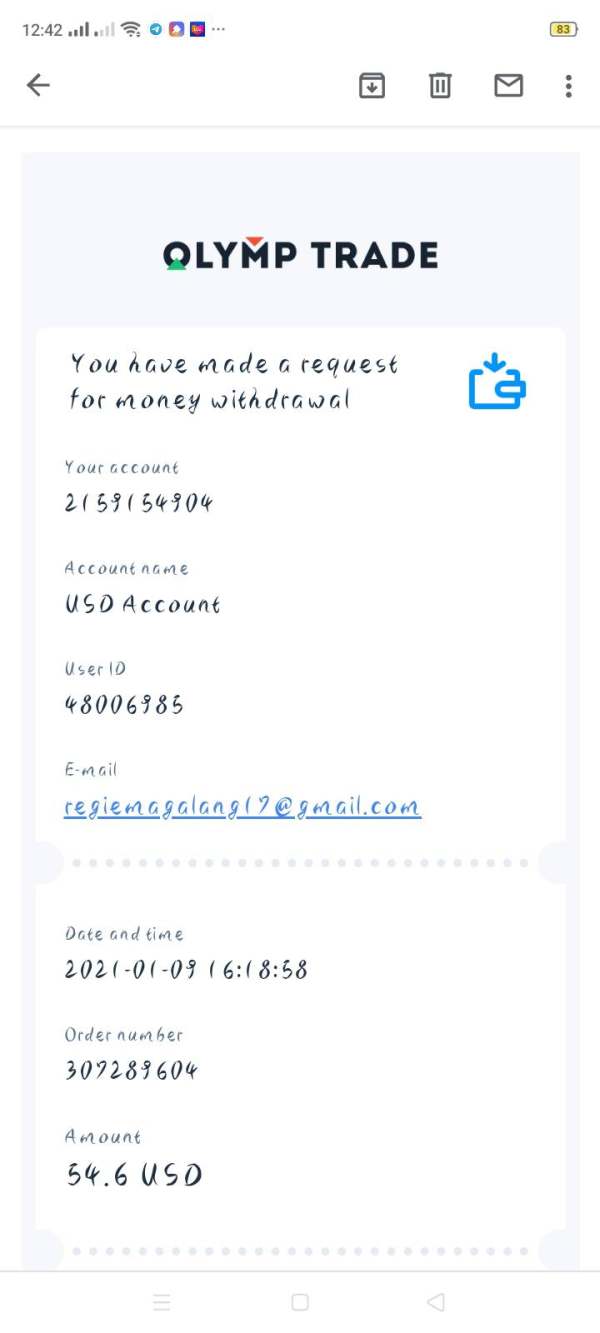

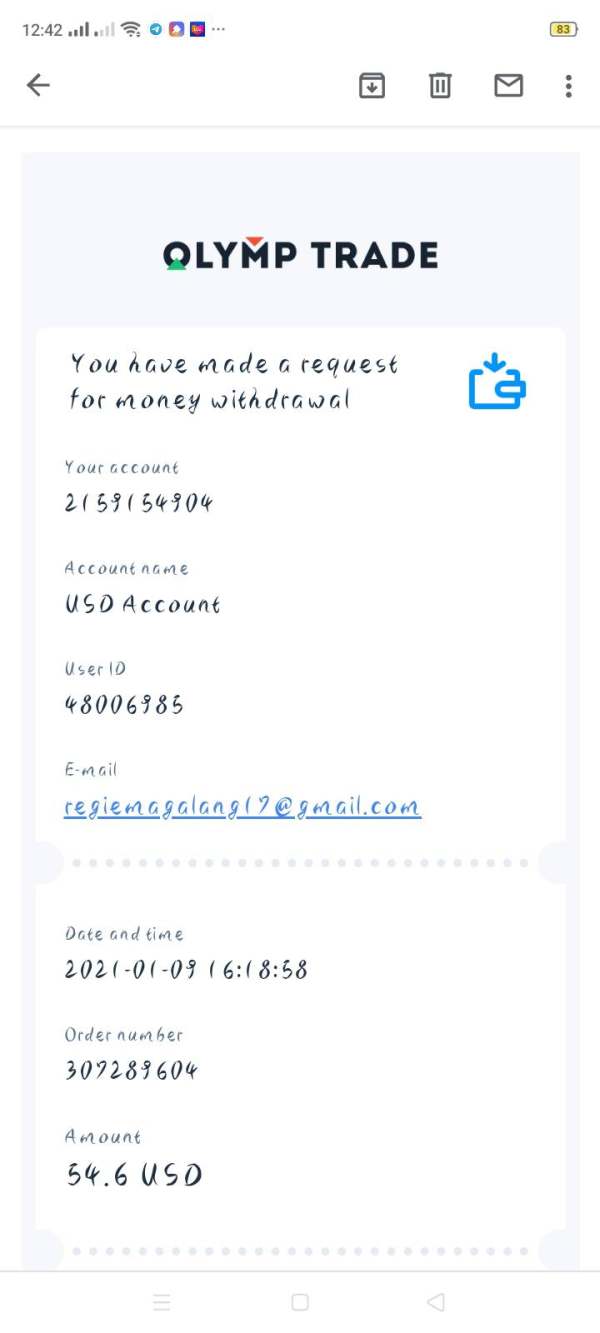

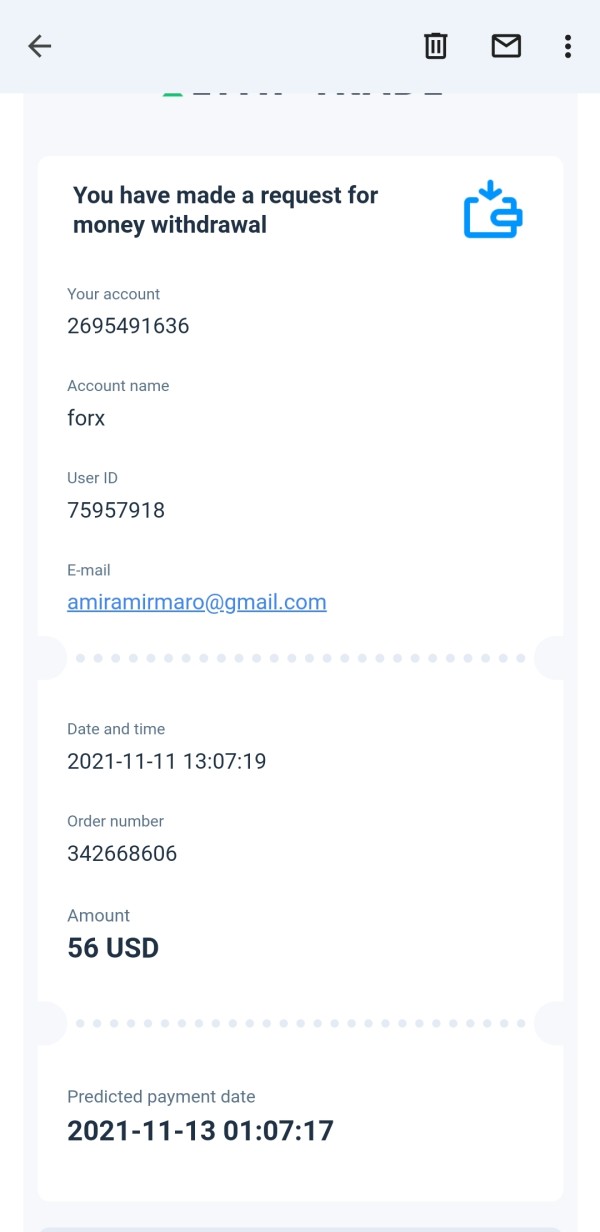

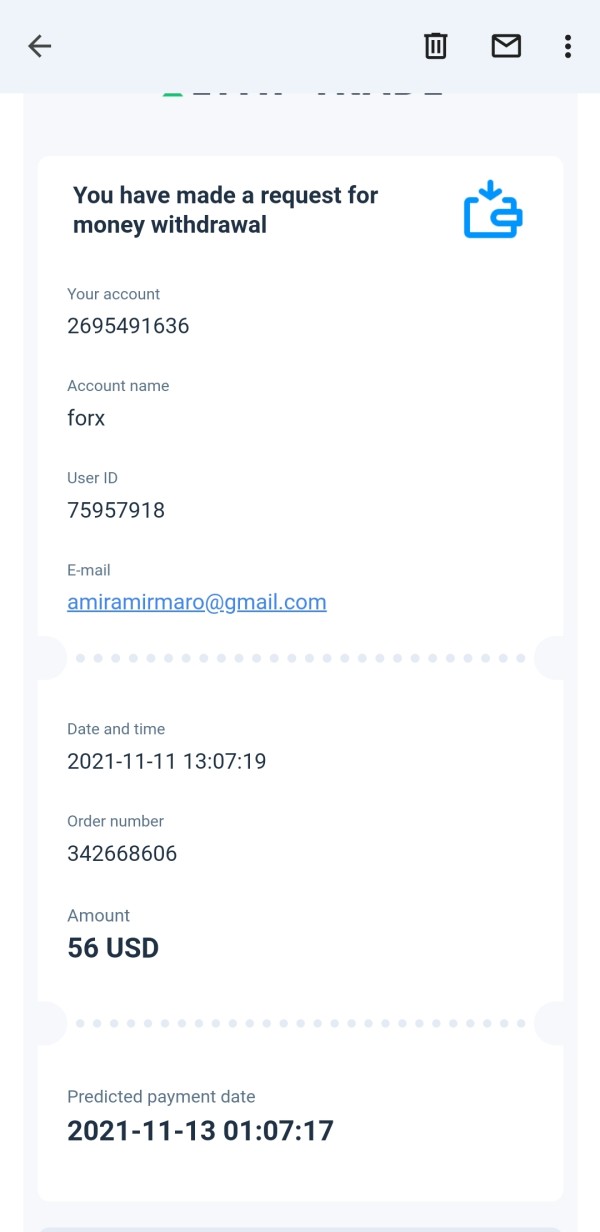

Account Opening Process Challenges

However, user feedback shows big issues with the verification process. Reports say that account verification can take more than 14 days, even when users submit complete and accurate documents. One specific case mentioned an account holder (ID: 117692014) who had long delays despite providing all required original documents. This verification bottleneck significantly impacts the account opening experience and represents a major operational weakness.

Special Account Features

We don't have information about specialized account types, such as Islamic accounts or professional trader accounts, in the source material. This suggests either limited options or poor communication of available features.

The combination of excellent accessibility through low minimum deposits and problematic verification processes creates a mixed assessment for account conditions.

Trading Tool Variety and Quality

Olymp Trade provides FTT, CFD, and cryptocurrency trading tools. This offers reasonable variety for its target market. The platform includes educational resources and analytical tools, though we don't have specific details about the quality and comprehensiveness of these resources in available sources.

Research and Analysis Resources

The availability of market analysis resources appears limited based on available information. While the platform mentions providing analytical tools, we don't have details about the depth and quality of market research, economic calendars, or trading signals. This suggests either limited offerings or inadequate promotion of available resources.

Educational Resource Assessment

Educational materials are reportedly available, which is crucial for the platform's target of beginning traders. However, the scope, quality, and updating frequency of these educational resources need direct evaluation, as we don't have detailed assessments in source materials.

Automated Trading Support

We don't have information about automated trading capabilities, expert advisors, or algorithmic trading support in available documents. This represents a potential limitation for traders seeking advanced trading automation features.

The tools and resources category receives an average rating due to basic functionality coverage but lacks detailed information about quality and comprehensiveness, preventing a higher assessment.

Customer Service and Support Analysis (Score: 4/10)

Service Channel Availability

We don't have specific information about customer service channels, including live chat, phone support, or email response systems, in available sources. This lack of transparency about support options already indicates potential communication issues.

Response Time Performance

User feedback reveals concerning response time issues, particularly regarding verification processes. Reports of delays exceeding 14 days for account verification suggest systemic problems with customer service efficiency. These delays appear to persist even when users escalate complaints to regulatory authorities like VFSC.

Service Quality Assessment

The prolonged verification delays reported by users indicate significant service quality issues. When customers submit complete documentation and still experience extended waiting periods without clear communication, it reflects poorly on overall customer service standards.

Multi-language and Availability

We don't have information about multi-language support and customer service hours in available documents. This makes it difficult for potential international users to assess service accessibility.

Problem Resolution Effectiveness

User reports suggest that even when complaints are filed with relevant authorities, resolution remains problematic. This indicates potential systemic issues in problem-solving processes and customer complaint handling.

The low rating reflects documented user frustrations with service delays and apparent inefficiencies in customer support operations.

Trading Experience Analysis (Score: 5/10)

Platform Stability and Performance

User feedback indicates suboptimal trading experiences. However, we don't have specific technical performance data regarding platform stability, execution speed, or system downtime in available sources. The lack of detailed performance metrics makes comprehensive assessment challenging.

Order Execution Quality

We don't have information about slippage rates, requote frequency, or execution speed in available documents. These factors are crucial for evaluating actual trading conditions but remain unclear based on current information.

Platform Functionality Completeness

The availability of FTT and CFD trading options provides basic functionality diversity. However, we don't have detailed information about charting capabilities, technical indicators, or advanced trading features in source materials.

Mobile Trading Experience

Mobile platform quality and functionality weren't specifically addressed in available information. This represents a significant gap given the importance of mobile trading for modern retail traders.

Trading Environment Assessment

We don't have details about critical trading environment factors such as spread stability, liquidity conditions, and market depth information. This makes it difficult to assess the actual trading conditions users can expect.

This Olymp trade review assigns an average rating due to basic functionality but notes significant information gaps that prevent thorough evaluation of the actual trading experience quality.

Trustworthiness Analysis (Score: 5/10)

Regulatory Credentials

Olymp Trade operates under FinaCom regulation. This provides basic oversight but may not offer the comprehensive investor protection associated with major financial regulators like FCA, ASIC, or CySEC. The Vanuatu registration provides legal framework but with limited regulatory depth compared to major financial centers.

Fund Security Measures

We don't have specific information about client fund protection measures, segregated accounts, or deposit insurance in available sources. This lack of transparency about fund security represents a significant concern for potential users evaluating platform safety.

Company Transparency

While the company provides basic operational information, we don't have detailed transparency regarding company financials, ownership structure, or operational reports readily available. This limits the ability to assess corporate transparency fully.

Industry Reputation Assessment

The platform has achieved notable visibility through sponsorship arrangements and maintains a substantial user base. However, user complaints regarding verification delays and service issues indicate mixed reputation elements that affect overall trustworthiness.

Negative Event Handling

User reports of prolonged verification delays and apparently ineffective complaint resolution suggest challenges in handling negative situations effectively. The persistence of these issues despite regulatory complaints indicates potential systemic problems.

The average rating reflects basic regulatory compliance balanced against user concerns and transparency limitations.

User Experience Analysis (Score: 4/10)

Overall User Satisfaction

User feedback reveals significant dissatisfaction with verification processes and service delays. Reports of verification taking over 14 days create negative first impressions and impact overall user satisfaction substantially.

Interface Design and Usability

We don't have specific information about platform interface design, navigation ease, or user interface quality in available sources. This prevents comprehensive assessment of design effectiveness.

Registration and Verification Process

The verification process represents a major user experience weakness. Despite users submitting complete documentation, delays exceeding two weeks create frustration and operational barriers. This problem appears systemic rather than isolated, as multiple user reports describe similar experiences.

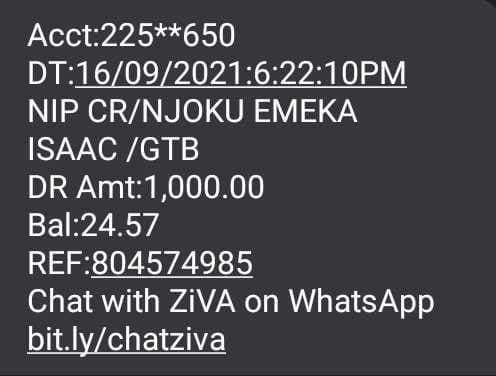

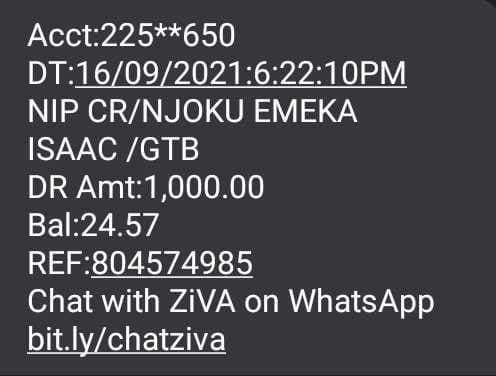

Fund Operation Experience

We don't have detailed information about deposit and withdrawal processes, processing times, or user experiences with fund operations in source materials. This represents a significant information gap.

Common User Complaints

The primary recurring complaint involves verification delays. Users express frustration about prolonged waiting periods despite submitting proper documentation. These delays affect account activation and trading access, creating substantial user experience problems.

User Demographics and Suitability

The platform appears designed for beginning traders, with low minimum deposits and educational resources supporting this demographic. However, operational issues may frustrate even novice users who expect reasonable service standards.

Improvement Recommendations

Based on user feedback, priority improvements should focus on streamlining verification processes, improving customer service response times, and enhancing communication about processing timelines.

The below-average rating reflects documented user frustration with core operational processes that significantly impact the overall platform experience.

Conclusion

This Olymp trade review reveals a trading platform with mixed characteristics that potential users should carefully consider. Olymp Trade succeeds in providing accessibility through its exceptionally low $10 minimum deposit requirement. This makes it genuinely approachable for beginning traders and those seeking to start trading with minimal capital risk. The platform's decade-long operation since 2014 and substantial user base of over 25,000 active traders demonstrate its ability to attract and maintain market presence.

However, significant operational challenges overshadow these accessibility advantages. User reports of verification delays exceeding 14 days represent serious service delivery problems that affect the fundamental user experience. These delays persist despite users providing complete documentation and even escalating complaints to regulatory authorities, suggesting systemic customer service issues rather than isolated incidents.

Recommended User Types: Olymp Trade may suit absolute beginners seeking low-cost market entry and individuals wanting to experiment with trading using minimal capital. However, users should be prepared for potential service delays and should consider whether the accessibility benefits outweigh the documented operational challenges.

Key Strengths and Weaknesses: The platform's primary strength lies in its low barrier to entry and basic educational resources. Major weaknesses include prolonged verification processes, limited transparency about trading costs, and apparent customer service inefficiencies that impact overall user satisfaction significantly.