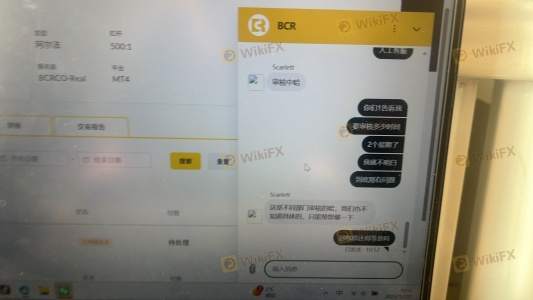

Regarding the legitimacy of BCR forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is BCR safe?

Pros

Cons

Is BCR markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

BACERA CO PTY LTD

Effective Date: Change Record

2008-12-19Email Address of Licensed Institution:

compliance@au.thebcr.comSharing Status:

Website of Licensed Institution:

www.bacera.com.auExpiration Time:

--Address of Licensed Institution:

VICTOR RINGOR SE 3 L 18 201 ELIZABETH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0284598050Licensed Institution Certified Documents:

Is BCR A Scam?

Introduction

BCR, or Bacera Co Pty Ltd, is an Australian-based forex and CFD broker that has been operating since 2009. It positions itself as a provider of comprehensive trading services, catering to both novice and experienced traders. Given the complexities and risks associated with forex trading, it is crucial for traders to thoroughly evaluate brokers before committing their funds. This article aims to provide an objective assessment of BCR, examining its regulatory status, company background, trading conditions, customer security measures, client experiences, platform performance, and associated risks. The evaluation is based on a comprehensive review of multiple sources, including user reviews, regulatory data, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant factors that determine its legitimacy and safety. BCR is regulated by the Australian Securities and Investments Commission (ASIC) and the British Virgin Islands Financial Services Commission (BV IFSC). The dual regulation by a top-tier authority like ASIC is generally seen as a positive sign, as it ensures that the broker adheres to strict financial standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 328794 | Australia | Verified |

| BV IFSC | SIBA/L/19/1122 | British Virgin Islands | Verified |

ASIC‘s oversight requires brokers to maintain segregated accounts for client funds, ensuring they are not used for operational expenses. This level of regulation is crucial for protecting traders' investments. However, the BV IFSC’s regulatory framework is often considered less stringent, which might raise concerns about the level of protection provided to international clients. Overall, while BCR's regulation by ASIC adds a layer of trust, potential clients should remain cautious due to the offshore entity's lesser regulatory scrutiny.

Company Background Investigation

BCR was established in 2009, originally focusing on CFD trading. The company operates under the ownership of Bacera Co Pty Ltd, which is incorporated in Australia. The management team consists of experienced professionals from the financial services sector, contributing to the broker's credibility. However, details about the specific individuals in the management team are not widely publicized, which could affect transparency.

The company has built a reputation for providing a user-friendly trading experience, but the lack of detailed information about its ownership structure and management team raises questions about its transparency. Effective communication regarding operational changes and company policies is essential for fostering trust with clients. BCR's website offers limited information on its history and management, which could be a potential red flag for traders seeking a transparent broker.

Trading Conditions Analysis

BCR offers various trading conditions, including competitive spreads and leverage options. The broker's fee structure is designed to be attractive to traders, but it is essential to scrutinize these costs closely. BCR provides a minimum deposit requirement of $300, which is relatively standard in the industry, but some users have reported that the spreads can be higher than average, particularly for certain account types.

| Fee Type | BCR | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.2 pips |

| Commission Structure | Varies by account type | $5 - $6 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by BCR can be competitive, especially for its Alpha account, which offers spreads starting from 0 pips with a commission. However, some users have reported that the standard account spreads can be higher than expected. Additionally, the presence of inactivity fees is a concern for traders who may not trade regularly. Overall, while BCRs trading conditions may appeal to some traders, it is essential to consider the overall cost of trading when evaluating this broker.

Client Funds Security

The safety of client funds is paramount when choosing a broker. BCR implements several measures to ensure the security of client funds, including the segregation of client accounts and the use of top-tier Australian banks for fund storage. This means that traders' funds are kept separate from the broker's operational funds, providing an additional layer of security.

BCR also offers negative balance protection, which ensures that clients cannot lose more than their deposited amount. This is particularly important in volatile markets where rapid price changes can lead to significant losses. However, it is crucial to note that while BCR has not reported any major incidents of fund mismanagement or security breaches, the offshore regulatory aspect raises questions about the level of investor protection in case of disputes.

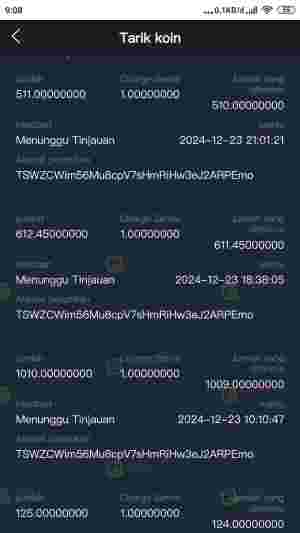

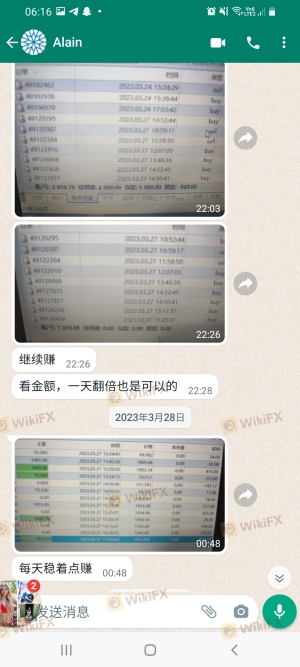

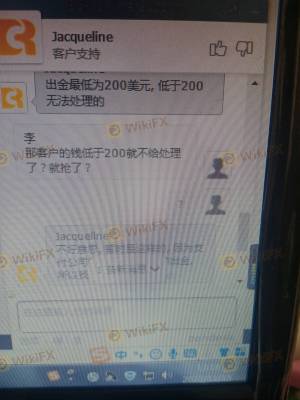

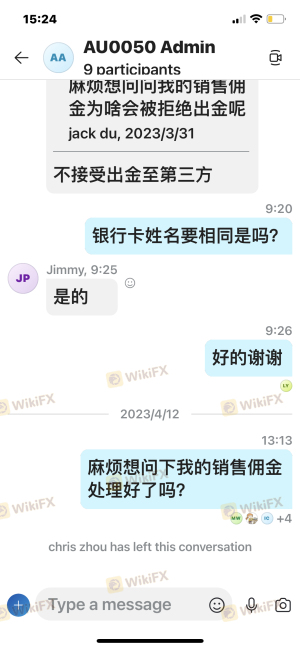

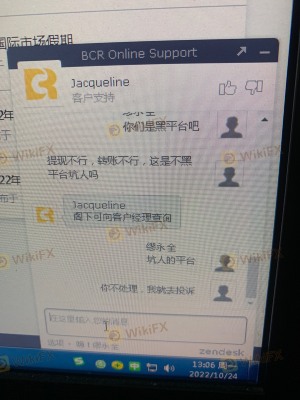

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating any broker. BCR has received mixed reviews from clients, with some praising its user-friendly platform and responsive customer service, while others have raised concerns over withdrawal issues and high fees. Common complaints include difficulty in withdrawing funds and high spreads, which can affect trading profitability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| High Spreads | Medium | Addressed in FAQs |

| Customer Support Quality | Medium | Generally positive |

Several users have reported delays in processing withdrawals, which is a common issue in the forex industry. For instance, one user mentioned that their withdrawal request took longer than expected, leading to frustration. While BCR's customer support has been noted for its helpfulness, the frequency of complaints regarding withdrawals suggests that this is an area needing improvement.

Platform and Trade Execution

BCR's trading platform is based on the widely recognized MetaTrader 4 (MT4), which is known for its reliability and user-friendly interface. The platform offers a range of tools for technical analysis and automated trading, appealing to both novice and experienced traders. Users generally report satisfactory execution speeds; however, there have been occasional complaints about slippage during volatile market conditions.

The broker claims to provide instant execution, but users should be aware that slippage can occur, especially during high-impact news events. It is essential for traders to understand the potential for slippage and to implement risk management strategies accordingly.

Risk Assessment

Trading forex and CFDs inherently carries risks, and BCR is no exception. While the broker is regulated by ASIC, the presence of an offshore entity raises concerns about the level of oversight and investor protection. Traders should be aware of the following risks associated with using BCR:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may offer less protection. |

| Withdrawal Risk | High | Complaints about delayed withdrawals. |

| Market Risk | High | Volatility in forex markets can lead to significant losses. |

To mitigate these risks, traders are advised to start with a demo account, develop a solid trading plan, and utilize risk management tools such as stop-loss orders. It is also crucial to stay informed about market conditions and potential changes in regulatory frameworks.

Conclusion and Recommendations

In conclusion, BCR presents a mixed picture for prospective traders. While it is regulated by ASIC, which provides a level of trust, the presence of an offshore entity and reports of withdrawal issues warrant caution. Traders should carefully consider their risk tolerance and trading goals before engaging with BCR.

For those seeking a reliable trading experience, it may be prudent to explore alternative options with stronger regulatory oversight and a proven track record of customer satisfaction. Brokers such as Pepperstone or IC Markets, which are also regulated by ASIC and have positive reputations, could serve as suitable alternatives for traders looking for a more secure trading environment.

Is BCR a scam, or is it legit?

The latest exposure and evaluation content of BCR brokers.

BCR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BCR latest industry rating score is 7.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.