BCR 2025 Review: Everything You Need to Know

Executive Summary

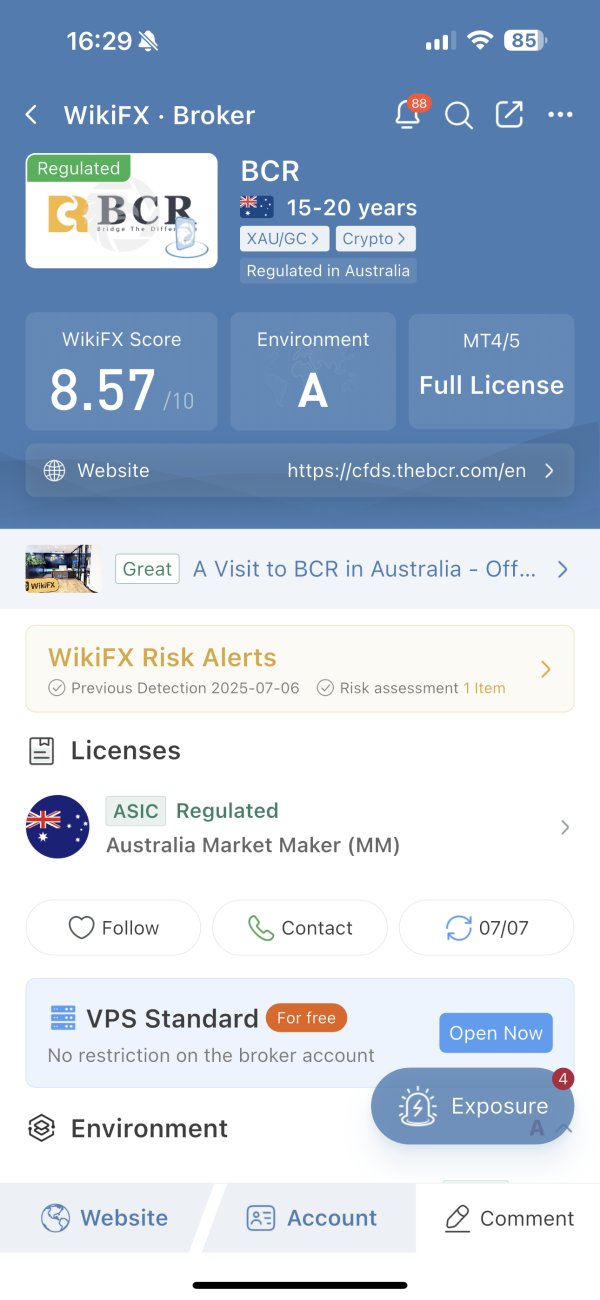

This comprehensive BCR review looks at one of the new players in the CFD trading industry. BCR is a forex and CFD broker that has become a regulated company offering good trading conditions across many types of assets. The company started in 2008 and has its main office in Sydney, Australia, where it works under the watch of both the Australian Securities and Investments Commission (ASIC) and the British Virgin Islands Financial Services Commission (BVIFSC).

The broker stands out by offering the popular MetaTrader 4 trading platform and access to many different types of assets including currencies, cryptocurrencies, indices, precious metals, energies, soft commodities, and stocks. User feedback shows that BCR keeps spreads competitive and commission costs low, which makes it appealing for traders who want cost-effective trading solutions.

BCR mainly focuses on traders who want diverse investment opportunities through CFD trading. The broker follows regulations and focuses on users, which makes it good for both new and experienced traders looking for a reliable trading environment. User ratings show a 4.0 satisfaction score, with 76% of employees willing to recommend the platform, which suggests clients generally have positive experiences.

Important Disclaimer

BCR operates in different regulatory areas, which may cause trading conditions, client protection policies, and available services to vary depending on where the trader lives. Potential clients should check which BCR entity serves their region and understand the specific terms and conditions that apply to their area.

This BCR review uses publicly available information, user feedback, official company disclosures, and market analysis conducted as of 2025. Trading conditions, fees, and services may change over time, and prospective clients should verify current information directly with the broker before making any trading decisions.

Rating Framework

Broker Overview

BCR started in the competitive forex and CFD trading market in 2008, setting up its main office in Sydney, Australia. As a CFD broker, the company has focused on building a complete trading system that serves both retail and institutional clients seeking exposure to global financial markets. The broker's business model centers around providing Contract for Difference (CFD) trading services, allowing users to speculate on price movements across various asset classes without owning the underlying instruments.

The company has positioned itself as a technology-forward broker, emphasizing reliable trading infrastructure and customer-focused services. BCR's commitment to regulatory compliance has been evident through its pursuit of authorizations from multiple respected financial regulators, demonstrating its dedication to operating within established legal frameworks and maintaining high standards of client protection.

BCR's trading ecosystem revolves around the MetaTrader 4 platform, one of the industry's most recognized and trusted trading interfaces. The broker provides access to many tradeable instruments spanning seven major asset categories: foreign exchange currencies, cryptocurrencies, stock indices, precious metals, energy commodities, soft commodities, and individual equities. This variety allows traders to use sophisticated portfolio strategies and take advantage of opportunities across different market sectors. The broker operates under dual regulatory oversight from ASIC and BVIFSC, ensuring compliance with international financial standards and providing clients with multiple layers of regulatory protection.

Regulatory Jurisdictions: BCR maintains regulatory compliance through authorizations from the Australian Securities and Investments Commission (ASIC) and the British Virgin Islands Financial Services Commission (BVIFSC). This dual regulatory framework ensures that the broker operates under strict financial guidelines and provides appropriate client protections across different jurisdictions.

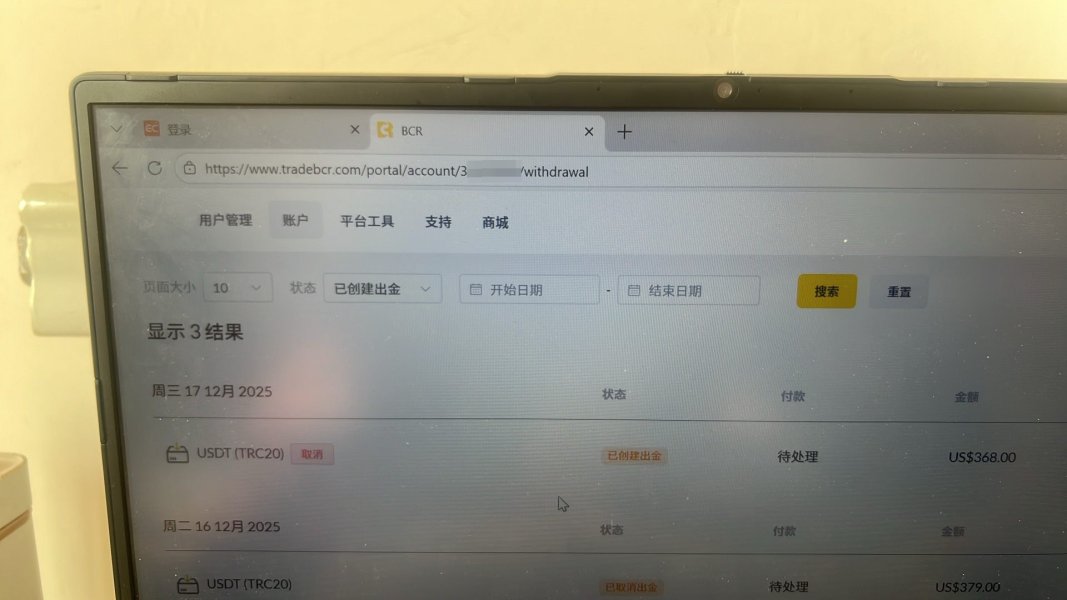

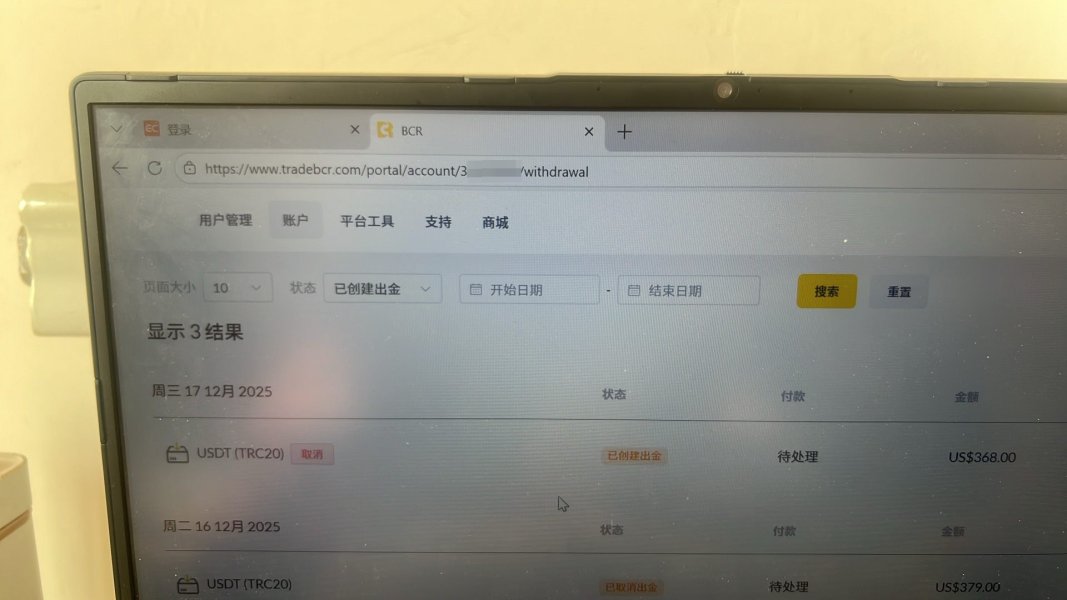

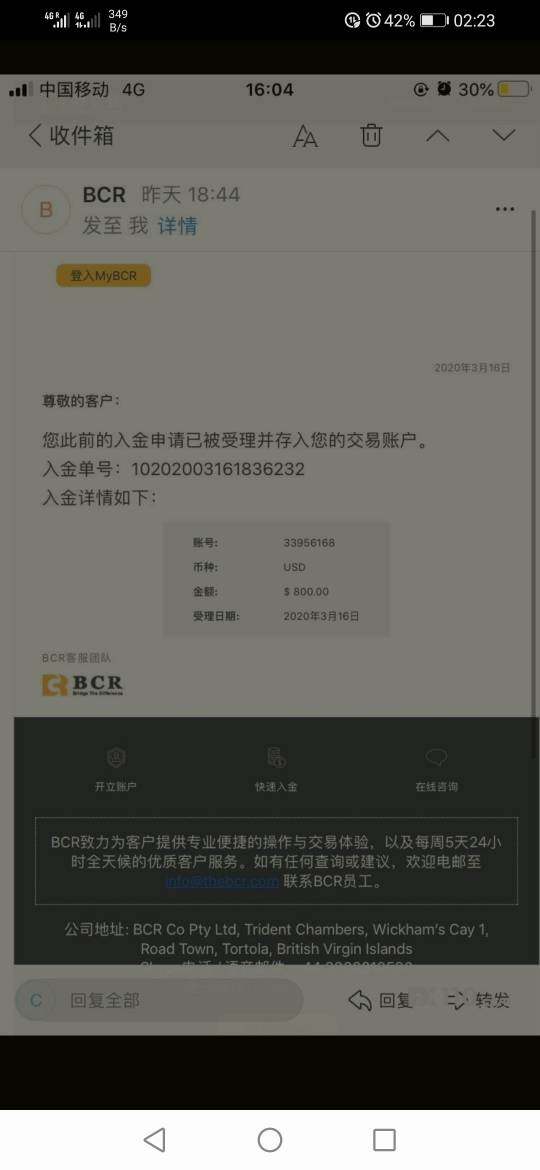

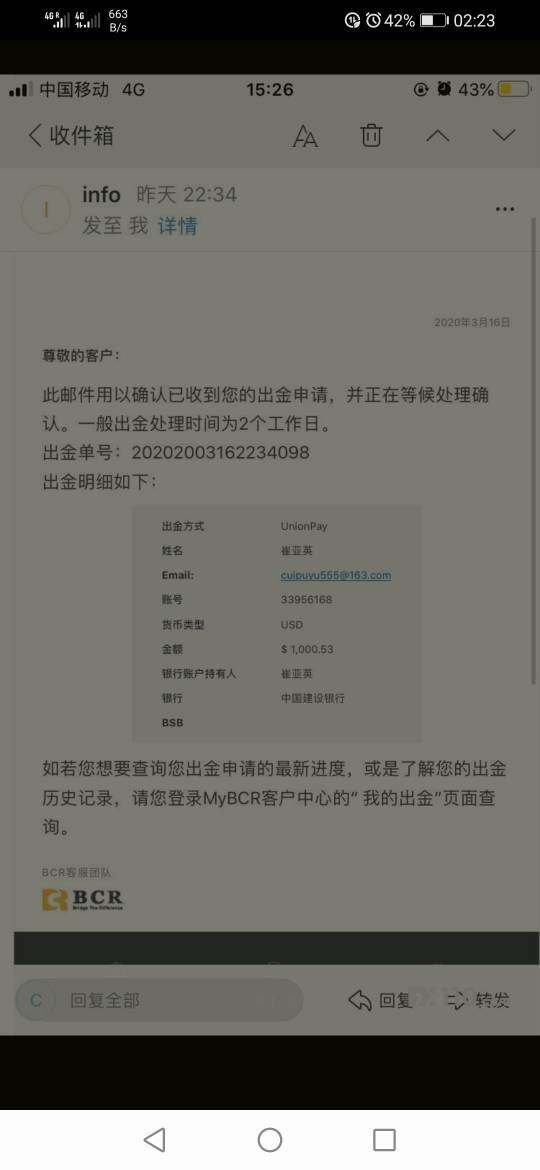

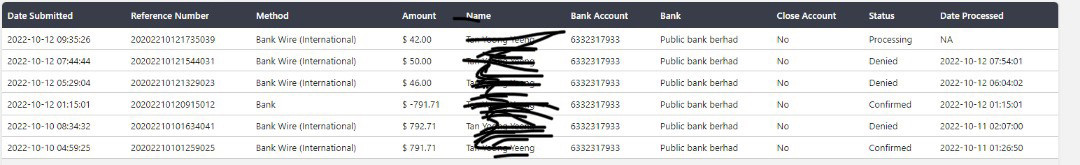

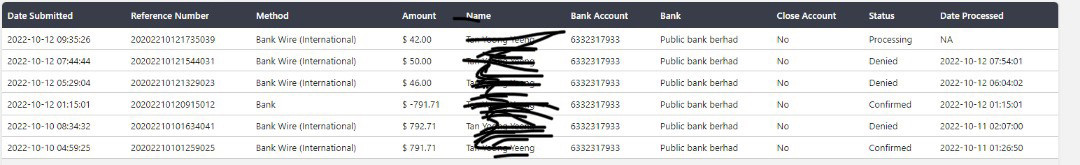

Funding Methods: Specific information regarding deposit and withdrawal methods was not detailed in available materials, requiring prospective clients to contact the broker directly for comprehensive funding options.

Minimum Deposit Requirements: The exact minimum deposit amount was not specified in available documentation, indicating that account opening requirements may vary based on account type and client jurisdiction.

Promotional Offers: Current bonus and promotional structures were not detailed in available materials, suggesting that any incentive programs would need to be verified directly with the broker.

Tradeable Assets: BCR offers comprehensive market access across seven distinct asset classes: major and minor currency pairs, popular cryptocurrencies, global stock indices, precious metals including gold and silver, energy commodities such as oil and natural gas, soft commodities, and individual stock CFDs from various international markets.

Cost Structure: According to user feedback, BCR implements highly competitive pricing through low spreads and minimal commission charges. However, specific numerical values for spreads, overnight financing rates, and commission structures were not provided in available materials, requiring direct verification with the broker.

Leverage Ratios: Maximum leverage offerings were not specified in available documentation, though regulatory constraints from ASIC and BVIFSC would typically limit leverage ratios according to respective jurisdictional requirements.

Platform Options: The broker exclusively offers MetaTrader 4, providing traders with access to advanced charting capabilities, technical analysis tools, automated trading support, and customizable trading environments suitable for various trading styles and experience levels.

This comprehensive BCR review indicates that while the broker offers solid foundational services, prospective clients should conduct direct research to obtain specific details about costs, account requirements, and available features.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

BCR's account conditions represent one of its strongest competitive advantages, earning a solid 8 out of 10 rating based on available information. The broker's commitment to competitive pricing structures appears to be a central element of its value proposition, with user feedback consistently highlighting the attractiveness of both spread and commission arrangements.

While specific account types and their respective features were not detailed in available materials, the positive user sentiment regarding cost structures suggests that BCR has successfully positioned itself competitively within the market. The absence of detailed information about minimum deposit requirements, account tiers, or special features such as Islamic accounts represents an area where prospective clients would need to engage directly with the broker for comprehensive details.

The account opening process specifics were not outlined in available documentation, though the broker's regulatory compliance with both ASIC and BVIFSC suggests adherence to standard Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This regulatory framework typically ensures that account opening processes meet international standards while maintaining appropriate client verification protocols.

The competitive nature of BCR's account conditions, particularly regarding costs, positions the broker favorably for traders prioritizing cost-effective trading solutions. However, the lack of detailed information about account variety and special features prevents a higher rating in this category. This BCR review suggests that while the fundamental account conditions appear strong, greater transparency about specific offerings would enhance the overall value proposition.

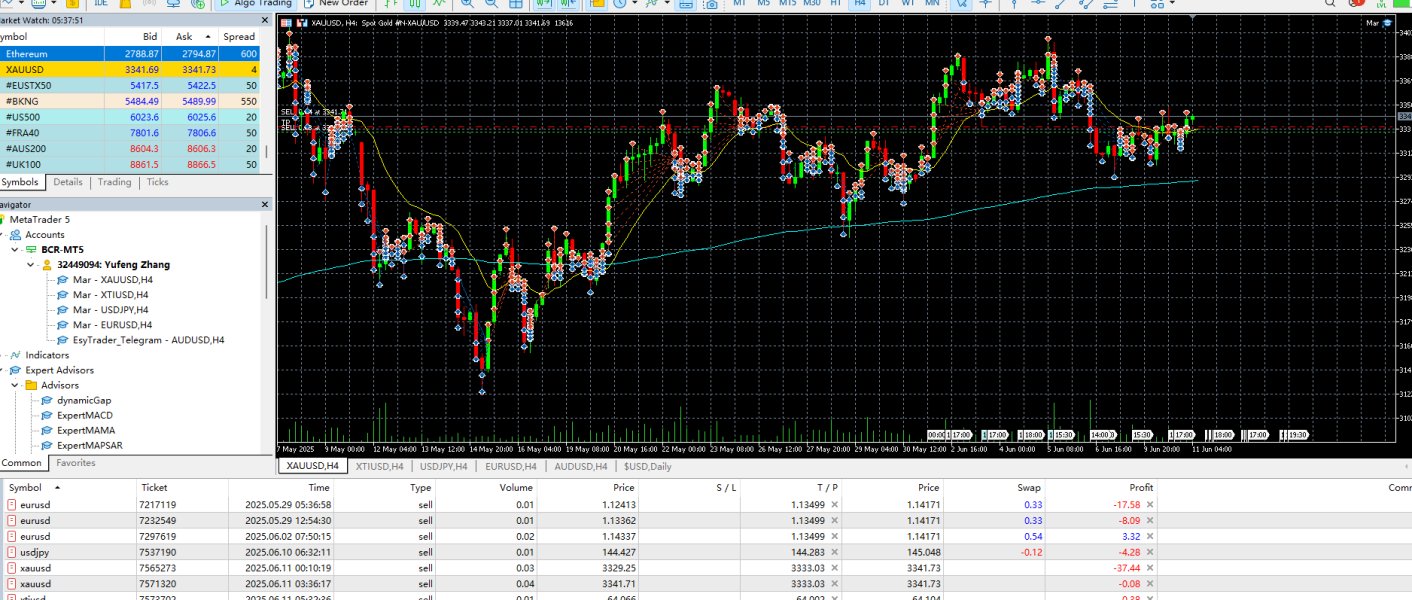

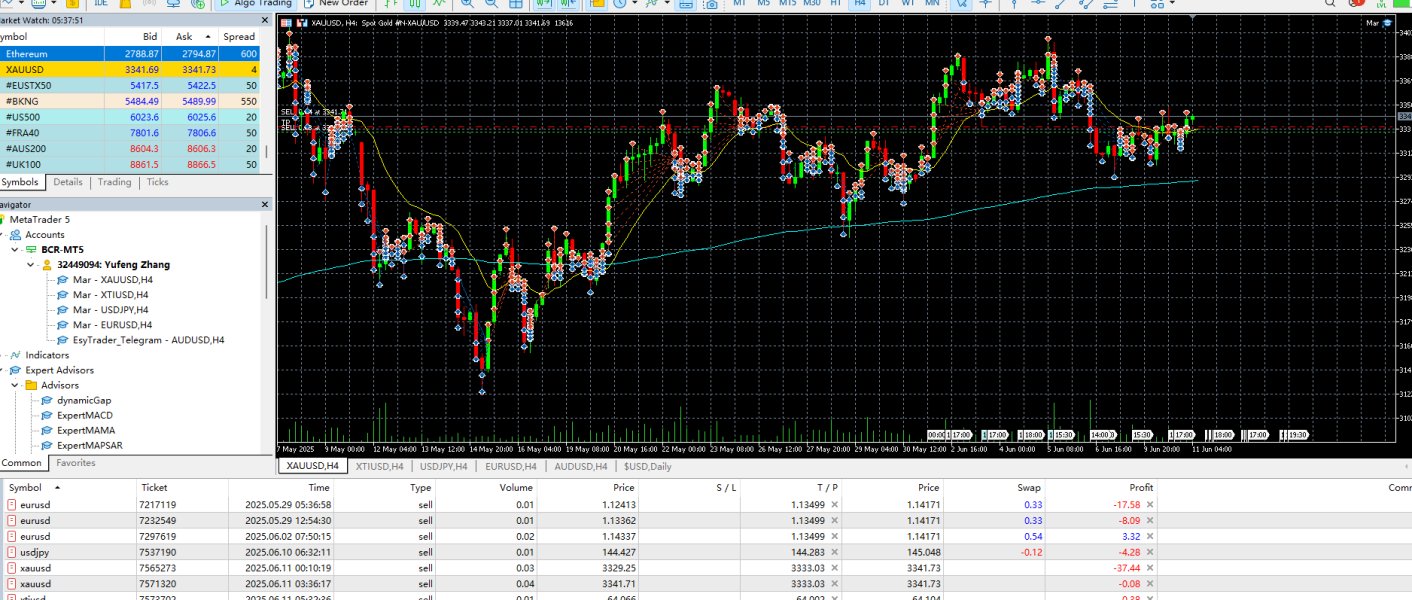

BCR's tools and resources offering earns a 7 out of 10 rating, primarily anchored by its provision of the MetaTrader 4 platform, which remains one of the industry's most respected trading interfaces. The platform provides traders with comprehensive charting capabilities, a wide array of technical indicators, and support for automated trading through Expert Advisors (EAs).

The MetaTrader 4 platform includes essential trading tools such as multiple chart types, customizable timeframes, and an extensive library of technical analysis indicators. Traders can implement various analytical approaches, from basic trend analysis to complex algorithmic strategies. The platform's reliability and user-friendly interface make it suitable for both novice traders learning market analysis and experienced professionals requiring sophisticated trading tools.

However, available materials did not provide specific information about additional research resources, market analysis, or educational content that BCR might offer beyond the standard MetaTrader 4 functionality. The absence of detailed information about proprietary research, daily market commentary, economic calendars, or educational webinars represents a significant gap in the available information about the broker's value-added services.

The lack of information about mobile trading capabilities, web-based platforms, or additional trading tools beyond MetaTrader 4 also limits the comprehensiveness of this assessment. Modern traders increasingly expect multi-platform access and comprehensive educational resources, areas where BCR's specific offerings remain unclear based on available documentation.

Customer Service and Support Analysis (9/10)

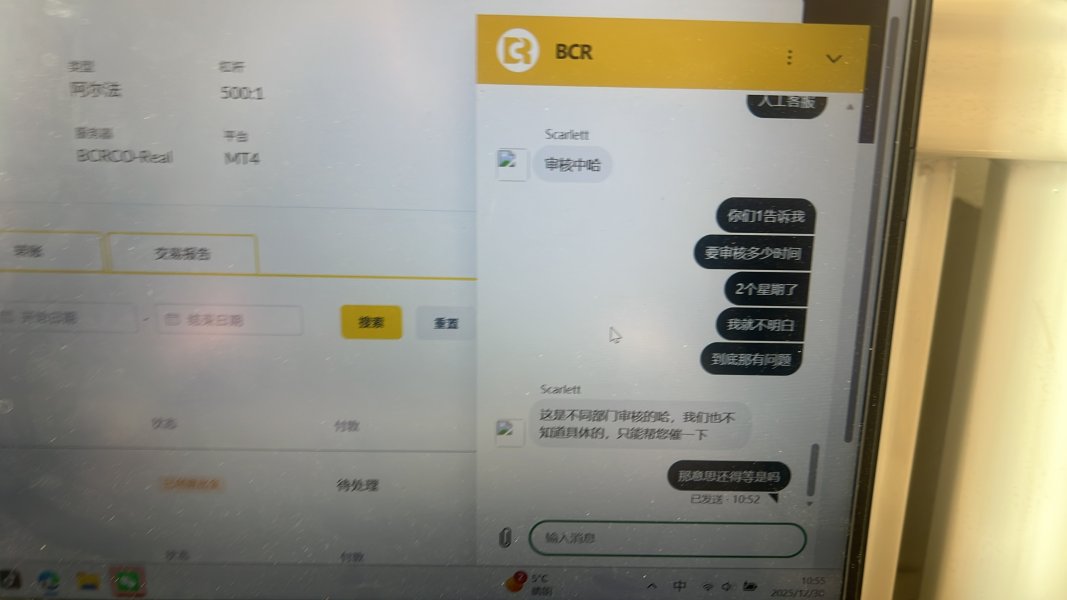

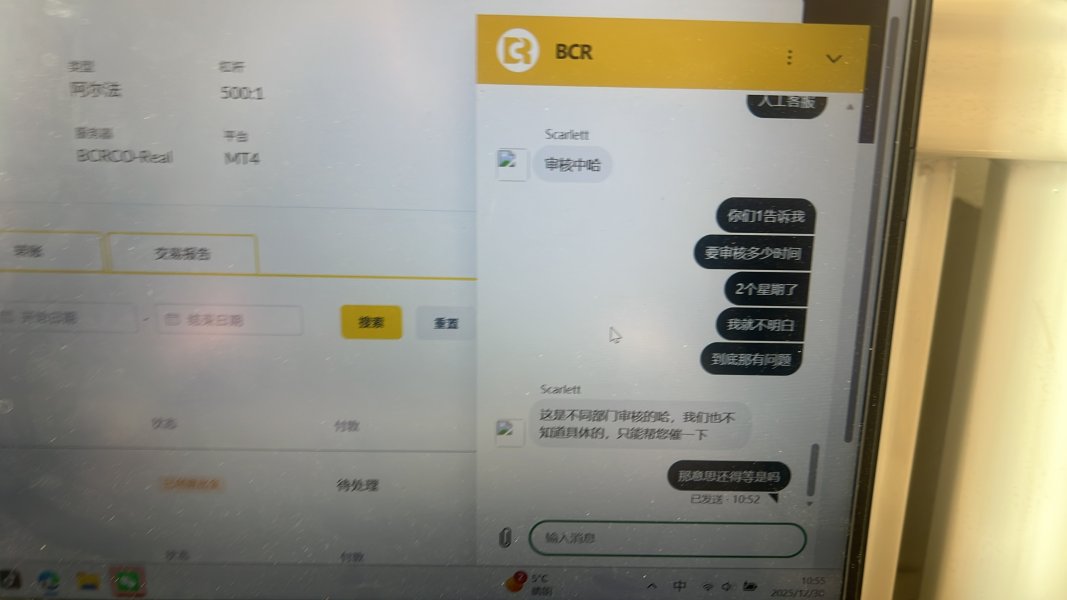

Customer service emerges as one of BCR's strongest attributes, earning an impressive 9 out of 10 rating based on consistent positive user feedback regarding responsiveness and service quality. According to available user reviews, the broker's customer support team demonstrates strong responsiveness and effective problem-resolution capabilities.

The positive user sentiment regarding customer service suggests that BCR has invested significantly in building a competent support infrastructure capable of addressing client inquiries and concerns efficiently. Users report satisfactory experiences with the overall support quality, indicating that the broker prioritizes client satisfaction and maintains professional service standards.

However, specific details about support channels, availability hours, and multi-language capabilities were not provided in available materials. Modern traders typically expect 24/5 support coverage, multiple contact methods including live chat, phone, and email, as well as support in various languages depending on the broker's target markets.

The absence of information about response time guarantees, escalation procedures, or specialized support for different account types represents areas where additional transparency would be beneficial. Despite these information gaps, the consistently positive user feedback about actual service experiences suggests that BCR has successfully implemented effective customer support practices that meet client expectations in real-world scenarios.

Trading Experience Analysis (8/10)

The trading experience with BCR receives an 8 out of 10 rating, reflecting generally positive user feedback about platform stability and overall trading conditions. Users report satisfactory experiences with the MetaTrader 4 platform's performance, suggesting that BCR maintains reliable server infrastructure and provides stable trading environments.

Platform stability represents a critical component of trading experience, and user feedback indicates that BCR successfully maintains consistent platform availability and responsiveness. The MetaTrader 4 platform's proven track record, combined with positive user experiences, suggests that traders can expect reliable order execution and minimal technical disruptions during trading sessions.

The broker's competitive spreads and low commissions contribute positively to the overall trading experience by minimizing trading costs, which directly impacts trader profitability. However, specific information about order execution quality, slippage rates, requotes frequency, or execution speeds was not available in the reviewed materials.

Mobile trading capabilities, which have become increasingly important for modern traders, were not specifically detailed in available information. The absence of information about advanced order types, one-click trading features, or platform customization options also limits the comprehensiveness of this trading experience evaluation.

This BCR review indicates that while the fundamental trading experience appears solid based on user feedback, additional technical performance data and feature details would provide a more complete picture of the broker's trading environment quality.

Trust and Security Analysis (8/10)

BCR's trust and security profile earns an 8 out of 10 rating, primarily supported by its dual regulatory framework under ASIC and BVIFSC supervision. These regulatory authorizations provide multiple layers of client protection and ensure that the broker operates within established financial industry standards.

The Australian Securities and Investments Commission (ASIC) represents one of the world's most respected financial regulators, known for stringent oversight and robust client protection requirements. ASIC regulation typically includes requirements for segregated client funds, professional indemnity insurance, and regular financial reporting, all of which contribute to enhanced client security.

The additional oversight from the British Virgin Islands Financial Services Commission (BVIFSC) provides supplementary regulatory coverage, though the specific client protection measures and regulatory requirements under this jurisdiction were not detailed in available materials.

However, specific information about client fund protection measures, deposit insurance schemes, segregated account arrangements, or the broker's financial strength was not provided in available documentation. Details about the company's ownership structure, management team, financial statements, or any industry recognition were also absent from available materials.

The lack of information about negative balance protection, compensation schemes, or the broker's handling of any past regulatory issues represents areas where additional transparency would strengthen the trust profile. Despite these information gaps, the dual regulatory framework provides a solid foundation for client confidence.

User Experience Analysis (7/10)

BCR's user experience receives a 7 out of 10 rating, supported by a 4.0 user satisfaction score and the notable statistic that 76% of employees express willingness to recommend the platform. These metrics suggest generally positive user sentiment and internal confidence in the broker's services.

The 4.0 user rating indicates above-average satisfaction levels, though it also suggests room for improvement in various aspects of the user experience. The high employee recommendation rate of 76% provides insight into internal company culture and employee confidence in the services they provide to clients.

However, specific information about user interface design, website navigation, account management tools, or the overall digital experience was not available in reviewed materials. Modern traders expect intuitive interfaces, streamlined account opening processes, efficient fund management systems, and comprehensive online account management capabilities.

The absence of detailed information about common user complaints, specific areas of user satisfaction or dissatisfaction, and the broker's responsiveness to user feedback represents a significant gap in understanding the complete user experience picture. Information about onboarding processes, educational support for new users, and user retention rates would also contribute to a more comprehensive user experience assessment.

The broker's target audience of traders seeking diversified CFD investment opportunities suggests a focus on providing access to multiple asset classes, which aligns with the comprehensive instrument offering across currencies, cryptocurrencies, indices, metals, energies, soft commodities, and stocks.

Conclusion

This comprehensive BCR review reveals a broker that demonstrates solid fundamentals across multiple evaluation criteria, earning respect for its competitive trading conditions and responsive customer service. BCR's dual regulatory framework under ASIC and BVIFSC provides a strong foundation for client trust, while the competitive spreads and low commissions structure addresses one of traders' primary concerns - cost-effective market access.

The broker appears particularly well-suited for traders seeking diversified investment opportunities across multiple asset classes through CFD trading. BCR's offering of currencies, cryptocurrencies, indices, precious metals, energies, soft commodities, and stocks provides comprehensive market exposure that can accommodate various trading strategies and portfolio diversification needs.

The primary strengths identified include robust regulatory oversight, competitive pricing structures, reliable MetaTrader 4 platform provision, and notably strong customer service performance. However, this evaluation also reveals significant information gaps regarding specific account features, educational resources, detailed cost structures, and comprehensive platform capabilities that prospective clients should investigate directly with the broker before making trading decisions.