VSTar 2025 Review: Everything You Need to Know

Executive Summary

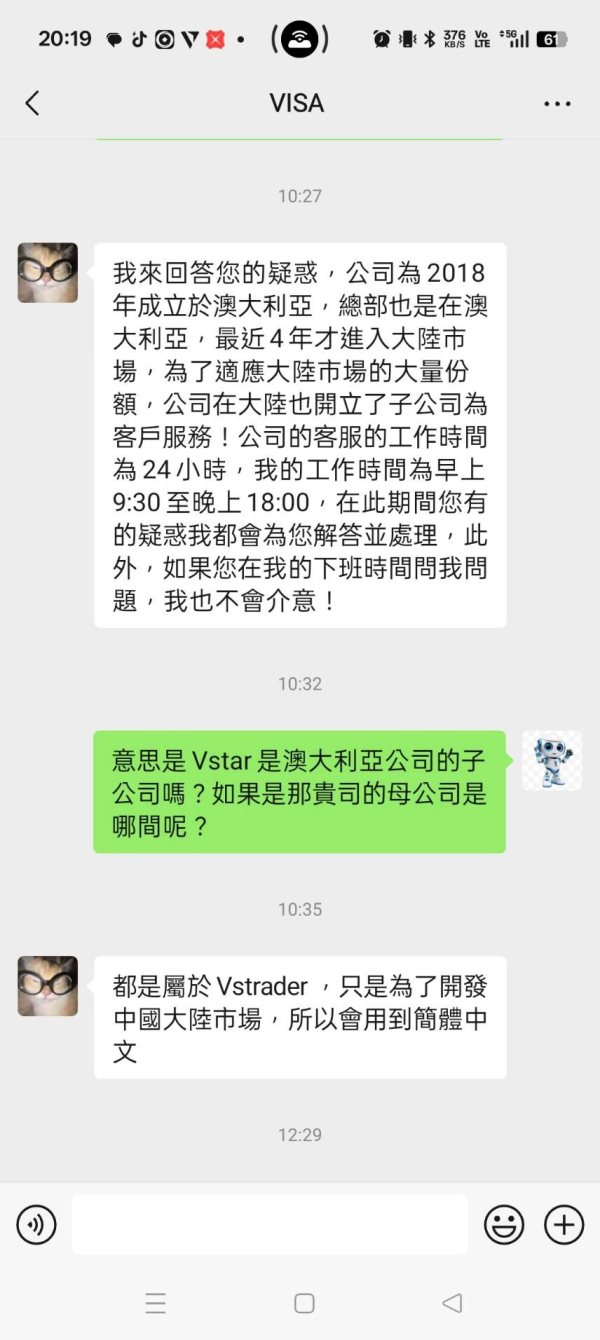

VSTar operates as VSTar Limited. It presents itself as a multi-asset broker offering trading services across various financial instruments, making it accessible to traders with different needs and experience levels. Based on available information, this vstar review reveals a platform that provides access to forex, CFDs, stocks, indices, commodities, and cryptocurrencies through the MetaTrader 5 platform. The broker operates under the regulation of the Mauritius Financial Services Commission with license number GB21026599. This positions it as a regulated entity in the offshore jurisdiction.

According to TraderKnows data, VSTar holds a user rating of 3.76 out of 10. This suggests mixed user experiences and highlights areas for potential improvement that traders should consider before choosing this platform. The platform appears to target traders seeking diversified investment opportunities across multiple asset classes. However, the limited availability of detailed information regarding trading conditions, account specifications, and comprehensive user feedback presents challenges for thorough evaluation that could help potential clients make informed decisions. This neutral assessment reflects the current state of available data and the need for more transparency in the broker's operations and service offerings.

Important Notice

This vstar review is based on information available from regulatory sources and user feedback platforms as of 2025. VSTar operates under the regulation of the Mauritius Financial Services Commission, which may not provide the same level of investor protection as tier-one regulatory jurisdictions that offer stronger safeguards for traders. Potential clients should be aware that regulatory standards and client protections may vary significantly based on their country of residence and the applicable regulatory framework.

The evaluation presented in this review is compiled from publicly available information, user ratings, and regulatory data. Traders are strongly advised to conduct their own due diligence and consider their specific trading needs, risk tolerance, and regulatory requirements before engaging with any broker, especially when dealing with offshore entities. The offshore regulatory status may impact the availability of services for clients from certain jurisdictions.

Rating Framework

Broker Overview

VSTar Limited operates as a multi-asset brokerage firm headquartered in Mauritius. It provides trading services under the regulatory oversight of the Mauritius Financial Services Commission, which gives it legal authority to offer financial services to international clients. The company positions itself as a comprehensive trading solutions provider, offering access to global financial markets through established trading infrastructure. While specific founding details are not readily available in current documentation, the broker has established its presence in the competitive online trading landscape by focusing on multi-asset trading capabilities that appeal to diverse trader preferences.

The business model centers around providing execution services across diverse asset classes. This enables traders to access forex markets, contract for differences (CFDs), equity markets, major indices, commodity markets, and cryptocurrency trading opportunities from a single platform. VSTar utilizes the MetaTrader 5 platform as its primary trading interface, leveraging this industry-standard software to deliver trading functionality to its client base. The regulatory framework provided by the Mauritius Financial Services Commission offers a structured operational environment, though traders should understand the implications of offshore regulation compared to tier-one regulatory jurisdictions that typically offer stronger consumer protections.

Regulatory Jurisdiction: VSTar operates under the supervision of the Mauritius Financial Services Commission. It holds license number GB21026599, which provides verification of its authorized status within the regulatory framework. This offshore regulatory framework provides operational legitimacy while maintaining competitive business conditions.

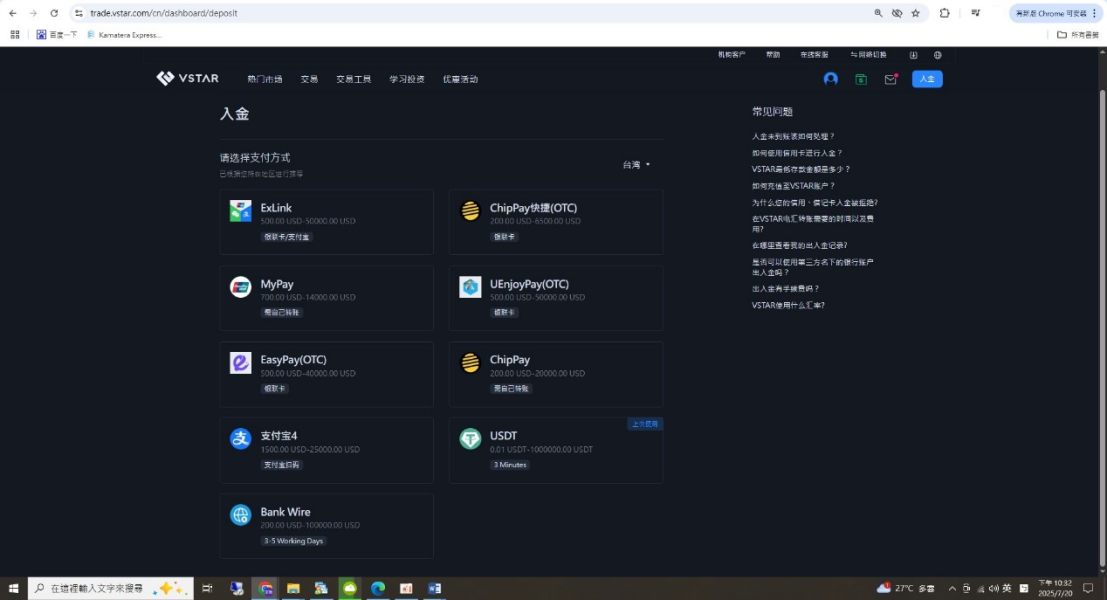

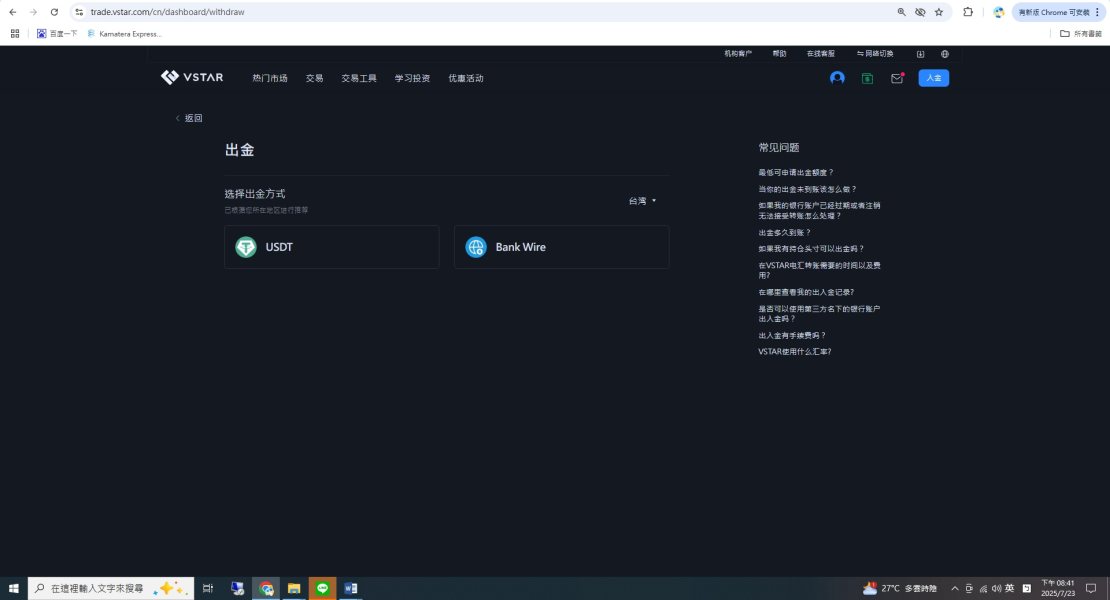

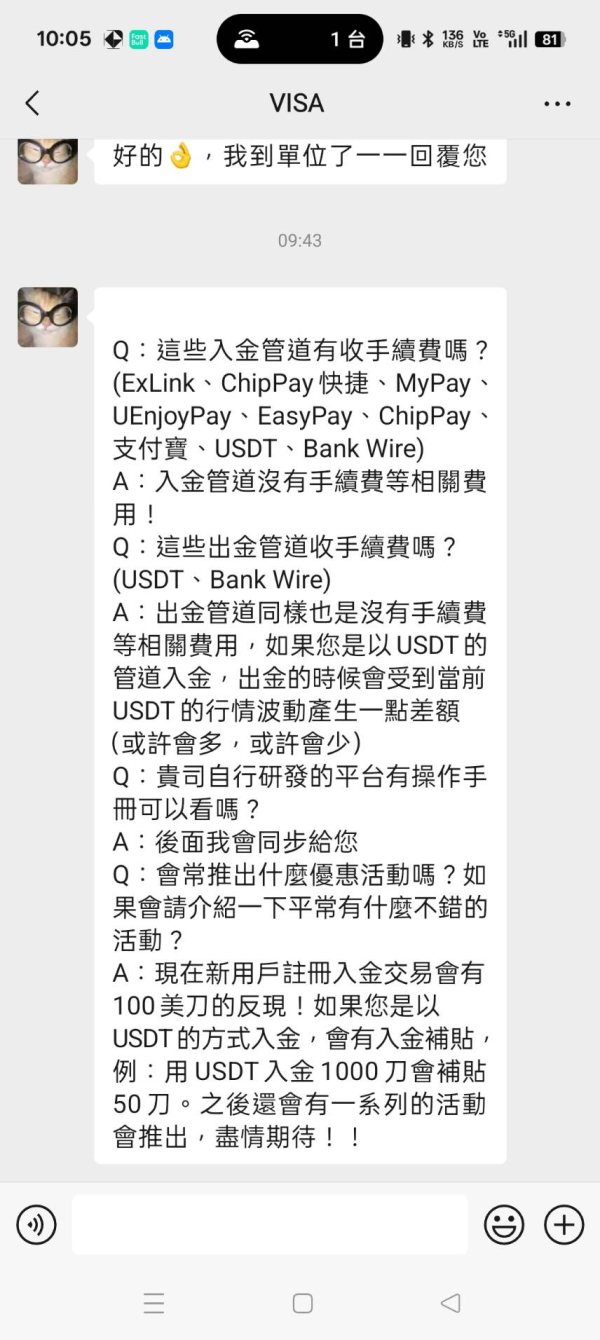

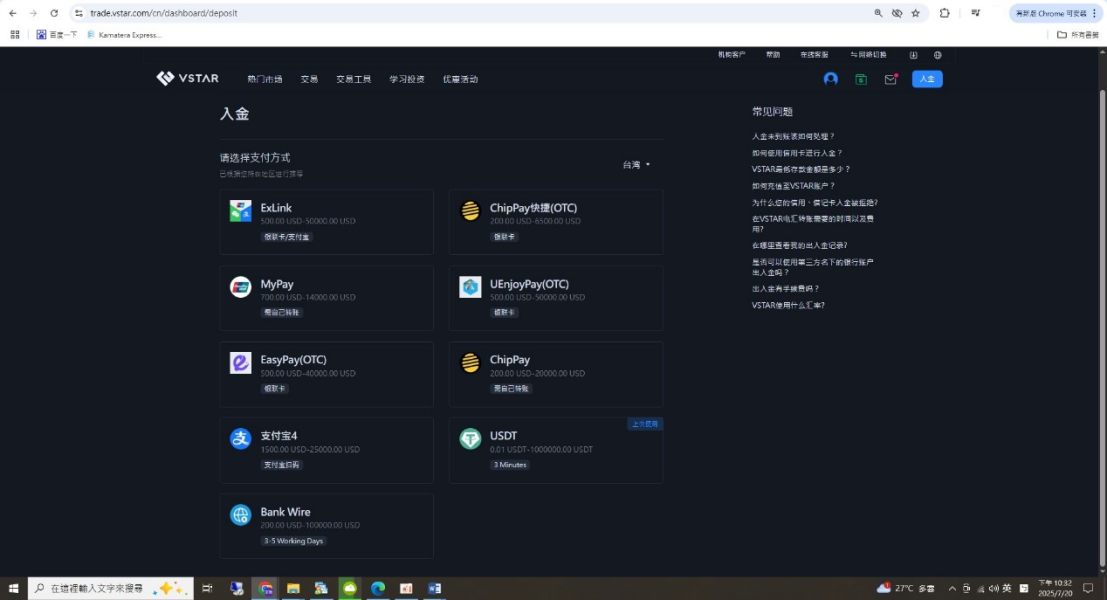

Deposit and Withdrawal Methods: Specific information regarding payment processing options, supported currencies, and transaction procedures is not detailed in available sources. This requires direct inquiry with the broker for comprehensive payment method information that could affect your trading decisions.

Minimum Deposit Requirements: Current documentation does not specify minimum deposit thresholds for different account types. This suggests potential flexibility or the need for direct consultation with the broker's account opening team to understand entry requirements.

Promotional Offerings: Available sources do not detail specific bonus structures, promotional campaigns, or incentive programs that may be available to new or existing clients.

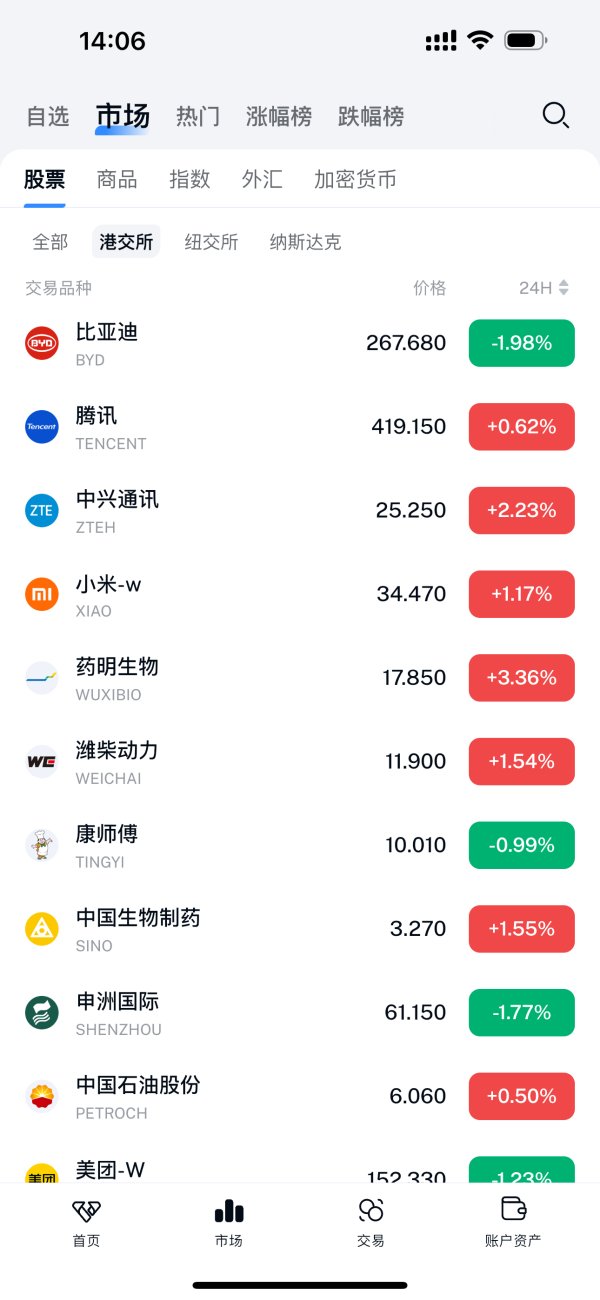

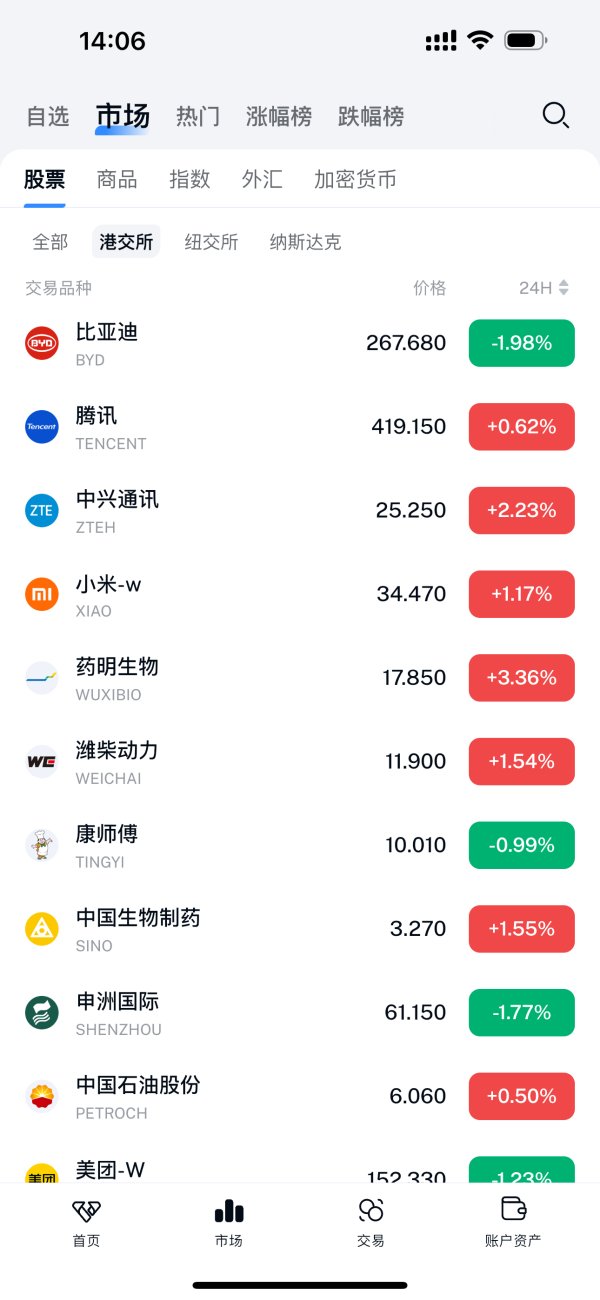

Tradeable Assets: The platform provides access to foreign exchange (forex) pairs, contracts for difference (CFDs) across multiple underlying assets, individual stock trading opportunities, major global indices, commodity markets including precious metals and energy products, and cryptocurrency trading options. This wide range of assets allows traders to diversify their portfolios according to their risk tolerance and market outlook.

Cost Structure: Detailed information regarding spreads, commission rates, overnight financing charges, and additional fees is not comprehensively outlined in current sources. This necessitates direct verification with the broker for accurate cost analysis that could significantly impact your trading profitability.

Leverage Ratios: Specific leverage offerings for different asset classes and account types are not detailed in available documentation.

Platform Options: VSTar provides trading services through the MetaTrader 5 platform. This offers advanced charting capabilities, automated trading support, and comprehensive market analysis tools that professional traders typically require.

Geographic Restrictions: Current sources do not specify regional limitations or restricted territories for service provision.

Customer Support Languages: Available documentation does not detail the range of languages supported by the customer service team.

Detailed Rating Analysis

Account Conditions Analysis (Rating: N/A)

The evaluation of VSTar's account conditions faces significant limitations. This occurs due to insufficient publicly available information regarding account structures, minimum deposit requirements, and specific account features that traders need to make informed decisions. This vstar review cannot provide a comprehensive assessment of account types, tier structures, or specialized account offerings such as Islamic accounts without access to detailed account specifications.

The absence of clear information regarding account opening procedures, verification requirements, and account management features presents challenges for potential clients. They need to understand the onboarding process before committing to any trading relationship with the broker. Professional traders and institutional clients would typically require detailed information about account conditions, including minimum balance requirements, trading volume commitments, and any associated benefits or restrictions.

Without specific details about account conditions, traders cannot adequately compare VSTar's offerings with industry standards or competitor services. This information gap highlights the need for greater transparency in the broker's public documentation and marketing materials that could help potential clients make better choices. Potential clients are advised to contact VSTar directly to obtain comprehensive account condition details before making trading decisions.

The lack of available information regarding account conditions significantly impacts the ability to provide a meaningful rating in this category. This results in an incomplete assessment that requires further investigation through direct broker communication.

VSTar demonstrates strong capabilities in the tools and resources category. This strength comes primarily through its implementation of the MetaTrader 5 platform, which is widely recognized as an industry standard. This industry-standard trading software provides traders with advanced charting capabilities, technical analysis tools, automated trading support through Expert Advisors (EAs), and comprehensive market monitoring features. The MT5 platform's robust architecture supports multi-asset trading across the diverse range of instruments offered by VSTar.

The multi-asset trading capability represents a significant strength. It allows traders to diversify their portfolios across forex, CFDs, stocks, indices, commodities, and cryptocurrencies from a single platform, which simplifies portfolio management. This comprehensive asset coverage provides flexibility for traders implementing various trading strategies and risk management approaches. The platform's advanced order management system and execution capabilities support both manual and automated trading approaches.

However, available sources do not provide detailed information about additional research resources, market analysis tools, educational materials, or proprietary trading tools. These resources could enhance the trading experience and help traders make better-informed decisions. The absence of information regarding third-party integrations, advanced analytics, or specialized trading tools limits the complete evaluation of the broker's resource offerings.

Despite these information limitations, the confirmed MetaTrader 5 implementation and multi-asset trading capabilities justify a strong rating in this category. However, comprehensive evaluation would benefit from additional details about supplementary tools and resources.

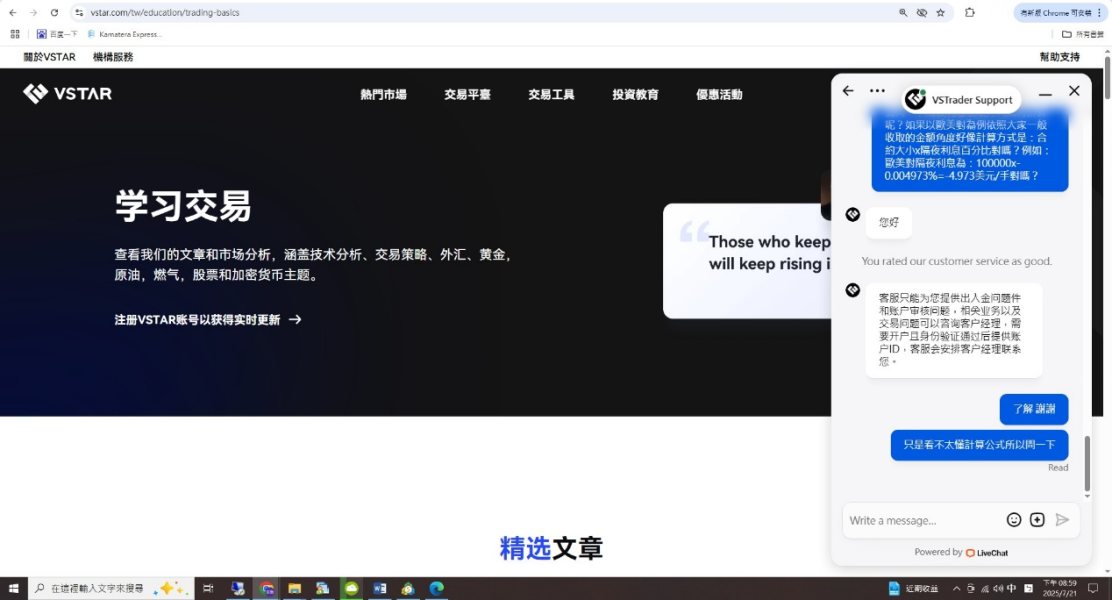

Customer Service and Support Analysis (Rating: N/A)

The assessment of VSTar's customer service and support capabilities cannot be completed. This limitation exists due to the lack of specific information regarding support channels, availability hours, response times, and service quality metrics that are essential for proper evaluation. This vstar review requires comprehensive data about customer service infrastructure to provide meaningful evaluation, including details about live chat availability, telephone support, email response procedures, and multi-language capabilities.

Professional trading environments demand reliable customer support. This becomes particularly important during market hours when technical issues or account inquiries require immediate attention to prevent potential losses. The absence of publicly available information regarding support team qualifications, escalation procedures, and problem resolution timeframes presents significant evaluation challenges.

User experience in customer service often serves as a crucial differentiator among brokers. It influences client satisfaction and retention rates, which can indicate the overall quality of the broker's operations. Without access to specific user feedback regarding support interactions, response quality, and issue resolution effectiveness, this review cannot provide adequate assessment of VSTar's customer service standards.

The information gap in customer service details highlights the need for greater transparency in broker operations. It suggests that potential clients should directly evaluate support quality through preliminary interactions before committing to trading relationships.

Trading Experience Analysis (Rating: N/A)

Evaluating VSTar's trading experience requires detailed information about platform performance, execution quality, order processing speed, and overall trading environment stability. The available sources do not provide sufficient user feedback or technical performance data to assess the practical trading experience offered by the broker's infrastructure, which makes it impossible to give a fair rating.

Critical trading experience factors include order execution speed, slippage rates, platform uptime, mobile trading capabilities, and overall system reliability during high-volatility market conditions. The vstar review cannot adequately address these essential elements without access to user testimonials, performance benchmarks, or independent testing results that would provide objective measures of performance.

The MetaTrader 5 platform implementation suggests professional-grade trading capabilities. However, the actual performance depends on the broker's infrastructure, server locations, liquidity providers, and technical implementation quality, all of which can vary significantly between brokers. These operational factors significantly impact the real-world trading experience but remain unaddressed in available documentation.

Mobile trading experience, platform customization options, and advanced trading features represent additional evaluation criteria. These require specific information about VSTar's implementation and user interface design to properly assess their effectiveness for different types of traders.

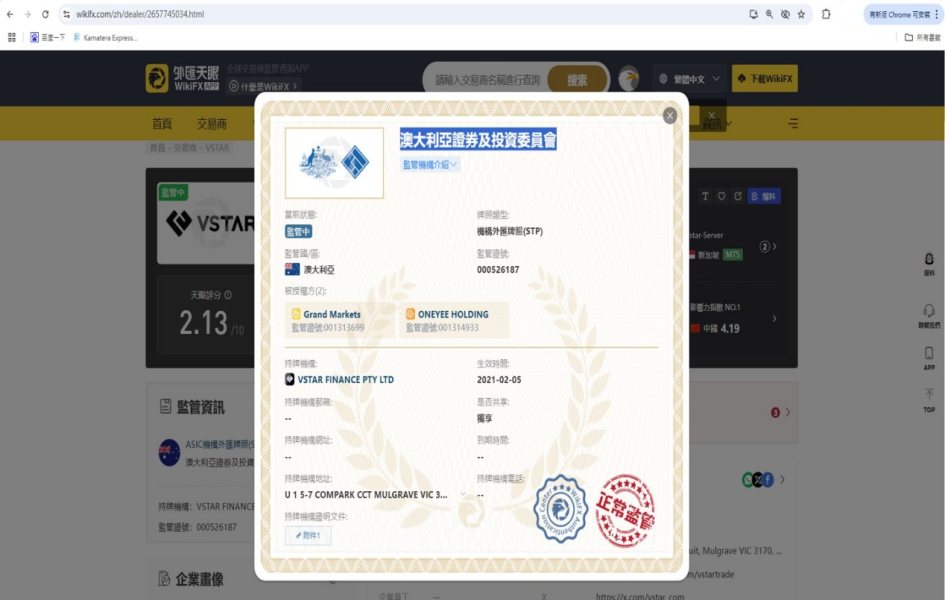

Trust and Regulation Analysis (Rating: 7/10)

VSTar's regulatory status under the Mauritius Financial Services Commission provides a foundation for operational legitimacy and regulatory compliance. The license number GB21026599 offers verification of the broker's authorized status within the Mauritian regulatory framework, providing some level of regulatory oversight and compliance requirements that traders can rely on.

However, the Mauritius regulatory jurisdiction represents an offshore regulatory environment. It may not provide the same level of investor protection, compensation schemes, or regulatory stringency as tier-one jurisdictions such as the UK's FCA, Australia's ASIC, or the United States' regulatory framework, which offer more comprehensive safeguards. Traders should understand these regulatory differences when evaluating counterparty risk and investor protection levels.

The TraderKnows user rating of 3.76 suggests mixed user experiences and potential trust concerns that warrant careful consideration. This relatively low user rating may indicate issues with service delivery, platform performance, or client relationship management that could impact overall trust levels and client satisfaction.

The absence of detailed information regarding client fund segregation, insurance coverage, compensation schemes, or additional regulatory registrations limits the comprehensive evaluation of trust factors. While the regulatory status provides basic legitimacy, the overall trust assessment requires consideration of both regulatory framework limitations and user experience indicators that may reveal operational issues.

User Experience Analysis (Rating: 3.76/10)

The user experience rating of 3.76 from TraderKnows indicates significant room for improvement in VSTar's service delivery and client satisfaction levels. This below-average rating suggests that users have encountered challenges or limitations in their interactions with the broker's services, though specific details about user complaints or satisfaction drivers are not available in current sources to identify particular problem areas.

User experience encompasses multiple factors including platform usability, account management processes, customer service interactions, deposit and withdrawal procedures, and overall service reliability. The relatively low rating indicates potential issues in one or more of these critical areas that impact client satisfaction and retention, which could affect your trading success.

The absence of detailed user feedback analysis prevents identification of specific improvement areas. It also prevents understanding of the primary factors contributing to the modest user rating, which would help potential clients make more informed decisions. Professional traders typically prioritize reliable execution, responsive customer service, and transparent business practices, and deficiencies in these areas could explain the user experience challenges.

The multi-asset trading capability and MetaTrader 5 platform implementation provide positive user experience elements. However, the overall rating suggests that operational execution or service delivery may not meet user expectations, creating a disconnect between technical capabilities and actual service quality. This disconnect between platform capabilities and user satisfaction warrants careful evaluation by potential clients considering VSTar's services.

Conclusion

This comprehensive vstar review reveals a broker with established regulatory credentials and multi-asset trading capabilities. However, it also shows significant information gaps that limit thorough evaluation and may concern potential clients seeking transparency. VSTar's regulation by the Mauritius Financial Services Commission provides operational legitimacy, while the MetaTrader 5 platform and diverse asset offerings demonstrate technical capabilities for serious trading activities.

However, the 3.76 user rating from TraderKnows and the lack of detailed information regarding trading conditions, customer service, and operational specifics raise important considerations. These factors should be carefully weighed by potential clients before making any commitment to trade with this broker. The broker appears suitable for traders seeking diversified investment opportunities across multiple asset classes, particularly those comfortable with offshore regulatory frameworks.

The primary advantages include regulatory oversight, multi-asset trading access, and professional-grade platform implementation. The main limitations involve insufficient transparency regarding trading conditions, limited user experience data, and the offshore regulatory jurisdiction's inherent limitations compared to tier-one regulatory environments that offer stronger consumer protections.