Sucden 2025 Review: Everything You Need to Know

Summary: Sucden Financial, a well-established broker since 1973, has garnered mixed reviews from users and experts alike. While it offers a robust trading platform with a wide range of available assets and regulatory oversight from notable authorities, many users have reported challenges with customer support and a lack of educational resources.

Note: It's important to recognize that Sucden operates through different entities across various regions, which can impact user experience and regulatory compliance. Our analysis aims for fairness and accuracy by considering these factors.

Rating Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert reviews, and factual data regarding broker offerings.

Broker Overview

Founded in 1973, Sucden Financial has established itself as a prominent player in the forex and derivatives trading landscape. Headquartered in London, the broker operates under the regulatory supervision of the Financial Conduct Authority (FCA) in the UK, the National Futures Association (NFA) in the USA, and the Securities and Futures Commission (SFC) in Hong Kong. This multi-regulatory framework enhances its credibility and provides a layer of security for traders.

Sucden offers a variety of trading platforms, including proprietary solutions and well-regarded platforms like MT4 and MT5. The broker provides access to a broad spectrum of assets, including forex, commodities, and precious metals, catering primarily to institutional clients rather than individual retail traders.

Detailed Analysis

Regulatory Regions

Sucden Financial is regulated in several jurisdictions, including the UK, USA, and Hong Kong, which allows it to provide cross-border trading solutions. However, it does not accept clients from certain regions, including the United States, which may limit its accessibility for some traders.

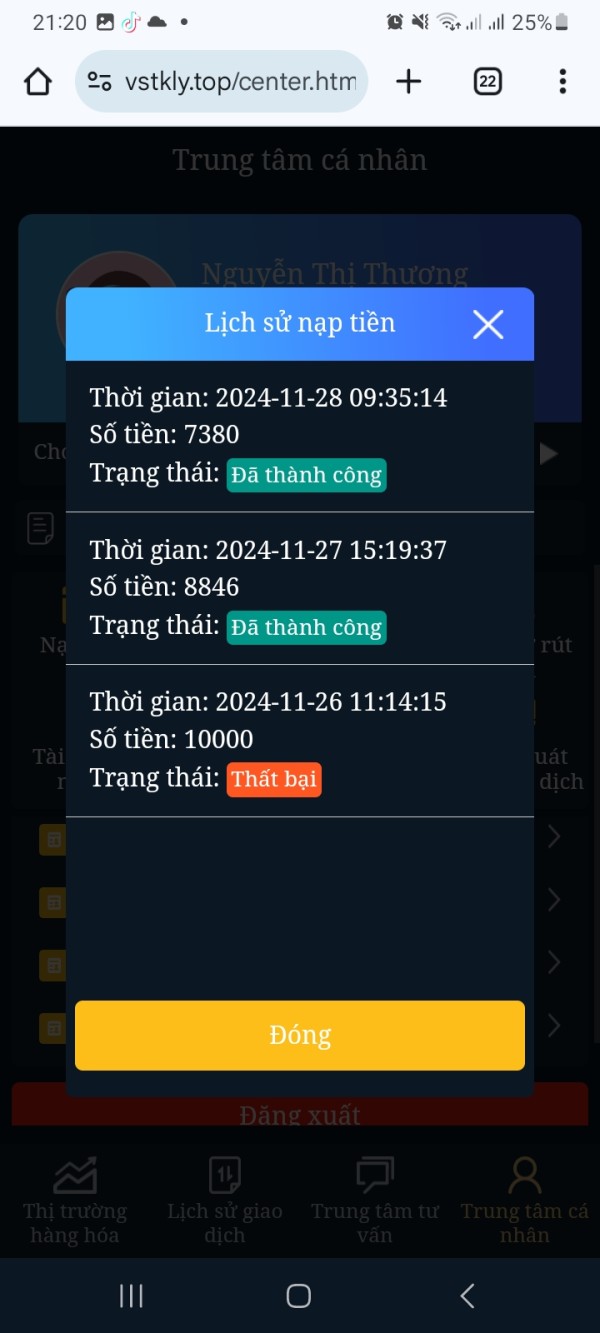

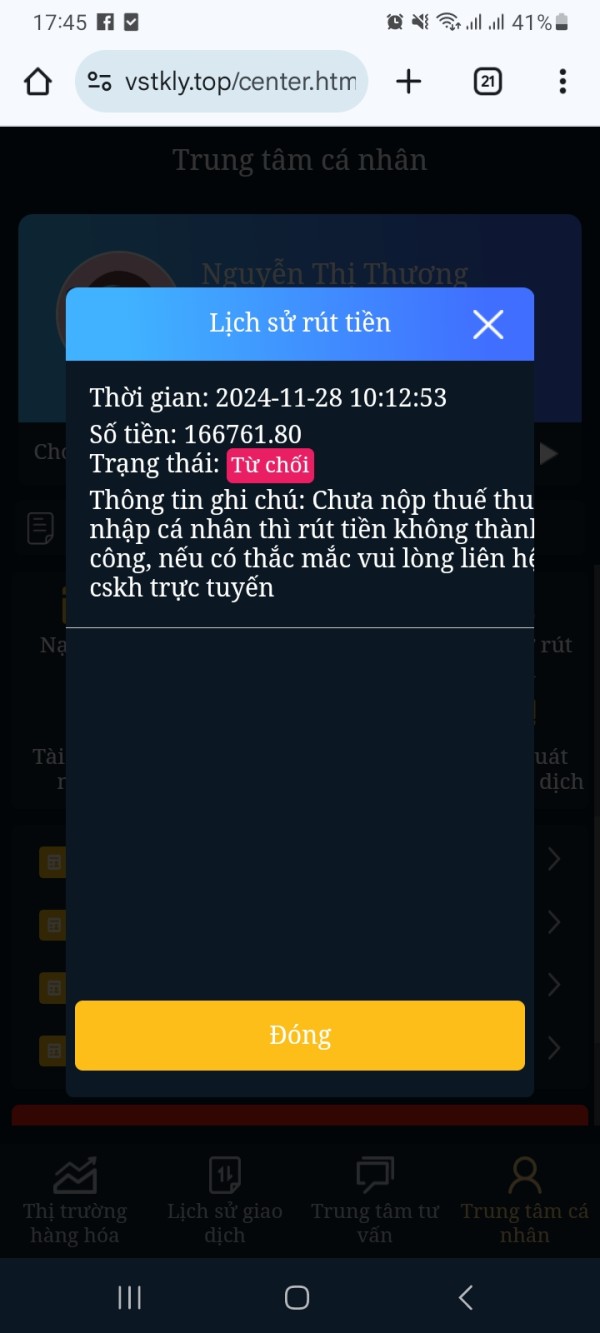

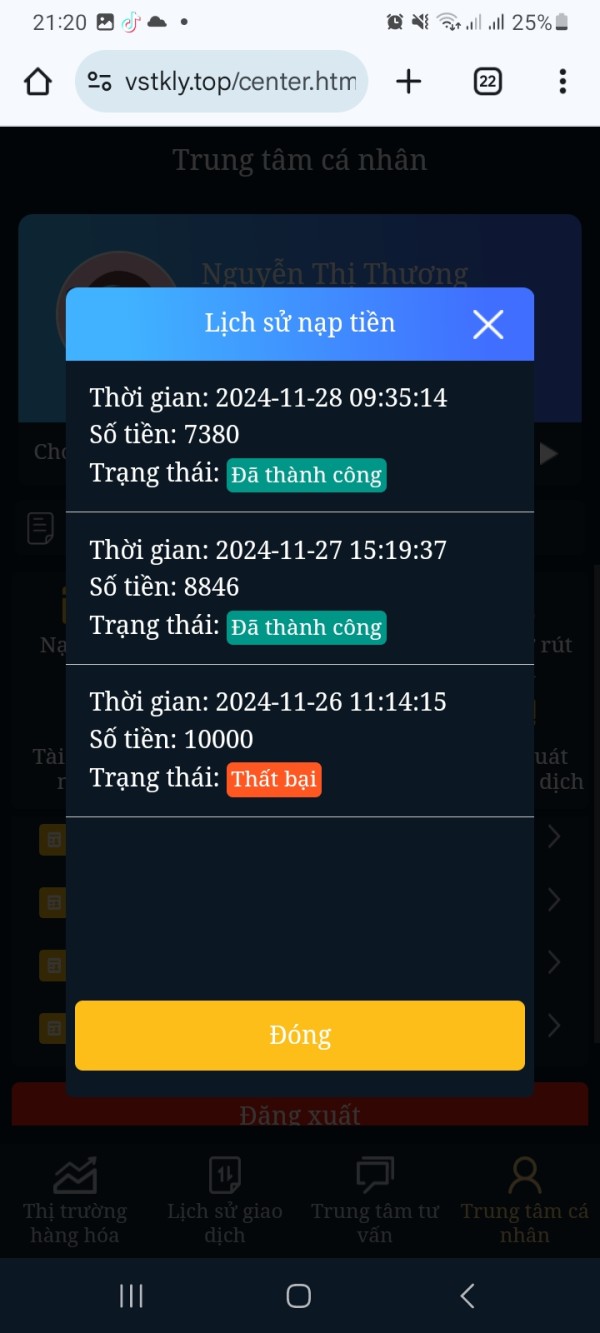

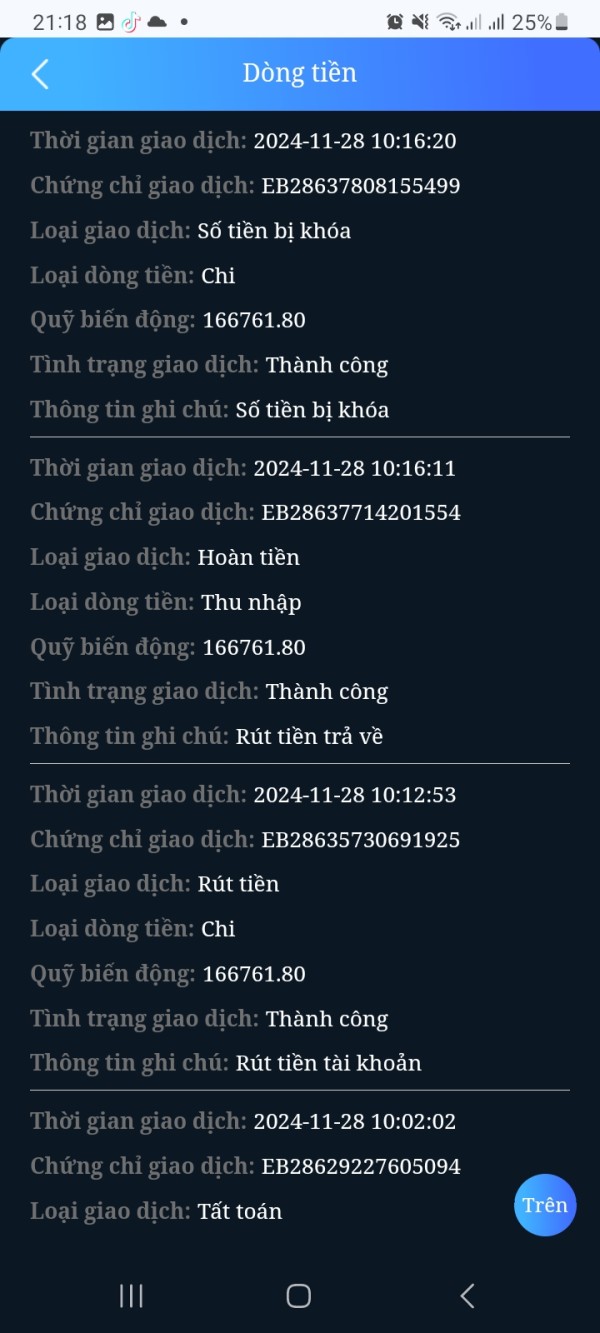

Deposit/Withdrawal Currencies and Cryptocurrencies

The broker predominantly operates in major currencies such as USD, GBP, and EUR. Sucden does not currently support cryptocurrency trading, which may deter traders looking to diversify their portfolios.

Minimum Deposit

One of the appealing features of Sucden is its low minimum deposit requirement, which is often cited as $0, making it accessible for institutional clients to start trading without a hefty initial investment.

Currently, Sucden does not offer any bonuses or promotional incentives, which is common among brokers focusing on institutional clients. This could be a downside for retail traders seeking additional value.

Tradable Asset Classes

Sucden provides a comprehensive range of trading instruments, including over 120 forex pairs, commodities, and precious metals. However, it lacks offerings in the cryptocurrency space, which is increasingly popular among traders.

Costs (Spreads, Fees, Commissions)

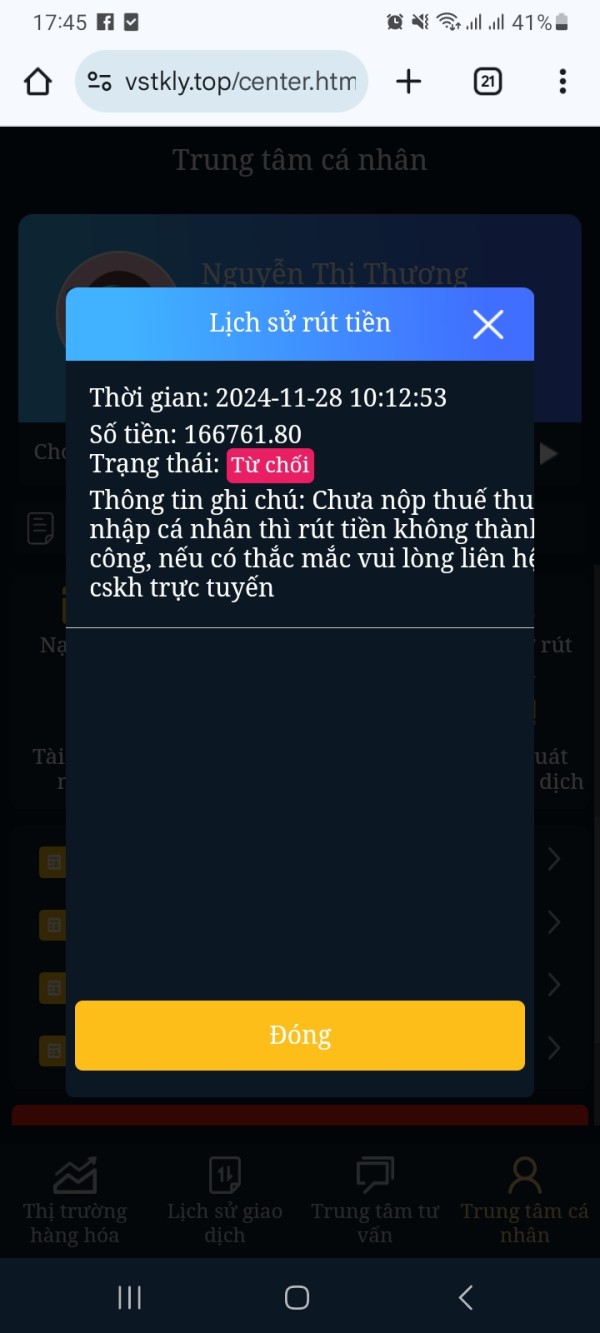

The broker's costs are competitive, with average spreads around 1 pip for major currency pairs. Sucden operates on a commission basis, which may vary depending on the trading conditions and asset class. Users should be aware of potential fees associated with withdrawals and inactivity.

Leverage

Leverage options vary depending on the regulatory entity, with UK clients typically offered leverage up to 1:30 for major currency pairs. This conservative approach is in line with FCA regulations, aiming to protect traders from excessive risk.

Sucden supports various trading platforms, including its proprietary platform, CQG, and popular options like MT4 and MT5. This flexibility allows traders to choose a platform that best suits their trading style.

Restricted Regions

While Sucden is available in many countries, it does not accept clients from the USA and several other jurisdictions, which could limit its market reach.

Available Customer Support Languages

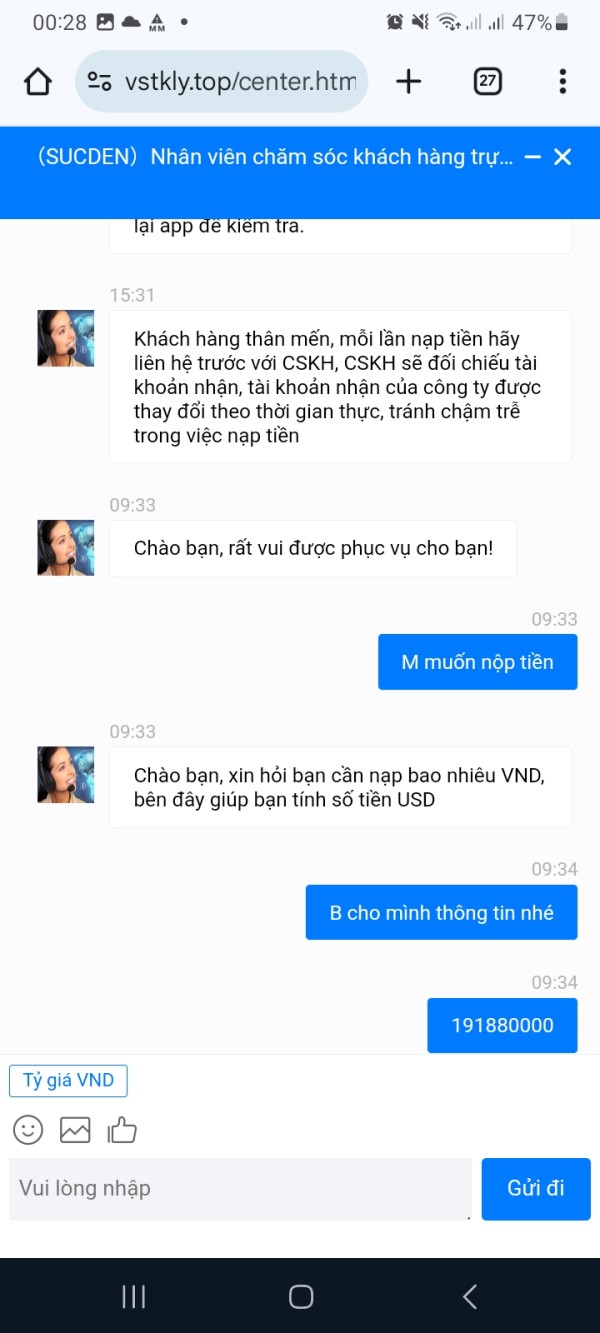

Customer support at Sucden is available in multiple languages, including English, Chinese, and Russian. However, users have reported challenges with response times and the overall effectiveness of customer support.

Repeated Rating Overview

Detailed Breakdown

Account Conditions

Sucden offers a straightforward account opening process, primarily targeting institutional clients. This focus on corporate accounts may not cater to individual traders, limiting its appeal.

While Sucden provides a range of trading tools, the lack of educational resources can be a drawback for new traders. Expert insights and market analysis are available, but they may not be sufficient for beginners.

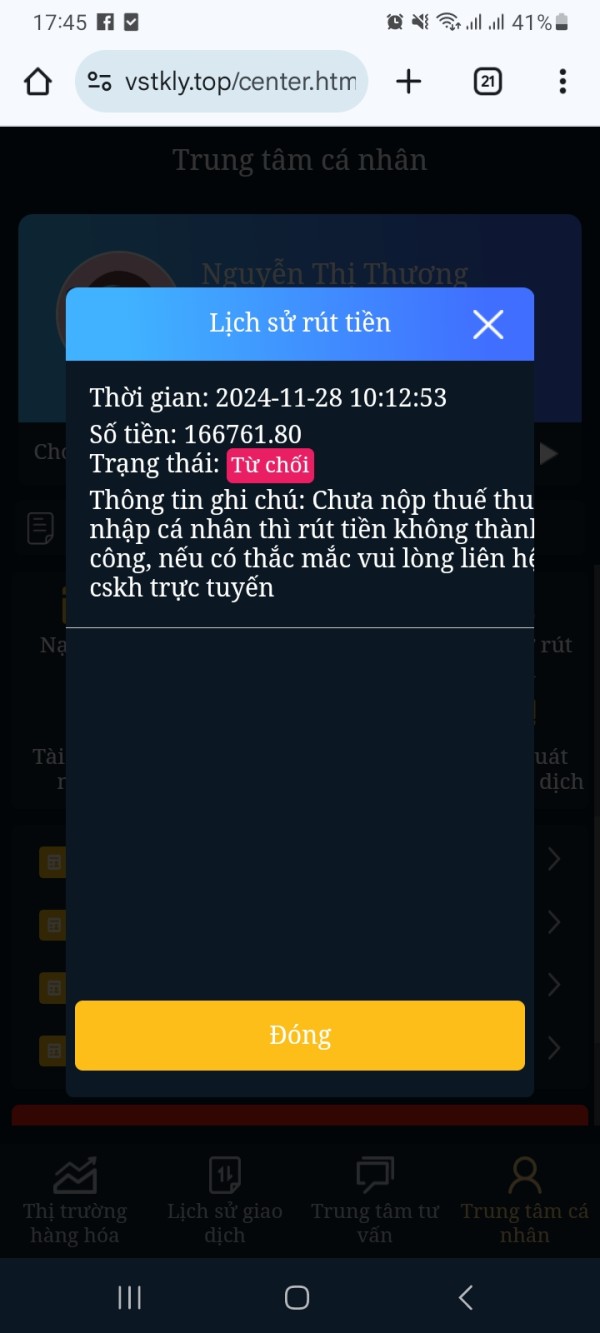

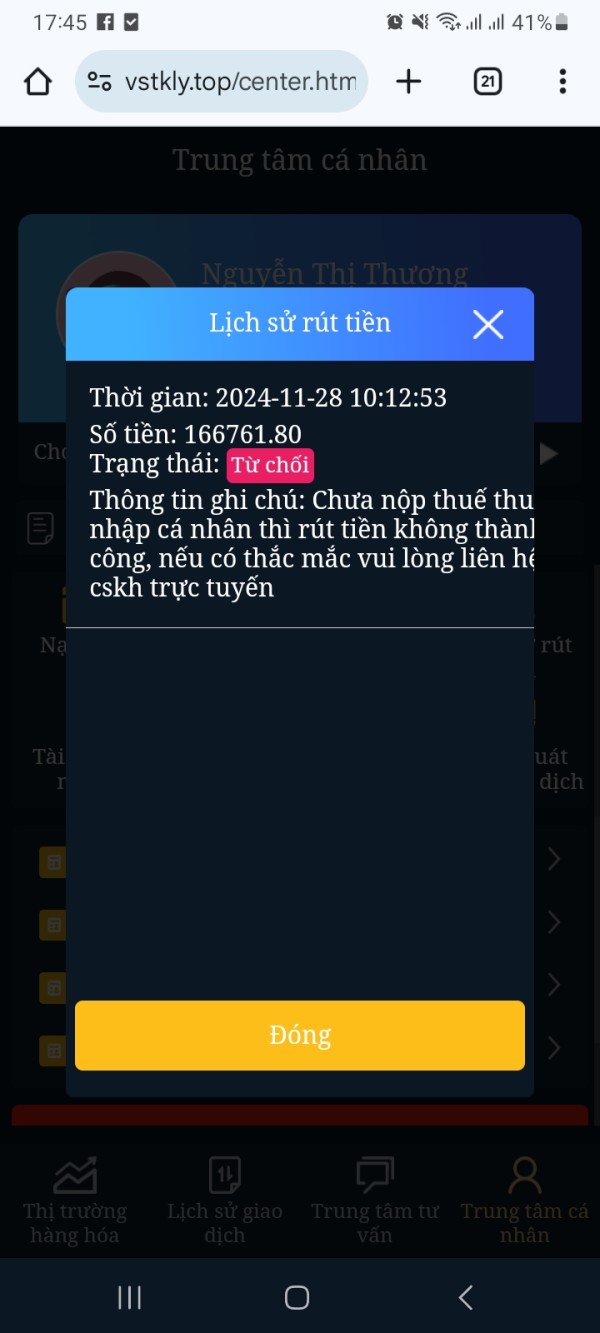

Customer Service & Support

Customer service has received mixed reviews, with some users reporting long wait times and unhelpful responses. The absence of 24/7 support can be a significant limitation for traders operating in different time zones.

Trading Setup (Experience)

The trading experience on Sucden's platforms is generally positive, with users appreciating the speed and reliability of trade execution. However, the complexity of the platforms may pose a learning curve for inexperienced traders.

Trustworthiness

Sucden's regulatory oversight by reputable authorities like the FCA enhances its trustworthiness. However, some concerns have been raised regarding its NFA status in the USA, which is marked as "unauthorized," warranting caution.

User Experience

Overall, user experiences are varied, with many appreciating the broker's offerings but expressing concerns about customer support and educational resources. The lack of a demo account can also hinder the onboarding process for new traders.

Additional Features

Sucden's focus on institutional clients means it lacks some features that retail traders may expect, such as bonuses or promotional offers. However, its strong market presence and regulatory compliance are notable strengths.

In conclusion, the Sucden review indicates that while the broker has a solid foundation and offers a range of trading options, potential clients should carefully consider their trading needs and expectations before engaging with Sucden Financial.