Regarding the legitimacy of Sucden forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Sucden safe?

Pros

Cons

Is Sucden markets regulated?

The regulatory license is the strongest proof.

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Sucden Financial Limited

Effective Date:

2001-12-01Email Address of Licensed Institution:

compliance@sucfin.comSharing Status:

No SharingWebsite of Licensed Institution:

www.sucdenfinancial.comExpiration Time:

--Address of Licensed Institution:

3rd Floor Plantation Place South 60 Great Tower Street London EC3R 5AZ UNITED KINGDOMPhone Number of Licensed Institution:

+4402032075000Licensed Institution Certified Documents:

Is Sucden Financial A Scam?

Introduction

Sucden Financial, established in 1973, positions itself as a reputable brokerage firm in the forex market, primarily catering to institutional and corporate clients. With over 50 years of experience, Sucden Financial offers a range of trading services including forex, commodities, and derivatives. However, as the online trading landscape grows increasingly complex, it is crucial for traders to carefully evaluate the legitimacy of brokers like Sucden Financial. The importance of due diligence cannot be overstated; a broker's regulatory status, financial practices, and customer feedback are essential indicators of its reliability. This article employs a comprehensive investigation approach, utilizing data from various sources to assess whether Sucden Financial is safe or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy and safety for traders. Sucden Financial is regulated by several authorities, which is generally a positive sign for potential clients. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 114239 | United Kingdom | Verified |

| National Futures Association (NFA) | 0403214 | United States | Unauthorized |

| Securities and Futures Commission (SFC) | AOK 518 | Hong Kong | Verified |

The FCA is a highly respected regulatory body in the UK, known for its stringent oversight of financial institutions. Sucden Financial's compliance with FCA regulations provides a level of assurance regarding its operational integrity. However, the NFA's designation of Sucden as "unauthorized" raises red flags and necessitates caution. This discrepancy highlights the importance of understanding the jurisdictional scope of a broker's regulatory compliance. Overall, while Sucden Financial is regulated in the UK and Hong Kong, its lack of authorization in the US could pose risks for American traders, suggesting that potential clients should carefully consider their trading locations and regulatory protections.

Company Background Investigation

Sucden Financial has a long-standing history, having been established in 1973. It operates as a subsidiary of the Sucden Group, which has a strong presence in the commodities and financial trading sectors. The firm's ownership structure and corporate governance are transparent, with a focus on serving institutional clients. The management team comprises experienced professionals with backgrounds in finance and trading, which contributes to the firm's credibility.

The company's transparency is reflected in its operational practices and the availability of information regarding its services. However, the absence of a dedicated educational section on its website may deter novice traders seeking guidance. This lack of educational resources could indicate a focus on institutional clients rather than retail traders. Overall, Sucden Financial's long history and operational transparency suggest that it is a legitimate brokerage, but potential clients should remain vigilant regarding its regulatory standing.

Trading Conditions Analysis

The trading conditions offered by Sucden Financial are essential for evaluating its overall value proposition. The firm employs a fee structure that includes spreads and commissions, which can vary based on the trading instruments and account types. A detailed overview of its fee structure is presented below:

| Fee Type | Sucden Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 1.2 pips |

| Commission Model | Varies by account | Varies by broker |

| Overnight Interest Range | Competitive | Competitive |

Sucden Financial's spreads for major currency pairs are competitive, particularly for an institutional broker. However, traders should be aware of any additional fees that may apply, such as withdrawal or inactivity fees. The absence of a minimum deposit requirement is appealing, but the potential for hidden costs necessitates a thorough understanding of the fee structure before engaging in trading activities.

Client Fund Security

The safety of client funds is paramount when assessing the credibility of a brokerage. Sucden Financial implements several measures to ensure the security of its clients' investments. Client funds are held in segregated accounts, which are separate from the company's operational funds, providing an additional layer of protection. Furthermore, Sucden Financial partners with tier-1 banks to enhance the security of client deposits.

The firm also adheres to strict regulatory guidelines, which include provisions for investor protection and risk management. While there have been no significant historical disputes regarding fund safety, it is crucial for potential clients to remain informed about the security measures in place. Overall, Sucden Financial appears to prioritize client fund security, but traders should always exercise caution and conduct their own due diligence.

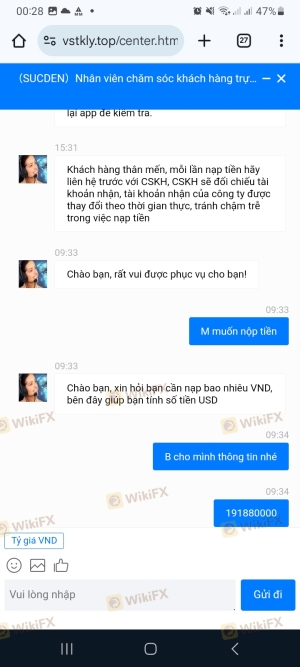

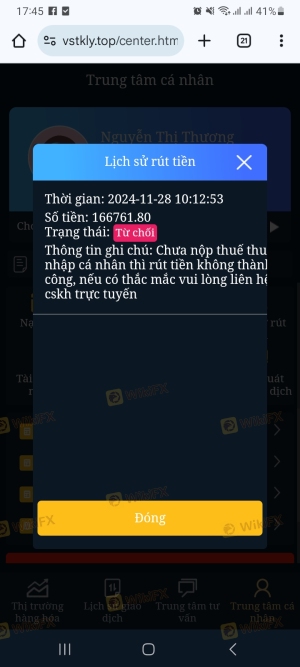

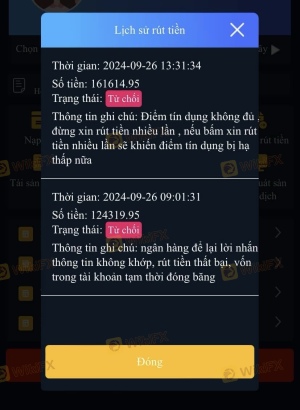

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. Reviews of Sucden Financial reveal a mix of positive and negative experiences among clients. Common complaints include issues related to customer service response times and the clarity of fee structures. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Customer Service Delays | Medium | Addressed within 24 hours |

| Fee Transparency Issues | High | Ongoing discussions |

| Withdrawal Processing Times | Medium | Generally prompt |

A few notable cases highlight the challenges faced by clients. For instance, some users reported prolonged delays in fund withdrawals, which can be concerning for traders needing timely access to their capital. However, Sucden Financial typically addresses these concerns promptly, indicating a willingness to improve customer relations. Overall, while customer feedback is mixed, the company's responsiveness to complaints suggests a commitment to enhancing the client experience.

Platform and Execution

The performance of a trading platform is crucial for a broker's credibility. Sucden Financial offers a variety of trading platforms, including its proprietary Star platform and popular options like MetaTrader 4. These platforms are designed to provide a seamless trading experience, with features such as advanced charting tools and risk management options.

However, some users have reported issues with order execution quality, including slippage and rejections. The potential for platform manipulation is a concern, particularly in volatile market conditions. Traders should be aware of these risks and monitor their experiences closely. Overall, while Sucden Financial's platforms are generally reliable, traders should remain vigilant regarding execution quality.

Risk Assessment

Engaging with any broker involves inherent risks, and Sucden Financial is no exception. A comprehensive risk assessment reveals several key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Concerns due to NFA status |

| Fund Security | Low | Strong measures in place |

| Customer Service | Medium | Mixed feedback on responsiveness |

| Platform Stability | Medium | Occasional execution issues |

To mitigate these risks, traders should engage in thorough research, maintain awareness of market conditions, and utilize risk management strategies such as setting stop-loss orders. Understanding the potential risks associated with trading through Sucden Financial can empower traders to make informed decisions.

Conclusion and Recommendations

In conclusion, Sucden Financial is not a scam; it operates as a regulated brokerage with a long history in the financial markets. However, potential clients should exercise caution due to its unauthorized status with the NFA and mixed customer feedback. The firm offers competitive trading conditions, robust security measures, and a range of services tailored to institutional clients.

For traders considering Sucden Financial, it is advisable to assess their individual trading needs and risk tolerance. If you are an institutional trader or an experienced professional, Sucden Financial may be a suitable choice. However, beginners or retail traders might want to explore alternative brokers with more comprehensive educational resources and customer support.

Ultimately, while Sucden Financial has established itself as a credible player in the forex market, the potential risks and regulatory concerns warrant careful consideration.

Is Sucden a scam, or is it legit?

The latest exposure and evaluation content of Sucden brokers.

Sucden Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sucden latest industry rating score is 6.70, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.70 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.