Skyline Trading 2025 Review: Everything You Need to Know

Executive Summary

Skyline Trading is a new forex broker. It says it's a leading forex broker in Dubai, but our complete skyline trading review shows a neutral rating that needs careful thought. The company started in 2024 and has its main office in Mauritius, targeting traders with some experience who want high-ratio trading chances in forex markets.

This broker has some key features that stand out. The maximum leverage goes up to 1:500, and you need at least 1,000 USD to start trading, which clearly aims at experienced traders with good money. Trustpilot shows that Skyline Trading has 46 customer reviews, though the exact rating score wasn't shown in the sources we found.

The main users are traders with some experience who want high leverage and don't mind higher entry costs. But people thinking about this broker should be careful because there's no clear regulatory information available, which really hurts how much we can trust this broker. This lack of regulatory clarity means Skyline Trading needs a lot of research before you decide to use it.

Important Notice

People thinking about trading should know that Skyline Trading doesn't show clear regulatory information right now. This missing regulatory oversight creates concerns about the legal framework and safety measures that protect client money and trading activities.

Users considering this broker should carefully check if it's legitimate and safe, especially since it operates across different countries without clear regulatory disclosure. This review uses publicly available information, user feedback from sites like Trustpilot, and broker data we could access as of 2025.

Since regulatory transparency is limited, traders should do more independent research. They should think about regulatory compliance as a main factor when choosing a broker.

Rating Framework

Broker Overview

Company Background and Market Position

Skyline Trading appeared in the forex world in 2024. It set up its main office in Mauritius while saying it's a leading forex broker that targets Dubai and the broader UAE market specifically.

The company focuses only on forex trading services and presents itself as a specialized provider for traders who want high-leverage chances in currency markets. Even though it started recently, Skyline Trading has gotten attention from traders with some experience, especially those working in the Middle Eastern trading community.

The broker's business model centers on giving forex trading access with competitive leverage ratios. However, specific details about whether they use market-making or ECN models stay unclear from available sources.

Their plan to position in both Mauritius and Dubai suggests they want to combine offshore regulatory benefits with regional market access. This dual-jurisdiction approach needs careful examination by potential clients though.

Service Offerings and Asset Coverage

Skyline Trading mainly focuses on forex trading services according to available information. Complete details about their full asset list stay limited in public sources though.

The broker seems to focus on major, minor, and possibly exotic currency pairs for traders who want diverse forex market exposure. However, specific information about other asset classes like commodities, indices, or cryptocurrencies hasn't been clearly shown in available materials.

Trading platform infrastructure and technology details weren't fully covered in accessible sources. This leaves questions about the specific trading platforms offered, execution technology, and advanced trading tools.

This information gap represents a big consideration for traders checking the broker's technical abilities and trading environment quality.

Regulatory Status and Jurisdiction

Available sources don't give clear information about Skyline Trading's specific regulatory oversight or licensing details. This regulatory transparency gap represents a big concern for potential clients who want regulated trading environments and investor protection measures.

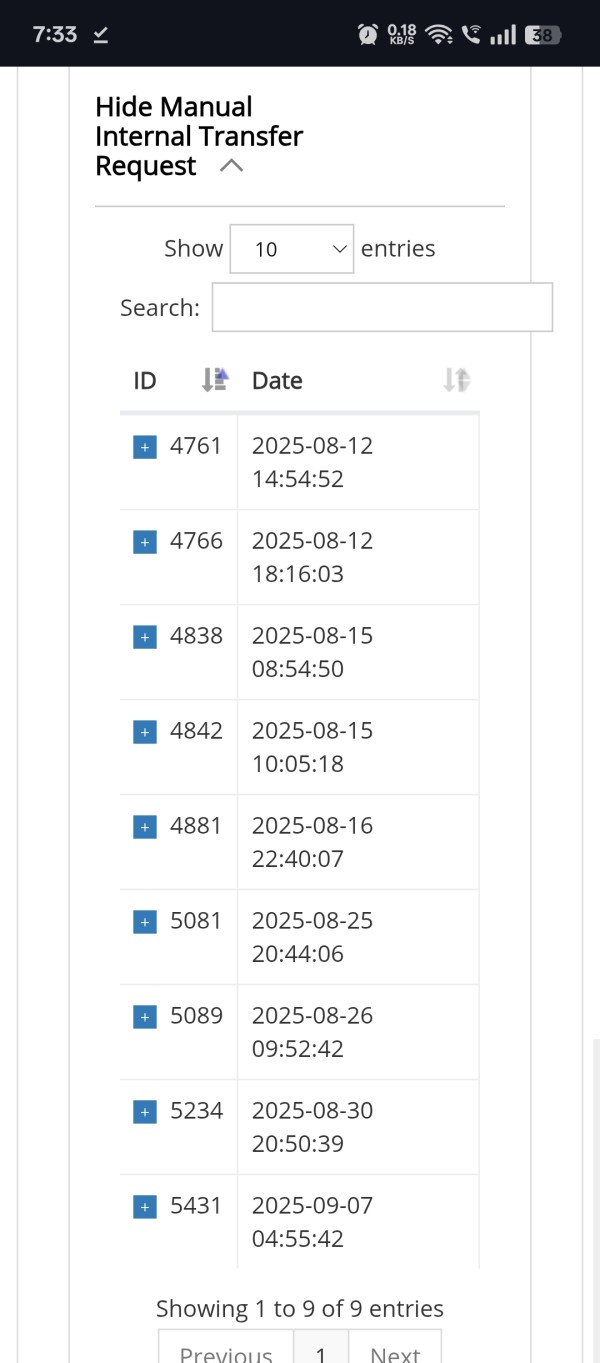

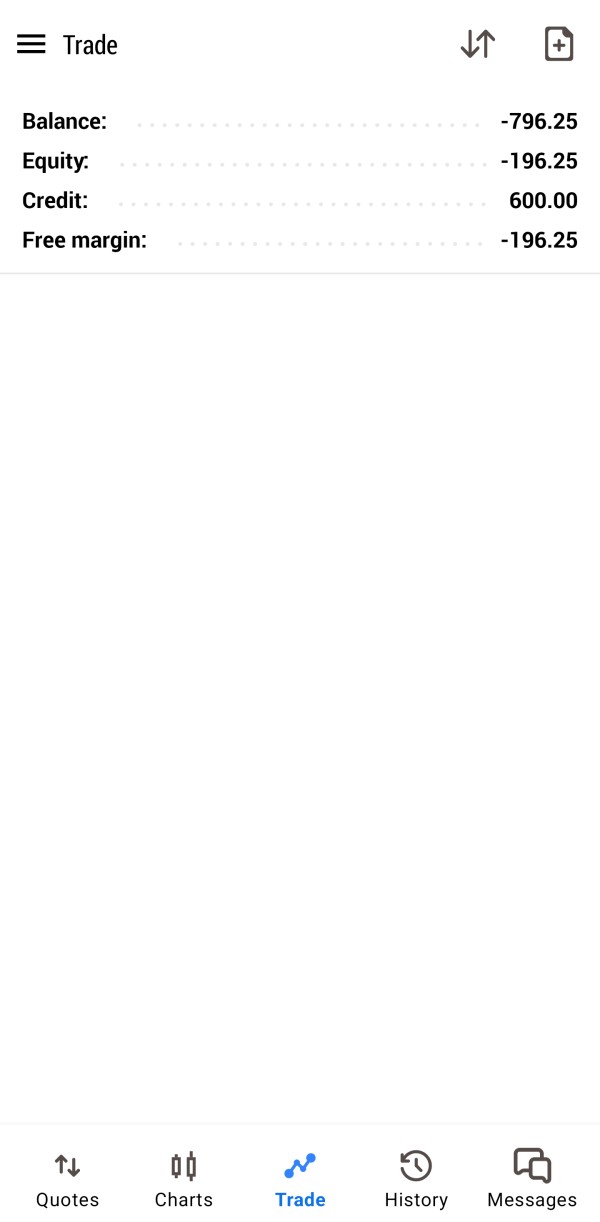

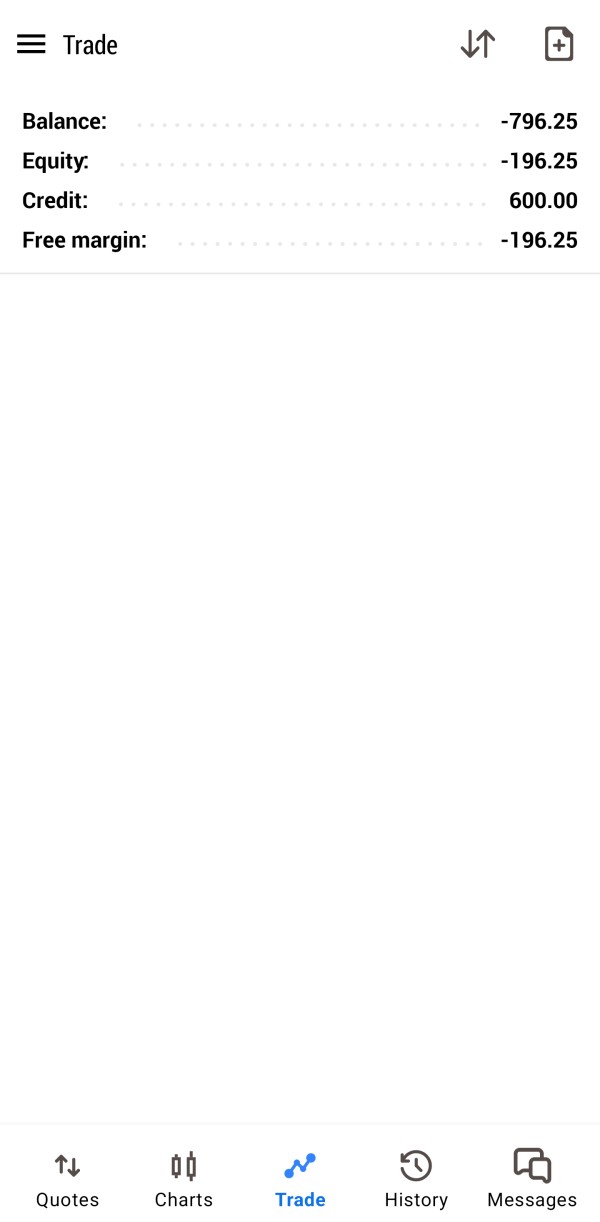

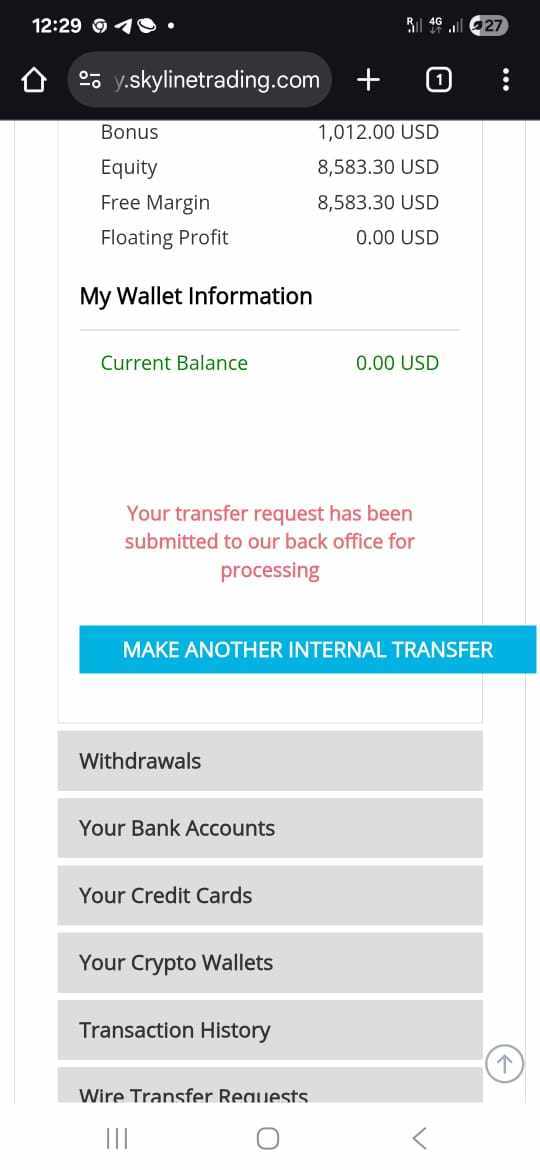

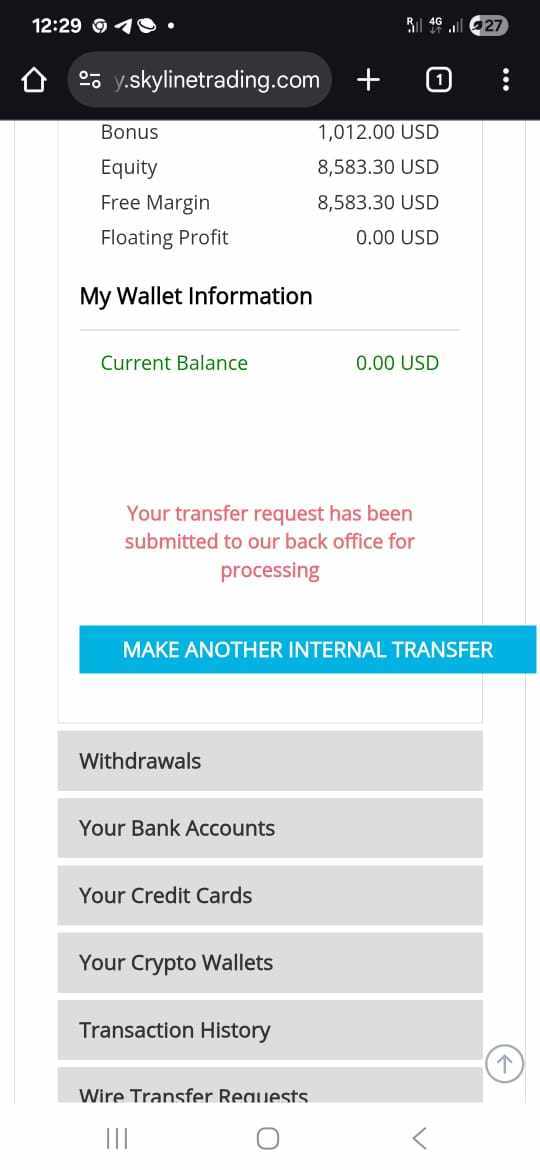

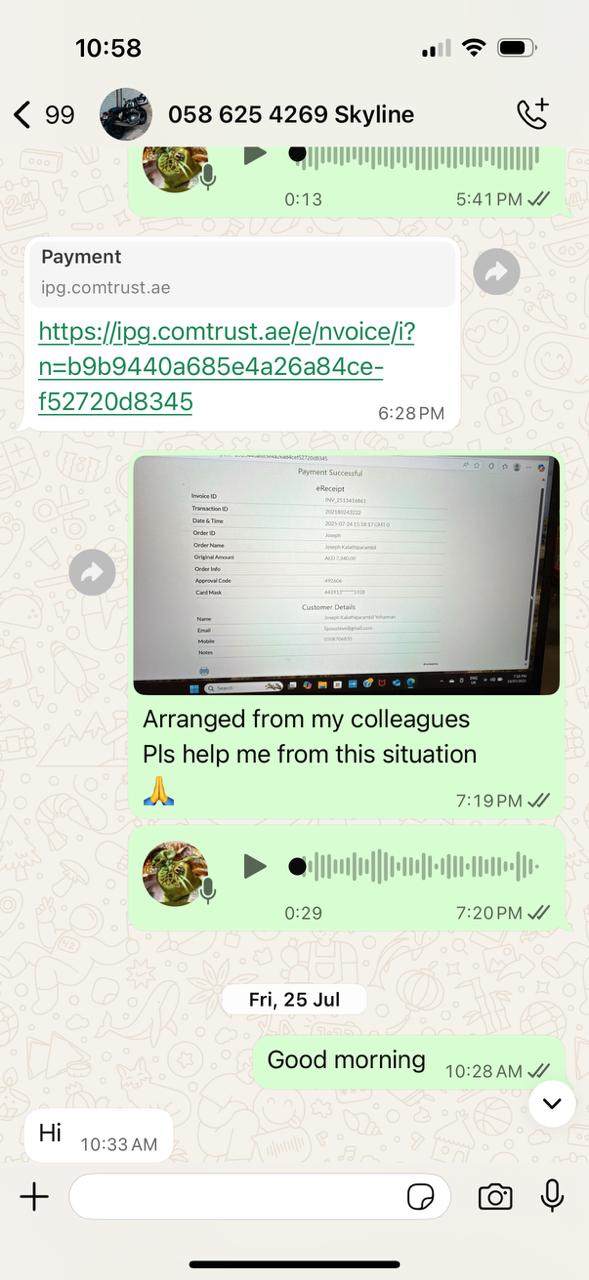

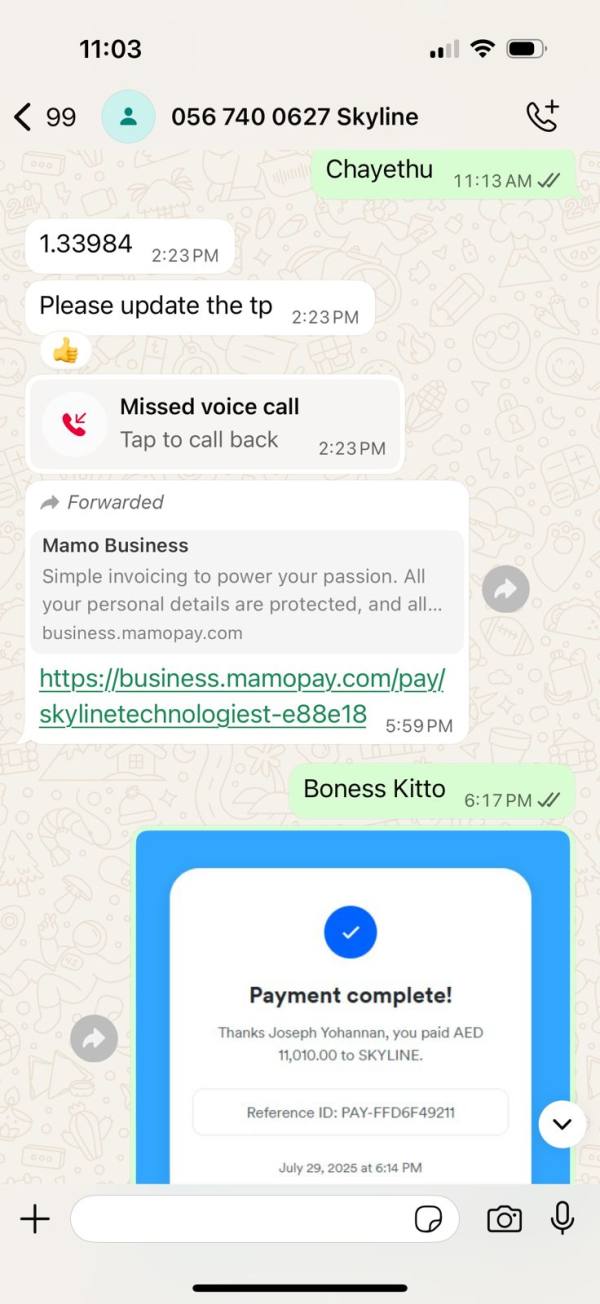

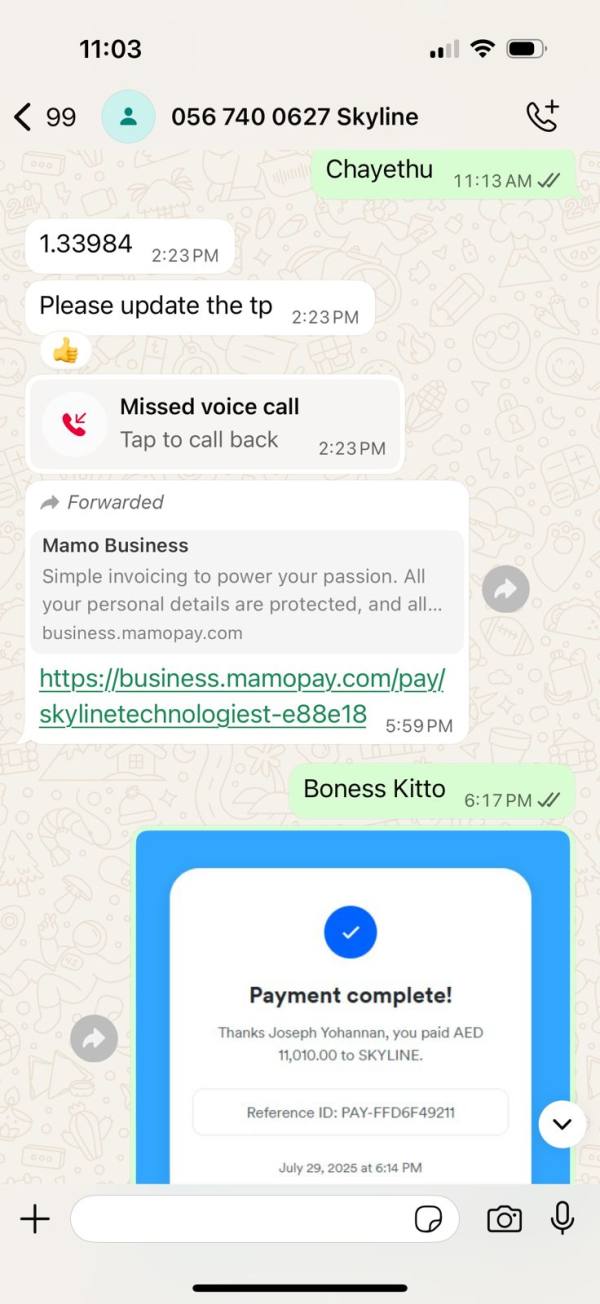

Deposit and Withdrawal Methods

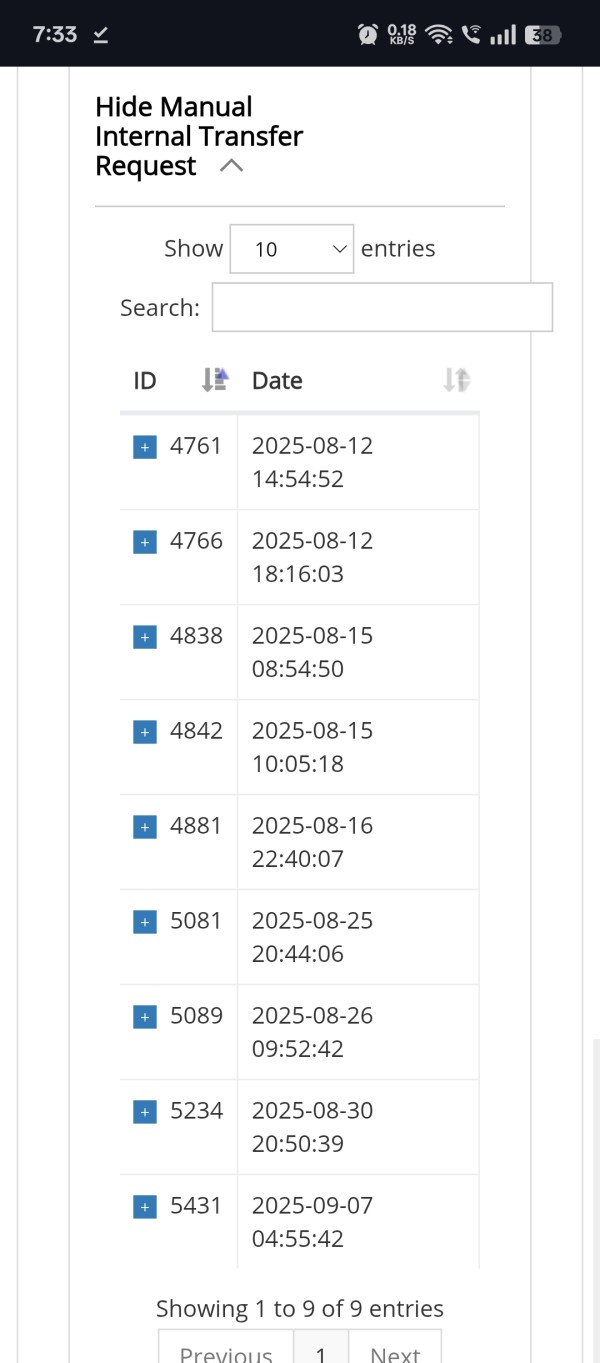

Specific information about available deposit and withdrawal methods hasn't been detailed in accessible public sources. The funding options, processing times, and fees stay unclear and require direct inquiry with the broker for complete payment method details.

Minimum Deposit Requirements

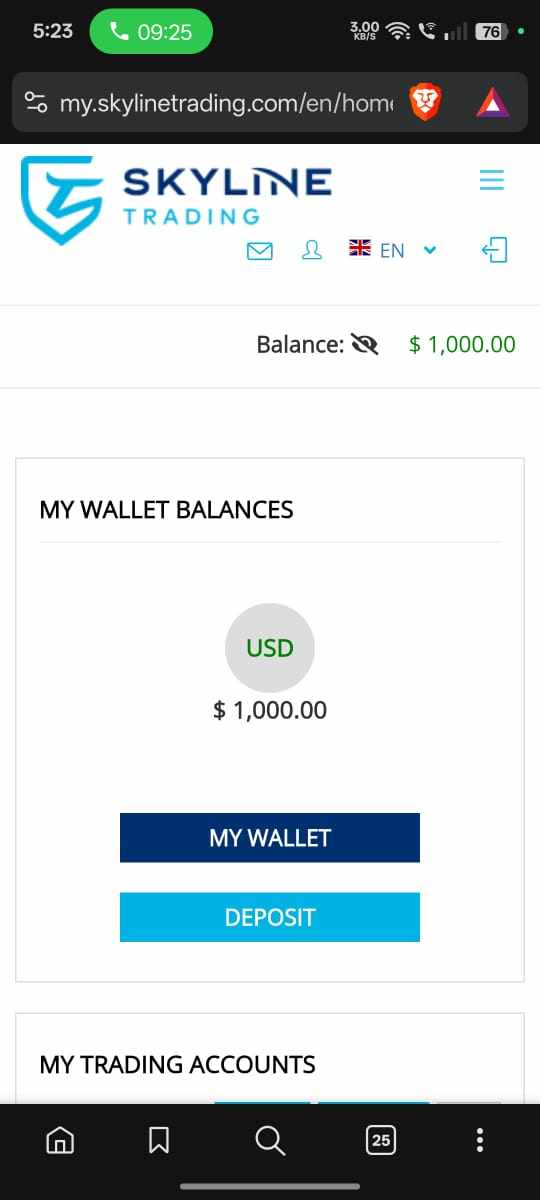

Skyline Trading requires a minimum deposit of 1,000 USD. This puts it in the higher entry-level category compared to many retail forex brokers.

This substantial minimum deposit clearly targets experienced traders with significant trading capital rather than beginners or casual retail traders.

Promotional Offers and Bonuses

Current promotional activities, welcome bonuses, or ongoing trading incentives haven't been specified in available public information. Potential clients should ask directly about any available promotional programs or trading benefits.

Available Trading Assets

The broker mainly focuses on forex trading services. However, complete asset listings including specific currency pairs, spreads, and trading conditions haven't been detailed in accessible sources.

Additional asset classes beyond forex remain unspecified in available materials.

Cost Structure and Fees

Detailed information about spreads, commission structures, overnight financing rates, and additional trading costs hasn't been fully disclosed in available public sources. This pricing transparency gap requires direct communication with the broker for complete cost analysis.

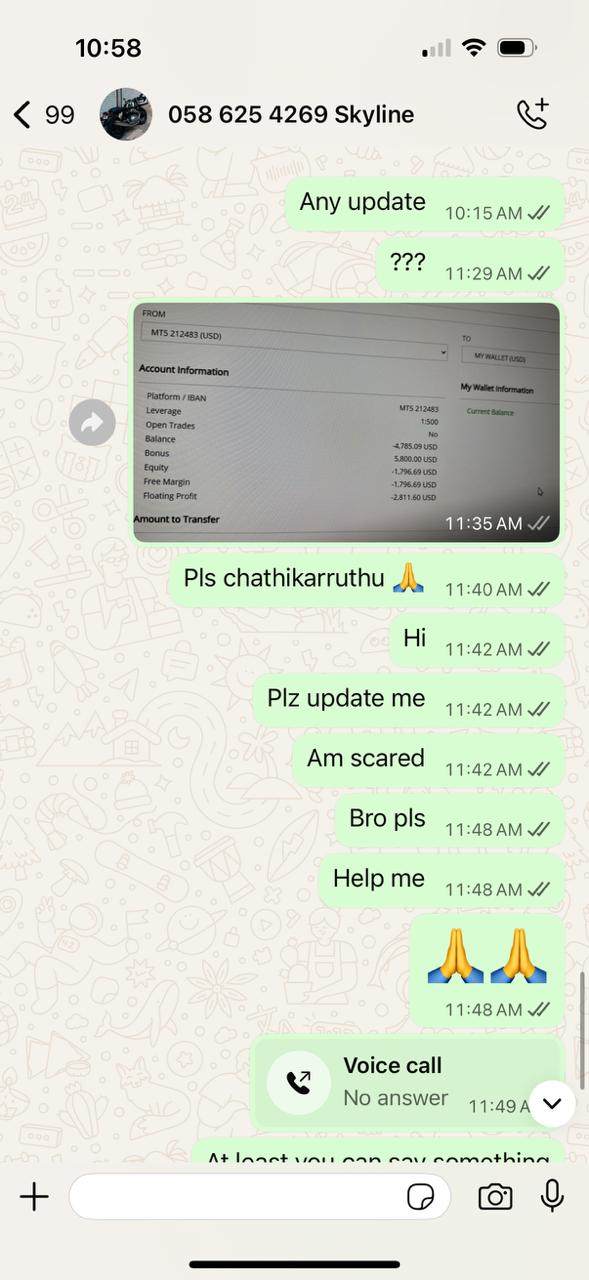

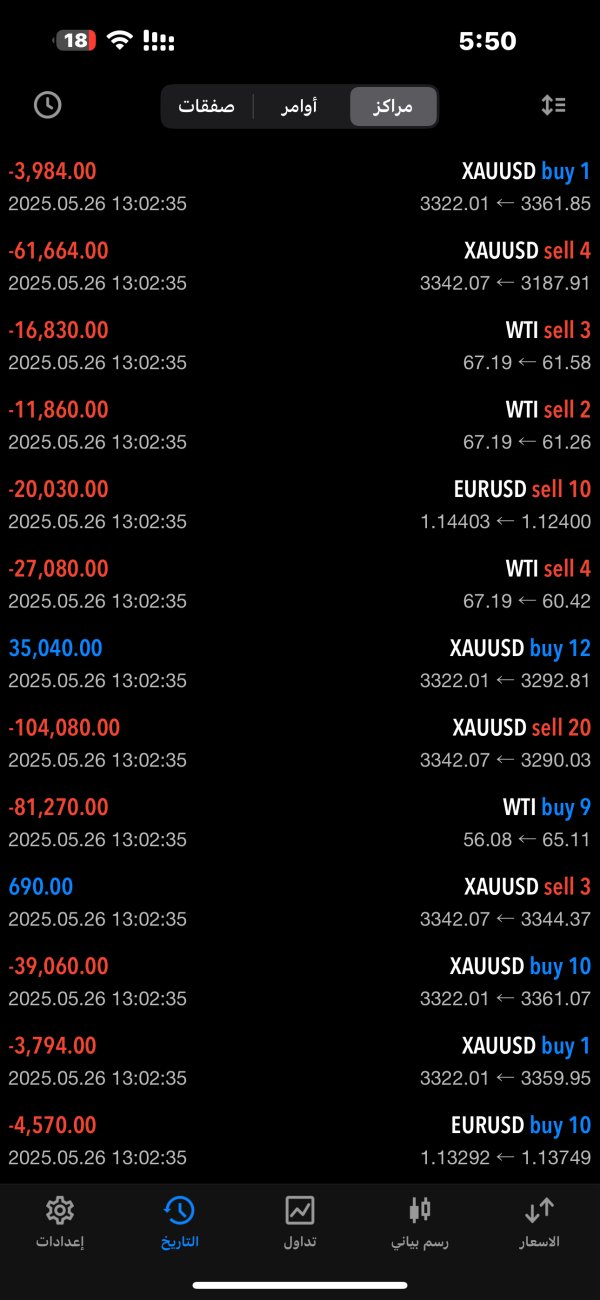

Leverage Options

Skyline Trading offers a maximum leverage ratio of 1:500. This gives significant trading power for experienced traders.

This high leverage option appeals to advanced traders who want substantial market exposure with limited capital requirements. However, it also increases risk exposure significantly.

Trading Platform Options

Specific trading platform details haven't been clearly specified in available public information. This includes whether the broker offers MetaTrader 4, MetaTrader 5, proprietary platforms, or web-based trading solutions.

Geographic Restrictions

Information about geographic trading restrictions or prohibited jurisdictions hasn't been detailed in accessible sources. This requires direct verification for specific regional availability.

Customer Support Languages

Available customer support languages and communication channels haven't been specified in public sources. This makes direct inquiry necessary for multilingual support capabilities.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Skyline Trading's account structure shows a clear focus on traders with some experience. It does this through its substantial 1,000 USD minimum deposit requirement.

This high entry threshold effectively filters out casual retail traders while attracting clients with serious trading capital and experience. The account conditions skyline trading review shows a broker positioning itself in the premium segment of the forex market, though specific account type variations and their features stay unclear from available sources.

The elevated minimum deposit requirement might limit new traders, but experienced traders can view it positively. It may indicate a more professional trading environment with potentially better execution and service quality.

However, the lack of detailed information about different account tiers, their specific benefits, and graduated service levels represents a significant information gap. This affects the overall account conditions evaluation.

Account opening procedures, verification requirements, and onboarding processes haven't been detailed in available sources. This makes it difficult to assess the convenience and efficiency of establishing trading relationships with this broker.

The absence of information about Islamic accounts, demo account availability, and special account features further limits the complete evaluation of account conditions.

The evaluation of Skyline Trading's tools and resources gets a low rating mainly because of the significant lack of publicly available information. Available sources don't detail the specific trading tools offered, analytical resources, or educational materials, representing a substantial transparency gap.

Professional forex trading typically requires complete analytical tools, real-time market data, economic calendars, technical analysis capabilities, and research resources. However, the absence of detailed information about these essential trading components makes it impossible to assess whether Skyline Trading provides adequate tools for serious forex trading activities.

Educational resources, which are crucial for trader development and ongoing market education, haven't been mentioned in available sources. The lack of information about webinars, trading guides, market analysis, or educational content suggests either limited educational offerings or poor communication about available resources.

This absence significantly impacts the broker's appeal to traders who want complete trading support and continuous learning opportunities.

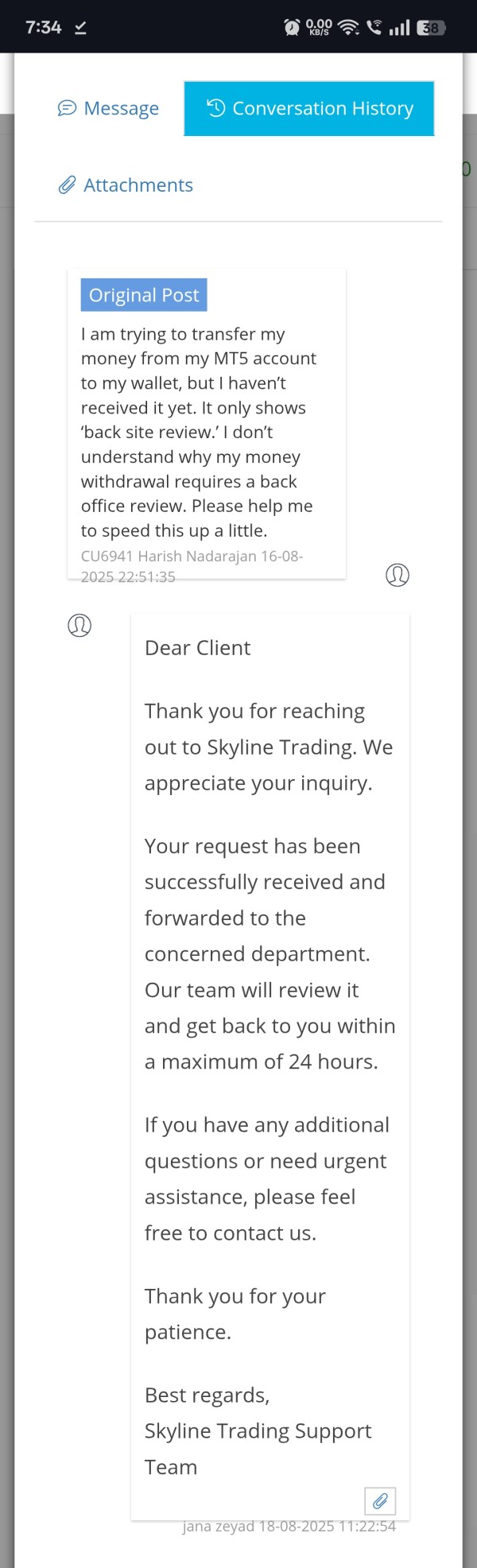

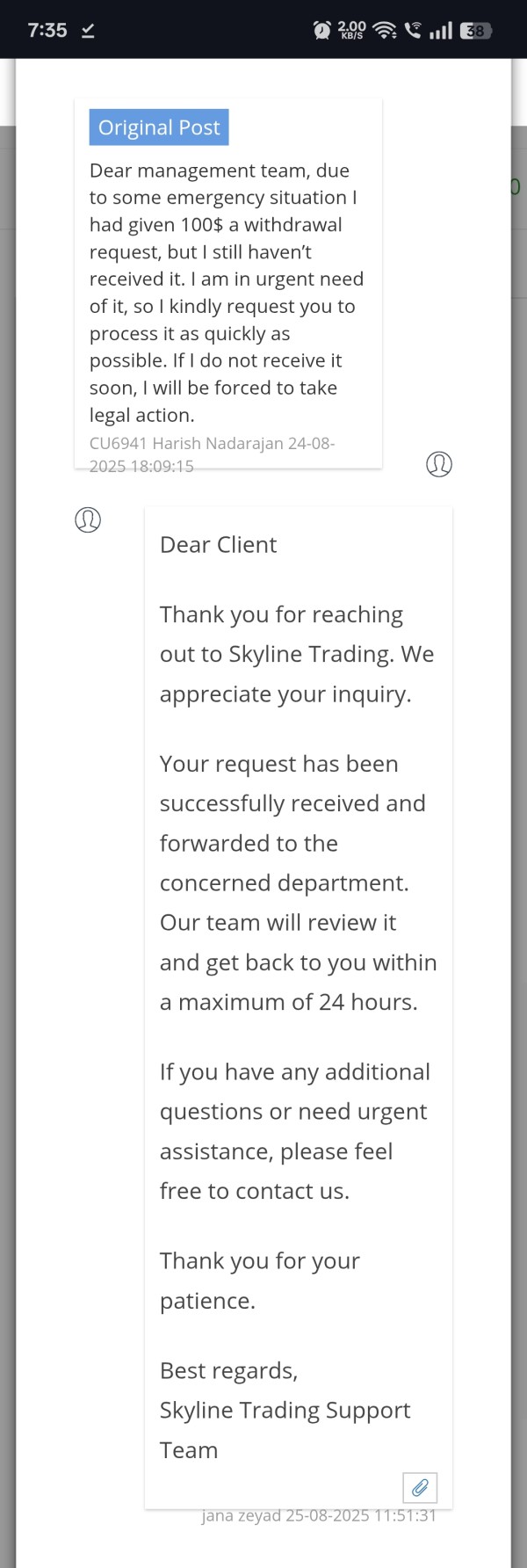

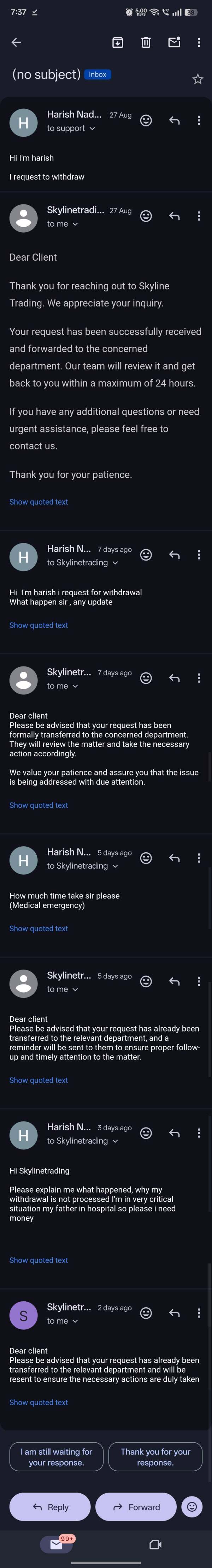

Customer Service and Support Analysis (4/10)

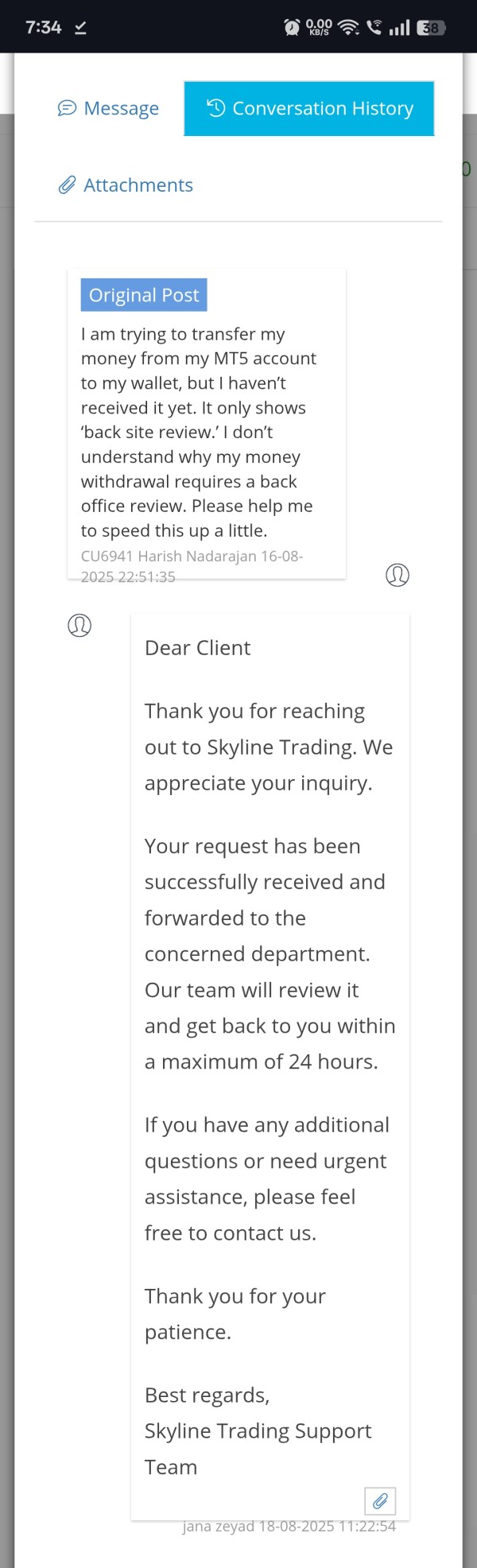

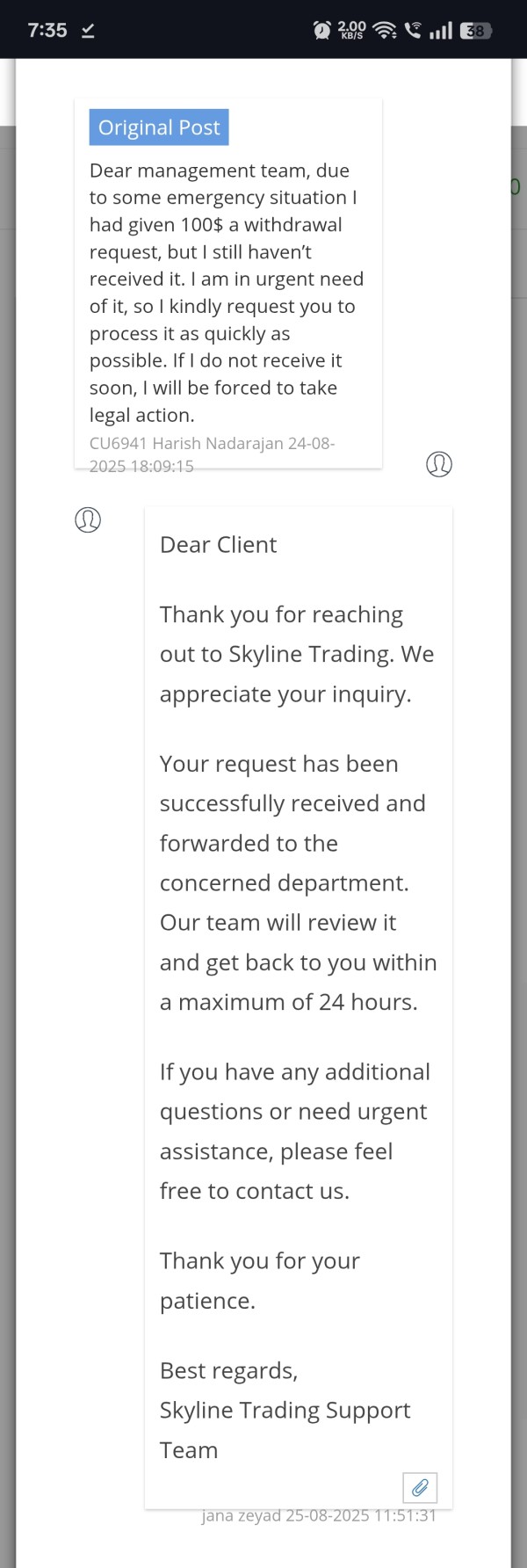

Customer service evaluation for Skyline Trading faces significant limitations because of insufficient public information. Available sources don't provide detailed information about support channels, response times, and service quality metrics, making complete assessment challenging.

The presence of 46 reviews on Trustpilot suggests some level of customer interaction and feedback. However, specific details about customer service experiences, problem resolution effectiveness, and support quality haven't been detailed in available sources.

This lack of specific customer service feedback represents a significant gap in understanding the broker's commitment to client support and satisfaction. Professional forex trading requires reliable, responsive customer support, particularly for account issues, technical problems, and trading-related inquiries.

The absence of clear information about support hours, available communication channels, and multilingual support capabilities raises concerns about the broker's service infrastructure and client support commitment.

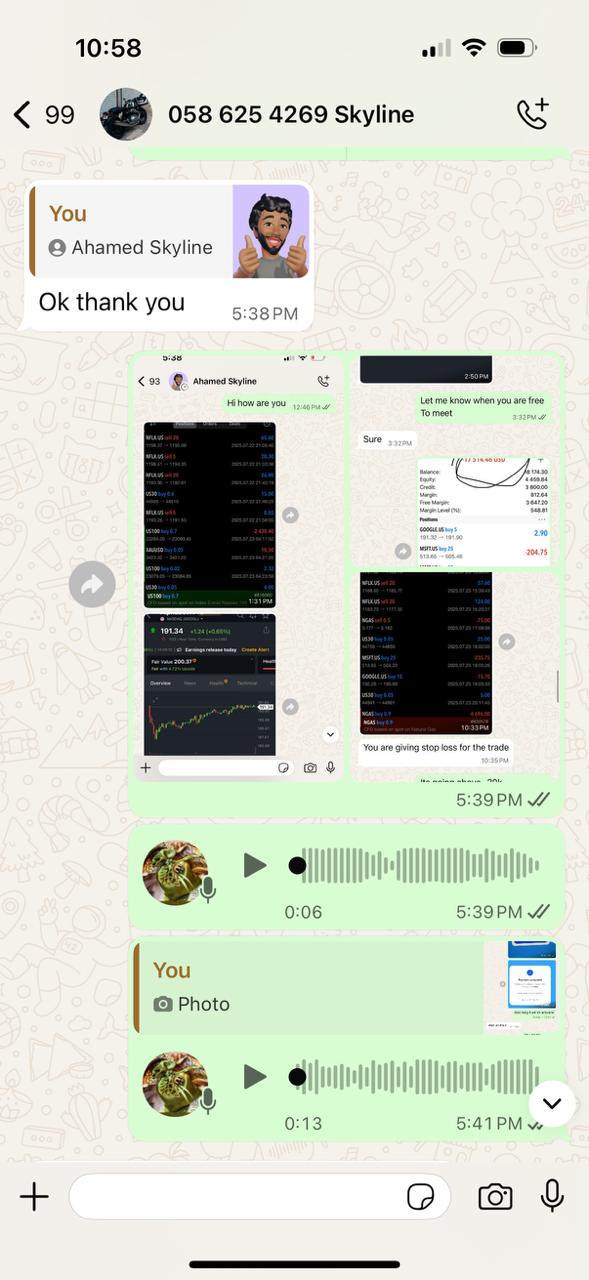

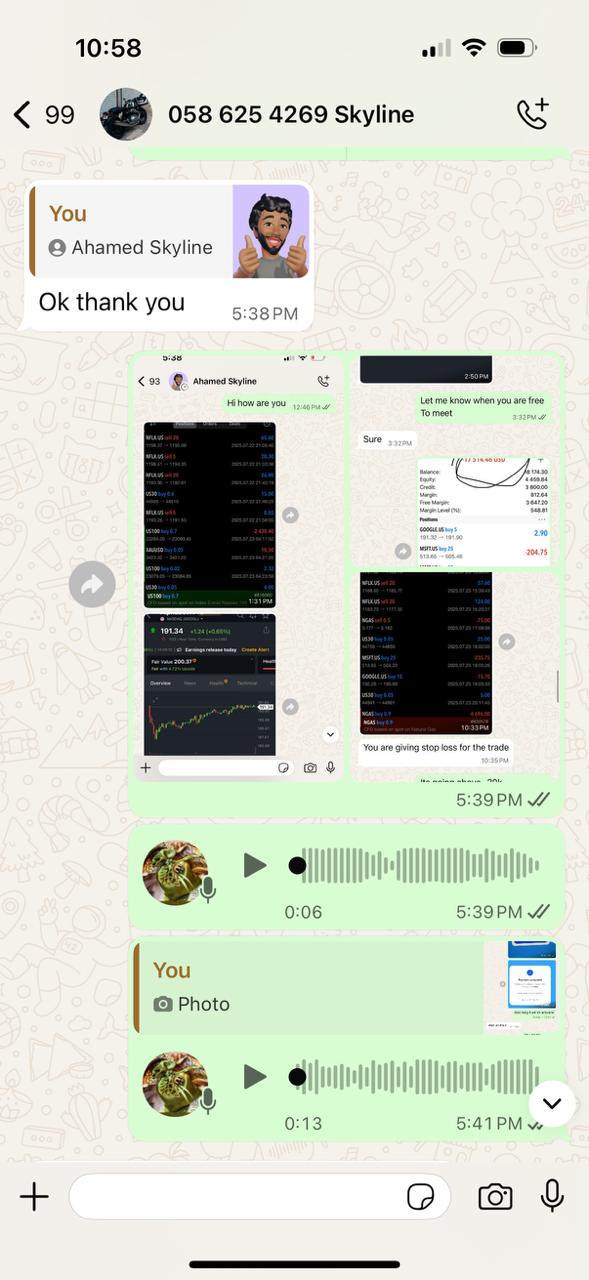

Trading Experience Analysis (5/10)

The trading experience evaluation for this skyline trading review gets a moderate rating mainly because of limited available information. Without complete user feedback data about platform performance, execution quality, and overall trading environment, it becomes challenging to assess the actual trading experience quality.

Platform functionality, user interface design, and trading tool integration represent crucial elements of trading experience that stay unclear from available sources. The absence of detailed information about mobile trading capabilities, platform customization options, and advanced trading features limits the ability to evaluate whether Skyline Trading provides a competitive trading environment for serious forex traders.

Order execution quality, including execution speed, price accuracy, and slippage management, represents critical factors for trading success. These haven't been adequately addressed in available public information though.

Professional traders require reliable, fast execution with minimal slippage, but the lack of performance data makes it impossible to assess these crucial trading experience elements.

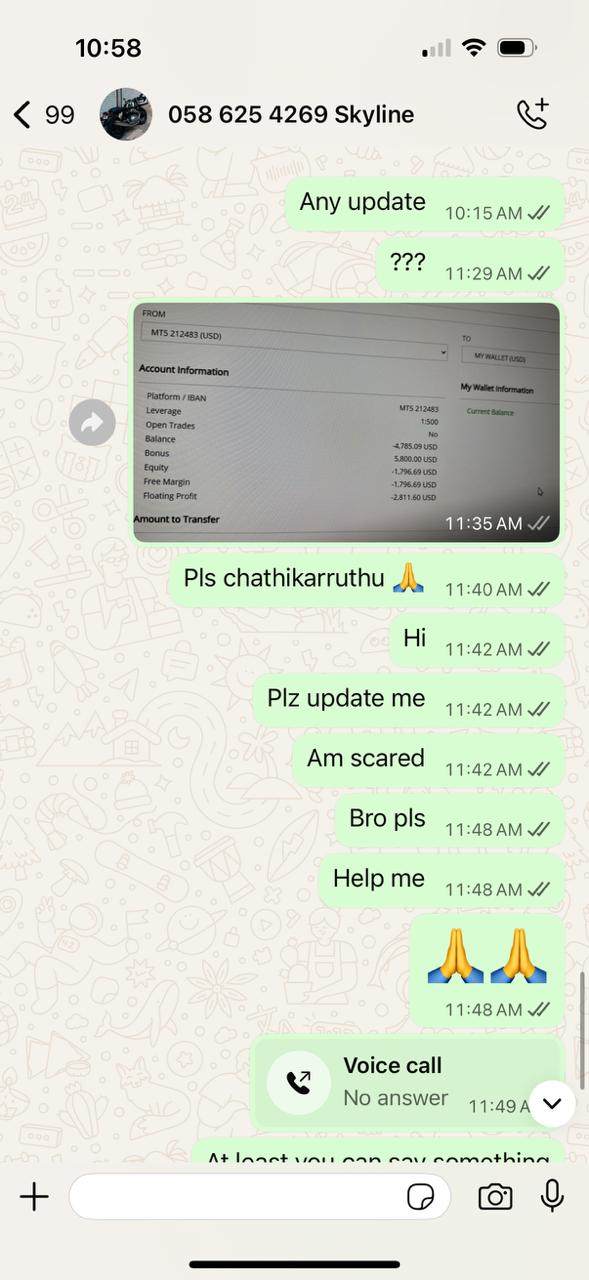

Trust and Safety Analysis (2/10)

Trust and safety evaluation for Skyline Trading gets the lowest rating among all assessment categories. This is mainly because of the significant absence of clear regulatory information and transparency concerns.

The lack of disclosed regulatory oversight represents a fundamental concern for traders who prioritize fund safety and regulatory protection. Regulatory compliance serves as the foundation of broker trustworthiness, providing legal frameworks for dispute resolution, fund segregation requirements, and operational oversight.

The absence of clear regulatory information in available sources raises substantial questions about investor protection measures and legal recourse options for potential clients. Fund safety measures, including client fund segregation, deposit protection schemes, and financial transparency, haven't been detailed in available public information.

Professional traders typically require clear understanding of how their funds are protected, regulated, and segregated from broker operational funds. This information remains unclear for Skyline Trading.

User Experience Analysis (4/10)

User experience evaluation faces limitations because of insufficient complete feedback data and limited information about platform usability. While Trustpilot shows 46 reviews, specific details about user satisfaction levels, common complaints, and positive experience highlights haven't been detailed in available sources.

The target demographic of traders with some experience who want high leverage suggests a specific user experience focus. However, details about how well the broker serves this market segment remain unclear.

User interface design, platform navigation, and trading workflow efficiency represent crucial user experience elements that require direct platform evaluation. This is because of limited public information.

Registration processes, account verification procedures, and onboarding experiences haven't been detailed in available sources. This makes it difficult to assess the initial user experience quality.

Fund management processes, including deposit and withdrawal experiences, represent crucial user experience components that remain unclear from available public information.

Conclusion

This complete skyline trading review shows a broker with mixed characteristics that need careful consideration by potential clients. Skyline Trading positions itself as a specialized forex broker targeting traders with some experience through its high leverage offerings and substantial minimum deposit requirements, though significant information gaps limit complete evaluation.

The broker's main strength lies in its high leverage capability of 1:500. This appeals to experienced traders who want substantial market exposure.

However, the elevated minimum deposit requirement of 1,000 USD and, more critically, the absence of clear regulatory information represent significant concerns. Potential clients must carefully weigh these issues.

Skyline Trading appears most suitable for experienced forex traders with substantial capital who prioritize high leverage access over regulatory transparency. However, the lack of complete information about trading tools, customer service quality, and regulatory oversight makes this broker a high-risk choice that requires extensive research before engagement.