Regarding the legitimacy of Skyline forex brokers, it provides FSC and WikiBit, .

Is Skyline safe?

Rating Index

Pros

Cons

Is Skyline markets regulated?

The regulatory license is the strongest proof.

FSC Retail Forex License

The Financial Services Commission

The Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Retail Forex License

Licensed Entity:

Skyline Markets Ltd

Effective Date:

2024-10-02Email Address of Licensed Institution:

--53748:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

20 Edith Cavell Street, Port Louis Level 6 Ken Lee Building,, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Skyline Trading Safe or a Scam?

Introduction

Skyline Trading positions itself as an online investment platform that aims to provide access to various financial markets, including forex, commodities, and cryptocurrencies. As the allure of quick profits and diverse trading opportunities grows, it becomes increasingly crucial for traders to carefully evaluate the legitimacy of forex brokers like Skyline Trading. This evaluation is not just about uncovering potential scams but also about ensuring the safety of one's investments. In this article, we will analyze Skyline Trading's regulatory status, company background, trading conditions, client fund security, customer experience, platform performance, and overall risk assessment to determine whether Skyline Trading is indeed safe or a scam.

Regulation and Legitimacy

A broker's regulatory status is one of the most critical factors in assessing its legitimacy. Regulation serves as a safeguard for investors, ensuring that the broker adheres to strict financial standards and practices. Unfortunately, Skyline Trading lacks valid regulation from recognized financial authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). This absence of oversight raises significant concerns about the broker's credibility.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The lack of regulation means that Skyline Trading is not subject to the same rigorous scrutiny and accountability that regulated brokers must adhere to. This situation exposes investors to higher risks, including potential fraud, mismanagement of funds, and lack of recourse in case of disputes. Furthermore, the absence of a regulatory history that demonstrates compliance with industry standards further exacerbates these concerns. Therefore, it is prudent to approach Skyline Trading with caution, as the absence of a regulatory framework is a significant red flag.

Company Background Investigation

Skyline Trading claims to be an established broker, yet detailed information about its history and ownership structure is sparse. The company appears to be registered in the autonomous island of Anjouan, Union of Comoros. However, the lack of transparency regarding its management team and operational history raises questions about its legitimacy.

A thorough investigation into the company's ownership structure reveals little about the qualifications and backgrounds of its executives. In a legitimate brokerage, one would expect to find information about the management teams experience in the financial industry, but this is largely absent for Skyline Trading. Furthermore, the broker's website does not provide adequate disclosures about its operations, which is a common practice among reputable firms. The overall lack of transparency regarding its corporate structure and management team adds to the uncertainty surrounding whether Skyline Trading is safe.

Trading Conditions Analysis

When evaluating whether Skyline Trading is safe, it is essential to examine its trading conditions, including fees and spreads. The broker offers various trading instruments, but the details about its fee structure are often vague. Traders should be particularly cautious of any unusual fees that may not be disclosed upfront.

| Fee Type | Skyline Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

Skyline Trading's spreads are slightly above the industry average, which could indicate higher trading costs for clients. Moreover, the absence of a clear commission structure raises questions about hidden fees that could impact profitability. Traders should be aware of any additional charges that may apply when making withdrawals or trading, as such practices are often associated with unregulated brokers. Therefore, the overall trading conditions at Skyline Trading warrant scrutiny, as they may not be as favorable as they initially appear.

Client Fund Security

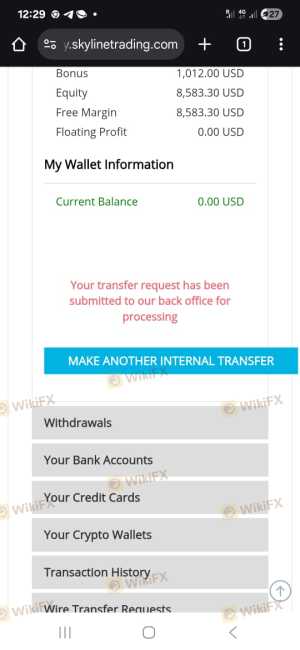

The security of client funds is a paramount concern for any trader. In the case of Skyline Trading, the absence of regulation means that there are no mandated protections in place for client funds. The broker does not appear to offer segregated accounts, which are essential for ensuring that client funds are kept separate from the company's operating capital.

Additionally, there is no evidence to suggest that Skyline Trading participates in any investor compensation schemes, which would provide a safety net for clients in the event of insolvency. The lack of transparency regarding its fund security measures raises concerns about the potential risks associated with trading on this platform. Historically, unregulated brokers have been known to engage in practices that compromise client funds, making it imperative for traders to be cautious about where they invest their money.

Customer Experience and Complaints

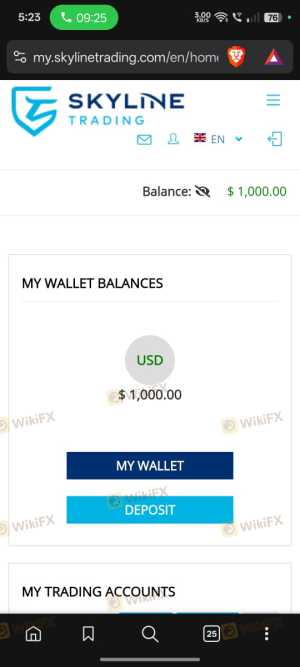

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of Skyline Trading indicate a pattern of complaints, primarily focusing on withdrawal issues and unresponsive customer support. Many users have reported difficulties in withdrawing their funds, which is a common red flag for potential scams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

One notable case involved a trader who was unable to withdraw their funds despite multiple requests. The company's lack of responsiveness and failure to address these issues led to frustration and a sense of distrust among clients. Such complaints should not be taken lightly, as they often indicate deeper systemic issues within the broker's operations. Therefore, the overall customer experience at Skyline Trading suggests that it may not be a safe choice for traders seeking a reliable and trustworthy platform.

Platform and Trade Execution

The trading platform offered by Skyline Trading is another crucial aspect to consider. A reliable trading platform should provide a seamless user experience, with efficient order execution and minimal slippage. However, user reviews suggest that Skyline Trading's platform may not meet these expectations.

Many users have reported instances of delayed order execution and high slippage, which can significantly impact trading performance. Additionally, there are concerns about potential platform manipulation, where brokers may interfere with trades to benefit themselves at the expense of their clients. Such practices are more common among unregulated brokers, further emphasizing the need for caution when trading with Skyline Trading.

Risk Assessment

Engaging with Skyline Trading presents several risks that traders should be aware of. The combination of unregulated status, withdrawal issues, and negative customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation increases fraud risk |

| Financial Risk | High | Potential for loss of invested funds |

| Operational Risk | Medium | Issues with platform performance |

To mitigate these risks, traders are advised to conduct thorough due diligence before investing. This includes researching alternative brokers that are regulated and have a proven track record of reliability. Moreover, it is essential to start with a small investment to assess the platform's performance before committing larger amounts.

Conclusion and Recommendations

After a comprehensive analysis of Skyline Trading, it is evident that the broker exhibits several concerning traits that suggest it may not be safe for traders. The lack of regulation, negative customer feedback, and withdrawal issues are significant red flags that should not be ignored. For traders seeking a reliable and trustworthy forex broker, it is advisable to consider alternatives that are regulated and offer robust customer support.

In conclusion, while Skyline Trading may present itself as a legitimate option, the evidence suggests that it carries a high risk of being a scam. Therefore, traders should exercise extreme caution and consider more reputable alternatives to safeguard their investments.

Is Skyline a scam, or is it legit?

The latest exposure and evaluation content of Skyline brokers.

Skyline Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Skyline latest industry rating score is 4.74, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.74 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.