Citibank 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Citibank stands as a significant player in the banking landscape, providing a comprehensive digital banking experience, primarily focusing on credit cards and investment services. This digital-first strategy allows clients access to various financial products, making it particularly appealing to individuals seeking loyalty rewards and automated investment options. However, potential customers need to be wary of navigating high fees and regulatory uncertainties that accompany these services.

For those prioritizing a wide array of banking and investment options, particularly with robust credit card rewards programs, Citibank offers a compelling choice. Conversely, novice investors or those with low credit scores might find themselves at a disadvantage, struggling with the high fees and complexities embedded in Citibank's offerings. Engaging with Citibank could yield significant rewards, but careful consideration of the associated risks is paramount.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement:

Engaging with Citibank entails navigating potentially high costs and regulatory uncertainties, posing substantial risks to certain customer segments.

Potential Harms:

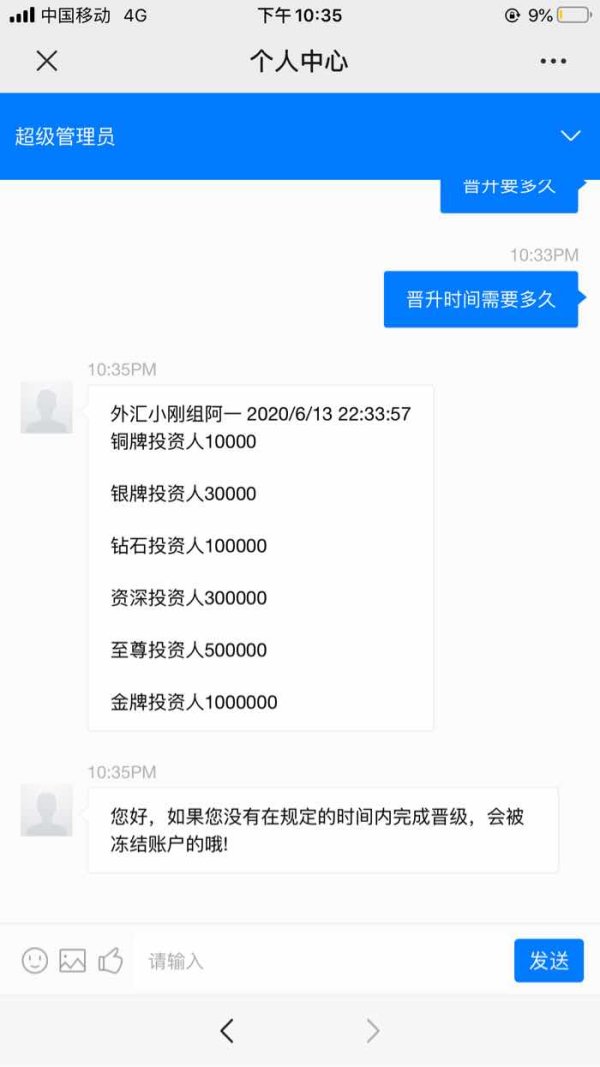

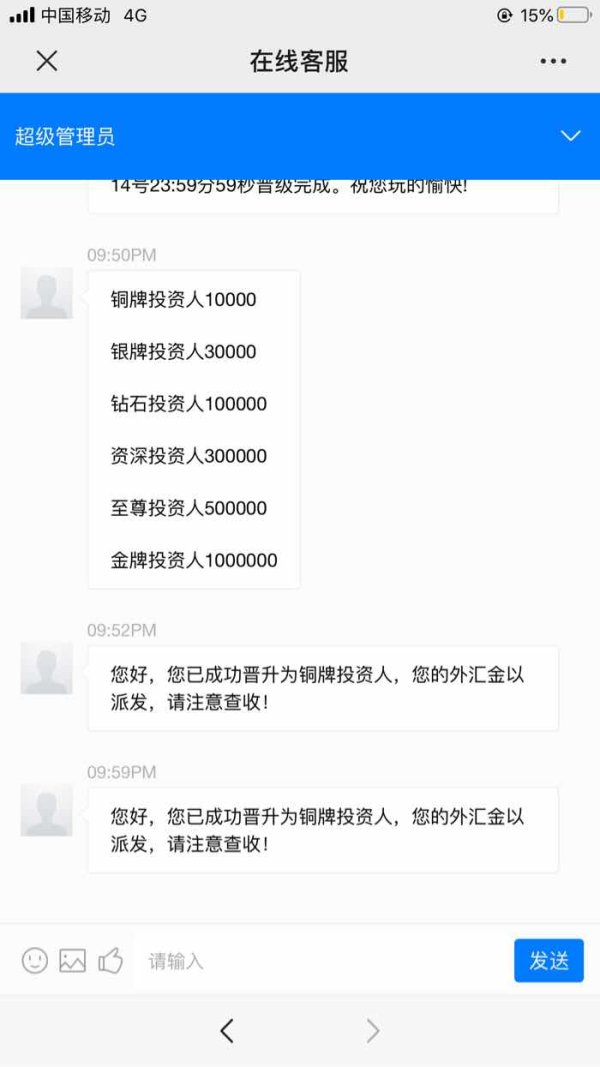

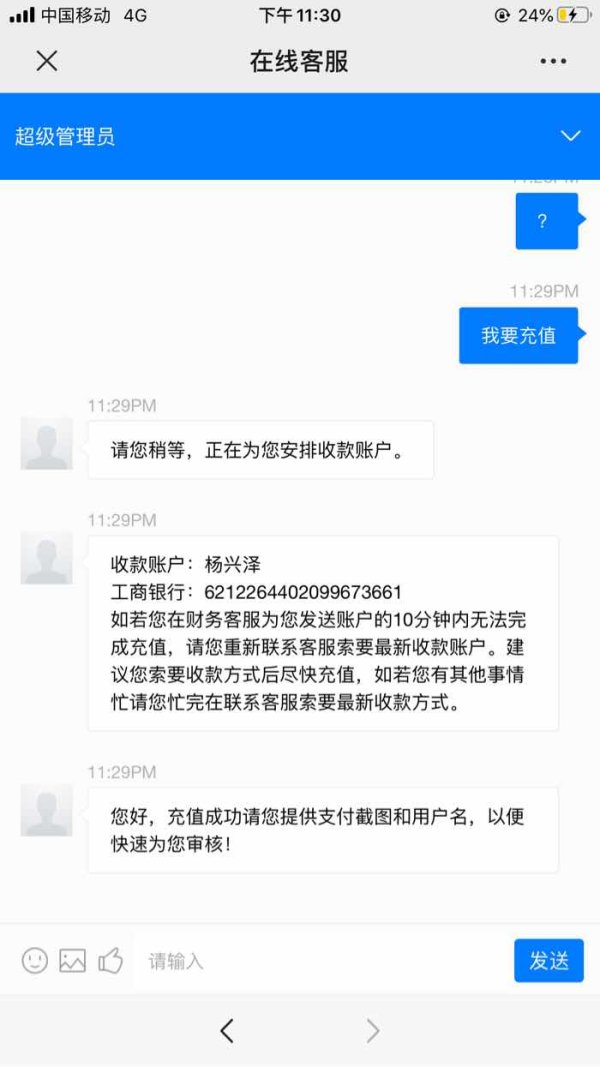

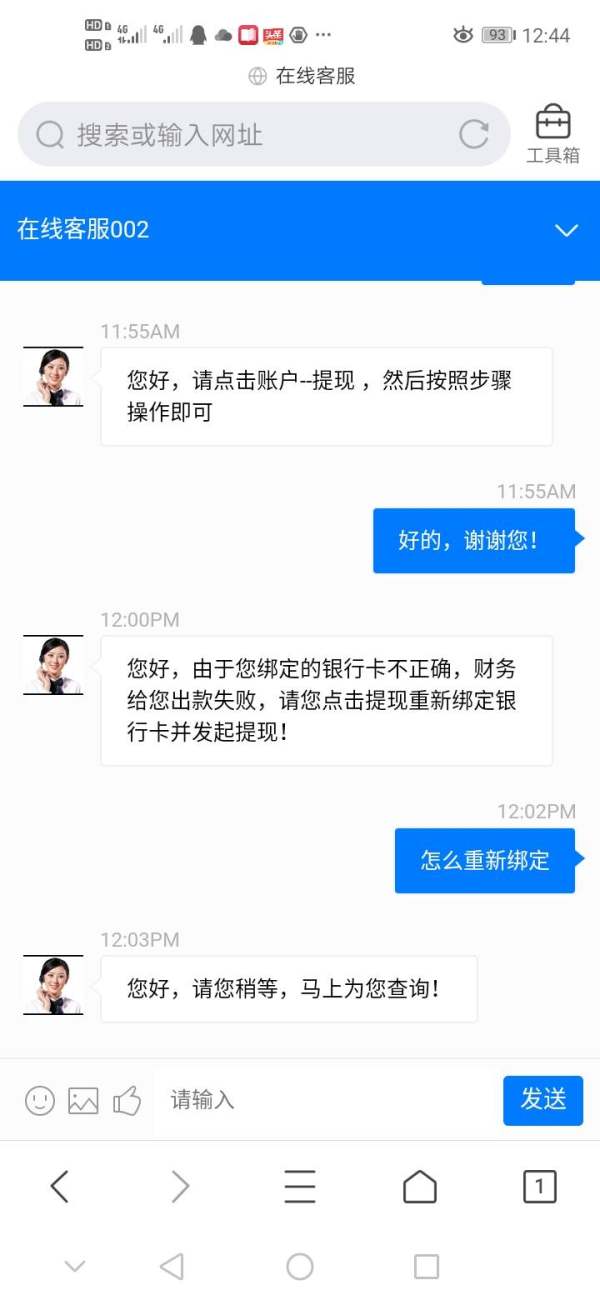

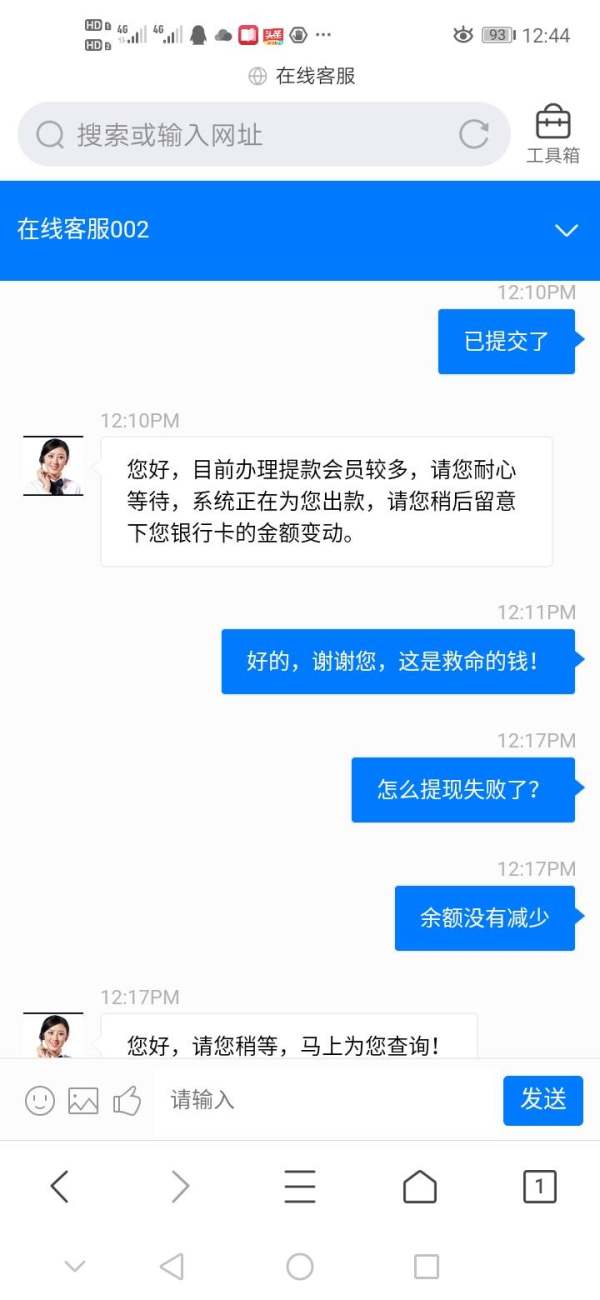

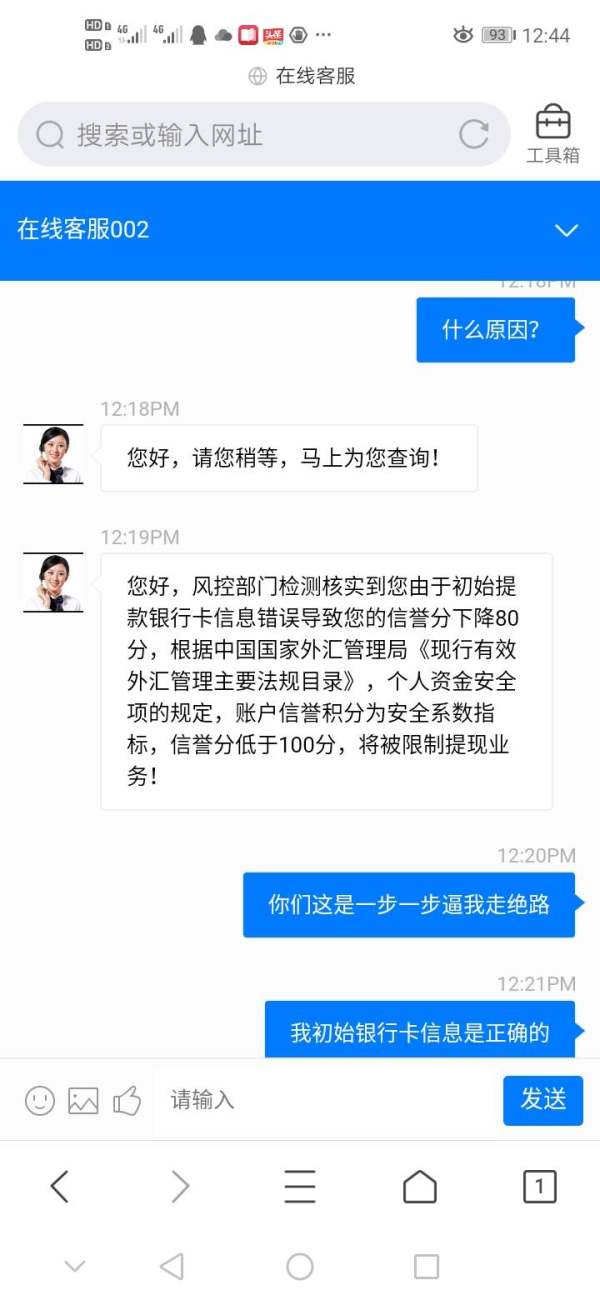

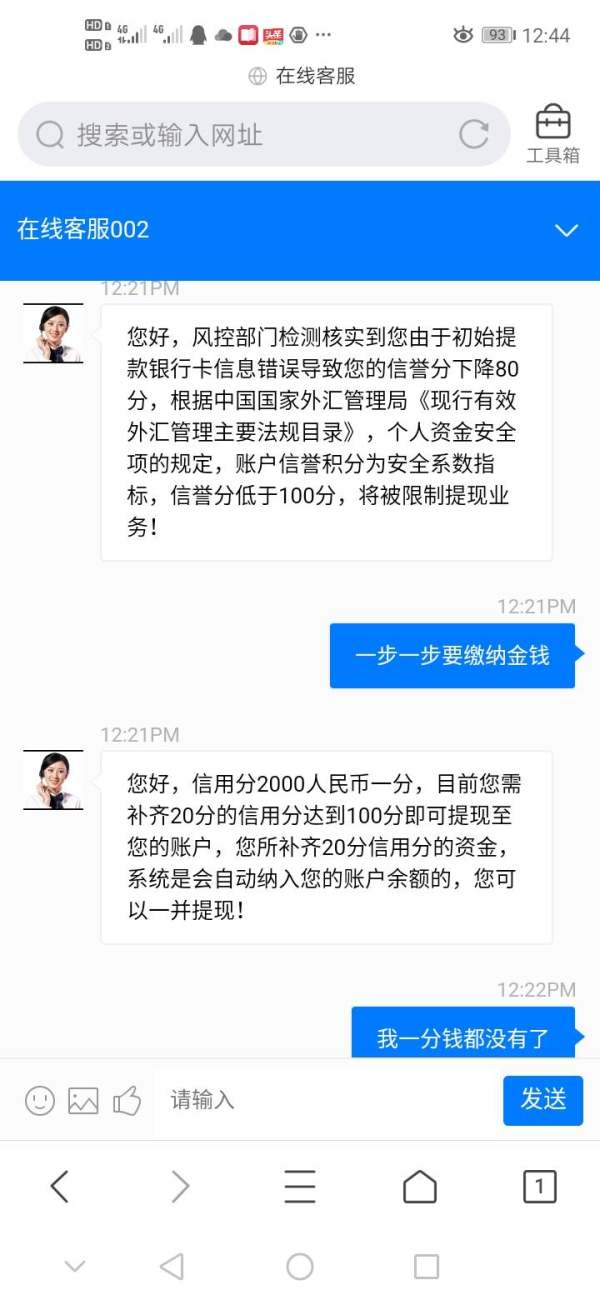

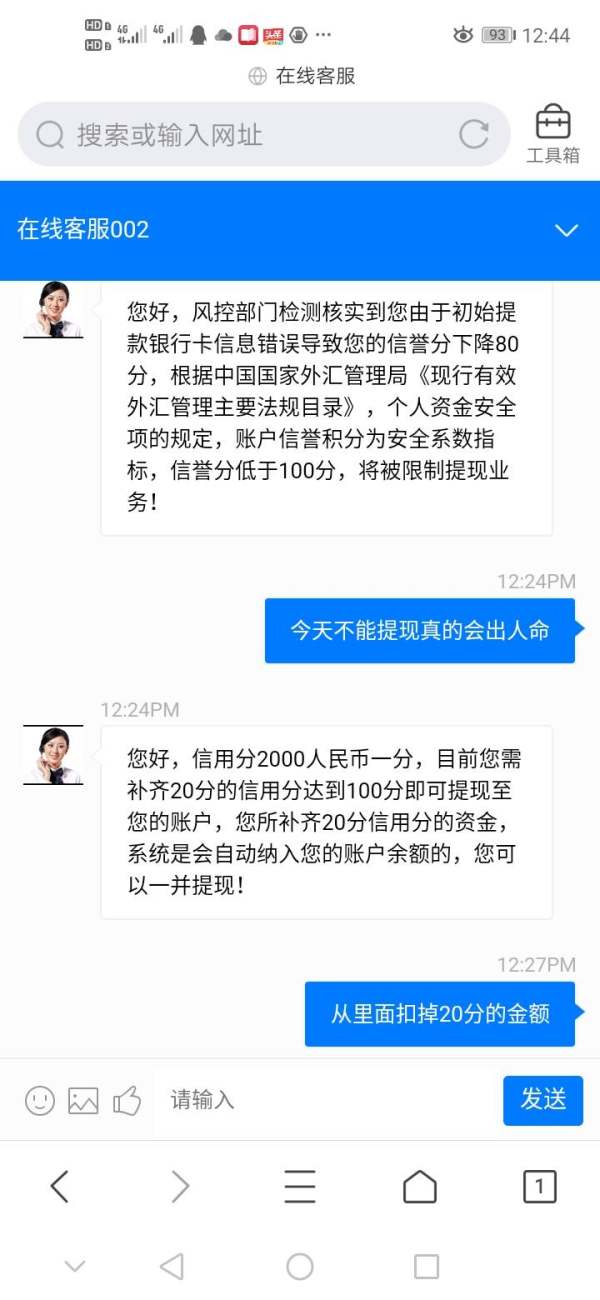

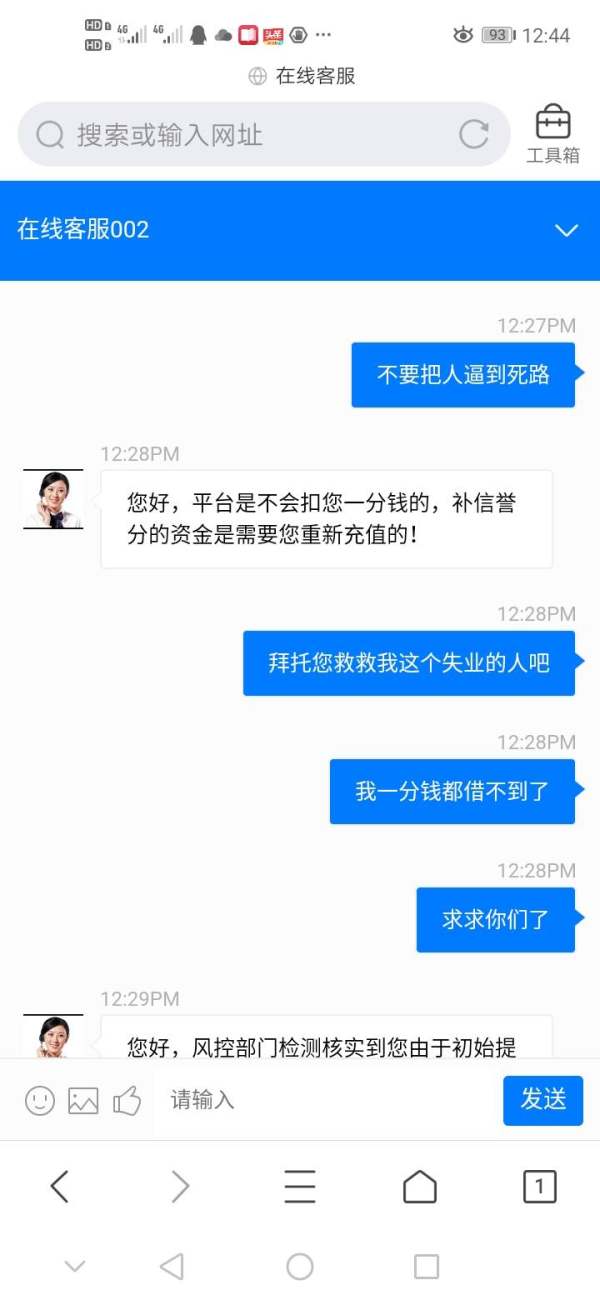

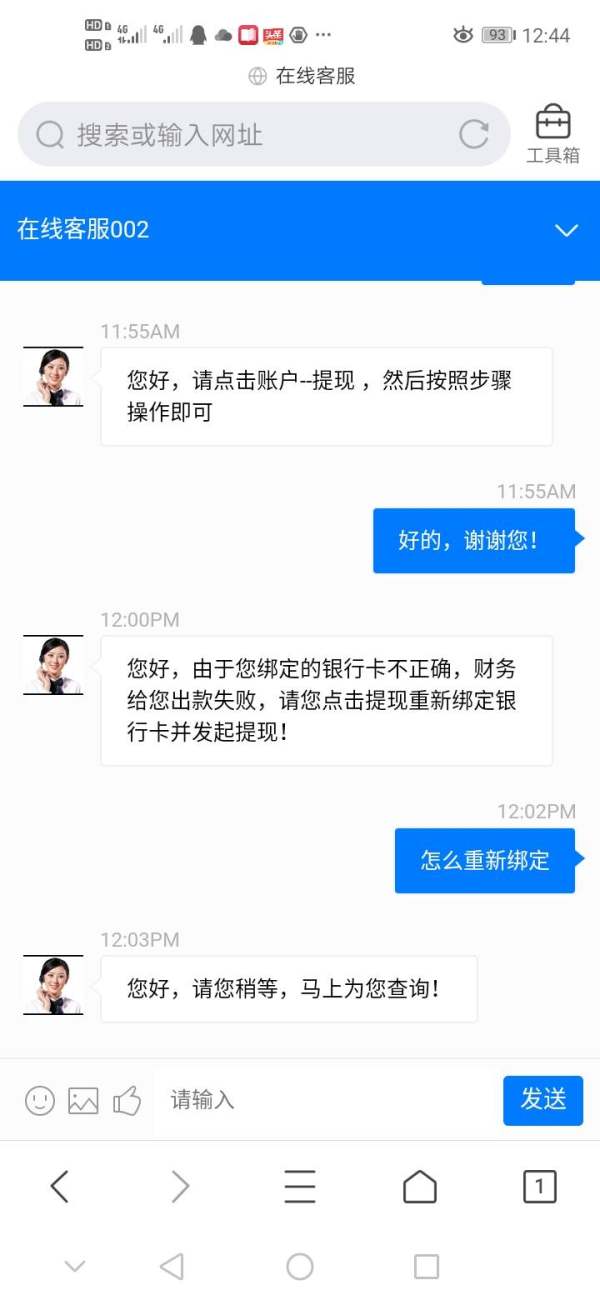

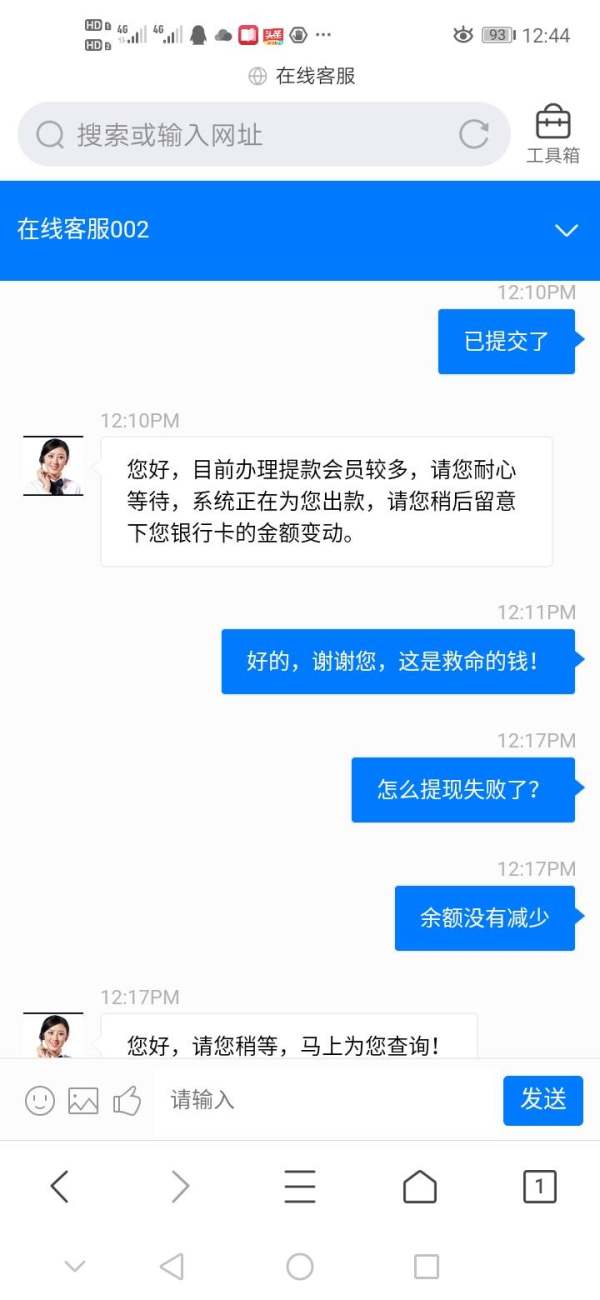

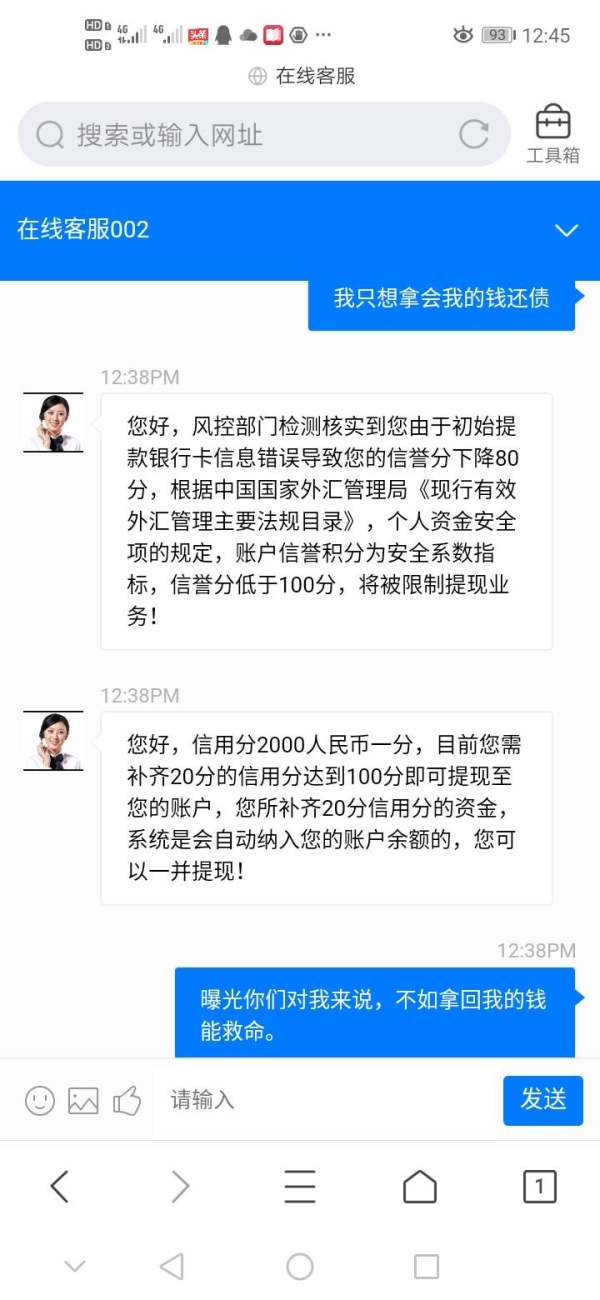

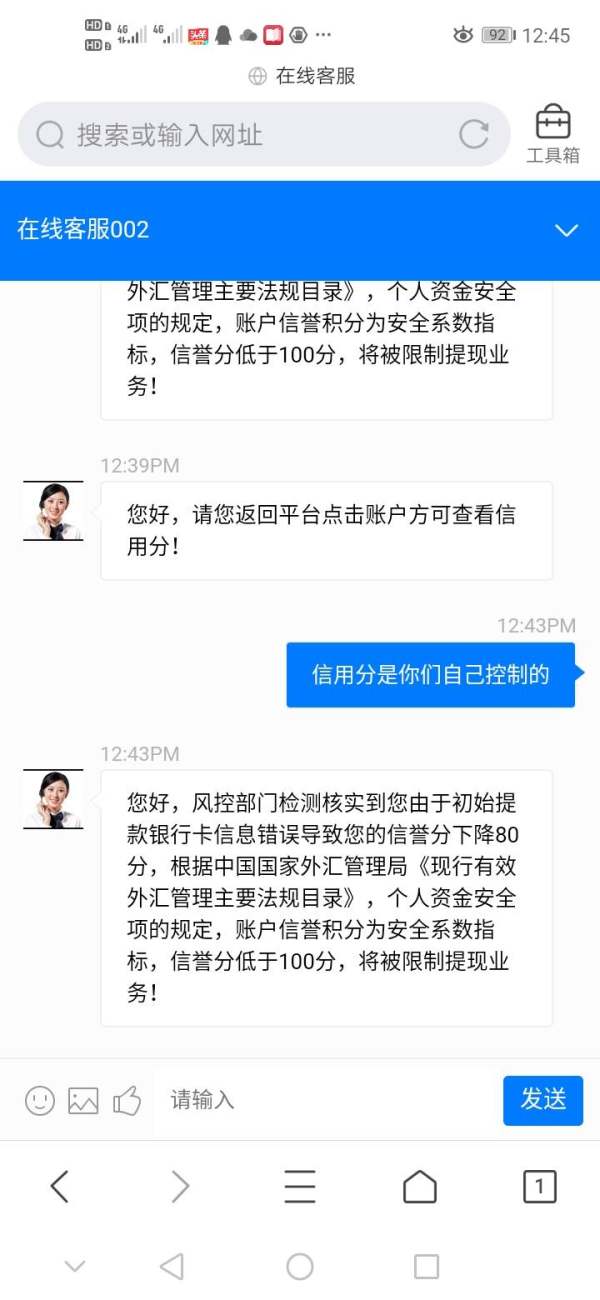

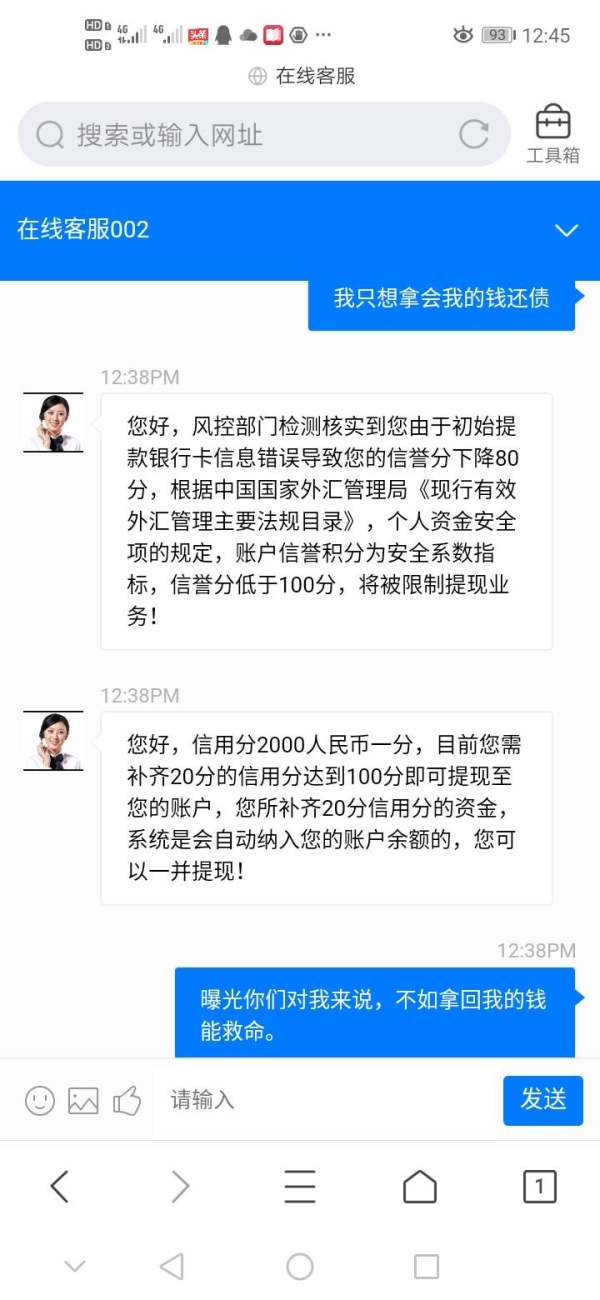

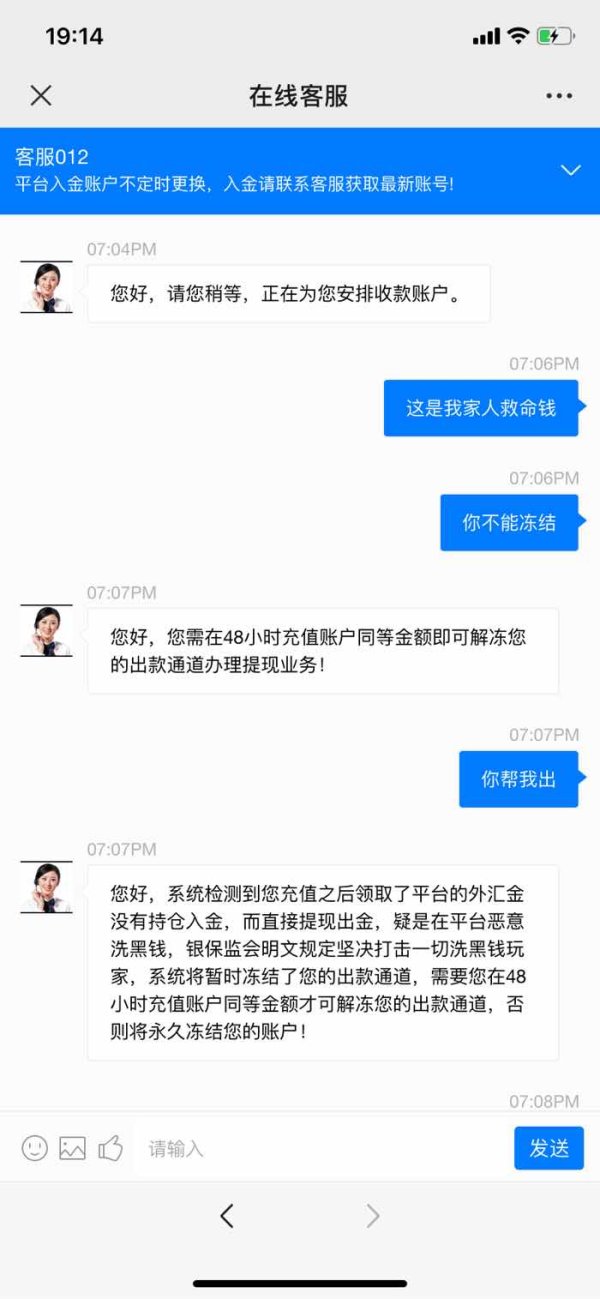

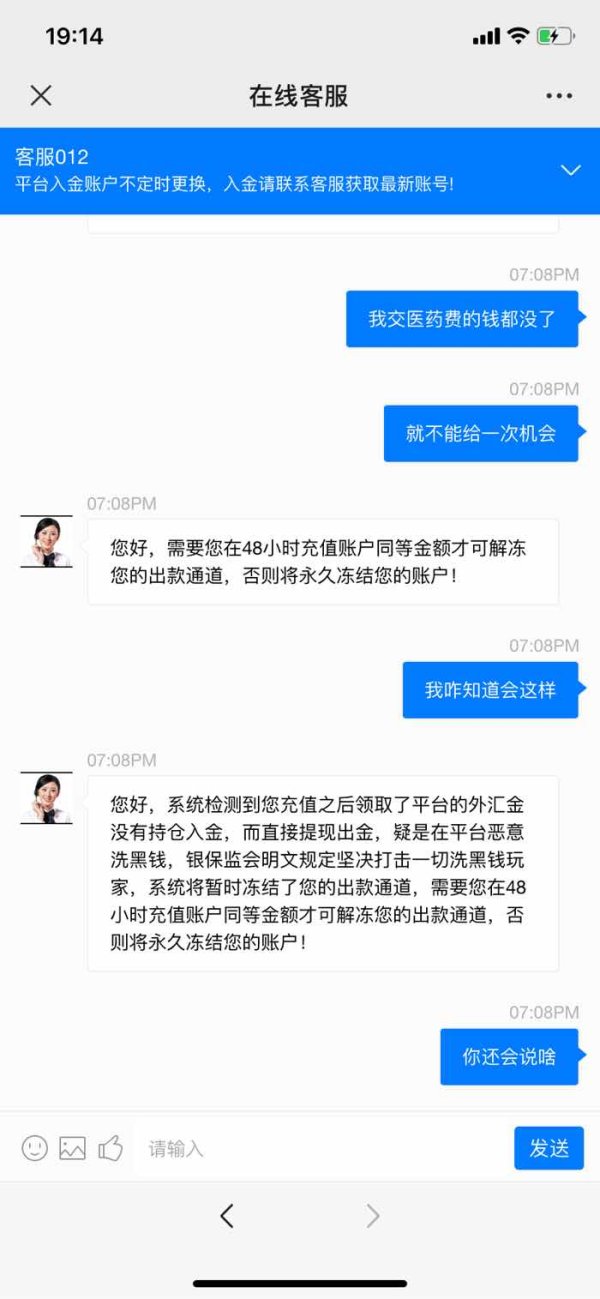

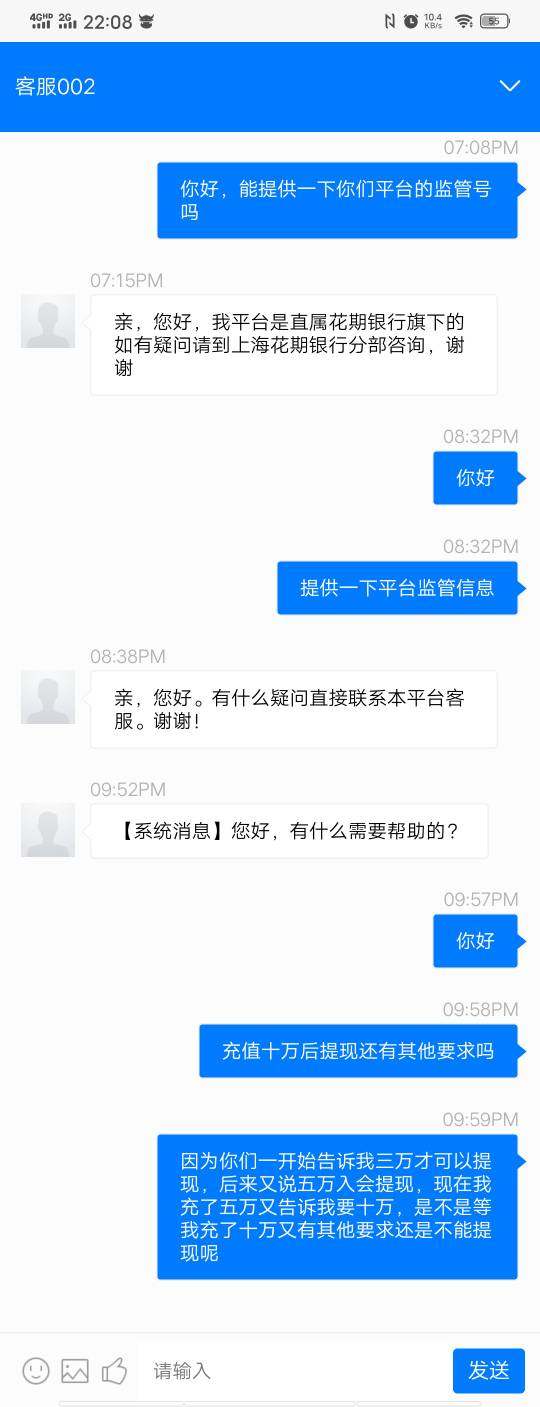

- Regulatory concerns and difficulties with fund withdrawals.

- Heavy annual percentage rates (APR) on credit cards, which could be exploitative for those with less favorable credit scores.

- Inconsistent customer service experiences that may lead to dissatisfaction.

Self-Verification Guide:

- Before opening an account, research Citibank's regulatory status through several authorized financial websites.

- Verify the terms and fees associated with various credit cards and investment services directly through Citibank's online portal.

- Read detailed customer reviews and feedback to grasp the overall service experience.

Rating Framework

Broker Overview

Company Background and Positioning

Citibank, part of Citigroup Inc., was established in 1812, making it one of the oldest banking institutions in the United States. It has significantly evolved, transitioning towards digital banking to offer modern banking solutions. Today, Citibank boasts approximately 110 million clients globally and operates in over 40 states, focusing on a rich array of financial services, with credit cards at the forefront of their offerings.

There are key distinctions that position Citibank as a neobank specializing in credit cards relative to traditional banks, primarily in user experience and service accessibility, reflecting the growing shift toward digitalization in financial services.

Core Business Overview

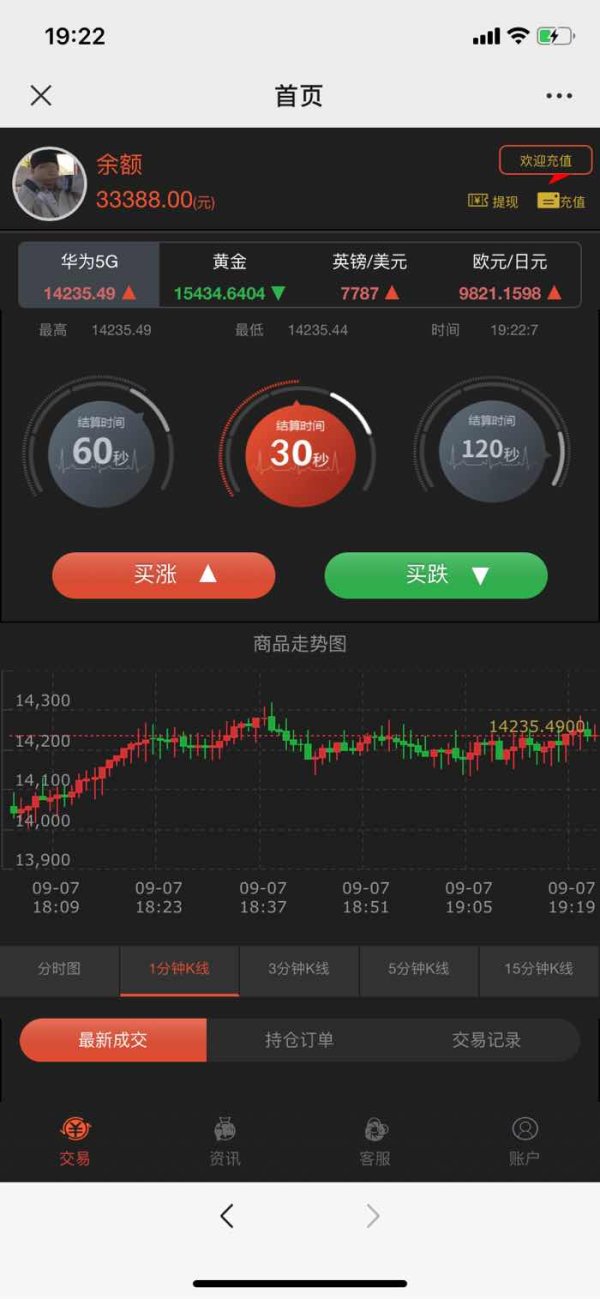

Citibank provides a multitude of services including credit cards, investment management, banking products like savings and checking accounts, and loans. The broker offers access to various asset classes through its integrated platforms, namely ‘Citi Self Invest’ for trading and investment services.

Citibank permits its clients to engage in international money transfers and provides options for automated investing, including robo-advised solutions. The bank also has regulatory claims that aim at ensuring client safety and resource management, though the regulatory framework's transparency is a continuing concern.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching Users to Manage Uncertainty.

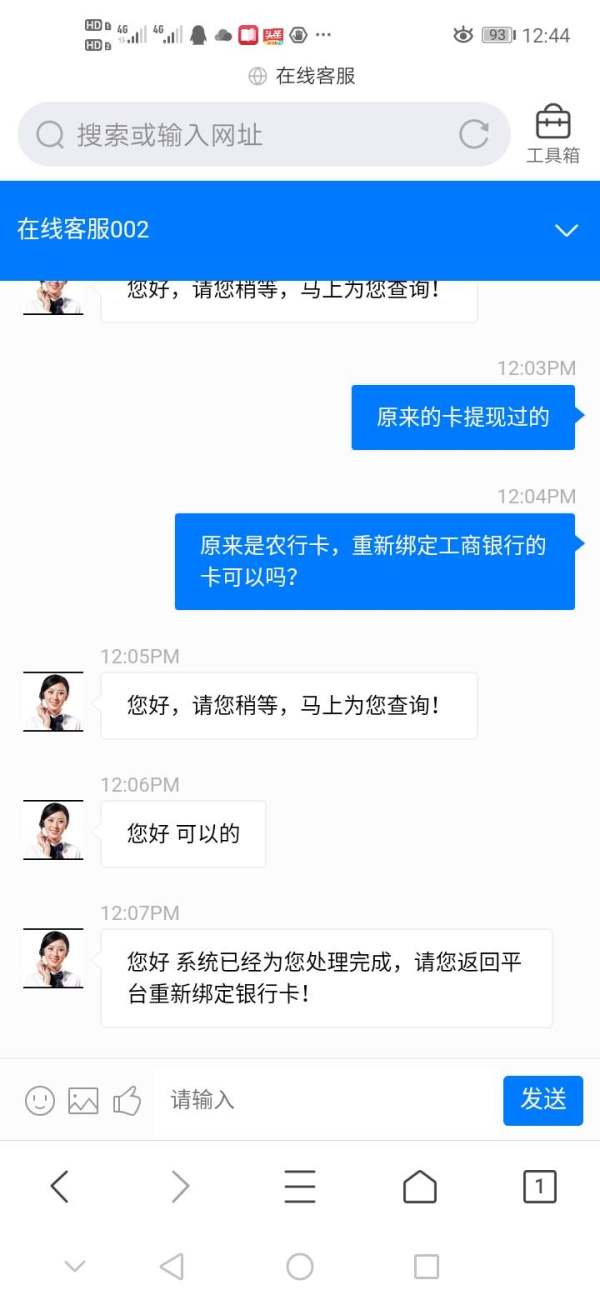

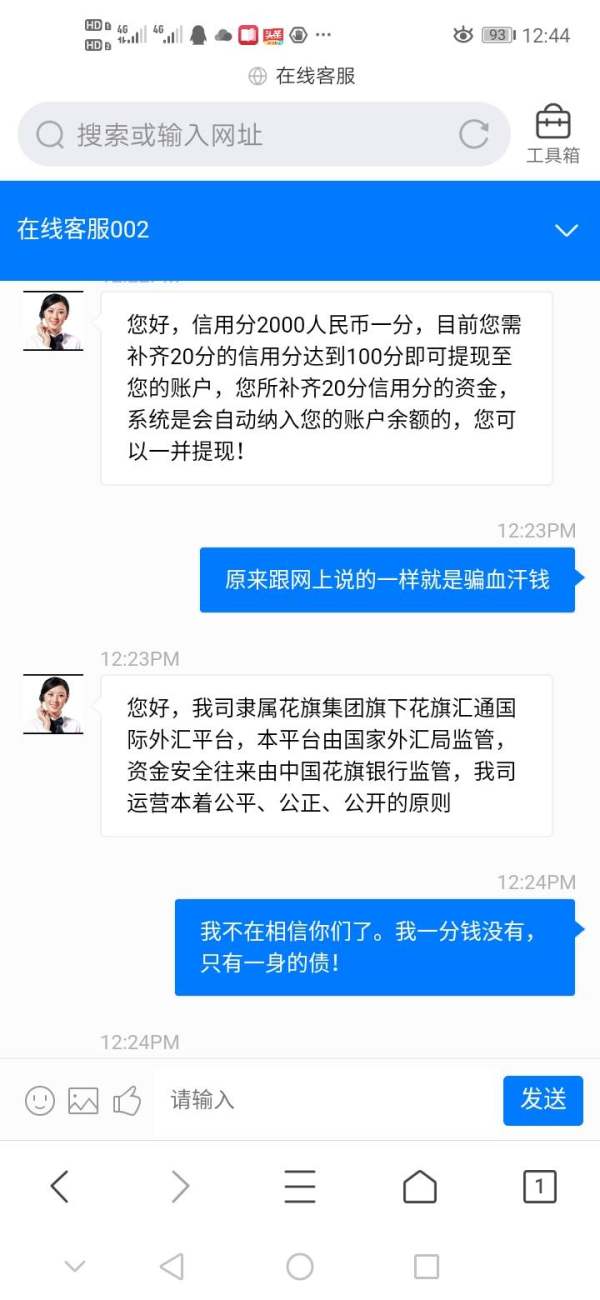

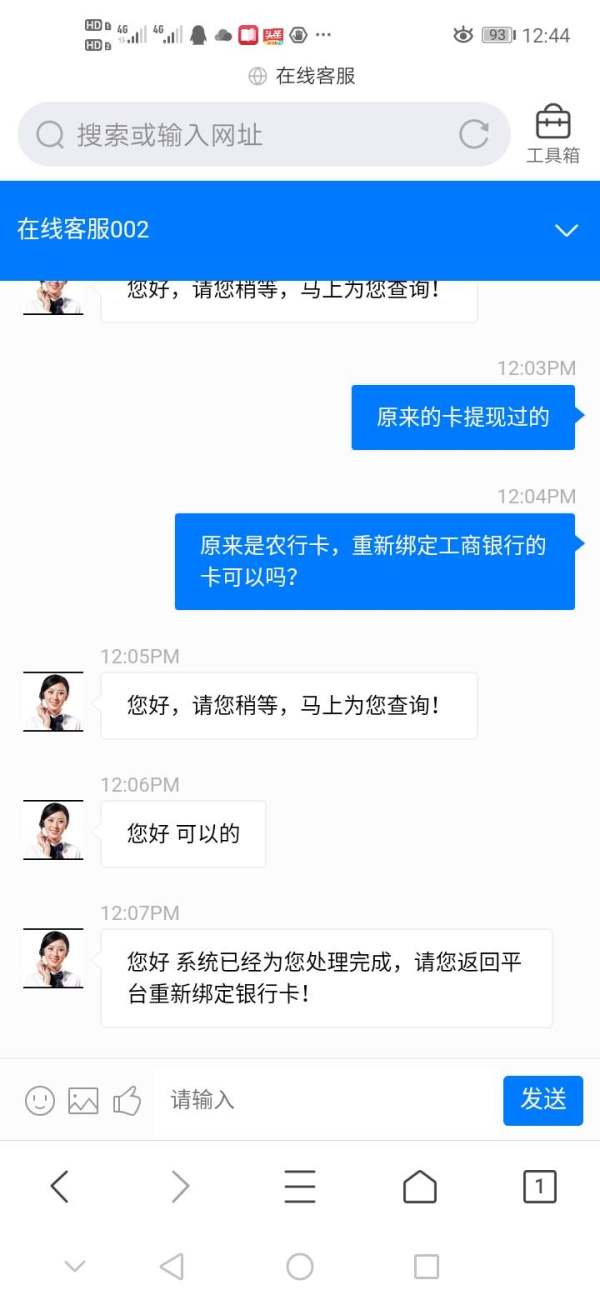

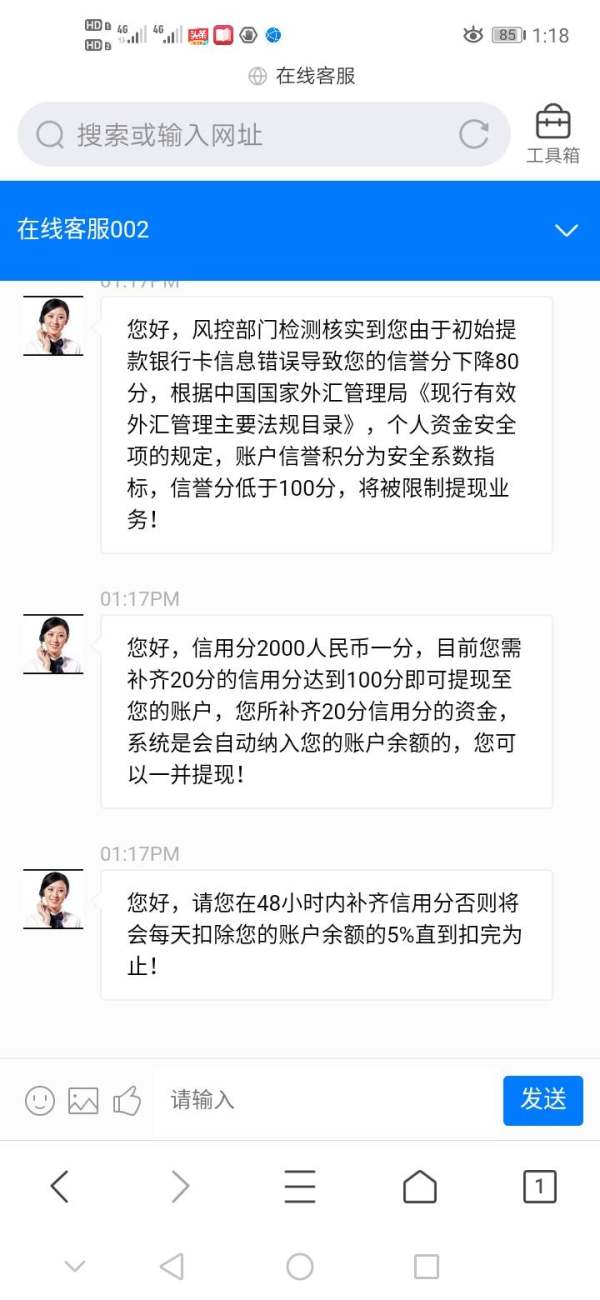

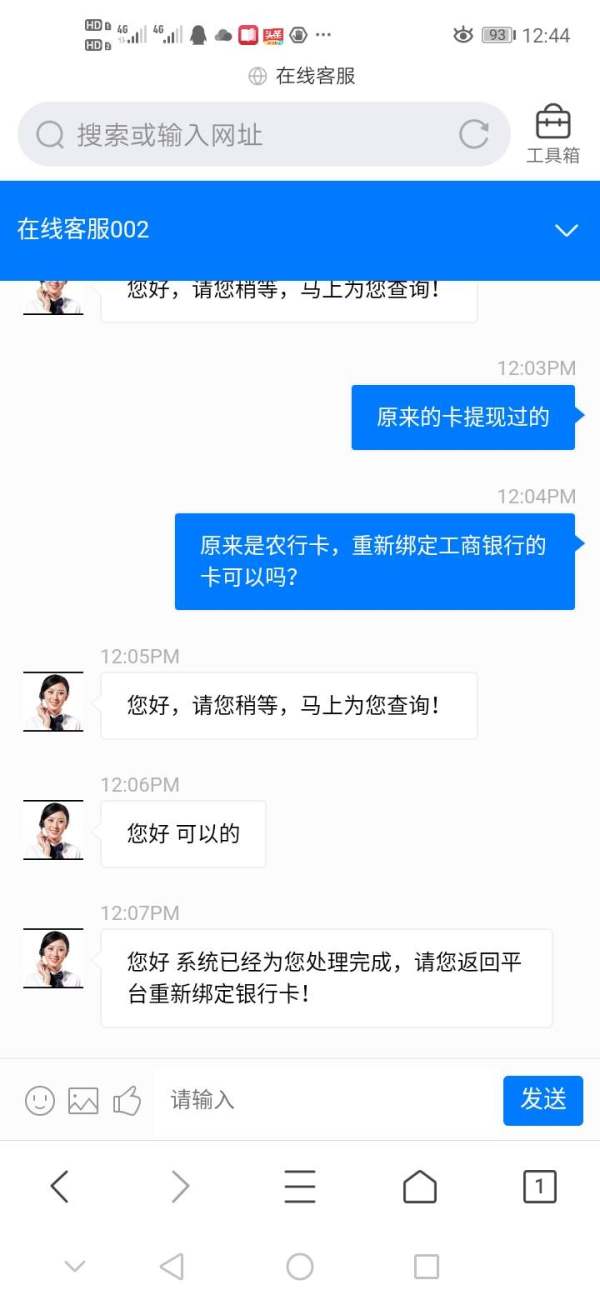

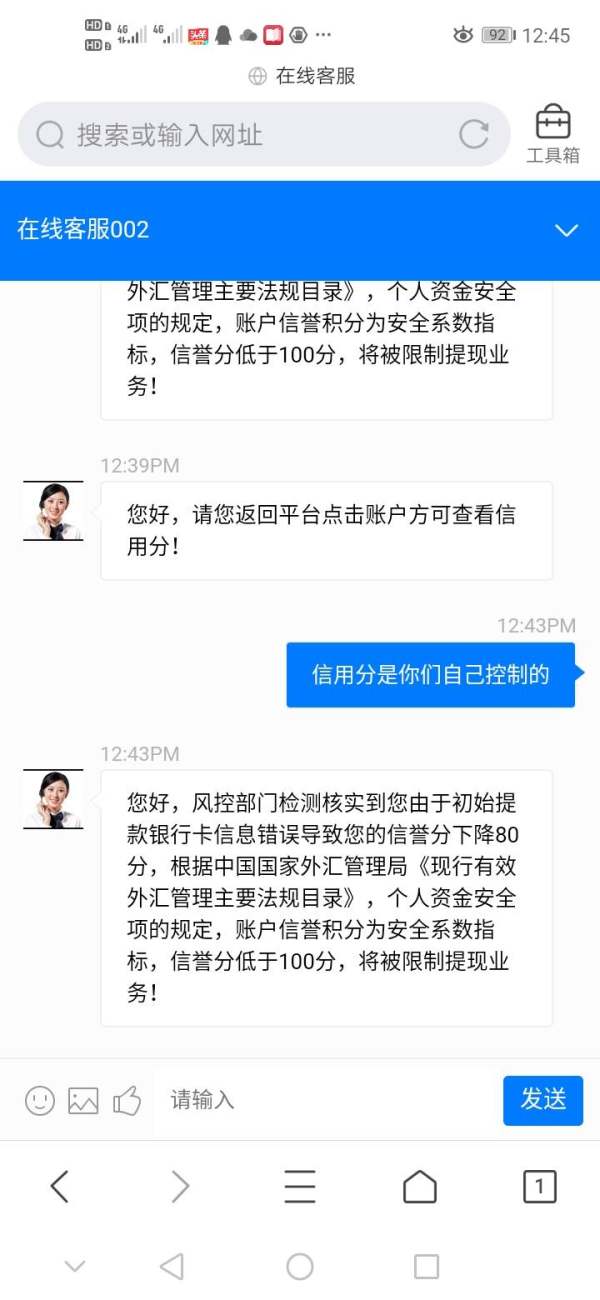

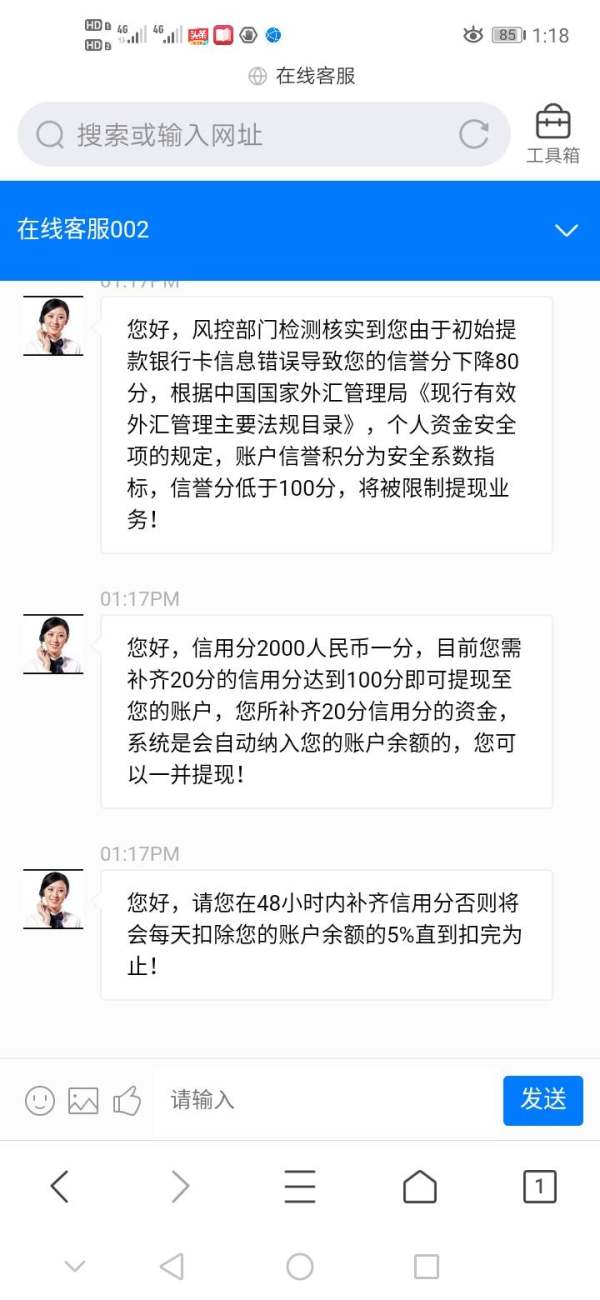

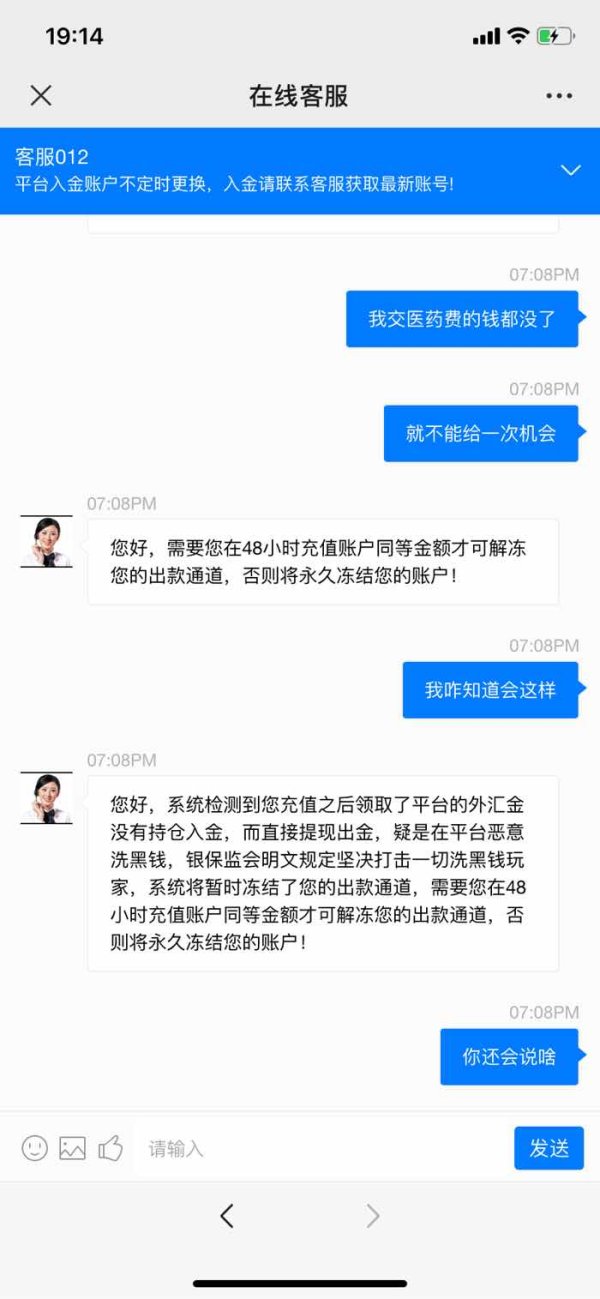

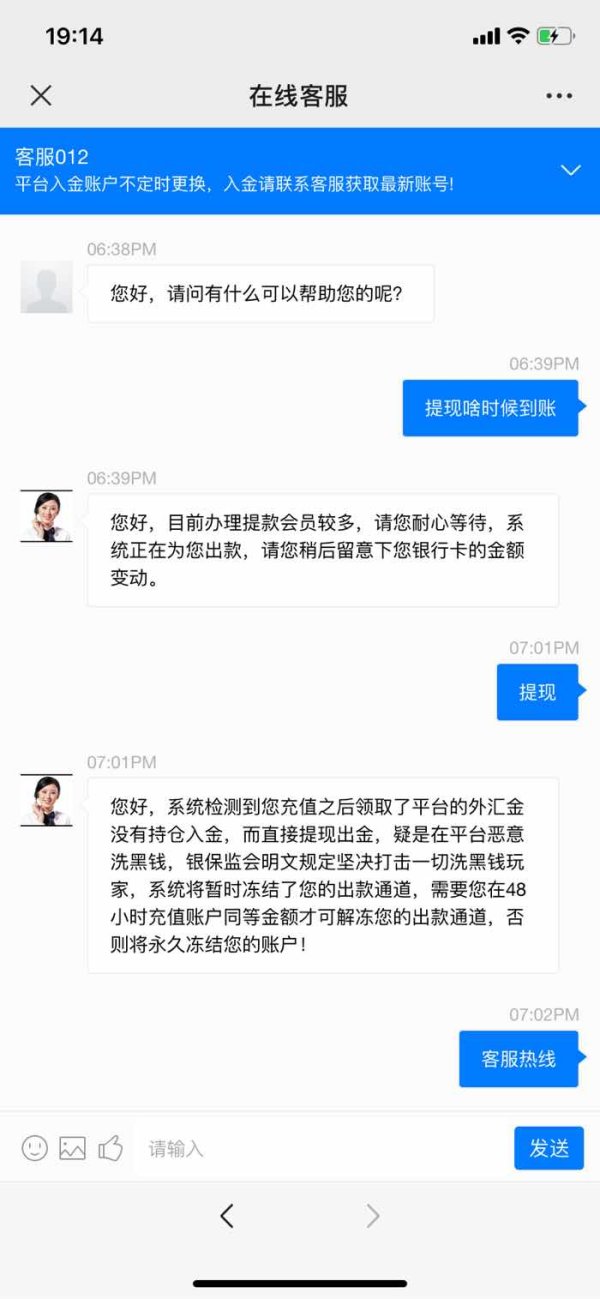

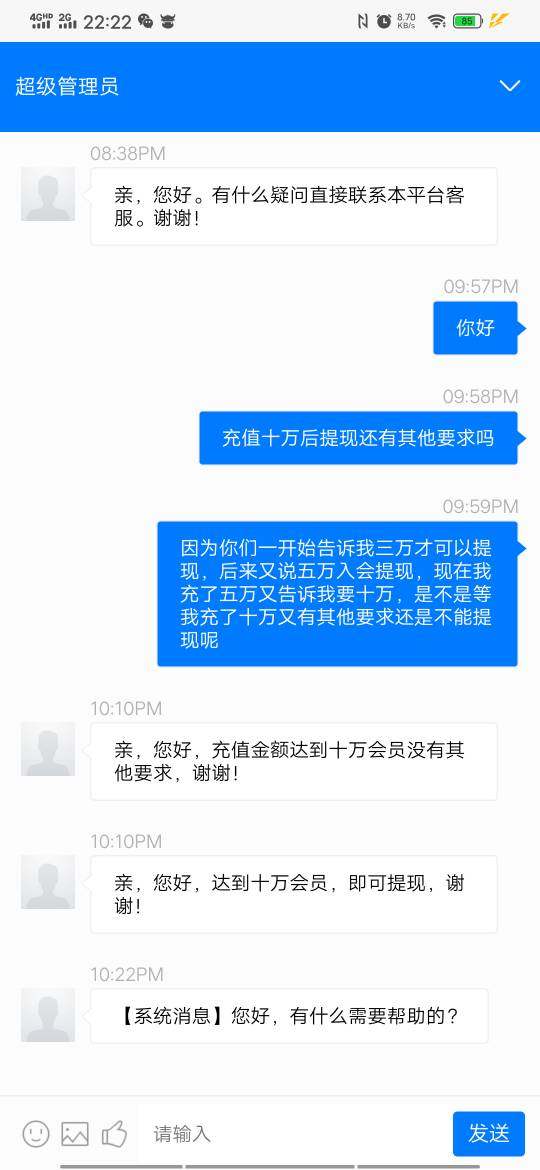

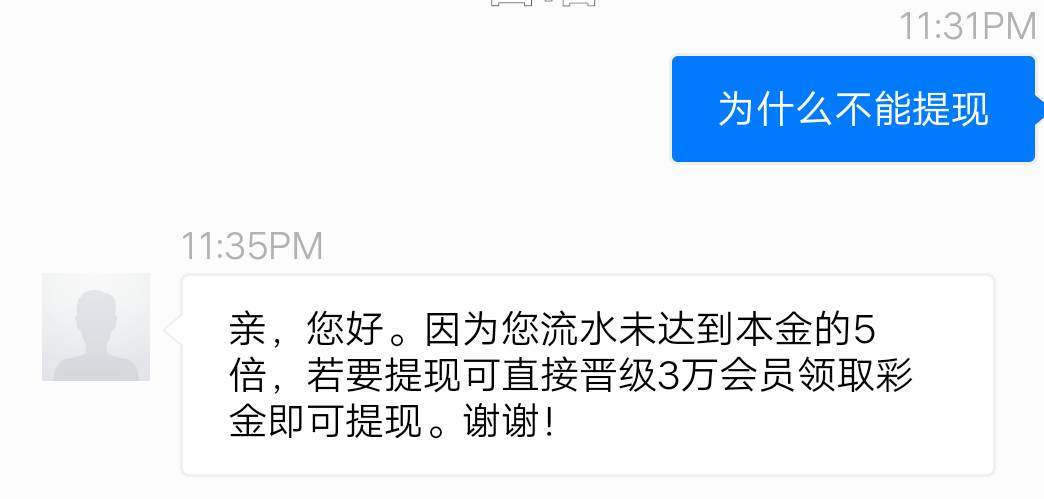

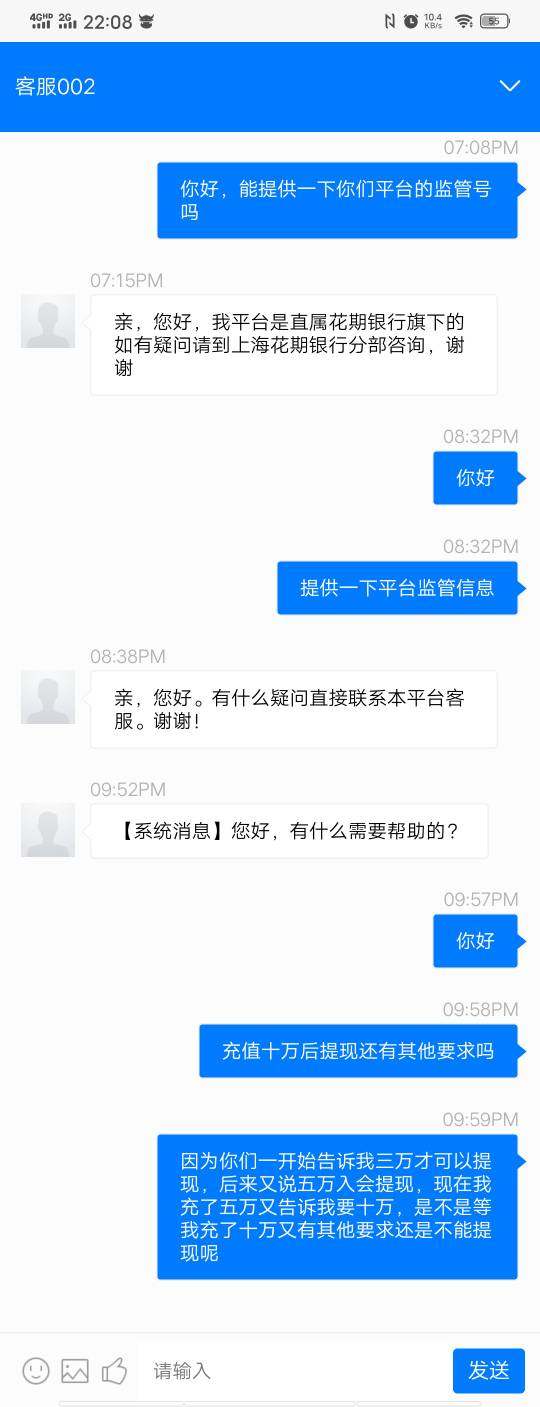

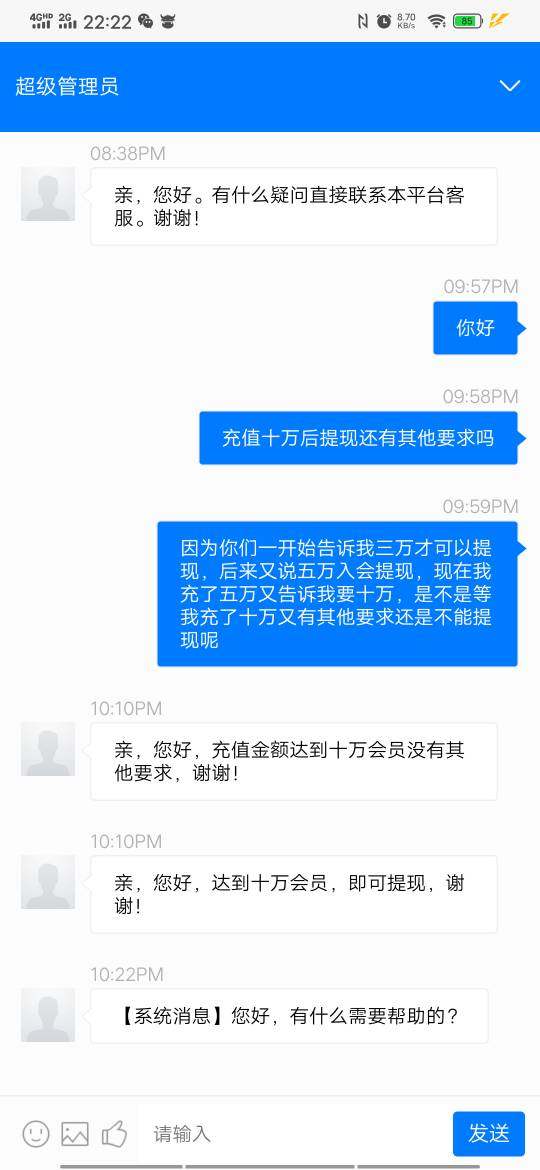

Discrepancies in regulatory information have created some level of distrust surrounding Citibank. While it holds licenses in various jurisdictions, there are reports indicating a lack of transparent, consistent communication regarding the withdrawal processes from user testimonials.

To verify Citibank's trustworthiness:

- Check Regulatory Status: Utilize official financial regulatory sites, such as the SEC or FCA to confirm Citibanks standing.

- Use Online Reviews: Browse consumer forums and financial review sites to catch real-time user impressions and experiences.

- Monitor Performance Metrics: Look for historical data regarding withdrawal responsiveness and service reliability.

User feedback emphasizes the necessity of client vigilance in ensuring the safety of funds and verifying that account structures align with personal financial circumstances.

Trading Costs Analysis

The Double-Edged Sword Effect.

Citibank stands out with competitive commission rates in trading; clients often experience low costs on traditional transactions.

Advantages in Commissions: For institutional clients, the broker provides a seamless experience with no commissions on trades for certain funds and automated solutions.

The "Traps" of Non-Trading Fees: However, hidden costs arise. User complaints note that:

"I incurred $34 in withdrawal fees that I was not aware of." – Source: User Review

- Cost Structure Summary: Citibank's structure may favor frequent traders, yet casual or new investors could face significant hurdles due to hidden fees and minimum balance requirements which can be steep.

Professional Depth vs. Beginner-Friendliness.

Citibank provides accessibility through multiple platforms, primarily driven by a mobile app that integrates banking and trading functionalities seamlessly:

Platform Diversity: Users can engage in stock, mutual funds, and ETF trading through the Citi Self Invest platform, which complements banking services.

Quality of Tools and Resources: Despite the user-friendly interface, traders may find the lack of advanced charting tools and insights limiting.

Platform Experience Summary: Most users reflect that the app is designed with beginners in mind, though advanced traders may find it lacking in sophistication.

User Experience Analysis

Polishing the Banking Experience.

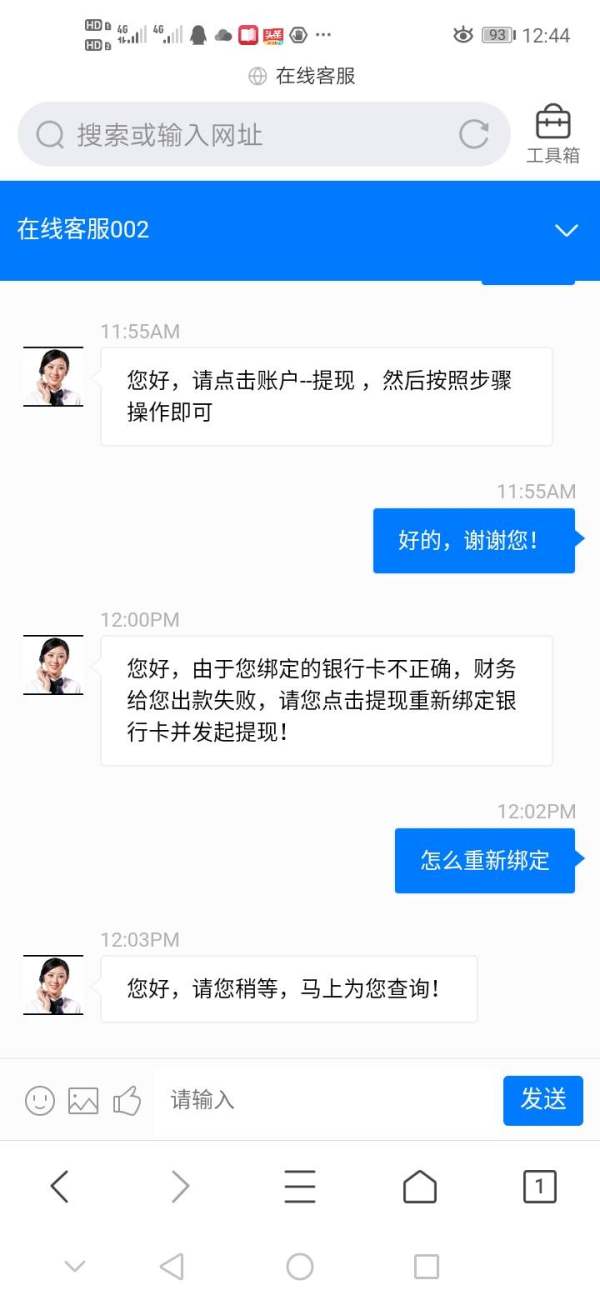

Users have reported mixed experiences navigating Citibank's offerings:

Onboarding Process: Initial registration requires detailed input, and clients report facing document delays or inconsistencies throughout the process, causing frustration.

Day-to-Day Banking: Many users appreciate the integrated services but express concerns regarding clarity in fee structures and withdrawal timelines.

Overall Summary: The experience reflects the balance of modern convenience against traditional banking complexities.

Customer Support Analysis

Navigating Support Expectations.

The availability of customer support is often cited as inconsistent, where clients have mixed interactions based on their needs:

Channels Available: Several contact routes are present, including forms, emails, and live chats, but responsiveness can vary significantly.

Quality Assessment: Customer reviews often highlight delays and a lack of resolution to issues, with users rating the support experience as needing improvement.

Account Conditions Analysis

Understanding Account Structures.

Citibank's account structures cater to diverse financial needs but come with some considerations:

High Minimum Balances: Certain accounts require high minimum deposits, which can limit accessibility for lower-income clients and beginners.

Interest-Achieving Accounts: The modest APY of up to 1.01% on certain savings accounts compares favorably to traditional savings but may not suffice in a low-interest rate environment.

Summary: While accounts can yield good returns, customers must assess their financial stability to avoid unnecessary charges or restrictions due to maintained balances.

Conclusion

Citibank provides a robust suite of banking and investment services that can be incredibly beneficial for savvy consumers looking to leverage its extensive offerings, especially in credit and investment management. However, potential users must navigate the landscape of high fees, regulatory concerns, and inconsistent customer service experiences. By employing careful research and vigilance, clients can better position themselves to capitalize on what Citibank has to offer while mitigating the inherent risks. Understanding both sides of the Citibank experience will be crucial for any potential customer deciding whether the opportunities outweigh the traps inherent in Citibanks vast services.