PTFX 2025 Review: Everything You Need to Know

Executive Summary

PTFX shows a complex picture in the forex brokerage world. Mixed user feedback demands careful thought from traders. This ptfx review reveals a broker that has gotten both positive and negative attention from traders since it started in 2017.

Some users praise the broker's competitive spreads and smooth withdrawal processing. However, big concerns have come up about the company's trustworthiness and customer service quality. PTFX works mainly as a forex and CFD broker, offering the popular MT4 trading platform and access to multiple asset classes.

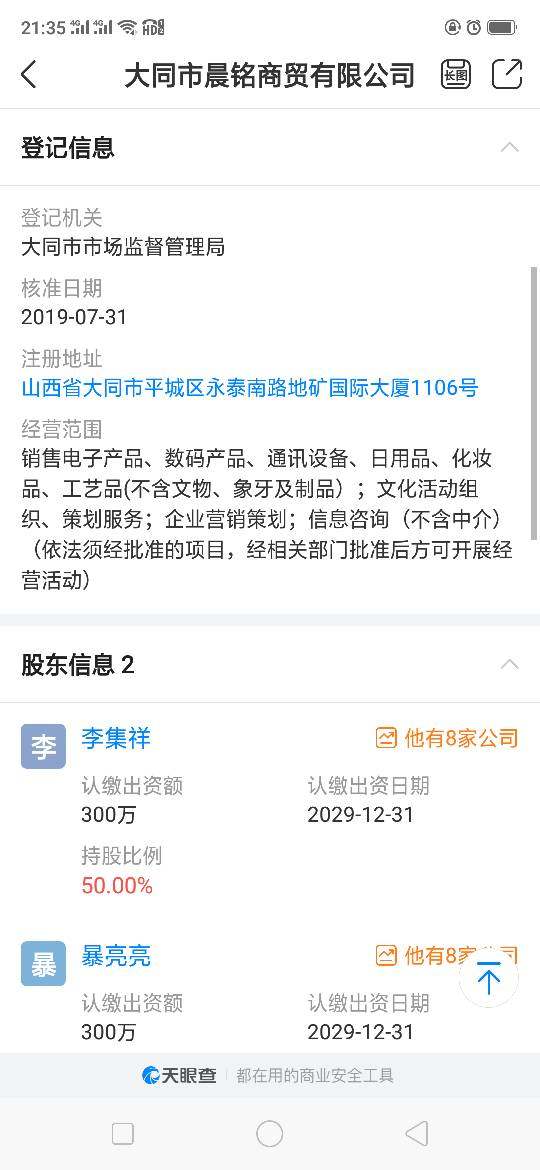

These include forex pairs, indices, precious metals, energy products, and commodities. The broker positions itself to serve small to medium-sized investors seeking diverse trading opportunities across various financial instruments. However, according to WikiFX reports, PTFX has received a concerning rating of 1.98 out of 10, along with 256 user complaints.

This raises serious questions about the broker's reliability and operational standards. This mixed reputation makes PTFX a broker that requires thorough research before any trading commitment.

Important Notice

Regional Entity Differences: PTFX's regulatory information is not clearly shown in available materials. Potential users must independently check the broker's compliance status and safety measures in their areas. Traders should use extreme caution when dealing with unregulated or poorly regulated entities.

Review Methodology: This evaluation is based on user feedback, third-party ratings, and publicly available information. Not all data points have been independently verified. Traders should conduct their own research before making any investment decisions.

Rating Overview

Broker Overview

PTFX entered the forex brokerage market in 2017. The company established itself as an Indonesia-based financial services provider specializing in forex and CFD trading. The company has positioned itself to serve the growing Southeast Asian trading community, though its services appear to extend beyond this regional focus.

Despite operating for several years, PTFX maintains a relatively low profile in the international forex community. Limited information is available about its corporate structure and leadership team. The broker's business model centers on providing access to global financial markets through the MetaTrader 4 platform.

This is one of the industry's most recognized trading interfaces. PTFX offers trading opportunities across multiple asset classes, including major and minor forex currency pairs, global stock indices, precious metals such as gold and silver, energy commodities including crude oil, and various other commodity instruments. This diverse offering appears designed to attract traders seeking exposure to different market sectors through a single brokerage account.

However, the lack of clear regulatory disclosure raises big concerns about the broker's operational framework and client protection measures. This ptfx review emphasizes the importance of understanding these regulatory gaps before engaging with the platform.

Regulatory Status: Available materials do not clearly specify PTFX's regulatory oversight. This represents a significant red flag for potential traders seeking regulated brokerage services.

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees is not detailed in accessible sources. This requires direct inquiry with the broker.

Minimum Deposit Requirements: The minimum account opening deposit is not specified in available documentation. This indicates a lack of transparency in account setup procedures.

Bonuses and Promotions: No specific promotional offers or bonus structures are mentioned in the reviewed materials. This suggests either absence of such programs or poor marketing transparency.

Tradeable Assets: PTFX provides access to forex currency pairs, global indices, spot precious metals, energy products, and various commodity instruments. This offers reasonable diversification for retail traders.

Cost Structure: While users have mentioned competitive spreads, detailed commission structures, overnight financing rates, and other trading costs are not clearly disclosed in available materials.

Leverage Ratios: Specific leverage offerings and their variations across different asset classes are not detailed in accessible information. This requires direct broker consultation.

Platform Options: The broker uses the MetaTrader 4 platform. However, specific customizations, additional tools, or mobile application features are not fully described.

Geographic Restrictions: Information about restricted countries or regional limitations is not available in reviewed materials.

Customer Support Languages: The range of languages supported by customer service teams is not specified in accessible documentation.

This ptfx review highlights significant information gaps that potential traders should address through direct communication with the broker before account opening.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

PTFX's account conditions receive a below-average rating mainly due to insufficient transparency about account types, minimum deposit requirements, and specific terms of service. Available materials do not provide clear information about different account tiers, their respective features, or the benefits associated with higher deposit levels. This lack of transparency makes it difficult for potential traders to make informed decisions about which account type might best suit their trading needs and capital allocation.

The absence of detailed information about account opening procedures, required documentation, and verification timelines further contributes to the poor rating in this category. Professional forex brokers typically provide complete account information upfront, including spreads by account type, commission structures, and any special features such as Islamic accounts for Muslim traders. PTFX's failure to clearly communicate these essential details represents a significant shortcoming in their service transparency.

Additionally, without clear information about account maintenance fees, inactivity charges, or minimum balance requirements, traders cannot accurately assess the total cost of maintaining an account with PTFX. This ptfx review emphasizes that such transparency gaps create unnecessary uncertainty for potential clients and suggest substandard operational practices.

PTFX receives an average rating for tools and resources, mainly based on their provision of the MetaTrader 4 platform. MT4 is widely recognized as a robust trading interface. MT4 offers essential charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, providing traders with fundamental analytical resources needed for forex and CFD trading.

However, the rating is limited by the apparent absence of proprietary research tools, market analysis resources, or educational materials that many established brokers provide to enhance their clients' trading capabilities. Professional forex brokers typically offer daily market commentary, economic calendar integration, fundamental analysis reports, and educational webinars to support trader development and decision-making processes. The lack of detailed information about available technical indicators, charting packages, or third-party tool integrations further limits the assessment of PTFX's analytical offerings.

Additionally, no information is available regarding mobile trading capabilities, web-based platforms, or advanced order types that experienced traders often require for sophisticated trading strategies.

Customer Service and Support Analysis (4/10)

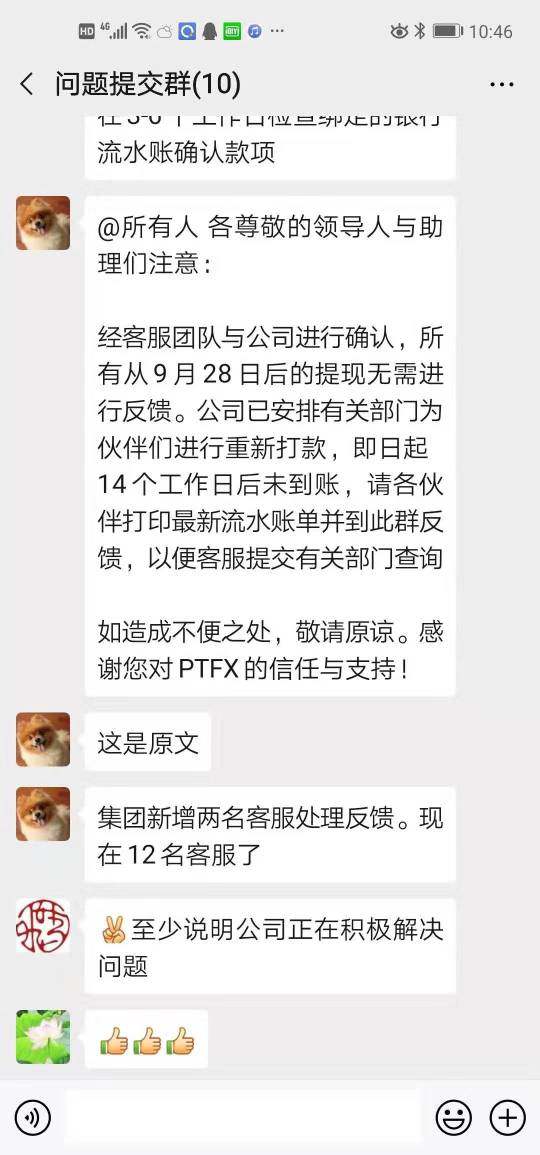

Customer service receives a poor rating based on negative user feedback and the lack of clear information about support channels, availability, and response standards. User complaints and the low WikiFX rating suggest that PTFX struggles with customer service delivery, which is crucial for maintaining trader confidence and resolving technical or account-related issues promptly. Professional forex brokers typically offer multiple contact methods including live chat, email support, and telephone assistance with clearly stated response time commitments.

The absence of detailed customer service information from PTFX suggests either inadequate support infrastructure or poor communication about available services. This creates uncertainty for traders who may need urgent assistance during volatile market conditions or technical difficulties. The high number of user complaints according to WikiFX indicates systemic issues with customer satisfaction and problem resolution.

Effective customer service is essential in forex trading, where technical issues or account problems can directly impact trading results and financial outcomes. PTFX's apparent shortcomings in this area represent a significant concern for potential clients.

Trading Experience Analysis (7/10)

Despite other concerns, PTFX receives a good rating for trading experience based on positive user feedback regarding platform stability and order execution quality. Users have reported satisfactory performance in terms of trade execution speed and platform reliability, which are fundamental requirements for successful forex trading. The MT4 platform provides a familiar interface for experienced traders and offers essential functionality for market analysis and trade management.

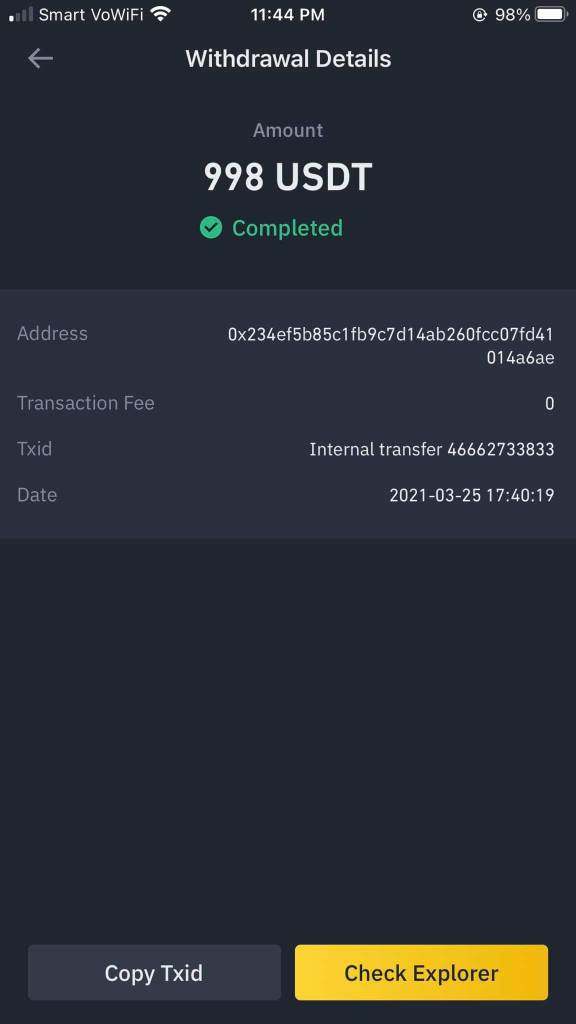

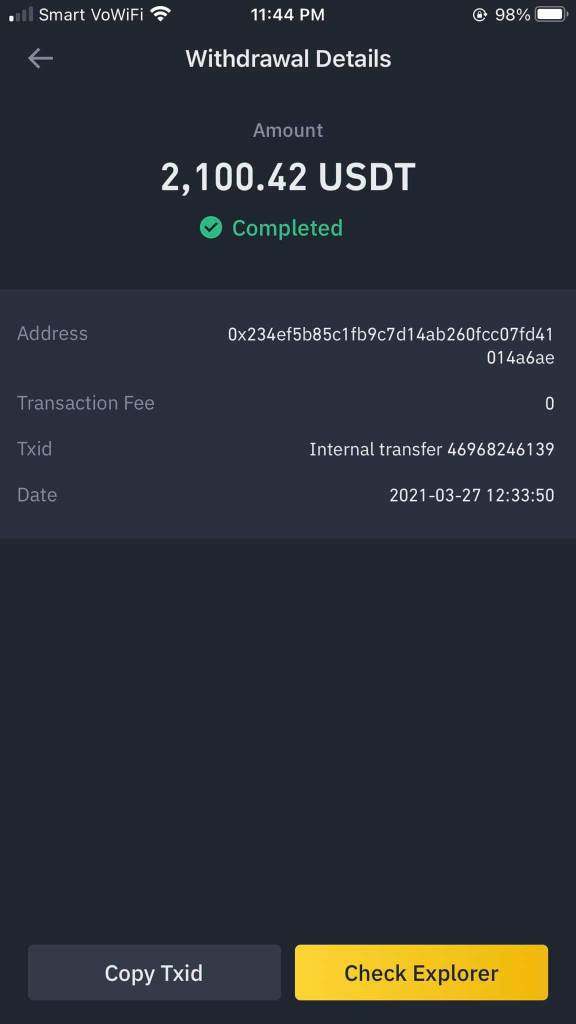

Competitive spreads mentioned in user feedback contribute positively to the trading experience, as tight spreads directly impact trading profitability, especially for active traders and scalping strategies. Smooth withdrawal processing, as reported by some users, also enhances the overall trading experience by ensuring traders can access their funds when needed. However, the rating is limited by insufficient information about slippage rates, requote frequency, and execution speed during high-volatility periods.

Additionally, the absence of detailed information about available order types, partial fill handling, and stop-out procedures prevents a more complete assessment of the trading environment quality. This ptfx review acknowledges the positive user feedback while noting the need for more complete performance data.

Trust and Safety Analysis (3/10)

Trust and safety receive the lowest rating due to several concerning factors that significantly impact PTFX's credibility as a forex broker. The WikiFX rating of 1.98 out of 10 represents an extremely poor industry assessment, suggesting serious concerns about the broker's operational standards, regulatory compliance, and client fund safety measures. The absence of clear regulatory information represents a major red flag, as legitimate forex brokers typically operate under strict regulatory oversight from recognized financial authorities.

Regulatory supervision provides essential client protections including segregated fund storage, compensation schemes, and operational oversight that helps ensure broker accountability and client fund security. With 256 user complaints reported on WikiFX, PTFX demonstrates a pattern of client dissatisfaction that extends beyond isolated incidents. This volume of complaints suggests systemic issues with business practices, fund handling, or service delivery that potential traders should carefully consider.

The combination of poor third-party ratings and high complaint volumes creates significant concerns about the broker's trustworthiness and long-term viability as a trading partner.

User Experience Analysis (5/10)

User experience receives an average rating reflecting the mixed feedback from PTFX clients, with both positive and negative elements contributing to an overall neutral assessment. Some users report satisfactory experiences with platform functionality and trade execution, while others express concerns about customer service quality and overall broker reliability. The availability of multiple asset classes through a single platform provides convenience for traders seeking diversified exposure across different markets.

However, the lack of detailed information about account management features, reporting tools, and mobile trading capabilities limits the assessment of overall user experience quality. Negative feedback regarding customer service and trust issues significantly impacts the user experience rating, as these factors directly affect trader confidence and satisfaction. The absence of complete educational resources or trader development programs also limits the value proposition for less experienced traders who might benefit from additional support and guidance.

Common user complaints appear to center on customer service responsiveness and trust-related concerns, which are fundamental to positive user experience in financial services.

Conclusion

This ptfx review reveals a forex broker with significant mixed characteristics that require careful consideration by potential traders. While PTFX offers some positive elements including competitive spreads, decent trading platform performance, and access to multiple asset classes, serious concerns about trust, regulatory transparency, and customer service quality overshadow these potential benefits. PTFX may be suitable for small to medium-sized investors seeking diverse trading opportunities across various asset classes, particularly those comfortable with higher-risk broker relationships.

However, the poor trust ratings, high complaint volumes, and lack of regulatory transparency make this broker inappropriate for risk-averse traders or those prioritizing fund safety and regulatory protection. The main advantages include competitive spreads and satisfactory trading platform performance, while significant disadvantages include poor trust ratings, inadequate customer service, and insufficient regulatory disclosure. Potential traders should exercise extreme caution and conduct thorough research before considering PTFX for their trading activities.