Regarding the legitimacy of ACY SECURITIES forex brokers, it provides ASIC, FSCA and WikiBit, (also has a graphic survey regarding security).

Is ACY SECURITIES safe?

Pros

Cons

Is ACY SECURITIES markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ACY Securities Pty Ltd

Effective Date: Change Record

2011-07-11Email Address of Licensed Institution:

compliance@acy.comSharing Status:

No SharingWebsite of Licensed Institution:

www.acy.com.auExpiration Time:

--Address of Licensed Institution:

'LEVEL 18 TOWER' B 799 PACIFIC HWY CHATSWOOD NSW 2067Phone Number of Licensed Institution:

0291882999Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ACY SECURITIES SA (PTY) LTD

Effective Date: Change Record

2021-02-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

4 STAN ROAD SANDTON JOHANNESBURG GAUTENG 2196Phone Number of Licensed Institution:

0061409 360370Licensed Institution Certified Documents:

Is ACY Securities A Scam?

Introduction

ACY Securities, an Australian-based forex and CFD broker, has established itself as a prominent player in the online trading landscape since its inception in 2011. With a focus on providing a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies, ACY Securities aims to cater to both novice and experienced traders. However, as the forex market is rife with potential scams and unreliable brokers, it is crucial for traders to exercise caution and conduct thorough assessments before engaging with any trading platform. This article undertakes a comprehensive investigation into ACY Securities, evaluating its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk profile. The analysis leverages data from various reputable sources, including regulatory bodies, user reviews, and financial reports, to provide a balanced perspective on whether ACY Securities is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its legitimacy and trustworthiness. ACY Securities is regulated by two primary authorities: the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). ASIC is recognized as a tier-1 regulator, known for its stringent oversight and consumer protection measures, while the VFSC operates in a less regulated environment, which may pose additional risks for traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 403863 | Australia | Verified |

| VFSC | 012868 | Vanuatu | Verified |

ASIC's robust regulatory framework mandates that brokers adhere to high standards of conduct, including the segregation of client funds and maintaining adequate capital reserves. This regulatory oversight is essential for protecting traders' interests and ensuring that brokers operate transparently. On the other hand, the VFSC's regulatory framework is less stringent, often attracting brokers seeking to operate with more flexibility, but potentially at the expense of consumer protection.

Historically, ACY Securities has maintained compliance with ASIC's regulations, which enhances its credibility. However, the existence of an offshore entity regulated by the VFSC raises questions about the level of protection available to clients trading through that entity. It is essential for prospective clients to be aware of the regulatory landscape and choose the entity under which they wish to open an account wisely.

Company Background Investigation

Founded in 2011, ACY Securities has grown from a local broker into an internationally recognized trading platform. The company is headquartered in Chatswood, Australia, and has expanded its operations to include additional offices in regions such as South Africa and St. Vincent and the Grenadines. The ownership structure of ACY Securities includes several subsidiaries, with ACY Securities Pty Ltd being the primary entity regulated by ASIC.

The management team at ACY Securities comprises experienced professionals from the financial services industry, bringing a wealth of knowledge and expertise to the company. This experience is crucial in navigating the complexities of the forex market and ensuring that the broker remains competitive in terms of technology and service offerings.

Transparency is a key characteristic of ACY Securities, as the company provides detailed information about its operations, including regulatory compliance, fees, and trading conditions. The broker also maintains an informative website that offers educational resources and market analysis, further enhancing its credibility in the eyes of potential clients.

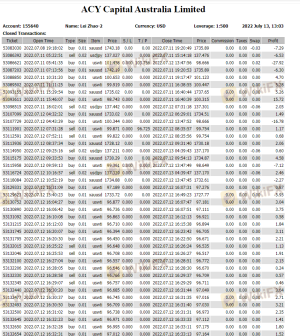

Trading Conditions Analysis

ACY Securities offers a range of trading conditions designed to accommodate various trading styles and preferences. The broker provides three primary account types: Standard, ProZero, and Bespoke, each with distinct features and fee structures.

The overall fee structure at ACY Securities is competitive, with no deposit fees and a low minimum deposit requirement of $50 for the Standard account. However, the ProZero account, which offers spreads starting from 0.0 pips, incurs a commission of $3 per lot, while the Bespoke account charges $2.50 per lot. It's important to note that while the spreads are attractive, the commission structure may not be favorable for all traders.

| Fee Type | ACY Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | $3 per lot (ProZero) | $6 per lot (average) |

| Overnight Interest Range | Variable | Variable |

While the spreads offered by ACY Securities are generally competitive, traders should be aware of the potential for higher costs associated with overnight positions and variable spreads that may increase during periods of high market volatility. Additionally, some users have reported issues with slippage and unexpected fees, which could impact overall trading profitability.

Customer Fund Safety

The safety of customer funds is paramount in the trading environment, and ACY Securities implements several measures to ensure the protection of client capital. Client funds are held in segregated accounts with reputable tier-1 banks, which provides an added layer of security against misappropriation or misuse of funds.

Furthermore, ACY Securities offers negative balance protection, ensuring that clients cannot lose more than their account balance, thus mitigating the risk of significant financial losses. The broker also adheres to anti-money laundering (AML) and know your customer (KYC) policies, requiring clients to verify their identity and address before trading.

Despite these safety measures, it is essential for traders to remain vigilant and conduct their due diligence. Historical concerns regarding fund withdrawal issues and reports of slippage have emerged, prompting some users to question the overall reliability of the broker in terms of fund accessibility.

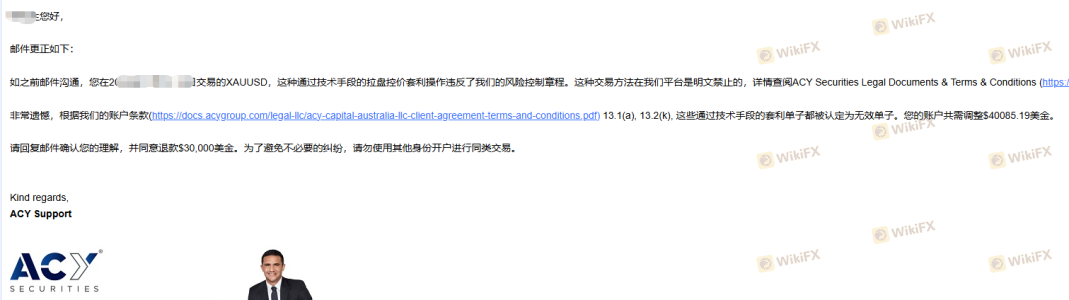

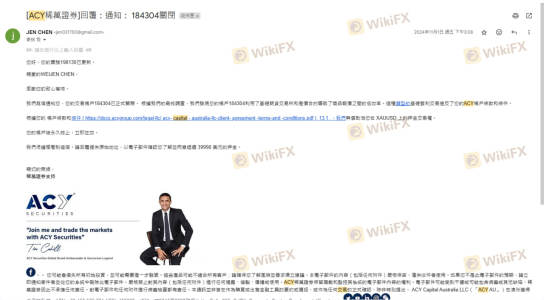

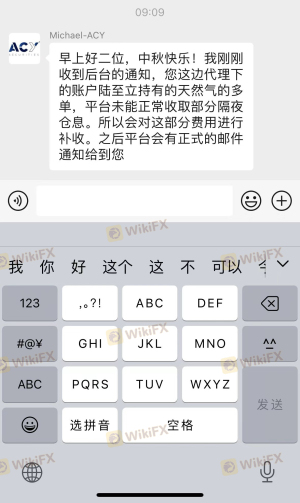

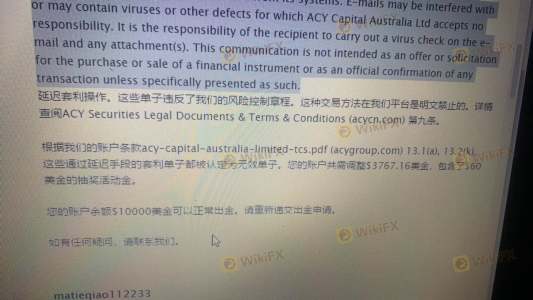

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. ACY Securities has received mixed reviews from users, with many praising its competitive spreads, low fees, and responsive customer support. However, some clients have reported difficulties with withdrawals and slippage during trading, which raises concerns about the broker's operational efficiency.

Common complaints about ACY Securities include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times reported |

| Slippage | Medium | Addressed but not consistently resolved |

| Customer Support Quality | Medium | Mixed reviews on responsiveness |

For instance, one user reported significant delays in processing withdrawal requests, while another highlighted issues with high slippage during volatile market conditions. These experiences emphasize the importance of user experience in evaluating the overall trustworthiness of ACY Securities.

Platform and Execution

The trading platform is a critical component of a trader's experience, and ACY Securities offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) as its primary trading platforms. These platforms are well-regarded in the industry for their robust features, including advanced charting tools, automated trading capabilities, and a user-friendly interface.

In terms of order execution, ACY Securities operates as an ECN broker, which typically results in faster execution speeds and reduced slippage. However, users have reported occasional issues with execution quality, particularly during periods of high volatility. It is essential for traders to assess their trading strategies and consider potential risks associated with execution delays or re-quotes.

Risk Assessment

Using ACY Securities entails several risks that traders should be aware of. While the broker is regulated by ASIC, which provides a level of security, the existence of an offshore entity and reports of withdrawal issues highlight potential vulnerabilities.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore entity may lack strong consumer protections. |

| Execution Risk | Medium | Reports of slippage and delays in order execution. |

| Fund Safety Risk | Medium | While funds are segregated, historical complaints exist. |

To mitigate these risks, traders are advised to thoroughly research the broker's policies, choose appropriate account types, and maintain a cautious approach to leverage and trading strategies.

Conclusion and Recommendations

In conclusion, ACY Securities presents a mixed picture based on available information. While the broker is regulated by ASIC, which is a positive indicator of its legitimacy, concerns regarding withdrawal issues and slippage warrant caution. Traders should carefully consider their individual needs and risk tolerance before engaging with ACY Securities.

For those seeking a reliable trading environment, it may be prudent to explore alternative brokers that offer strong regulatory oversight, transparent fee structures, and a proven track record of customer satisfaction. Some reputable options include brokers like IG, OANDA, and Pepperstone, which are known for their robust regulatory frameworks and positive user experiences. Ultimately, conducting thorough research and due diligence will empower traders to make informed decisions in their trading endeavors.

Is ACY SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of ACY SECURITIES brokers.

ACY SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ACY SECURITIES latest industry rating score is 7.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.