Regarding the legitimacy of Golden Group forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Golden Group safe?

Pros

Cons

Is Golden Group markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

香港高地集團有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://thegoldenholdings.comExpiration Time:

--Address of Licensed Institution:

香港港灣道26號華潤大廈29樓2907-08室Phone Number of Licensed Institution:

24960066Licensed Institution Certified Documents:

Is Golden Group A Scam?

Introduction

Golden Group is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market. Established in Hong Kong, the broker offers a variety of trading services, including forex, commodities, and precious metals. However, as with any financial service, it is crucial for traders to conduct thorough due diligence before engaging with a broker. This is particularly important in the forex market, where regulatory oversight can vary significantly, and the risk of fraud is an ongoing concern.

In this article, we will investigate whether Golden Group is a scam or a legitimate trading platform. Our assessment will be based on a comprehensive review of the broker's regulatory compliance, company background, trading conditions, customer experiences, and safety measures. We will also analyze customer feedback to provide a well-rounded view of the broker's reputation in the market.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A broker that operates under a reputable regulatory authority is generally considered safer for traders. Golden Group claims to be regulated in multiple jurisdictions, including Australia and Hong Kong. However, the specifics of these claims warrant scrutiny.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 480291 | Australia | Verified |

| CGSE | 192 | Hong Kong | Verified |

| NFA | 0521462 | USA | Suspicious |

The table above outlines the key regulatory information for Golden Group. While the broker is regulated by the Australian Securities and Investments Commission (ASIC) and the Chinese Gold & Silver Exchange Society (CGSE), it also faces scrutiny from the National Futures Association (NFA) in the USA, where it has been flagged as suspicious. This raises concerns about its operational legitimacy, particularly because the NFA is a well-respected authority in the financial services sector.

The quality of regulation plays a significant role in the level of investor protection. ASIC is known for its stringent regulations, which include mandatory capital requirements and investor compensation schemes. However, the NFA's concerns indicate that traders should be cautious when considering Golden Group for their trading activities.

Company Background Investigation

Golden Group Consulting Limited, the parent company of Golden Group, was established in December 2018. The company operates primarily in Hong Kong and has expanded its services to various international markets. However, the management teams background and experience are critical in assessing the broker's reliability.

The management team consists of individuals with varying degrees of experience in the financial services industry. While some team members have a solid background in trading and financial management, there is limited publicly available information on their qualifications and professional history. This lack of transparency can be a red flag for potential investors.

Furthermore, the company's website provides minimal information about its operational structure and ownership. A reputable broker typically discloses detailed information about its management team and corporate governance. The absence of such information may indicate a lack of commitment to transparency, which is essential for building trust with clients.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its competitiveness in the market. Golden Group has set its minimum deposit at $100, which is relatively standard among forex brokers. However, the overall fee structure and trading conditions require closer examination.

| Fee Type | Golden Group | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 2.8 pips | 1.5-2.0 pips |

| Commission Model | No commission | Varied |

| Overnight Interest Range | 0.5% | 0.5%-1.0% |

The table above compares Golden Group's trading costs to industry averages. While the minimum deposit is reasonable, the spreads for major currency pairs are notably higher than the industry average. This could impact traders' profitability, particularly for those who engage in high-frequency trading.

Moreover, Golden Group's commission-free model may seem appealing; however, the presence of overnight interest fees could accumulate costs for long-term positions. Traders should be aware of these potential expenses when calculating their trading strategies.

Customer Funds Security

The safety of client funds is paramount when choosing a forex broker. Golden Group claims to implement several security measures to protect customer funds. These include segregating client funds from the company's operational funds and utilizing tier-1 banks for holding client deposits.

However, the effectiveness of these measures can only be verified through customer experiences and any historical issues related to fund security. While the broker asserts that it has not faced significant security breaches, the lack of independent verification raises questions about the robustness of its security protocols.

In the past, some brokers have faced significant scandals related to the mismanagement of client funds. Therefore, it is essential for prospective clients to thoroughly investigate the broker's history regarding fund security and to consider the risks involved in trading with Golden Group.

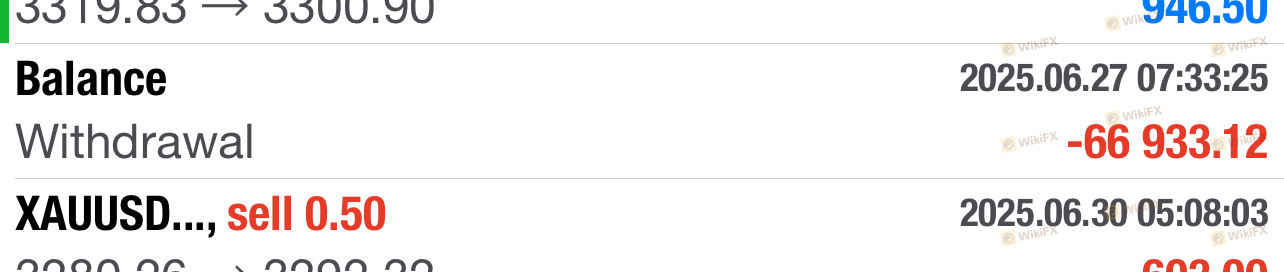

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. An analysis of user reviews reveals a mixed bag of experiences with Golden Group. While some clients report satisfactory trading experiences and prompt customer service, others have raised concerns about withdrawal processes and communication issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Poor Customer Support | Medium | Average |

| High Spreads | Medium | Acknowledged |

The table above summarizes common complaints associated with Golden Group. Withdrawal delays appear to be a frequent issue, with clients reporting slow processing times. This can be particularly concerning for traders who require quick access to their funds.

Additionally, the quality of customer support has been criticized, with some users experiencing long response times. In contrast, a few clients have praised the broker's overall service quality, indicating that experiences may vary significantly based on individual circumstances.

Platform and Execution

The trading platform offered by Golden Group is MetaTrader 4 (MT4), a widely recognized platform in the forex industry. MT4 is known for its user-friendly interface and robust trading tools, making it a popular choice among traders of all levels.

However, the quality of order execution, including slippage and rejection rates, is a critical factor that can impact trading performance. Anecdotal evidence suggests that some users have experienced issues with order execution, indicating potential problems with the broker's infrastructure.

Traders should be cautious and consider testing the platform with a demo account before committing significant capital. This allows them to assess the platform's performance in real-time market conditions.

Risk Assessment

Engaging with any broker involves inherent risks, and Golden Group is no exception. Based on the information gathered, we can summarize the key risk areas associated with trading through this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Concerns from NFA indicate potential issues. |

| Customer Support | Medium | Mixed reviews on responsiveness and effectiveness. |

| Trading Costs | Medium | Higher spreads than average may impact profitability. |

| Fund Security | Medium | Claims of segregation and tier-1 banks, but lack of independent verification. |

The risk assessment highlights several areas of concern that traders should consider. The high regulatory compliance risk, primarily due to the NFA's warnings, raises red flags about the broker's operational integrity.

To mitigate these risks, potential clients are advised to conduct thorough research, consider starting with a demo account, and maintain a cautious approach when trading with Golden Group.

Conclusion and Recommendations

In conclusion, the investigation into Golden Group reveals a broker that operates within a complex regulatory environment. While it is regulated in some jurisdictions, the presence of warnings from the NFA raises significant concerns about its legitimacy.

Traders should approach Golden Group with caution, particularly given the mixed reviews regarding customer service, withdrawal processes, and trading conditions. For those seeking reliable alternatives, brokers with stronger regulatory oversight, such as those regulated by the FCA or ASIC, may provide a more secure trading environment.

Ultimately, due diligence is essential when selecting a forex broker. Traders are encouraged to weigh the risks and benefits carefully and consider their trading needs and objectives before making a commitment.

Is Golden Group a scam, or is it legit?

The latest exposure and evaluation content of Golden Group brokers.

Golden Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Golden Group latest industry rating score is 7.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.