24option Review 8

I’m very disappointed that they sole my money!

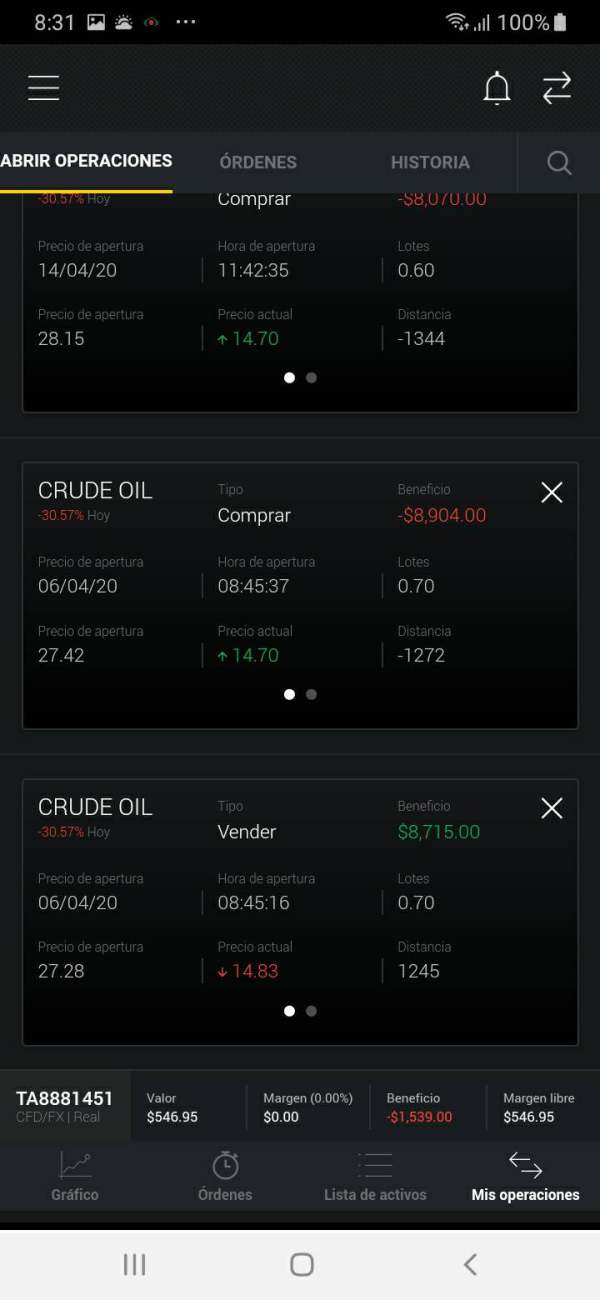

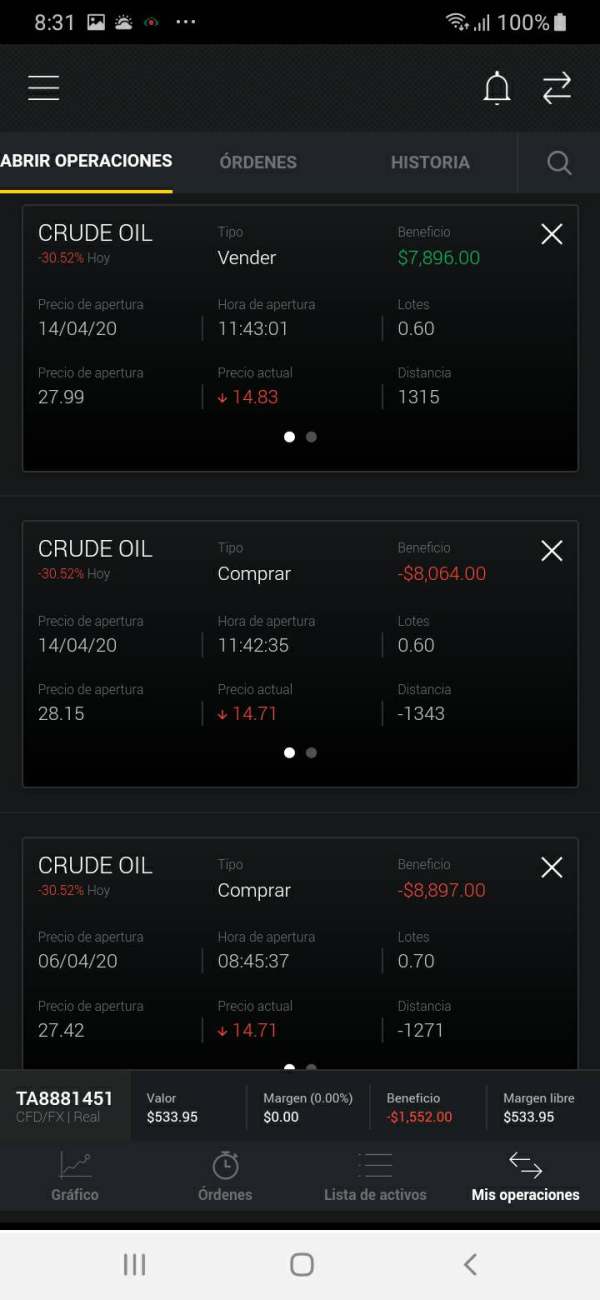

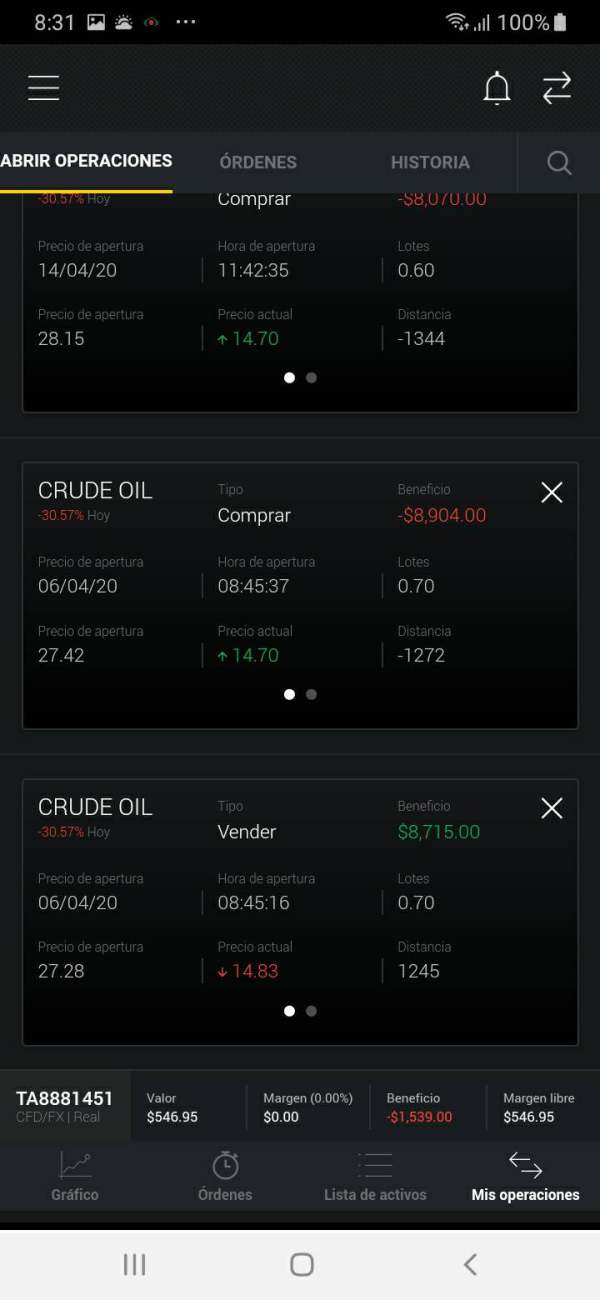

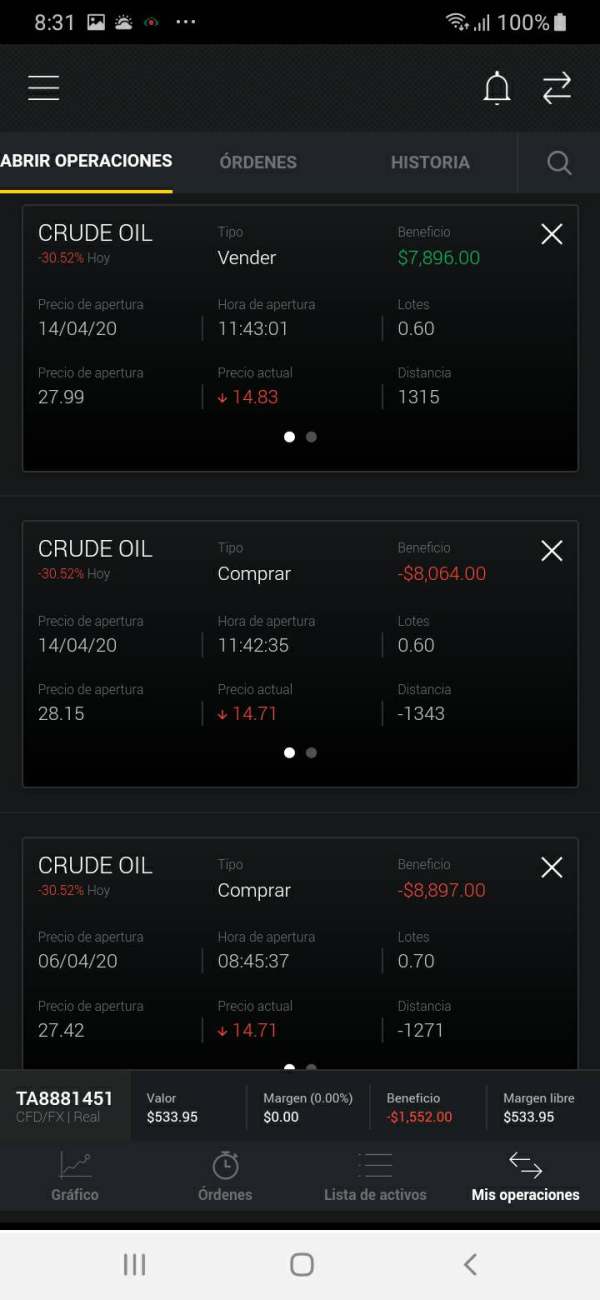

I lost all my money $4,000 for they making the app slag. You think it's your fault but it isn't.

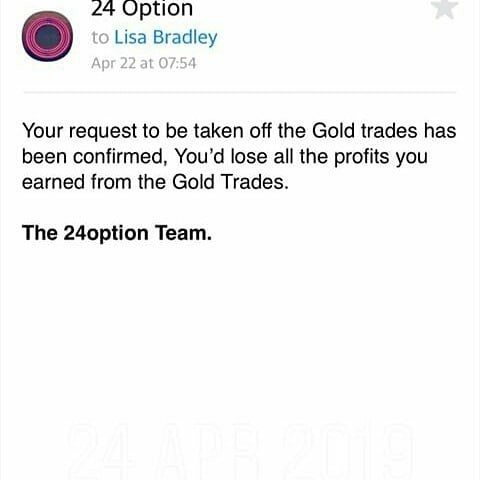

From September 2020 I have deposited $10000 without receiving any payout. Everytime I want to withdraw, a new fee or activation fee is required. Will it be possible to get my money back? Please help?

I wouldn't recommend 24option to anyone looking for a trustworthy broker. Their minimum deposit requirement of 250 dollars is quite high compared to other brokers in the market. The only thing that seems attractive is their leverage of up to 1:500, but that's just asking for trouble if you're not an experienced trader. But the thing that really rubbed me the wrong way is their withdrawal fee, which is way too high!! I think there are much better options out there.

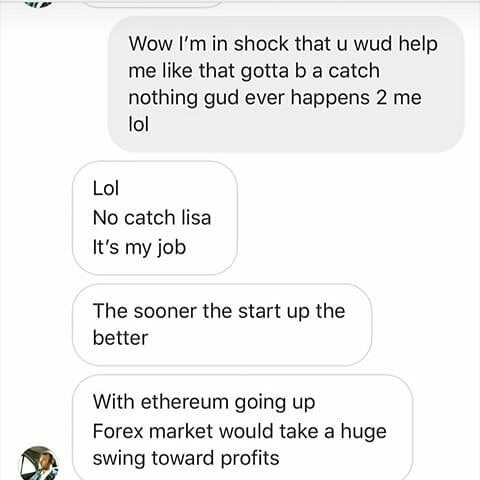

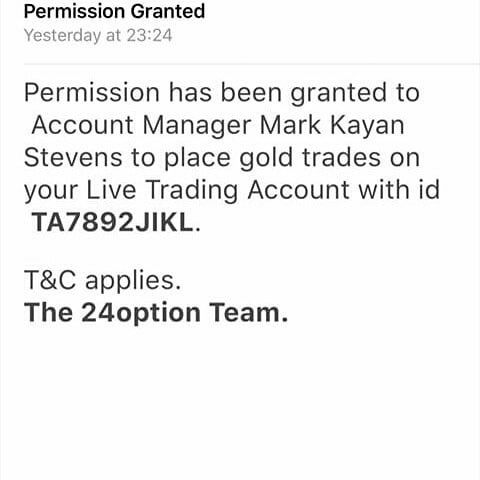

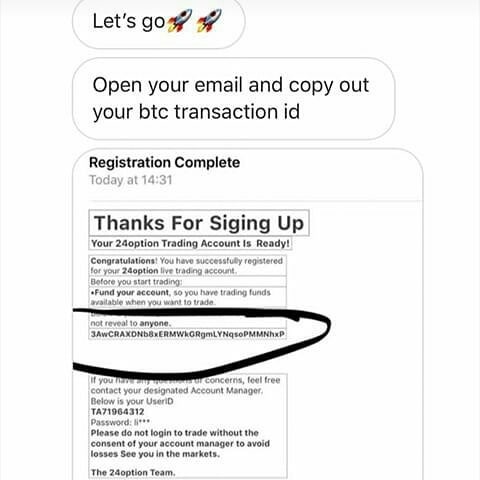

I would like to draw the attention of the public to the scam 24option is committing. Please stay clear and save yourself as they’ve already been flagged.

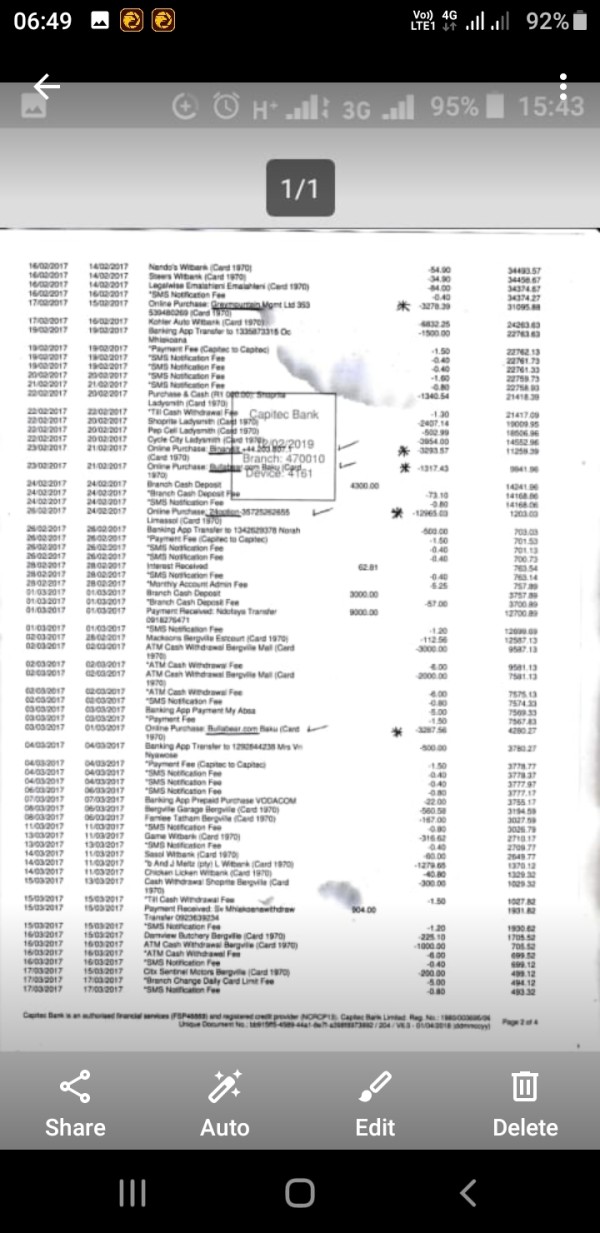

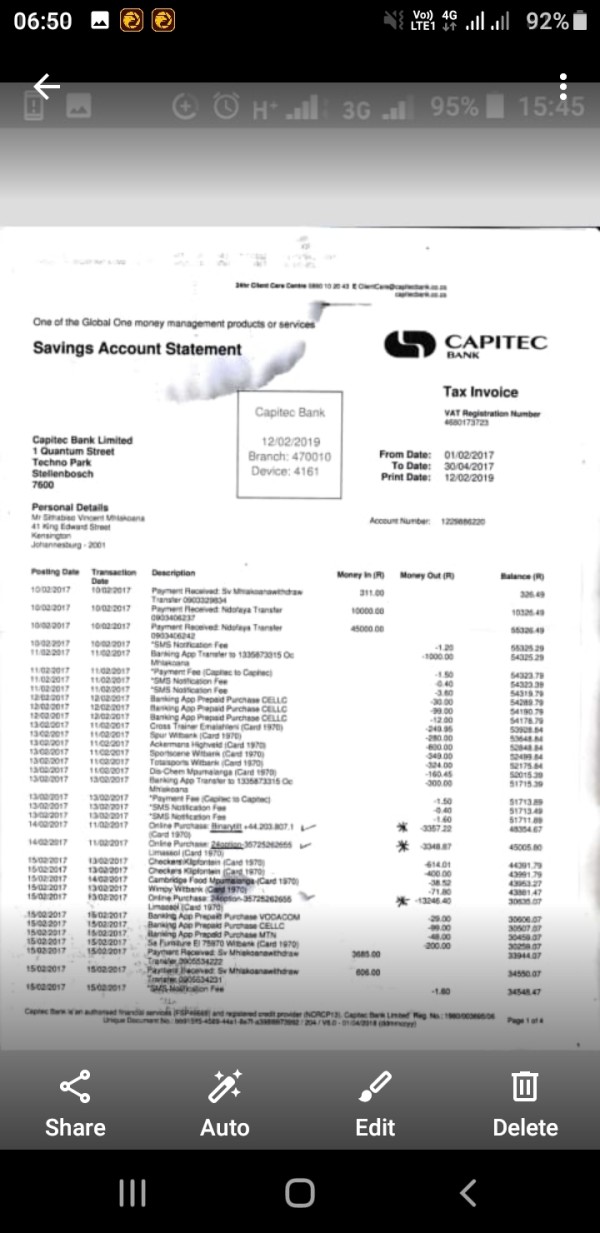

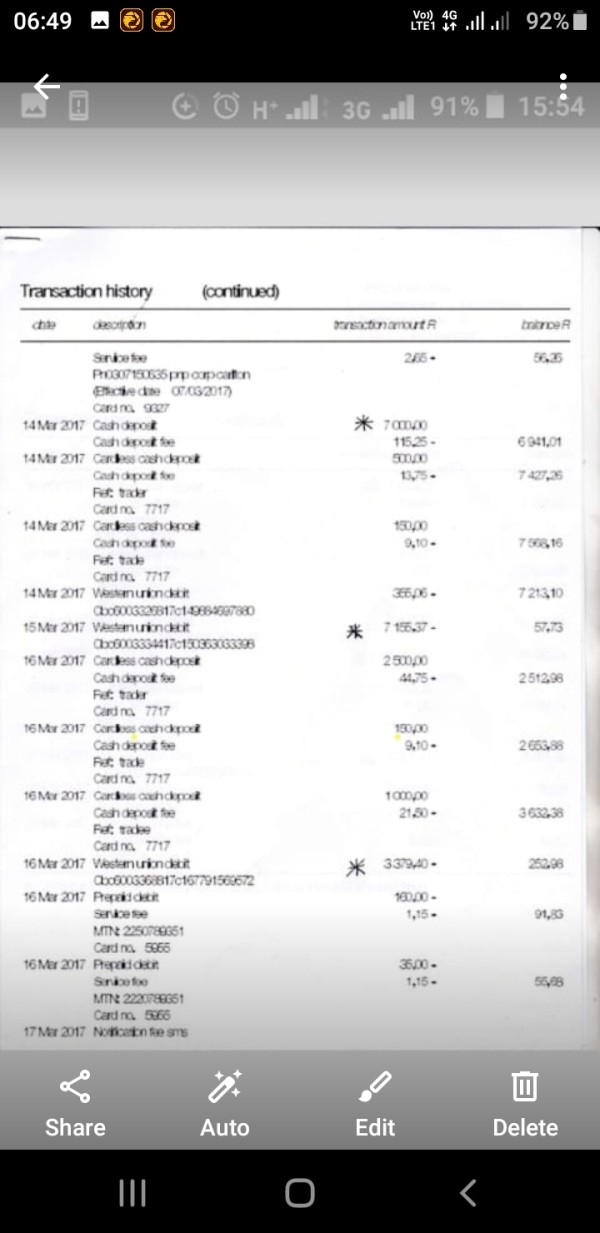

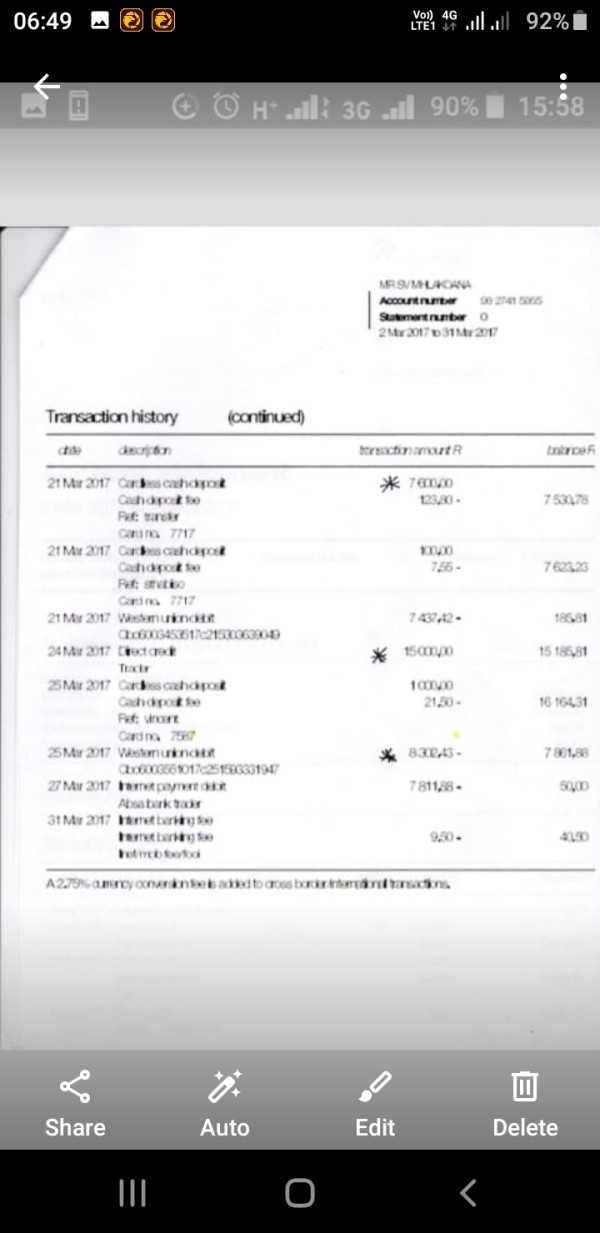

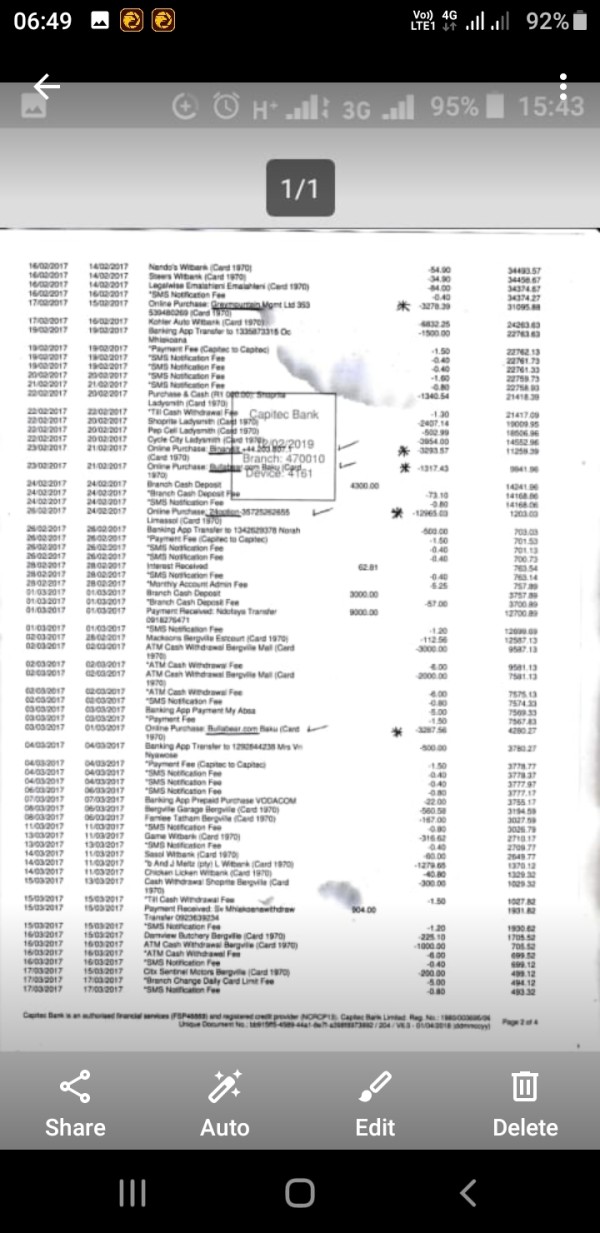

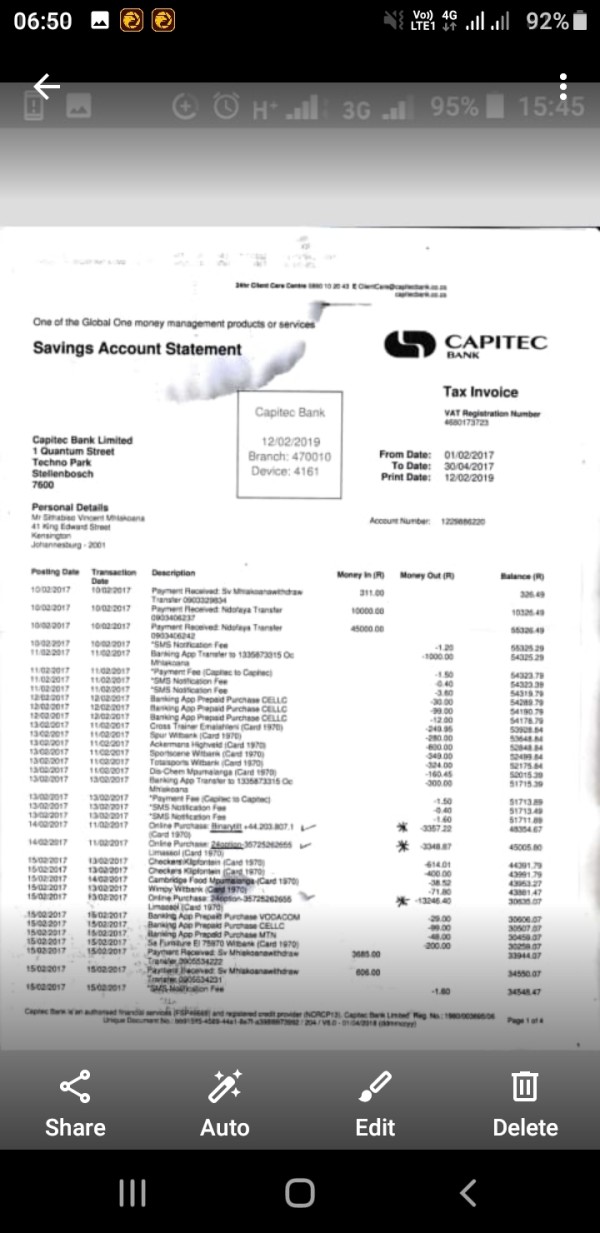

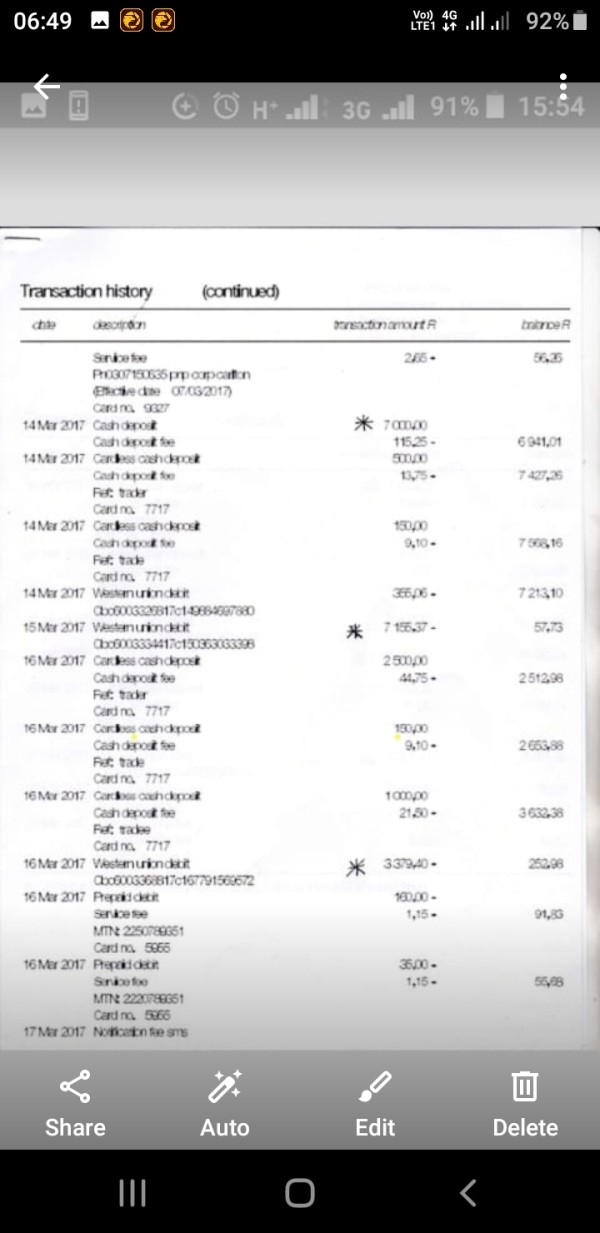

Hi my name is Sithabiso Mhlakoana from South Africa. In 2017 I was scammed by different brokers of a lot of money totalling to more than $8000. Most of the funds were paid online through my bank card. I do have proof of payments for all transactions including some of our conversations with them as I was trying to demand my money back. In some instances I was making some profits after trading, but when I wanted to make withdrawals they would refuse to process them until they block any means

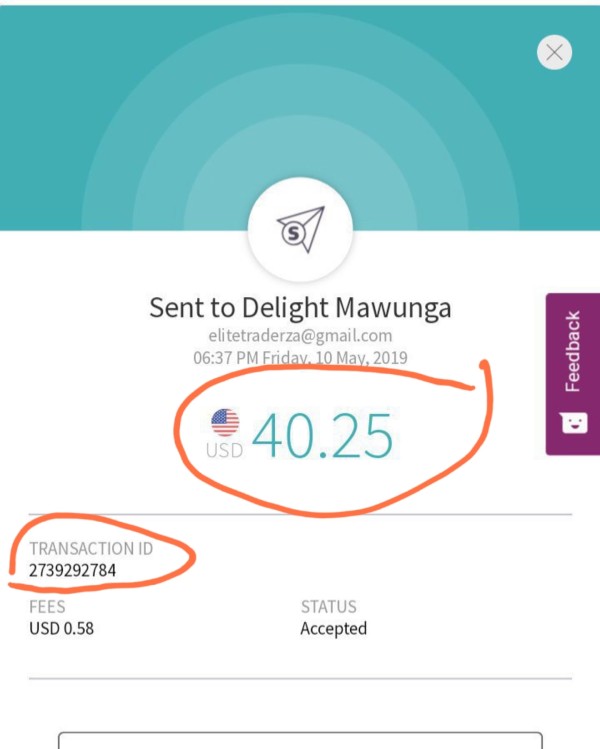

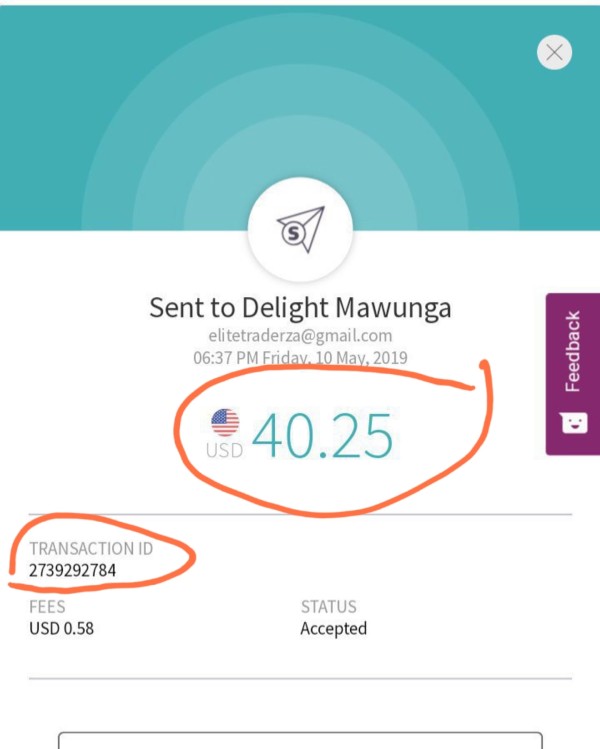

ScamAlert 24option trader is accepting payments but blocks the client right away when payment is made. His e-mail is 24option@gmail.com. His full name is Delight Mawunga. His channel changes from logo and name time after time. Be careful and never send any funds to this guy! One big scam

many regulatory authorities have avoided regulating 24option for various reasons. This broker is also banned from doing business in France and Italy. It is also been fined by its own regulatory company for unethical practices.