Regarding the legitimacy of TOPFX forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is TOPFX safe?

Pros

Cons

Is TOPFX markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 22

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Topfx Ltd

Effective Date:

2011-04-19Email Address of Licensed Institution:

info@topfx.comSharing Status:

No SharingWebsite of Licensed Institution:

www.topfx.comExpiration Time:

--Address of Licensed Institution:

KSENOS BUILDING, Office No.502, Troodous 2, Agios Athanasios, 4105, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 352 244Licensed Institution Certified Documents:

Is TopFX A Scam?

Introduction

TopFX is an international forex and CFD broker that has been operating since 2010. It positions itself as a liquidity provider, catering to both retail and institutional traders. With a wide array of trading instruments, including forex pairs, commodities, and cryptocurrencies, TopFX has attracted a diverse clientele. However, the forex market is fraught with risks, and it is essential for traders to thoroughly evaluate the legitimacy and trustworthiness of their brokers. This evaluation is crucial because the forex landscape is filled with both reputable firms and potential scams, making due diligence imperative for safeguarding investments.

In this article, we will conduct a comprehensive assessment of TopFX, examining its regulatory status, company background, trading conditions, and client experiences. Our investigation will draw on multiple sources, including regulatory filings, user reviews, and expert analyses, to provide a balanced view of whether TopFX is a safe and reliable broker or a potential scam.

Regulation and Legitimacy

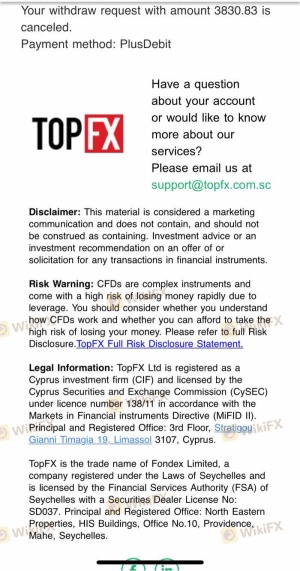

The regulatory framework within which a broker operates is one of the most critical factors influencing its legitimacy. TopFX is regulated by two entities: the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA). The CySEC regulation is particularly noteworthy, as it is considered a tier-1 regulatory authority, ensuring a higher level of oversight and investor protection compared to tier-3 regulators like the FSA.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 138/11 | Cyprus | Verified |

| FSA | SD 037 | Seychelles | Verified |

CySEC regulations include stringent requirements for capital adequacy, regular audits, and the segregation of client funds. This means that client funds are kept separate from the broker's operational funds, reducing the risk of misuse. In contrast, the FSA's oversight is less rigorous, which may pose a higher risk for clients trading under that jurisdiction.

Historically, TopFX has maintained a clean regulatory record with no significant compliance issues reported. This regulatory backing provides a level of assurance to traders about the broker's operational integrity and commitment to adhering to industry standards.

Company Background Investigation

TopFX was founded in 2010 and has since evolved from a liquidity provider to a full-service brokerage. The company is owned by Fondex Limited, which operates under the regulatory framework of both CySEC and the FSA. The management team at TopFX comprises experienced professionals from the financial services industry, contributing to its operational stability and strategic growth.

The company's transparency is commendable, with clear information available regarding its ownership, regulatory compliance, and operational practices. This level of openness is essential for building trust with clients. Additionally, TopFX has made significant investments in technology, ensuring that its trading platforms are robust and reliable.

However, some criticisms have been raised regarding the level of information disclosed about its operations under the Seychelles entity. While the Cyprus branch is well-documented, the offshore nature of the Seychelles operation raises some concerns among traders regarding the level of protection and oversight they may receive.

Trading Conditions Analysis

TopFX offers a variety of trading accounts, including a zero account and a raw account, each designed to cater to different trading strategies. The overall fee structure is competitive, with spreads starting as low as 0.0 pips on the raw account. However, the raw account requires a minimum deposit of $5,000, which may be a barrier for novice traders.

| Fee Type | TopFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | $2.75 per lot | $5.00 per lot |

| Overnight Interest Range | Variable | Variable |

While the spreads are attractive, it is essential to note that the commission structure can add to the overall trading costs, especially for high-frequency traders. Additionally, TopFX charges a monthly inactivity fee after 90 days of dormancy, which could be seen as a disadvantage for traders who do not trade frequently.

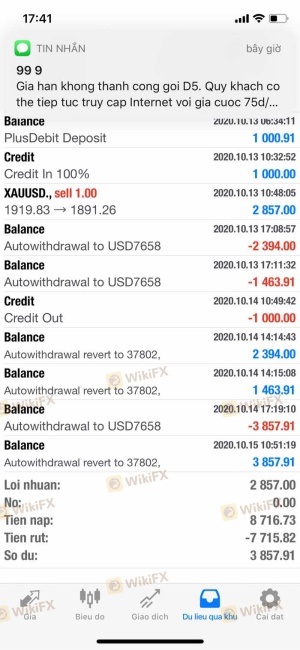

The broker also offers various deposit and withdrawal options, with no fees for deposits and the first two withdrawals each month. However, subsequent withdrawals may incur fees, which could affect traders who frequently withdraw funds.

Client Funds Security

The security of client funds is a top priority for any reputable broker. TopFX employs several measures to ensure the safety of its clients' funds. Client deposits are kept in segregated accounts at reputable banks, which means that in the event of financial difficulties, client funds are protected and cannot be used to settle the broker's liabilities.

Moreover, TopFX provides negative balance protection, ensuring that clients cannot lose more than their initial investment. This feature is particularly important for traders using leverage, as it mitigates the risk of significant losses during volatile market conditions.

However, it is worth noting that while the CySEC entity offers a compensation scheme for investors, the Seychelles entity does not have such protections in place. This disparity may pose risks for clients trading under the less regulated jurisdiction.

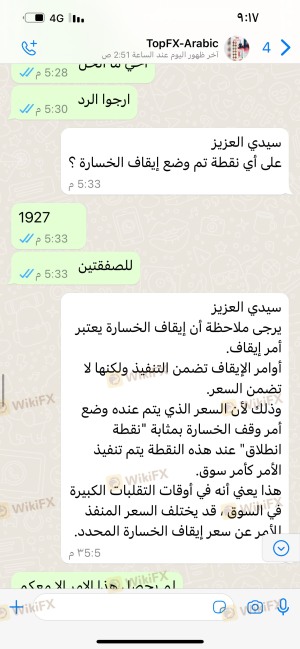

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of TopFX are mixed, with many users praising the broker's competitive spreads and efficient execution. However, some clients have reported issues related to withdrawal delays and difficulties in accessing customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Varies |

Common complaints include delayed withdrawals, with some users experiencing wait times of over a week without satisfactory explanations from the customer service team. While TopFX does provide multiple channels for support, including email and phone, the absence of 24/7 live chat support has been noted as a drawback.

A few specific cases highlight these issues. One user reported being unable to withdraw funds after a profitable trading period, citing a lack of communication from the broker. Another trader experienced slippage on a significant trade and felt that the response from TopFX was inadequate.

Platform and Trade Execution

TopFX offers two primary trading platforms: MetaTrader 4 (MT4) and cTrader. Both platforms are well-regarded in the industry for their performance and user-friendly interfaces. However, there are concerns regarding execution speed and slippage, particularly for scalpers and high-frequency traders.

Traders have reported average execution speeds of around 75 milliseconds, which, while reasonable, may not be fast enough for those relying on rapid market movements. Additionally, some users have experienced slippage during high volatility periods, raising concerns about the broker's ability to execute trades at the desired prices.

Risk Assessment

When evaluating the overall risk of trading with TopFX, several factors come into play. These include regulatory oversight, trading conditions, and customer service responsiveness.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation but varying standards. |

| Trading Conditions Risk | Medium | High minimum deposits for some accounts. |

| Customer Service Risk | High | Reports of slow response times and withdrawal issues. |

To mitigate these risks, traders should conduct thorough research before opening an account, carefully read the terms and conditions, and consider starting with a demo account to gauge the broker's performance.

Conclusion and Recommendations

In conclusion, TopFX is not a scam; it is a regulated broker with a solid reputation in the forex market. However, traders should exercise caution and be aware of the potential risks associated with trading under its Seychelles entity. The regulatory oversight provided by CySEC is a significant advantage, but the lack of investor protection for the Seychelles operations is a concern.

For novice traders, it may be wise to start with smaller amounts and consider the zero account option, which has a lower minimum deposit requirement. Experienced traders may find the raw account appealing due to its competitive spreads and commission structure.

Overall, it is advisable for traders to conduct their own due diligence and consider alternative brokers with a more comprehensive regulatory framework and robust customer support if they are concerned about the issues highlighted in this review.

Is TOPFX a scam, or is it legit?

The latest exposure and evaluation content of TOPFX brokers.

TOPFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TOPFX latest industry rating score is 5.94, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.94 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.