Exclusive Capital 2025 Review: Everything You Need to Know

Abstract

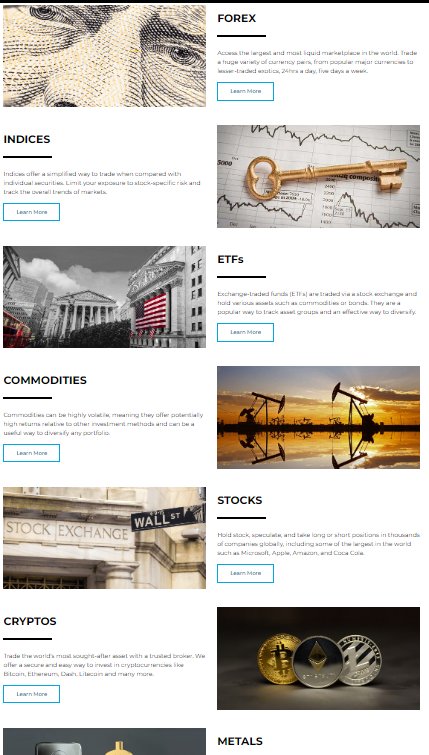

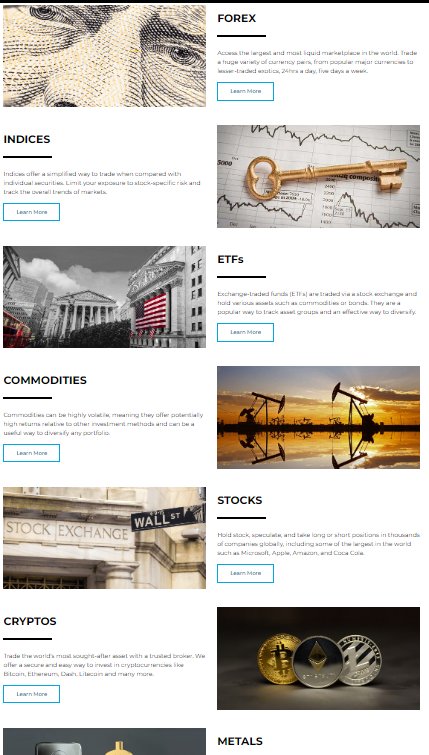

The Exclusive Capital review shows a balanced view of a broker that follows rules but gets mixed user feedback. This company started in 2000 and is watched by the Cyprus Securities and Exchange Commission . The broker offers up to 5000 trading tools and very high leverage of up to 1:500 for professional accounts, though retail clients can only use 1:30. This mix makes it good for both regular and big traders who want different trading choices, even though the TrustScore is only 3.12 based on 39 user reviews. The review shows the wide range of CFDs you can use, which includes forex, indices, ETFs, goods, stocks, metals, and digital money. This gives traders a complete platform experience. Even though it has regulatory approval, the lower user happiness and missing details about fees lead to a neutral rating overall. In short, this exclusive capital review wants to give potential clients a deep look by weighing the platform's strong features against its service problems, making sure every trader can make a smart choice.

Notice and Considerations

Different regions have different rules, so users might see different trading conditions and protection measures. This review uses the latest market data and user feedback, including details like CySEC's oversight and a specific license number . The method behind this exclusive capital review includes a fair look at things from account conditions to trading experience, making sure potential clients get a complete analysis. It's important to know that while some details like deposit and withdrawal methods and bonus offers weren't available in the data we had, all information we could access has been reviewed to give a balanced view for traders from different regions. The analysis is only meant to inform and help potential investors make smart trading choices.

Rating Framework

Broker Overview

Exclusive Capital started in 2000 and has its main office in Cyprus, working mainly as a CFD STP broker. The company serves both big institutions and individual clients by giving one solution for different trading needs. Based on the data we have, the broker offers several types of trading accounts that work well for different trading styles and what people prefer. Its long time in the market supports its claim of being reliable, but user reviews show that while the platform follows strict rules, the overall service quality doesn't meet expectations. The focus on giving a wide range of trading tools and high leverage options makes Exclusive Capital an appealing choice for those looking to explore multiple types of assets.

Using the standard MT5 trading platform, Exclusive Capital supports trades in forex, indices, ETFs, goods, stocks, precious metals, and digital money. This wide range of assets is one of the broker's main features, letting traders spread out their portfolios well. Also, being watched by the Cyprus Securities and Exchange Commission makes sure that the broker follows the needed legal and financial safety rules. Even with these good points, specific details about commission structures and deposit and withdrawal processes stay unclear, leaving room for more questions. This exclusive capital review captures both the strengths and areas that need work, giving a complete view for potential clients.

-

Regulation:

Exclusive Capital is regulated by the Cyprus Securities and Exchange Commission , ensuring adherence to stringent regulatory standards.

Deposit and Withdrawal Methods:

Specific details on deposit and withdrawal mechanisms are not fully disclosed in the available information.

Minimum Deposit Requirement:

The minimum deposit requirement is set at 0, making it accessible for new traders.

Bonus Promotions:

Bonus and promotional offerings were not detailed in the provided information.

Tradable Assets:

Traders have access to up to 5000 instruments, including a wide range of asset classes such as forex, commodities, stocks, indices, ETFs, metals, and cryptocurrencies.

Cost Structure:

The cost structure features a minimum spread of 1.6 pips on EUR/USD. However, details regarding additional commission charges have not been provided.

Leverage Ratio:

The broker offers a maximum leverage of up to 1:500 for professional clients, while retail traders are limited to 1:30 leverage.

Platform Choice:

Trading is conducted primarily via the MT5 platform, known for its robustness and extensive analytical tools.

Region Restrictions:

Specific regional restrictions were not mentioned within the available data.

Customer Service Languages:

Detailed information regarding language support for customer service was not provided in the summary.

This exclusive capital review offers a complete look into the detailed working parts of the broker, mixing regulatory insights with practical trading conditions to help traders make a well-informed decision.

Detailed Rating Analysis

2.6.1 Account Conditions Analysis

Exclusive Capital gives a range of account types designed to appeal to many different traders. With a zero minimum deposit requirement, this broker makes it easier for new market participants to start. Also, the offering of high leverage—up to 1:500 for professional clients—adds to its appeal for those wanting larger exposure, though retail clients are capped at a much lower ratio of 1:30. Even with these competitive parts, the lack of clear commission information and extra account-related fees may leave potential clients without complete transparency. The account opening process is thought to be simple given industry standards, but detailed information about verification times or special account types is not given in the available data. Compared with other brokers in the market, the zero deposit feature is a notable advantage, yet the lack of commission clarity may turn away high-frequency traders who need transparent fee structures. According to the information summary, the overall rating for account conditions is 6/10, showing a balance between accessibility and incomplete fee disclosure. This analysis is supported only by the details given in the exclusive capital review.

Exclusive Capital impresses with its offering of up to 5000 trading instruments, covering a wide range of markets and asset classes. This breadth makes sure that both new and experienced traders find suitable options for spreading out their portfolios. The variety goes to forex, indices, ETFs, goods, stocks, precious metals, and digital money, making the platform highly flexible. Also, the use of the MT5 platform guarantees that traders have access to advanced charting tools, technical indicators, and the potential for automated trading strategies such as scalping and hedging. Though the collection of research and educational resources has not been explained in the given information, the sheer volume of tradable assets shows the broker's commitment to offering complete tools. Feedback on user experience specifically about these resources is not detailed, yet the number offering alone awards the broker a solid 8/10 in this category. This exclusive capital review emphasizes that while the wider educational and research materials might be limited, the diversity and number of tradeable instruments make up a considerable strength of the broker.

2.6.3 Customer Service and Support Analysis

In the area of customer service, Exclusive Capital appears to fall short compared to its technology and trading instrument strengths. User feedback shows a TrustScore of 3.12 based on 39 reviews, suggesting that clients have been less than satisfied with the quality and responsiveness of the support given. Though details such as the specific customer support channels and their operating hours are not described in the available data, the overall user feeling shows slower response times and potential shortcomings in effective issue resolution. The lack of detailed information on multi-language support further complicates the customer service landscape for non-English speaking traders. Given the competitive nature of the forex industry, where prompt customer service is critical, the broker's rating of 5/10 seems justified. This part of the exclusive capital review highlights that despite the regulatory strength, the customer support aspect needs significant improvements to align with the expectations of a diverse client base. Issues such as unclear complaint handling and overall service responsiveness have been noted as key areas needing attention.

2.6.4 Trading Experience Analysis

The trading experience at Exclusive Capital is anchored by the industry-standard MT5 platform, known for its strong functionality and advanced trading tools. The platform supports many trading strategies, including hedging and scalping, which is a significant plus for active traders. The stability and speed given by the MT5 platform contribute to an overall positive execution environment, with the notable advantage of low spreads—such as the reported 1.6 pips on the EUR/USD pair. However, the lack of complete details about order execution quality and the liquidity of other instruments limits the full assessment of the trading experience. Mobile trading capabilities and integration with automated trading systems remain areas where more detailed user feedback would be valuable. Even with these gaps, the general consensus is that the trading infrastructure is solid yet not without room for improvement. This is why the trading experience receives a score of 7/10 in this exclusive capital review, underlining that while the technical framework is commendable, enhancements in execution specifics and platform adaptability could further elevate user satisfaction.

2.6.5 Trust Analysis

Trust in Exclusive Capital is a mixed proposition. On one hand, the broker is regulated by the Cyprus Securities and Exchange Commission under license CIF 330/17, a factor that signifies adherence to established European regulatory standards and a commitment to operational transparency. Also, the use of segregated client accounts is generally implied under such regulatory regimes, offering a layer of security regarding client funds. However, the relatively low TrustScore of 3.12 from 39 user reviews casts a shadow over its reliability from a trader's perspective. This difference between formal regulatory compliance and practical user feeling suggests that while the institutional framework is in place, the actual performance in client interactions may not fully align with the expectations of a trustworthy broker. The lack of detailed public disclosures on company finances and management further complicates trust-building measures. Therefore, the trust dimension is rated at 6/10 in this exclusive capital review, reflecting the balance between strong regulatory oversight and weaker user confidence as indicated by feedback.

2.6.6 User Experience Analysis

The overall user experience at Exclusive Capital is characterized by mixed reviews, with a reported TrustScore of 3.12 reflecting that many users have encountered challenges. While the MT5 platform offers a modern and feature-rich interface, user feedback shows issues that could impact the overall trading experience. These include possible difficulties during the registration and verification processes and unspecified concerns over fund transfer procedures, which are typical pain points in many trading environments. Furthermore, while the wide variety of tradable assets offers potential for portfolio diversification, it does little to counterbalance the frustrations related to customer service responsiveness and system usability reported by several traders. In the absence of detailed information on interface usability and step-by-step guides for first-time users, the user experience is rated a modest 5/10 in this exclusive capital review. This rating sums up the feeling that while the broker has the technical foundation to deliver a strong trading experience, practical shortcomings in support and user-friendliness detract from the overall client satisfaction.

Conclusion

In summary, Exclusive Capital stands as a broker that follows essential regulatory standards, offering a strong array of over 5000 trading instruments and the advantage of high leverage for experienced traders. However, its lower user satisfaction, particularly in customer service and overall user experience, reduces its appeal. While the platform is well-equipped for diversified trading, potential users should remain careful about hidden fees and the quality of support services. This exclusive capital review suggests that it may be best suited for traders who prioritize a wide choice of instruments and technical capabilities over premium client support. Balancing its strengths and weaknesses, Exclusive Capital remains a viable option for retail and institutional clients aiming for diversified market exposure.