Magic Compass 2025 Review: Everything You Need to Know

Executive Summary

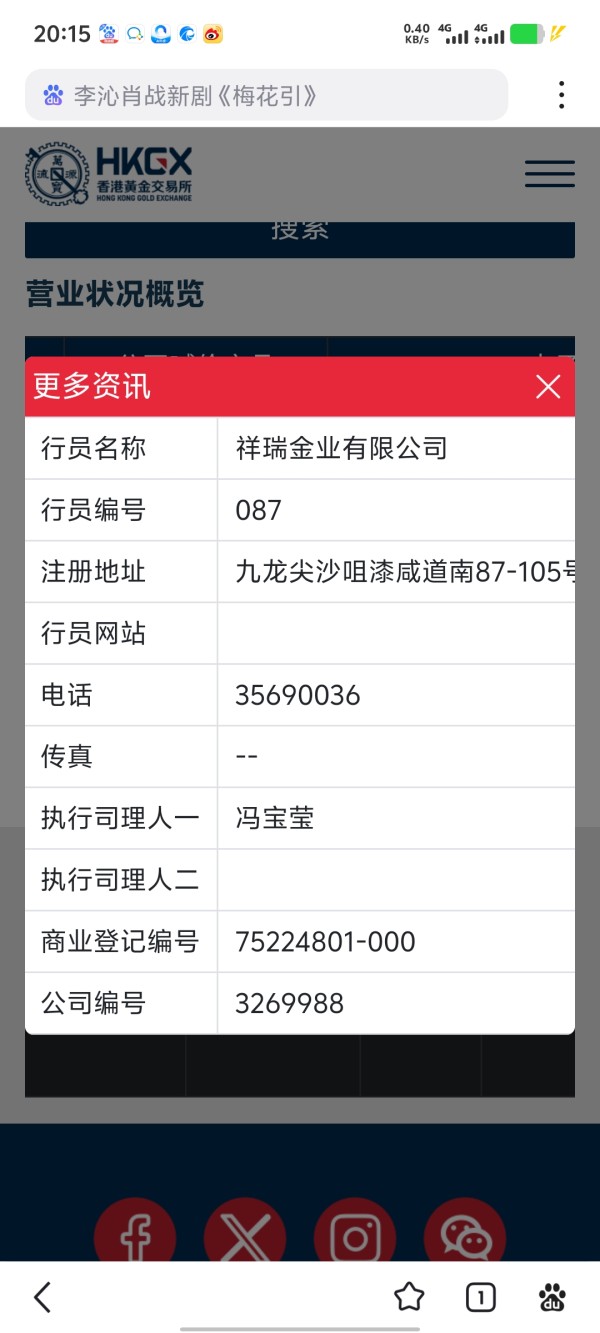

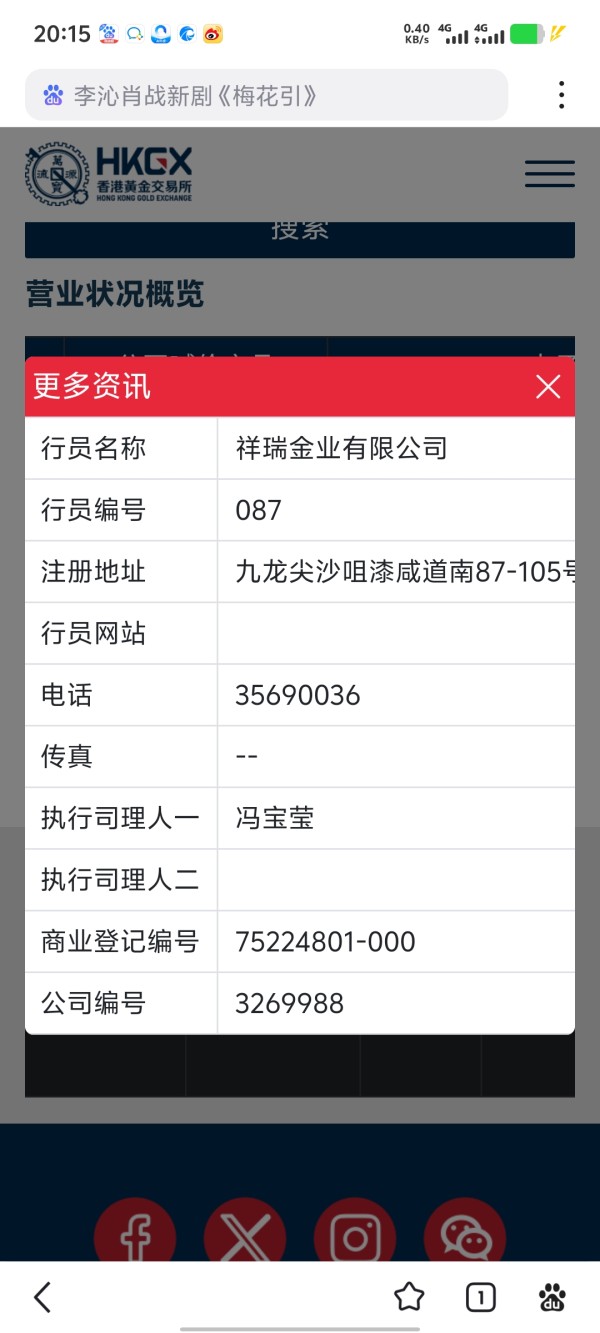

Magic Compass is a regulated forex and CFD broker that has been serving both novice and experienced traders since 2016. This magic compass review shows that the broker works under the Cyprus Securities and Exchange Commission (CySEC) with license number 299/16, which gives traders a strong base of regulatory protection for their trading services.

The broker stands out through two key features that make it especially attractive to retail investors. First, Magic Compass has authorization from CySEC, one of Europe's respected financial regulators. This ensures the broker follows strict operational standards and client fund protection rules. Second, the platform offers demo accounts made specifically for beginners. This allows new traders to practice and develop their skills in a risk-free environment before using real money.

Magic Compass mainly targets retail investors who want exposure to foreign exchange markets and contracts for difference (CFDs). The broker's service model focuses on providing easy trading solutions with a minimum deposit requirement of just $100 USD. This makes it financially accessible to a broad range of individual traders. According to available traffic data, the platform attracts about 4,186 monthly visits with a relatively low bounce rate of 16%. This suggests that users find the platform engaging and relevant to their trading needs.

The broker operates from dual headquarters in Cyprus and Hong Kong. This positioning helps it serve international markets while maintaining regulatory compliance in key areas.

Important Notice

Magic Compass operates under specific geographical restrictions that potential clients must consider before opening accounts. The broker does not provide services to citizens or residents of several countries including Canada, Cuba, Iran, Iraq, Japan, Myanmar, North Korea, Sudan, Syria, Turkey, and the United States. These restrictions reflect compliance requirements with various international regulations and sanctions.

This comprehensive review is based on publicly available information, regulatory filings, and user feedback collected from multiple sources. Our assessment method focuses on providing objective analysis of the broker's offerings, regulatory status, and user experience based on verifiable data. All information presented reflects the current status as of 2025. Readers should verify current terms and conditions directly with the broker before making trading decisions.

Rating Framework

Broker Overview

Magic Compass established its operations in 2016 as a Cyprus and Hong Kong-based regulated investment firm that specializes in foreign exchange and CFD trading services. The company has built its business model around serving retail investors who seek access to global financial markets through regulated and accessible trading platforms. As a CySEC-licensed entity, Magic Compass operates within the European regulatory framework. This requires adherence to strict capital adequacy requirements, client fund segregation, and operational transparency standards.

The broker's business model centers on providing comprehensive forex and CFD trading services to individual investors. Magic Compass generates revenue through spread-based pricing models typical of retail forex brokers. However, specific commission structures are not detailed in available documentation. The company's dual-jurisdiction approach, with operations in both Cyprus and Hong Kong, allows it to serve diverse international markets while maintaining regulatory compliance in key financial centers.

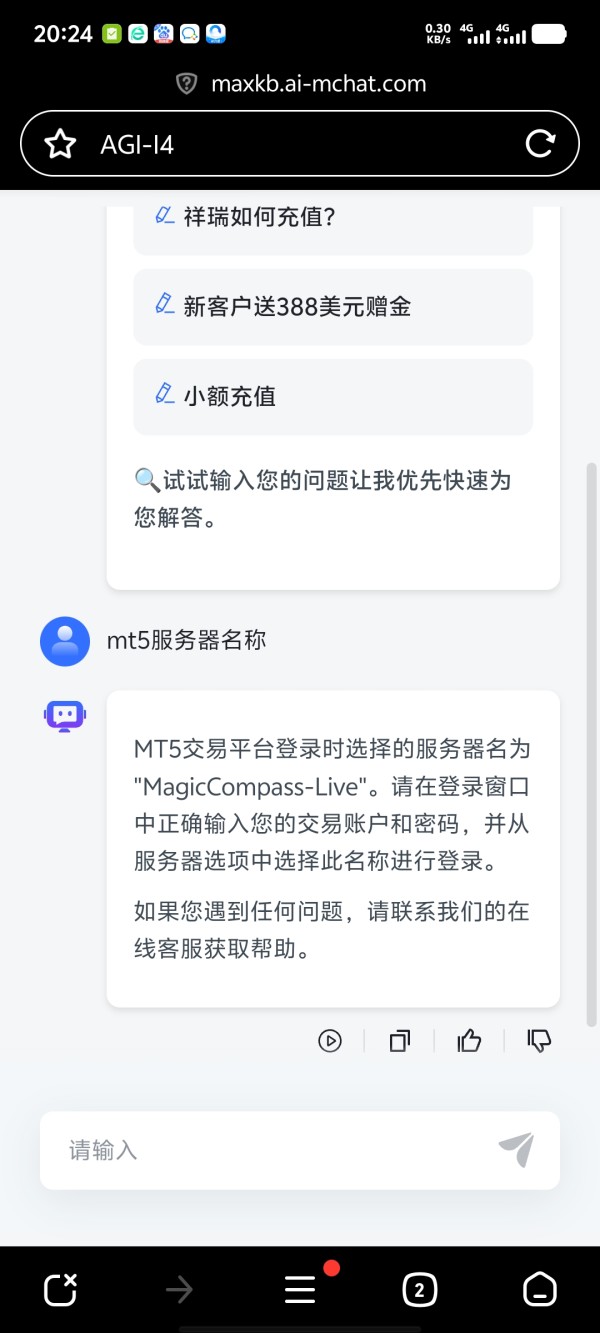

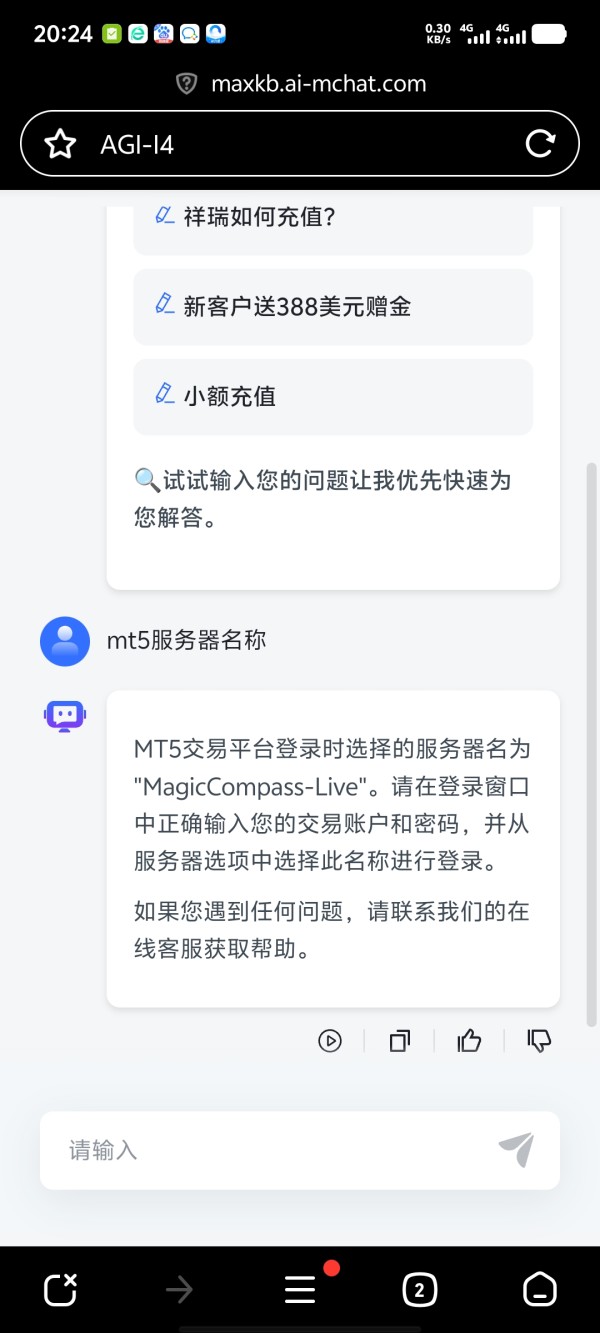

Magic Compass offers trading access through two primary platforms: MetaTrader 4 (MT4) and MCtrader. The MT4 platform provides traders with industry-standard charting capabilities, technical analysis tools, and automated trading functionality through Expert Advisors. MCtrader appears to be the broker's proprietary platform solution. However, specific features and capabilities of this platform are not extensively documented. The broker supports trading in foreign exchange pairs and contracts for difference, covering major currency pairs and CFD instruments across various asset classes.

The regulatory framework under which Magic Compass operates is anchored by its CySEC authorization, license number 299/16. This magic compass review confirms that CySEC regulation provides important protections for client funds through segregated account requirements and participation in investor compensation schemes. This offers up to €20,000 in coverage per client in qualifying circumstances.

Regulatory Jurisdiction: Magic Compass operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC), holding license number 299/16. This European Union-based regulation provides comprehensive oversight of the broker's operations and ensures compliance with MiFID II requirements.

Deposit and Withdrawal Methods: The broker accepts bank transfers as a confirmed deposit method. Specific information regarding additional payment options such as credit cards, e-wallets, or other electronic payment systems is not detailed in available documentation.

Minimum Deposit Requirements: Magic Compass sets its minimum deposit threshold at $100 USD. This positions it as accessible to beginning traders and those with smaller initial capital allocations.

Promotional Offers: Current information does not specify active bonus or promotional campaigns. Traders should verify current promotional offerings directly with the broker.

Available Trading Assets: The platform provides access to foreign exchange trading and contracts for difference (CFDs). Specific details regarding the number of available currency pairs, CFD instruments, or coverage of commodities, indices, and other asset classes are not extensively documented.

Cost Structure: Detailed information regarding spreads, commissions, overnight financing charges, and other trading costs is not specified in available documentation. This magic compass review notes that traders should request comprehensive fee schedules before opening accounts.

Leverage Ratios: Magic Compass offers trading leverage of 1:20. This aligns with European regulatory requirements for retail clients under ESMA guidelines.

Platform Options: Traders can access markets through MetaTrader 4 (MT4) and the broker's MCtrader platform. This provides options for both industry-standard and proprietary trading environments.

Geographic Restrictions: The broker maintains restrictions on service provision to residents of multiple countries as previously detailed.

Customer Service Languages: Specific information regarding supported languages for customer service is not detailed in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Magic Compass presents a mixed picture in terms of account conditions, earning a moderate score due to both accessible features and information limitations. The broker's minimum deposit requirement of $100 USD positions it favorably for beginning traders and those seeking to start with smaller capital allocations. This threshold is competitive within the retail forex industry. It removes significant barriers to entry that might otherwise prevent new traders from accessing international markets.

However, this magic compass review identifies significant gaps in available information regarding account type variety and specific features. The documentation does not detail whether Magic Compass offers different account tiers with varying benefits, such as reduced spreads for higher-volume traders or premium account features for larger deposits. Additionally, information about specialized account options, such as Islamic accounts for clients requiring Sharia-compliant trading conditions, is not available in current documentation.

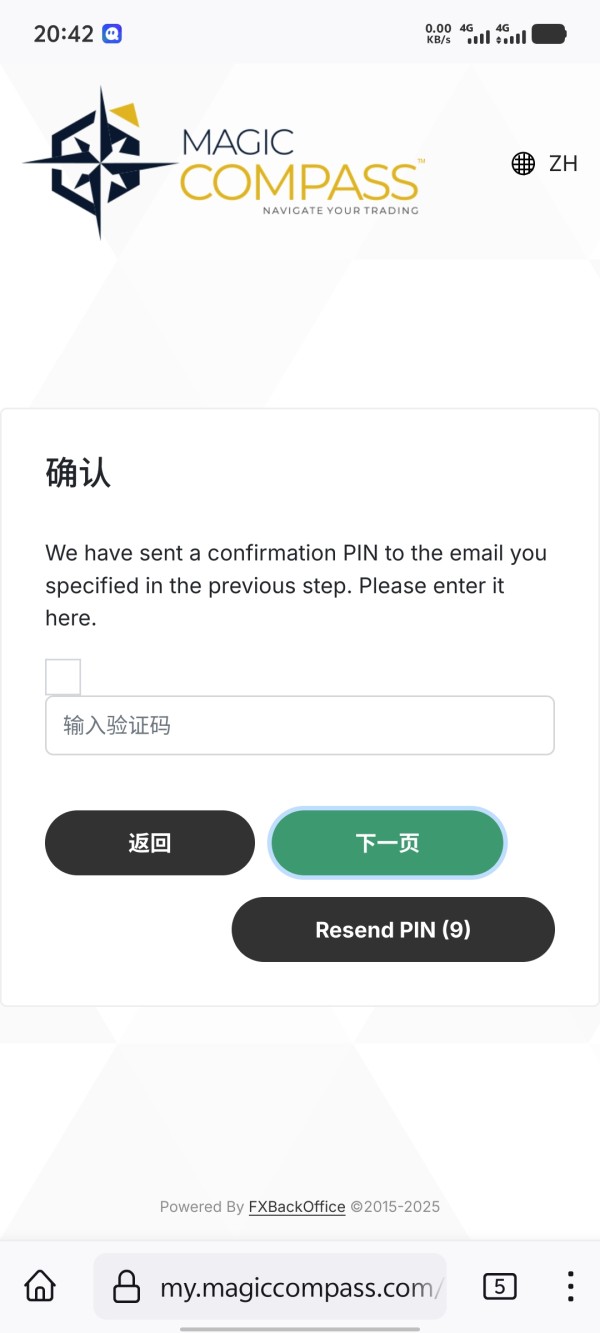

The account opening process details are not extensively documented. This makes it difficult to assess the efficiency and user-friendliness of the onboarding experience. Modern retail traders often prioritize streamlined digital account opening processes, and the lack of specific information about verification requirements, processing times, and required documentation represents a transparency gap.

The availability of demo accounts is a positive feature that supports the broker's appeal to beginning traders. This allows risk-free practice and platform familiarization before committing real capital.

The trading tools and resources offering at Magic Compass centers around its dual-platform approach, providing both MetaTrader 4 and the proprietary MCtrader platform. MT4 represents an industry-standard choice that offers comprehensive charting capabilities, technical analysis tools, and automated trading functionality through Expert Advisors. This platform choice indicates that Magic Compass recognizes the importance of providing traders with familiar and robust trading infrastructure.

The inclusion of MCtrader as an additional platform option suggests that the broker has invested in developing proprietary trading solutions. However, specific features and advantages of this platform are not detailed in available documentation. The effectiveness of proprietary platforms often depends on their ability to offer unique features or improved user experience compared to industry-standard alternatives.

However, this analysis reveals significant gaps in information regarding research and analytical resources. Modern forex brokers typically provide market analysis, economic calendars, trading signals, and educational content to support trader decision-making. The absence of detailed information about these resources makes it difficult to assess the comprehensive value proposition for traders who rely on broker-provided analysis and market insights.

Educational resources represent another area where specific information is limited. While the availability of demo accounts indicates some commitment to trader education, comprehensive educational programs including webinars, tutorials, trading guides, and market education materials are not documented. The quality and breadth of educational offerings often distinguish brokers in the competitive retail forex market.

Customer Service and Support Analysis (Score: Not Rated)

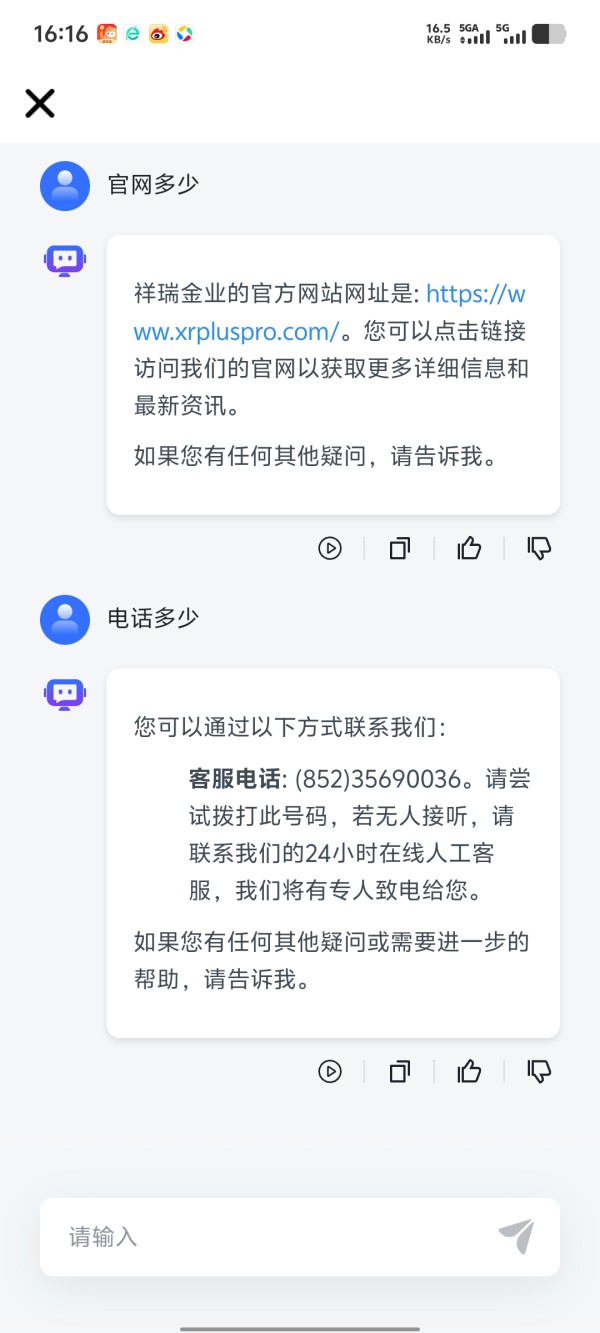

The customer service and support dimension cannot be adequately rated due to insufficient information in available documentation. This represents a significant transparency gap that affects the overall assessment of Magic Compass as a retail broker option. Modern traders expect comprehensive customer support through multiple channels, including live chat, telephone support, email assistance, and potentially social media engagement.

Response time expectations have evolved significantly in the retail forex industry. Many traders expect near-immediate responses to urgent trading-related inquiries, particularly during active market hours. The absence of specific information about customer service availability, response time commitments, and service level agreements makes it impossible to assess whether Magic Compass meets contemporary customer service standards.

Multilingual support capabilities are particularly important for international brokers serving diverse client bases. Given Magic Compass's international focus and dual-jurisdiction operations, the availability of customer support in multiple languages would be expected. However, specific information about supported languages and regional support capabilities is not documented.

The quality of customer service often becomes apparent through user feedback and testimonials, but specific customer service experiences are not detailed in available documentation. Problem resolution processes, escalation procedures, and customer satisfaction metrics would provide valuable insights into the practical effectiveness of the broker's support infrastructure.

Trading Experience Analysis (Score: 7/10)

The trading experience at Magic Compass benefits from the inclusion of MetaTrader 4, which provides a stable and feature-rich trading environment familiar to many forex traders. MT4's proven track record in the industry suggests that traders can expect reliable order execution, comprehensive charting capabilities, and access to automated trading functionality through Expert Advisors. The platform's widespread adoption means that traders can leverage existing knowledge and third-party resources.

However, specific information about platform stability, execution speeds, and server reliability is not detailed in available documentation. These technical performance factors significantly impact the practical trading experience, particularly for active traders or those employing automated trading strategies. Slippage rates, execution quality during high-volatility periods, and platform uptime statistics would provide valuable insights into the technical trading environment.

The availability of MCtrader as an alternative platform option provides flexibility. However, the specific advantages and features of this proprietary solution are not extensively documented. The effectiveness of having multiple platform options depends on whether each platform offers distinct advantages for different trading styles or preferences.

Mobile trading capabilities represent an increasingly important component of the modern trading experience, but specific information about mobile platform availability, features, and performance is not detailed. Many contemporary traders require robust mobile trading solutions for market monitoring and trade management while away from desktop computers.

Order execution quality, including the handling of market orders, limit orders, and stop-loss orders, represents a crucial component of trading experience that lacks detailed documentation in available materials.

Trust and Safety Analysis (Score: 8/10)

Magic Compass demonstrates strong regulatory foundations through its CySEC authorization under license number 299/16. This European Union-based regulation provides comprehensive oversight and requires adherence to strict operational standards including capital adequacy requirements, client fund segregation, and participation in investor compensation schemes. CySEC regulation offers up to €20,000 in compensation coverage per client in qualifying circumstances. This provides important protection for retail traders.

The regulatory framework under which Magic Compass operates includes requirements for transparent reporting, regular audits, and adherence to MiFID II provisions that govern client treatment and market conduct. These regulatory protections represent significant advantages compared to unregulated or poorly regulated alternatives in the retail forex market.

However, this magic compass review notes that information about additional safety measures beyond regulatory requirements is limited. Details about client fund segregation practices, the specific banks used for client fund custody, and additional insurance coverage beyond regulatory minimums are not extensively documented. Many leading brokers provide enhanced client fund protections that exceed regulatory minimums.

Company transparency regarding financial performance, ownership structure, and corporate governance practices is not detailed in available documentation. While regulatory compliance provides important baseline protections, additional transparency regarding company operations and financial stability would strengthen the overall trust profile.

Information about the broker's handling of negative events, regulatory communications, or client complaints is not available in current documentation. This makes it difficult to assess crisis management capabilities and client advocacy practices.

User Experience Analysis (Score: Not Rated)

The user experience dimension cannot be comprehensively rated due to limited specific feedback and detailed information about the practical aspects of trading with Magic Compass. Overall user satisfaction metrics, which would typically be derived from client surveys, testimonials, or third-party review platforms, are not extensively documented in available materials.

Interface design and usability assessments for both the MT4 and MCtrader platforms would provide valuable insights into the practical user experience. However, detailed usability reviews are not available. Modern traders expect intuitive navigation, responsive design, and efficient workflow management in their trading platforms.

The account registration and verification process represents a crucial first impression for new clients. However, specific information about the efficiency, user-friendliness, and time requirements for account opening is not detailed. Streamlined onboarding processes have become competitive differentiators in the retail forex industry.

Fund management experience, including the ease and speed of deposits and withdrawals, significantly impacts overall user satisfaction. While bank transfer capability is confirmed, the efficiency of these processes and user feedback about fund management experiences are not documented.

Common user complaints or areas of dissatisfaction that might provide insights for potential improvements are not detailed in available documentation. Understanding typical user pain points would help potential clients set appropriate expectations and make informed decisions about broker selection.

Conclusion

Magic Compass presents itself as a CySEC-regulated forex and CFD broker that offers legitimate trading services suitable for both beginning and experienced retail traders. The broker's regulatory foundation through CySEC authorization provides important client protections and operational oversight. The accessible $100 minimum deposit requirement removes significant barriers for new traders entering the forex market.

The primary strengths identified in this magic compass review include the solid regulatory framework, provision of demo accounts for skill development, and access to the industry-standard MT4 platform. These features position Magic Compass as a potentially viable option for retail investors seeking regulated access to foreign exchange and CFD markets.

However, significant information gaps regarding specific fee structures, comprehensive customer service details, and detailed user experience feedback limit the ability to provide a complete assessment. Potential clients should conduct additional due diligence regarding trading costs, customer support capabilities, and platform performance before making final broker selection decisions. The broker appears most suitable for retail investors who prioritize regulatory compliance and are comfortable with standard industry offerings. However, those seeking extensive educational resources or premium service features may need to evaluate additional options.