Is MAX safe?

Pros

Cons

Is Max Safe or a Scam?

Introduction

Max is a foreign exchange broker that has gained attention in the trading community since its establishment in 2017. Operating primarily in Australia, Max presents itself as a platform for traders seeking to engage with the forex market. However, the rising number of complaints and concerns about its legitimacy has raised questions among potential users. In an industry where trust and transparency are paramount, traders must exercise caution and thoroughly evaluate brokers before committing funds. This article will investigate whether Max is safe or a scam, using various sources to analyze its regulatory status, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

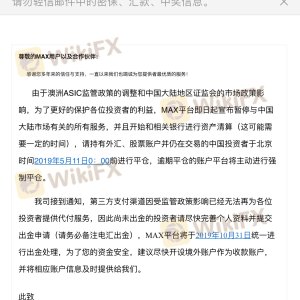

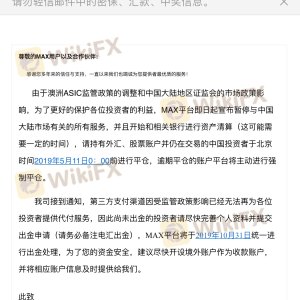

Regulation is a critical aspect of any trading platform, as it ensures that brokers adhere to specific standards of conduct and financial practices. Max claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is known for its strict regulatory environment. However, the legitimacy of this claim must be scrutinized.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 411136 | Australia | Verified |

The significance of regulation cannot be overstated. Brokers under the oversight of reputable regulatory bodies like ASIC are required to maintain high levels of capital, segregate client funds, and adhere to strict reporting and compliance standards. However, regulatory quality varies, and while ASIC is considered a top-tier regulator, the presence of numerous complaints against Max raises concerns about its operational practices. In the past three months, multiple complaints regarding withdrawal issues and customer service responsiveness have surfaced, indicating potential red flags.

Company Background Investigation

Max was established in 2017, positioning itself as a reliable broker in the forex market. However, a deeper dive into its ownership structure and management team reveals a lack of transparency. Information regarding the company's executive team is sparse, and there are no clear details about its operational history or the experience of its management. This opacity can be a significant concern for potential investors, as a broker's credibility is often linked to the qualifications and track record of its leadership.

Furthermore, the absence of detailed disclosures about the company's financial health and operational practices raises questions about its commitment to transparency. Traders should be wary of brokers that do not provide comprehensive information about their backgrounds and management, as this could be indicative of underlying issues.

Trading Conditions Analysis

Max offers a range of trading conditions that are designed to attract both novice and experienced traders. However, an analysis of its fee structure reveals some concerning aspects. The broker provides access to the MetaTrader 4 platform, which is popular among traders for its user-friendly interface and advanced trading tools. Yet, the overall cost of trading with Max may not be as competitive as it appears.

| Fee Type | Max | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The spread for major currency pairs at Max is higher than the industry average, which could erode potential profits for traders. Additionally, the commission structure appears to be variable, which can lead to uncertainty regarding total trading costs. Such discrepancies should be carefully considered by traders evaluating whether Max is safe or a scam.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Max claims to implement several security measures, including segregating client funds from its operational capital. However, the effectiveness of these measures is called into question by the numerous complaints regarding withdrawal issues and account accessibility.

Max's policies on negative balance protection and investor compensation schemes are also crucial. While the broker states that it adheres to these practices, the lack of independent verification and the history of user complaints suggest that traders should remain cautious. The absence of documented evidence supporting these claims can be alarming for potential clients, leading to the conclusion that Max may not be as safe as it professes.

Customer Experience and Complaints

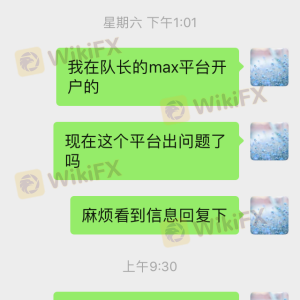

Customer feedback is an essential component of evaluating a broker's reliability. Max has garnered a range of reviews, many of which highlight significant issues with customer service and withdrawal processes. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Delayed Responses |

| Unresponsive Customer Support | Medium | Inconsistent |

One notable case involved a trader who reported being unable to withdraw funds for several weeks, with customer support providing little assistance. This pattern of complaints raises serious concerns about the broker's commitment to customer service and its overall reliability. Traders should carefully weigh these experiences when considering whether to engage with Max.

Platform and Execution

The trading platform provided by Max, MetaTrader 4, is widely regarded for its robust features and reliability. However, reports of execution issues, including slippage and order rejections, have been noted by users. These execution problems can significantly impact trading performance and profitability, leading to frustration among traders.

Furthermore, any signs of platform manipulation or irregularities in order execution should not be overlooked. Traders must remain vigilant and consider the implications of these issues on their overall trading experience with Max.

Risk Assessment

Using Max as a trading platform presents various risks that potential users should be aware of. Below is a summary of key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Numerous complaints and concerns |

| Customer Service | Medium | Inconsistent responses to issues |

| Withdrawal Processes | High | Delays and complications reported |

Given these risks, it is advisable for traders to exercise caution when dealing with Max. Potential users should explore risk mitigation strategies, such as starting with a smaller investment and conducting thorough due diligence.

Conclusion and Recommendations

In conclusion, the investigation into whether Max is safe or a scam yields concerning findings. While the broker claims to be regulated by ASIC, the numerous complaints regarding customer service, withdrawal issues, and lack of transparency suggest that potential traders should approach with caution.

For those considering trading with Max, it is crucial to weigh these factors carefully. Traders may want to explore alternative brokers that have established reputations for reliability and transparency. Recommended alternatives include brokers with strong regulatory oversight, positive customer feedback, and proven track records in the forex market. Ultimately, the decision to engage with Max should be made with a comprehensive understanding of the associated risks and potential rewards.

Is MAX a scam, or is it legit?

The latest exposure and evaluation content of MAX brokers.

MAX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MAX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.