TopFX 2025 Review: Everything You Need to Know

Executive Summary

TopFX is a regulated forex broker. This company has built itself as a complete trading platform since it started in 2010. This topfx review shows a broker that offers many trading tools and gives traders a good experience when they want variety in their investment portfolios. The platform has two main features that make it special: fast trade execution using smart order routing technology, and low spreads across many types of assets including forex, CFDs, commodities, and cryptocurrencies.

TopFX offers 60 forex pairs and 655 tradeable symbols through both MetaTrader 4 and cTrader platforms. This makes TopFX a good choice for small to medium-sized traders and investors who want different investment options. User feedback shows the broker has a 4/5 user rating, which means most clients are happy with the service. The platform works hard to provide low spreads and stable trading conditions, which has helped build its good reputation in the competitive forex market.

TopFX shows strength in execution speed and platform variety. However, some parts of its service need closer examination, especially regarding specific regulatory details and complete market research tools.

Important Disclaimers

Regional Entity Differences: TopFX operates as a regulated broker. However, specific regulatory authority details and license numbers are not clearly shown in available materials. This may mean there are differences in legal frameworks and regulatory oversight across different regions where they operate. Potential clients should check the specific regulatory status that applies to their area before opening accounts.

Review Methodology: This complete evaluation uses publicly available information, user reviews, and industry reports from multiple sources. The analysis aims to give prospective users an objective assessment for reference purposes, though individual trading experiences may vary based on specific circumstances and requirements.

Rating Framework

Broker Overview

TopFX was established in 2010. The company evolved from its origins as a liquidity provider into a full-service brokerage firm dedicated to delivering efficient trading services to its global client base. TopFX has built its reputation on providing reliable access to financial markets while maintaining a focus on technological innovation and customer satisfaction. Over its operational history, the company has developed a complete service model that emphasizes both execution quality and platform diversity.

The broker's business model centers on providing multi-asset trading opportunities across various financial instruments. TopFX offers access to foreign exchange markets, contracts for difference (CFDs), commodities trading, and cryptocurrency markets. This varied approach allows clients to build different investment portfolios through a single trading account. According to available data, the platform supports 60 forex pairs and maintains a total of 655 tradeable symbols across all asset categories.

TopFX operates primarily through two established trading platforms: MetaTrader 4 (MT4) and cTrader. These platforms provide clients with professional-grade trading tools, technical analysis capabilities, and automated trading support. The broker's technology infrastructure emphasizes speed and reliability, utilizing intelligent order routing systems to optimize trade execution. While specific regulatory authority information requires verification, TopFX maintains its commitment to operating within established financial regulatory frameworks.

Regulatory Jurisdiction: TopFX operates as a regulated entity. However, specific regulatory authority details and license numbers are not clearly specified in available documentation. This regulatory uncertainty may impact user confidence levels and requires potential clients to conduct additional verification regarding oversight mechanisms applicable to their trading jurisdiction.

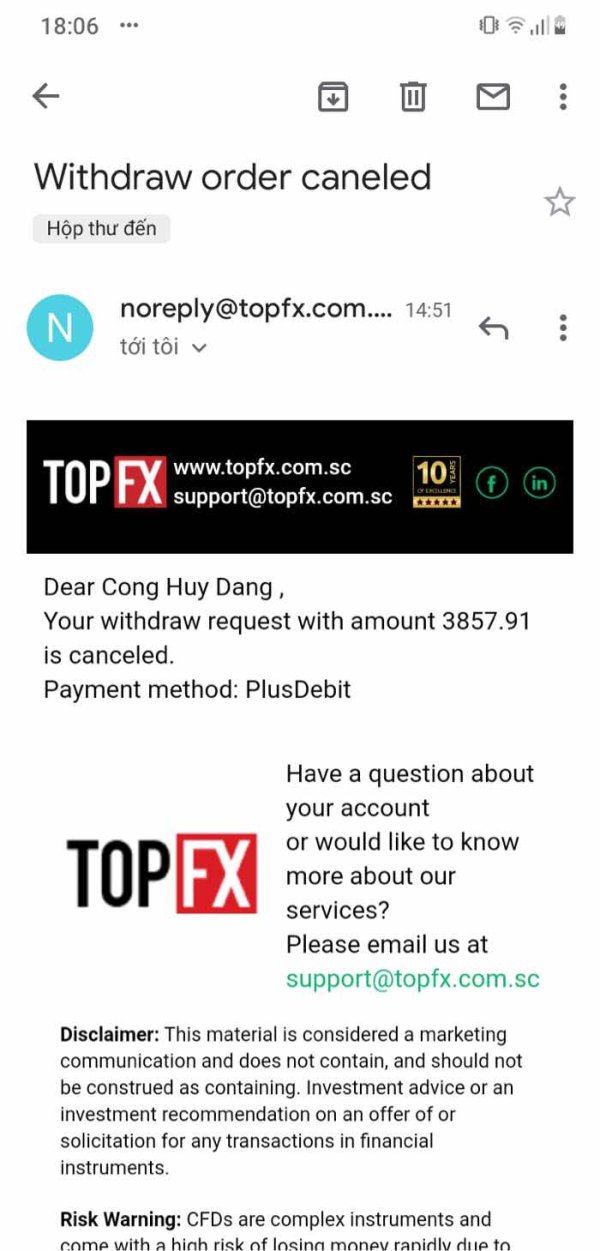

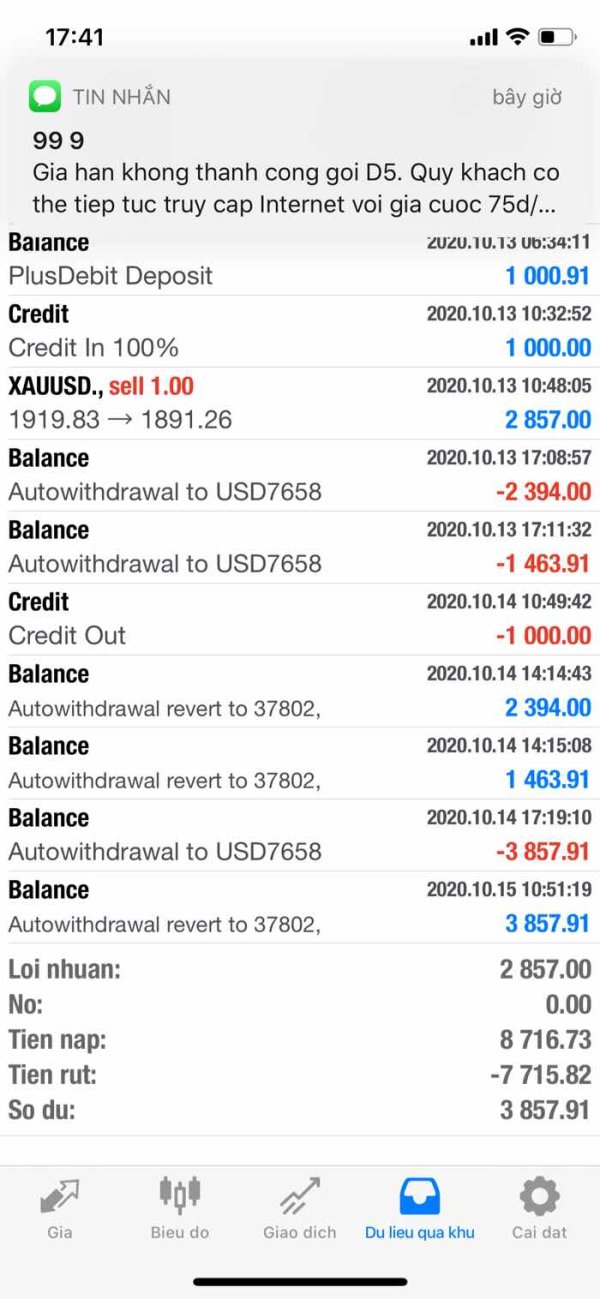

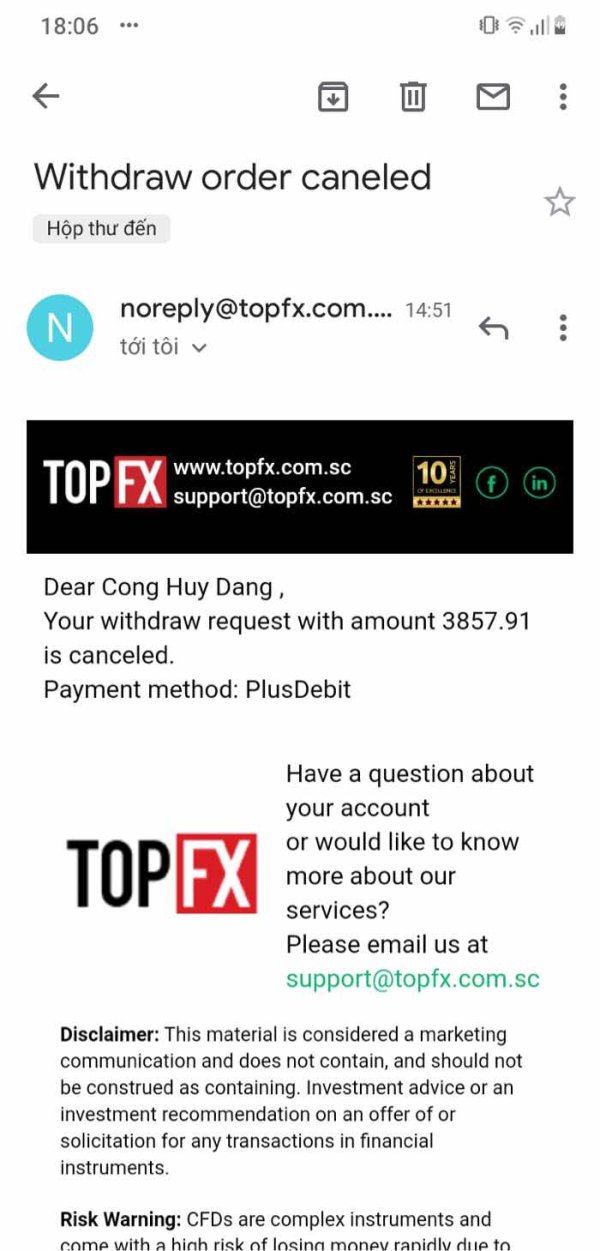

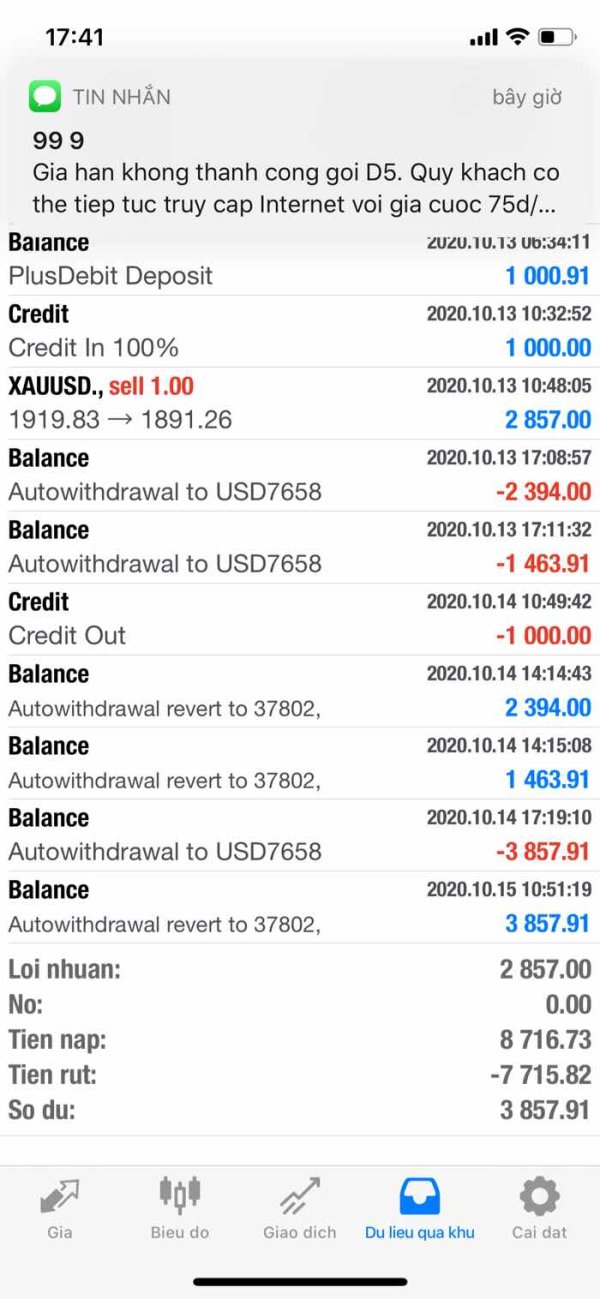

Deposit and Withdrawal Methods: Available materials do not provide complete details regarding supported deposit and withdrawal methods, processing timeframes, or associated fees. This information gap represents an area where prospective clients would need to contact the broker directly for clarification.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in current available information. This makes it difficult for potential clients to assess initial funding requirements across different account types.

Promotional Offerings: Current promotional programs, welcome bonuses, or ongoing incentive structures are not prominently featured in available broker information. This suggests either limited promotional activities or insufficient public disclosure of such programs.

Available Trading Assets: TopFX provides access to 60 forex currency pairs alongside 655 total tradeable symbols spanning multiple asset categories. The platform covers major, minor, and exotic forex pairs while extending into CFDs, commodities, ETFs, and cryptocurrency markets, offering substantial diversification opportunities for traders.

Cost Structure Analysis: The broker emphasizes competitive spreads across its trading instruments. However, specific commission structures, overnight financing rates, and additional fee schedules require direct inquiry for complete transparency. The low-spread approach appears to be a key competitive element in TopFX's pricing strategy.

Leverage Capabilities: Maximum leverage ratios reach up to 1:30. This aligns with regulatory standards in many jurisdictions while providing sufficient leverage for most retail trading strategies.

Platform Selection: Trading is facilitated through both MetaTrader 4 and cTrader platforms. This provides clients with choice between industry-standard interfaces and access to comprehensive trading tools, technical indicators, and automated trading capabilities.

Geographic Restrictions: Specific regional limitations or restricted territories are not detailed in available information. This requires potential clients to verify service availability in their jurisdiction.

Customer Support Languages: Available customer service language options are not comprehensively documented in current materials. However, the broker's international focus suggests multi-language support capabilities.

This topfx review indicates that while the broker offers solid core services, several important operational details require direct verification with the company.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

TopFX's account structure demonstrates competitive positioning within the retail forex market. However, specific account type variations and their corresponding features are not comprehensively detailed in available materials. The broker's emphasis on low spreads represents a significant advantage for cost-conscious traders, particularly those employing high-frequency or scalping strategies where transaction costs significantly impact profitability.

The maximum leverage offering of 1:30 aligns with regulatory standards while providing sufficient margin capabilities for most retail trading approaches. This leverage level strikes a balance between capital efficiency and risk management, making it suitable for both conservative and moderately aggressive trading styles. However, the absence of clearly specified minimum deposit requirements creates uncertainty for potential clients during initial account planning phases.

Account opening procedures and verification requirements are not detailed in current documentation. This may indicate either streamlined processes or insufficient public disclosure of onboarding requirements. The lack of information regarding special account features, such as Islamic accounts for Sharia-compliant trading, represents a potential service gap for specific client segments.

User feedback suggests general satisfaction with account conditions. However, specific testimonials regarding account setup experiences, funding processes, or condition modifications are not prominently featured in available reviews. The competitive spread environment appears to be a primary driver of positive account holder sentiment.

topfx review data indicates that while core account conditions are competitive, enhanced transparency regarding account types, requirements, and special features would strengthen the broker's market position.

TopFX demonstrates strong performance in trading tools and platform resources through its dual-platform approach utilizing both MetaTrader 4 and cTrader systems. This combination provides clients with access to industry-standard trading interfaces while offering choice based on individual preferences and trading style requirements. MT4's widespread adoption and extensive third-party tool compatibility complement cTrader's advanced order management and market depth visualization capabilities.

The platform suite includes comprehensive technical analysis tools, with multiple timeframe charts, extensive indicator libraries, and customizable workspace configurations. These features support various trading methodologies from short-term scalping to long-term position management. The intelligent order routing technology mentioned in broker materials suggests sophisticated execution infrastructure designed to optimize trade processing and minimize slippage.

However, specific details regarding proprietary research resources, market analysis tools, or educational materials are not prominently featured in available information. This represents a potential weakness compared to brokers offering comprehensive market research, economic calendars, and trading education programs. The absence of detailed information about automated trading support, expert advisor capabilities, or social trading features limits assessment of the platform's full technological capabilities.

User feedback indicates satisfaction with available trading tools and platform stability. However, specific testimonials regarding research resources or educational support are not readily available. The focus appears to be primarily on execution quality and platform reliability rather than comprehensive market analysis support.

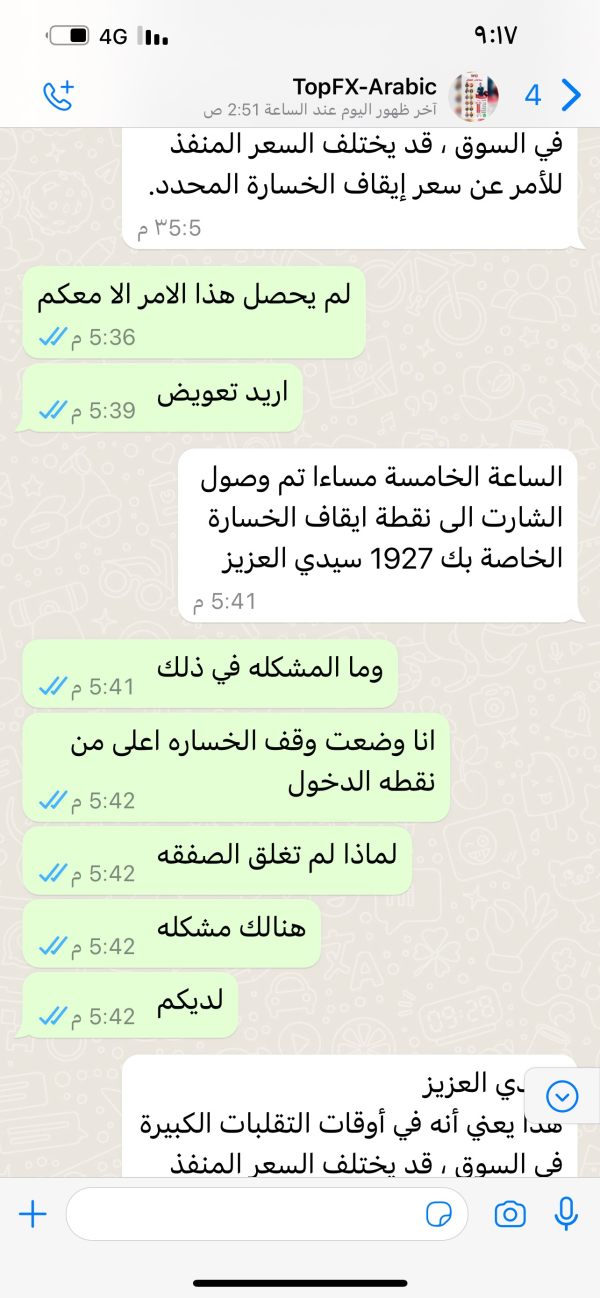

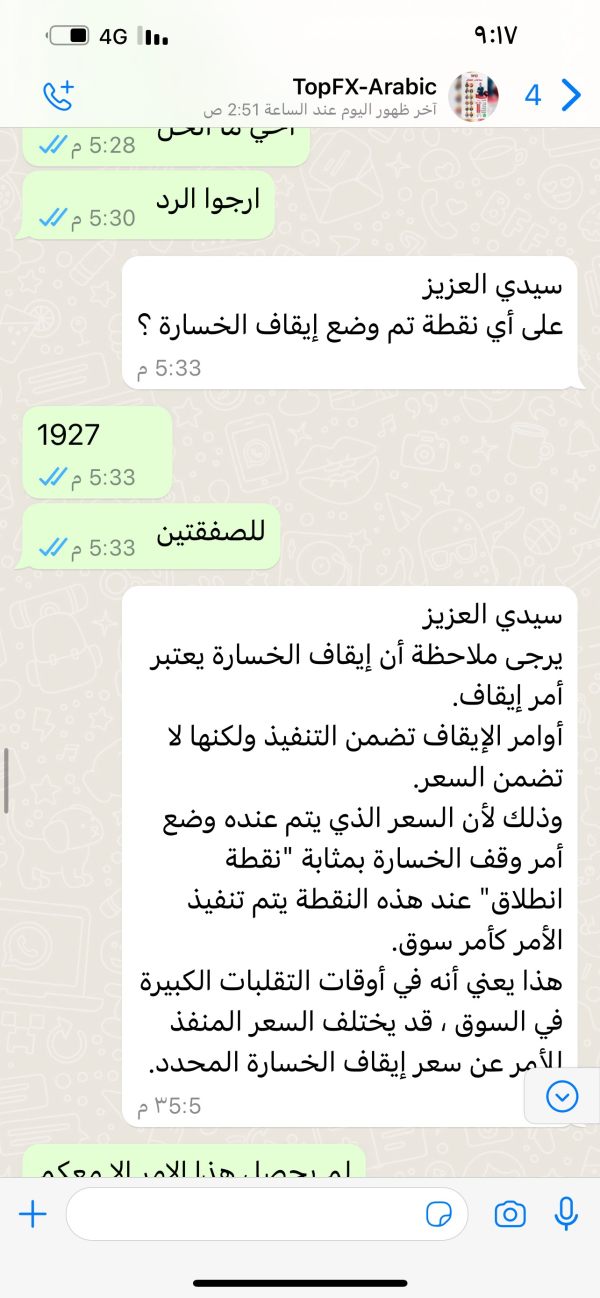

Customer Service and Support Analysis (7/10)

Available information indicates generally positive user sentiment regarding TopFX's customer service quality. User feedback suggests responsive and helpful support interactions. However, specific details about customer service channels, availability hours, and response time benchmarks are not comprehensively documented in current materials, creating uncertainty about support accessibility and efficiency metrics.

The international nature of TopFX's operations suggests multi-language support capabilities. However, specific language options and regional support specialization are not clearly outlined. This lack of clarity may impact non-English speaking clients' confidence in receiving adequate support in their preferred language during critical trading situations or account management needs.

Service quality appears to meet user expectations based on available feedback. However, the absence of detailed problem resolution case studies or specific support channel information limits comprehensive assessment. The 7/10 rating reflects positive user sentiment while acknowledging information gaps regarding support infrastructure and capabilities.

Response time performance, escalation procedures, and specialized support for different account types or trading issues are not detailed in available materials. This represents an area where enhanced transparency could improve client confidence and service perception. The broker would benefit from more comprehensive disclosure of support capabilities and performance metrics.

Trading Experience Analysis (8/10)

TopFX delivers strong trading experience performance through fast execution speeds and stable platform operation, according to user feedback and available performance information. The intelligent order routing technology implementation appears to effectively minimize execution delays and optimize trade processing, contributing to positive user experiences during active trading sessions.

Platform stability receives positive mentions in user feedback. This suggests reliable uptime and consistent performance during various market conditions. The dual-platform approach provides flexibility for traders with different interface preferences while maintaining execution quality across both MT4 and cTrader systems. Technical indicator functionality and charting capabilities support comprehensive market analysis requirements.

However, specific performance metrics such as average execution speeds, slippage statistics, or uptime percentages are not publicly disclosed. This limits objective assessment of trading environment quality. Mobile platform performance and functionality details are not comprehensively covered in available materials, though mobile access is presumably supported through standard MT4 and cTrader mobile applications.

Spread stability appears consistent based on user feedback. However, detailed spread comparison data across different market conditions and trading sessions would enhance transparency. The overall trading environment receives positive user assessment, with particular emphasis on execution reliability and platform responsiveness during normal market operations.

This topfx review indicates that while core trading experience elements perform well, enhanced performance metric disclosure would strengthen the broker's competitive positioning and user confidence levels.

Trustworthiness Analysis (7/10)

TopFX maintains regulated broker status. However, specific regulatory authority details and license numbers require verification through direct inquiry or regulatory database searches. This regulatory ambiguity represents the primary factor limiting the trustworthiness rating, as clear regulatory disclosure is fundamental to broker credibility assessment and client confidence building.

Fund safety measures, segregated account policies, and client fund protection mechanisms are not comprehensively detailed in available materials. These elements are crucial for trustworthiness evaluation, particularly for clients managing substantial trading capital or considering long-term broker relationships. The absence of specific safety measure disclosure creates uncertainty regarding client asset protection protocols.

Company transparency regarding ownership structure, financial backing, and operational history could be enhanced through more comprehensive public disclosure. While the 2010 founding date provides some operational history context, additional information about company development, regulatory compliance history, and industry recognition would strengthen credibility assessment.

Third-party ratings, industry awards, or independent broker evaluations are not prominently featured in available information. This limits external validation of the broker's reputation and service quality. User feedback suggests general satisfaction with broker reliability, though specific testimonials regarding fund safety experiences or regulatory interaction outcomes are not readily available.

The trustworthiness assessment reflects the broker's regulated status while acknowledging the need for enhanced transparency regarding specific regulatory details and client protection measures that would elevate confidence levels among prospective clients.

User Experience Analysis (8/10)

TopFX achieves strong user experience performance with a reported 4/5 user rating. This indicates high overall satisfaction levels among the client base. This rating suggests that the broker successfully meets most user expectations across various service aspects, from platform functionality to customer support interactions and trading condition satisfaction.

The user experience benefits from the dual-platform approach, allowing traders to select interfaces that best match their experience levels and trading preferences. Both MT4 and cTrader offer familiar environments for traders with previous experience while providing sufficient functionality for newcomers to develop their trading skills effectively.

However, specific details regarding user interface design, account registration processes, and verification procedures are not comprehensively covered in available materials. The onboarding experience, which significantly impacts initial user impressions, lacks detailed documentation that would help prospective clients understand setup requirements and timeline expectations.

Fund operation experiences, including deposit and withdrawal processes, processing times, and user satisfaction with financial transactions, are not specifically addressed in available user feedback summaries. These operational elements significantly impact overall user experience and satisfaction levels throughout the client relationship lifecycle.

The target user profile appears well-suited for small to medium-sized traders seeking diversified investment opportunities. However, specific user demographic information or trading volume statistics that would validate this positioning are not readily available in current documentation.

Conclusion

TopFX presents itself as a competent regulated forex broker offering diverse trading instruments and maintaining solid performance across multiple evaluation criteria. The platform's strengths lie in its competitive spreads, fast execution capabilities, and dual-platform approach that accommodates various trader preferences through both MT4 and cTrader access.

The broker appears particularly well-suited for small to medium-sized traders and investors seeking portfolio diversification opportunities across forex, CFDs, commodities, and cryptocurrency markets. The 4/5 user rating and positive feedback regarding execution quality and platform stability support this positioning, indicating general client satisfaction with core trading services.

However, TopFX faces challenges in transparency regarding specific regulatory details, comprehensive customer service information, and detailed operational procedures that would enhance client confidence and competitive positioning. The primary areas for improvement include clearer regulatory disclosure, enhanced customer service channel documentation, and more comprehensive educational and research resource offerings that would elevate the overall service proposition to match leading industry competitors.