Rakuten Securities 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Rakuten Securities review evaluates one of Asia's most established forex and securities brokers. The company has been operating since 1999. Rakuten Securities stands out as a multi-regulated broker offering competitive trading conditions with fixed spreads and commission-free trading across multiple asset classes. The broker provides leverage up to 1:400. It also uses the popular MetaTrader 4 platform, making it accessible for both novice and experienced traders.

Key highlights include a low minimum deposit requirement of just $50 USD. This makes it particularly attractive for retail traders seeking cost-effective market access. The company operates under a hybrid Market Maker (MM) and Straight Through Processing (STP) model, ensuring competitive execution across forex, commodities, stocks, and indices. With regulatory oversight from ASIC, SCM, SFC, and JFSA, Rakuten Securities maintains strong compliance standards across its operational jurisdictions.

The broker primarily targets retail clients seeking diversified trading opportunities with transparent pricing structures. User feedback indicates a generally positive experience with platform stability and competitive trading costs. However, some areas for improvement remain in customer service accessibility and educational resources.

Important Disclaimers

Potential traders should be aware that Rakuten Securities operates through different regional entities. Each entity is subject to varying regulatory requirements that may impact trading conditions, available leverage, and client protections. Traders in different jurisdictions may experience different terms of service and regulatory protections.

This review is based on comprehensive analysis of publicly available information, regulatory filings, user feedback, and market data current as of 2025. Trading involves significant risk of capital loss. Past performance does not guarantee future results. Potential clients should carefully consider their financial situation and risk tolerance before engaging in forex or securities trading.

Overall Rating Framework

Broker Overview

Rakuten Securities was established in 1999. The company represents a significant player in the Asian financial services sector with headquarters in Australia and strategic offices across Malaysia, Hong Kong, and Japan. According to multiple industry sources, the company has evolved from its Japanese roots to become a multinational broker serving diverse markets across the Asia-Pacific region. The broker's expansion strategy has focused on establishing regulated entities in key financial centers. This ensures compliance with local regulatory requirements while maintaining operational consistency.

The company operates under a hybrid business model combining Market Maker (MM) and Straight Through Processing (STP) execution. This allows for competitive pricing while maintaining execution quality. This dual approach enables Rakuten Securities to offer fixed spreads on major currency pairs while providing direct market access for institutional-grade execution when market conditions favor such routing.

Rakuten Securities uses the industry-standard MetaTrader 4 platform as its primary trading interface. The platform supports automated trading strategies and comprehensive technical analysis tools. The broker's asset coverage spans traditional forex pairs, commodities including precious metals and energy products, equity indices from major global markets, and individual stock CFDs. Regulatory oversight comes from four major financial authorities: the Australian Securities and Investments Commission (ASIC), Securities Commission Malaysia (SCM), Securities and Futures Commission of Hong Kong (SFC), and Japan Financial Services Agency (JFSA). This provides robust client protection frameworks across all operational jurisdictions.

Detailed Trading Conditions

Regulatory Coverage: Rakuten Securities maintains regulatory compliance across four major jurisdictions through ASIC (Australia), SCM (Malaysia), SFC (Hong Kong), and JFSA (Japan). This ensures comprehensive client protection and operational transparency.

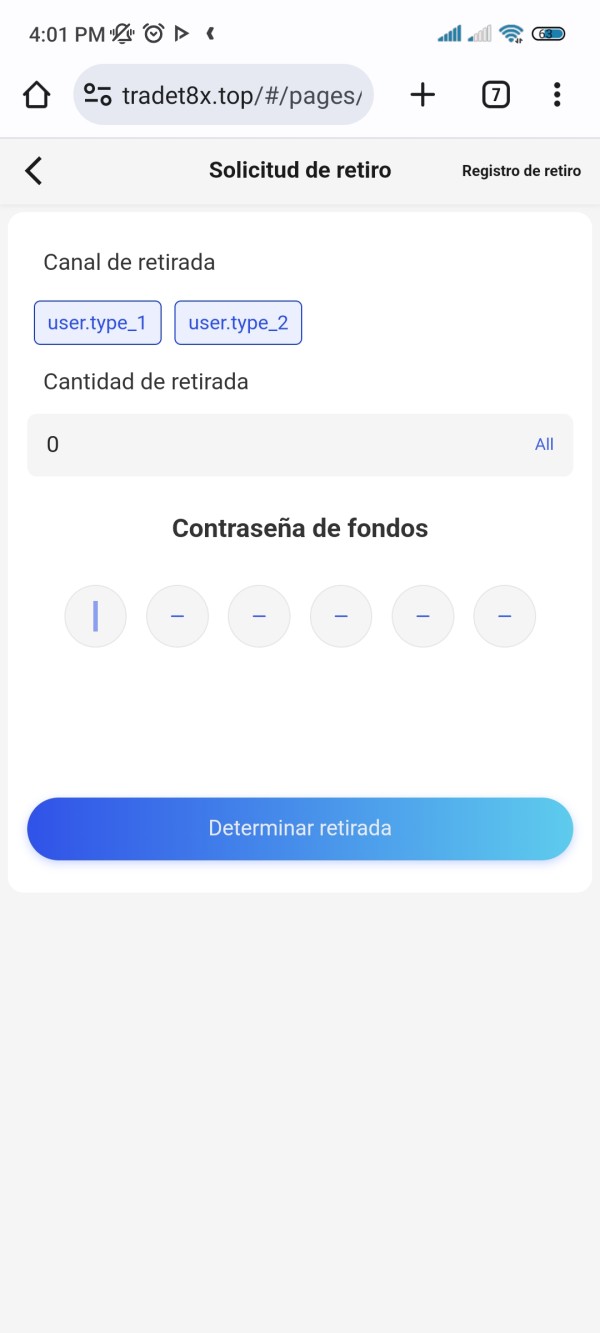

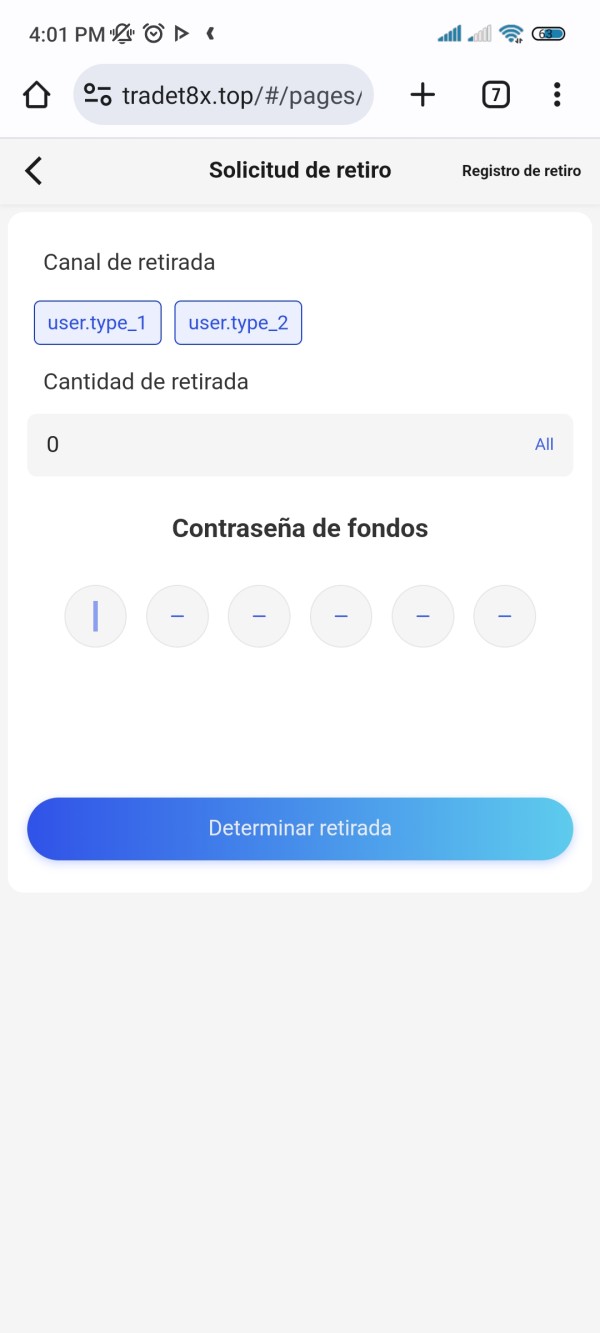

Funding Methods: Specific deposit and withdrawal options are not detailed in available documentation. This requires direct inquiry with the broker for comprehensive funding information.

Minimum Deposit: The broker requires a minimum initial deposit of $50 USD. This positions it as accessible for retail traders with limited capital.

Promotional Offers: Current bonus and promotional programs are not specified in available materials. This suggests potential clients should inquire directly about any available incentives.

Asset Coverage: Trading opportunities include major and minor forex pairs, commodity CFDs covering precious metals and energy products, global equity indices, and individual stock CFDs across multiple markets.

Cost Structure: The broker employs a commission-free model with fixed spreads. This provides cost predictability for traders. According to industry analysis, this pricing structure offers competitive total trading costs compared to variable spread alternatives, particularly during volatile market conditions.

Leverage Options: Maximum leverage reaches 1:400. However, some sources indicate 1:30 limits may apply depending on regulatory jurisdiction and client classification, reflecting varying regulatory requirements across operational regions.

Platform Technology: MetaTrader 4 serves as the primary trading platform. It offers comprehensive charting tools, automated trading capabilities, and extensive technical indicator libraries for both manual and algorithmic trading strategies.

Geographic Restrictions: Specific country restrictions are not detailed in available documentation. This requires verification based on individual circumstances and regulatory compliance requirements.

Customer Support Languages: Available support languages are not specified in current materials. However, the broker's multi-regional presence suggests multilingual capabilities.

This Rakuten Securities review reveals a broker structure designed for accessibility while maintaining professional-grade trading infrastructure across multiple regulated markets.

Account Conditions Analysis (Score: 7/10)

Rakuten Securities offers a streamlined account structure with a single primary account type designed to accommodate traders across experience levels. The $50 USD minimum deposit requirement represents one of the most accessible entry points in the forex industry. This significantly lowers barriers for new traders while remaining practical for the broker's operational requirements. According to user feedback, this low threshold has been particularly appreciated by traders testing the platform or those with limited initial capital.

The commission-free trading model with fixed spreads provides cost transparency that many traders find preferable to variable spread structures. This approach eliminates uncertainty about trading costs during volatile market periods. It allows for more precise trade planning and risk management. However, the lack of multiple account tiers means that high-volume traders may not benefit from reduced costs typically available through VIP or professional account classifications.

Account opening procedures are not extensively detailed in available materials. However, the broker's regulatory compliance across multiple jurisdictions suggests standard KYC and AML verification processes. The absence of specific information about Islamic account options or other specialized account features represents a potential limitation for traders with specific religious or trading requirements.

User feedback regarding account conditions has been generally positive. Traders particularly appreciate the low entry barrier and transparent fee structure. However, some traders have noted the lack of account customization options compared to brokers offering multiple account tiers with varying features and pricing structures.

The evaluation reflects strong accessibility through low minimum deposits and transparent costs. This is balanced against limited account variety and insufficient publicly available information about specialized account features. This Rakuten Securities review finds the account conditions well-suited for standard retail trading but potentially limiting for traders seeking specialized account features.

Rakuten Securities provides a comprehensive trading environment centered around the MetaTrader 4 platform. It offers access to forex, commodities, stocks, and indices through a single interface. The platform includes standard MT4 features such as multiple chart types, over 30 technical indicators, and support for Expert Advisors (EAs) for automated trading strategies. According to user feedback, the platform's stability and execution speed have received positive recognition.

The broker's multi-asset approach allows traders to diversify across different market sectors without requiring multiple platform logins or account management systems. This integration is particularly valuable for traders implementing cross-asset strategies or seeking to hedge positions across different asset classes. The inclusion of major global equity indices and individual stock CFDs expands trading opportunities beyond traditional forex markets.

However, specific information about proprietary research tools, market analysis resources, or educational materials is not extensively documented in available sources. This represents a potential gap for traders who rely heavily on broker-provided market insights or educational support. The absence of detailed information about mobile trading capabilities also limits the complete assessment of the platform's accessibility across different devices.

Technical analysis capabilities through MT4 are robust. The platform supports both manual analysis and algorithmic trading development. The platform's widespread industry adoption means extensive community support and third-party tool availability, though specific enhancements or customizations by Rakuten Securities are not clearly documented.

The strong score reflects the reliable MT4 platform foundation and multi-asset access. However, it's tempered by limited information about additional research tools and educational resources that could enhance the overall trading experience.

Customer Service and Support Analysis (Score: 6/10)

Customer service evaluation for Rakuten Securities faces significant limitations due to insufficient publicly available information about support channels, response times, and service quality metrics. This lack of transparency represents a notable concern for potential clients who prioritize accessible customer support as a key selection criterion.

The broker's multi-regional presence across Australia, Malaysia, Hong Kong, and Japan suggests potential for localized support services. However, specific language capabilities and regional support hours are not documented in available materials. This geographic distribution could theoretically provide extended support coverage across different time zones, benefiting traders in various markets.

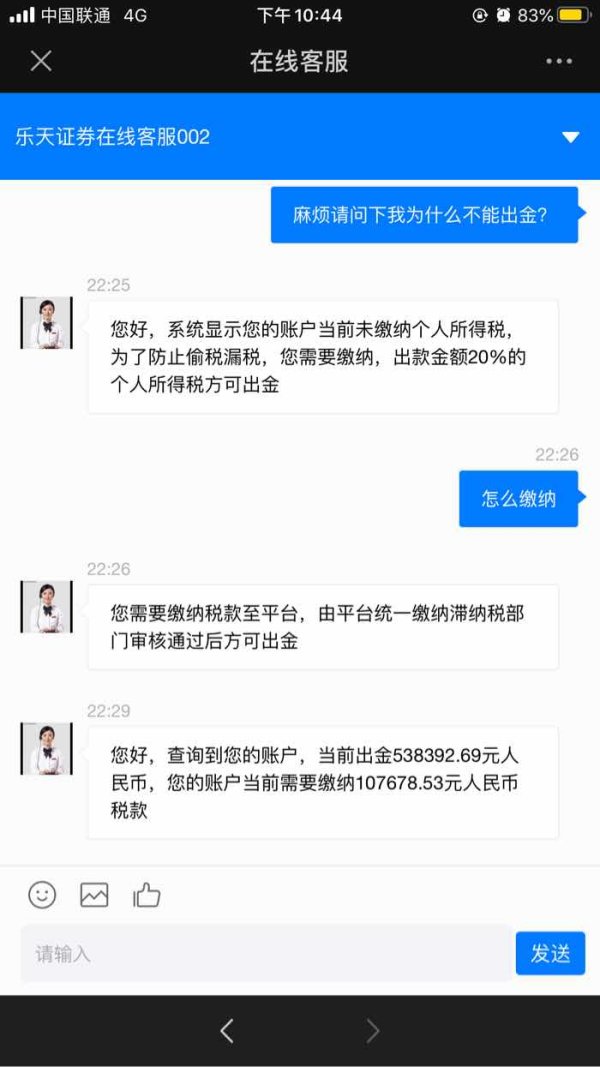

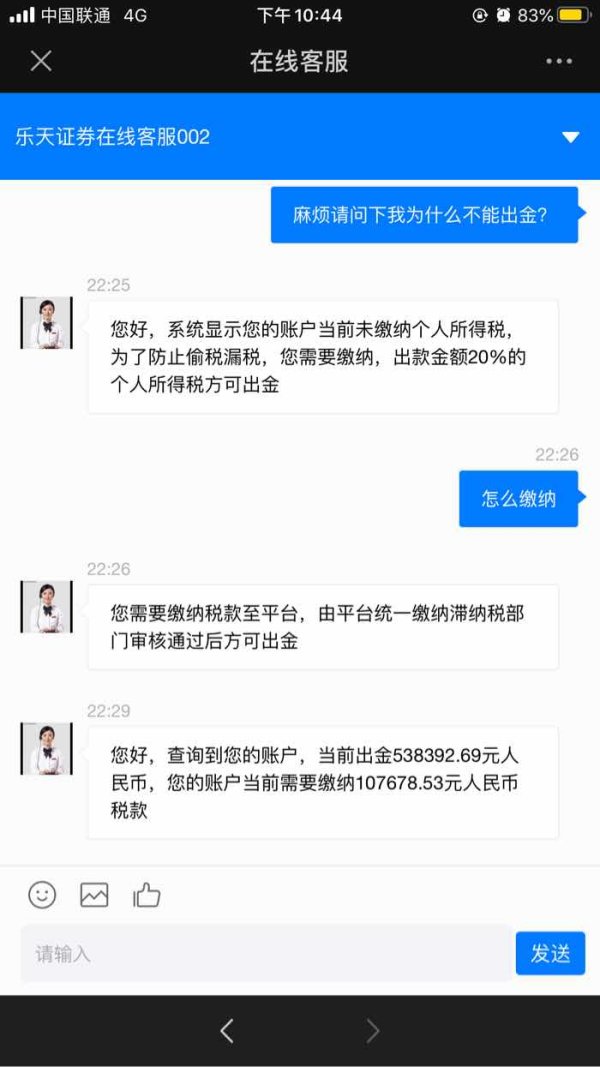

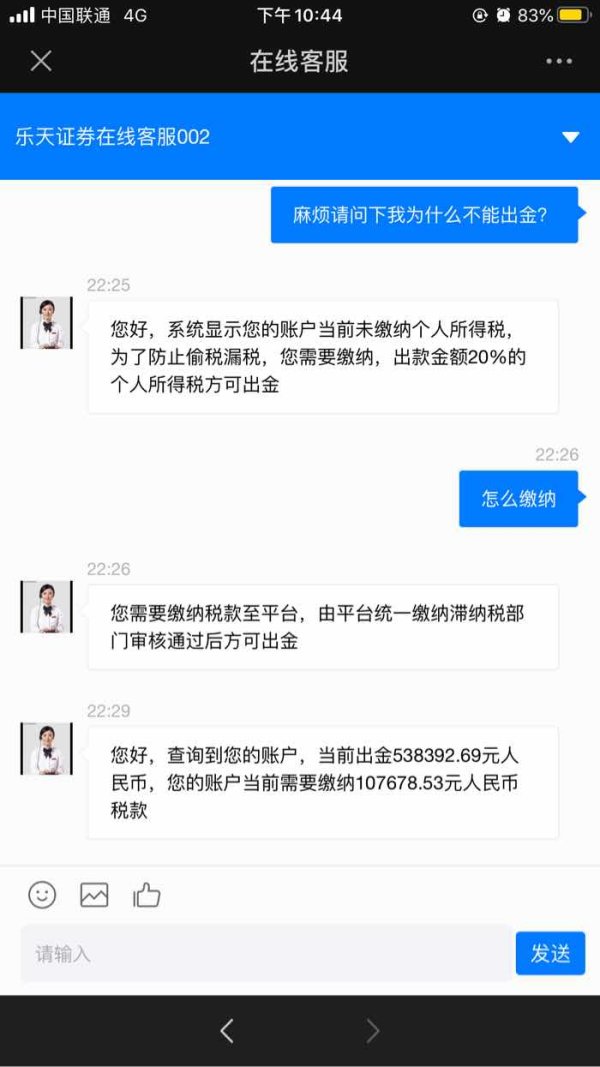

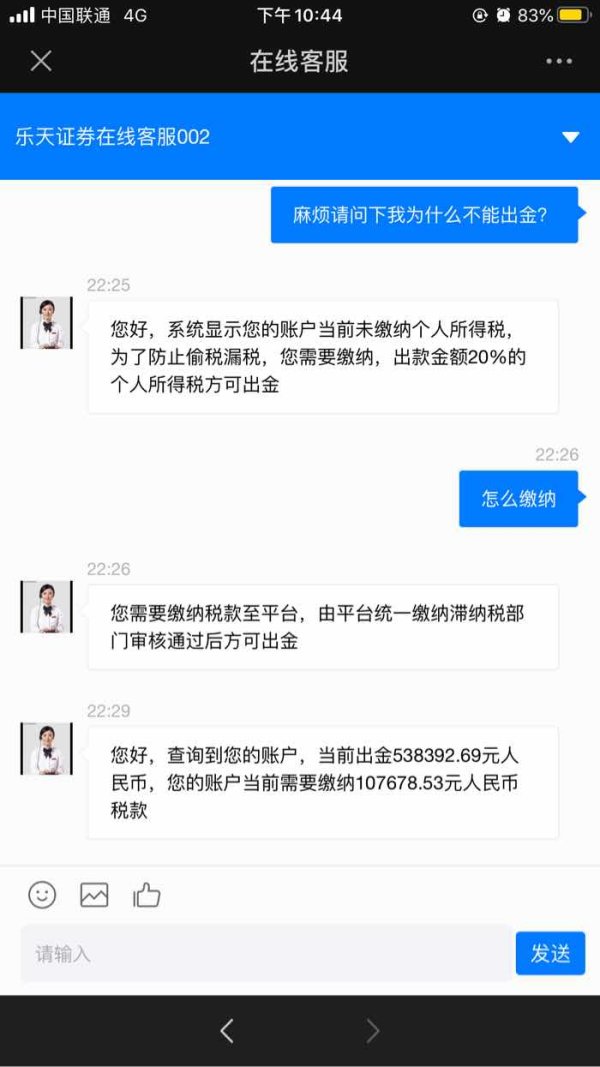

Without specific user feedback regarding customer service experiences, response times, or problem resolution effectiveness, it's challenging to assess the actual quality of support provided. The absence of clearly documented support channels such as live chat, phone support, or ticketing systems raises questions about accessibility during critical trading situations.

The regulatory oversight from multiple authorities (ASIC, SCM, SFC, JFSA) does provide alternative recourse mechanisms for dispute resolution. This adds a layer of client protection beyond direct customer service. However, this doesn't substitute for responsive day-to-day support for technical issues or account inquiries.

The moderate score reflects the uncertainty surrounding customer service quality and accessibility. While the broker's regulatory compliance suggests professional operations, the lack of transparent information about support services represents a significant evaluation limitation. Potential clients should directly verify support capabilities and test response times before committing significant capital to trading activities.

Trading Experience Analysis (Score: 7/10)

User feedback indicates that Rakuten Securities provides a stable trading environment with reliable platform performance and acceptable execution quality. The MetaTrader 4 platform serves as a familiar and robust foundation for trading activities. Users report consistent access and minimal technical disruptions during normal market conditions.

The fixed spread structure contributes to predictable trading costs, which many users appreciate for position sizing and risk management calculations. According to available feedback, slippage incidents appear to be minimal during standard market conditions. However, performance during high-volatility periods is not extensively documented. The commission-free model simplifies cost calculations and appeals to traders who prefer transparent pricing structures.

Platform functionality includes standard MT4 features such as multiple order types, pending orders, and stop-loss/take-profit capabilities. The support for automated trading through Expert Advisors allows for strategy implementation and backtesting. However, specific performance metrics or platform optimizations by Rakuten Securities are not detailed in available materials.

Mobile trading experience information is not comprehensively available in current documentation. This represents a significant gap given the importance of mobile access for modern traders. The absence of detailed information about mobile platform features, synchronization capabilities, or mobile-specific tools limits the complete assessment of trading accessibility.

The broker's multi-asset offering allows for portfolio diversification within a single platform. Users have noted this as convenient for cross-market strategies. However, specific execution statistics, average spread data during different market conditions, and detailed performance metrics are not publicly available.

This Rakuten Securities review finds the trading experience generally satisfactory based on available user feedback. However, limited detailed performance data and mobile platform information constrain the evaluation comprehensiveness.

Trust and Regulation Analysis (Score: 8/10)

Rakuten Securities demonstrates strong regulatory credentials through oversight by four major financial authorities across key Asia-Pacific markets. The Australian Securities and Investments Commission (ASIC) provides robust client protection frameworks including segregated client funds and compensation schemes. Similarly, regulation by Securities Commission Malaysia (SCM), Securities and Futures Commission of Hong Kong (SFC), and Japan Financial Services Agency (JFSA) creates multiple layers of regulatory oversight and client protection.

This multi-jurisdictional regulatory approach significantly enhances trustworthiness compared to brokers operating under single or less stringent regulatory frameworks. Each regulatory body imposes specific capital requirements, operational standards, and client protection measures. This creates comprehensive oversight of the broker's operations across different markets.

The company's establishment in 1999 provides substantial operational history. This demonstrates longevity in the competitive financial services sector. This extended operational period suggests successful navigation of various market cycles and regulatory changes, contributing to overall credibility assessment.

However, specific information about fund segregation practices, compensation scheme details, or third-party auditing procedures is not extensively documented in available materials. The absence of detailed transparency reports or specific capital adequacy disclosures limits the complete assessment of financial stability and client protection measures.

User trust indicators appear generally positive based on available feedback. No significant negative incidents or regulatory actions are prominently reported in accessible sources. The broker's integration with the broader Rakuten ecosystem, known for consumer financial services, may provide additional brand recognition and trust factors.

The strong score reflects robust multi-jurisdictional regulatory oversight and established operational history. However, it's moderated by limited specific information about internal risk management and client protection implementation details.

User Experience Analysis (Score: 7/10)

Available user feedback indicates a 3.8/5 overall rating, suggesting generally positive experiences with some areas for improvement. Users have consistently praised the platform's stability and the accessibility provided by the low minimum deposit requirement. This makes the broker particularly attractive for new or small-scale traders testing forex markets.

The user interface receives positive feedback for its familiarity, leveraging the widely-adopted MetaTrader 4 platform that many traders already understand. This reduces the learning curve for platform navigation and feature utilization. It contributes to overall user satisfaction. The commission-free trading structure is frequently mentioned as a positive aspect, providing cost predictability that users appreciate for budgeting and strategy planning.

However, some users have noted limitations in customer service accessibility and response times. This impacts the overall experience particularly during technical issues or account inquiries. The lack of comprehensive educational resources has also been mentioned as an area where the broker could enhance user support, especially for newer traders who might benefit from structured learning materials.

Registration and account verification processes are not extensively detailed in available user feedback. However, the broker's regulatory compliance suggests standard KYC procedures. The absence of specific complaints about onboarding suggests reasonably smooth account opening processes, though verification timeframes are not documented.

Fund management experiences vary, with limited specific feedback about deposit and withdrawal processes, processing times, or any associated fees. This represents an information gap that potential users should clarify directly with the broker before account opening.

User demographics appear to span both novice traders attracted by low entry barriers and experienced traders seeking cost-effective multi-asset access. The platform's suitability for automated trading through EA support appeals to more sophisticated users implementing algorithmic strategies.

Conclusion

This comprehensive Rakuten Securities review reveals a well-established broker offering competitive trading conditions through robust regulatory oversight and accessible account requirements. The broker's strength lies in its multi-jurisdictional regulatory compliance, low entry barriers with a $50 minimum deposit, and commission-free trading structure that appeals to cost-conscious traders.

Rakuten Securities is particularly well-suited for new traders seeking reliable market access without significant capital requirements. It also serves experienced traders who value transparent pricing and stable platform performance. The MetaTrader 4 platform provides familiar functionality for both manual and automated trading strategies across multiple asset classes.

However, potential limitations include insufficient publicly available information about customer service quality, educational resources, and mobile trading capabilities. The lack of multiple account tiers may also limit appeal for high-volume traders seeking customized trading conditions.

Key Advantages: Low minimum deposit, commission-free trading, strong regulatory oversight, stable platform performance, multi-asset access.

Areas for Improvement: Customer service transparency, educational resource availability, mobile platform documentation, account customization options.

Overall, Rakuten Securities represents a solid choice for traders prioritizing regulatory security, cost-effective trading, and platform reliability. However, potential clients should verify specific service aspects directly with the broker before committing to trading activities.