ACY Securities 2025 Review: Everything You Need to Know

Executive Summary

ACY Securities stands as a globally recognized multi-asset trading provider that has established itself as a reputable force in the financial services industry since its founding in 2011. This acy securities review reveals a broker that operates under ASIC regulation and emphasizes core pillars of transparency, client-focused service, and cutting-edge technology. The Sydney-based FinTech company has built its reputation on offering comprehensive trading solutions across multiple asset classes.

The broker's standout features include an extensive selection of over 2,200 trading instruments spanning forex, shares, indices, cryptocurrencies, precious metals, and commodities. ACY Securities has positioned itself as one of the fastest-growing multi-asset trading providers in the industry, delivering what they promise to be fast execution speeds and competitive trading conditions. Their platform offerings include the industry-standard MetaTrader 4 and MetaTrader 5, alongside their proprietary LogixTrader platform.

This broker primarily targets traders seeking portfolio diversification opportunities across various asset classes. Whether you're interested in traditional forex trading, stock investments, cryptocurrency exposure, or commodity trading, ACY Securities aims to provide a comprehensive solution. The broker has garnered recognition within the global forex community, though like many brokers, it faces both positive feedback and criticism from its user base, with 630 reviews currently available on Trustpilot reflecting mixed experiences.

Important Disclaimers

Regional Entity Variations: It's crucial to understand that ACY Securities operates under different regulatory frameworks across various jurisdictions, which may result in varying trading conditions, available instruments, and customer support services depending on your location. ASIC regulation applies specifically to Australian operations, and traders from different regions should verify the specific regulatory status and terms applicable to their jurisdiction before opening an account.

Review Methodology: This comprehensive evaluation is based on extensive analysis of user feedback, industry recognition, available public information, and testing methodologies employed by financial review platforms. The assessment draws from multiple sources including FXEmpire testing procedures, industry reports, and documented user experiences to provide a balanced perspective on ACY Securities' offerings and performance.

Overall Rating Framework

Broker Overview

ACY Securities emerged in the financial services landscape in 2011, establishing its headquarters in Sydney, Australia. The company has built its foundation on three fundamental pillars: transparency, client-focused service, and technological innovation. As an ASIC-regulated derivative product issuer and provider, ACY Securities has positioned itself as a leading Australian financial services company with a strong emphasis on fintech innovation. The broker's leadership, including co-founder and director Jimmy Ye, brings extensive experience from telecommunications, energy, and financial services sectors, contributing to the company's comprehensive understanding of both technology and financial markets.

The company's business model centers around providing multi-asset trading solutions that cater to diverse investment strategies and risk profiles. ACY Securities has designed its services to accommodate both retail and professional traders who seek exposure to global financial markets through a single platform. Their approach emphasizes providing access to a wide range of financial instruments while maintaining competitive trading conditions and reliable execution standards.

ACY Securities operates through multiple trading platforms, including the widely recognized MetaTrader 4 and MetaTrader 5 platforms, which offer comprehensive charting tools, technical analysis capabilities, and automated trading support. Additionally, their proprietary LogixTrader platform provides an alternative trading environment designed to meet specific trader requirements. The broker's asset coverage spans traditional forex pairs, global equities, major stock indices, popular cryptocurrencies, precious metals including gold and silver, and various commodity markets, making it a comprehensive solution for traders seeking diversified market exposure.

Regulatory Jurisdiction: ACY Securities operates under ASIC (Australian Securities and Investments Commission) regulation as a multiple ASIC regulated Australian entity. While the specific license numbers were not detailed in available materials, the broker emphasizes its commitment to regulatory compliance and transparency in its operations.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in the available materials, though the broker's emphasis on client-focused service suggests multiple convenient funding options are likely available to accommodate various client preferences and regional requirements.

Minimum Deposit Requirements: The exact minimum deposit requirements were not specified in the available documentation, indicating that prospective traders should contact the broker directly for current account opening requirements and funding minimums.

Bonus and Promotions: Current promotional offerings and bonus structures were not detailed in the available materials, suggesting that ACY Securities may focus more on competitive trading conditions rather than promotional incentives, though specific offers may be available upon inquiry.

Tradeable Assets: ACY Securities offers an impressive selection of over 2,200 trading instruments across six major asset categories. This includes comprehensive forex coverage with major, minor, and exotic currency pairs, access to global stock markets, major international indices, popular cryptocurrencies, precious metals trading opportunities, and various commodity markets including energy and agricultural products.

Cost Structure: While specific spread and commission details were not provided in the available materials, ACY Securities promotes competitive trading conditions with emphasis on fast execution and what they describe as favorable pricing. The broker appears to focus on providing transparent pricing structures, though traders should verify current spreads and fees directly with the broker.

Leverage Ratios: Specific leverage information was not detailed in the available materials, though as an ASIC-regulated entity, leverage offerings would be subject to Australian regulatory requirements and may vary based on asset class and client classification.

Platform Options: The broker provides access to MetaTrader 4, MetaTrader 5, and their proprietary LogixTrader platform, offering traders flexibility in choosing their preferred trading environment based on their specific needs and experience levels.

Geographic Restrictions: Specific geographic restrictions were not detailed in the available materials, though regulatory requirements may limit service availability in certain jurisdictions.

Customer Support Languages: The range of supported languages for customer service was not specified in the available documentation, though the broker's global focus suggests multi-language support capabilities.

This acy securities review indicates a broker that emphasizes comprehensive market access and technological innovation, though some specific operational details require direct verification with the broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

ACY Securities demonstrates solid account conditions that reflect their commitment to transparency and client-focused service, though specific details about account types and structures were not extensively detailed in available materials. The broker's emphasis on fast execution suggests streamlined account management processes, which likely contributes to efficient account opening and maintenance procedures. While minimum deposit requirements and specific account tier structures weren't specified, the broker's positioning as a multi-asset provider suggests they accommodate various trader profiles and capital levels.

The account opening process appears to be designed with efficiency in mind, reflecting ACY Securities' fintech approach to financial services. Their technology-focused methodology likely translates into digital account management capabilities and automated processing where possible. However, the lack of detailed information about specific account features, such as Islamic account availability or premium account benefits, prevents a higher rating in this category.

The broker's ASIC regulation provides fundamental account protection and operational standards, ensuring that client accounts operate within established regulatory frameworks. This regulatory oversight contributes positively to account condition reliability and client fund protection, though specific details about account insurance or segregation policies weren't detailed in available materials. The score reflects solid foundational account conditions with room for improvement in transparency and detailed feature disclosure.

User feedback regarding account conditions was not extensively detailed in available materials, though the overall emphasis on client-focused service suggests attention to account holder needs and preferences. This acy securities review finds account conditions to be adequate but requiring more detailed information for comprehensive evaluation.

ACY Securities excels in providing comprehensive tools and resources, with their offering of over 2,200 trading instruments representing one of the most extensive selections available in the multi-asset trading space. This vast instrument selection spans six major asset categories, providing traders with exceptional diversification opportunities and the ability to implement complex trading strategies across multiple markets simultaneously. The breadth of available instruments demonstrates the broker's commitment to meeting diverse trading needs and investment objectives.

The platform selection including MetaTrader 4, MetaTrader 5, and LogixTrader provides traders with robust technical analysis capabilities, automated trading support, and comprehensive charting tools. MetaTrader platforms are industry standards that offer extensive indicator libraries, expert advisor support, and multi-timeframe analysis capabilities. The addition of LogixTrader suggests the broker's commitment to providing alternative trading environments that may offer unique features or improved functionality for specific trading styles.

While specific details about research and analysis resources weren't extensively covered in available materials, the broker's emphasis on technology and innovation suggests that analytical tools and market research capabilities are likely integrated into their platform offerings. The technological focus of ACY Securities indicates that traders probably have access to real-time market data, news feeds, and analytical resources necessary for informed trading decisions.

Educational resource availability wasn't specifically detailed, though the comprehensive platform offerings suggest that standard educational materials and trading guides are likely available to support trader development and platform familiarity. The high score in this category reflects the exceptional instrument variety and solid platform selection, with minor deductions for limited information about supplementary research and educational resources.

Customer Service and Support Analysis (Score: 6/10)

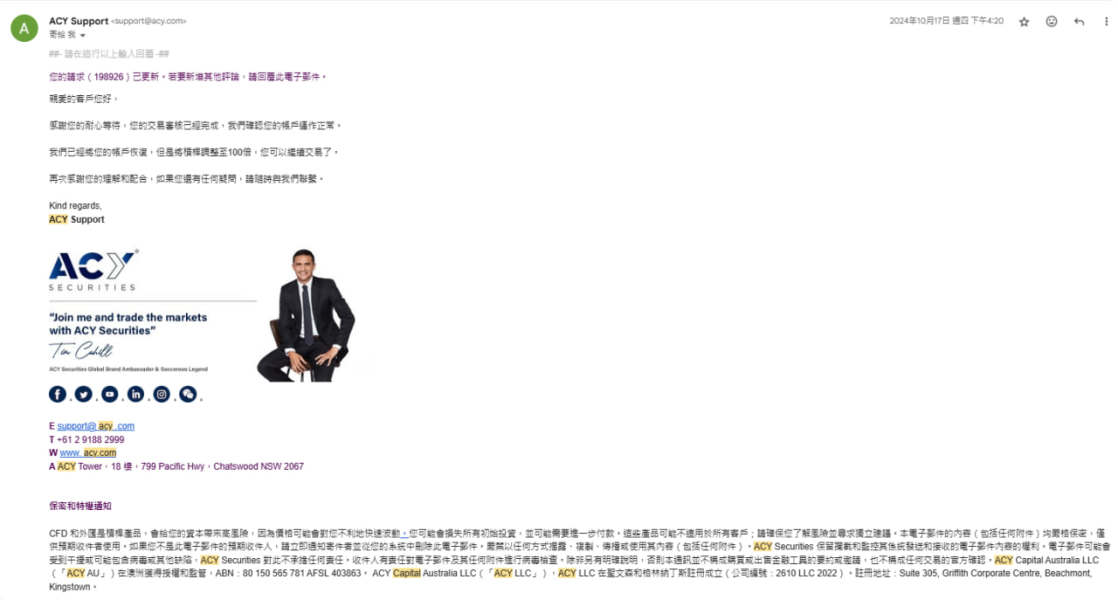

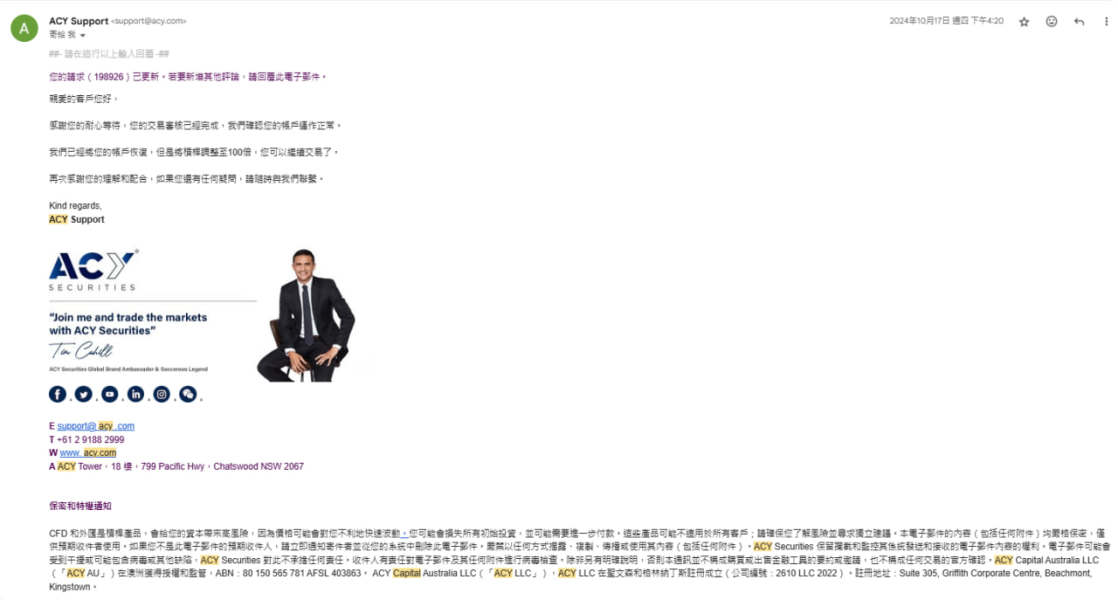

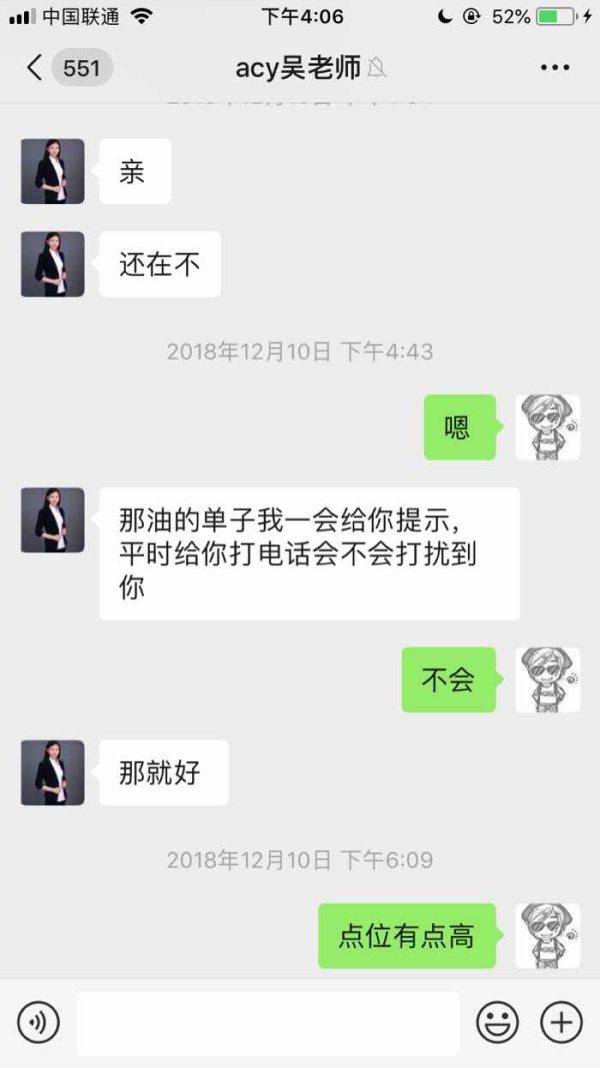

Customer service represents an area where ACY Securities shows mixed performance based on available feedback and information. While the broker emphasizes client-focused service as one of their core pillars, user experiences appear to vary significantly, with some feedback indicating challenges in customer support interactions. The availability of 630 reviews on Trustpilot suggests active user engagement, though the specific nature of customer service experiences wasn't detailed in available materials.

Response times and service quality metrics weren't specifically provided, making it difficult to assess the efficiency and effectiveness of customer support operations. The broker's fintech approach and technology focus suggest that digital support channels are likely available, potentially including live chat, email support, and comprehensive FAQ resources. However, the lack of detailed information about support availability hours, response time commitments, and escalation procedures impacts the overall service assessment.

Multi-language support capabilities weren't specified, though ACY Securities' global market presence suggests that international client support is likely available in multiple languages. The broker's Australian base and ASIC regulation provide a foundation for professional service standards, though specific service level commitments weren't detailed in available materials.

User feedback indicates some concerns about customer service experiences, though specific examples and resolutions weren't extensively documented. The moderate score reflects a service level that meets basic requirements but may benefit from enhanced transparency about service standards and improved consistency in customer support experiences. Problem resolution effectiveness and customer satisfaction metrics would provide better insight into actual service quality performance.

Trading Experience Analysis (Score: 7/10)

ACY Securities delivers a solid trading experience built on their emphasis of fast execution and competitive trading conditions. The broker's technology-focused approach appears to translate into reliable platform performance and efficient order processing, which are critical components of positive trading experiences. User feedback suggests that execution speed is generally satisfactory, contributing to the overall trading environment quality.

Platform stability appears adequate based on the broker's emphasis on technological innovation and their offering of industry-standard MetaTrader platforms alongside their proprietary LogixTrader solution. The variety of platform options allows traders to select environments that best match their trading styles, experience levels, and specific requirements. MetaTrader platforms provide comprehensive functionality including advanced charting, technical analysis tools, and automated trading capabilities.

Order execution quality, while not extensively detailed with specific metrics about slippage or requotes, appears to benefit from the broker's focus on fast execution and competitive conditions. The emphasis on transparency suggests that execution practices are designed to be fair and efficient, though specific execution statistics weren't provided in available materials.

Mobile trading experience details weren't specifically covered, though the availability of MetaTrader platforms suggests that mobile trading capabilities are accessible through standard MT4 and MT5 mobile applications. The trading environment benefits from the broker's competitive approach to spreads and execution, though specific performance metrics would strengthen the assessment.

The score reflects a trading experience that meets industry standards with particular strengths in execution speed and platform variety, while acknowledging that more detailed performance data would support a higher rating. This acy securities review finds the trading experience to be generally positive with room for enhanced transparency about execution statistics.

Trust and Regulation Analysis (Score: 6/10)

ACY Securities operates under ASIC regulation, which provides a solid foundation for regulatory compliance and client protection. As a multiple ASIC regulated Australian entity, the broker adheres to established financial services standards and regulatory requirements that govern client fund handling, operational procedures, and business conduct. ASIC regulation is generally regarded as robust and provides important protections for retail traders.

The broker's emphasis on transparency as a core operational pillar contributes positively to trustworthiness, though specific details about financial reporting, audit procedures, and corporate governance weren't extensively detailed in available materials. While the company has been operating since 2011, providing operational longevity, specific information about company financial stability or third-party ratings wasn't provided.

Fund safety measures and client money segregation practices weren't specifically detailed, though ASIC regulatory requirements typically mandate appropriate client fund protection procedures. The broker's commitment to transparency suggests adherence to regulatory standards, though more specific information about fund protection and insurance arrangements would strengthen trust assessment.

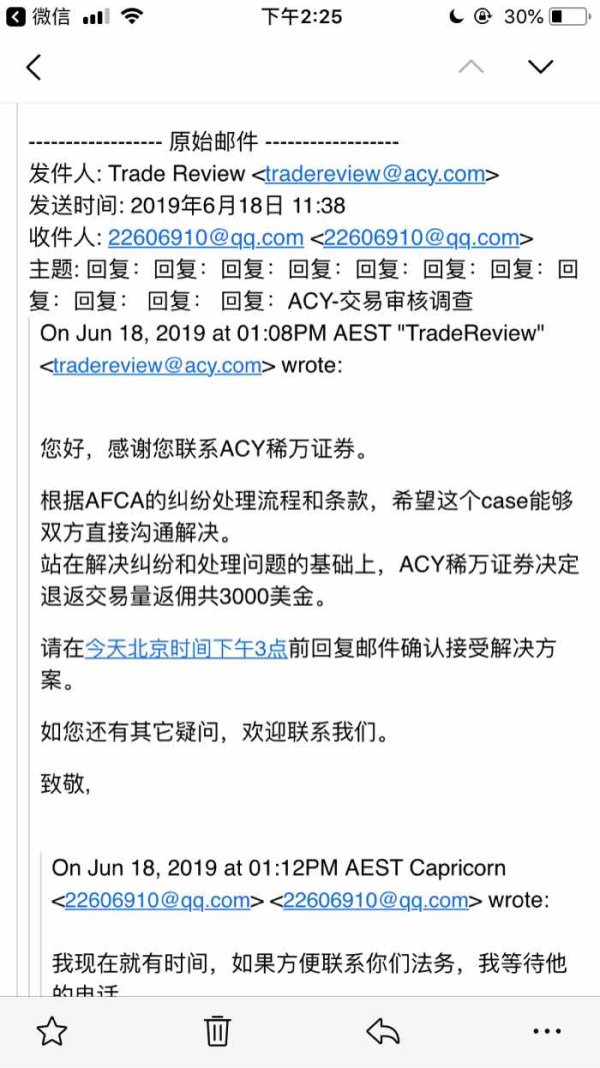

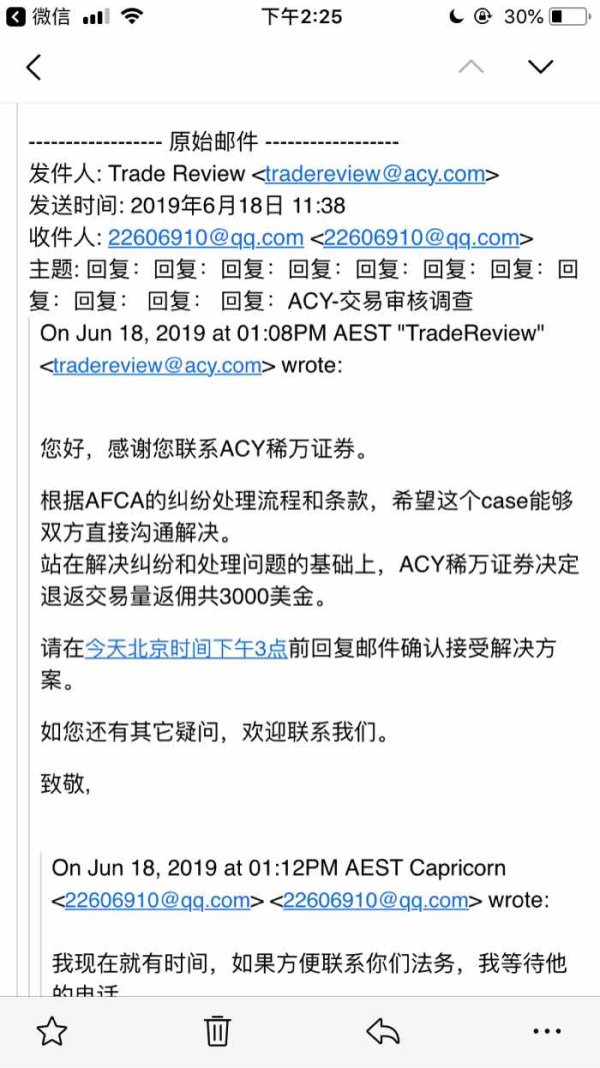

Industry reputation appears generally positive, with recognition within the global forex community mentioned, though specific awards, certifications, or third-party endorsements weren't detailed. User complaints about certain practices have been noted, including concerns about profit handling, which impacts the overall trust assessment despite regulatory oversight.

The moderate score reflects solid regulatory foundation with ASIC oversight, balanced against limited detailed information about specific trust and safety measures and some user concerns about business practices. Enhanced transparency about fund protection and corporate governance would support improved trust ratings.

User Experience Analysis (Score: 6/10)

User experience with ACY Securities presents a mixed picture based on available feedback and platform offerings. The presence of 630 reviews on Trustpilot indicates active user engagement and suggests a substantial client base, though specific satisfaction ratings and detailed feedback analysis weren't provided in available materials. The variety of user experiences appears to range from positive to concerning based on available information.

Interface design and platform usability benefit from the broker's technology focus and the availability of well-established MetaTrader platforms, which offer familiar and comprehensive trading environments. The addition of LogixTrader provides alternative interface options that may better suit different user preferences and trading styles. However, specific details about platform customization, user interface innovations, or unique usability features weren't extensively covered.

Registration and account verification processes weren't specifically detailed, though the broker's fintech approach and emphasis on efficiency suggest streamlined onboarding procedures. The technology focus likely translates into digital verification processes and automated account management capabilities where regulatory requirements permit.

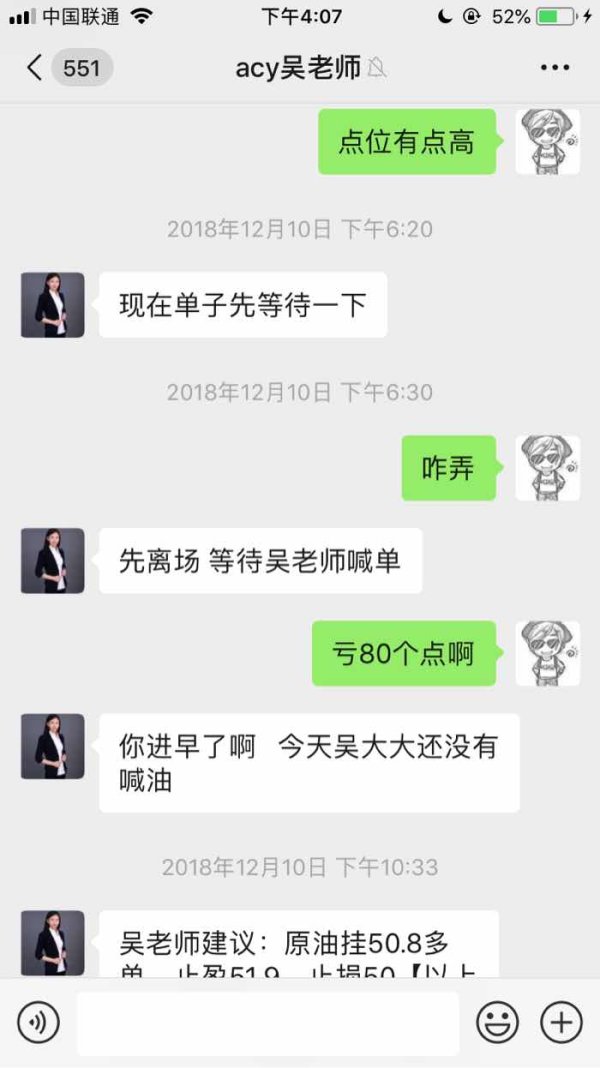

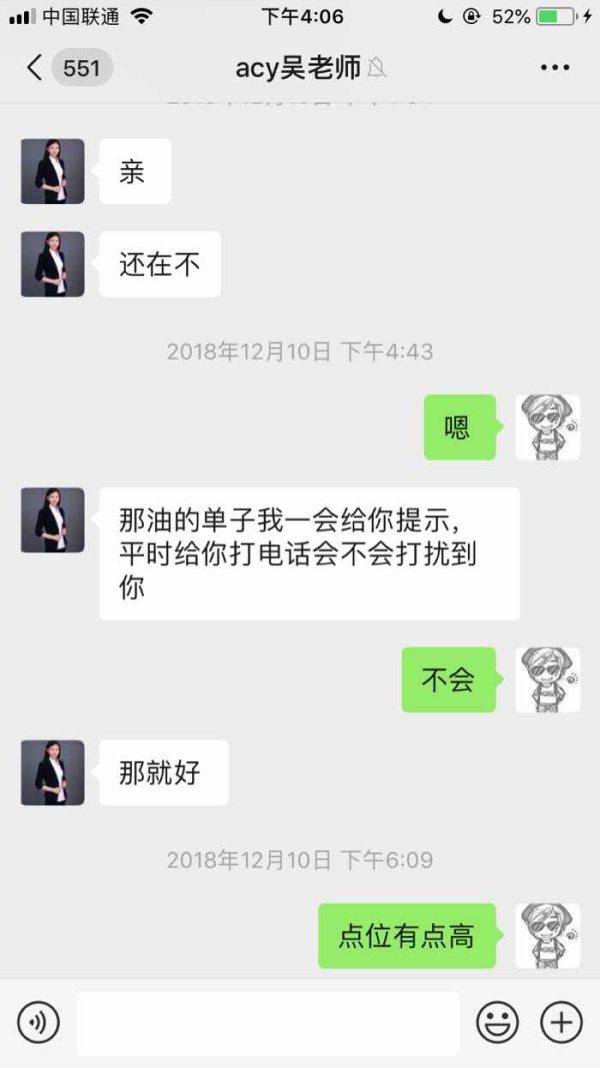

User feedback indicates some significant concerns, including complaints about customer service interactions and issues with profit handling that have generated negative reviews. These concerns impact the overall user experience assessment, despite the broker's emphasis on client-focused service and technological innovation.

Common user complaints appear to center around customer support responsiveness and certain business practices, though specific resolution rates and improvement measures weren't detailed. The moderate score reflects a user experience that meets basic functionality requirements through solid platform offerings, while acknowledging significant concerns raised by some users that impact overall satisfaction levels.

Conclusion

ACY Securities emerges from this comprehensive analysis as a regulated multi-asset trading provider that offers substantial market access and technological capabilities, while facing some challenges in customer service and transparency areas. The broker's strength lies in its extensive offering of over 2,200 trading instruments across six major asset categories, making it particularly suitable for traders seeking diversified investment opportunities and comprehensive market exposure.

The broker is best suited for traders who prioritize instrument variety, platform choice, and regulatory oversight in their trading decisions. Active traders who require access to multiple asset classes, including forex, stocks, indices, cryptocurrencies, precious metals, and commodities, will find ACY Securities' comprehensive offerings particularly valuable. The availability of both MetaTrader platforms and proprietary solutions accommodates various trading styles and experience levels.

Key advantages include the exceptional range of trading instruments, ASIC regulatory oversight, emphasis on fast execution speeds, and technology-focused approach to financial services. The broker's commitment to transparency and client-focused service, combined with their fintech innovation approach, provides a solid foundation for trading operations.

Primary drawbacks center around mixed user feedback regarding customer service quality, limited detailed information about specific trading conditions and fees, and some user concerns about business practices that have generated negative reviews. The lack of comprehensive transparency about account conditions, cost structures, and specific service commitments also impacts the overall assessment.

This acy securities review concludes that while ACY Securities offers substantial trading opportunities and regulatory protection, prospective clients should carefully evaluate their specific needs against the broker's offerings and consider the mixed user feedback when making their decision.