Regarding the legitimacy of Exclusive Capital forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Exclusive Capital safe?

Risk Control

Software Index

Is Exclusive Capital markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Exclusive Change Capital Ltd

Effective Date:

2017-08-08Email Address of Licensed Institution:

--Sharing Status:

Website of Licensed Institution:

www.exclusivecapital.com, https://www.excaprime.comExpiration Time:

--Address of Licensed Institution:

Theodorou Potamianou 56, 4th floor, Kato Polemidia, 4155, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 255 155Licensed Institution Certified Documents:

Is Exclusive Capital A Scam?

Introduction

Exclusive Capital is a forex and CFD broker based in Cyprus, which has been operating since 2017. Positioned as an investment firm, it offers a range of trading services, including access to various asset classes like forex, commodities, indices, and cryptocurrencies. In a highly competitive and sometimes opaque market like forex trading, it is crucial for traders to carefully evaluate brokers before committing their funds. This evaluation is not only about the potential for profit but also about the inherent risks associated with trading, including the safety of funds, regulatory compliance, and the overall reputation of the broker.

In this article, we will investigate the legitimacy of Exclusive Capital, assessing its regulatory status, company background, trading conditions, client fund safety measures, customer experiences, and overall risk profile. Our analysis is based on a comprehensive review of available online resources, user feedback, and expert opinions, aiming to provide a balanced view of whether Exclusive Capital is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory framework under which a broker operates is paramount in determining its legitimacy and reliability. Exclusive Capital is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is considered a reputable regulatory authority within the European Union. The importance of regulation cannot be overstated, as it provides a layer of protection for traders and ensures that the broker adheres to strict operational standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 330/17 | Cyprus | Verified |

CySEC regulation means that Exclusive Capital is required to follow the Markets in Financial Instruments Directive (MiFID II), which mandates transparency and investor protection measures. Additionally, the broker is a member of the Investor Compensation Fund (ICF), which offers further protection to clients by compensating them up to €20,000 in case of broker insolvency. However, it is noteworthy that while CySEC offers a level of oversight, it does not provide the same level of protection as some top-tier regulators like the UK's Financial Conduct Authority (FCA) or Australia's Australian Securities and Investments Commission (ASIC).

Despite being regulated, some traders have reported issues with the broker, particularly regarding withdrawal processes and transparency in trading conditions. These concerns highlight the necessity for potential clients to conduct thorough due diligence before engaging with Exclusive Capital.

Company Background Investigation

Exclusive Capital is operated by Exclusive Change Capital Ltd., a company registered in Cyprus. Since its inception in 2017, it has aimed to cater primarily to European clients, offering trading services in a variety of financial instruments. The company's ownership structure is not fully transparent, with limited publicly available information regarding its shareholders or management team. This lack of transparency may raise red flags for potential clients who prioritize knowing the individuals behind the brokerage.

The management team of Exclusive Capital is reported to have experience in the financial services industry; however, specific details about their backgrounds are not readily available. A strong management team with a proven track record can significantly enhance a broker's credibility, and the absence of such information may lead to skepticism among potential traders.

In terms of information disclosure, Exclusive Capital's website provides basic details about its services, but it lacks comprehensive educational resources or transparency regarding trading conditions, fees, and account types. This opacity can be concerning for traders seeking a clear understanding of the broker's offerings and could contribute to a perception of mistrust.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is crucial. Exclusive Capital offers a variety of trading instruments, but the specifics of the trading costs can be somewhat unclear. Traders have reported high spreads and hidden fees, which can significantly impact profitability.

| Cost Type | Exclusive Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 - 2.5 pips | 1.0 - 1.5 pips |

| Commission Structure | $6 per side (for certain accounts) | $3 - $5 per side |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Exclusive Capital are generally higher than the industry average, particularly for major currency pairs. Additionally, the commission structure appears to be less competitive compared to other brokers. Traders have also noted a lack of clarity regarding overnight interest rates, which can lead to unexpected costs when holding positions overnight.

Another concerning aspect is the absence of detailed information regarding the minimum deposit requirements and account types, which can vary significantly between brokers. Traders often rely on this information to make informed decisions, and a lack of clarity can deter potential clients.

Client Fund Safety

The safety of client funds is a critical concern for any trader. Exclusive Capital claims to implement various measures to protect client funds, including segregated accounts and adherence to regulatory requirements. Segregated accounts ensure that client deposits are kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency.

Moreover, the broker participates in the ICF, which provides additional security for clients' investments. However, there have been reports from users regarding difficulties in withdrawing funds, particularly with larger amounts. Such issues can be indicative of potential problems with fund management and may raise concerns about the broker's financial stability.

Historically, there have been no major scandals or fraud allegations against Exclusive Capital, but the recurring complaints about withdrawal delays and lack of transparency in fee structures are noteworthy. These factors can impact the overall perception of safety and reliability associated with the broker.

Customer Experience and Complaints

Customer feedback is an essential component of assessing a broker's reliability. Reviews of Exclusive Capital reveal a mixed bag of experiences. While some users report satisfactory trading conditions and prompt customer service, others highlight significant issues, particularly regarding fund withdrawals and transparency.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| High Spreads | Medium | Standard response |

| Lack of Transparency | Medium | General information provided |

Common complaints include withdrawal delays, with some users reporting that their requests took weeks to process. In several cases, clients expressed frustration over the lack of communication from the broker during these delays. Additionally, traders have noted that the spreads offered by Exclusive Capital are often higher than initially advertised, leading to dissatisfaction.

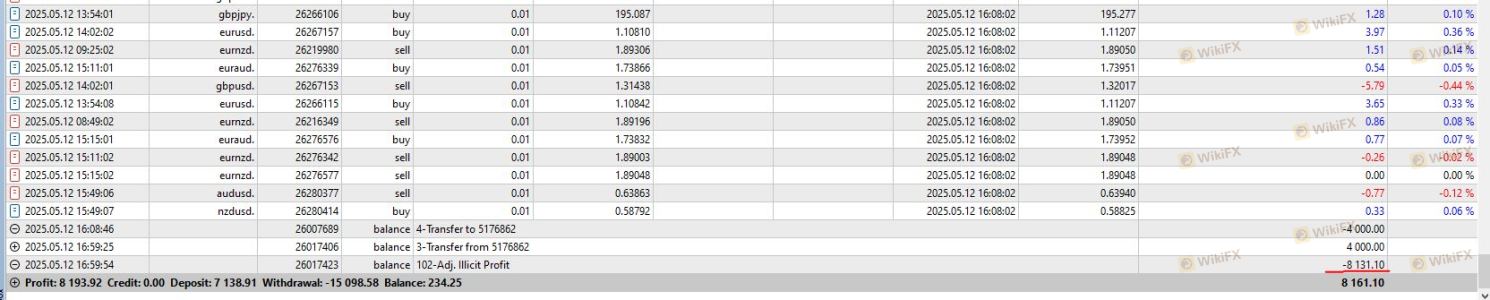

A typical case involves a user who successfully generated profits but faced difficulties when attempting to withdraw those funds. The broker cited technical issues, leading to a prolonged waiting period for the withdrawal. Such scenarios can create distrust and anxiety among traders, impacting their overall trading experience.

Platform and Trade Execution

The trading platform offered by Exclusive Capital is MetaTrader 5 (MT5), a widely used platform known for its advanced features and user-friendly interface. The platform provides various tools for analysis and trading, making it a popular choice among traders. However, the performance of the platform, including execution speed and slippage, is crucial for a positive trading experience.

Users have reported mixed experiences with order execution on the platform. While some traders appreciate the stability and functionality of MT5, others have encountered issues with slippage during volatile market conditions. High slippage can significantly affect trade outcomes, particularly for scalpers and day traders who rely on precise execution.

There have also been anecdotal reports of rejected orders during crucial trading periods, which can be detrimental to traders looking to capitalize on market movements. These factors warrant careful consideration, as they can influence a trader's overall success and satisfaction with the broker.

Risk Assessment

Engaging with any broker carries inherent risks, and Exclusive Capital is no exception. The combination of regulatory oversight, customer feedback, and trading conditions contributes to an overall risk profile that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulated by CySEC, but lacks top-tier licenses |

| Fund Safety | Medium | Segregated accounts and ICF membership provide some protection, but withdrawal issues exist |

| Trading Costs | High | Higher spreads and unclear fee structures can erode profits |

| Customer Support | Medium | Mixed reviews on responsiveness and effectiveness |

To mitigate risks associated with trading with Exclusive Capital, potential clients should conduct thorough research and consider starting with a smaller investment. Additionally, utilizing demo accounts can help traders familiarize themselves with the platform and trading conditions before committing significant capital.

Conclusion and Recommendations

In conclusion, while Exclusive Capital is regulated by CySEC and offers a range of trading services, there are several concerns that potential clients should be aware of. The broker's higher-than-average spreads, unclear fee structures, and reports of withdrawal delays may indicate a lack of transparency and reliability.

For traders seeking a broker, it is essential to weigh these factors carefully. If you are risk-averse or new to trading, you may want to consider alternative brokers with a stronger reputation and clearer trading conditions. Brokers regulated by top-tier authorities like the FCA or ASIC may offer more robust protections and a better overall trading experience.

In summary, while Exclusive Capital is not outright a scam, it is crucial for traders to exercise caution and conduct thorough research before engaging with this broker.

Is Exclusive Capital a scam, or is it legit?

The latest exposure and evaluation content of Exclusive Capital brokers.

Exclusive Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Exclusive Capital latest industry rating score is 6.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.