Regarding the legitimacy of DECODE forex brokers, it provides ASIC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is DECODE safe?

Pros

Cons

Is DECODE markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

DECODE CAPITAL PTY LTD

Effective Date: Change Record

2004-03-01Email Address of Licensed Institution:

info@decodecapital.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.decodecapital.com.auExpiration Time:

--Address of Licensed Institution:

'01B TOWER ONE' SE 25 L 25 100 BARANGAROO AVE BARANGAROO NSW 2000Phone Number of Licensed Institution:

0283192338Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

DECODE GLOBAL LIMITED

Effective Date:

2023-04-25Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Decode Global A Scam?

Introduction

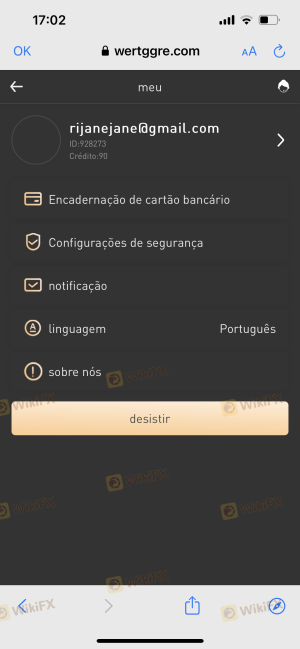

Decode Global, a forex and CFD broker, has emerged in the trading landscape, attracting attention for its offerings and competitive trading conditions. Established in 2023 and registered in Vanuatu, Decode Global positions itself as a viable option for traders seeking access to various financial markets. However, with the proliferation of online trading platforms, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and reliability of any broker before committing their funds. This article aims to provide a comprehensive analysis of Decode Global, assessing its regulatory standing, company background, trading conditions, and customer experiences. The evaluation is based on an extensive review of online sources, user feedback, and regulatory databases.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and reliability. Decode Global is regulated by the Vanuatu Financial Services Commission (VFSC), which is generally considered a tier-3 regulatory authority. While the VFSC provides a degree of oversight, its regulatory standards are often less stringent compared to tier-1 regulators like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 700415 | Vanuatu | Active |

The VFSCs oversight primarily involves the registration of brokers rather than rigorous enforcement of compliance standards, which raises concerns regarding investor protection. Additionally, Decode Global claims to be associated with ASIC, which mandates higher capital requirements and investor protections. However, it is essential to note that ASIC regulation applies only to its Australian entity, Decode Capital Pty Ltd, while the Vanuatu entity operates under much looser regulations. This dual structure may create confusion among traders regarding the level of protection afforded to their investments.

Company Background Investigation

Decode Global Limited, the entity behind Decode Global, was established in 2023, which raises questions about its operational history and experience in the financial sector. While the company claims to have a team of experts with backgrounds in major banks and investment firms, the lack of detailed information about its ownership structure and management team limits transparency. A well-established broker typically provides clear insights into its leadership and operational history, which helps build trust among potential clients.

The absence of detailed disclosures regarding the company's history and the experience of its management team may lead to skepticism about its reliability. Furthermore, the limited operational history since its establishment raises concerns about its ability to withstand market fluctuations and provide consistent service to clients. Transparency in business practices is crucial for establishing credibility, and Decode Global's lack of comprehensive information could be a red flag for potential investors.

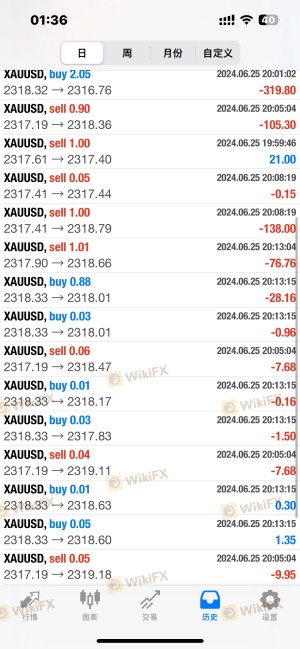

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and spreads, is essential. Decode Global offers two types of accounts: Standard and Pro. The Standard account has a minimum deposit of $100, while the Pro account requires a minimum deposit of $500. The leverage offered is up to 1:500, which is significantly higher than what is permitted by many tier-1 regulators, increasing potential risks for traders.

| Fee Type | Decode Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | 1.0 - 2.0 pips |

| Commission Structure | $7 per lot (Pro) | $5 - $10 per lot |

| Overnight Interest Range | Not specified | Varies by broker |

The spreads offered by Decode Global are competitive, starting from 1.5 pips for the Standard account and potentially lower for the Pro account. However, the commission structure, particularly the $7 per lot for the Pro account, may not be favorable compared to industry averages. Additionally, the lack of transparency regarding overnight interest rates and other potential fees could lead to unexpected costs for traders.

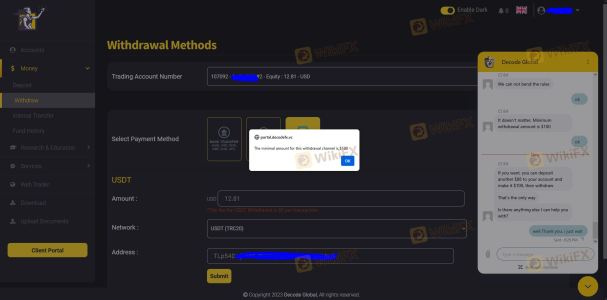

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Decode Global claims to implement several measures to protect client funds, such as segregating client accounts from operational funds. However, the absence of an investor compensation fund or negative balance protection is a significant drawback, particularly for traders utilizing high leverage.

The lack of robust investor protection mechanisms may expose traders to higher risks, especially in volatile market conditions. Furthermore, historical issues regarding fund security or disputes with clients are not well-documented, leaving potential investors without a clear understanding of the broker's track record in safeguarding client assets.

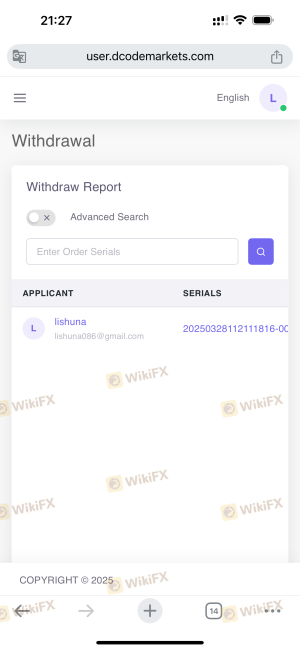

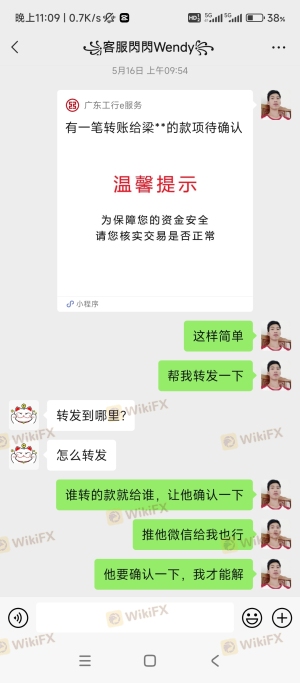

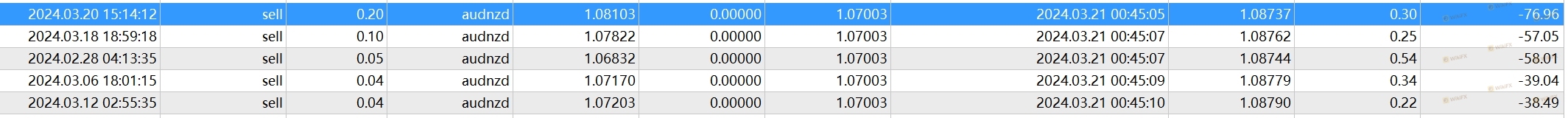

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of Decode Global reveal a mixed bag of experiences. Some users express satisfaction with the trading platform's performance and the ease of fund deposits, while others report issues with withdrawals and customer support responsiveness.

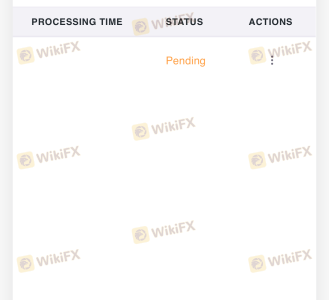

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Platform Reliability | Medium | Mixed feedback |

| Customer Support | High | Often unresponsive |

Common complaints include difficulties in withdrawing funds and slow response times from customer support. For instance, one user reported a significant delay in processing their withdrawal request, raising concerns about the broker's operational efficiency. These issues can severely impact a trader's experience and trust in the platform.

Platform and Execution

The trading platform provided by Decode Global is based on the popular MetaTrader 4 and MetaTrader 5, which are widely regarded for their functionality and user-friendly interfaces. However, the performance of these platforms in terms of stability, order execution quality, and slippage remains a crucial aspect of the trading experience.

Traders have reported varying experiences with order execution, with some indicating instances of slippage during high volatility periods. The absence of documented evidence suggesting platform manipulation is a positive aspect, but the mixed reviews regarding execution quality warrant caution.

Risk Assessment

Using Decode Global comes with inherent risks, particularly given its regulatory status and customer feedback. The high leverage offered can amplify both potential gains and losses, making it essential for traders to approach with caution.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under a tier-3 regulator with limited oversight. |

| Fund Safety Risk | High | No investor protection fund or negative balance protection. |

| Execution Risk | Medium | Mixed reviews regarding order execution quality. |

To mitigate risks, traders should consider using lower leverage, thoroughly understand the fee structure, and remain vigilant regarding their withdrawal requests. It is advisable to start with a demo account or minimal investment to gauge the broker's performance before committing significant funds.

Conclusion and Recommendations

In conclusion, while Decode Global presents itself as a competitive forex and CFD broker, several factors raise concerns about its legitimacy and reliability. The broker operates under a tier-3 regulatory authority, lacks robust investor protection measures, and has received mixed feedback from users regarding its services.

For traders considering Decode Global, it is essential to proceed with caution, particularly if they are risk-averse or new to trading. It may be prudent to explore alternative brokers with stronger regulatory oversight, better customer support, and a more transparent operational history. Brokers regulated by tier-1 authorities, such as FCA or ASIC, may offer more security and reliability for traders seeking to navigate the forex market effectively.

Is DECODE a scam, or is it legit?

The latest exposure and evaluation content of DECODE brokers.

DECODE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DECODE latest industry rating score is 7.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.