Is PTFX safe?

Business

License

Is PTFX Safe or a Scam?

Introduction

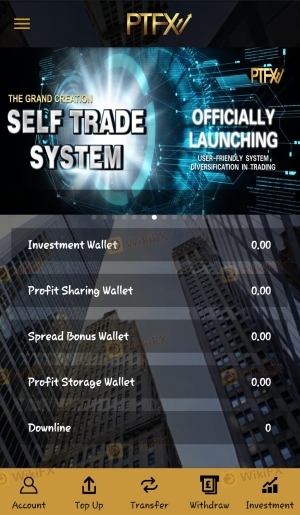

PTFX is a forex broker that emerged in the market around 2017, primarily targeting traders in China and Southeast Asia. It offers a range of trading instruments, including forex pairs, indices, commodities, and CFDs. However, the broker has garnered significant attention for its controversial practices and lack of regulatory oversight. As the forex market can be rife with scams and unregulated brokers, it is crucial for traders to conduct thorough evaluations before engaging with any trading platform. This article aims to investigate the legitimacy of PTFX by analyzing its regulatory status, company background, trading conditions, customer experiences, and risk factors. The assessment is based on multiple sources, including user reviews, regulatory disclosures, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is a vital aspect that determines its credibility. Unfortunately, PTFX is not regulated by any recognized financial authority, which raises serious concerns about its operational legitimacy. Below is a summary of the broker's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that PTFX does not adhere to the stringent compliance standards that licensed brokers must follow. This lack of oversight can expose traders to significant risks, including the potential for fraud and mismanagement of funds. Furthermore, reports indicate that PTFX has been associated with numerous complaints regarding withdrawal issues, further highlighting its questionable practices. Engaging with unregulated brokers like PTFX can lead to a loss of funds without any legal recourse, making it imperative for traders to be cautious.

Company Background Investigation

PTFX is part of the Pruton Group and operates under the name Pruton Capital. The company was established in China and has been in operation for several years. However, detailed information about its ownership structure and management team is scarce, which raises transparency concerns. The lack of publicly available information about the management teams qualifications and experience further complicates the evaluation of the broker's credibility.

Transparency is crucial in the financial industry, and brokers that fail to disclose essential information about their operations and leadership often raise red flags. The limited information available about PTFX and its parent company indicates a potential lack of accountability, which is a significant concern for prospective traders. Without a clear understanding of who is behind the broker, traders may be putting their funds at risk.

Trading Conditions Analysis

PTFX offers a variety of trading conditions, including leverage up to 1:200 and spreads ranging from 1.1 to 1.3 pips for major currency pairs. However, the overall fee structure is somewhat opaque, with limited information provided on commissions and overnight interest rates. Below is a comparison of the core trading costs associated with PTFX:

| Fee Type | PTFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.1 - 1.3 pips | 1.0 - 1.5 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of clarity regarding commissions and other costs can lead to unexpected expenses for traders, which is a common tactic employed by unregulated brokers to obscure their true costs. Additionally, the high minimum deposit requirement of $1,000 may deter novice traders from engaging with the platform. Traders should be wary of brokers that impose high fees and lack transparency in their pricing structures.

Customer Funds Safety

When it comes to trading, the safety of customer funds is paramount. Unfortunately, PTFX does not provide adequate information regarding its fund protection measures. There are no indications of segregated accounts, investor protection schemes, or negative balance protection policies. This lack of safeguards can leave traders vulnerable to significant financial losses.

Moreover, historical complaints indicate that PTFX has faced numerous issues concerning fund withdrawals, with many users reporting that they were unable to access their funds. Such incidents are alarming and suggest a pattern of behavior that could indicate that PTFX is not a safe broker. Traders should always prioritize brokers that offer robust safety measures and transparent information regarding fund management.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. PTFX has amassed a considerable number of complaints, particularly concerning withdrawal issues. Many users have reported being unable to withdraw their funds, with some claiming that their accounts were frozen without explanation. Below is a summary of the primary complaint types associated with PTFX:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | High | Poor |

| Transparency | High | Poor |

Typical cases involve users depositing significant amounts only to face barriers when attempting to withdraw their funds. For instance, one user reported being unable to withdraw their funds after months of attempts, leading to frustration and financial loss. This pattern of complaints raises serious concerns about the broker's operational integrity and customer service quality.

Platform and Trade Execution

The trading platform offered by PTFX is the widely used MetaTrader 4 (MT4). While MT4 is generally regarded as a reliable platform, user experiences with PTFX indicate issues with execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Moreover, there are allegations of potential platform manipulation, with some users suggesting that the broker may engage in practices that disadvantage traders. Such concerns are particularly prevalent among unregulated brokers, where oversight is minimal, and accountability is lacking. Traders should be vigilant about the quality of execution and the reliability of the trading platform they choose to use.

Risk Assessment

Using PTFX presents several risks that traders should be aware of. The following risk assessment summarizes the primary concerns:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, exposing traders to fraud. |

| Fund Safety | High | Lack of safeguards for customer funds. |

| Customer Support | High | Poor response to complaints and issues. |

| Execution Quality | Medium | Reports of slippage and potential manipulation. |

To mitigate these risks, it is advisable for traders to conduct comprehensive research and consider using regulated alternatives. Engaging with brokers that demonstrate high standards of regulatory compliance and customer service can significantly reduce the likelihood of encountering issues.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that PTFX is not a safe broker. The absence of regulation, numerous customer complaints, and poor transparency raise significant red flags. Engaging with PTFX could expose traders to substantial risks, including potential financial loss and lack of recourse in the event of disputes.

For traders seeking a reliable forex trading experience, it is advisable to consider regulated alternatives that prioritize customer safety and transparency. Brokers such as OctaFX, FXOpen, and Hantec Markets offer more secure trading environments and better customer support. Always ensure to conduct thorough research and prioritize safety when selecting a broker.

In summary, is PTFX safe? The overwhelming consensus indicates that it is not.

Is PTFX a scam, or is it legit?

The latest exposure and evaluation content of PTFX brokers.

PTFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PTFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.