ICM Brokers 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

ICM Brokers positions itself as a competitive trading platform, offering low-cost options and a diversified selection of financial instruments, making it an appealing choice for retail traders seeking cost-effective trading solutions. Operating since 2009, ICM Brokers is particularly attractive to experienced traders familiar with platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), especially those trading from regions outside the USA and North Korea who might be comfortable with offshore brokers.

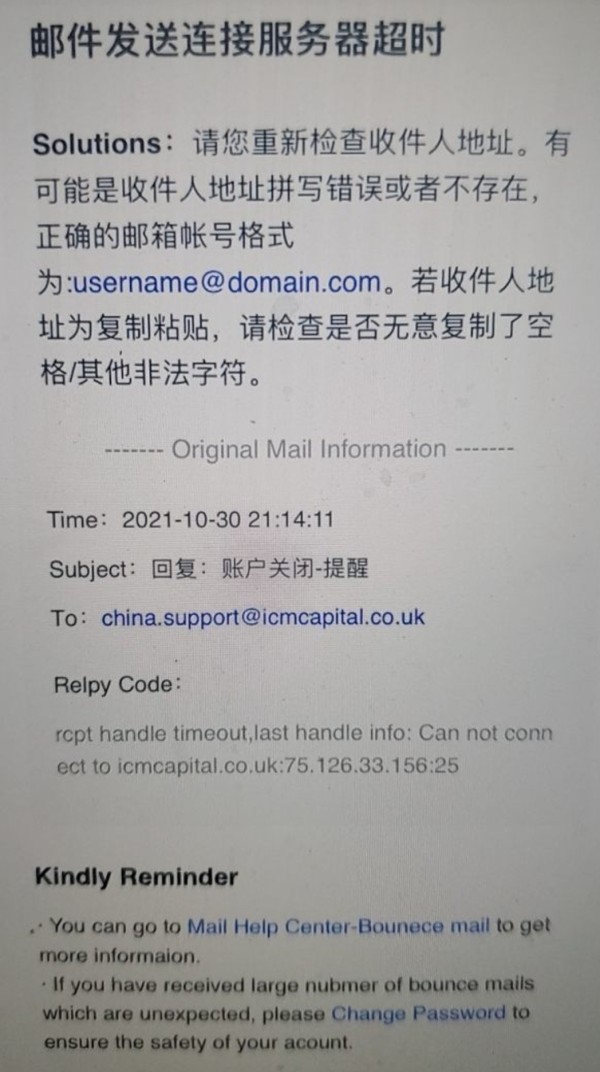

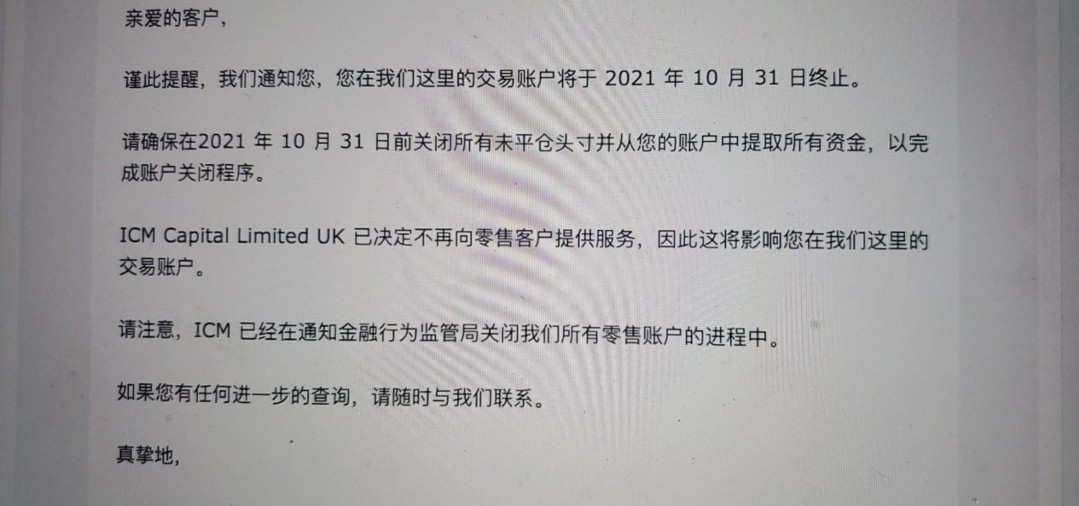

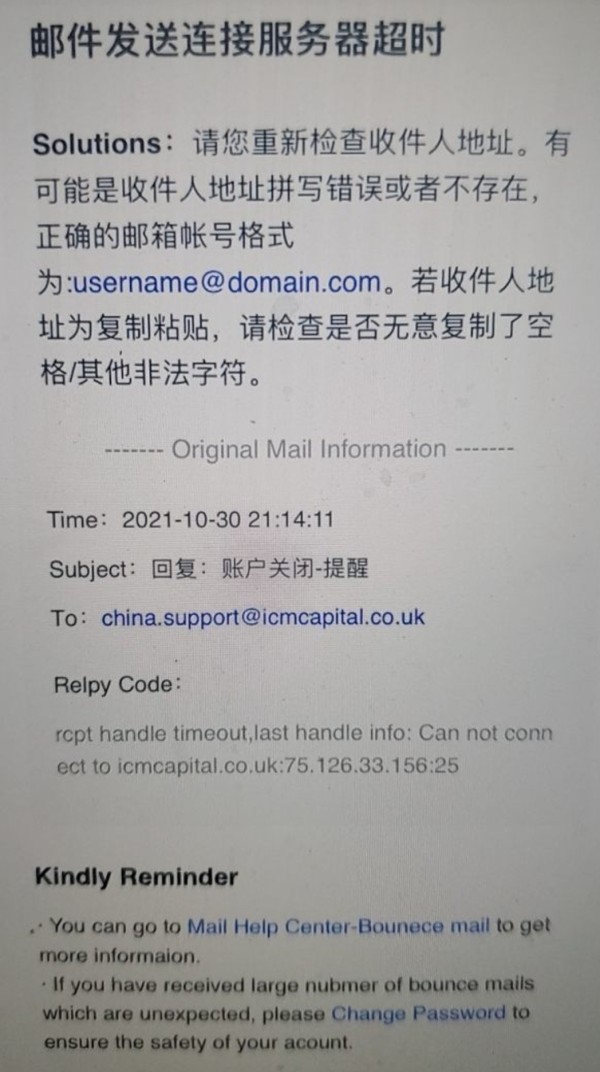

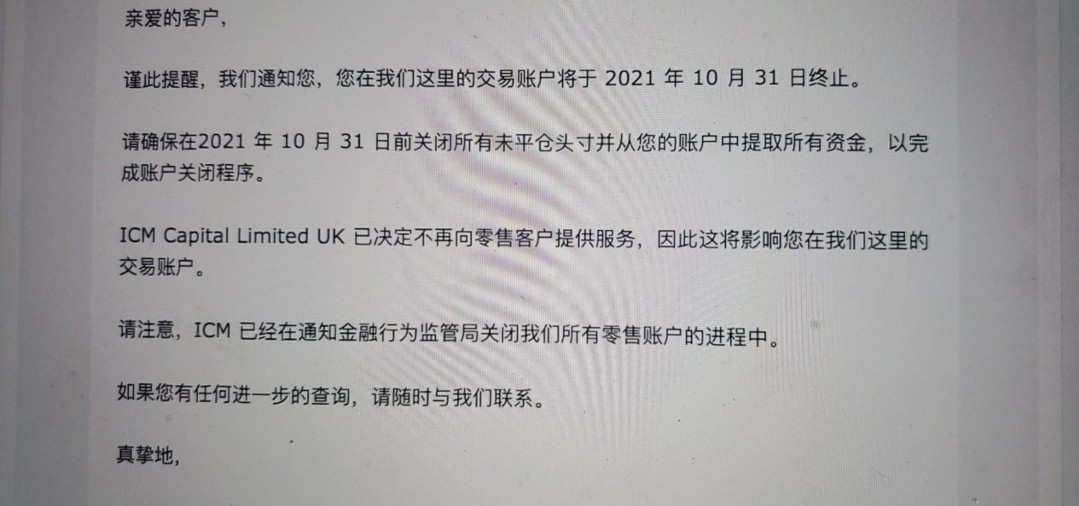

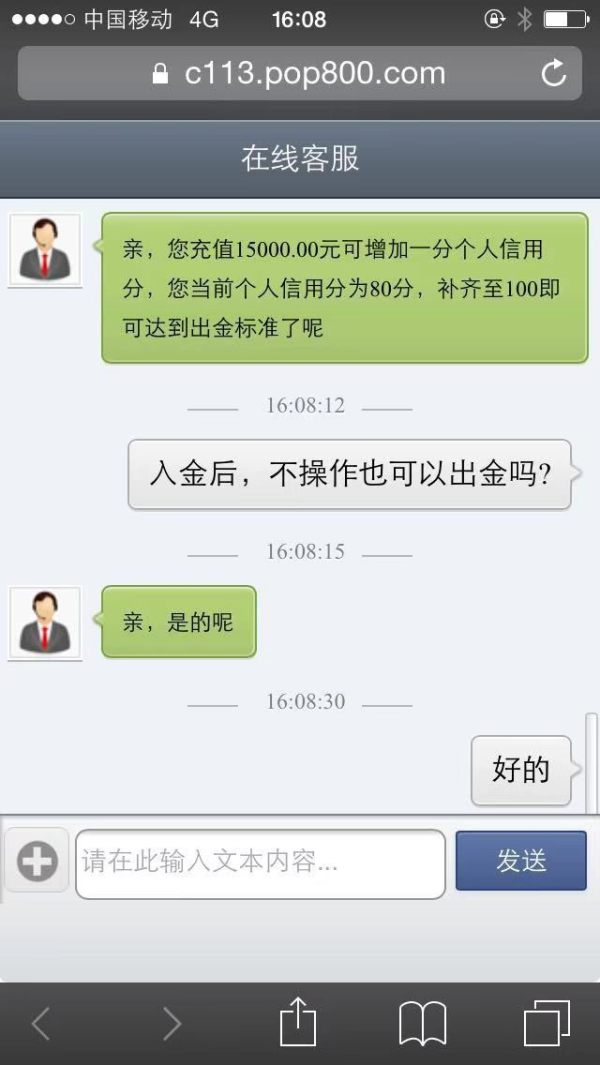

However, significant risks accompany these offerings. ICM's regulatory status raises concerns, primarily operating under tier-3 regulations, which provide minimal protection for traders. Additionally, users have reported numerous withdrawal issues, leading to questions about the reliability of fund access and overall safety of their investments. Traders prioritizing stringent regulatory oversight are advised to be cautious. Beginners, in particular, may find themselves unprepared for the risks associated with trading on an unregulated platform.

⚠️ Important Risk Advisory & Verification Steps

Risk Advisory:

- Regulatory Status: ICM Brokers operates under tier-3 regulation, which may not offer sufficient protection for your funds.

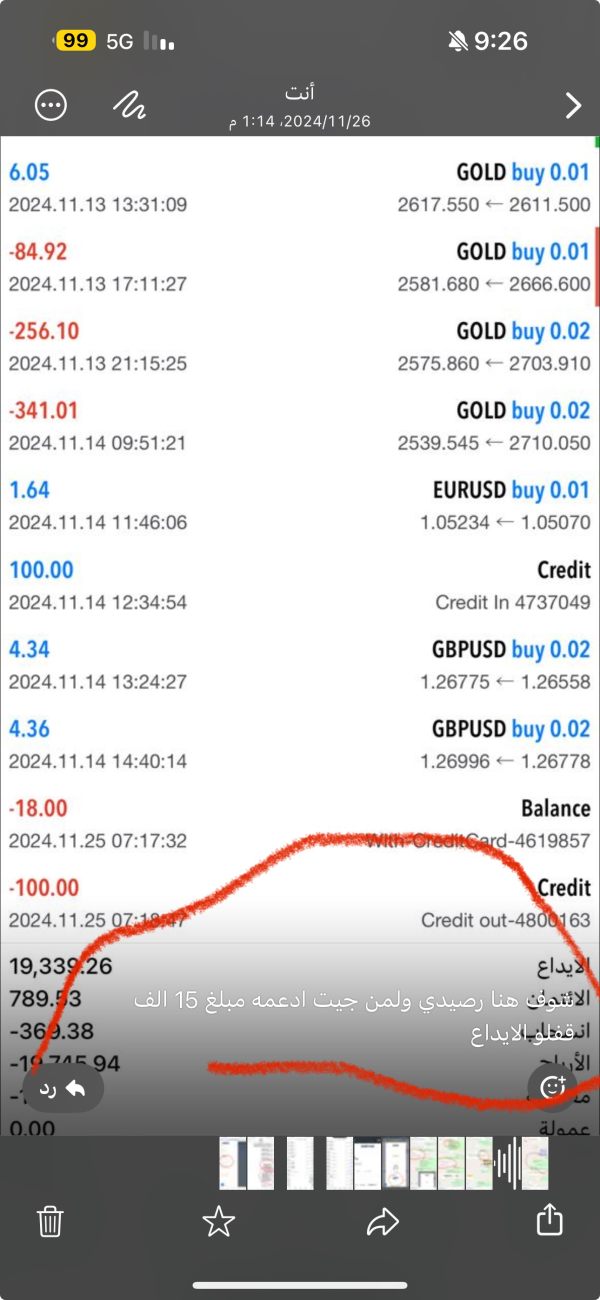

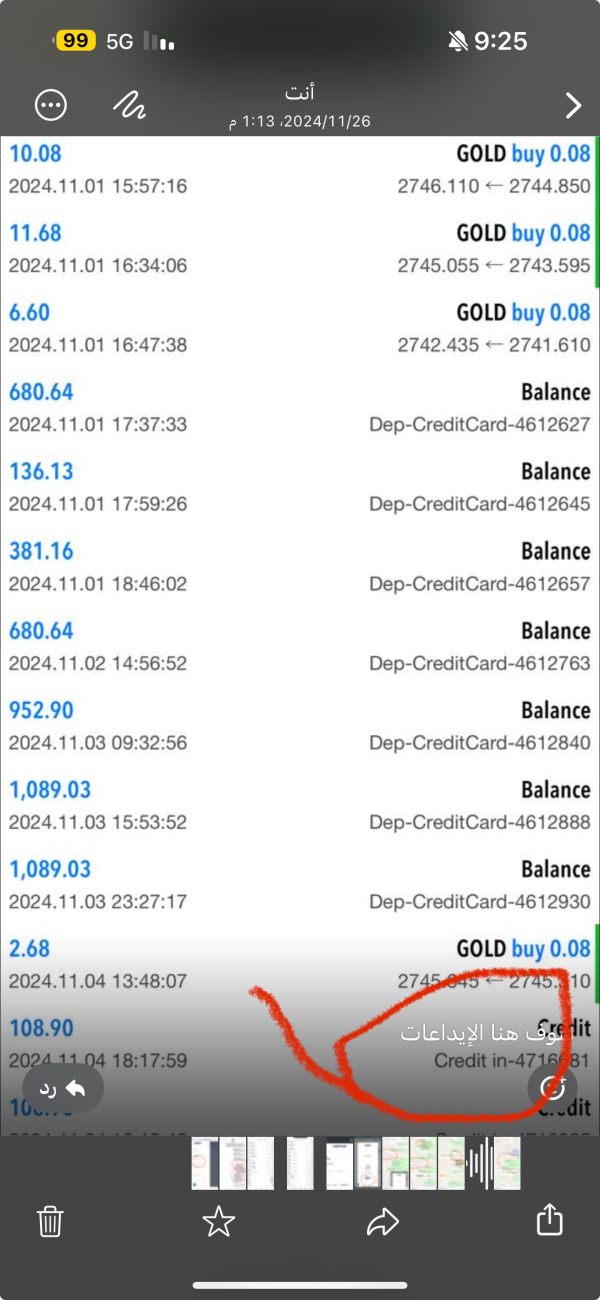

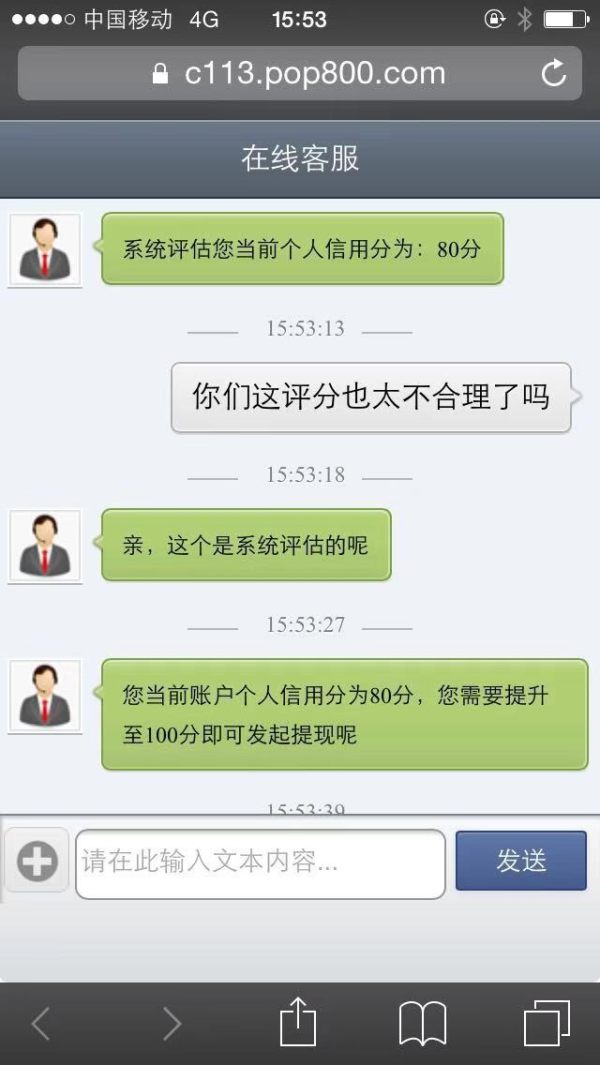

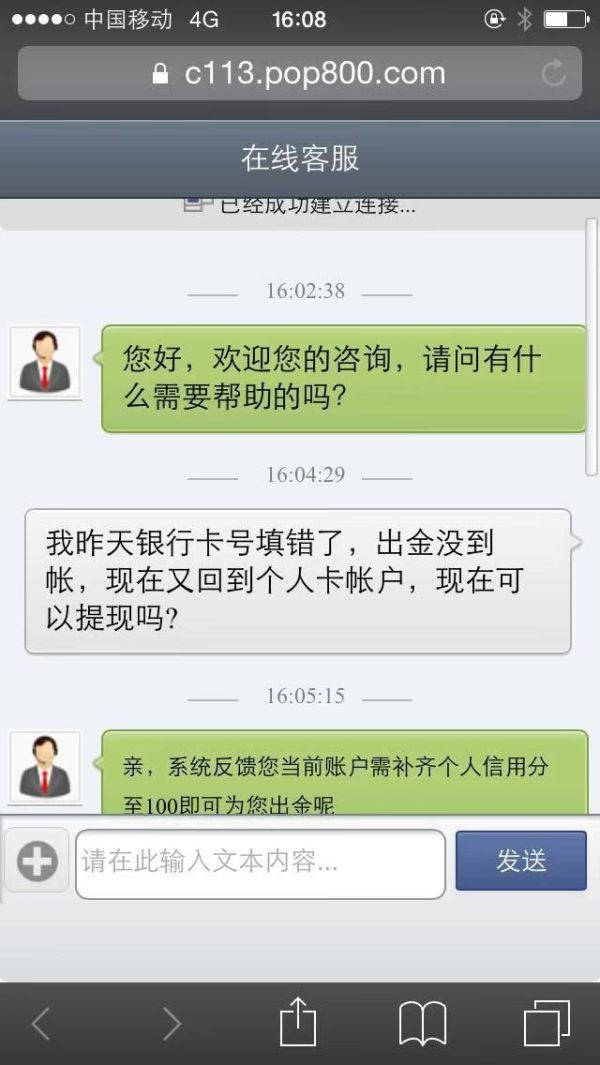

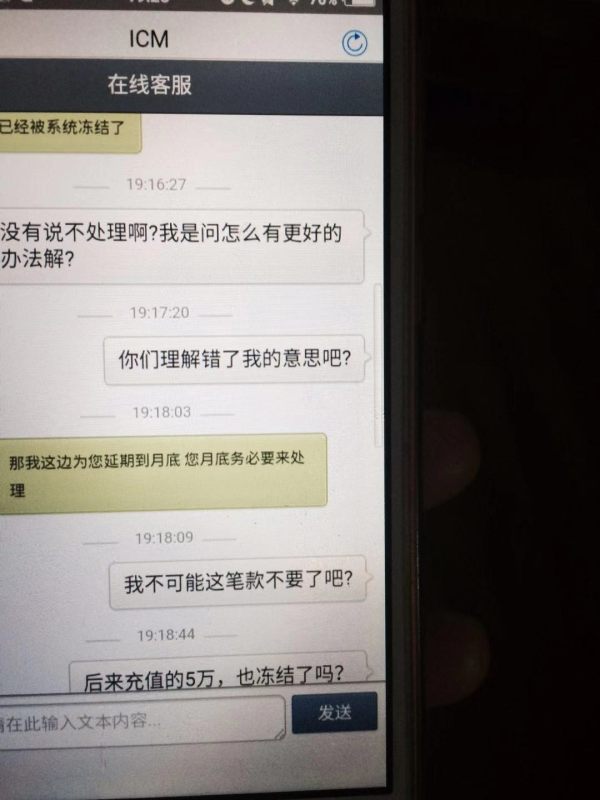

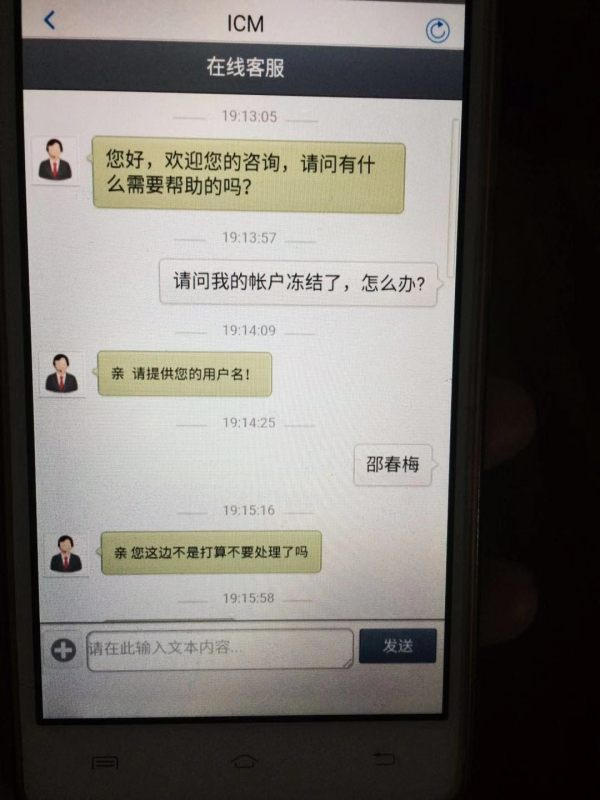

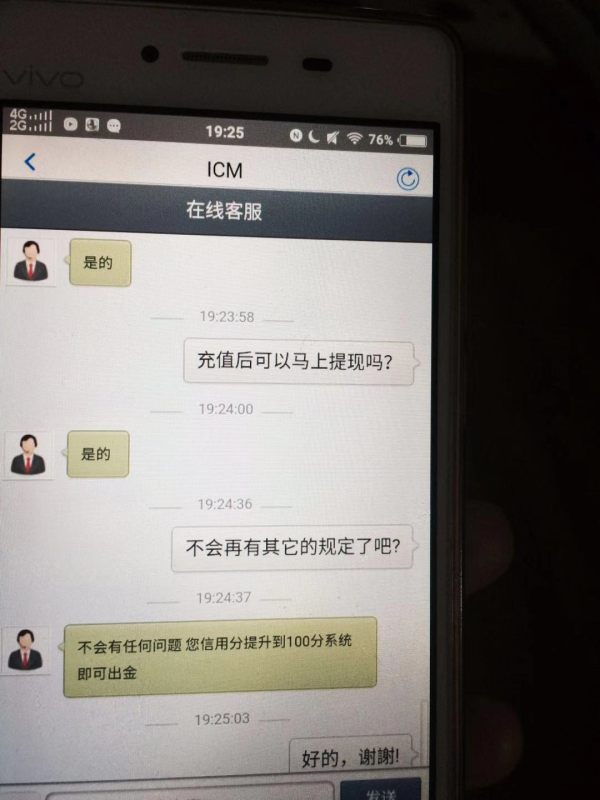

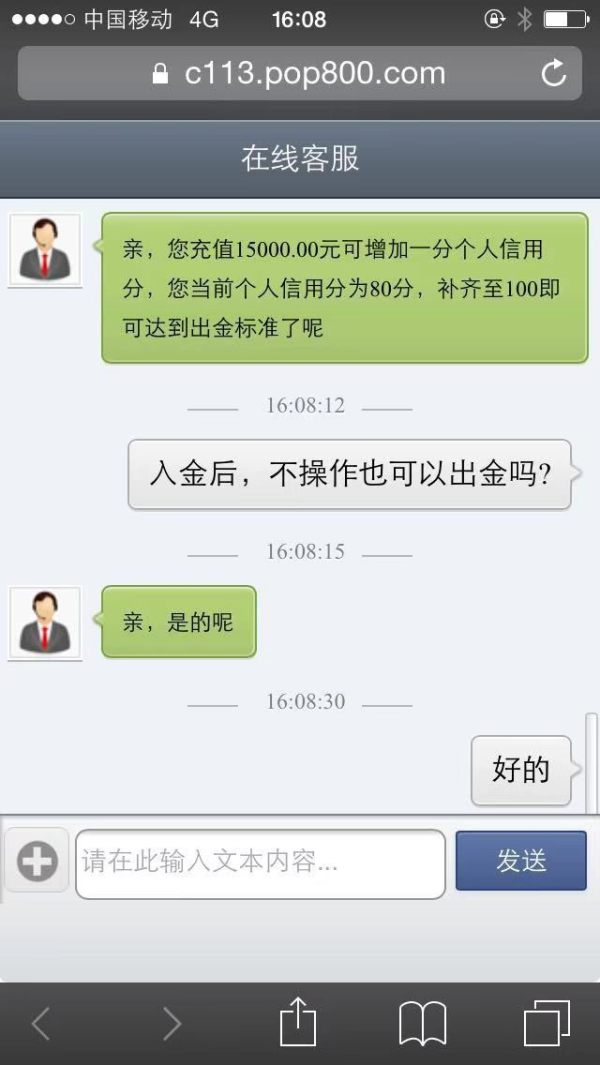

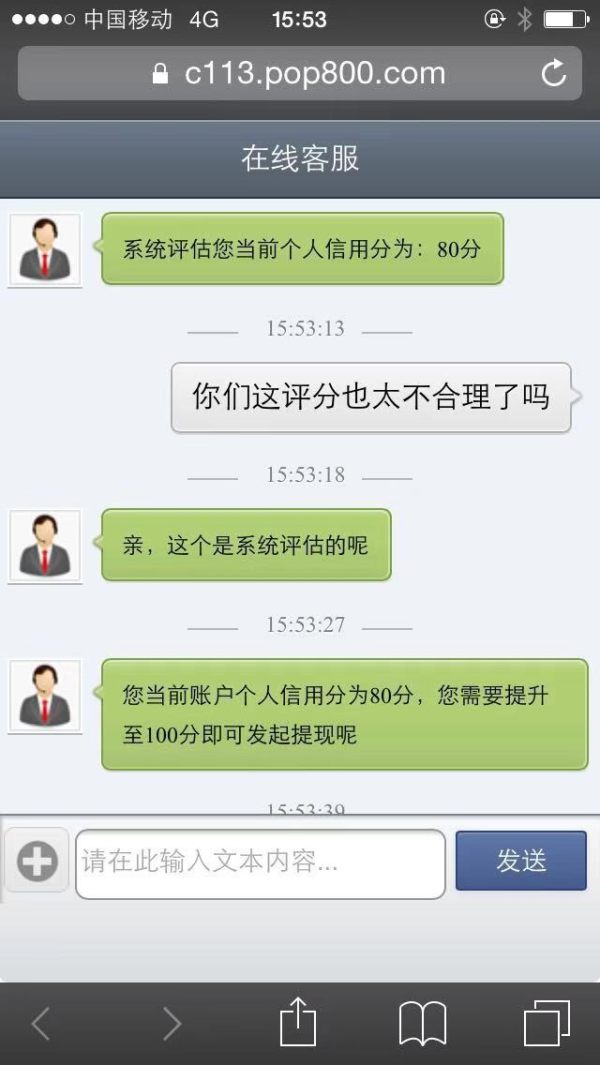

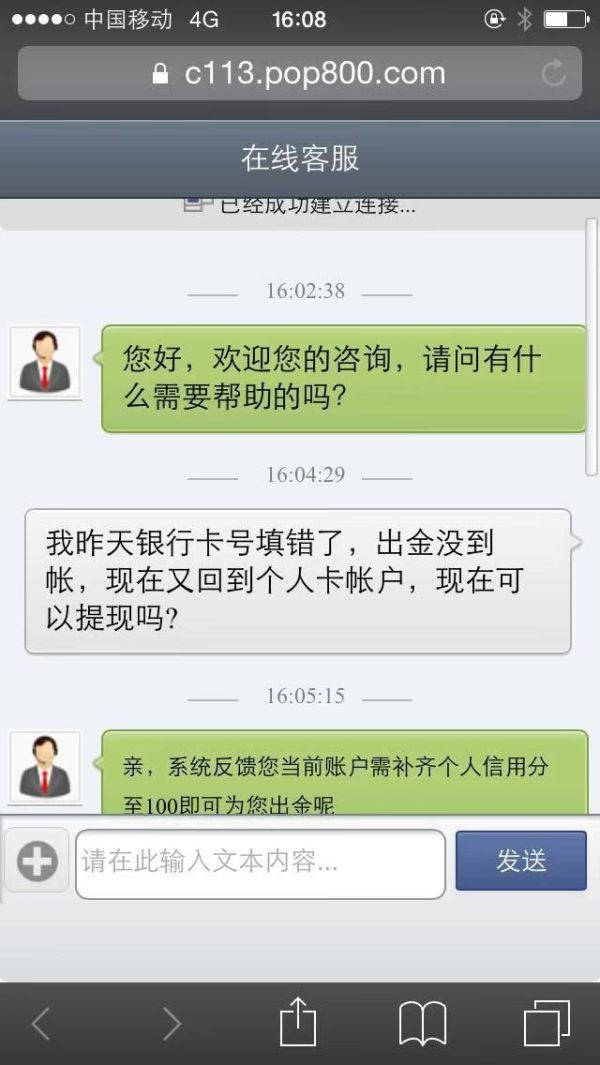

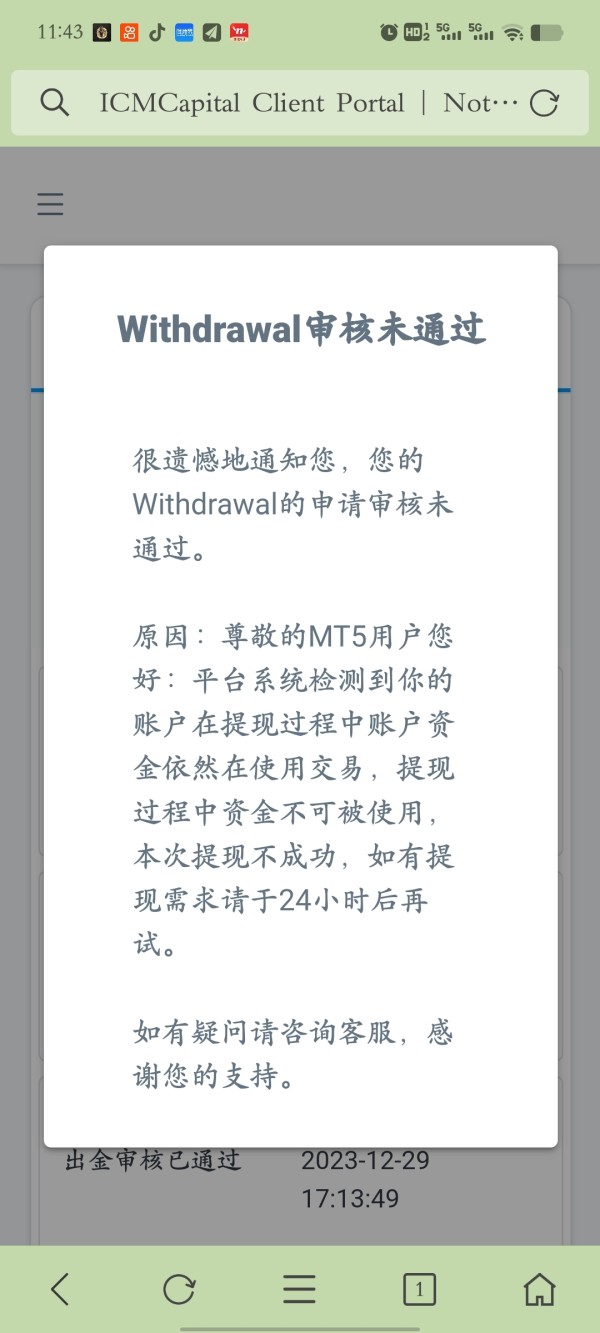

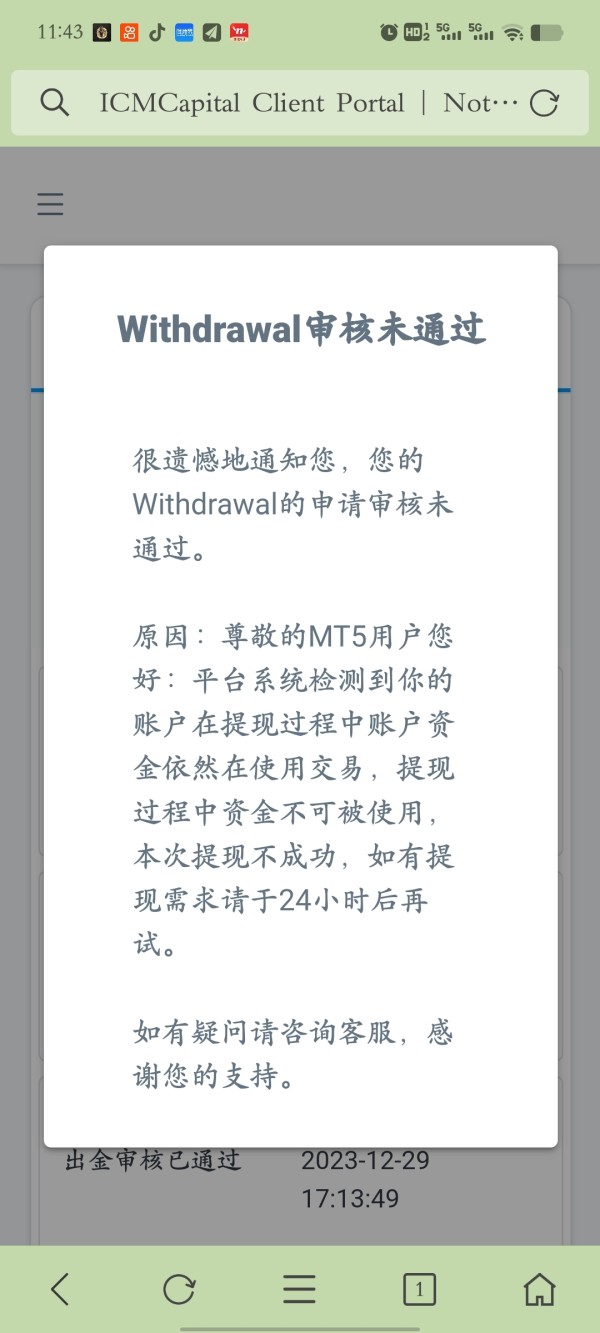

- Withdrawal Complaints: Be wary of widespread reports detailing difficulties in withdrawing funds.

- User Feedback: Examine user feedback thoroughly, as many traders have reported negative experiences.

Self-Verification Steps:

- Check Regulatory Details: Visit the official ICM website to verify their regulatory claims.

- Consult Regulatory Authorities: Use the official websites of regulatory bodies to confirm ICM's registration and licensing status.

- Read User Reviews: Check multiple trading forums and review websites for feedback from other traders regarding their experiences with ICM.

- Contact Customer Support: Reach out to ICMs customer support to clarify any doubts and gauge their responsiveness.

Rating Framework

Broker Overview

Company Background and Positioning

ICM Brokers, also known as ICM Capital Limited, was established in 2009 and is headquartered in London, UK. The broker claims to be regulated by various financial authorities, including the Financial Conduct Authority (FCA). However, user reports question the validity of these claims, as the broker is primarily under tier-3 regulation from Seychelles and St. Vincent and the Grenadines, known for lenient regulations.

Core Business Overview

ICM Brokers offers a diverse range of financial instruments for trading, including:

- Forex: Over 60 major, minor, and exotic currency pairs.

- Commodities: Precious metals such as gold and silver.

- Stocks: Trading options include shares from leading global exchanges like NYSE and NASDAQ.

- Futures and Options: Access to various market contracts.

- Cryptocurrencies: CFD trading for several popular digital currencies.

The trading platforms available for clients include MT4, MT5, and cTrader, allowing for both automated and manual trading strategies.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Analysis of Regulatory Information Conflicts

ICM Brokers markets itself as a regulated entity; however, its real regulatory standing is quite controversial. It operates predominantly under tier-3 regulations, questioned by many due to the lack of sufficient investor protection. Such frameworks often result in a higher risk of malpractice.

User Self-Verification Guide

To verify the legitimacy of ICM Brokers, follow these steps:

- Review the companys claims on its regulatory website.

- Use the registration number provided to check against official database listings.

- Search through independent third-party review platforms for trader insights.

- Contact customer support for more information regarding your concerns.

Industry Reputation and Summary

Feedback regarding ICMs reputation is mixed, with many users expressing skepticism about fund safety. A persistent theme in complaints revolves around difficulties involved in withdrawing money.

Trading Costs Analysis

Advantages in Commissions

ICM Brokers provides a cost-effective trading structure, with low commission costs and competitively narrow spreads. The average spread for EUR/USD starts from 1.2 pips for the ICM Direct account, which is favorable compared to other brokers.

The "Traps" of Non-Trading Fees

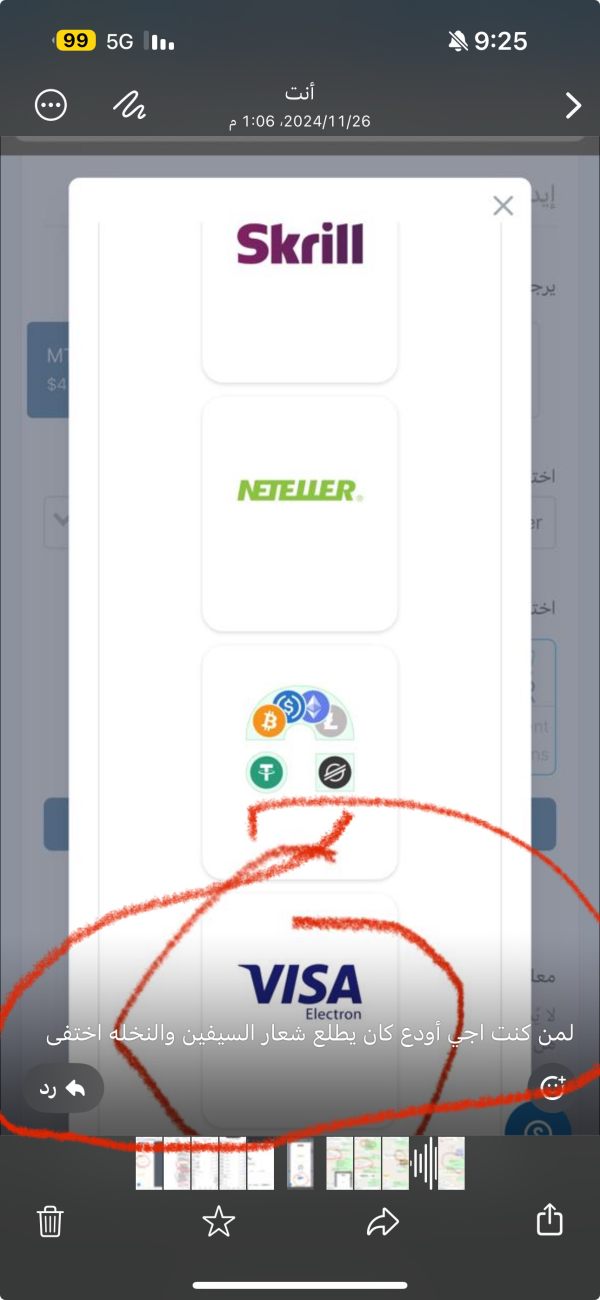

Despite competitive trading costs, several users have reported high unforeseen withdrawal fees. For instance, "I had to pay $30 just to withdraw my funds, which was unexpected!" Users also report hidden charges related to conversion fees and inactivity penalties, which can add up significantly.

Cost Structure Summary

For active traders seeking low commission structures, ICM may be advantageous. However, long-term traders should remain cautious and anticipate potential hidden costs that reflect negatively on the overall trading experience.

Platform Diversity

ICM Brokers offers multiple platforms, including MT4, MT5, and cTrader, catering to traders with diverse preferences. MT4 remains a favored choice due to its extensive functionalities, ideal for manual and automated trading strategies.

Quality of Tools and Resources

While the platforms feature advanced charting tools and automate trading capabilities, user feedback indicates insufficient educational resources. This deficiency may hinder beginners from fully utilizing the available tools effectively.

Platform Experience Summary

User feedback suggests that while the platforms are generally user-friendly, issues arise concerning execution speed during volatile market conditions.

User Experience Analysis

Onboarding Process

ICM Brokers provides a streamlined account opening process that is fully digital and simple for anyone familiar with online trading platforms.

Trading Experience

Traders often remark on the straightforward interface, however, users also highlight experiences of lag and slow execution, particularly during peak trading hours.

Overall User Satisfaction

Overall feedback fluctuates, painting a picture of a platform with potential but marred by execution issues and reported difficulties during critical trading times.

Customer Support Analysis

Availability and Channels

ICM Brokers offers customer support 24/5, allowing clients to get assistance via multiple channels including live chat and email. However, some users report that response times can vary.

Response Times and Effectiveness

Despite the availability of support, many traders have expressed dissatisfaction with the resolution process, citing issues where their queries remain unanswered, leading to delays.

Summary of Customer Support Quality

Although the support channels are varied, the effectiveness of service remains questionable, emphasizing a need for improvement to enhance user experience.

Account Conditions Analysis

Account Types and Features

ICM Brokers provides several account types, mainly ICM Direct and ICM Zero, catering to different trader preferences based on trading volume and strategy.

Minimum Deposits and Leverage

Both accounts boast an accessible minimum deposit requirement. However, traders should be mindful that higher leverage increases risks significantly, necessitating effective risk management strategies.

Summary of Account Conditions

The account options are attractive, but potential clients should evaluate the limitations and characteristics associated with the account types to align with their personal trading strategies.

Quality Control

Given the numerous discrepancies in regulatory status and withdrawal issues reported by users, it is paramount to highlight these conflicts and guide potential users toward verifying information through trusted sources.

- Clarity on specific regulatory bodies and their effectiveness.

- Detailed user testimonials or case studies regarding withdrawal experiences.

- A comprehensive list of all fees associated with trading on ICM Brokers.

In conclusion, while ICM Brokers offers low-cost trading and a variety of instruments that may appeal to retailers familiar with platforms like MT4 and MT5, the significant regulatory concerns, reports of withdrawal difficulties, and mixed user feedback suggest that potential users should approach with caution. The importance of thorough self-verification and awareness of the inherent risks cannot be overstated for those considering trading with this broker.