Regarding the legitimacy of ICM.com forex brokers, it provides ADGM, FSCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is ICM.com safe?

Pros

Cons

Is ICM.com markets regulated?

The regulatory license is the strongest proof.

ADGM Forex Execution License (STP)

Abu Dhabi Global Market

Abu Dhabi Global Market

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

ICM Limited

Effective Date:

2022-10-12Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

United Arab Emirates, Abu Dhabi, Reem Island, Office 10, 11 Floor, Sky Tower, Shams Abu DhabiPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ICM CAPITAL SA (PTY) LTD

Effective Date:

2023-09-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

UNIT 19 BUILDING 4150 RIVONIA ROAD OFFICE PARKSANDTON2196Phone Number of Licensed Institution:

071 2535577Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ICM Capital Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.icmcapital.scExpiration Time:

--Address of Licensed Institution:

Office No: 103, IMAD Complex, Ile Du Port, SeychellesPhone Number of Licensed Institution:

+248 4321544Licensed Institution Certified Documents:

Is ICM Safe or Scam?

Introduction

ICM, also known as ICM Capital, is a forex and CFD broker based in the United Kingdom, established in 2009. It positions itself as a multi-regulated broker, offering a wide range of trading instruments, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, the number of brokers has surged, making it crucial for traders to carefully assess their options. The importance of due diligence cannot be overstated, as unregulated or poorly regulated brokers can pose significant risks to traders' investments. This article investigates the credibility of ICM by evaluating its regulatory status, company history, trading conditions, client fund safety, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy and safety. ICM claims to be regulated by several reputable authorities, including the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles. Below is a summary of the key regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 520965 | United Kingdom | Verified |

| FSA | SD201 | Seychelles | Verified |

| FSCA | 53234 | South Africa | Verified |

The presence of multiple regulatory bodies overseeing ICM's operations is a positive sign, as it indicates a level of oversight that can help protect traders. However, the quality of regulation varies significantly between jurisdictions. The FCA is known for its stringent requirements, while the Seychelles FSA is often criticized for its lax regulatory standards. Therefore, while ICM's claim of being regulated may offer some reassurance, it is essential to consider the implications of operating under less stringent regulations.

Company Background Investigation

ICM was founded in London and has expanded its operations globally, with offices in various regions, including the Middle East and Asia. The company operates under the ownership of ICM Capital Limited, which is structured to provide a range of financial services. The management team at ICM consists of experienced professionals with backgrounds in finance and trading. This expertise is crucial for ensuring that the broker adheres to industry standards and provides reliable services.

Transparency is another vital aspect of a brokerage's credibility. ICM has made efforts to maintain a degree of transparency regarding its operations, providing information about its regulatory status and trading conditions on its website. However, the level of detail regarding its financial practices and potential conflicts of interest remains somewhat limited. Transparency in financial disclosures is essential for building trust with clients, and a lack of comprehensive information can raise concerns about the broker's integrity.

Trading Conditions Analysis

Understanding the trading conditions offered by ICM is essential for assessing its overall value to traders. ICM provides competitive spreads, a variety of account types, and access to popular trading platforms like MetaTrader 4 and MetaTrader 5. However, it's crucial to analyze the fee structure in detail to identify any potential red flags.

| Fee Type | ICM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 1.2 pips | 1.0 - 1.5 pips |

| Commission Model | $7 per round lot (ICM Zero) | $0 - $5 |

| Overnight Interest Range | Varies by instrument | Varies by broker |

While the spreads offered by ICM are competitive, the commission structure for certain accounts may be considered high compared to industry standards. Additionally, the presence of overnight interest fees can impact profitability, especially for traders who hold positions for extended periods. Traders should carefully evaluate these costs in the context of their trading strategies to determine if ICM's conditions align with their expectations.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's reliability. ICM emphasizes the importance of fund security by implementing several measures, including segregated accounts and negative balance protection. These measures are designed to ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security in the event of insolvency.

However, the effectiveness of these measures can vary depending on the regulatory environment in which the broker operates. For instance, while the FCA mandates strict rules regarding fund segregation, the same may not be true for the Seychelles FSA. As such, potential clients should be cautious and consider the implications of trading with a broker that operates in multiple jurisdictions with varying regulatory standards.

Customer Experience and Complaints

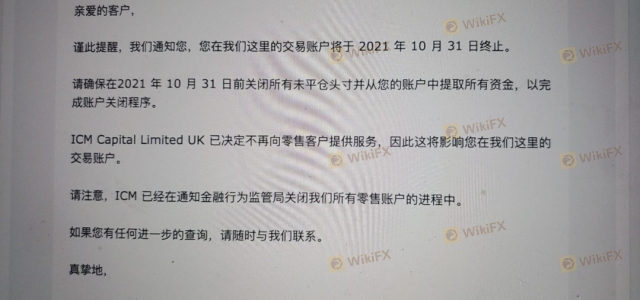

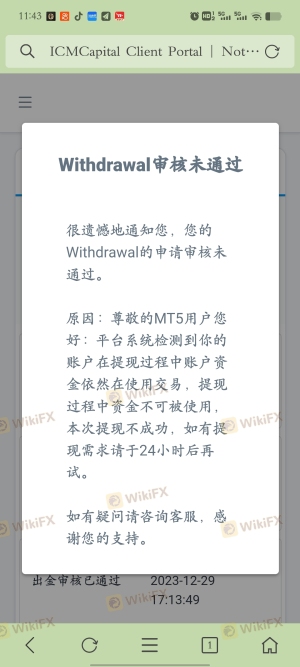

Customer feedback is a valuable source of information when assessing a broker's reliability. ICM has received mixed reviews from users, with some praising its trading platform and customer service, while others have reported issues with fund withdrawals and platform stability. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Platform Stability | Medium | Acknowledged but unresolved |

| Customer Service Availability | Medium | Generally responsive |

Two notable case studies highlight these concerns. One trader reported significant delays in withdrawing funds, which led to frustration and a loss of trust in the broker. Another user experienced frequent platform outages during high volatility periods, raising questions about ICM's ability to provide a stable trading environment. These issues underscore the importance of assessing customer experiences alongside regulatory credentials.

Platform and Trade Execution

The performance of the trading platform is critical for a seamless trading experience. ICM offers several platforms, including MetaTrader 4 and MetaTrader 5, which are known for their reliability and user-friendly interfaces. However, the quality of order execution can vary, with reports of slippage and rejections during volatile market conditions.

Traders should be aware that while ICM provides access to a robust trading platform, issues such as high slippage and execution delays can undermine the trading experience. These factors can significantly impact trading outcomes, especially for those employing high-frequency trading strategies.

Risk Assessment

Using ICM comes with inherent risks that traders must consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Operates under multiple regulations, some less stringent. |

| Fund Safety Risk | Medium | Segregated accounts but varying regulatory standards may affect safety. |

| Execution Risk | High | Reports of slippage and execution delays during volatility. |

| Customer Service Risk | Medium | Mixed reviews regarding responsiveness and issue resolution. |

To mitigate these risks, traders should conduct thorough research, maintain realistic expectations, and consider using risk management strategies such as stop-loss orders and position sizing.

Conclusion and Recommendations

In conclusion, the question "Is ICM safe or a scam?" invites careful consideration. While ICM is regulated by multiple authorities, including the FCA, the varying quality of regulation across jurisdictions raises concerns. The broker offers competitive trading conditions and a user-friendly platform, but issues related to fund withdrawals and platform stability cannot be overlooked.

For traders considering ICM, it is essential to weigh the potential benefits against the risks. Those new to trading or with limited capital may want to explore alternative brokers with stronger regulatory oversight and better customer service records. Reliable options include brokers like eToro or IG, which are known for their robust regulatory frameworks and positive customer feedback.

Ultimately, while ICM may not be a scam, traders should exercise caution and conduct thorough due diligence before committing their funds. Understanding the broker's strengths and weaknesses will empower traders to make informed decisions and navigate the forex market more effectively.

Is ICM.com a scam, or is it legit?

The latest exposure and evaluation content of ICM.com brokers.

ICM.com Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ICM.com latest industry rating score is 4.20, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.20 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.