Regarding the legitimacy of UBFX forex brokers, it provides FSPR, VFSC and WikiBit, (also has a graphic survey regarding security).

Is UBFX safe?

Pros

Cons

Is UBFX markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

GREAT MOTIVATION INTERNATIONAL COMPANY LIMITED

Effective Date:

2016-11-19Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2020-07-10Address of Licensed Institution:

Suite 128, Level 1, Quad 7 Building 6 Leonard Isitt Drive Auckland 2022Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

FINANCE MANAGERS CO. LIMITED

Effective Date:

2021-09-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Ubfx Safe or Scam?

Introduction

Ubfx, an online forex broker established in 2016, has gained attention in the forex trading community for its promise of low minimum deposits and high leverage. Operating under the name Finance Managers Co., Limited, and headquartered in Vanuatu, Ubfx positions itself as a gateway for traders seeking access to a variety of financial instruments, including forex, CFDs, and commodities. However, the question remains: Is Ubfx safe or a scam?

As the forex market continues to expand, traders must exercise caution when selecting a broker. The potential for fraud and mismanagement is significant, especially with offshore brokers like Ubfx that operate under less stringent regulatory frameworks. This article aims to provide a comprehensive analysis of Ubfx's safety and legitimacy by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining a broker's legitimacy and safety. Ubfx claims to be regulated by the Vanuatu Financial Services Commission (VFSC), which is known for having relatively lenient requirements compared to major regulatory bodies like the UKs Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 14745 | Vanuatu | Active |

While the VFSC has made strides in tightening regulations, it still lacks the capacity and authority to oversee international brokers effectively. This raises concerns about the quality of oversight and protection for traders. Furthermore, the absence of a compensation scheme means that traders may not have recourse in the event of a broker's insolvency.

In summary, while Ubfx is technically regulated, the quality of that regulation raises serious questions about the safety of trading with them. The lack of robust oversight and the potential for regulatory arbitrage make it imperative for traders to be cautious.

Company Background Investigation

Ubfx was founded in 2016 and operates under the ownership of Finance Managers Co., Limited. The broker's headquarters in Vanuatu places it in a jurisdiction known for being a tax haven, which often attracts brokers seeking to avoid stringent regulatory requirements.

The management team behind Ubfx has not been prominently featured in available resources, raising questions about their experience and credibility within the financial services industry. A lack of transparency regarding the management team can be a red flag, as it makes it difficult for potential clients to assess the competence and integrity of those running the company.

Moreover, the companys information disclosure appears limited, which is not unusual for offshore brokers. This lack of transparency can lead to mistrust among potential clients, who may feel uncertain about the broker's operations and financial stability.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are paramount. Ubfx presents an attractive proposition with a minimum deposit requirement of just $1 and leverage of up to 1:400. However, such high leverage often comes with increased risk, making it essential for traders to approach with caution.

The overall fee structure at Ubfx includes variable spreads and commissions, which can vary widely depending on the account type.

| Fee Type | Ubfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.2 pips |

| Commission Model | $5 per lot (for raw spread account) | $3 per lot |

| Overnight Interest Range | Varies | Varies |

While the low entry barrier may seem appealing, the potential for hidden fees and high trading costs can quickly erode profitability. Additionally, the lack of a demo account directly available for testing trading conditions further complicates the decision-making process for potential clients.

Customer Funds Security

The security of customer funds is a critical aspect of evaluating any brokerage. Ubfx claims to offer segregated accounts, which theoretically protects client funds by keeping them separate from the broker's operational funds. However, the effectiveness of this measure is questionable given the regulatory environment in Vanuatu.

There is no clear information available regarding investor protection policies or negative balance protection, which are essential for safeguarding traders' capital in volatile market conditions. The absence of robust security measures raises concerns about the safety of funds held with Ubfx, especially given the historical issues surrounding offshore brokers.

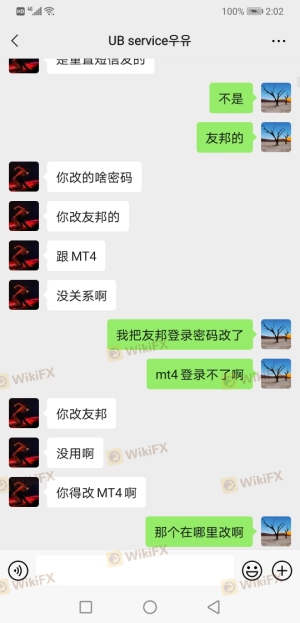

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Ubfx reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and poor customer service responses.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or no response |

| Customer Support | Medium | Unhelpful responses |

| Account Blocking | High | No clear communication |

Many clients have expressed frustration over the withdrawal process, indicating that requests are often delayed or ignored. This pattern of complaints is concerning and suggests that potential traders should be wary when considering Ubfx as their broker.

Platform and Trade Execution

Ubfx offers the widely-used MetaTrader 4 platform, which is known for its user-friendly interface and extensive analytical tools. However, the performance of the platform, including order execution speed and slippage, has been called into question by some users. Reports of high slippage and occasional rejections of orders have surfaced, which can significantly impact trading outcomes.

The potential for platform manipulation is another issue that traders should be aware of. If a broker has the ability to influence order execution, it can lead to unfair trading conditions, especially for retail traders who may not have the same level of information or resources.

Risk Assessment

Using Ubfx for trading carries several risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Limited oversight from a weak regulatory body. |

| Financial Risk | High | Potential for loss due to high leverage and hidden fees. |

| Operational Risk | Medium | Possible issues with platform stability and order execution. |

To mitigate these risks, traders are advised to conduct thorough research before committing funds and to consider using risk management strategies such as setting stop-loss orders and limiting leverage.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ubfx is not a safe trading option. The combination of weak regulatory oversight, a lack of transparency, and numerous customer complaints raises significant red flags. While some traders may be attracted by the low minimum deposit and high leverage, the potential risks far outweigh the benefits.

For traders seeking a more secure trading environment, it is advisable to consider alternatives that are regulated by reputable authorities such as the FCA or ASIC. Brokers with a solid regulatory framework typically offer better protection for client funds and a more transparent trading experience.

Ultimately, thorough due diligence is essential when selecting a broker, and potential clients should approach Ubfx with caution, as the risks associated with trading through this platform may lead to significant financial losses.

Is UBFX a scam, or is it legit?

The latest exposure and evaluation content of UBFX brokers.

UBFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UBFX latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.