Regarding the legitimacy of TS CAPITAL forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is TS CAPITAL safe?

Pros

Cons

Is TS CAPITAL markets regulated?

The regulatory license is the strongest proof.

FCA Derivatives Trading License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

TS CAPITAL LIMITED

Effective Date:

2006-05-16Email Address of Licensed Institution:

adrian.hickman@tscapital.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

http://www.tscapital.co.uk/Expiration Time:

2024-06-11Address of Licensed Institution:

63 St. Mary Axe 1st Floor London EC3A 8AAE C 3 A 8 A A UNITED KINGDOM, 130 Fenchurch Street, London EC3M 5DJPhone Number of Licensed Institution:

44 2074489800Licensed Institution Certified Documents:

Is TS Capital Safe or a Scam?

Introduction

TS Capital is an investment firm based in the United Kingdom, primarily involved in stockbroking and investment consulting. Established in 2017, the company aims to provide a range of financial services to its clients, including investment advice and execution across various markets. However, as with any financial service provider, it is crucial for traders to carefully evaluate the legitimacy and reliability of TS Capital before engaging in any trading activities. This is particularly important given the prevalence of scams and fraudulent brokers in the forex market, which can lead to significant financial losses for unsuspecting investors.

In this article, we will conduct a thorough investigation into TS Capital's regulatory status, company background, trading conditions, customer fund security, and user experiences. Our assessment will be based on data collected from various reputable sources, including regulatory bodies and customer reviews, to provide a comprehensive overview of whether TS Capital is indeed safe or a potential scam.

Regulation and Legitimacy

Understanding the regulatory environment in which a broker operates is essential for assessing its legitimacy. TS Capital claims to be regulated by the Financial Conduct Authority (FCA) in the UK. However, it is crucial to note that their license has been revoked, raising significant concerns about their operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 447281 | United Kingdom | Revoked |

The revocation of TS Capital's FCA license indicates that it is no longer permitted to conduct regulated activities, which is a red flag for potential investors. The FCA is known for its stringent regulatory standards, and losing its license suggests serious compliance issues. While the absence of any recent negative disclosures during our evaluation might seem reassuring, the historical context of the revoked license necessitates a cautious approach. This situation raises questions about the broker's ability to operate within legal frameworks and protect client interests effectively.

Company Background Investigation

TS Capital was founded in 2017 and is registered in the UK. Despite its relatively short history, the company has positioned itself within the investment consulting sector. However, the lack of a robust operational history and the revocation of its regulatory license prompt further scrutiny.

The company's ownership structure and management team are also critical factors in assessing its reliability. Unfortunately, detailed information about the management teams professional background is limited, making it difficult to gauge their experience and competence in managing a financial services firm. Transparency is a fundamental attribute for any financial institution, and the absence of accessible information about key personnel and their qualifications raises concerns about the firm's operational integrity.

Trading Conditions Analysis

When evaluating whether TS Capital is safe, it is essential to analyze its trading conditions, including fees and commissions. Reports suggest that TS Capital offers a range of investment products, including shares, bonds, and options. However, specific details regarding their fee structure remain vague, which is concerning for potential traders.

| Fee Type | TS Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | Varies by Broker |

| Commission Structure | N/A | Varies by Broker |

| Overnight Interest Range | N/A | Varies by Broker |

The lack of transparency regarding fees can be indicative of underlying issues, as reputable brokers typically provide clear and accessible information about their cost structures. Additionally, the absence of information on trading costs may lead to unexpected expenses for traders, further complicating the assessment of whether TS Capital is safe.

Customer Fund Security

The security of customer funds is a paramount concern for any trader. TS Capital claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, the revocation of their FCA license raises questions about the effectiveness of these measures.

The lack of detailed information regarding fund segregation, negative balance protection, and any historical issues related to fund security adds to the uncertainty surrounding TS Capital's operations. Without a regulatory framework backing these claims, traders may find themselves vulnerable to potential losses without recourse.

Customer Experience and Complaints

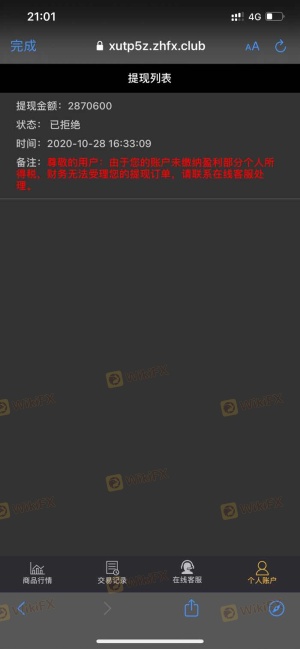

Analyzing customer feedback is crucial in determining the overall reliability of a broker. While some users report satisfactory experiences with TS Capital, others have raised significant complaints regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow response time |

| Customer Service Issues | Medium | Delayed replies |

Common complaints include difficulties in withdrawing funds and long wait times for customer service responses. These issues can significantly impact a trader's experience and raise concerns about the broker's operational efficiency. Notably, several users have reported being unable to access their funds, which is a major warning sign when assessing whether TS Capital is safe.

Platform and Execution

The trading platform offered by TS Capital is another critical aspect to evaluate. While the firm provides a web-based trading platform, there is limited information available regarding its performance, stability, and user experience. Traders often prefer established platforms like MetaTrader 4 or 5 due to their reliability and user-friendly features.

The quality of order execution is also a vital factor. Reports of slippage and order rejections can indicate potential manipulation or inefficiencies within the trading platform. Without transparent information on execution quality, traders may be left uncertain about the reliability of TS Capital's trading infrastructure.

Risk Assessment

Considering the various factors discussed, it is essential to conduct a comprehensive risk assessment regarding TS Capital.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked FCA license raises serious concerns. |

| Financial Stability | Medium | Limited information on financial health and transparency. |

| Customer Fund Security | High | Lack of clarity on fund protection measures. |

Overall, the risks associated with trading through TS Capital appear to be significant. Potential investors should be cautious and consider these risks before deciding to engage with the broker.

Conclusion and Recommendations

In conclusion, the investigation into TS Capital reveals several concerning factors that suggest the broker may not be safe for trading. The revocation of its FCA license, lack of transparency regarding fees, and numerous customer complaints raise significant red flags.

Traders are advised to exercise caution and consider alternative brokers that are well-regulated and have a proven track record of reliability and customer satisfaction. If you are looking for a safer trading environment, consider brokers regulated by top-tier authorities such as the FCA, ASIC, or SEC, which offer better protection for your investments and a more transparent trading experience.

Ultimately, while TS Capital may present itself as a legitimate trading platform, the evidence suggests that potential traders should be wary and conduct thorough due diligence before proceeding.

Is TS CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of TS CAPITAL brokers.

TS CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TS CAPITAL latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.