TRI 2025 Review: Everything You Need to Know

Executive Summary

TRI is a forex broker that started in 2016. The company focuses on foreign exchange trading and other financial instruments. This tri review shows big gaps in public information about rules and user feedback, even though TRI has been around for almost ten years. The broker calls itself a forex trading specialist and offers various financial tools to traders who want to trade currencies.

TRI lacks clear information in key areas that modern traders expect from good brokers. The missing regulatory details and few user reviews raise questions about where the broker stands in the market. But the company has been running since 2016, which shows some market experience and that it keeps clients.

The broker seems to target experienced forex traders who might work with less clear operations. This tri review gives a full analysis based on public information, but readers should know there are limits because detailed operational data is scarce.

Important Notice

TRI has limited regulatory and operational information available. Users in different regions may face varying legal and compliance risks because of this. The rules for forex brokers change a lot between countries, and without clear regulatory disclosure from TRI, potential clients should be extra careful when checking them out.

This review uses mainly public information and market data analysis. The assessment doesn't include full user reviews or detailed regulatory checks, which are usually essential parts of thorough broker evaluations. Future traders should do more independent research before making any trading decisions.

Rating Framework

Broker Overview

TRI started in the forex trading industry in 2016. The company calls itself a specialized provider of foreign exchange and financial instrument trading services. TRI has been operating for almost nine years, which shows some market sustainability and client retention, though specific details about its corporate structure and headquarters location are not available in public materials.

The broker's business model centers on forex market access. TRI gives traders opportunities to trade currency pairs along with other financial instruments. However, the specific nature of these additional instruments and the depth of the trading system remain unclear from public sources. The company seems to focus on serving traders who already know forex markets rather than teaching beginners.

This tri review finds that while the broker's long operation suggests it can work, the lack of detailed information about trading platforms, corporate governance, and regulatory compliance creates uncertainties for potential clients. The company's approach to market communication appears minimal, with limited public disclosure about its operational framework, management team, or strategic partnerships that might make traders more confident.

Regulatory Jurisdiction: Available materials do not specify which regulatory authorities oversee TRI's operations. This represents a significant transparency gap for potential clients seeking regulatory protection and ways to solve problems.

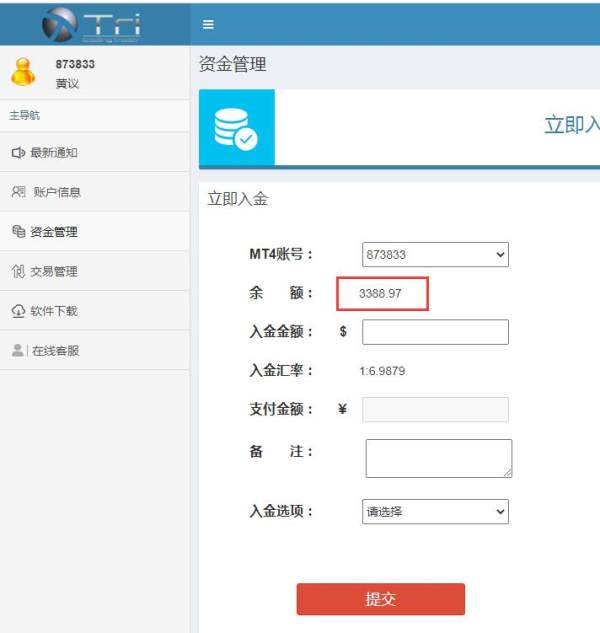

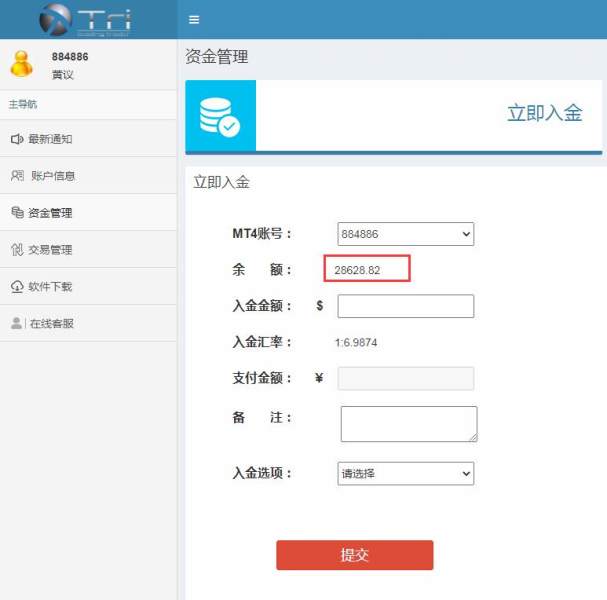

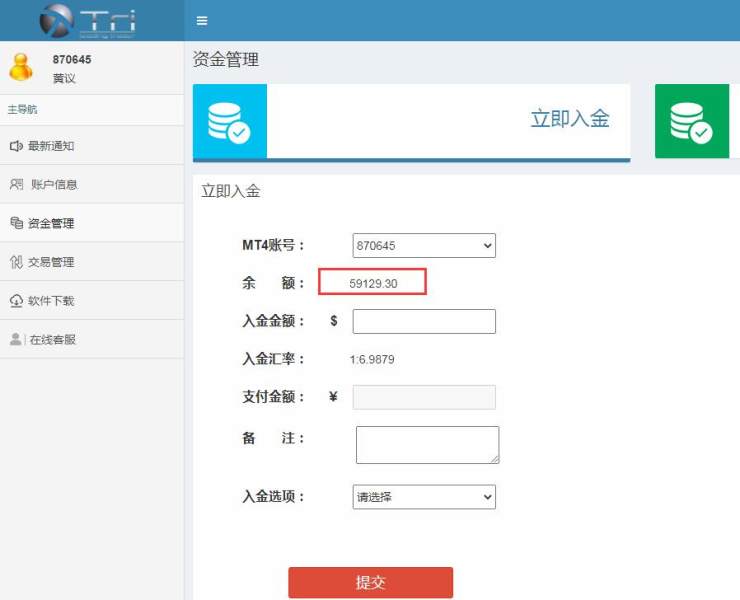

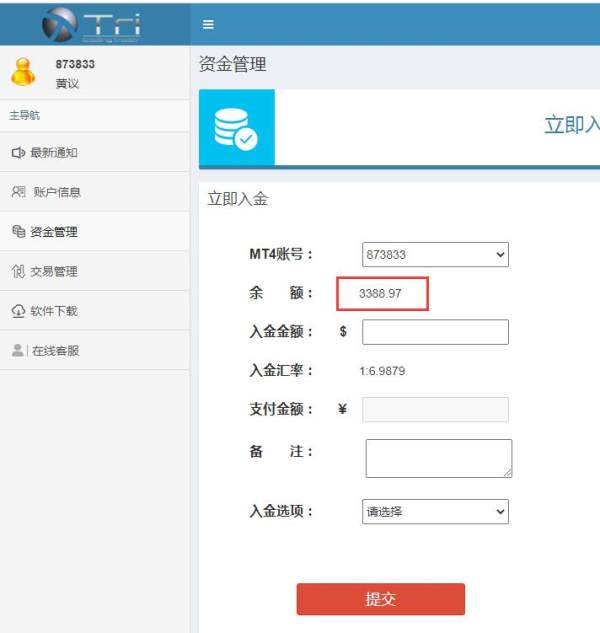

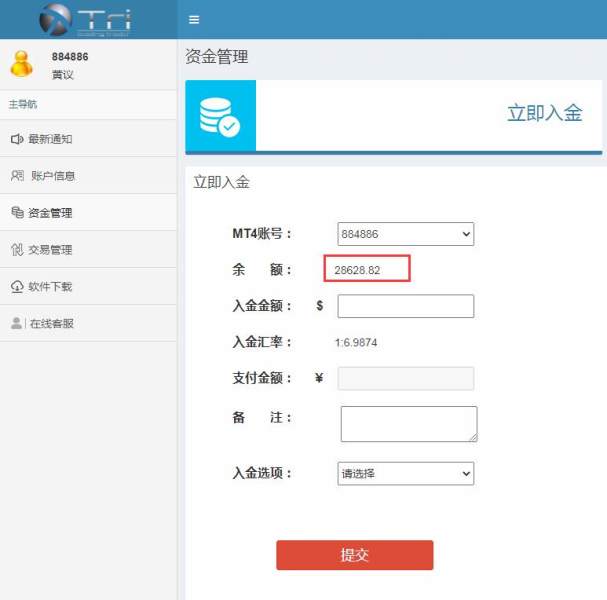

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and fees for deposits and withdrawals is not detailed in accessible public documentation.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit amounts for different account types. This makes it difficult for potential clients to assess accessibility and entry barriers.

Bonuses and Promotions: Current promotional offerings, welcome bonuses, or ongoing incentive programs are not specified in available public materials. This suggests either absence of such programs or limited marketing disclosure.

Tradable Assets: TRI focuses on forex trading and other financial instruments. The specific range of currency pairs, exotic options, and additional asset classes available for trading requires further clarification from the broker directly.

Cost Structure: Detailed information about spreads, commission structures, overnight fees, and other trading costs is not readily available in public documentation. This makes cost comparison with other brokers challenging for potential clients.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in accessible materials. This is crucial information for traders planning their risk management strategies.

Platform Options: The specific trading platforms supported by TRI are not detailed in available public information. This includes proprietary solutions or third-party integrations like MetaTrader.

This tri review notes that the lack of detailed operational information creates challenges for full evaluation and may require direct broker contact for clarification.

Account Conditions Analysis

The assessment of TRI's account conditions faces big limitations due to missing detailed public information about account structures, requirements, and features. Without specific documentation about account types, minimum balance requirements, or special account features, potential clients cannot properly evaluate whether the broker's offerings match their trading needs and financial abilities.

The lack of information about account opening procedures, verification requirements, and documentation needed for different client categories creates uncertainty about the onboarding experience. Professional traders typically need clear understanding of account separation policies, negative balance protection, and institutional account features, none of which are clearly detailed in available materials.

The missing information about Islamic account options, demo account availability, and account management tools limits the ability to assess how well the broker accommodates diverse client needs. This tri review finds that the limited transparency about account conditions significantly impacts the evaluation score, as traders cannot make informed decisions without access to basic account information.

The scoring reflects these information gaps and the resulting inability to verify competitive positioning against industry standards for account conditions and client protection measures.

TRI's trading tools and resources evaluation is limited by the lack of specific information about the technology infrastructure and analytical support provided to clients. Without detailed disclosure about charting capabilities, technical analysis tools, and market research resources, it becomes difficult to assess the broker's competitive position in providing trader support tools.

The missing information about automated trading support, algorithmic trading capabilities, and API access represents a significant gap for modern traders who rely on sophisticated trading technologies. Educational resources, which are increasingly important for broker differentiation, are not detailed in available public materials, suggesting either limited offerings or poor communication of available resources.

Market analysis tools, economic calendars, news feeds, and research reports are standard offerings among competitive brokers. Yet TRI's specific provisions in these areas remain unclear. The lack of information about mobile trading capabilities and cross-platform synchronization further limits the assessment of the broker's technological sophistication.

Without user feedback about tool effectiveness and resource quality, this evaluation cannot include practical usage experiences that typically inform comprehensive broker assessments.

Customer Service and Support Analysis

The evaluation of TRI's customer service capabilities is significantly hampered by the absence of detailed information about support channels, availability, and service quality metrics. Standard customer service assessment typically includes analysis of contact methods, response times, and multilingual support capabilities, none of which are clearly documented in available public materials.

Without specific information about customer service hours, regional support availability, and escalation procedures, potential clients cannot assess whether the broker's support infrastructure meets their operational needs. The lack of user testimonials about service experiences prevents incorporation of real-world feedback about problem resolution effectiveness and staff competency.

Modern forex brokers typically provide multiple communication channels including live chat, phone support, email ticketing systems, and sometimes social media engagement. The absence of clear documentation about TRI's support infrastructure suggests potential limitations in customer service accessibility and responsiveness.

The scoring reflects these information gaps and the resulting inability to verify service quality standards that are essential for trader confidence and operational support.

Trading Experience Analysis

Assessment of TRI's trading experience is constrained by limited information about platform stability, execution quality, and overall trading environment characteristics. Without specific data about order execution speeds, slippage rates, and platform uptime statistics, it becomes challenging to evaluate the technical quality of the trading experience provided to clients.

The absence of information about trading platform features, order types supported, and risk management tools available within the trading interface limits the ability to assess user experience quality. Mobile trading capabilities, which are increasingly critical for modern traders, are not detailed in available documentation.

Platform customization options, advanced charting capabilities, and one-click trading features are standard expectations among competitive brokers. Yet TRI's specific offerings in these areas remain unclear. Without user feedback about actual trading experiences, platform reliability, and execution quality, this tri review cannot incorporate practical usage assessments.

The evaluation score reflects these information limitations and the resulting inability to verify trading experience quality against industry benchmarks and user expectations.

Trust Factor Analysis

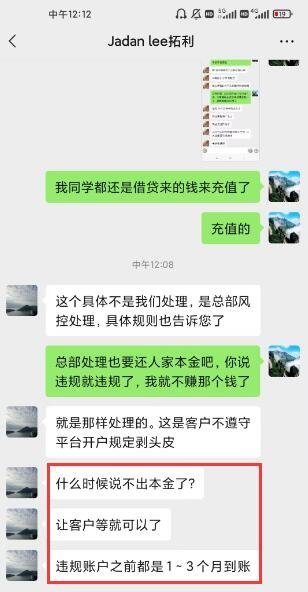

TRI's trust factor evaluation reveals significant concerns due to the absence of clear regulatory information and transparency gaps that are crucial for trader confidence. The lack of specific regulatory oversight details means potential clients cannot verify the legal protections and ways to solve problems typically associated with regulated forex brokers.

Without information about fund separation policies, deposit insurance coverage, and regulatory compliance measures, traders cannot assess the safety of their capital and the broker's commitment to client protection standards. The absence of third-party audits, financial reporting, or regulatory filing accessibility further complicates trust assessment.

Industry reputation indicators, such as awards, certifications, or recognition from trading communities, are not evident in available public materials. The limited public disclosure about corporate governance, management team, and operational transparency creates additional trust concerns for potential clients seeking reliable trading partners.

The scoring reflects these significant transparency gaps and the resulting challenges in establishing confidence in the broker's reliability and commitment to client protection standards.

User Experience Analysis

The user experience evaluation for TRI faces substantial limitations due to the absence of comprehensive user feedback and detailed interface information. Without access to user testimonials, satisfaction surveys, or community reviews, it becomes impossible to assess real-world user experiences and satisfaction levels with the broker's services.

Interface design quality, navigation ease, and overall platform usability cannot be properly evaluated without specific information about the trading platforms and user interface characteristics. The registration and account verification process efficiency, which significantly impacts initial user experience, is not detailed in available materials.

Fund management experience, including deposit and withdrawal processes, transaction clarity, and account management tools, requires user feedback and detailed process documentation that is not readily available. Common user complaints and resolution effectiveness cannot be assessed without access to user community feedback and customer service interaction records.

The evaluation reflects these information gaps and the resulting inability to provide meaningful user experience insights based on actual client experiences and satisfaction metrics.

Conclusion

This tri review reveals that while TRI has maintained market presence since 2016, significant information transparency gaps limit comprehensive evaluation of the broker's services and reliability. The absence of detailed regulatory information, user feedback, and operational specifics creates substantial challenges for potential clients seeking to make informed trading decisions.

TRI may be suitable for experienced forex traders who are willing to conduct extensive research and can operate with limited transparency. But the broker's current public information disclosure falls short of modern industry standards. The main advantage appears to be the broker's focus on forex trading with nearly a decade of operational experience, while significant disadvantages include the lack of regulatory transparency and limited user feedback availability.

Prospective clients should exercise heightened caution and conduct thorough independent research before engaging with this broker, particularly regarding regulatory protection and operational transparency verification.