TS Capital 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive ts capital review evaluates a London-based investment advisory firm that presents significant concerns for potential clients. Based on current available information, TS Capital is not authorized to conduct any regulated activities, which raises substantial questions about trust and safety for prospective investors. While the company positions itself as providing customized financial services to maximize client trading performance, the lack of regulatory authorization represents a critical limitation that cannot be ignored.

TS Capital's registration in the United Kingdom initially suggests legitimacy. However, the absence of proper regulatory permissions creates a concerning gap between appearance and reality that potential investors must understand. The firm specializes in offering tailored financial consultation services, targeting investors who seek personalized investment strategies that align with their specific goals. However, the regulatory status significantly impacts the overall assessment of this broker in ways that affect client safety and fund protection.

This review aims to provide potential clients with essential information needed to make informed decisions about whether TS Capital aligns with their investment needs and risk tolerance. The regulatory uncertainties surrounding the firm's operations create additional complexity that requires careful consideration before making any financial commitments.

Important Notice

Prospective clients should exercise extreme caution when considering TS Capital's services due to significant regulatory concerns. Although the company maintains registration in the United Kingdom, it lacks authorization to conduct any regulated financial activities, creating potential risks for client funds and investment security that extend beyond normal market risks. This regulatory gap means that clients would not benefit from standard investor protections typically available through properly licensed financial institutions.

This evaluation is based exclusively on publicly available information and user feedback found through independent research. The assessment does not include actual trading experience or direct interaction with the company's services, which limits the depth of analysis possible. Potential clients should conduct their own due diligence and consider consulting with independent financial advisors before making any investment decisions involving TS Capital.

Rating Framework

Broker Overview

TS Capital operates as an investment advisory company headquartered in London, positioning itself as a specialized provider of customized financial services. The firm focuses on delivering tailored investment consultation designed to maximize client trading performance through personalized strategies that address individual investor needs. According to available information, the company emphasizes its commitment to understanding individual client needs and developing bespoke financial solutions that align with specific investment objectives and risk profiles.

The business model centers around providing comprehensive investment advisory services rather than traditional brokerage operations. This ts capital review reveals that the company targets investors seeking more personalized attention than typically available through standard retail brokers who often provide one-size-fits-all solutions. However, the regulatory landscape presents significant challenges for the firm's operations, as it maintains registration in the United Kingdom but lacks the necessary authorization to conduct regulated financial activities, which fundamentally impacts its service delivery capabilities.

Regulatory Status: TS Capital holds registration in the United Kingdom but critically lacks authorization to conduct any regulated activities. This regulatory gap creates substantial concerns about client protection and compliance with financial industry standards that govern legitimate investment firms.

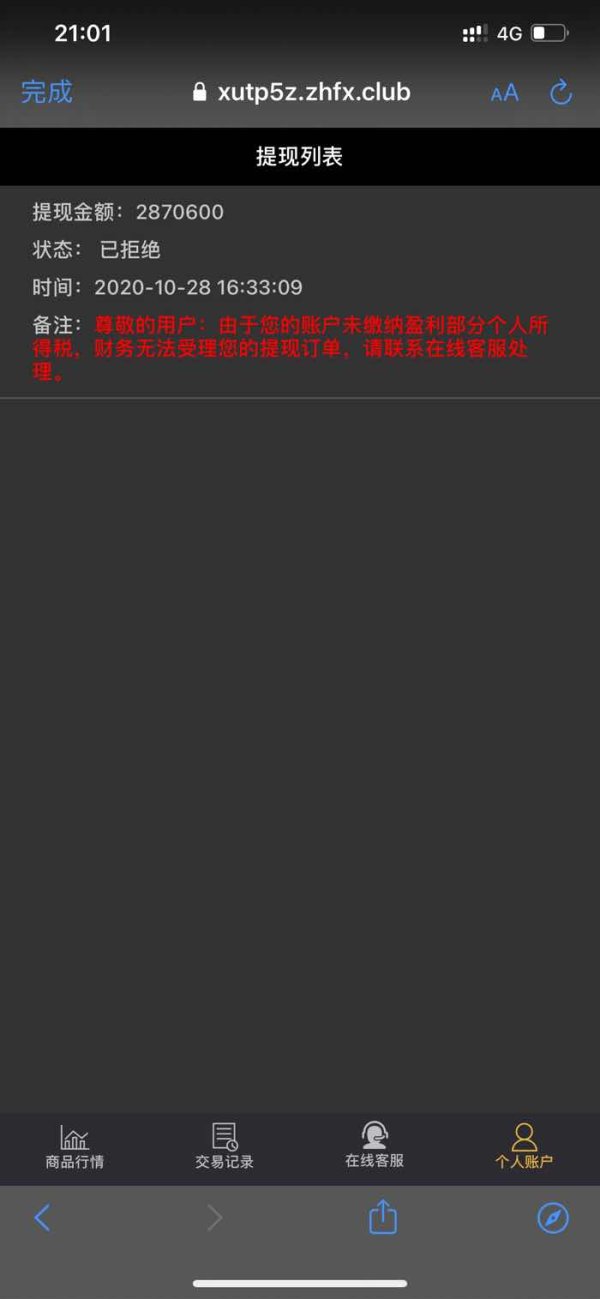

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available documentation.

Minimum Deposit Requirements: The company has not publicly disclosed minimum deposit amounts or account opening requirements in accessible sources. This lack of transparency makes it difficult for potential clients to plan their initial investment approach.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not available in current documentation.

Tradeable Assets: Information about available financial instruments, asset classes, and market access is not specified in available sources. This absence of detail prevents potential clients from understanding what investment opportunities the firm actually provides.

Cost Structure: Comprehensive details about spreads, commissions, overnight fees, and other trading costs are not provided in accessible documentation.

Leverage Options: Specific leverage ratios and margin requirements are not disclosed in available information. Understanding leverage options is crucial for risk management and trading strategy development.

Platform Options: Details about trading platforms, software compatibility, and technological infrastructure are not documented in accessible sources.

Geographic Restrictions: Information about service availability in different regions and regulatory jurisdictions is not specified. This creates uncertainty about who can actually access the firm's services legally.

Customer Support Languages: Available languages for customer service and support are not detailed in current documentation.

This ts capital review highlights significant information gaps that potential clients should consider when evaluating the broker's services.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of TS Capital's account conditions faces substantial limitations due to insufficient publicly available information. Standard account features such as account types, minimum deposit requirements, and opening procedures are not detailed in accessible documentation, which creates significant barriers to proper evaluation. Most reputable brokers typically offer multiple account tiers designed for different trader profiles, ranging from basic retail accounts to premium services for high-net-worth individuals.

Without specific information about TS Capital's account structure, potential clients cannot adequately assess whether the broker's offerings align with their trading needs and financial capabilities. The absence of clear account condition details raises questions about transparency and may indicate limited service standardization that could affect client experience. Professional brokers typically provide comprehensive account information including deposit requirements, account benefits, and special features such as Islamic accounts for clients with specific religious requirements.

The lack of transparency regarding account conditions, combined with the regulatory authorization issues, suggests potential clients should exercise significant caution. This ts capital review cannot provide definitive guidance on account suitability without access to detailed terms and conditions, fee structures, and account comparison charts that professional brokers typically make readily available to prospective clients.

Assessment of TS Capital's trading tools and resources proves challenging due to limited available information about the company's technological offerings. Professional brokers typically provide comprehensive suites of analytical tools, charting software, economic calendars, and market research resources to support informed trading decisions that can significantly impact investment success. These tools often include technical analysis indicators, fundamental analysis reports, and automated trading capabilities.

Educational resources represent another critical component of broker evaluation, as reputable firms usually offer webinars, tutorials, market analysis, and trading guides to help clients improve their market knowledge and trading skills. The absence of detailed information about TS Capital's educational offerings makes it difficult to assess the firm's commitment to client development and success in the competitive financial markets.

Research and analysis capabilities typically distinguish professional brokers from basic service providers. Quality brokers often provide daily market commentary, economic analysis, and trading signals developed by in-house research teams or third-party providers who specialize in market analysis. Without access to information about TS Capital's research capabilities, potential clients cannot evaluate the analytical support available for their trading decisions.

Customer Service and Support Analysis

Evaluating TS Capital's customer service requires comprehensive information about support channels, availability, and service quality that is not currently accessible through public sources. Professional brokers typically offer multiple contact methods including phone support, live chat, email assistance, and sometimes social media engagement to ensure clients can receive help when needed during critical trading situations. Response times and service quality represent crucial factors in broker selection, particularly for active traders who may require immediate assistance with technical issues or account problems.

The availability of support often distinguishes premium brokers from basic service providers, especially for clients trading in multiple time zones or during extended market hours. Language support capabilities also impact the overall customer experience, as international brokers typically provide multilingual assistance to serve diverse client bases effectively across different geographic regions. The lack of specific information about TS Capital's customer service infrastructure makes it impossible to assess whether the firm can provide adequate support for potential clients' needs.

Without access to user feedback about customer service experiences, response times, and problem resolution effectiveness, this evaluation cannot provide meaningful insights into TS Capital's support quality.

Trading Experience Analysis

The assessment of TS Capital's trading experience faces significant limitations due to the absence of detailed information about platform performance, execution quality, and user interface design. Professional trading platforms typically offer advanced charting capabilities, real-time market data, order management tools, and mobile accessibility to ensure comprehensive trading functionality that meets modern trader expectations. Platform stability and execution speed represent critical factors for successful trading, particularly for strategies that depend on precise timing and minimal slippage.

Professional brokers usually provide detailed specifications about their technological infrastructure, including server locations, execution speeds, and reliability metrics that help clients understand the trading environment. Mobile trading capabilities have become increasingly important as traders seek flexibility to monitor and manage positions while away from desktop computers throughout the trading day. Quality brokers typically offer fully functional mobile applications that mirror desktop platform capabilities, ensuring consistent trading experiences across different devices.

Without access to platform demonstrations, user feedback, or technical specifications, this ts capital review cannot provide meaningful evaluation of the actual trading experience.

Trustworthiness Analysis

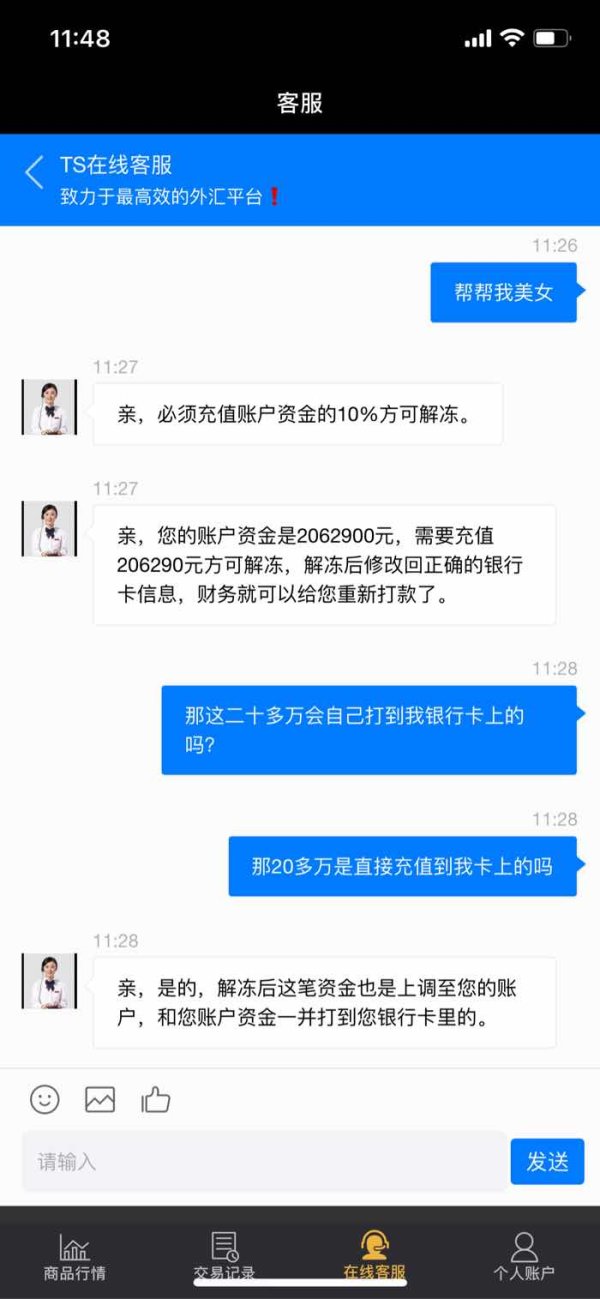

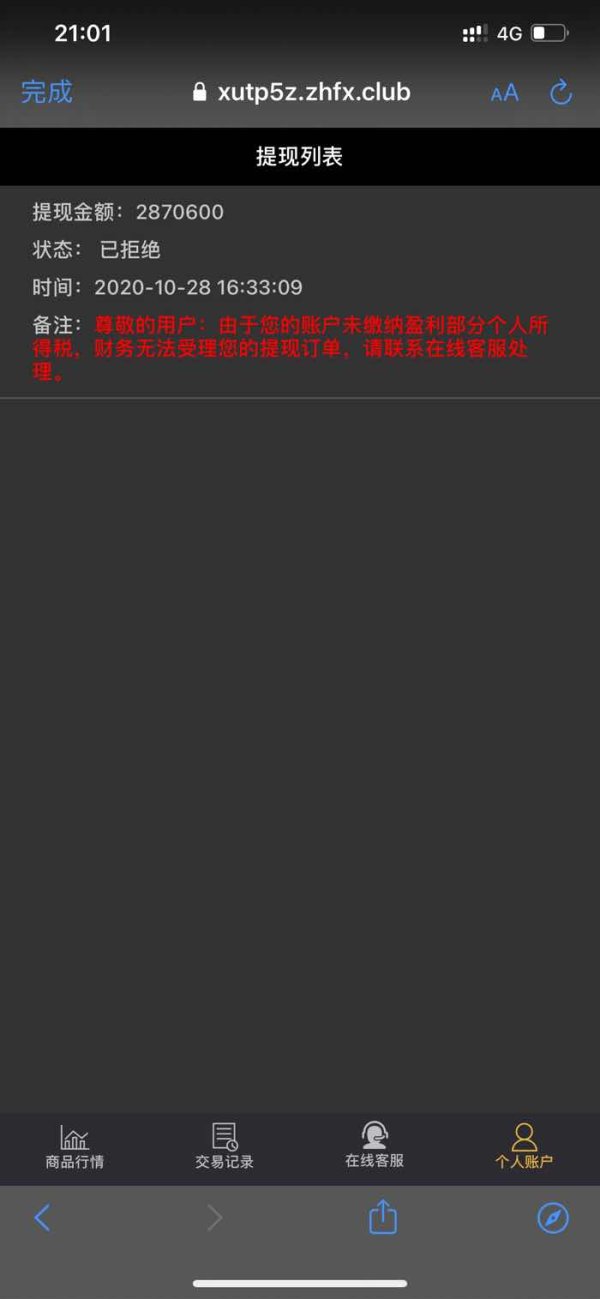

TS Capital's trustworthiness assessment reveals significant concerns primarily related to regulatory authorization status. While the company maintains registration in the United Kingdom, the critical absence of authorization to conduct regulated activities fundamentally impacts client protection and regulatory compliance in ways that create substantial risk for potential investors. This regulatory gap means clients would not benefit from standard investor protections typically provided through properly licensed financial institutions.

Regulatory oversight provides essential safeguards including segregated client funds, dispute resolution mechanisms, and compensation schemes that protect investors in case of broker failure. The lack of proper authorization suggests TS Capital operates outside these protective frameworks, potentially exposing clients to increased risks regarding fund security and regulatory recourse that extend beyond normal investment risks. Company transparency also factors into trustworthiness evaluation, as reputable brokers typically provide comprehensive information about their operations, leadership, financial backing, and regulatory compliance.

The limited publicly available information about TS Capital's operational details raises questions about the firm's commitment to transparency and client communication.

User Experience Analysis

Comprehensive user experience evaluation for TS Capital proves challenging due to limited available feedback and documentation about client interactions with the firm's services. Professional brokers typically maintain strong online presences with extensive user reviews, testimonials, and feedback that provide insights into actual client experiences and satisfaction levels across different service areas. Interface design and usability represent important factors in overall user experience, as intuitive platforms and streamlined processes enhance client satisfaction and trading efficiency.

Without access to platform demonstrations or user interface screenshots, potential clients cannot assess the ease of use and functionality of TS Capital's systems. Registration and account verification processes also impact user experience, as efficient onboarding procedures help clients begin trading quickly while maintaining necessary compliance standards that protect both the firm and its clients. The absence of detailed information about TS Capital's account opening procedures makes it difficult to evaluate the user-friendliness of initial interactions with the firm.

Fund management operations, including deposit and withdrawal processes, significantly influence user satisfaction and overall experience with any financial service provider.

Conclusion

This comprehensive evaluation of TS Capital reveals significant concerns that potential clients must carefully consider before engaging with the firm's services. The most critical issue involves the company's regulatory status, as despite UK registration, TS Capital lacks authorization to conduct regulated activities, which fundamentally impacts client protection and regulatory oversight in ways that create substantial risk. The absence of detailed information about trading conditions, account features, platform capabilities, and service offerings creates additional uncertainty for potential clients seeking comprehensive broker evaluation.

TS Capital may be suitable for investors specifically seeking customized financial advisory services and willing to accept the associated regulatory risks, but the lack of traditional broker protections requires careful consideration. The primary advantages appear to center around the firm's focus on personalized service delivery, while significant disadvantages include regulatory authorization gaps and limited transparency about operational details that affect client decision-making. Potential clients should conduct extensive due diligence and consider consulting independent financial advisors before making investment decisions involving TS Capital.