UBFX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

UBFX positions itself as a low-cost forex trading platform, appealing primarily to new traders attracted by its minimal entry requirements and enticing leverage options. With a minimum deposit starting at just $1 and leverage reaching up to 1:400, it aims to provide access to a wide range of trading instruments, including forex, CFDs, metals, and commodities. However, this enticing facade is accompanied by significant risks that should not be overlooked. The broker is associated with various red flags regarding regulatory compliance and fund safety, indicating that traders should exercise caution when considering UBFX. While new traders may be drawn to the notion of high returns with low initial investment, individuals prioritizing security and a stable trading environment may want to steer clear.

⚠️ Important Risk Advisory & Verification Steps

Warning: Entrusting your funds to unregulated brokers poses significant risks.

- Potential Harms:

- Inability to withdraw funds due to operational issues.

- Lack of regulatory oversight leading to high-risk trading conditions.

Self-Verification Guide:

- Check Regulatory Status: Confirm the broker's claimed regulatory status via official financial authority websites.

- Read User Reviews: Look for real user feedback on platforms like Forexing.com, BrokerXplorer.com, and Valforex.com.

- Find Contact Details: Ensure that the broker offers legitimate support options.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2016, UBFX operates under the name Finance Managers Co. Limited, registered in Vanuatu. While it markets itself as a competitive new player in the forex brokerage space, several reports suggest that it has not been functional since 2022. The choice of an offshore regulatory framework raises serious questions about its legitimacy, given that Vanuatu's oversight is often viewed as lax and susceptible to scams.

Core Business Overview

UBFX provides a variety of trading instruments, including currency pairs, indices, precious metals, and CFDs. The broker asserts to be regulated by the Ministry of Finance and Economic Management in Vanuatu, with a leverage cap of 1:400 and a minimal deposit requirement of just $1. However, users have raised multiple complaints regarding poor fund access and unfulfilled withdrawal requests, contributing to the broker's dubious reputation.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

A look into the regulatory status of UBFX reveals significant inconsistencies. Despite claiming regulation under Vanuatu's financial authorities, many user complaints suggest a lack of operational transparency. This raises the possibility that UBFX may not be compliant with fundamental financial regulations, leading to substantial risks in trading environments.

Analysis of Regulatory Information Conflicts:

Reports indicate that UBFX lacks solid regulatory oversight, a critical factor for establishing trust in a broker. Users have highlighted difficulties in accessing their funds, often leading to withdrawals being delayed or blocked entirely.

User Self-Verification Guide:

To help verify the brokers claims, users should:

- 1. Visit the official Vanuatu financial regulatory website to confirm licensing.

- 2. Check independent review sites for trader experiences.

- 3. Directly contact UBFXs support for clarity on withdrawals.

- Industry Reputation and Summary:

"I tried reaching their customer service for a withdrawal request and my account got blocked without explanation."

- Such negative feedback illustrates the pervasive issues around fund management and transaction integrity.

Trading Costs Analysis

The double-edged sword effect.

When evaluating trading costs, UBFX presents advantages and disadvantages that are crucial for potential traders to consider.

Advantages in Commissions:

The broker advertises low trading commissions, creating an attractive proposition for high-frequency traders. However, specifics about these rates should always be confirmed before signing up.

The "Traps" of Non-Trading Fees:

Users frequently report high withdrawal fees that undermine the apparent cost benefits.

"Withdrawing funds often costs more than I expected, totaling to substantial losses over time."

Such complaints indicate hidden traps within the fee structure that can catch inexperienced traders off guard.

- Cost Structure Summary:

This combination of low trading fees but high withdrawal costs presents a complex cost environment for traders, suggesting they weigh options carefully based on their trading frequency and withdrawal needs.

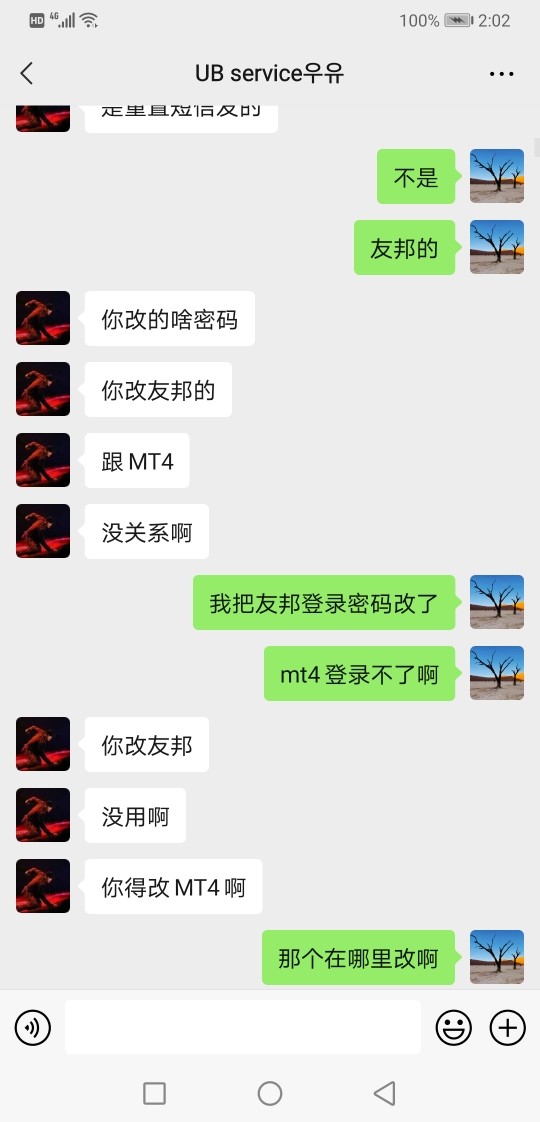

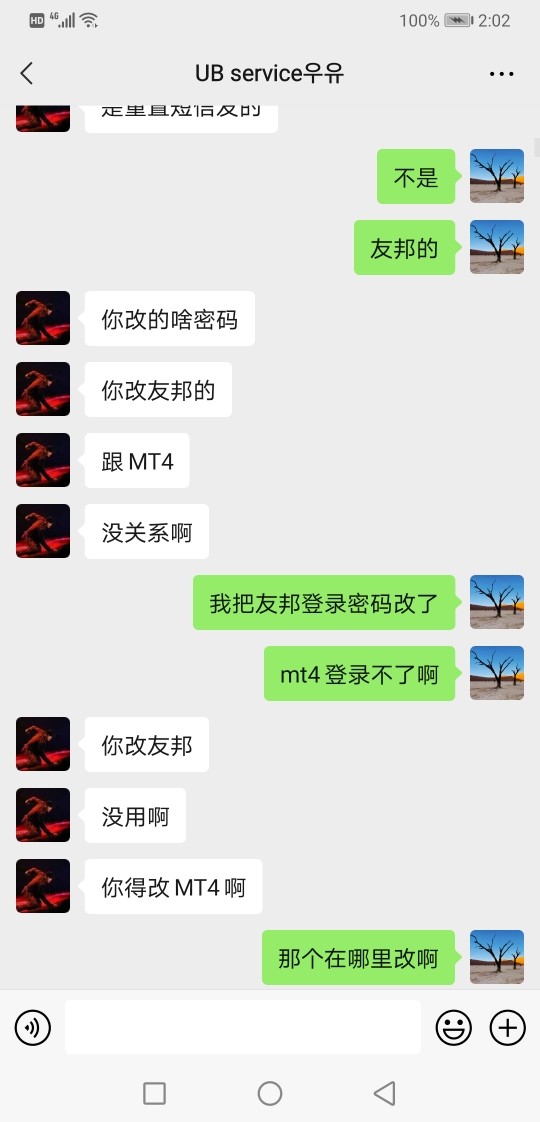

Professional depth vs. beginner-friendliness.

In terms of platforms, UBFX claims to provide the popular MetaTrader 4, a robust trading software favored by many professionals. However, exploration reveals both strengths and weaknesses.

Platform Diversity:

The sole offering of MT4 may deter some traders who expect more diverse platform options. MT4 is functionally strong but may lack tailored features for beginners.

Quality of Tools and Resources:

While well-known for charting and analytical capabilities, MT4 may not have the educational resources or community support necessary for new traders looking to learn.

Platform Experience Summary:

"The MT4 platform was frequently down during crucial trading hours, leading to missed opportunities."

Feedback demonstrates that while the platform can be effective, consistent operational stability is vital for user experience.

User Experience Analysis

Journey assessment through the trader's eyes.

User journeys with UBFX highlight considerable challenges tied to platform functionality and customer service.

User Feedback on Usability:

Many users describe navigating the UBFX platform as frustrating, particularly when trying to execute trades or resolve issues.

Report on Accessibility and Ease:

The lack of a comprehensive onboarding process for new traders has left many feeling unprepared. Traders report needing external resources to understand how to navigate the platform effectively.

Failure of Customer Service:

"Their support team seemed unreachable during critical hours, leading to losses and frustration."

Such comments emphasize the essential role of responsive customer service in ensuring a positive trading experience.

Customer Support Analysis

How does UBFX rank in support?

The nature of UBFX's customer support reflects its broader operational issues.

Channels Available:

Users report that despite multiple channels like live chat and email, responses are not timely or effective, especially for urgent fund recovery requests.

Effectiveness of Communication:

An overall lack of transparency manifests with delayed responses to withdrawal requests.

"I waited over a week without receiving a clear answer regarding my funds."

Such prolonged gaps in communication can erode trust and confidence among traders.

- Customer Satisfaction Ratings:

User ratings of the customer service experience tend to skew low, often reflecting frustrations over unresponsive support that fails to yield results.

Account Conditions Analysis

Examine the fine print.

The account offerings at UBFX highlight both the allure and the hidden complexities for traders.

Types of Accounts Offered:

UBFX offers several account types with varying minimum deposits. While the standard account requires only $1, higher-tier accounts impose significantly more stringent conditions for varying returns.

Accessibility of Features:

The requirement for higher minimum deposits for accounts that may seem similar in offerings raises questions about intrinsic value and trader motivation.

Consequences for Non-Active Accounts:

Users have expressed concerns regarding account inactivity fees and the implications this has for longer-term traders or those testing the waters with minimal initial investment.

Conclusion

UBFX presents itself as an attractive option for the budget-conscious trader, emphasizing low costs and diverse offerings. However, the profound risks associated with its questionable regulatory standing and multiple user complaints about fund accessibility and support services are alarming. Traders are strongly discouraged from engaging with UBFX due to significant warning signs suggesting potential operational instability and lack of transparency. In the world of forex trading, informed decision-making is crucial, and potential investors should consider safer, regulated alternatives to protect their investments.

Recommendations:

- Proceed with extreme caution if considering UBFX; perform extensive self-verification using the steps outlined.

- Consider regulated platforms that provide greater transparency and security for your trading activities.