tigerwit 2025 Review: Everything You Need to Know

1. Abstract

Tigerwit started in 2015 as a forex broker. The company has gotten a lot of user attention, but not all of it is good. Recent reports and user feedback show the broker has a TrustScore of 2.87 based on 13 user reviews. This points to mostly negative reactions from users. Tigerwit offers attractive maximum leverage of up to 1:400 and gives access to multiple asset classes like forex, commodities, and cryptocurrencies. But there's a major problem. The broker's website cannot be reached right now, which hurts the user experience badly. The broker requires only 50 USD as a minimum deposit, which seems good for beginners. However, people should be careful because of reliability problems that keep coming up. This tigerwit review will look at the good and bad points, covering account conditions, tools, customer service, trading experience, how trustworthy it is, and overall user experience.

2. Important Considerations

Different regions have different leverage limits. UK traders can only use maximum leverage of 1:30, while other regions might get up to 1:200. This review uses mostly user feedback and market information rather than direct personal trading experiences. So specific details like commission costs, withdrawal methods, and bonus offers are not clear. We always tell potential users to do more research and check regulatory details for their region before using Tigerwit.

3. Rating Framework

Below is the rating framework based on six critical dimensions:

4. Broker Overview

Company Background and Operational History

Tigerwit was founded in 2015 and has its headquarters in the United Kingdom. The broker became known as a new player in the forex industry. Tigerwit has focused on giving global trading solutions to retail clients, with special attention to offering access to many asset classes. These include traditional forex and commodities like oil and metals, plus a growing range of cryptocurrency pairs. The broker tries to appeal to new traders by keeping a low minimum deposit of just 50 USD. This approach targets beginners who want to test trading in a fast-moving market without putting up a lot of money at first. But the broker's reputation has gotten worse because of low user ratings and a TrustScore of only 2.87. The mix of seemingly good trading conditions with clear operational problems—especially the fact that its website cannot be reached—raises questions about whether the broker can keep operating and be transparent.

Tigerwit uses the well-known MetaTrader 4 platform. This platform is a standard across the forex industry and is famous for being reliable and easy to use. Users can trade many different instruments through this platform, including major currencies, precious metals, and new crypto assets. This multi-asset approach aims to give clients diverse exposure and a chance to try different trading strategies using one trading interface. But despite these promising offerings, the lack of detailed information about regulatory oversight and platform improvements creates uncertainty. Reports show that while Tigerwit promises advanced execution systems and a multi-asset environment, the unclear details about spreads, commissions, and other hidden costs hurt user confidence. So while MetaTrader 4 is still a strong selling point from a technology view, overall broker transparency keeps being a problem in this tigerwit review.

This section provides in-depth details about Tigerwit's available features and aspects of its service:

Regulatory Jurisdiction :

The available documents about Tigerwit do not show any regulatory oversight or licensing details. Different sources point out that clear regulatory information is missing, which puts extra burden on potential traders to check compliance and legitimacy, especially in their own countries. This lack of regulatory transparency has been mentioned as a major problem in multiple reviews.

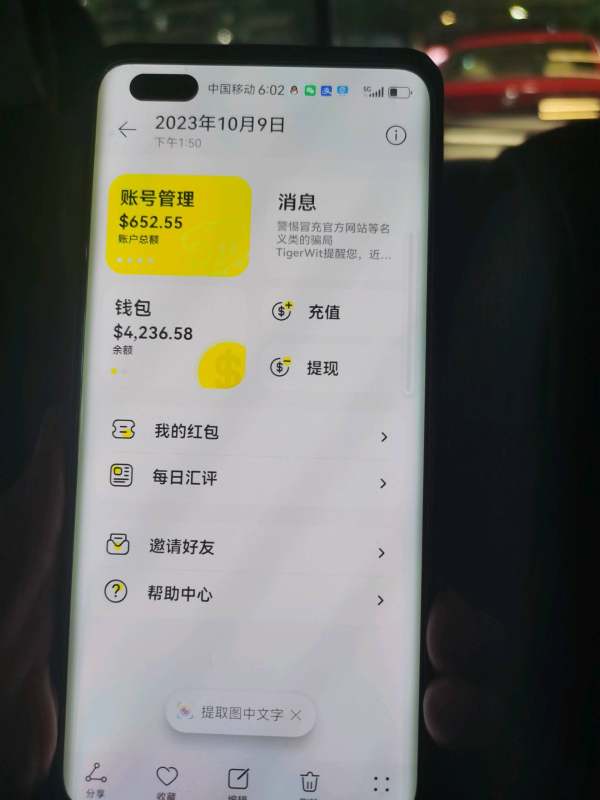

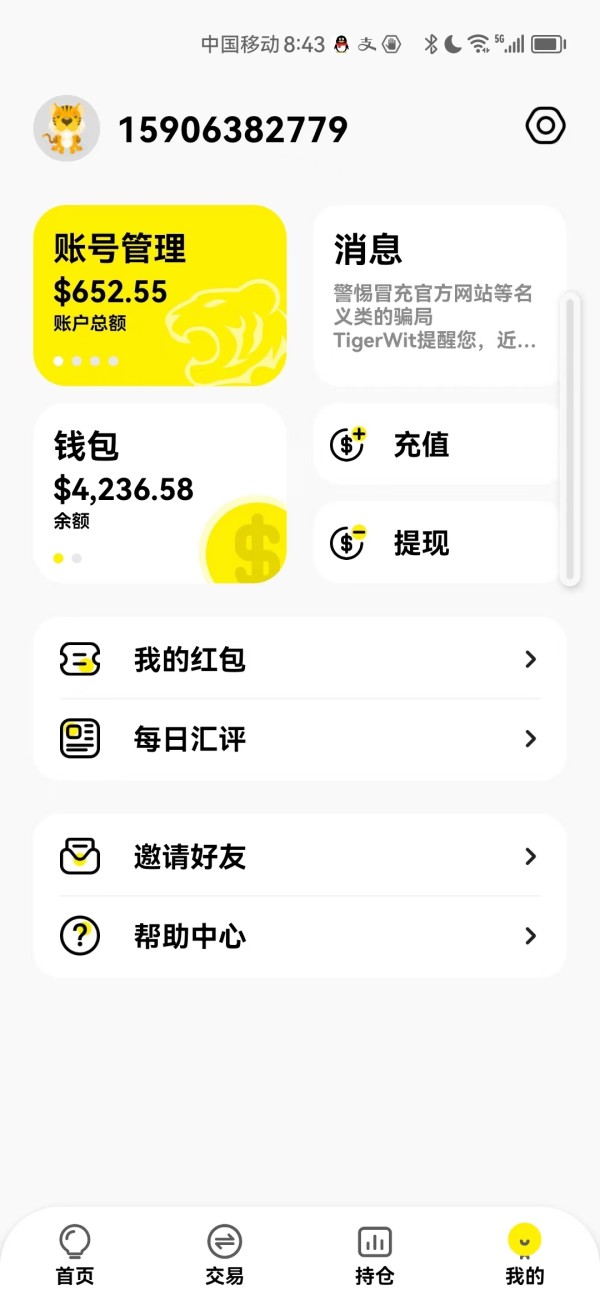

Deposit and Withdrawal Methods :

The review sample does not give clear details about deposit and withdrawal methods. While Tigerwit allows funding in USD with a low minimum deposit of 50 USD, specific transaction methods like payment processors, bank transfers, e-wallets, or related fees are mostly not specified in the publicly available information.

Minimum Deposit Requirement :

Tigerwit requires a minimum deposit of just 50 USD. This makes it an accessible option for beginners who want to trade forex and other asset classes without a big initial investment.

Promotions and Bonus Offers :

Right now, there is no detailed information available about any bonus promotions or incentive programs offered by Tigerwit. The absence of promotional offers in the available documents might show that Tigerwit focuses mainly on standard trading features rather than attracting new customers through high-value bonuses.

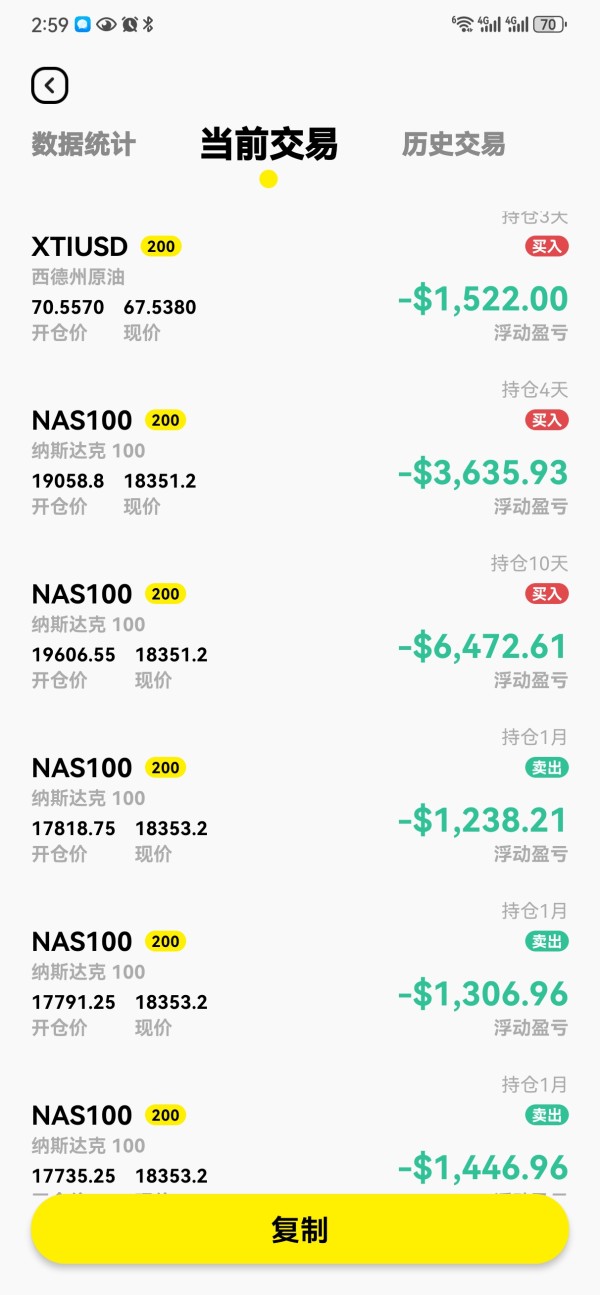

Tradable Asset Classes :

Tigerwit provides trading across many assets including forex pairs, commodities like crude oil and precious metals, and cryptocurrencies. This cross-asset approach aims to give traders diverse exposure in one trading account. But it is important to note that while multiple asset classes are promoted, the operational challenges—like the unreachable website—could hurt effective execution of trades across these markets.

Cost Structure :

One of the main concerns in this tigerwit review is the unclear cost structure. Important pricing details like commission rates, spread changes, and other transaction fees are not clearly shown in the available data. As a result, traders may face unexpected costs during live operations. This lack of transparency makes it hard to compare Tigerwit against other brokers, where detailed cost breakdowns are usually provided. Without clear insight into the fee structure, it becomes harder for traders to do precise risk-reward analyses and prepare for potential hidden costs.

Leverage Offered :

Tigerwit allows leverage as high as 1:400, but with noted changes depending on regional rules. For example, traders in the UK might face stricter limits compared to those in less regulated areas.

Platform Options :

The broker mainly supports trading through the MetaTrader 4 platform—a long-standing choice in the forex industry known for its strong tools and analytical functions. Although MetaTrader 4 is highly regarded, additional platform options or mobile trading improvements are not specified in the available materials, which may limit user choice compared to brokers offering many platforms.

Regional Restrictions :

No detailed information on specific regional restrictions is provided, though reports suggest that regional differences exist—particularly about leverage limits and maybe other regulatory requirements as required by local authorities.

Customer Service Languages :

Tigerwit supports customer service in multiple languages, serving a diverse client base. However, detailed information about availability hours or response times remains limited.

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

Several factors stand out when looking at Tigerwit's account conditions. The broker's entry barrier is very low, with a minimum deposit requirement of 50 USD, which theoretically makes it suitable for new traders. But while a low deposit requirement looks attractive, the lack of detail about account types, commission fees, and spread specifics hurts its competitive appeal when compared to more transparent brokers. The promise of maximum leverage of 1:400 could be seen as either good or risky, especially in places where higher leverage can lead to bigger losses. The missing detailed information on the account opening process makes things more complicated. Overall, the account conditions are mixed: easy to access on paper but likely to have hidden costs and operational confusion. This analysis matches user feedback that points out low initial costs but highlights concerns about cost transparency.

used: tigerwit review*

Looking at Tigerwit's tools and resources, using the MetaTrader 4 platform is a big plus. This platform is well known for its analytical tools, charting abilities, and automated trading features. But despite using such a respected platform, there is little in the way of additional research materials or educational content that could help new traders improve their skills. The broker does not seem to offer specialized tutorials, market research reports, or special trading tools beyond what MetaTrader 4 naturally provides. So while the technical setup is solid, the surrounding resources that could make the trading experience better remain limited. Overall, Tigerwit offers a standard set of tools but lacks innovation in education and detailed market insights. This matches user reports that like the platform's abilities but want more complete trading support.

used: tigerwit review*

6.3 Customer Service and Support Analysis

Tigerwit tries to offer multi-language customer support with promises of fast response times. This is important in the forex world where quick solutions to technical or trading problems are crucial. But detailed feedback about the actual performance of their customer support remains hard to find. In many online reviews, while the promise of multilingual support is appreciated, the specifics about process efficiency—like average response time or how well issues get resolved—are not well documented. The lack of clear metrics or verifiable case studies on customer service outcomes adds to uncertainties, especially for traders who may need quick support in volatile market conditions. So while the theoretical framework of Tigerwit's customer support is in place, the practical execution seems uneven. Users should be careful and perhaps look for independent feedback on support efficiency before putting in significant capital.

6.4 Trading Experience Analysis

A strong trading experience depends on platform stability, order execution efficiency, and a user-friendly interface. Tigerwit uses the MetaTrader 4 platform, which in theory provides a dependable trading environment. But a critical problem is the currently unreachable website—a major red flag. This disruption seriously hurts the ability of traders to execute orders quickly, access account information, or use customer support services. Also, there is no detailed information available about order execution quality, like incidents of slippage or re-quotes, which are common concerns for many traders. The limited operational functionality combined with these technical problems negatively affects the overall trading experience. In summary, even though the underlying platform is trusted, the challenges with website accessibility and unclear execution metrics greatly hurt the practical day-to-day trading environment.

used: tigerwit review*

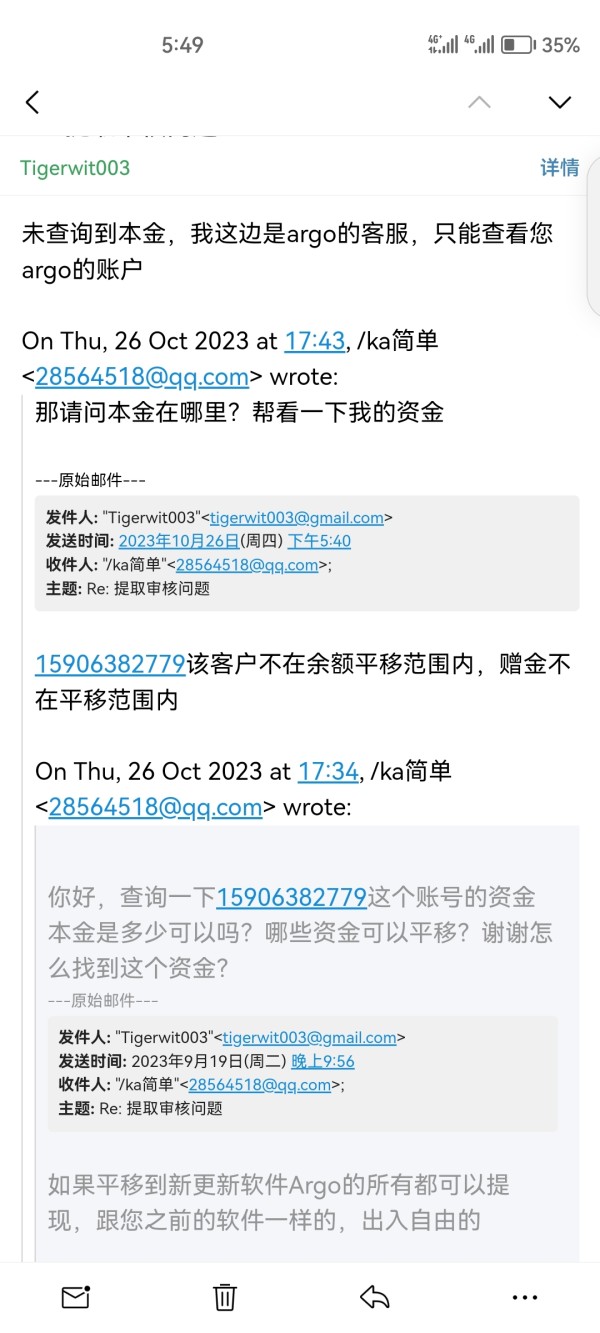

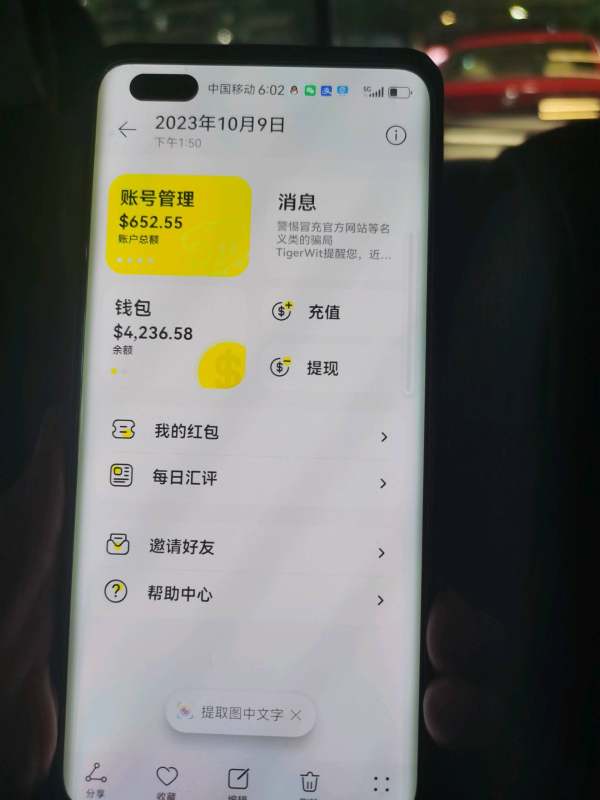

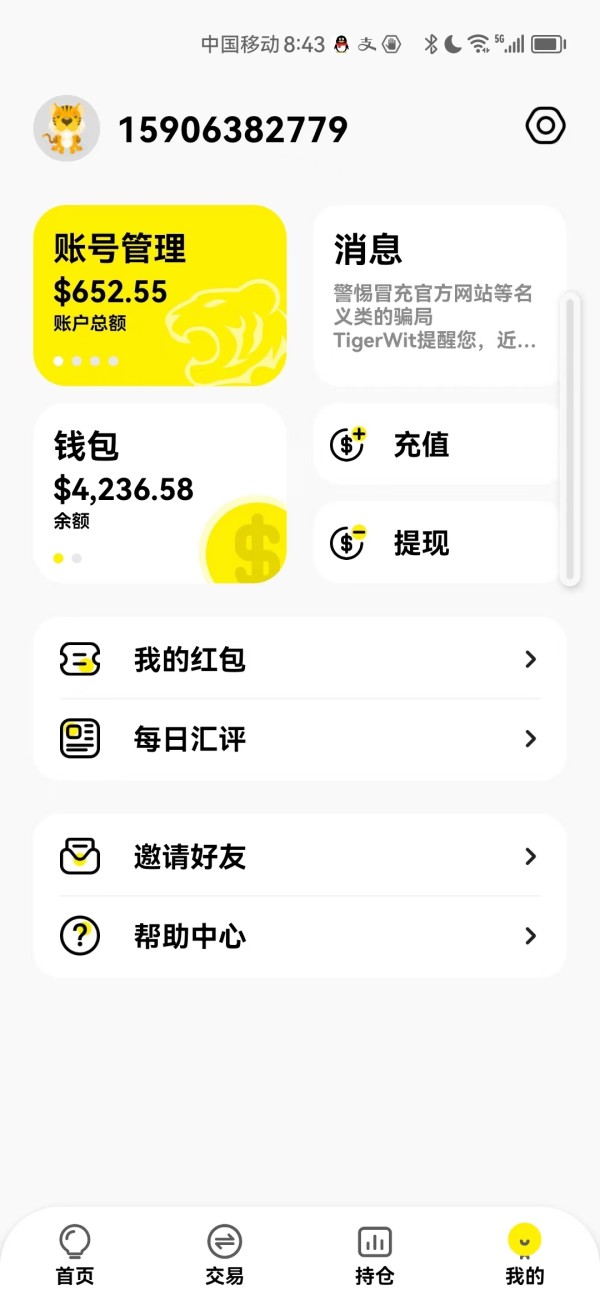

6.5 Trustworthiness Analysis

Trust is a cornerstone of any successful forex broker, and Tigerwit currently falls short in this area. The reported TrustScore of 2.87, based on 13 user evaluations, clearly shows widespread dissatisfaction. This low score suggests that users have faced issues possibly ranging from unclear fee structures to difficulties in accessing the platform. Also, the absence of clear regulatory information and licensing details further reduces trust, as regulatory oversight is very important for ensuring client fund protection and operational transparency. Industry experts and user reports have marked these missing elements as significant red flags. Together, the combination of a poor TrustScore, operational uncertainties, and the general lack of verifiable compliance data contributes to an overall negative picture about Tigerwit's reliability and integrity.

6.6 User Experience Analysis

User experience includes the entirety of a trader's interaction with a broker, from registration to executing trades. In the case of Tigerwit, while the low minimum deposit and access to a range of asset classes make for an appealing offer on paper, several practical issues hurt the overall experience. The damaged reputation—as shown by a TrustScore of 2.87—and the present inability to access the official website result in a disconnected, frustrating user journey. Also, the review data does not provide any detailed insight into other critical aspects like how intuitive the interface is, ease of registration, or processing speeds of funds transfers. This uncertainty leads to an overall user experience that is far from satisfactory. Potential clients, while attracted by the promise of cost-effective entry to trading, may ultimately be turned away by these operational problems and the general lack of clarity that characterizes Tigerwit's service delivery.

used: tigerwit review*

7. Conclusion

In summary, the overall evaluation of Tigerwit shows a broker that presents an attractive entry-level opportunity with a low minimum deposit and high leverage options. Yet it suffers from significant operational and transparency issues. The TrustScore of 2.87 and the current inability to access its website highlight serious concerns about reliability and efficiency. While Tigerwit might be suitable for traders looking to start in the forex market with minimal capital, potential investors should be very careful and consider alternative brokers with better-established reputations. This tigerwit review calls for prospective users to weigh the benefits of low entry barriers against the considerable risks associated with trust and service quality.

Note: All information provided in this review is based on the latest available market data, user feedback, and reputable industry reports as of 2023-10. Potential users are encouraged to verify details specific to their jurisdiction before engaging with Tigerwit.