SVSFX 2025 Review: Everything You Need to Know

Executive Summary

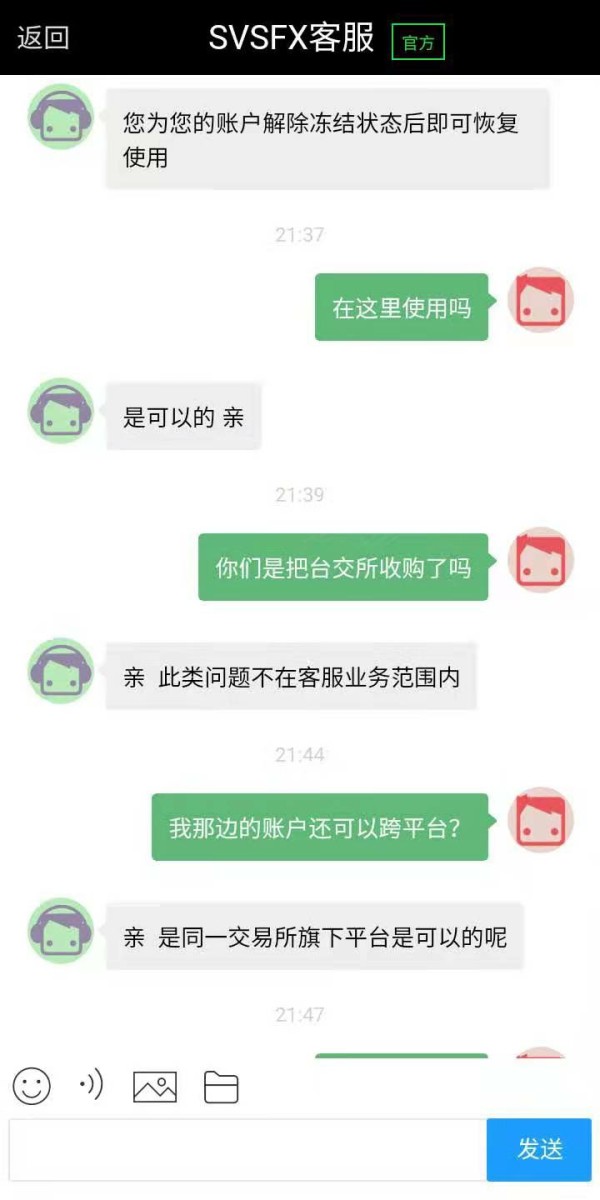

SVSFX is a regulated forex and CFD broker that has been operating since 2003. The company positions itself as a service provider for both retail and institutional clients. This SVSFX review reveals a mixed picture of a broker with legitimate regulatory backing but concerning user feedback regarding transparency and trustworthiness. The broker operates under SVS Securities PLC, which is listed on the London Stock Exchange and regulated by the UK's Financial Conduct Authority.

The platform offers MetaTrader 4 and MT Mobile trading platforms. These platforms focus primarily on forex and CFD trading services. While SVSFX has established regulatory credentials and over two decades of operational history, user reviews and industry assessments suggest significant concerns about the broker's overall reliability and service quality. The broker's global ranking of 1290 and a safety score of 50 indicate below-average performance compared to industry standards.

For traders considering SVSFX, this review provides a comprehensive analysis of the broker's offerings, regulatory status, and user experiences. The analysis helps traders make an informed decision about whether this platform aligns with their trading needs and risk tolerance.

Important Disclaimers

This evaluation is based on publicly available information and user feedback current as of 2025. SVSFX operates primarily in the UK under FCA regulation, and regulatory standards may differ across various jurisdictions. Traders should be aware that regulatory protections and service offerings may vary depending on their location and the specific entity they are dealing with.

The assessment methodology employed in this review relies on available public information, user testimonials, and industry data. Given the limited transparency in some areas of SVSFX's operations, certain aspects of this review are based on incomplete information. This has been clearly indicated throughout the analysis.

Overall Rating Framework

Broker Overview

SVSFX was established in 2003 as a brand of SVS Securities PLC. The company is registered in London, England, and publicly traded on the London Stock Exchange. This long operational history suggests institutional stability, though recent user feedback raises questions about service quality and transparency. The broker has positioned itself to serve both retail and institutional clients seeking exposure to foreign exchange and contract for difference trading opportunities.

The company's business model centers on providing access to global financial markets through electronic trading platforms. The broker places particular emphasis on forex and CFD instruments. As a subsidiary of a publicly listed company, SVSFX operates within an established corporate structure that theoretically provides additional oversight and accountability compared to privately held brokerages.

The broker offers MetaTrader 4 and MT Mobile trading platforms, catering to different trader preferences and technical requirements. The platform selection includes both desktop and mobile solutions, allowing clients to access markets from various devices. SVSFX operates under the regulatory oversight of the UK's Financial Conduct Authority, which provides a framework for client fund protection and operational standards. However, specific license details were not readily available in public documentation.

Regulatory Jurisdiction: SVSFX operates under UK Financial Conduct Authority regulation. This provides clients with regulatory protections standard to UK-based financial services providers. This regulatory framework includes compensation schemes and operational requirements designed to protect client interests.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available documentation. This represents a transparency gap that potential clients should address directly with the broker.

Minimum Deposit Requirements: The minimum deposit requirement information was not specified in available sources. This raises concerns about transparency in account opening procedures and cost expectations for new clients.

Bonus and Promotional Offers: No specific information about bonus programs or promotional offers was available in the reviewed documentation. This suggests either an absence of such programs or insufficient marketing transparency.

Tradeable Assets: SVSFX provides access to foreign exchange markets and contracts for difference. The broker covers major, minor, and exotic currency pairs along with various CFD instruments across different asset classes.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not readily available. This represents a significant transparency issue that affects the ability to assess the broker's competitiveness in pricing.

Leverage Ratios: Specific leverage information was not detailed in available sources. However, as an FCA-regulated entity, the broker would be subject to European Securities and Markets Authority leverage restrictions for retail clients.

Platform Options: The broker provides MetaTrader 4 and MT Mobile platforms. These offer both desktop and mobile trading solutions with standard charting tools and technical analysis capabilities.

Geographic Restrictions: Specific geographic limitations were not detailed in available documentation. However, regulatory requirements typically restrict services in certain jurisdictions.

Customer Support Languages: Information about supported languages for customer service was not specified in available sources. This indicates another area where transparency could be improved.

Account Conditions Analysis

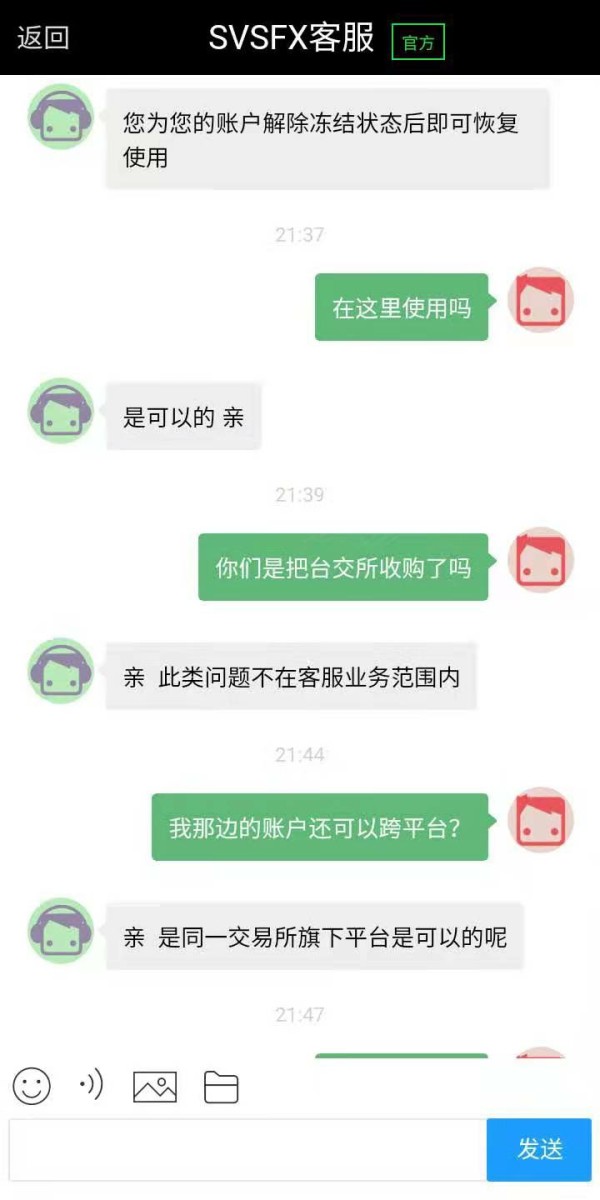

The account conditions offered by SVSFX present several transparency challenges that affect the overall assessment of this SVSFX review. Available information does not specify the different account types available, their respective features, or the minimum deposit requirements for each tier. This lack of clarity makes it difficult for potential clients to understand what they can expect when opening an account with the broker.

The account opening process details were not comprehensively outlined in available documentation. This raises questions about the efficiency and user-friendliness of the onboarding experience. Modern traders typically expect clear, streamlined processes with transparent requirements and timelines, and the absence of this information in public documentation suggests potential areas for improvement.

Special account features such as Islamic accounts, professional trading accounts, or institutional-grade services were not specifically mentioned in available sources. Given the broker's stated focus on both retail and institutional clients, the lack of detailed information about differentiated service offerings represents a significant gap in transparency.

User feedback regarding account conditions has been mixed. Some clients express concerns about unclear terms and conditions. The absence of readily available information about account features, costs, and requirements contributes to user uncertainty and affects the broker's overall credibility in the competitive forex market.

SVSFX's trading infrastructure centers around MetaTrader 4 and MT Mobile platforms, which represent industry-standard solutions for forex and CFD trading. MetaTrader 4 provides comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. However, the broker's offering appears limited compared to competitors who provide additional proprietary tools and resources.

The availability of research and market analysis resources was not detailed in available documentation. This suggests either a limited offering in this area or insufficient transparency about available services. Modern traders typically expect access to market commentary, economic calendars, and analytical tools to support their trading decisions.

Educational resources, which are crucial for trader development and broker differentiation, were not specifically mentioned in available sources. The absence of information about webinars, tutorials, trading guides, or educational materials represents a potential weakness in the broker's value proposition. This is particularly true for newer traders.

Automated trading support through the MetaTrader 4 platform provides some capability for algorithmic trading strategies. However, specific information about server specifications, execution speeds, or additional automation tools was not readily available. This limitation affects the assessment of the broker's suitability for more sophisticated trading approaches.

Customer Service and Support Analysis

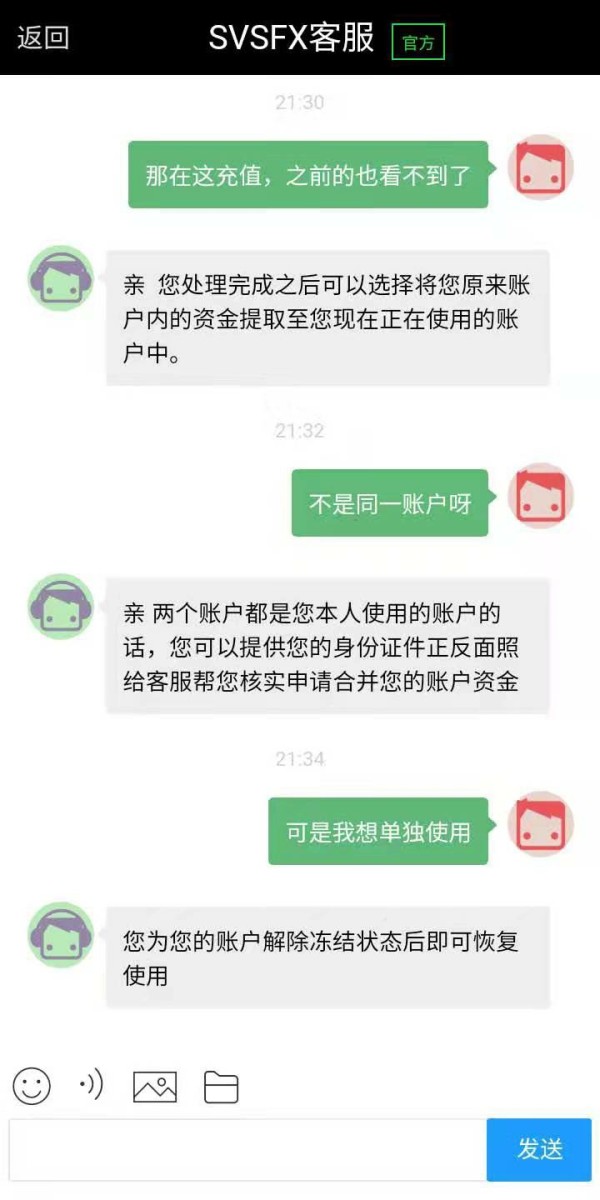

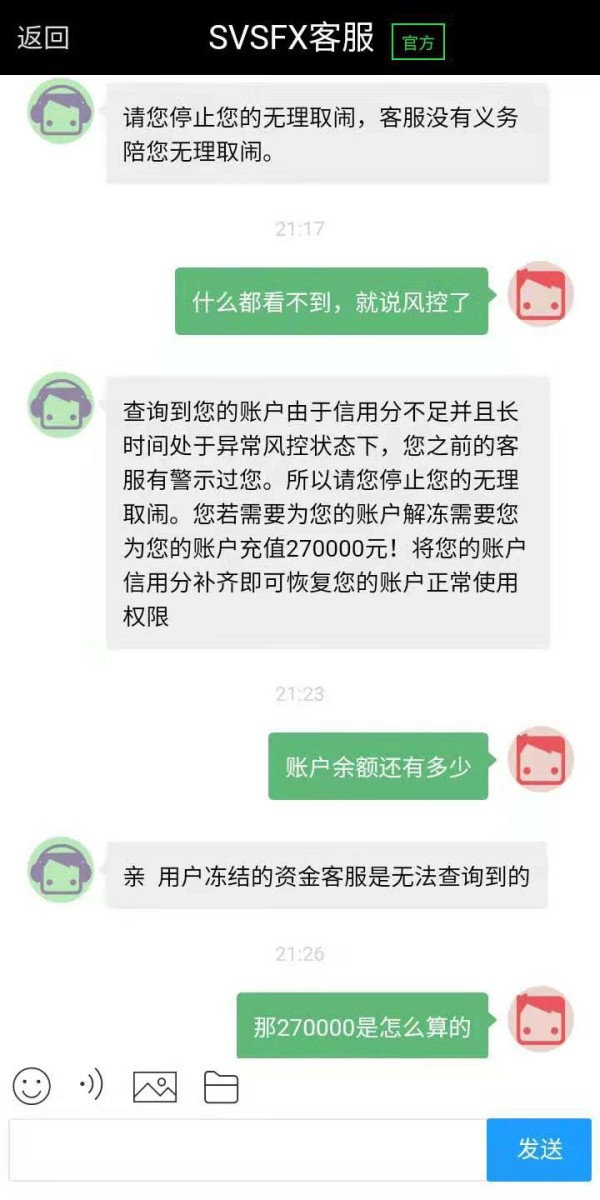

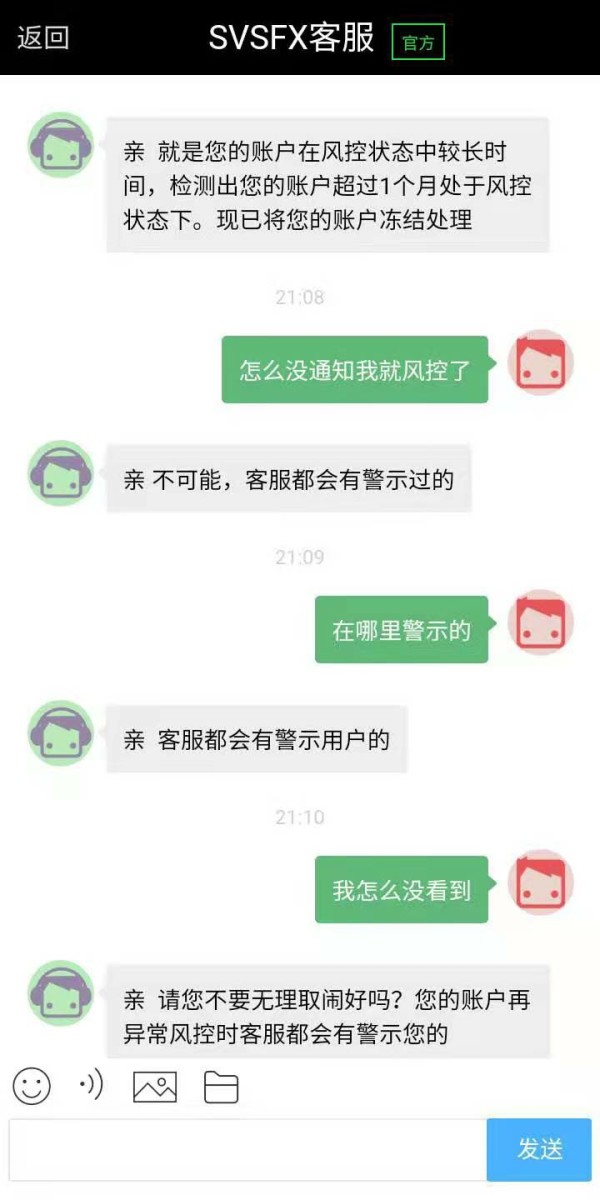

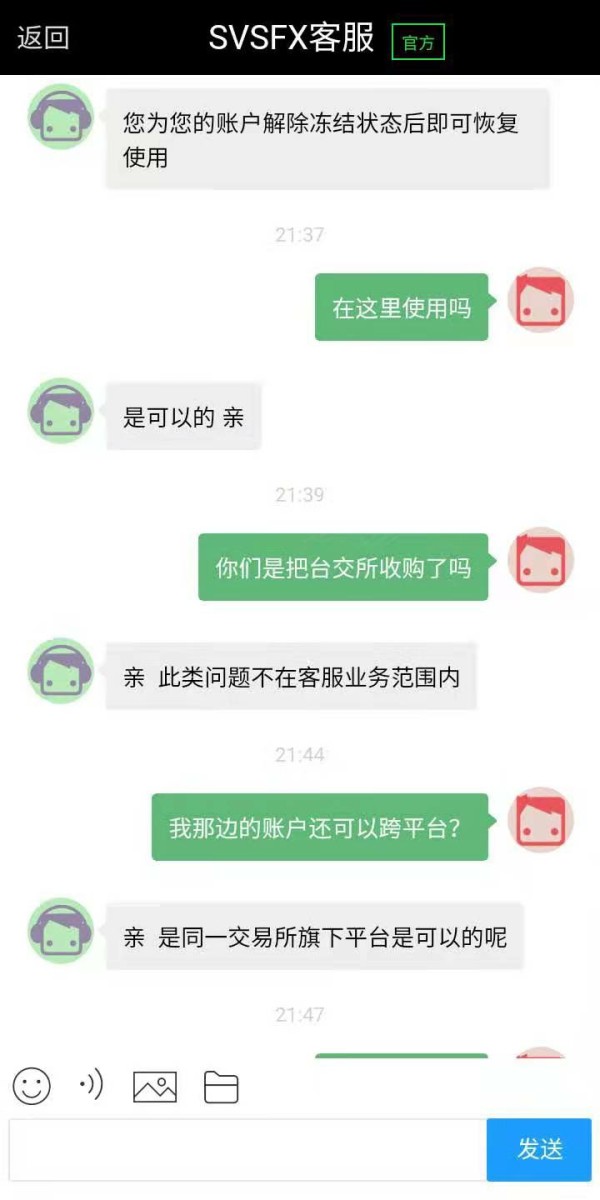

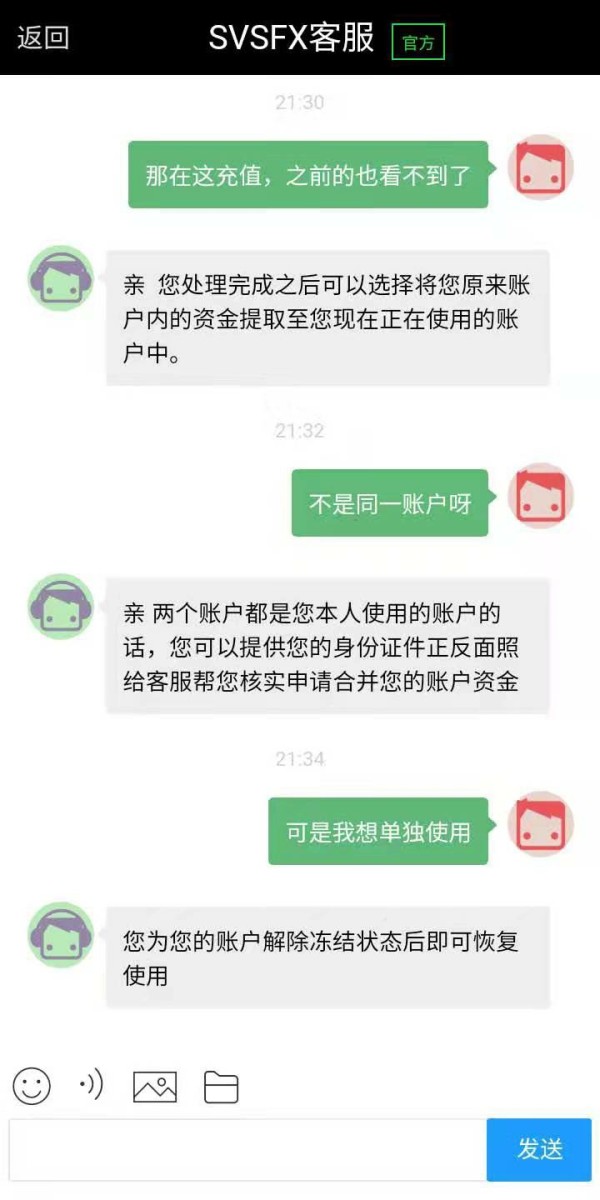

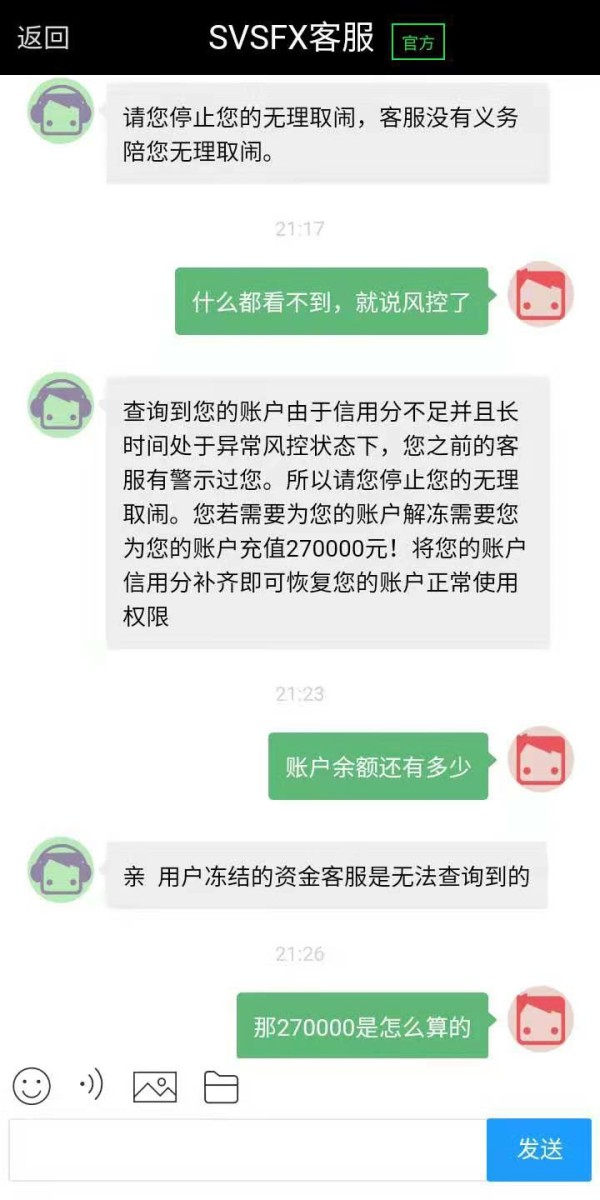

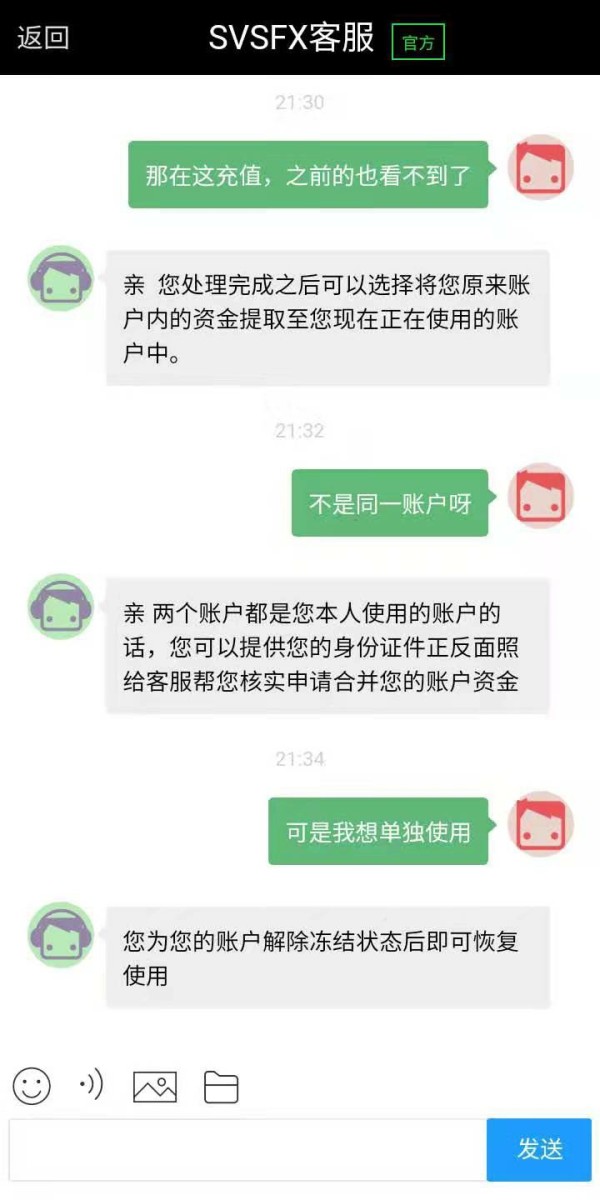

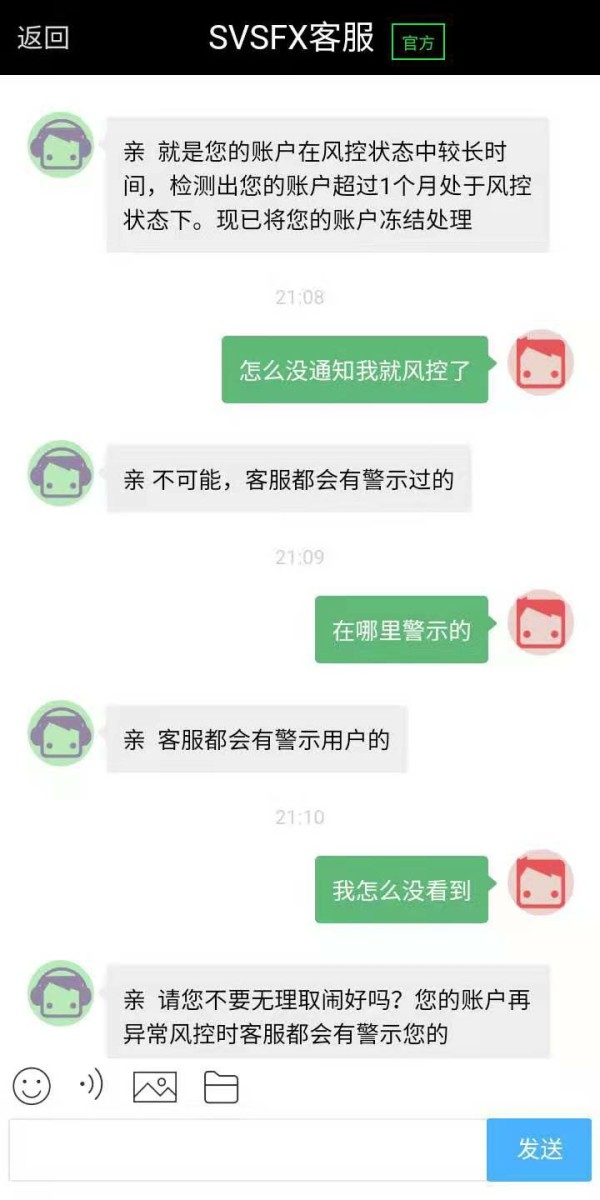

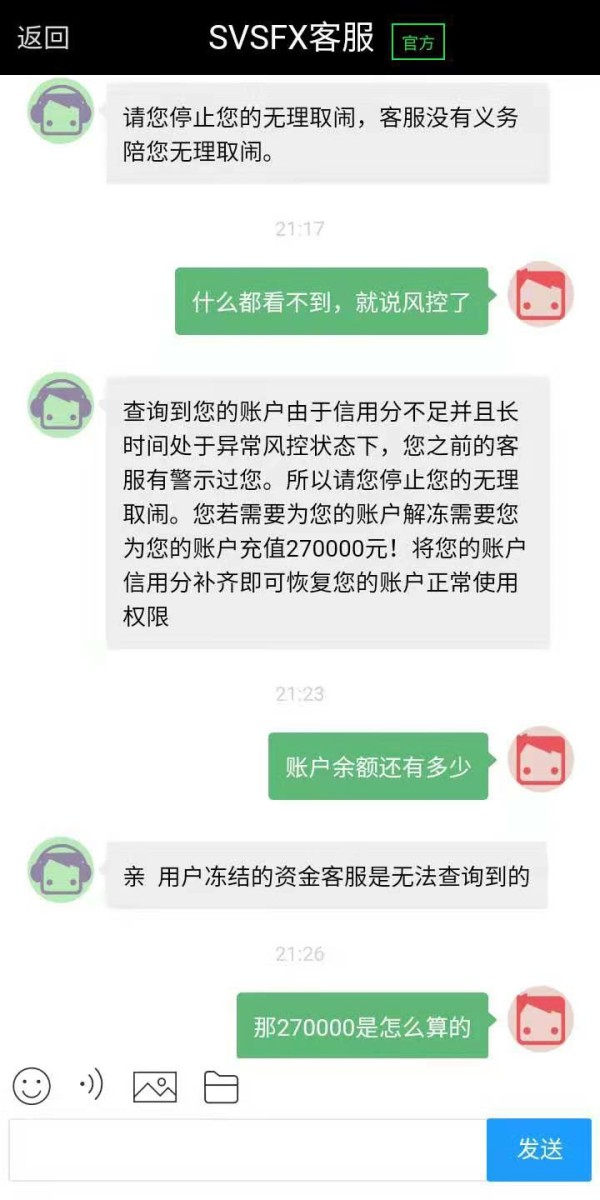

Customer service quality represents a significant concern area based on available user feedback and the lack of detailed information about support channels and availability. User reviews present inconsistent experiences with customer support, ranging from satisfactory interactions to complaints about responsiveness and problem resolution effectiveness.

The specific customer service channels available were not comprehensively detailed in available documentation. This makes it difficult to assess the accessibility and convenience of support options. Modern brokers typically provide multiple contact methods with clearly stated availability hours and response time expectations.

Response time performance data was not available in reviewed sources. However, user feedback suggests inconsistent experiences with support ticket resolution and inquiry handling. Some users have reported delays in receiving responses to important account-related questions, which affects overall service quality perception.

Multilingual support capabilities were not specified in available documentation. This could limit the broker's accessibility for international clients. Given the global nature of forex trading, language support represents an important service differentiator that affects user experience quality.

The quality of problem resolution has received mixed reviews from users. Some express satisfaction while others report difficulties in getting issues addressed effectively. This inconsistency in service quality contributes to the moderate rating assigned to customer support in this evaluation.

Trading Experience Analysis

The trading experience with SVSFX centers around the MetaTrader 4 and MT Mobile platforms, which provide standard functionality for forex and CFD trading. However, user feedback suggests concerns about platform stability and overall trading environment quality that affect the SVSFX review assessment.

Platform stability and execution speed data were not comprehensively available in reviewed sources. Some user feedback indicates occasional technical issues and concerns about order execution quality. Reliable platform performance is crucial for effective trading, and any instability can significantly impact trading outcomes and user satisfaction.

Order execution quality, including slippage rates, rejection frequencies, and fill rates, was not detailed in available documentation. This lack of transparency about execution statistics makes it difficult for traders to assess whether the broker can meet their performance expectations. This is particularly true for active trading strategies.

The completeness of platform functionality, including charting tools, technical indicators, and analytical capabilities, appears standard for MetaTrader 4 implementations. However, additional proprietary tools or enhanced features that might differentiate the broker's offering were not specifically mentioned in available sources.

Mobile trading experience through MT Mobile provides basic functionality for on-the-go trading. However, detailed user feedback about mobile platform performance, reliability, and feature completeness was not comprehensively available in reviewed documentation.

The overall trading environment, including factors such as spreads, liquidity, and market access, received mixed feedback from users. Some express concerns about trading conditions and cost competitiveness compared to alternative brokers in the market.

Trust and Security Analysis

The trust and security assessment of SVSFX reveals a complex picture of regulatory legitimacy combined with user confidence concerns. While the broker operates under FCA regulation through SVS Securities PLC, which is listed on the London Stock Exchange, user feedback and industry ratings suggest trust issues that affect the overall SVSFX review evaluation.

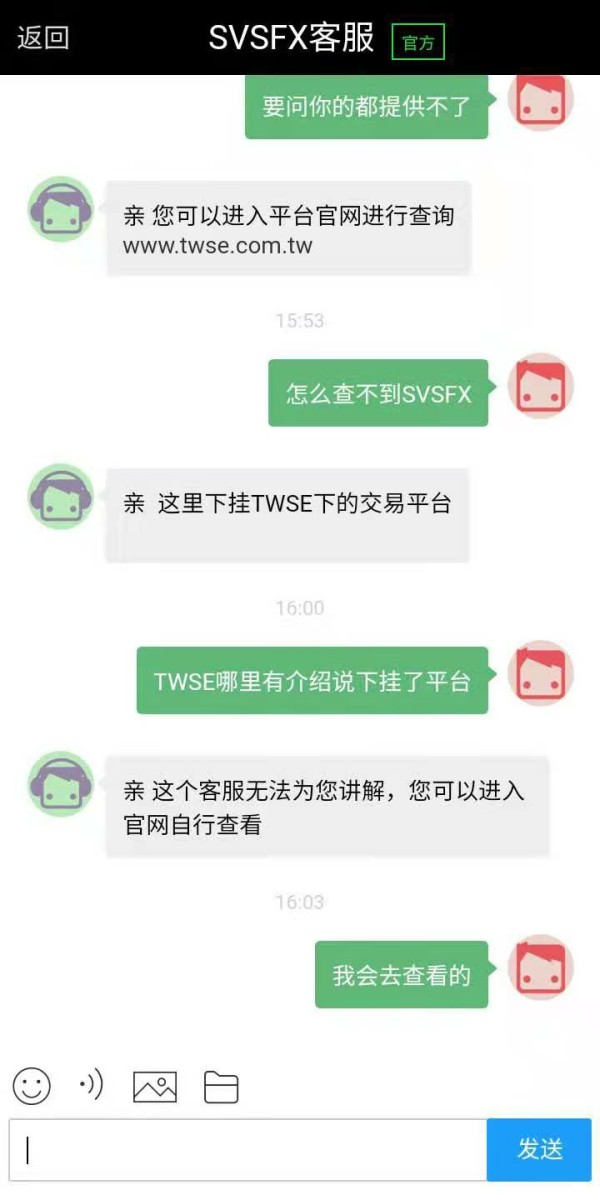

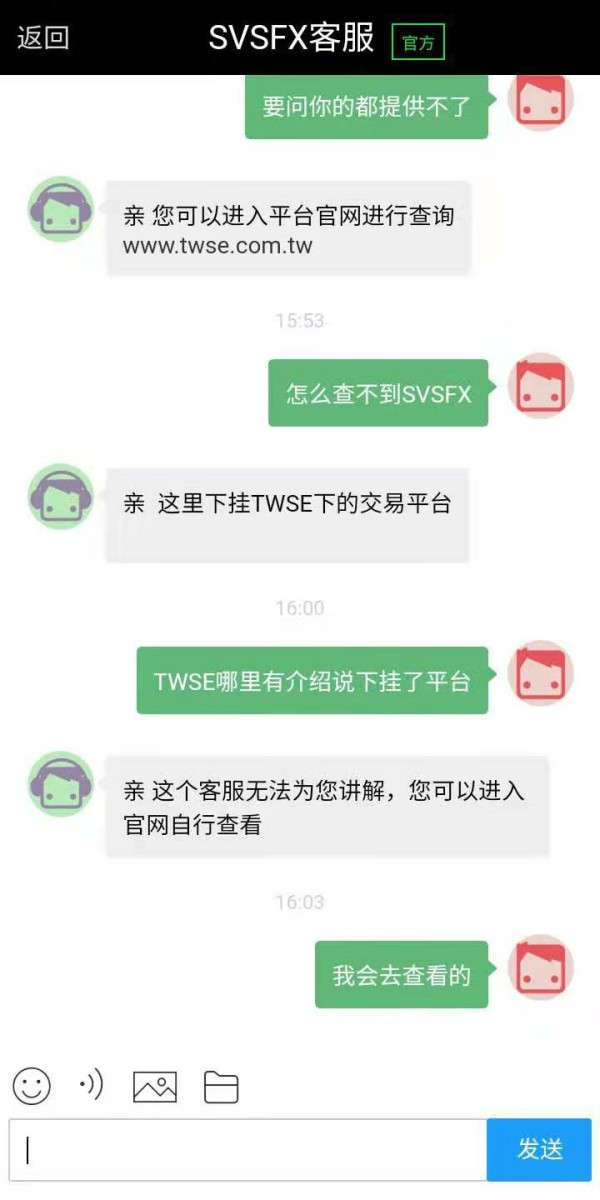

Regulatory credentials include FCA oversight, which provides a framework for client fund protection, operational standards, and dispute resolution mechanisms. However, specific license numbers and detailed regulatory information were not readily available in public documentation. This affects transparency and verification capabilities.

Fund safety measures, including client money segregation, compensation scheme participation, and operational risk controls, were not comprehensively detailed in available sources. This lack of transparency about security measures contributes to user uncertainty about fund protection and safety protocols.

Company transparency presents mixed signals. The parent company being publicly listed provides some level of corporate oversight, but limited disclosure about business operations, financial performance, and risk management affects overall transparency assessment.

Industry reputation indicators, including a global ranking of 1290 and a safety score of 50, suggest below-average performance compared to industry standards. These metrics reflect concerns about service quality, reliability, and overall market position relative to competing brokers.

User trust feedback reveals significant concerns. Some clients question the broker's legitimacy and express worries about fund safety. These trust issues, combined with limited transparency in key operational areas, contribute to the moderate security rating assigned in this evaluation.

User Experience Analysis

Overall user satisfaction with SVSFX presents a mixed picture, with experiences varying significantly among different client segments and usage patterns. The diversity in user feedback suggests inconsistent service delivery and potential issues with meeting client expectations across different aspects of the trading experience.

Interface design and usability feedback was limited in available sources. The use of standard MetaTrader platforms provides familiar functionality for experienced traders. However, the lack of proprietary interface innovations or enhanced user experience features may limit appeal for traders seeking more advanced or customized solutions.

Registration and account verification processes were not detailed in available documentation. This represents a gap in understanding the user onboarding experience. Efficient and transparent account opening procedures are crucial for positive first impressions and user satisfaction.

Funding operation experiences, including deposit and withdrawal processes, received mixed feedback from users. Some express concerns about transaction processing times and procedures. The lack of detailed information about payment methods and processing timelines affects the assessment of operational efficiency.

Common user complaints center around concerns about legitimacy, fund safety, and service quality consistency. These recurring themes in user feedback suggest systemic issues that affect overall user experience and satisfaction levels.

The user demographic appears to include both retail and institutional clients. However, specific feedback from different client segments was not comprehensively available. Understanding the varied needs and experiences of different user types would provide better insight into the broker's effectiveness in serving diverse client requirements.

Conclusion

This comprehensive SVSFX review reveals a broker with legitimate regulatory backing but significant concerns about transparency, user trust, and service quality. While SVSFX operates under FCA regulation and has over two decades of operational history, the combination of limited transparency, mixed user feedback, and below-average industry ratings suggests caution for potential clients.

The broker may be suitable for traders specifically seeking FCA-regulated access to forex and CFD markets through standard MetaTrader platforms. This is particularly true for those who prioritize regulatory oversight over enhanced features or superior service quality. However, the lack of transparency in key areas such as costs, account conditions, and operational procedures represents significant limitations.

The main advantages include regulatory legitimacy through FCA oversight and the stability associated with being part of a publicly listed company. However, significant disadvantages include limited transparency, inconsistent user experiences, below-average industry ratings, and concerns about service quality and trustworthiness. These factors affect the overall value proposition for most traders.