Regarding the legitimacy of TFY forex brokers, it provides VFSC and WikiBit, .

Is TFY safe?

Pros

Cons

Is TFY markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

TFY GLOBAL MARKETS LIMITED

Effective Date:

2017-05-02Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Tfy Safe or Scam?

Introduction

Tfy Forex is a relatively new player in the foreign exchange market, aiming to provide trading opportunities for both novice and experienced traders. As with any broker in the financial sector, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is known for its volatility and the potential for scams, making it essential for traders to evaluate the legitimacy and trustworthiness of brokers like Tfy. In this article, we will analyze Tfy's regulatory status, company background, trading conditions, customer experiences, and overall risk profile to determine whether Tfy is safe or a scam.

To assess Tfy, we will utilize a structured evaluation framework that includes a review of regulatory compliance, company history, trading conditions, customer feedback, and risk assessment. This comprehensive approach will provide a clear picture of Tfy's standing in the forex market.

Regulation and Legitimacy

The regulatory environment is a critical aspect of any forex broker's credibility. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect investors' interests. Tfy claims to be regulated in Vanuatu, a jurisdiction known for its lenient regulatory framework. However, many traders express concern about the quality of regulation in such regions.

Here is a summary of Tfy's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | Not provided | Vanuatu | Revoked |

The current status of Tfy's regulatory license is alarming. The VFSC has revoked its license, raising significant red flags about the broker's legitimacy. A revoked license indicates that the broker may not comply with regulatory requirements, which can put traders' funds at risk. Furthermore, Tfy is not regulated by any top-tier authorities such as the FCA (UK) or ASIC (Australia), which would provide a higher level of investor protection. Therefore, when considering the question, "Is Tfy safe?" the answer leans towards caution due to its questionable regulatory standing.

Company Background Investigation

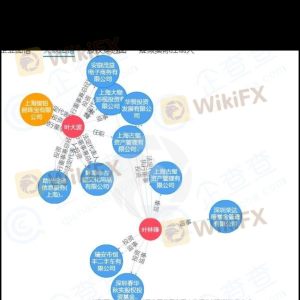

Tfy Forex was established with the intent to cater to a global trading audience. However, the lack of transparency regarding its ownership structure and management team raises concerns about its credibility. Information regarding the company's founders and executive team is sparse, making it difficult to assess their qualifications and experience in the financial sector.

The absence of a robust corporate history and the lack of detailed disclosures about the management team contribute to the uncertainty surrounding Tfy's operations. A reputable broker typically provides comprehensive information about its history, ownership, and management to instill confidence in potential clients. Unfortunately, Tfy falls short in this regard, further questioning its safety and reliability.

Moreover, the company's website does not provide adequate information about its operational practices, which is another indicator of potential issues. Transparency is key in the forex industry, and Tfy's lack of information raises the question: "Is Tfy safe for traders?"

Trading Conditions Analysis

Understanding the trading conditions offered by Tfy is essential for evaluating its overall reliability. The broker claims to provide competitive spreads and various trading instruments; however, detailed information about fees and commissions is not readily available. This lack of transparency can be a significant drawback for traders who need to assess the cost of trading accurately.

Here is a comparison of Tfy's core trading costs with industry averages:

| Fee Type | Tfy Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not disclosed | Varies (often $0 - $10 per lot) |

| Overnight Interest Range | Not disclosed | Varies by currency pair |

The absence of clear information on spreads, commissions, and overnight fees makes it challenging to determine whether Tfy's trading conditions are competitive. Furthermore, traders should be wary of any hidden fees that could erode their profits. A broker that lacks transparency in its fee structure raises further concerns about its legitimacy, leading to the question: "Is Tfy safe for trading?"

Customer Fund Security

When evaluating a broker's safety, the security of customer funds is paramount. Tfy claims to implement measures such as segregated accounts to protect clients' funds. However, the effectiveness of these measures is questionable given the revoked regulatory license.

Additionally, the absence of negative balance protection, which ensures that traders cannot lose more than their initial investment, is a significant concern. Traders should be aware of the risks associated with trading with a broker that does not offer such protections, as it can lead to substantial financial losses in volatile market conditions.

Historically, there have been reports of withdrawal issues and complaints from customers regarding difficulty in accessing their funds. Such issues raise alarms about the broker's reliability and further contribute to the skepticism surrounding Tfy's safety.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reputation. A review of online forums and complaint platforms reveals a pattern of dissatisfaction among Tfy's clients. Common complaints include difficulties with withdrawals, lack of responsive customer service, and issues with trade execution.

Here is a summary of the primary complaint types associated with Tfy:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response, unresolved |

| Customer Service | Medium | Delayed replies, lack of support |

| Trade Execution | Medium | Reports of slippage and re-quotes |

One notable case involved a trader who reported being unable to withdraw their funds after multiple requests. This situation highlights the potential risks associated with trading with Tfy and raises the question: "Is Tfy safe for your investments?"

Platform and Trade Execution

The trading platform is another critical factor in evaluating a broker's reliability. Tfy offers a trading platform that is commonly used in the industry; however, user experiences indicate that the platform may suffer from performance issues, including slippage and slow execution times.

Traders have reported instances of orders not being executed at the desired price, which can significantly impact trading outcomes. Additionally, any signs of market manipulation or unfair practices on the platform would further question the broker's integrity.

Risk Assessment

In summary, the overall risk of using Tfy is elevated due to its questionable regulatory status, lack of transparency, and negative customer feedback. Here is a risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked license from VFSC |

| Financial Risk | High | Reports of withdrawal issues |

| Operational Risk | Medium | Complaints about trade execution |

To mitigate these risks, traders should consider using only well-regulated brokers with a proven track record. Conducting thorough research and using demo accounts to test platforms before investing real funds is also advisable.

Conclusion and Recommendations

Based on the comprehensive analysis, it is evident that Tfy poses several risks that warrant caution. The revoked regulatory license, lack of transparency, and negative customer experiences raise significant concerns about its safety. Therefore, the answer to the question, "Is Tfy safe?" is a resounding no—traders should exercise extreme caution when considering this broker.

For those looking for reliable alternatives, consider brokers regulated by top-tier authorities such as the FCA or ASIC, which offer robust investor protections and transparent trading conditions. Always prioritize your capital's safety by choosing brokers with a solid reputation and positive customer feedback.

Is TFY a scam, or is it legit?

The latest exposure and evaluation content of TFY brokers.

TFY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TFY latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.