Regarding the legitimacy of TigerWit forex brokers, it provides SFC, FCA, SCB and WikiBit, (also has a graphic survey regarding security).

Is TigerWit safe?

Pros

Cons

Is TigerWit markets regulated?

The regulatory license is the strongest proof.

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

TigerWit (Hong Kong) Limited

Effective Date:

2019-12-12Email Address of Licensed Institution:

jim@tigerwit.comSharing Status:

No SharingWebsite of Licensed Institution:

www.tigerwit.comExpiration Time:

--Address of Licensed Institution:

Office 58, 11/F Admiralty Centre Tower 2, 18 Harcourt Road, Admiralty, Hong KongPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Calico Capital Limited

Effective Date:

2016-01-26Email Address of Licensed Institution:

simon@calicocapital.coSharing Status:

No SharingWebsite of Licensed Institution:

calicocapital.coExpiration Time:

2024-06-28Address of Licensed Institution:

18th Floor, Signature 100 Bishopsgate London EC2N 4AGE C 2 N 4 A G UNITED KINGDOMPhone Number of Licensed Institution:

+44 07712535281Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

TigerWit Limited

Effective Date:

--Email Address of Licensed Institution:

compliance@tigerwit.com, darell.taylor@tigerwit.com, jacquelin.hunt@tigerwit.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Sea Sky Lane, Sandyport, Nassau, Bahamas, 7th Floor, Augustine House, 6a Austin Friars, London, EC2N 2HA, United KingdomPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is TigerWit A Scam?

Introduction

TigerWit is a forex and CFD broker that has positioned itself as a player in the global trading market since its inception in 2015. Based in the UK, it aims to provide a user-friendly trading experience through its advanced platforms and a range of trading instruments. However, with the rise of online trading, the market has also seen an influx of unregulated brokers, making it imperative for traders to exercise caution and conduct thorough evaluations before engaging with any broker. This article adopts a comprehensive investigative approach, utilizing various sources and data points to assess TigerWits credibility, regulatory compliance, and overall trading conditions.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the trading industry. A broker's regulatory status not only ensures adherence to industry standards but also provides a safety net for traders. TigerWit claims to be regulated by the Financial Conduct Authority (FCA) in the UK and the Securities Commission of the Bahamas (SCB). The significance of these regulatory bodies cannot be overstated, as they are tasked with safeguarding traders' interests and ensuring fair trading practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 679941 | United Kingdom | Active |

| SCB | SIA-F185 | Bahamas | Active |

Despite being regulated by the FCA, concerns have been raised regarding the quality of oversight provided by the SCB, which is often perceived as less stringent compared to top-tier regulators. Furthermore, there have been reports of TigerWit facing compliance issues in the past, raising questions about its commitment to regulatory standards. Overall, while TigerWit does hold licenses from reputable authorities, the mixed reviews regarding its regulatory compliance warrant a cautious approach from potential traders.

Company Background Investigation

TigerWit was founded in 2015 and has since expanded its reach to various global markets. The company is registered in England and Wales, and its ownership structure is somewhat opaque, with limited publicly available information on its management team. This lack of transparency can be concerning for potential investors, as a clear understanding of the management's background and expertise is crucial for assessing a broker's reliability.

The management team at TigerWit is said to have diverse backgrounds in finance and technology, but specific details about their professional history remain scarce. This raises questions about the company's accountability and governance. A broker's transparency in disclosing its ownership and management structure is a vital aspect of building trust with its clients. Therefore, the ambiguous nature of TigerWits corporate structure and leadership may deter some traders from engaging with the broker.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is essential. TigerWit offers a competitive trading environment, with a minimum deposit requirement of $50 and leverage options up to 1:400, depending on the jurisdiction. However, the high leverage can pose significant risks, particularly for inexperienced traders.

| Fee Type | TigerWit | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | 0% | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads for major currency pairs are slightly above the industry average, TigerWit does not charge commissions on most trades, which can be appealing to many traders. However, the absence of negative balance protection raises concerns, especially for those who may be tempted to trade with high leverage. Traders need to be aware of the potential for significant losses in volatile market conditions, which can be exacerbated by high leverage and lack of protective measures.

Client Funds Security

The security of client funds is paramount when choosing a broker. TigerWit claims to implement robust security measures, including segregated accounts for client funds and adherence to regulatory requirements. This means that client funds are kept separate from the broker's operational funds, which is a standard practice among reputable brokers.

However, the effectiveness of these measures is contingent on the broker's operational integrity and regulatory compliance. There have been historical concerns regarding the safety of funds with certain brokers operating under less stringent regulations, particularly those based in offshore jurisdictions like the Bahamas. Therefore, while TigerWit asserts that it employs sound security practices, potential clients should remain vigilant and conduct their due diligence before depositing funds.

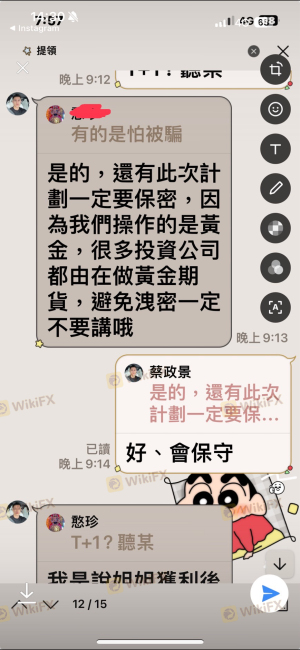

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. Reviews of TigerWit reveal a mixed bag of experiences, with some users praising its trading platform and customer service, while others express frustration over withdrawal issues and unresponsive support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| Platform Glitches | High | Limited Solutions |

Common complaints include difficulties in withdrawing funds, leading to frustration among traders. In some cases, users reported that their withdrawal requests were delayed or went unanswered. This lack of timely response can significantly affect a traders experience and raises concerns about the broker's operational efficiency. While some traders have had positive interactions with customer service, the inconsistency in response times and effectiveness is a point of concern.

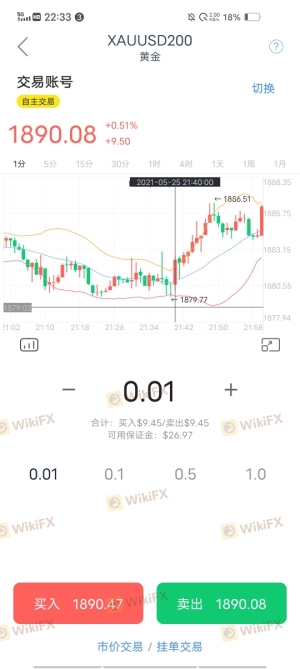

Platform and Trade Execution

The trading platform is a critical component of the trading experience. TigerWit utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and extensive analytical tools. However, user reviews indicate that there have been issues with order execution, including slippage and rejections.

The quality of order execution is vital for traders, particularly in fast-moving markets. Reports of frequent slippage and rejected orders can indicate potential manipulation or inefficiencies within the trading environment. Such practices are detrimental to traders and can significantly impact their profitability. Therefore, while MT4 is a solid platform, the execution quality at TigerWit raises red flags that potential traders should consider.

Risk Assessment

Engaging with any broker comes with inherent risks, and TigerWit is no exception. The combination of high leverage, mixed regulatory status, and customer complaints indicates a moderate to high risk level for potential traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Mixed reviews regarding adherence |

| Fund Security | Medium | Segregated accounts, but offshore risks |

| Customer Service Reliability | High | Numerous complaints about support |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and trading conditions. Additionally, setting strict risk management rules, including limiting leverage and using stop-loss orders, can help protect against significant losses.

Conclusion and Recommendations

In conclusion, while TigerWit presents itself as a legitimate forex and CFD broker, there are several concerns that potential traders should be aware of. The mixed regulatory status, customer complaints, and issues with trade execution suggest that caution is warranted.

Traders should consider their experience level and risk tolerance before engaging with TigerWit. For those who are new to trading, it may be prudent to explore alternative brokers with a stronger regulatory framework and a proven track record of customer satisfaction. Brokers like XTB, FP Markets, and HotForex may offer more reliable trading conditions and customer support.

In summary, while TigerWit is not outright a scam, the potential risks and historical complaints indicate that it may not be the best choice for all traders. Conduct thorough research and consider your options carefully before making a commitment.

Is TigerWit a scam, or is it legit?

The latest exposure and evaluation content of TigerWit brokers.

TigerWit Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TigerWit latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.