Regarding the legitimacy of SVSFX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is SVSFX safe?

Business

License

Is SVSFX markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

SVS Securities Plc

Effective Date:

2003-04-09Email Address of Licensed Institution:

info@svssecurities.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.svssecurities.comExpiration Time:

2023-08-31Address of Licensed Institution:

4th FloorPrinces Court7 Princes StreetLondonEC2R 8AQUNITED KINGDOMPhone Number of Licensed Institution:

442037000100Licensed Institution Certified Documents:

Is SVSFX A Scam?

Introduction

SVSFX is an online forex broker that has been operational since 2003, primarily focusing on foreign exchange (forex) and contracts for difference (CFD) trading for both retail and institutional clients. As the forex market continues to grow rapidly, traders are increasingly drawn to various brokers, each promising unique advantages in terms of trading conditions, platforms, and customer service. However, the proliferation of brokers has also led to a rise in fraudulent schemes, making it crucial for traders to evaluate the legitimacy and reliability of their chosen broker carefully. This article aims to assess whether SVSFX is a safe trading platform or if it raises red flags that should concern potential investors. Our evaluation is based on a thorough analysis of regulatory compliance, company background, trading conditions, customer safety measures, and user feedback.

Regulation and Legitimacy

When evaluating a forex broker, regulatory compliance is a fundamental aspect that traders must consider. SVSFX operates under the auspices of SVS Securities PLC, which claims to be regulated by the UK's Financial Conduct Authority (FCA). Regulatory oversight is essential as it ensures that brokers adhere to stringent financial standards, thus protecting traders' interests.

Here is a summary of SVSFX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 220929 | United Kingdom | In Administration |

The FCA is known for its rigorous standards, requiring brokers to maintain client funds in segregated accounts and adhere to strict operational guidelines. However, it is important to note that SVSFX's parent company, SVS Securities PLC, has been under special administration since August 2019. This situation raises questions about the broker's operational integrity and its ability to meet regulatory obligations. The FCA has issued warnings about SVSFX, indicating that while it may have been regulated in the past, its current status is questionable. Given these circumstances, traders should exercise caution when considering SVSFX as a trading platform.

Company Background Investigation

SVSFX was established in 2003 and has positioned itself as a provider of forex and CFD trading services. The broker is owned by SVS Securities PLC, a company headquartered in London. Over the years, SVSFX has aimed to cater to both retail and institutional clients, emphasizing a range of trading products and services tailored to meet diverse trading needs.

The management team behind SVSFX has a wealth of experience in the financial services sector, which can be a positive indicator for potential clients. However, the lack of transparency regarding the company's operational changes, particularly following its entry into special administration, raises concerns about its long-term viability. The company has faced scrutiny regarding its information disclosure practices, particularly in light of its current regulatory status. Investors should be aware of the potential risks associated with a broker that has undergone significant operational changes and lacks clear communication about its future.

Trading Conditions Analysis

SVSFX offers a variety of trading conditions, including different account types and fee structures. The broker primarily operates on a market-making model, which means that it acts as the counterparty to its clients' trades. This model can sometimes lead to conflicts of interest, particularly if the broker benefits from clients' losses.

The broker's fee structure is of particular interest to potential users. Here is a comparison of core trading costs:

| Fee Type | SVSFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.9 pips (EUR/USD) | 1.0 - 1.5 pips |

| Commission Model | No commission | Varies widely |

| Overnight Interest Range | Varies | Varies widely |

While SVSFX does not charge commissions on most accounts, its spreads are notably higher than the industry average. This could significantly impact profitability, especially for high-frequency traders. Additionally, the broker may impose fees for deposits and withdrawals, particularly for credit card transactions, which could further affect the overall trading cost. Traders should carefully assess these conditions before committing funds to SVSFX.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. SVSFX claims to implement several measures to protect client funds, including the use of segregated accounts. This practice ensures that client funds are kept separate from the broker's operational funds, providing a layer of protection in the event of insolvency.

Moreover, SVSFX is a member of the Financial Services Compensation Scheme (FSCS), which offers additional protection for clients should the broker fail. However, the ongoing special administration status of SVS Securities PLC raises concerns about the actual effectiveness of these safety measures. Historical issues regarding fund security can also affect a broker's reputation, and any past incidents involving lost or inaccessible funds should be scrutinized.

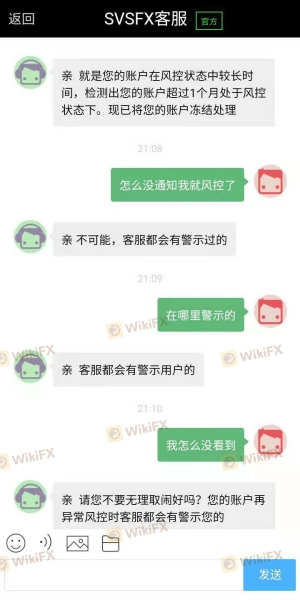

Customer Experience and Complaints

User feedback is a critical component in assessing whether SVSFX is a trustworthy broker. Various reviews indicate a mixed bag of experiences, with some users praising the broker's trading conditions and customer service, while others have reported difficulties with withdrawals and responsiveness.

Here are some common complaint types regarding SVSFX:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Availability | Medium | Mixed reviews |

| High Fees | Medium | Acknowledged |

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and dissatisfaction. Such complaints can be indicative of underlying operational issues and should not be taken lightly. Potential traders should consider these experiences and weigh them against their risk tolerance when evaluating SVSFX.

Platform and Trade Execution

The trading experience on SVSFX is primarily facilitated through the widely used MetaTrader 4 (MT4) platform. MT4 is known for its robust features, including advanced charting tools and automated trading capabilities. However, the platform's performance and execution quality are critical factors that can influence a trader's success.

While MT4 generally offers reliable performance, any signs of slippage or high rejection rates can be red flags. Traders should be wary of platforms that exhibit signs of manipulation or poor execution, as these can significantly impact trading outcomes.

Risk Assessment

Using SVSFX comes with inherent risks that traders should carefully evaluate. Here is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Ongoing special administration status raises concerns. |

| Fund Safety | Medium | Segregated accounts and FSCS membership offer some protection, but historical issues exist. |

| Execution Quality | Medium | Potential for slippage and execution delays. |

| Customer Support Availability | High | Mixed reviews on support responsiveness. |

To mitigate these risks, traders should conduct thorough due diligence, maintain a diversified trading strategy, and consider using smaller amounts of capital when starting with SVSFX.

Conclusion and Recommendations

In conclusion, while SVSFX has a history of operation in the forex market and is regulated by the FCA, its current status raises significant concerns. The ongoing special administration of its parent company, combined with mixed user reviews and higher-than-average trading costs, suggests that traders should approach SVSFX with caution.

For those considering forex trading, it may be prudent to explore alternative brokers with more stable regulatory standings and positive user feedback. Brokers such as IG, OANDA, or Forex.com may offer safer and more reliable trading environments. Ultimately, the decision to trade with SVSFX should be based on a careful assessment of the risks involved and the trader's individual circumstances.

In summary, is SVSFX safe? Given the potential risks and regulatory uncertainties, it would be wise for traders to consider their options carefully before proceeding.

Is SVSFX a scam, or is it legit?

The latest exposure and evaluation content of SVSFX brokers.

SVSFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SVSFX latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.