GM Trading 2025 Review: Everything You Need to Know

Executive Summary

GM Trading presents itself as a financial brokerage firm operating in the forex and trading markets. This gm trading review reveals several concerning aspects that potential traders should carefully consider. According to available information from WikiFX and other industry sources, GM Trading operates as an unregulated financial broker, which immediately raises significant red flags for serious traders seeking secure and compliant trading environments.

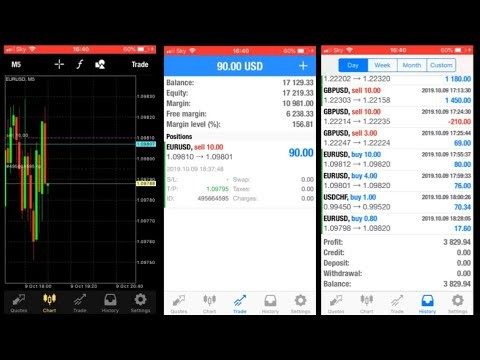

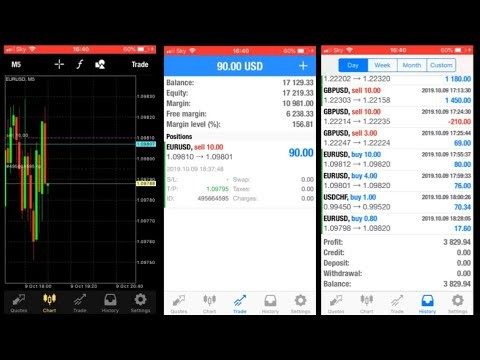

The broker offers multiple account types with varying deposit requirements. Standard accounts require a minimum deposit of $200. GM Trading provides access to popular trading platforms including MetaTrader 4 and MetaTrader 5, catering to traders who prefer these established platforms. The company supports various deposit and withdrawal methods including credit cards, debit cards, wire transfers, and electronic wallets. This offers flexibility in funding options.

However, the lack of proper regulatory oversight remains the most significant concern in this evaluation. The broker's target demographic appears to be traders interested in experimenting with different account conditions and trading setups. The unregulated status makes it unsuitable for risk-averse investors. Based on available information from industry watchdogs and review platforms, GM Trading's overall assessment leans heavily toward the negative side, primarily due to regulatory concerns and limited positive user feedback.

Important Disclaimer

This gm trading review is based on currently available information and should not be considered as comprehensive financial advice. GM Trading operates as an unregulated broker, which inherently carries higher risks compared to properly licensed and supervised financial institutions. The lack of regulatory oversight means that client funds may not be protected by investor compensation schemes or other safety nets typically provided by regulated brokers.

Potential traders should exercise extreme caution when considering GM Trading as their broker of choice. The information presented in this review reflects available data at the time of writing and may not represent the complete picture of all user experiences. Given the unregulated nature of this broker, traders are strongly advised to conduct thorough due diligence and consider regulated alternatives before making any financial commitments.

Rating Framework

Based on available information and industry standards, GM Trading receives the following ratings across six key dimensions:

Overall Rating: 4.5/10

Broker Overview

GM Trading positions itself as a financial services provider in the competitive forex and CFD trading space. Specific details about its establishment date and corporate structure remain limited in available documentation. According to WikiFX reports, the broker has been operating for an estimated 5-10 years. The exact founding date and comprehensive corporate background are not clearly disclosed in public records. This lack of transparency regarding fundamental company information already raises concerns about the broker's commitment to openness and regulatory compliance.

The company's business model centers around providing trading services without proper regulatory authorization. This fundamentally distinguishes it from legitimate, licensed brokers in the industry. While GM Trading offers multiple account types and claims to serve international clients, the absence of regulatory oversight means that standard investor protections and compliance measures may not be in place. The broker's operational approach appears to target traders who prioritize account variety and flexible conditions over regulatory security.

Regarding trading infrastructure, GM Trading provides access to both MetaTrader 4 and MetaTrader 5 platforms. These are industry-standard solutions used by millions of traders worldwide. The broker offers trading in forex currency pairs and potentially other asset classes. Specific information about the complete range of available instruments is not comprehensively detailed in available sources. This gm trading review emphasizes that while the platform selection is adequate, the lack of regulatory backing significantly undermines the overall value proposition for serious traders seeking secure and compliant trading environments.

Regulatory Status: GM Trading operates without proper regulatory authorization from recognized financial authorities. This unregulated status means the broker is not subject to standard compliance requirements, capital adequacy rules, or client protection measures typically enforced by legitimate regulatory bodies such as the FCA, ASIC, or CySEC.

Deposit and Withdrawal Methods: The broker supports multiple funding options including credit cards, debit cards, wire transfers, and various electronic wallet services. This variety provides flexibility for traders from different regions. Specific processing times and fees are not clearly detailed in available information.

Minimum Deposit Requirements: Standard accounts with GM Trading require a minimum deposit of $200. This is relatively moderate compared to industry standards. Specific details about other account tiers and their respective minimum requirements are not comprehensively outlined in available sources.

Promotional Offers: Available information does not provide clear details about current bonus structures or promotional campaigns offered by GM Trading. The absence of transparent promotional information may indicate limited marketing efforts or selective disclosure practices.

Tradable Assets: The broker offers access to currency pairs in the forex market. The complete list of available instruments, including potential CFDs on stocks, commodities, or indices, is not specifically detailed in current documentation. This gm trading review notes that asset diversity information remains limited.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not clearly outlined in available sources. This lack of transparency regarding fee structures makes it difficult for potential clients to accurately assess the true cost of trading with GM Trading.

Leverage Ratios: Maximum leverage offerings are not specifically mentioned in available documentation. This is concerning given that leverage information is crucial for risk management and regulatory compliance in legitimate brokerages.

Platform Options: GM Trading provides access to MetaTrader 4 and MetaTrader 5. Both are well-established and widely accepted trading platforms in the industry. These platforms offer comprehensive charting tools, automated trading capabilities, and extensive customization options.

Geographic Restrictions: Specific information about regional limitations or restricted countries is not detailed in available sources. Unregulated brokers often face restrictions in jurisdictions with strict financial oversight.

Customer Support Languages: Available documentation does not specify the range of languages supported by GM Trading's customer service team.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

GM Trading offers multiple account types including Standard, Professional, and VIP accounts. The standard tier requires a minimum deposit of $200. This deposit requirement falls within reasonable ranges compared to industry standards, making it accessible to retail traders without requiring substantial initial capital commitments. However, the account structure lacks the comprehensive details and transparency typically expected from regulated brokers.

The variety of account options suggests an attempt to cater to different trader preferences and experience levels. This could be beneficial for users seeking specific trading conditions. However, the absence of detailed information about account-specific features, benefits, and limitations significantly undermines the overall value proposition. Professional and VIP accounts presumably offer enhanced conditions. Specific details about spreads, commissions, execution speeds, and additional services are not clearly outlined.

According to AmbitionBox ratings, employee satisfaction with GM Trading stands at 0 points. This raises serious concerns about internal operations and management practices. Poor employee satisfaction often correlates with substandard client service and operational inefficiencies. The account opening process details are not specified in available sources, making it difficult to assess the ease and efficiency of onboarding new clients.

The lack of regulatory oversight means that account holders do not benefit from standard investor protection measures. These include segregated client funds, negative balance protection, or compensation scheme coverage. This gm trading review emphasizes that while account variety may appear attractive, the fundamental lack of regulatory safeguards significantly compromises the security and reliability of these offerings.

GM Trading's platform offering includes both MetaTrader 4 and MetaTrader 5. These are industry-leading trading platforms with comprehensive functionality. These platforms provide advanced charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and extensive customization options. The availability of both MT4 and MT5 demonstrates some commitment to providing traders with familiar and powerful trading environments.

However, beyond platform access, specific information about additional trading tools, market research resources, economic calendars, or educational materials is not detailed in available documentation. Legitimate brokers typically provide comprehensive market analysis, daily market updates, educational webinars, and trading guides to support client success. The absence of clear information about these supplementary resources suggests limited commitment to trader education and support.

Research and analysis resources are crucial for informed trading decisions. Available sources do not indicate whether GM Trading provides market commentary, technical analysis reports, or fundamental analysis materials. Educational resources, which are essential for developing trader skills and knowledge, are also not mentioned in current documentation. This gap is particularly concerning for novice traders who rely on broker-provided educational content.

Automated trading support through MT4 and MT5 platforms is available. This allows users to implement algorithmic trading strategies and use Expert Advisors. However, specific information about any proprietary trading tools, signal services, or advanced analytics beyond standard platform offerings is not available. User feedback regarding tool effectiveness and resource quality is limited, making it difficult to assess real-world performance and utility.

Customer Service and Support Analysis (4/10)

Customer service quality is a critical factor in broker evaluation. Available information about GM Trading's support infrastructure is notably limited. Specific details about available support channels, such as live chat, phone support, email assistance, or help desk systems, are not clearly outlined in current documentation. This lack of transparency regarding customer service accessibility raises concerns about the broker's commitment to client support.

Response times and service quality metrics are not available in current sources. This makes it impossible to assess the efficiency and effectiveness of customer support operations. The absence of clear information about support availability hours, whether 24/5 or 24/7, further complicates the evaluation of customer service adequacy. For active traders who may need immediate assistance during market hours, reliable customer support is essential.

According to available ratings from AmbitionBox and references to Trustpilot feedback, GM Trading appears to have received poor customer evaluations. Employee satisfaction ratings of 0 points suggest internal operational issues that likely translate to substandard customer service experiences. Negative feedback patterns on review platforms indicate potential systemic issues with client support and service delivery.

Multi-language support capabilities are not specified in available documentation. This may limit accessibility for international clients. Problem resolution case studies and success stories are also absent from available information, making it difficult to assess the broker's track record in handling client issues and disputes. This gm trading review notes that the combination of limited transparency and negative feedback patterns significantly undermines confidence in customer service quality.

Trading Experience Analysis (5/10)

The trading experience evaluation for GM Trading is hampered by limited specific information about platform performance, execution quality, and user satisfaction metrics. The broker offers MetaTrader 4 and MetaTrader 5 platforms, which are known for their stability and comprehensive functionality. Specific performance data regarding GM Trading's implementation of these platforms is not available in current documentation.

Order execution quality is a crucial factor for trading success. Available sources do not provide specific information about execution speeds, slippage rates, or rejection frequencies. Without this data, it's impossible to assess whether GM Trading provides competitive execution standards that meet trader expectations. The absence of user feedback specifically addressing execution quality further complicates this evaluation.

Platform functionality completeness depends on how well GM Trading has implemented MT4 and MT5 features. Specific customizations, additional tools, or limitations are not detailed in available sources. Mobile trading experience, which is increasingly important for active traders, is not specifically addressed in current documentation. The availability and quality of mobile applications can significantly impact overall trading experience.

Trading environment assessment is limited by the lack of detailed user feedback and performance metrics. Specific information about server stability, platform downtime, or connectivity issues is not available in current sources. The unregulated status of the broker raises additional concerns about trading environment reliability and consistency.

User testimonials specifically addressing trading experience are notably absent from available information. This makes it difficult to gauge real-world satisfaction with GM Trading's trading conditions. This gm trading review emphasizes that the lack of comprehensive trading experience data significantly limits the ability to recommend this broker for serious trading activities.

Trust and Reliability Analysis (3/10)

Trust and reliability represent the most significant concerns in this GM Trading evaluation. The broker operates without regulatory authorization from recognized financial authorities. This fundamentally undermines its credibility and trustworthiness. Regulatory oversight provides essential investor protections, ensures compliance with industry standards, and offers recourse mechanisms in case of disputes or broker failures.

The absence of regulatory backing means that client funds are not subject to segregation requirements, deposit insurance, or investor compensation schemes that are standard in regulated environments. This lack of protection exposes traders to significant risks including potential loss of deposits, inability to withdraw funds, and lack of legal recourse in case of disputes. Legitimate regulatory bodies such as the FCA, ASIC, CySEC, or other recognized authorities provide crucial oversight that is completely absent in GM Trading's case.

Company transparency is notably limited. Fundamental information about corporate structure, ownership, financial statements, and operational details are not readily available in public documentation. This opacity contrasts sharply with regulated brokers who are required to maintain transparency and provide regular disclosures about their financial condition and business operations.

Industry reputation appears problematic based on available feedback. Employee ratings of 0 points on AmbitionBox and negative feedback patterns on Trustpilot create concerning indicators. These suggest systemic issues with business operations and client satisfaction. The combination of unregulated status and poor feedback ratings creates a concerning picture regarding the broker's reliability and trustworthiness.

Third-party verification through recognized financial authorities is completely absent. GM Trading operates without proper licensing or regulatory oversight. This lack of external validation means that traders must rely solely on the broker's own representations without independent verification of claims or operational standards.

User Experience Analysis (4/10)

Overall user satisfaction with GM Trading appears to be poor based on available feedback and rating information. The combination of negative reviews on platforms like Trustpilot and zero employee satisfaction ratings on AmbitionBox suggests systemic issues with service delivery and operational quality. These indicators point to a user experience that falls significantly below industry standards and trader expectations.

Interface design and usability assessment is limited by the lack of specific information about GM Trading's proprietary interfaces beyond the standard MT4 and MT5 platforms. These trading platforms are well-designed and user-friendly. The broker's own website, client portal, and account management interfaces may not meet the same standards. Without detailed user feedback about these proprietary systems, it's difficult to assess overall interface quality.

Account registration and verification processes are not detailed in available documentation. This makes it impossible to evaluate the ease and efficiency of onboarding new clients. Streamlined registration and quick verification are important factors in modern broker selection, yet GM Trading's processes in these areas remain unclear. The absence of information about required documentation, verification timeframes, and account activation procedures is concerning.

Fund management experience, including deposit and withdrawal processes, lacks specific user feedback in available sources. Multiple funding methods are reportedly available. Actual user experiences with processing times, fees, and reliability are not documented. Negative user feedback patterns suggest potential issues with fund management operations, though specific details are not available.

Common user complaints appear to center around the broker's unregulated status and poor service quality. Specific complaint categories and resolution patterns are not detailed in available sources. The target user demographic appears to be traders interested in experimenting with different account conditions. The high-risk nature of dealing with an unregulated broker makes this approach inadvisable for most serious traders.

Conclusion

This comprehensive gm trading review reveals significant concerns that strongly advise against choosing this broker for serious trading activities. GM Trading's unregulated status represents the most critical flaw. This fundamentally undermines trader security and eliminates essential investor protections that are standard in legitimate brokerage relationships. The combination of poor employee satisfaction ratings, negative user feedback patterns, and lack of regulatory oversight creates a risk profile that is unacceptable for prudent traders.

GM Trading offers some potentially attractive features such as multiple account types, MetaTrader platform access, and various funding options. These benefits are completely overshadowed by the fundamental lack of regulatory compliance and transparency. The broker may appeal to traders seeking to experiment with different account conditions. The associated risks far outweigh any potential advantages.

For traders seeking reliable, secure, and professionally managed trading services, regulated alternatives with proper licensing, transparent operations, and positive user feedback represent far superior choices. The financial markets offer numerous legitimate brokers with comprehensive regulatory oversight. This makes it unnecessary and inadvisable to accept the risks associated with unregulated operators like GM Trading.