Regarding the legitimacy of TRI forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is TRI safe?

Pros

Cons

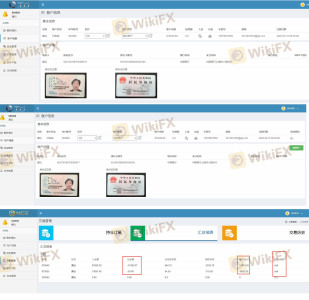

Is TRI markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

TRILT LTD

Effective Date:

2014-10-30Email Address of Licensed Institution:

info@trilt.comSharing Status:

No SharingWebsite of Licensed Institution:

www.trilt.comExpiration Time:

--Address of Licensed Institution:

51 Omonias Avenue, Christodoulou court, Office 201-2, 3052, LimassolPhone Number of Licensed Institution:

+357 25 510 210Licensed Institution Certified Documents:

Is TRI Safe or Scam?

Introduction

In the ever-evolving landscape of the forex market, TRI has emerged as a player, offering trading services to a diverse clientele. Established in 2017, TRI positions itself as a broker for traders looking to engage with various financial instruments, including currencies, commodities, and indices. However, with the proliferation of online trading platforms, the importance of due diligence cannot be overstated. Traders must carefully assess the legitimacy and safety of brokers before entrusting them with their hard-earned money. This article aims to provide an in-depth analysis of TRI, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on a comprehensive review of available data, user feedback, and regulatory information, allowing us to present a balanced view of whether TRI is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. A well-regulated broker is more likely to adhere to industry standards and protect customers' interests. TRI claims to operate under the auspices of several financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). However, reports indicate that TRI's regulatory licenses are regarded as suspicious clones, raising concerns about their authenticity.

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 750779 | United Kingdom | Suspicious Clone |

| CySEC | 254/14 | Cyprus | Suspicious Clone |

| BaFin | 148055 | Germany | Revoked |

The implications of these findings are significant. The designation of "suspicious clone" suggests that TRI may not be operating under legitimate oversight, which can expose traders to undue risks. Furthermore, the revocation of its BaFin license raises additional red flags regarding its compliance history. In the forex industry, regulatory compliance is paramount, and the lack of a credible regulatory framework could indicate potential malpractices. Thus, assessing whether TRI is safe requires a closer look at its regulatory environment and compliance history.

Company Background Investigation

TRI was founded in 2017 and claims to be based in the United Kingdom. However, a deeper investigation into its operational history reveals a lack of transparency regarding its ownership structure and management team. The absence of detailed information about the individuals behind TRI raises questions about accountability and trustworthiness.

The companys management team should ideally possess a wealth of experience in finance and trading, which contributes to the broker's credibility. However, available data does not provide sufficient insight into the qualifications or backgrounds of TRI's leadership. A transparent company typically shares information about its founders, their previous roles in the financial industry, and their vision for the broker. The lack of such disclosures can be a warning sign for potential investors, suggesting that TRI may not prioritize transparency.

Moreover, the company's website has been reported as inaccessible at times, further complicating efforts to verify its legitimacy and operational practices. A broker that is difficult to research or contact may not be a safe choice for traders. Therefore, the opaque nature of TRI's background raises significant concerns about its safety and trustworthiness.

Trading Conditions Analysis

When evaluating whether TRI is safe, it is essential to analyze its trading conditions, including fees, spreads, and overall cost structure. A transparent fee structure is crucial for traders to make informed decisions. However, TRI has been criticized for its unclear and potentially excessive fees, which can significantly impact a trader's profitability.

| Fee Type | TRI | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 1-2 pips |

| Commission Model | Unclear | $0 - $10 per lot |

| Overnight Interest Range | Unspecified | Varies by broker |

The lack of specific information regarding spreads and commissions is concerning. Traders should expect clear disclosures about the costs associated with trading, including spreads and commissions, as these can vary significantly between brokers. The absence of clarity in TRI's fee structure could lead to unexpected costs, making it difficult for traders to manage their expenses effectively.

Furthermore, some users have reported hidden fees during withdrawal processes, which can further complicate the trading experience. Such practices are often indicative of brokers that prioritize profit over customer satisfaction, raising questions about whether TRI is safe for traders seeking a reliable platform.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. Brokers must implement robust measures to protect clients' investments, including fund segregation and investor protection policies. TRI claims to follow industry standards for fund security, but the lack of clear information on these measures raises concerns.

Traders should expect their funds to be held in segregated accounts, which ensures that client money is protected in the event of the broker's insolvency. Additionally, investor protection schemes offered by regulatory bodies can provide an added layer of security. However, given TRI's questionable regulatory status, it is unclear whether such protections are in place.

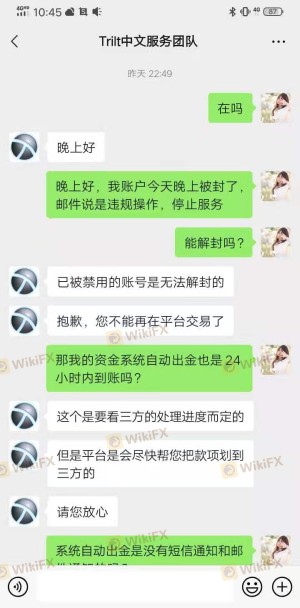

Moreover, historical complaints about difficulties in withdrawing funds from TRI raise serious concerns about the broker's commitment to safeguarding client assets. Reports of account restrictions and unresponsive customer service highlight potential vulnerabilities in TRI's operations. As such, the question of whether TRI is safe for handling customer funds remains unanswered.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Analysis of user experiences with TRI reveals a pattern of complaints, particularly regarding withdrawal issues and customer support. Many users have reported difficulties in accessing their funds, with some stating that their accounts were restricted without clear explanations.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Restrictions | High | Unresponsive |

| Customer Support Issues | Medium | Slow |

The severity of these complaints cannot be overlooked. Users have expressed frustration with the company's lack of responsiveness, which can exacerbate the challenges faced during trading. A broker that fails to address customer concerns in a timely manner may not be acting in the best interests of its clients, raising further doubts about whether TRI is safe.

Additionally, specific case studies highlight the struggles faced by users attempting to withdraw funds. For instance, one user reported being unable to access their account for several months, while another mentioned that their withdrawal requests were consistently ignored. Such experiences indicate systemic issues within TRI's customer service operations, which could be detrimental to traders seeking reliable support.

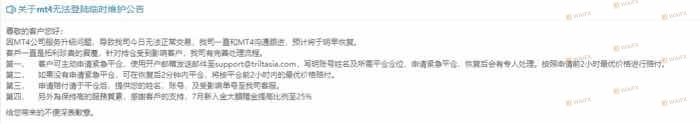

Platform and Trade Execution

The trading platform is a critical component of the trading experience, influencing order execution quality and overall user satisfaction. TRI utilizes the widely recognized MetaTrader 4 platform, known for its user-friendly interface and robust trading tools. However, user feedback suggests that the platform may experience stability issues, leading to execution delays and slippage.

Traders have reported instances of orders not being executed as expected, which can severely impact trading outcomes. The presence of slippage—where orders are filled at different prices than expected—can erode profits and create frustration among users. Furthermore, concerns about potential platform manipulation have been raised, particularly in light of TRI's regulatory status.

A reliable broker should provide a stable trading environment, ensuring that users can execute trades efficiently without undue delays. The reported issues with TRI's platform performance raise questions about whether it can be trusted for consistent and reliable trade execution.

Risk Assessment

Using TRI as a trading platform presents several risks that traders should be aware of. The combination of questionable regulatory status, unclear fee structures, and poor customer experiences contributes to an overall risk profile that is concerning for potential users.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Suspicious clone status raises concerns |

| Customer Support Issues | Medium | Unresponsive support can exacerbate issues |

| Withdrawal Challenges | High | Historical difficulties in fund access |

To mitigate these risks, potential traders should approach TRI with caution. It is advisable to assess the broker's credibility thoroughly and consider alternative options with better regulatory oversight and customer feedback. Additionally, maintaining a diversified portfolio and using risk management strategies can help protect against potential losses.

Conclusion and Recommendations

In summary, the evidence suggests that TRI may not be a safe option for traders. The combination of a suspicious regulatory status, unclear fee structures, and a pattern of customer complaints raises significant concerns about the broker's legitimacy and reliability. While TRI may offer trading opportunities, the associated risks may outweigh the potential benefits.

For traders seeking a safer environment, it is recommended to consider brokers with robust regulatory oversight, transparent fee structures, and positive customer feedback. Brokers regulated by top-tier authorities such as the FCA, ASIC, or CySEC can provide a more secure trading experience. In light of the findings presented, it is essential for traders to exercise caution and conduct thorough research before engaging with TRI or similar brokers.

Is TRI a scam, or is it legit?

The latest exposure and evaluation content of TRI brokers.

TRI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRI latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.