BESTLEADER 2025 Review: Everything You Need to Know

Summary

This complete bestleader review looks at a forex broker that has gotten a lot of attention in the trading community for worrying reasons. BESTLEADER shows a mixed picture based on market data and user feedback that potential traders need to think about carefully. WikiFX monitoring data gives the broker a very low rating of 1 out of 10, which shows major red flags that traders should know about.

BESTLEADER works as an online forex and CFD broker. It offers the popular MetaTrader 4 platform to its clients. The broker mainly serves the Chinese and Hong Kong markets and provides support in English, Simplified Chinese, and Traditional Chinese. User reports show big operational problems, with many complaints about platform access and withdrawal troubles.

The broker targets retail traders in Asian markets. These traders want MT4 trading capabilities for forex and CFD instruments. The broker offers standard trading tools, but the overwhelming negative user feedback raises serious questions about the broker's reliability and operational integrity, making this review essential reading for anyone considering their services.

Important Notice

This bestleader review uses publicly available information, user feedback, and market intelligence reports. Readers should know that broker services and conditions may be very different across regions and jurisdictions. The evaluation here reflects the most current available data, though specific regulatory information was not detailed in the source materials.

You must understand that this assessment does not consider potentially hidden regulatory frameworks or licensing arrangements that may not be publicly documented. Traders should strongly conduct independent research and verify all regulatory claims directly with relevant authorities before engaging with any broker.

Rating Framework

Broker Overview

BESTLEADER entered the forex brokerage market in 2017. It positioned itself as a specialized provider of online forex and CFD trading services. The company established its headquarters in Hong Kong and strategically targeted the growing Asian retail trading market. As an online broker, BESTLEADER focuses mainly on providing electronic trading access to global currency markets and contracts for difference, operating under a business model that serves individual retail traders rather than institutional clients.

The broker's operational framework centers around the MetaTrader 4 platform. This is one of the industry's most recognized trading interfaces. BESTLEADER offers access to forex currency pairs and CFD instruments, though the specific range and variety of available assets remain limited compared to larger, more established brokers. The company has not disclosed detailed regulatory oversight according to available information, which represents a significant concern for traders evaluating the safety and legitimacy of their operations.

This bestleader review reveals that while the broker presents itself as a legitimate trading service provider, the lack of transparent regulatory information and the concerning user feedback patterns suggest potential operational challenges that prospective clients should carefully evaluate.

Regulatory Status: The available information does not specify concrete regulatory oversight or licensing arrangements for BESTLEADER. This absence of clear regulatory disclosure represents a significant red flag for potential traders, as legitimate brokers typically prominently display their regulatory credentials and licensing information.

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available sources. This lack of transparency about financial transactions is concerning for users who need to understand how they can fund their accounts and access their profits.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit requirements or account opening thresholds. Without this fundamental information, potential traders cannot properly assess the accessibility and affordability of the broker's services.

Promotional Offers: No information is available about bonus structures, promotional campaigns, or incentive programs that BESTLEADER may offer to new or existing clients.

Tradeable Assets: BESTLEADER provides access to forex currency pairs and CFD instruments through the MT4 platform. However, the specific number of available currency pairs, commodity CFDs, index CFDs, or other derivative instruments is not detailed in the source materials.

Cost Structure: Critical pricing information including spreads, commission structures, overnight holding costs, and other trading-related fees is not specified in available documentation. This lack of cost transparency makes it impossible for traders to accurately assess the true expense of trading with this broker.

Leverage Ratios: Information about maximum leverage ratios, margin requirements, and risk management parameters is not disclosed in the available materials.

Platform Options: BESTLEADER offers the MetaTrader 4 platform as their primary trading interface. It provides standard charting tools, technical indicators, and automated trading capabilities typical of MT4 installations.

Geographic Restrictions: The broker mainly serves traders in China and Hong Kong. Services are tailored to these specific markets.

Customer Support Languages: BESTLEADER provides customer service in English, Simplified Chinese, and Traditional Chinese to accommodate their target demographic.

This bestleader review highlights significant information gaps that potential traders should consider when evaluating the broker's suitability for their trading needs.

Account Conditions Analysis

The account conditions offered by BESTLEADER present significant transparency challenges that potential traders must carefully consider. The broker has not disclosed fundamental account details that are typically standard across the industry based on available information. This includes the absence of information about account types, minimum deposit requirements, account opening procedures, and special account features that might differentiate various service levels.

The lack of detailed account condition disclosure represents a substantial red flag in this bestleader review. Legitimate brokers typically provide complete information about their account structures, including micro, standard, and premium account options with clearly defined benefits and requirements. The absence of such information makes it impossible for traders to make informed decisions about which account type might suit their trading style and capital requirements.

Without clear information about account opening procedures, verification requirements, and ongoing account maintenance conditions, potential clients cannot adequately assess the administrative burden and compliance requirements associated with trading through BESTLEADER. This information vacuum extends to special account features such as Islamic accounts, demo account availability, and any premium services that might be offered to higher-tier clients.

The overall assessment of account conditions receives a poor rating due to the fundamental lack of transparency and disclosure that characterizes professional brokerage operations.

BESTLEADER's tools and resources offering centers mainly around the MetaTrader 4 platform. This provides traders with a familiar and widely-used trading interface. MT4 includes standard charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, representing the core strength of the broker's technological offering.

This bestleader review reveals significant limitations in the broader tools and resources ecosystem. The broker does not appear to provide complete market research, daily analysis, or educational resources that are typically expected from modern forex brokers. The absence of proprietary analytical tools, market commentary, or trading signals limits the value proposition for traders who rely on broker-provided insights to inform their trading decisions.

Educational resources appear to be minimal or non-existent based on available information. These are crucial for developing traders. Modern brokers typically offer webinars, tutorials, market analysis, and educational content to support their clients' trading development. The apparent lack of such resources suggests that BESTLEADER may not be suitable for novice traders who require additional support and learning materials.

The automation trading support through MT4's Expert Advisor functionality provides some technological capability. However, without additional proprietary tools or enhanced platform features, the overall offering remains basic compared to industry standards.

Customer Service and Support Analysis

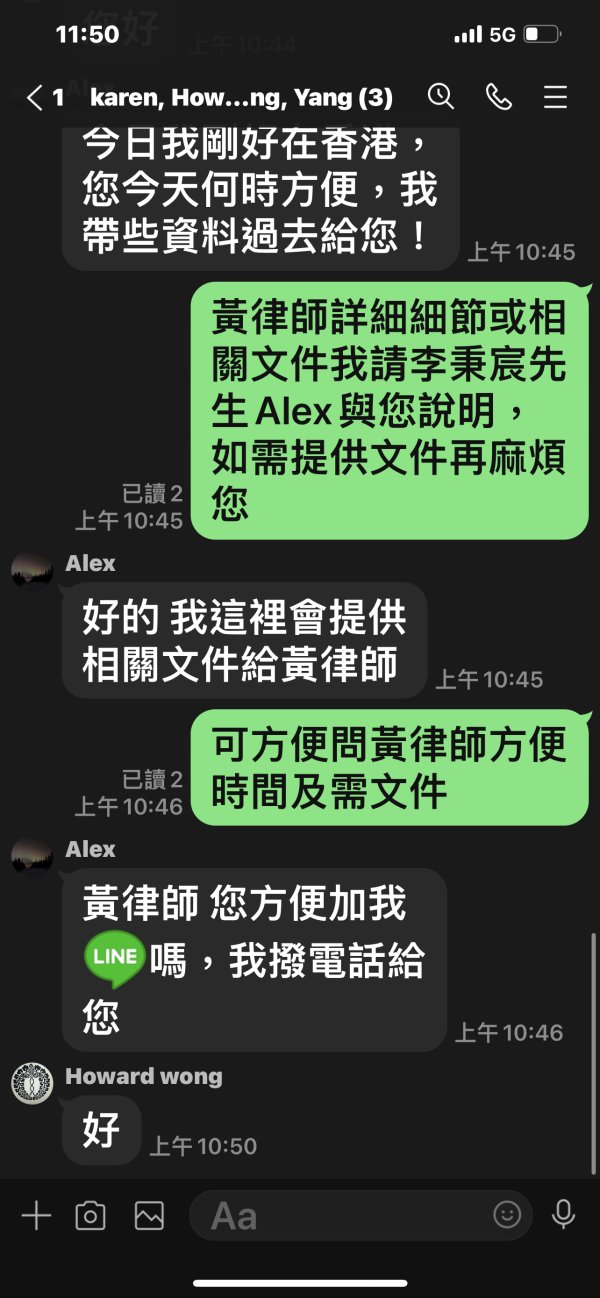

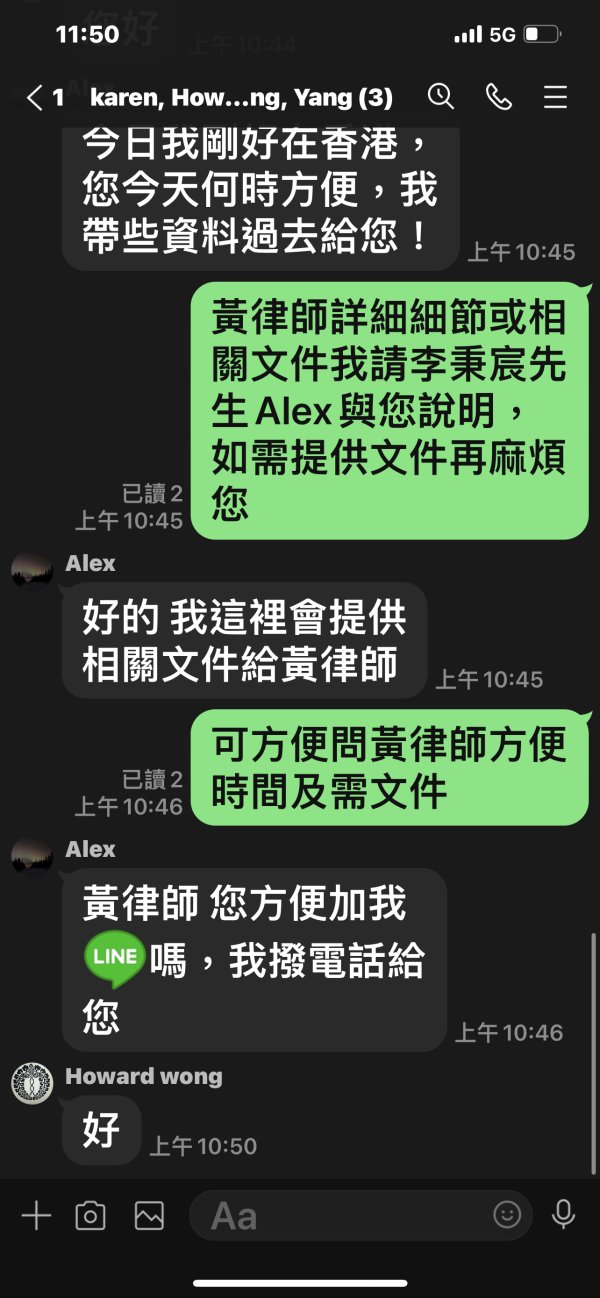

Customer service represents a critical weak point in BESTLEADER's operations based on user feedback and available information. The broker offers multilingual support in English, Simplified Chinese, and Traditional Chinese to serve their target markets, but the quality and effectiveness of this support appears to be significantly compromised according to user reports.

The availability of multiple language options demonstrates an understanding of their target demographic's needs, particularly in the Chinese and Hong Kong markets. User feedback suggests that the actual service delivery falls short of professional standards expected in the forex industry. Reports indicate poor response times, inadequate problem resolution, and general dissatisfaction with the support experience.

Specific details about customer service channels, operating hours, and escalation procedures are not clearly documented in available sources. This lack of transparency about support infrastructure raises additional concerns about the broker's commitment to client service. Professional brokers typically provide multiple contact methods including live chat, email, phone support, and complete FAQ sections.

The concerning user feedback about customer service quality, combined with the lack of detailed support infrastructure information, contributes to the below-average rating in this category. Effective customer support is essential for resolving trading issues, account problems, and technical difficulties that inevitably arise in forex trading operations.

Trading Experience Analysis

The trading experience with BESTLEADER presents significant challenges that potential clients must carefully evaluate. User reports indicate serious operational issues, including platform login difficulties and system accessibility problems that directly impact the ability to execute trades effectively. These technical issues represent fundamental failures in broker operations that can result in missed trading opportunities and financial losses.

Traders have experienced difficulties accessing their trading accounts through the broker's systems according to user feedback examined in this bestleader review. Such accessibility issues are particularly concerning in the fast-paced forex market where timing is crucial for trade execution and risk management. The inability to reliably access trading platforms can expose traders to uncontrolled market risk and prevent proper position management.

The MetaTrader 4 platform itself provides standard functionality when accessible. This includes basic order types, charting capabilities, and automated trading support. However, the reported system reliability issues appear to compromise the overall trading experience regardless of the platform's inherent capabilities.

Mobile trading experience details are not specified in available sources. Given the reported desktop platform issues, mobile accessibility may face similar challenges. The overall trading environment appears to be compromised by technical reliability issues that undermine the fundamental requirements of professional forex trading operations.

Trust and Safety Analysis

Trust and safety represent the most concerning aspects of BESTLEADER's operations. They earn the lowest possible rating in this bestleader review. The WikiFX rating of 1 out of 10 indicates severe trust and safety concerns that potential traders must carefully consider before engaging with this broker.

The absence of clear regulatory disclosure represents a fundamental trust issue in the forex industry. Legitimate brokers typically operate under strict regulatory oversight and prominently display their licensing information, regulatory compliance measures, and client protection protocols. The lack of such transparency raises serious questions about the broker's legal standing and operational legitimacy.

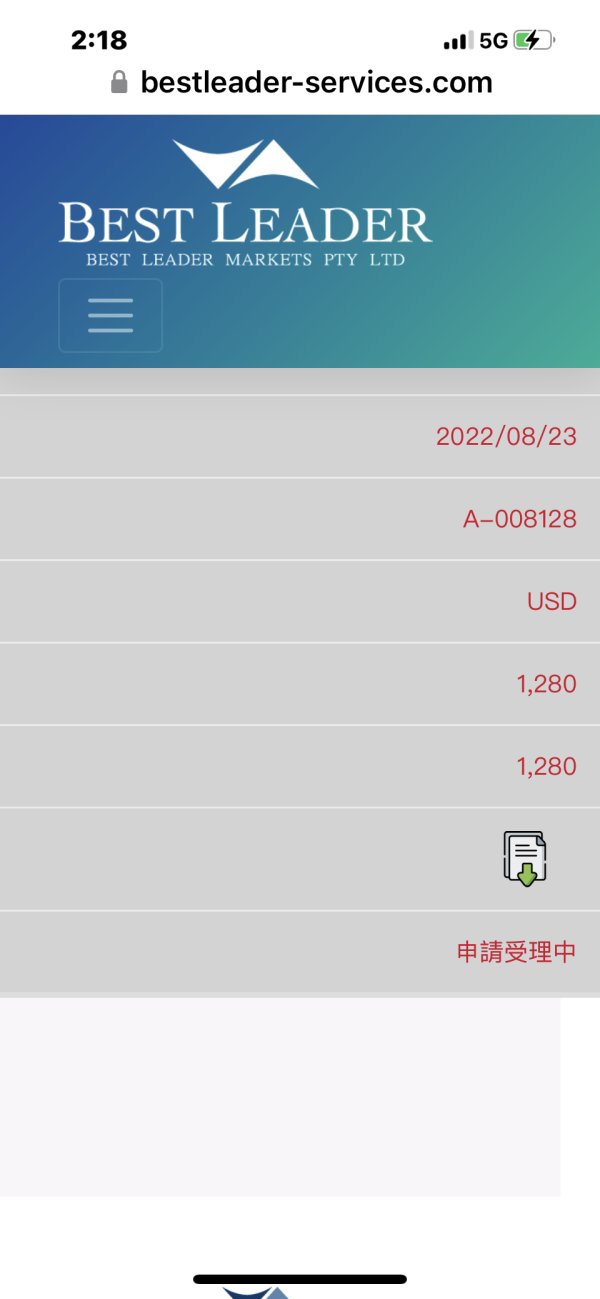

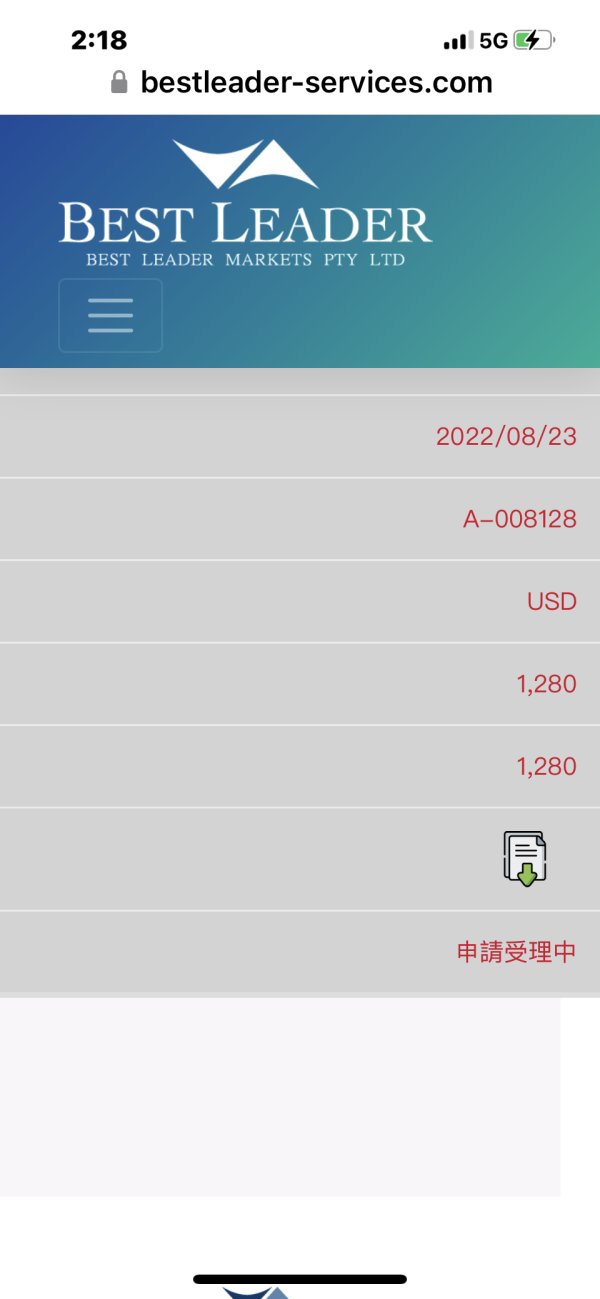

User reports indicate significant withdrawal difficulties. Some clients report inability to access their funds. Such reports represent the most serious red flags in forex broker evaluation, as they suggest potential issues with fund segregation, operational solvency, or business model integrity. The ability to withdraw funds is the fundamental test of any broker's legitimacy and operational viability.

The company's transparency about its operations, management structure, and business practices appears limited based on available information. Professional brokers typically provide detailed company information, management backgrounds, and clear operational procedures. The apparent lack of such transparency further undermines trust and confidence in the broker's operations.

Third-party evaluations, particularly the WikiFX monitoring data, consistently indicate serious concerns about BESTLEADER's operations and reliability.

User Experience Analysis

The overall user experience with BESTLEADER appears to be significantly compromised based on available feedback and evaluation data. The WikiFX rating of 1 out of 10 reflects widespread user dissatisfaction and operational concerns that extend beyond simple service quality issues to fundamental business operation problems.

User feedback indicates that the broker fails to meet basic expectations for forex trading services. The reported inability to withdraw funds represents the most serious user experience failure possible in the brokerage industry. Such issues suggest fundamental operational problems that go beyond typical service quality concerns to potential business model or solvency issues.

The registration and account verification processes are not detailed in available sources. This makes it impossible to assess the user-friendliness of the onboarding experience. However, given the reported operational issues, it's reasonable to assume that administrative processes may also be problematic.

Fund management represents the most critical user experience failure. Reports indicate withdrawal difficulties that prevent traders from accessing their own capital. This represents the ultimate failure in user experience and suggests serious operational or regulatory compliance issues.

The common user complaints appear to center around platform accessibility, fund withdrawal problems, and general operational reliability. These issues indicate systemic problems rather than isolated service quality concerns. The overwhelmingly negative feedback suggests that BESTLEADER may not be suitable for traders who prioritize reliable operations and professional service standards.

The broker appears most unsuitable for risk-averse traders or those requiring reliable access to their trading capital and profits based on available user feedback.

Conclusion

This complete bestleader review reveals significant concerns about BESTLEADER's operations and suitability as a forex broker. The overwhelming evidence suggests that potential traders should exercise extreme caution when considering this broker for their trading activities. The WikiFX rating of 1 out of 10, combined with user reports of withdrawal difficulties and platform accessibility issues, indicates fundamental operational problems that extend beyond typical service quality concerns.

BESTLEADER appears unsuitable for most trader categories. This is particularly true for risk-averse individuals, beginners, and anyone requiring reliable access to their trading capital. The lack of regulatory transparency, combined with serious user complaints about fund accessibility, suggests that this broker may not meet the basic standards expected in professional forex trading operations.

The primary advantage of MT4 platform availability is overshadowed by the significant disadvantages. These include poor user ratings, withdrawal difficulties, platform reliability issues, and lack of regulatory disclosure. These fundamental concerns make it difficult to recommend BESTLEADER to any category of forex trader seeking reliable and professional brokerage services.