Is COZFX safe?

Business

License

Is COZFX Safe or Scam?

Introduction

COZFX is a forex broker that has emerged in the trading landscape, claiming to offer a range of trading services to both novice and experienced traders. Positioned as a platform that bridges the gap between institutional trading conditions and retail users, COZFX aims to attract a wide audience with its competitive spreads and diverse account types. However, as with any forex broker, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. This is particularly important in an industry rife with scams and unregulated entities.

In this article, we will investigate COZFX's legitimacy and safety by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. Our analysis is based on data collected from various credible sources, including user reviews and regulatory databases, providing a comprehensive overview of whether COZFX is indeed safe for trading.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety. A well-regulated broker is typically more trustworthy, as it must adhere to strict guidelines and provide a certain level of protection to its clients. Unfortunately, COZFX's regulatory status raises significant concerns.

Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 247017 | Australia | Suspicious Clone |

COZFX claims to be regulated by the Australian Securities and Investments Commission (ASIC); however, investigations reveal that this license is under scrutiny and may be a clone of a legitimate entity. The lack of verification from ASIC and the absence of any credible regulatory oversight heighten the risks associated with trading on this platform. The broker has also received numerous complaints regarding its operations, which further compounds the concern about its legitimacy.

The importance of regulatory compliance cannot be overstated. Traders using unregulated brokers like COZFX face the risk of losing their funds without any recourse for recovery. Additionally, without regulatory oversight, there are no guarantees regarding the safety of client funds or the integrity of the trading platform.

Company Background Investigation

Understanding the history and ownership structure of a broker can provide valuable insights into its legitimacy. COZFX was established relatively recently, and its brief operational history raises questions about its stability and reliability.

The company is registered under the name COZ FX Limited, but there is limited information available regarding its management team and operational practices. This lack of transparency can be a red flag for potential investors. Furthermore, the broker's website does not provide adequate information about its founders or key personnel, which is essential for assessing the credibility of any financial institution.

Given that the company is relatively new and claims to operate from Australia, the absence of a well-established track record makes it challenging to determine its long-term viability. Traders are advised to be cautious and consider these factors when evaluating whether COZFX is safe for trading.

Trading Conditions Analysis

A broker's trading conditions can significantly impact a trader's experience and profitability. COZFX offers various account types and claims to provide competitive spreads; however, it is essential to scrutinize these conditions closely.

Cost Structure Comparison

| Fee Type | COZFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | $7 per lot | $5 per lot |

| Overnight Interest Range | Variable | Variable |

While COZFX advertises low spreads, it is crucial to consider the overall fee structure, including commissions and potential hidden fees. Reports indicate that withdrawal fees can be as high as $50, which could significantly affect a trader's net earnings. Such discrepancies from industry standards may indicate that traders should be wary of the true cost of trading with COZFX.

Furthermore, the broker's leverage options, which go up to 1:500, may be enticing for some traders but also pose substantial risks. High leverage can amplify losses as much as it can amplify gains, making it essential for traders to understand the implications of using such leverage.

Client Fund Security

The safety of client funds is paramount when choosing a trading platform. COZFX's approach to fund security raises several concerns.

The broker claims to implement measures for fund protection, but there is little transparency regarding the specifics of these measures. Client funds should ideally be held in segregated accounts to ensure they are protected in the event of a broker's insolvency. However, there is no clear information on whether COZFX follows this practice.

Additionally, the absence of investor protection schemes, such as those provided by regulatory bodies, means that traders using COZFX may not have any recourse if the broker mismanages or loses their funds. Historical complaints about withdrawal issues and fund accessibility further exacerbate concerns regarding the safety of client funds on this platform.

Customer Experience and Complaints

Customer feedback can provide critical insights into a broker's operations and service quality. Unfortunately, the reviews for COZFX are largely negative, indicating a troubling pattern of complaints.

Complaint Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Management | Medium | Poor |

| Customer Support Delays | High | Poor |

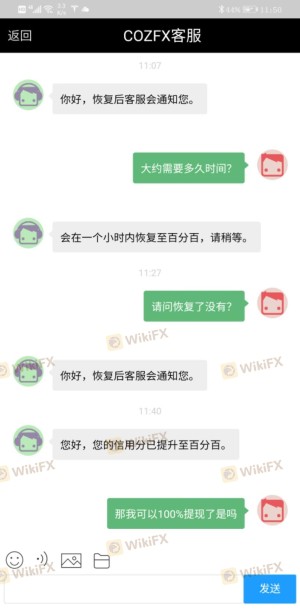

Many users have reported difficulties in withdrawing their funds, with some claiming that they faced long delays or were completely unable to access their money. This pattern of complaints suggests significant operational inefficiencies and raises questions about COZFX's commitment to customer service.

A few notable cases highlight these issues. For instance, one user reported waiting over a month for a withdrawal request to be processed, while another claimed that their account was modified without their consent, leading to further complications. Such experiences paint a concerning picture of COZFX's customer service and operational reliability.

Platform and Trade Execution

The trading platform's performance and execution quality are crucial factors for traders. COZFX claims to use the widely respected MetaTrader 4 (MT4) platform; however, user feedback suggests that there may be issues with stability and execution.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. Additionally, the platform's performance has been criticized for its lack of reliability, potentially leading to missed opportunities or unexpected losses.

Risk Assessment

Engaging with COZFX carries several risks that potential traders should be aware of.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | High | Lack of transparency and complaints about withdrawals. |

| Customer Service Risk | High | Poor response to user complaints. |

Given these risks, it is advisable for traders to approach COZFX with extreme caution. Conducting thorough research and considering alternative, well-regulated brokers may provide a safer trading environment.

Conclusion and Recommendations

In summary, the evidence suggests that COZFX may not be a safe trading option for most investors. Its unregulated status, poor customer feedback, and lack of transparency raise significant red flags. While the broker offers attractive trading conditions on the surface, the underlying issues present serious concerns.

For traders seeking to engage in forex trading, it is recommended to consider well-regulated and reputable alternatives that prioritize client safety and offer robust customer support. Brokers like IG, OANDA, and Forex.com are examples of platforms with strong regulatory oversight and positive user experiences, making them safer choices for trading.

In conclusion, it is crucial for traders to prioritize safety and conduct due diligence when evaluating brokers like COZFX. The question of "Is COZFX safe?" leans heavily towards skepticism, urging potential investors to tread carefully.

Is COZFX a scam, or is it legit?

The latest exposure and evaluation content of COZFX brokers.

COZFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

COZFX latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.