Regarding the legitimacy of USGFX forex brokers, it provides ASIC, FCA, VFSC and WikiBit, (also has a graphic survey regarding security).

Is USGFX safe?

Pros

Cons

Is USGFX markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

UNION STANDARD INTERNATIONAL GROUP PTY LTD

Effective Date:

2006-09-14Email Address of Licensed Institution:

smonis@brifnsw.com.auSharing Status:

No SharingWebsite of Licensed Institution:

http://www.usgfx.comExpiration Time:

--Address of Licensed Institution:

SuiTe 3 G, 135 Macquarie STreeT, SYDNEY NSW 2000Phone Number of Licensed Institution:

02 8263 2300Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Forex Execution License (STP)

Licensed Entity:

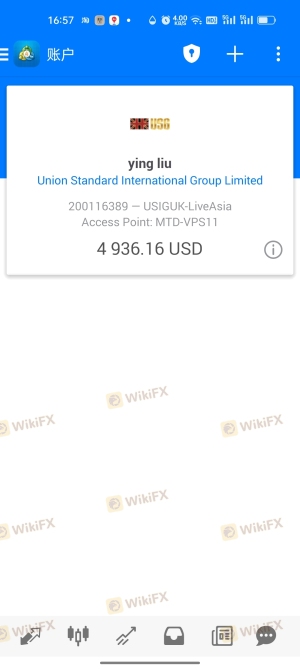

Union Standard International Group Limited

Effective Date:

2018-11-05Email Address of Licensed Institution:

compliance@ukusg.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.ukusg.co.uk/Expiration Time:

2022-12-16Address of Licensed Institution:

75 King William Street London EC4N 7BE UNITED KINGDOMPhone Number of Licensed Institution:

+4402078463712Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

UNION STANDARD INTERNATIONAL GROUP LTD

Effective Date:

2020-01-13Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is USGFX A Scam?

Introduction

USGFX, also known as Union Standard Group, is an Australian-based forex and CFD broker that has been operating since 2005. With its headquarters in Sydney and additional offices in Auckland, Hong Kong, and Shanghai, USGFX positions itself as a significant player in the Pacific Rim forex market. Given the complexities and risks associated with forex trading, it is crucial for traders to carefully evaluate brokers before committing their funds. The importance of this evaluation stems from the potential for financial loss, fraud, and the lack of recourse in unregulated environments. This article will investigate USGFX's legitimacy by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and associated risks.

Regulation and Legitimacy

Regulation is one of the most critical factors in assessing the safety of a forex broker. USGFX was previously regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK. However, both licenses have been revoked due to compliance issues. This raises significant concerns about the broker's legitimacy and adherence to industry standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 302792 | Australia | Revoked |

| FCA | 798776 | United Kingdom | Revoked |

| VFSC | 41706 | Vanuatu | Revoked |

The revocation of licenses indicates a lack of oversight and could potentially expose traders to higher risks. The quality of regulation is paramount; brokers regulated by respected authorities like ASIC are generally held to stringent standards regarding client fund protection and transparency. The history of compliance issues at USGFX, particularly with ASIC and the FCA, raises red flags about its operational integrity.

Company Background Investigation

USGFX was established with the aim of providing a reliable trading environment for forex and CFD traders. Over the years, it has expanded its operations and client base, but its ownership structure and management team have not been extensively detailed in public disclosures. The lack of transparency regarding the company's leadership and operational practices can be concerning for potential clients.

The management team at USGFX has experience in the financial sector, but specific qualifications and backgrounds are not readily available. This lack of information can lead to uncertainty among traders regarding the broker's reliability. Furthermore, the absence of clear communication about the company's operations and financial health could affect traders' trust.

Trading Conditions Analysis

USGFX offers a variety of trading accounts, each with different minimum deposit requirements and trading conditions. The broker claims to provide competitive spreads and a user-friendly trading environment, but many users have reported higher-than-average costs.

| Fee Type | USGFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.8 pips (Mini) | 1.0 - 1.5 pips |

| Commission Model | No commissions | Varies by broker |

| Overnight Interest Range | Varies | Varies |

The spreads offered by USGFX, particularly on its mini account, are significantly higher than the industry average, which could impact profitability for traders, especially those engaged in high-frequency trading. Additionally, the absence of a clear commission structure raises questions about hidden fees that may not be immediately apparent to new clients.

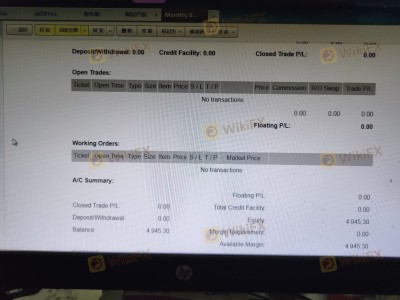

Client Fund Safety

The safety of client funds is a paramount concern when evaluating a forex broker. USGFX claims to hold client funds in segregated accounts at the Commonwealth Bank of Australia, which is a positive indicator. Segregation of funds is a standard practice among regulated brokers to ensure that client money is not used for operational expenses.

Moreover, USGFX reportedly implements negative balance protection, which prevents clients from losing more than their account balance. However, the historical compliance issues and the revocation of its licenses raise concerns about the effectiveness of these measures. There have been instances where clients have reported issues with fund withdrawals, which further complicates the assessment of USGFX's reliability.

Customer Experience and Complaints

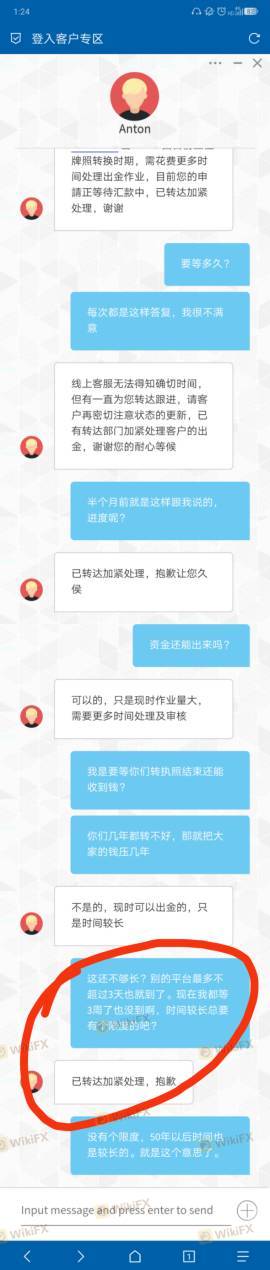

Customer feedback is an essential aspect of evaluating a broker's performance. USGFX has received mixed reviews, with many clients expressing dissatisfaction regarding withdrawal processes and customer support quality.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Support Quality | Medium | Limited availability |

Common complaints include difficulties in withdrawing funds, with some users reporting that their requests were ignored or delayed for extended periods. The quality of customer support has also been a point of contention, with many users indicating that they faced challenges in getting timely assistance.

Platform and Execution

USGFX offers its clients access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are known for their robust features and user-friendly interfaces. However, reports of execution delays and slippage have surfaced, leading to concerns about the overall trading experience.

The quality of order execution is crucial for traders, especially in a fast-paced market like forex. Users have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. The lack of transparency regarding execution policies raises questions about the broker's operational integrity.

Risk Assessment

Using USGFX presents various risks that traders should be aware of before opening an account.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked licenses |

| Withdrawal Risk | High | Complaints about withdrawals |

| Execution Risk | Medium | Reports of slippage and re-quotes |

The combination of revoked licenses, withdrawal issues, and execution risks suggests that trading with USGFX may not be suitable for all traders. It is advisable for potential clients to consider these factors carefully and assess their risk tolerance before proceeding.

Conclusion and Recommendations

In conclusion, while USGFX presents itself as a legitimate forex broker, the evidence suggests that it may not be the safest choice for traders. The revocation of its regulatory licenses, coupled with numerous customer complaints regarding withdrawals and execution, raises significant concerns about its trustworthiness.

For traders seeking a reliable forex broker, it may be prudent to consider alternatives with stronger regulatory oversight and better customer feedback. Brokers such as ZFX or FP Markets, which maintain robust regulatory frameworks and have positive reputations, could offer safer trading environments.

In summary, is USGFX safe? The answer remains uncertain, and potential traders should approach with caution, ensuring they conduct thorough research and consider their options carefully.

Is USGFX a scam, or is it legit?

The latest exposure and evaluation content of USGFX brokers.

USGFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

USGFX latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.