Regarding the legitimacy of Westfield Global forex brokers, it provides FSPR and WikiBit, (also has a graphic survey regarding security).

Is Westfield Global safe?

Business

License

Is Westfield Global markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

GAIN WEALTH GLOBAL BROKERS LIMITED

Effective Date:

2015-02-21Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Southern Cross Building Level 3, 59-67 High Street Auckland 1010Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Westfield Global Safe or a Scam?

Introduction

Westfield Global is a Forex broker that has gained attention in the trading community for its offerings in various financial instruments, including CFDs on currencies, commodities, and cryptocurrencies. As the Forex market continues to evolve, traders are increasingly aware of the need to conduct thorough evaluations of brokers before committing their funds. This vigilance is crucial, as the industry is rife with both legitimate and fraudulent entities. In this article, we will explore the safety and legitimacy of Westfield Global, examining its regulatory status, company background, trading conditions, customer experiences, and more. Our investigation is based on a comprehensive review of available online resources, including regulatory databases, user reviews, and industry analyses.

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of any financial service provider, particularly in the Forex market, where the risk of fraud can be significant. Westfield Global's regulatory status is concerning, as it appears to lack proper licensing from reputable authorities. The absence of regulation can lead to questionable practices and a higher risk of losing funds. Below is a summary of the core regulatory information regarding Westfield Global:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The lack of regulatory oversight from established entities such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission) raises significant red flags. Reports indicate that Westfield Global has had its licenses revoked or has operated without valid licensing, which is a critical factor to consider when assessing if Westfield Global is safe. The history of regulatory compliance is essential, as brokers with a clean record are more likely to be trustworthy.

Company Background Investigation

Understanding a broker's history and ownership structure is crucial to evaluating its legitimacy. Westfield Global was reportedly established in New Zealand, but detailed information about its ownership and management team is scarce. The lack of transparency regarding the company's background can be alarming for potential traders. A reputable broker typically provides clear information about its founders, management team, and operational history.

Furthermore, the absence of detailed disclosures can lead to concerns about the broker's integrity and commitment to ethical practices. Traders should be cautious of brokers that do not openly share their history and operational framework, as this can be indicative of potential issues down the line.

Trading Conditions Analysis

When considering whether Westfield Global is safe, it is imperative to analyze its trading conditions and fee structure. A thorough understanding of the costs associated with trading can prevent unexpected financial burdens. Reports suggest that Westfield Global employs a complex fee structure that may not be clearly communicated to clients.

Heres a comparison of core trading costs:

| Fee Type | Westfield Global | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not disclosed | 1-2 pips |

| Commission Model | Not disclosed | $5-$10 per lot |

| Overnight Interest Range | Not disclosed | Varies |

The lack of transparency regarding fees raises concerns about hidden costs that could affect traders' profitability. Unusual or excessive fees can be a warning sign of a broker that may not operate in the best interests of its clients.

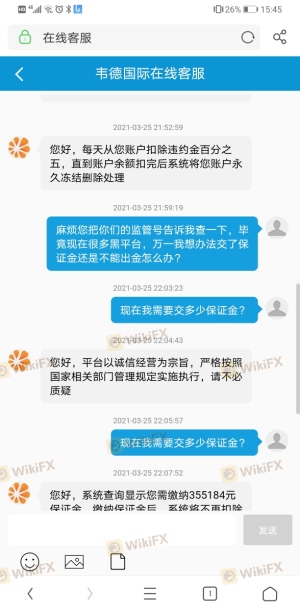

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's reliability. Westfield Global's approach to fund security is unclear, as there is little information available regarding its policies on fund segregation, investor protection, and negative balance protection. These factors are critical in ensuring that clients' funds are safeguarded against potential losses.

Traders should look for brokers that maintain segregated accounts, which protect their funds from being used for operational expenses. Additionally, the presence of investor compensation schemes can offer an extra layer of security. Historical issues with fund safety, such as reports of clients being unable to withdraw their funds, further exacerbate concerns about the broker's reliability.

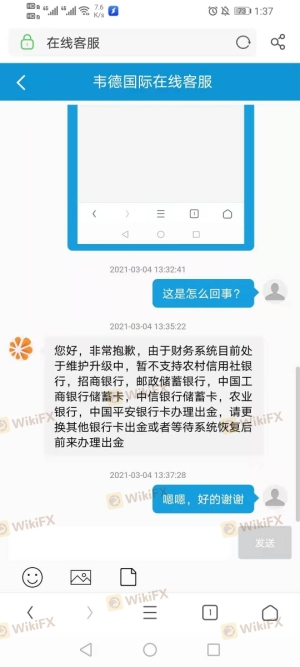

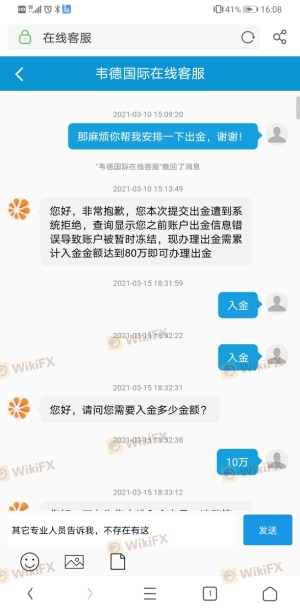

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's credibility. A review of user experiences with Westfield Global reveals a pattern of complaints, particularly regarding withdrawal difficulties and unresponsive customer support.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Support | Medium | Slow response |

| Transparency Issues | High | No clear response |

Several users have reported issues with accessing their accounts and withdrawing funds, leading to allegations that Westfield Global may have engaged in fraudulent practices. These complaints are serious indicators that potential clients should consider when evaluating whether Westfield Global is safe.

Platform and Trade Execution

A broker's trading platform is a critical component of the overall trading experience. Westfield Global claims to offer advanced trading platforms, but user reviews suggest that execution quality may be inconsistent. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes.

The performance and stability of the trading platform play a crucial role in ensuring a seamless trading experience. If a broker's platform frequently experiences outages or delays, it can lead to missed trading opportunities and frustration among clients.

Risk Assessment

When evaluating the overall risk of trading with Westfield Global, several factors come into play. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of regulation raises concerns. |

| Fund Safety | High | Unclear policies on fund security. |

| Customer Support | Medium | Reports of unresponsive support. |

Traders should exercise caution when considering Westfield Global as their broker. It is advisable to conduct thorough due diligence and weigh the risks before engaging with the platform.

Conclusion and Recommendations

In conclusion, the evidence suggests that Westfield Global raises several red flags that indicate it may not be a safe option for traders. The lack of regulatory oversight, transparency issues, and a history of customer complaints collectively point to a broker that could pose significant risks.

For traders seeking a reliable Forex broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Some reputable options include brokers that are regulated by top-tier authorities like the FCA or ASIC. Ultimately, traders must prioritize their safety and conduct thorough research before committing their funds to any broker, including Westfield Global.

In summary, is Westfield Global safe? The consensus leans towards caution due to its questionable practices and lack of transparency.

Is Westfield Global a scam, or is it legit?

The latest exposure and evaluation content of Westfield Global brokers.

Westfield Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Westfield Global latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.