Regarding the legitimacy of TeraFX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is TeraFX safe?

Pros

Cons

Is TeraFX markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Gildencrest Capital Limited

Effective Date:

2012-05-30Email Address of Licensed Institution:

compliance@gildencrest.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.gildencrestcapital.co.ukExpiration Time:

--Address of Licensed Institution:

Studio 11, 7th Floor One Canada Square Canary Wharf London E14 5AA UNITED KINGDOMPhone Number of Licensed Institution:

+44 2030484764Licensed Institution Certified Documents:

Is TeraFX A Scam?

Introduction

TeraFX is an online trading platform that positions itself within the competitive landscape of the forex market. Operating since 2011 and headquartered in London, UK, TeraFX specializes in forex trading and contracts for difference (CFDs) on indices, commodities, and precious metals. As with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market's inherent volatility and the potential for financial loss necessitate careful evaluation of a broker's legitimacy and reliability. This article aims to provide an objective analysis of TeraFX's credibility by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The assessment is based on a review of multiple reputable sources, including regulatory databases, user reviews, and financial analysis platforms.

Regulation and Legitimacy

TeraFX is regulated by the Financial Conduct Authority (FCA) in the UK, a highly regarded regulatory body known for its strict oversight of financial firms. Regulation by the FCA is a significant factor that enhances the credibility of TeraFX, as it ensures compliance with stringent operational standards and consumer protection measures. The following table summarizes TeraFX's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 564741 | United Kingdom | Verified |

The FCA's regulatory framework requires brokers to maintain segregated accounts for client funds, ensuring that traders' money is protected in the event of a broker's insolvency. Additionally, the FCA mandates regular audits and compliance checks, providing an added layer of security for clients. Historically, TeraFX has maintained its FCA registration without any major compliance issues reported, indicating a commitment to regulatory adherence. However, it is important to note that regulatory oversight does not eliminate all risks associated with trading, and traders should remain vigilant.

Company Background Investigation

TeraFX operates under the ownership of Tera Europe Limited, a company incorporated in the UK. The broker has been active in the financial markets for over a decade, and its establishment in London places it in one of the world's leading financial hubs. The management team comprises professionals with extensive experience in the financial services sector, contributing to the firm's operational integrity and strategic direction.

Transparency is crucial in the financial industry, and TeraFX has made efforts to provide essential information about its services, fees, and trading conditions on its website. However, some users have reported issues with the website, including inactive pages and broken links, which may raise concerns about the broker's commitment to maintaining a user-friendly platform. Overall, TeraFX appears to be a legitimate broker with a solid foundation, but potential clients should consider the level of transparency and accessibility of information when evaluating the broker.

Trading Conditions Analysis

TeraFX offers a range of trading conditions that are competitive within the industry. The broker employs a no dealing desk (NDD) execution model, which facilitates direct market access for traders. This model is generally favorable as it minimizes conflicts of interest between the broker and the trader. The overall fee structure includes variable spreads and commissions based on the account type, which can impact trading costs significantly. The following table outlines the core trading costs associated with TeraFX:

| Cost Type | TeraFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.2 pips |

| Commission Model | Variable | Variable |

| Overnight Interest Range | Varies by account | Varies by account |

TeraFX's spreads are generally competitive, particularly for major currency pairs. However, traders should be aware of additional costs, such as swap rates for overnight positions and potential inactivity fees. A thorough understanding of these costs is essential for effective trading strategy development.

Client Funds Security

The safety of client funds is a paramount concern for any trader. TeraFX implements several measures to ensure the security of its clients' money. As mentioned earlier, client funds are maintained in segregated accounts, which means that traders' deposits are kept separate from the broker's operational funds. This segregation is a critical aspect of FCA regulation, designed to protect clients in case the broker faces financial difficulties.

Additionally, TeraFX is a member of the Financial Services Compensation Scheme (FSCS), which provides further protection for clients. In the unlikely event that TeraFX becomes insolvent, clients can claim compensation up to £85,000 per individual. This safety net is a significant advantage for traders considering TeraFX as their broker. Nonetheless, it is essential for potential clients to be aware of any historical issues related to fund security or disputes that may have arisen in the past.

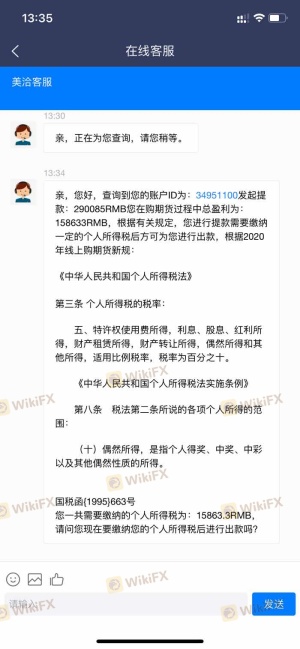

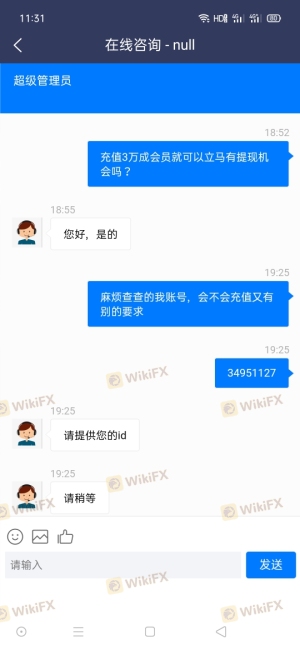

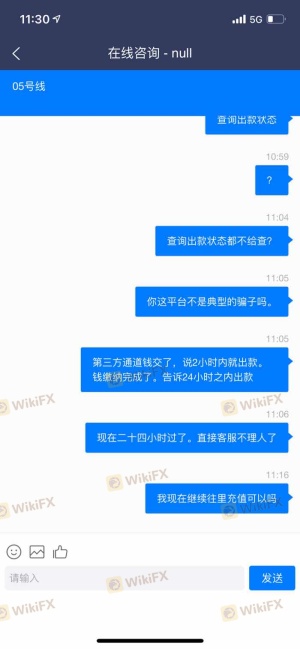

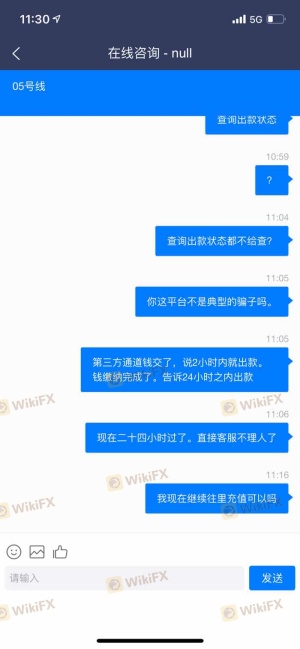

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of TeraFX reveal a mixed bag of experiences among users. While some traders commend the broker for its competitive spreads and user-friendly platforms, others have raised concerns about withdrawal issues and customer service responsiveness. The following table summarizes the primary types of complaints received regarding TeraFX:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Quality | Medium | Generally positive |

| Platform Stability | Low | Minor complaints |

One notable case involved a trader who reported difficulties in withdrawing funds, claiming that the process was delayed and that customer support was unresponsive. Such complaints, while not universal, highlight the importance of assessing a broker's customer service and operational efficiency. TeraFX's ability to address these concerns effectively will be crucial in maintaining its reputation.

Platform and Execution

TeraFX utilizes the widely recognized MetaTrader 4 (MT4) platform, which is favored by many traders for its robust functionality and ease of use. The platform offers a variety of tools for technical analysis, automated trading, and order management, making it suitable for both novice and experienced traders. The execution quality has been generally reported as satisfactory, with minimal slippage and a low rate of rejected orders.

However, like any trading platform, MT4 is not immune to issues. Some users have reported occasional connectivity problems, which can impact trading efficiency. Overall, TeraFX's platform performance appears to be on par with industry standards, but traders should remain vigilant for any signs of manipulation or irregularities.

Risk Assessment

Engaging with any broker comes with inherent risks. The following risk assessment summarizes the key risk factors associated with trading through TeraFX:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | FCA regulation provides strong oversight. |

| Financial Risk | Medium | Market volatility can lead to significant losses. |

| Operational Risk | Medium | Potential for withdrawal issues and platform stability. |

| Customer Service Risk | High | Mixed feedback on responsiveness and issue resolution. |

To mitigate these risks, traders should conduct thorough research, utilize risk management strategies, and maintain realistic expectations regarding their trading outcomes. Understanding the broker's policies and practices is vital for minimizing exposure to potential pitfalls.

Conclusion and Recommendations

In conclusion, TeraFX is a regulated broker that offers a range of trading opportunities with competitive conditions. While the FCA regulation provides a level of security and legitimacy, potential clients should remain cautious due to reports of withdrawal issues and mixed customer experiences. Overall, TeraFX does not exhibit clear signs of being a scam; however, traders should exercise due diligence and consider their individual trading needs before opening an account.

For those seeking alternatives, brokers such as FXPro and IG Markets offer similar services with strong regulatory oversight and positive user feedback. Ultimately, the choice of a broker should align with the trader's risk tolerance, trading style, and specific requirements.

Is TeraFX a scam, or is it legit?

The latest exposure and evaluation content of TeraFX brokers.

TeraFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TeraFX latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.