TeraFX 2025 Review: Everything You Need to Know

Executive Summary

TeraFX is a mid-to-high trust foreign exchange broker. It has built a strong position in the competitive forex market since 2011. This terafx review shows a UK-based brokerage that works under the Financial Conduct Authority (FCA). The broker gives traders access to over 60 currency pairs through a No Dealing Desk execution model that cuts trading delays and makes execution better.

The broker stands out by offering both MetaTrader 4 and MetaTrader 5 platforms. This setup serves different trading styles while keeping entry easy with just a US$100 minimum deposit. TeraFX uses a straight-through processing (STP) business model. This approach reduces conflicts of interest by sending client orders straight to liquidity providers instead of taking the other side of trades.

The platform serves many trading instruments including forex pairs, contracts for difference (CFDs) on indices, commodities, and precious metals like gold and silver. This wide asset selection makes TeraFX good for small to medium-sized traders and investors who want to spread their portfolios across different asset types. The broker's leverage of 1:30 follows current European rules while giving reasonable trading flexibility.

Important Notice

Traders should know that rules and trading conditions can change a lot across different countries and regions where TeraFX works. The specific terms, conditions, and available services can differ based on local rules and licensing needs. Future clients should carefully review all relevant documents and regulatory disclosures that apply to their area before opening an account.

This review uses publicly available information, user feedback, and industry data sources available when it was written. The analysis aims to give an objective look at TeraFX's services and offerings. However, trading conditions, fees, and services may change over time, so readers should check current information directly with the broker before making any trading decisions.

Rating Framework

Broker Overview

TeraFX started operations in 2011. The company set up its headquarters in London, United Kingdom, and has since gone through corporate changes, now working under the name Gildencrest Capital. The company has built its reputation on providing clear trading conditions through its No Dealing Desk execution model. This approach aims to remove potential conflicts of interest by sending client orders directly to institutional liquidity providers rather than taking the opposite side of trades internally.

The broker's business philosophy centers on straight-through processing (STP). This execution method gives faster order execution and more competitive pricing by accessing real market liquidity. This approach appeals particularly to traders who want execution speed and transparency in their trading operations. TeraFX has positioned itself as a bridge that connects retail traders with institutional-grade market access while keeping the user-friendly interface and support services that individual investors expect.

The company's trading setup supports both MetaTrader 4 and MetaTrader 5 platforms. This recognizes the different preferences within the trading community. While MT4 stays popular for its simplicity and widespread third-party support, MT5 offers better features including additional timeframes, more technical indicators, and improved backtesting abilities. TeraFX's asset portfolio includes foreign exchange pairs, contracts for difference on major indices, commodity markets, and precious metals including gold and silver trading opportunities.

Operating under Financial Conduct Authority regulation with license number FRN 564741, TeraFX follows strict UK financial services standards. This regulatory framework requires following capital adequacy requirements, client fund separation, and operational transparency standards designed to protect retail investor interests.

Regulatory Jurisdiction: TeraFX operates under the supervision of the UK's Financial Conduct Authority (FCA), one of the world's most respected financial regulators. This oversight ensures following strict operational standards, capital requirements, and client protection measures that boost trader confidence and fund security.

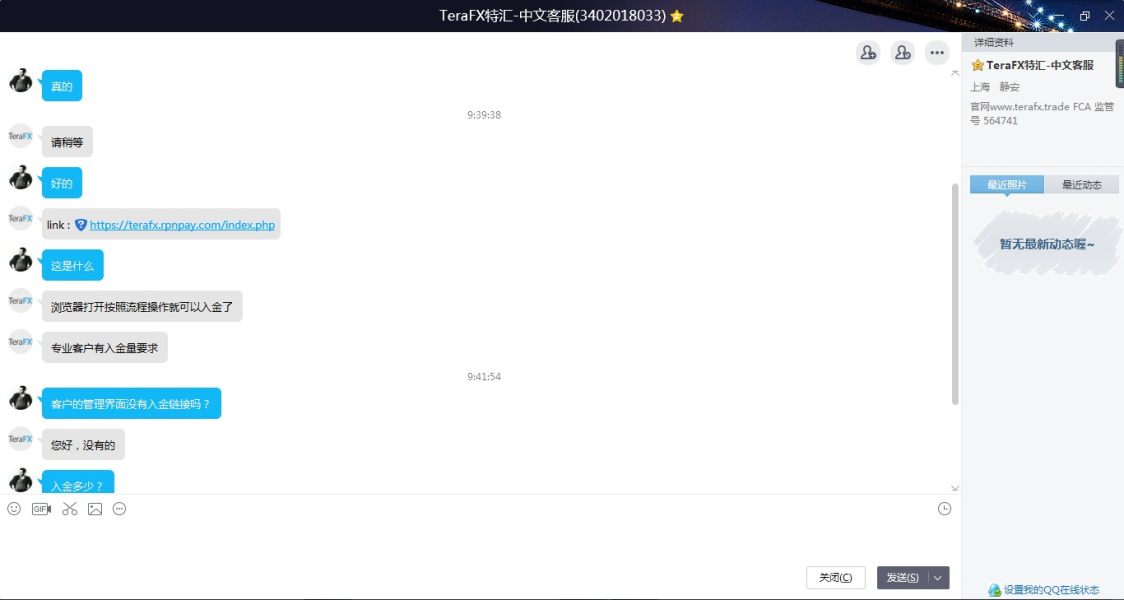

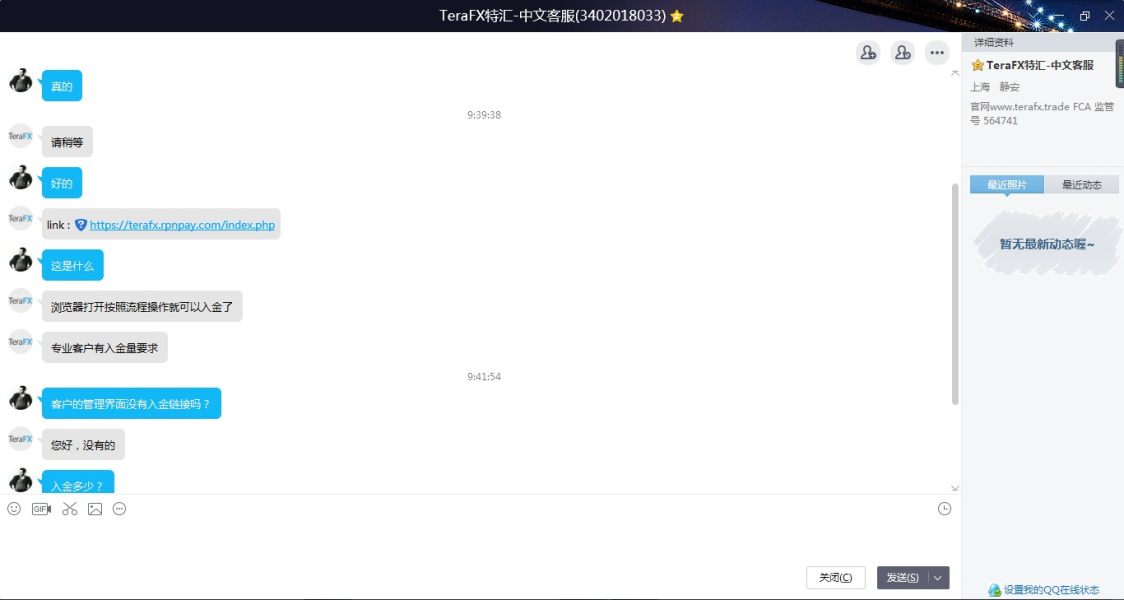

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in the available materials. This requires direct inquiry with the broker for complete payment options and processing timeframes.

Minimum Deposit Requirements: The broker keeps an accessible entry threshold with a minimum deposit requirement of US$100. This makes it suitable for beginning traders and those testing the platform before putting in larger amounts of capital.

Promotional Offers: Current bonus and promotional information was not specified in available documentation. This suggests potential clients should contact TeraFX directly for any available incentive programs or promotional trading conditions.

Available Trading Assets: TeraFX provides access to over 60 currency pairs covering major, minor, and exotic forex combinations. The platform also supports CFD trading across multiple asset classes including stock indices, commodity markets, and precious metals. This offers portfolio diversification opportunities for traders seeking exposure beyond traditional currency markets.

Cost Structure: Detailed spread and commission information was not fully outlined in available materials. Traders should request specific pricing details directly from TeraFX to understand the complete cost structure for their intended trading activities and account types.

Leverage Ratios: The broker offers leverage up to 1:30, following European regulatory standards while providing enough leverage for most retail trading strategies. This ratio balances trading flexibility with risk management requirements.

Platform Options: Clients can choose between MetaTrader 4 and MetaTrader 5 platforms, both industry-standard solutions offering complete charting tools, technical analysis capabilities, and automated trading support through Expert Advisors.

Geographic Restrictions: Specific information about geographic trading restrictions was not detailed in available materials. This requires verification with the broker for service availability in particular areas.

Customer Support Languages: The range of supported languages for customer service was not specified in available documentation. However, given the UK base, English support is assured.

This comprehensive terafx review continues with detailed analysis across all evaluation categories to provide traders with thorough insights into the broker's offerings.

Account Conditions Analysis

TeraFX's account structure appears streamlined. However, specific details about multiple account tiers were not fully outlined in available materials. The broker's US$100 minimum deposit requirement positions it well within the retail forex market, particularly appealing to new traders who prefer testing services without significant initial capital commitment. This threshold is much lower than many institutional-focused brokers while staying higher than some promotional offerings from market makers, suggesting a balanced approach to client acquisition.

The account opening process specifics, including required documentation and verification timeframes, were not detailed in available sources. However, operating under FCA regulation typically requires standard Know Your Customer (KYC) procedures including identity verification, address confirmation, and financial suitability assessments. Prospective clients should expect document submission requirements consistent with UK financial services standards.

About specialized account features, information about Islamic (swap-free) accounts or other religious compliance options was not specified in available materials. Given the diverse client base typically served by UK-regulated brokers, such options may be available upon request. The absence of detailed account type descriptions suggests TeraFX may operate a simplified account structure, potentially reducing complexity for traders while potentially limiting customization options for specific trading strategies.

The leverage offering of 1:30 aligns with European Securities and Markets Authority (ESMA) regulations for retail clients. This provides reasonable trading flexibility while maintaining regulatory compliance. This ratio supports most retail trading strategies without exposing clients to excessive leverage risks that have historically caused significant retail trader losses.

User feedback about account conditions was not extensively detailed in available sources. This makes it difficult to assess real-world experiences with account setup, maintenance, or modification processes. This terafx review recommends direct broker contact for specific account condition clarifications.

TeraFX's platform offering centers on the widely-adopted MetaTrader ecosystem. It supports both MT4 and MT5 versions to accommodate varying trader preferences and requirements. MetaTrader 4 remains popular among forex-focused traders for its stability, extensive third-party support, and straightforward interface, while MetaTrader 5 appeals to those requiring additional asset classes, enhanced backtesting capabilities, and more sophisticated order types.

The availability of over 60 currency pairs provides substantial trading opportunities across major pairs like EUR/USD and GBP/USD, minor crosses, and exotic combinations. This selection supports diverse trading strategies from scalping major pairs during high-volume sessions to longer-term positioning in emerging market currencies. The inclusion of CFD products on indices, commodities, and precious metals expands trading possibilities beyond pure forex, enabling portfolio diversification and cross-asset arbitrage opportunities.

However, specific information about proprietary research resources, market analysis tools, or educational materials was not fully detailed in available sources. Many competitive brokers provide daily market commentary, economic calendar integration, sentiment indicators, and educational webinars. The absence of detailed information about such resources in this review suggests potential clients should inquire directly about available analytical support.

Automated trading support through Expert Advisors (EAs) is built into both MetaTrader platforms. This allows algorithmic trading strategies and signal copying services. The effectiveness of EA performance depends partly on execution speed and server stability, factors that should be evaluated during any trial period.

The straight-through processing execution model theoretically enhances trading tools effectiveness by providing faster order execution and reduced slippage. This is particularly beneficial for scalping strategies and high-frequency trading approaches that depend on rapid order processing.

Customer Service and Support Analysis

TeraFX provides multiple customer contact channels including live chat functionality, email correspondence, and telephone support. This covers the standard communication preferences of most traders. This multi-channel approach ensures clients can reach support through their preferred method, whether requiring immediate assistance through chat or detailed inquiry resolution via email.

The quality and responsiveness of customer service significantly impact trader satisfaction, particularly during volatile market conditions when technical issues or account problems require immediate attention. However, specific information about average response times, support quality ratings, or customer satisfaction metrics was not detailed in available materials. This limits this review's ability to assess service effectiveness fully.

Operating from the UK timezone potentially provides optimal support hours for European traders. However, global forex markets operate 24/5, creating support challenges for clients in significantly different timezones. The availability of round-the-clock support during market hours is crucial for active traders, particularly those engaging in news trading or managing positions during major economic announcements.

Multilingual support capabilities were not specified in available documentation. However, UK-based operations typically provide English-language support as standard. Traders requiring support in other languages should verify availability before account opening, as language barriers can complicate technical support and account management processes.

The effectiveness of customer service often becomes apparent during account funding, withdrawal processing, or technical difficulties. User feedback about support experience was not extensively available in reviewed sources, making it challenging to assess real-world service quality. New clients might consider testing support responsiveness during the account opening process as an indicator of ongoing service levels.

Trading Experience Analysis

The trading experience with TeraFX centers on the MetaTrader platform ecosystem. This provides familiar interfaces for traders experienced with industry-standard tools. Platform stability and execution speed are critical factors for trading success, particularly for strategies dependent on precise timing or rapid market movements. The broker's straight-through processing model theoretically enhances execution quality by reducing intermediary delays and providing direct market access.

Order execution quality, including slippage rates and requote frequency, significantly impacts trading profitability, especially for scalping and high-frequency strategies. However, specific performance metrics about execution statistics were not detailed in available materials. Traders should evaluate execution quality during any trial period, particularly during high-volatility periods when liquidity may be reduced and slippage more likely.

Platform functionality completeness is assured through MetaTrader's comprehensive feature set. This includes advanced charting tools, technical indicators, and automated trading capabilities. Both MT4 and MT5 support custom indicators, Expert Advisors, and third-party plugins, enabling strategy customization and automated trading implementation.

Mobile trading experience, increasingly important for active traders, depends on MetaTrader's mobile applications rather than proprietary broker apps. This approach ensures feature consistency across devices while leveraging MetaTrader's established mobile platform development. However, specific information about mobile platform optimization or custom mobile features was not available in reviewed sources.

Trading environment factors including spread stability, liquidity depth, and market hours coverage directly impact trading costs and opportunity availability. The broker's access to over 60 currency pairs suggests reasonable market coverage, though specific liquidity provider relationships and spread competitiveness require direct evaluation.

This terafx review emphasizes the importance of testing trading conditions during demo or small live account periods before committing significant capital.

Trust and Reliability Analysis

TeraFX's regulatory standing under the Financial Conduct Authority provides substantial credibility within the forex industry. FCA regulation requires following strict capital adequacy standards, client fund segregation requirements, and operational transparency measures designed to protect retail investor interests. The specific license number FRN 564741 enables verification of regulatory status through official FCA registers, providing transparency about authorized activities and any regulatory actions.

Client fund protection measures, while not specifically detailed in available materials, are typically robust under FCA oversight. UK regulation generally requires client fund segregation from operational capital, ensuring trader deposits remain protected even in scenarios of broker financial difficulty. However, specific details about deposit insurance coverage or compensation scheme participation should be verified directly with the broker.

Company transparency about ownership structure, financial reporting, and management information was not fully available in reviewed sources. Publicly available information about corporate structure, annual reports, or key personnel provides additional confidence indicators for prospective clients evaluating broker stability and longevity.

Industry reputation and recognition through awards, certifications, or professional associations were not detailed in available materials. Such recognition often indicates peer acknowledgment of service quality, though absence of awards doesn't necessarily indicate poor service quality.

The user trust score of 76 points suggests moderate-to-high confidence levels among existing clients. However, the methodology and sample size for this rating were not specified. This score indicates generally positive user experiences while suggesting room for service improvements.

Negative incident handling, regulatory actions, or customer complaint resolution processes were not detailed in available sources. This limits assessment of crisis management capabilities and regulatory compliance history.

User Experience Analysis

Overall user satisfaction assessment is challenging due to limited specific feedback available in reviewed sources. The user trust score of 76 suggests moderate-to-high satisfaction levels, though detailed user testimonials or comprehensive satisfaction surveys were not available for analysis. This score indicates generally positive experiences while highlighting potential areas for service enhancement.

Interface design and usability depend primarily on MetaTrader platform familiarity rather than proprietary broker interfaces. This approach ensures consistent user experience for traders familiar with industry-standard platforms while potentially limiting unique feature differentiation. The effectiveness of broker-specific customizations or platform enhancements was not detailed in available materials.

Account registration and verification process experiences were not fully documented in available sources. However, FCA regulatory requirements typically necessitate thorough KYC procedures that balance regulatory compliance with user convenience. The efficiency of these processes significantly impacts initial user experience and broker perception.

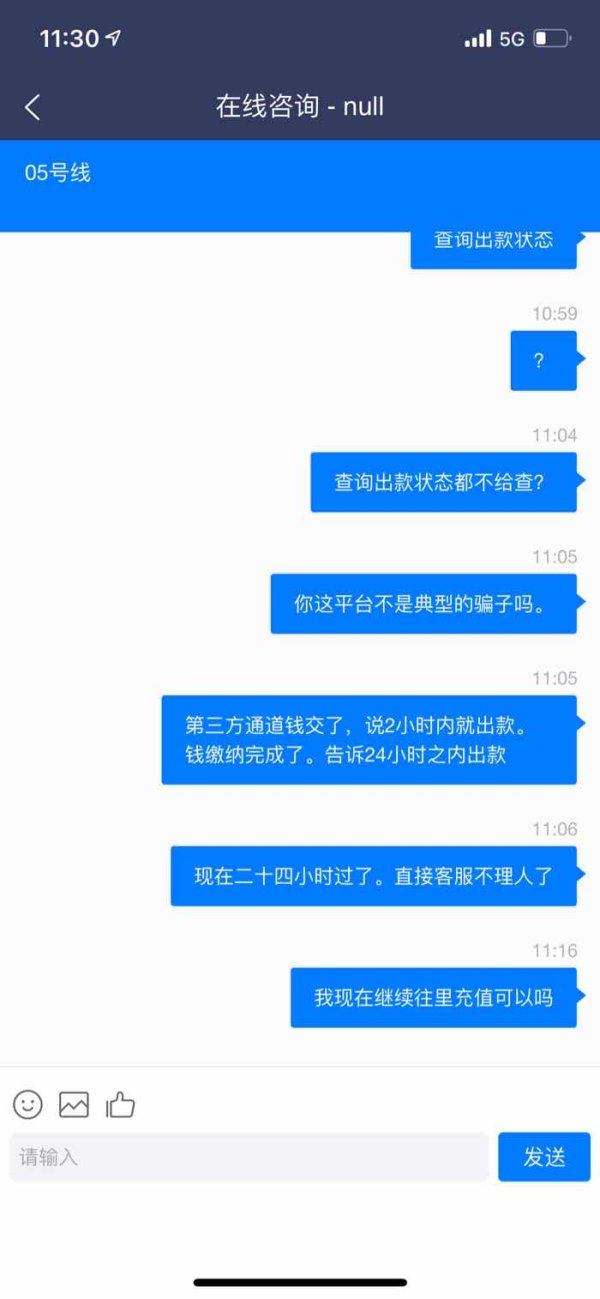

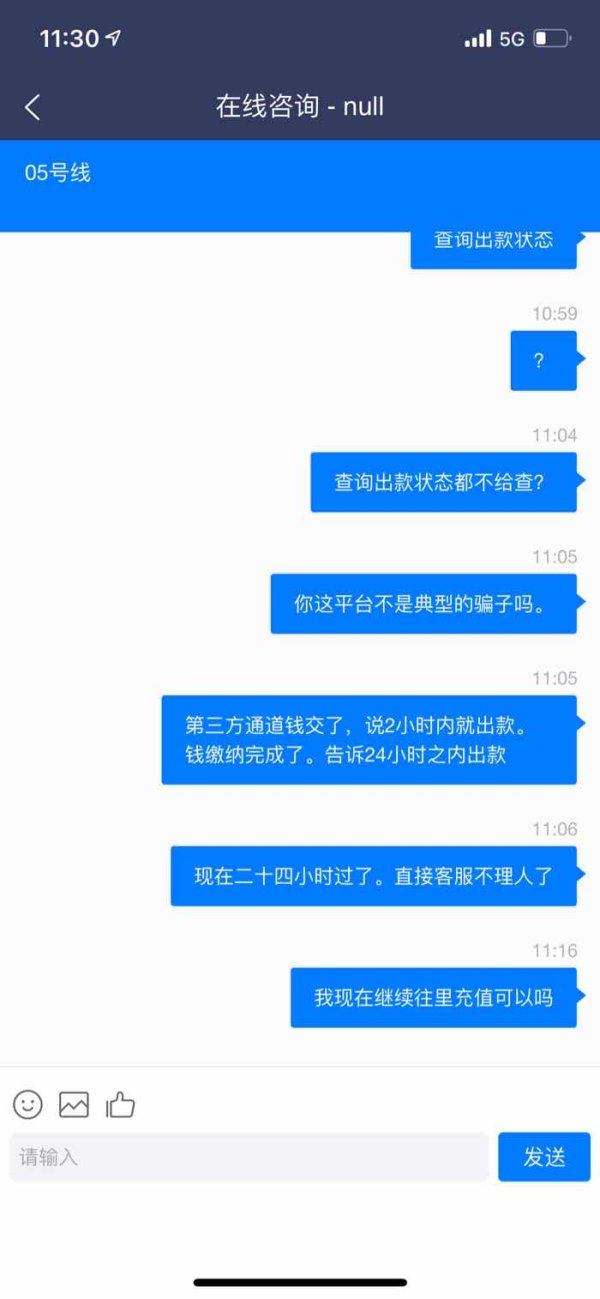

Fund operation experience, including deposit and withdrawal processing times, payment method variety, and transaction fees, directly affects user satisfaction but was not detailed in reviewed materials. These operational aspects often determine long-term client relationships and should be evaluated during initial account testing.

Common user complaints or frequently reported issues were not specified in available sources. This limits identification of potential service weaknesses or areas requiring attention. Such feedback typically provides valuable insights into real-world operational challenges and service gaps.

The target user profile appears suited for small-to-medium retail traders seeking regulated broker services with standard platform access and reasonable entry requirements. The US$100 minimum deposit and 1:30 leverage suggest positioning toward beginning-to-intermediate traders rather than institutional or high-net-worth clients requiring specialized services.

Conclusion

TeraFX presents itself as a competent foreign exchange broker with solid regulatory credentials through FCA oversight and reasonable trading conditions for retail clients. This terafx review reveals a broker suitable for small-to-medium traders, particularly those new to forex markets, seeking regulated services with accessible entry requirements and standard platform access.

The broker's primary strengths include strong regulatory oversight, diverse asset selection with over 60 currency pairs, and industry-standard MetaTrader platform support. The straight-through processing execution model and UK regulatory framework provide confidence in operational transparency and client protection measures.

However, areas requiring improvement include transparency about pricing structures, detailed service descriptions, and comprehensive user feedback availability. The limited specific information about spreads, commissions, customer service quality, and user experiences suggests potential clients should conduct thorough due diligence through direct broker contact and demo account testing.

TeraFX appears most suitable for beginning-to-intermediate traders seeking regulated broker services without requiring specialized features or institutional-grade offerings. The accessible minimum deposit and standard leverage ratios support typical retail trading requirements while maintaining regulatory compliance and reasonable risk management parameters.