Regarding the legitimacy of Swiss Markets forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Swiss Markets safe?

Pros

Cons

Is Swiss Markets markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Viverno Markets Ltd

Effective Date: Change Record

2013-05-31Email Address of Licensed Institution:

info@viverno.comSharing Status:

No SharingWebsite of Licensed Institution:

www.viverno.comExpiration Time:

--Address of Licensed Institution:

Apostolou Andrea Street 11 Hyper Tower 5th Floor 4007 Mesa Yeitonia Limassol CyprusPhone Number of Licensed Institution:

+357 25 053 940Licensed Institution Certified Documents:

Is Swiss Markets A Scam?

Introduction

Swiss Markets is a forex and CFD broker that has positioned itself as a player in the online trading arena since its inception in 2016. Operating under the umbrella of BDSwiss Group, it offers a range of financial instruments, including forex pairs, commodities, and indices. As the forex market continues to grow, traders must exercise caution and due diligence when selecting a broker. The potential for scams and fraudulent activities in this space is significant, making it essential for investors to assess the legitimacy and safety of their trading partners thoroughly.

In this article, we will investigate Swiss Markets to determine whether it is a safe trading platform or a scam. Our analysis is based on a combination of regulatory reviews, customer feedback, and an examination of the broker's operational history. By employing a structured evaluation framework, we aim to provide a comprehensive overview of Swiss Markets, helping traders make informed decisions.

Regulation and Legitimacy

Regulation is a critical factor in assessing the safety and trustworthiness of a forex broker. Swiss Markets claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission (FSC) in Mauritius. Regulatory oversight is designed to protect traders and ensure fair trading practices, but the quality of regulation can vary significantly across jurisdictions.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 199/13 | Cyprus | Verified |

| FSC | c116016172 | Mauritius | Verified |

| FSA | sd 047 | Seychelles | Verified |

While Swiss Markets holds licenses from these regulatory bodies, it is essential to note that both Mauritius and Seychelles are often viewed as offshore jurisdictions with less stringent regulatory requirements compared to Tier 1 regulators like the UK‘s FCA or Australia’s ASIC. This raises concerns about the overall safety of trading with Swiss Markets, as the lax regulatory environment may not provide adequate protection for traders.

Additionally, Swiss Markets has been flagged on warning lists for unauthorized trading activities, particularly by the Ministry of Trade in Indonesia. This negative exposure can raise red flags for potential investors, suggesting that the broker may not operate entirely above board. Thus, while Swiss Markets is regulated, the quality of that regulation and its implications for trader safety remain questionable.

Company Background Investigation

Swiss Markets operates under BDS Markets, which is part of the BDSwiss Group. Founded in 2016, the company has developed a reputation for offering a variety of trading products and services. However, the companys history is somewhat murky, as it is linked to other brands that have faced regulatory scrutiny and negative reviews.

The management team behind Swiss Markets comprises individuals with backgrounds in finance and trading, but specific details about their professional experience and qualifications are not readily available. This lack of transparency can be concerning for traders who wish to know the expertise behind the brokers operations.

Furthermore, the level of information disclosure from Swiss Markets is relatively low. While the broker provides basic information about its services and regulatory status, there is little insight into its operational practices, financial health, or any potential legal issues it may have faced in the past. This lack of transparency can be a significant drawback for traders looking for reliable and trustworthy brokers.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Swiss Markets provides two primary account types: the STP Classic and the STP Raw accounts. The minimum deposit requirement for both accounts is set at $200.

The overall fee structure at Swiss Markets has raised some concerns among traders. While the broker advertises competitive spreads, the commission structure can be relatively high compared to industry standards.

| Fee Type | Swiss Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.9 pips | 0.5-1.0 pips |

| Commission Model | $11 per lot | $5-$8 per lot |

| Overnight Interest Range | Varies | Varies |

The commission fees, particularly for the STP Raw account, are notably higher than the industry average. This can significantly impact the profitability of traders, especially those engaging in high-frequency trading strategies. Moreover, traders have reported unexpected fees during the withdrawal process, which can further complicate the trading experience.

Client Fund Security

The security of client funds is paramount when choosing a broker. Swiss Markets claims to implement various measures to protect trader funds, including segregated accounts and a commitment to transparency. However, the specifics of these safety measures are not well-documented.

The broker does not offer negative balance protection, which is a crucial feature that prevents traders from losing more than their deposited funds. This omission can expose traders to significant financial risks, especially in volatile market conditions.

Additionally, historical complaints have surfaced regarding withdrawal issues, with clients reporting delays and unexpected charges. These incidents raise concerns about the broker's commitment to safeguarding client funds and processing transactions efficiently.

Customer Experience and Complaints

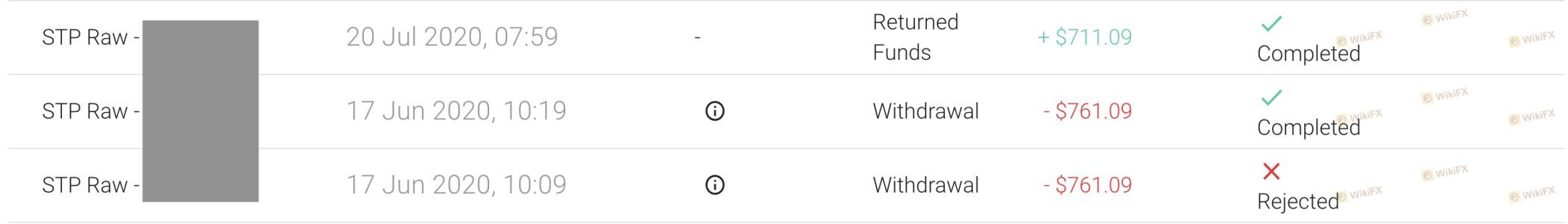

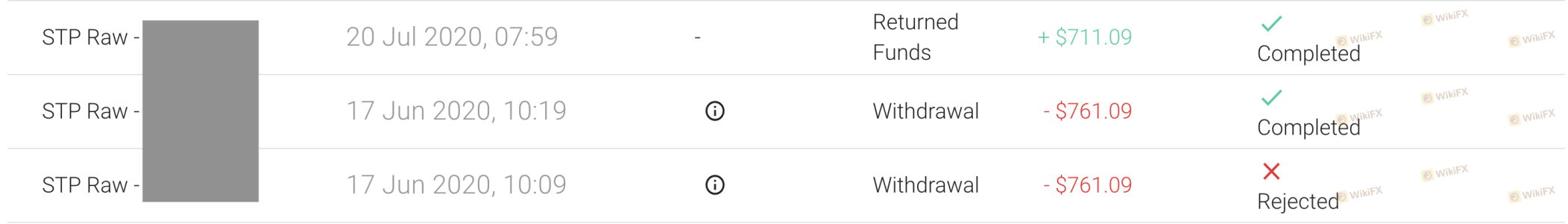

Customer feedback is a vital aspect of assessing a broker's reliability. Swiss Markets has garnered mixed reviews from users, with many reporting unsatisfactory experiences. Common complaints include difficulties with withdrawals, high fees, and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| High Fees | Medium | Minimal explanation |

| Poor Customer Support | High | Ongoing issues |

For instance, one user reported waiting over a month for a withdrawal to be processed, only to have the funds returned due to an intermediary bank issue. Despite multiple attempts to resolve the situation, the user found the company's support lacking. This level of service can be alarming for potential traders considering Swiss Markets.

Platform and Trade Execution

Swiss Markets utilizes the widely recognized MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools. However, the performance of the platform in terms of execution quality and reliability is critical.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. While Swiss Markets claims to operate as a true STP broker, the presence of execution issues raises questions about the integrity of its trading environment.

Risk Assessment

Using Swiss Markets presents several risks that traders should be aware of. The combination of high commission fees, potential withdrawal issues, and the lack of negative balance protection contributes to an overall risk profile that may be concerning for many traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight |

| Financial Risk | Medium | High fees and potential withdrawal issues |

| Operational Risk | High | Reports of slippage and order rejections |

To mitigate these risks, traders should consider diversifying their investments and not committing significant capital to a broker with questionable practices. It is also advisable to conduct thorough research and potentially seek out brokers with stronger regulatory frameworks.

Conclusion and Recommendations

In conclusion, while Swiss Markets presents itself as a regulated broker, significant concerns regarding its operational practices, customer service, and overall transparency raise red flags. The combination of high fees, withdrawal issues, and a lack of negative balance protection suggests that traders should exercise caution.

For those considering trading with Swiss Markets, it is essential to weigh the risks against potential rewards. We recommend that traders seek alternatives with stronger regulatory backing and more favorable trading conditions. Brokers regulated by Tier 1 authorities such as the FCA or ASIC may provide a more secure trading environment.

Overall, assessing whether Swiss Markets is safe or a scam requires careful consideration of the evidence presented. While it may not be outright fraudulent, the potential for issues and risks associated with trading on this platform should not be overlooked.

Is Swiss Markets a scam, or is it legit?

The latest exposure and evaluation content of Swiss Markets brokers.

Swiss Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Swiss Markets latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.