Swiss Markets 2025 Review: Everything You Need to Know

Executive Summary

Swiss Markets is a Cyprus Securities and Exchange Commission regulated forex and CFD trading platform. It has gained recognition within the trading community since its establishment in 2016. This comprehensive swiss markets review reveals a broker that positions itself as a reliable choice for traders seeking a seamless trading experience across multiple jurisdictions including Cyprus, Mauritius, and Seychelles.

The platform offers diverse asset selection with a primary focus on forex and CFD trading. It caters to traders who prioritize regulatory compliance and operational reliability. Swiss Markets has built its reputation on providing transparent trading conditions under stringent CySEC oversight, which is known for maintaining high standards of client protection and operational transparency.

The broker's multi-jurisdictional presence allows it to serve a global clientele. It maintains compliance with various regulatory frameworks. This strategic positioning makes Swiss Markets particularly suitable for forex traders who value regulatory oversight and seek a dependable trading environment for their investment activities.

Important Disclaimers

Swiss Markets operates through multiple regional entities across Cyprus, Mauritius, and Seychelles. This means regulatory policies and trading conditions may vary depending on the specific jurisdiction and entity serving your region. Traders should verify which entity they are dealing with and understand the applicable regulatory framework for their specific location.

This evaluation is based on publicly available official information and industry standard assessment criteria. The analysis presented does not incorporate user ratings or customer reviews as reference points, focusing instead on factual operational data and regulatory compliance information. Prospective traders should conduct their own due diligence and consider their individual trading requirements before making any decisions.

Rating Framework

Broker Overview

Swiss Markets established its presence in the financial markets in 2016. It built operations across multiple strategic locations including Cyprus, Mauritius, and Seychelles. The company has positioned itself as a dedicated provider of seamless trading experiences, focusing specifically on delivering reliable forex and CFD trading services to an international client base.

The broker's business model centers on providing a trustworthy trading platform. It emphasizes regulatory compliance and operational transparency. Swiss Markets has developed its reputation by maintaining strict adherence to regulatory standards while offering diverse trading opportunities that cater to various trader preferences and experience levels.

As a CySEC-regulated entity, Swiss Markets operates under one of Europe's most respected financial regulatory frameworks. The platform specializes in forex and CFD trading, providing access to multiple asset classes that enable traders to diversify their portfolios according to their individual strategies and risk tolerance levels. This swiss markets review indicates that the broker has successfully established itself as a reliable option for traders who prioritize regulatory oversight and operational stability in their trading activities.

Regulatory Framework

Swiss Markets operates under the supervision of the Cyprus Securities and Exchange Commission. It ensures compliance with European financial regulations and maintains high standards of client protection and operational transparency.

Available Trading Assets

The platform provides access to forex and CFD trading opportunities. It offers traders diversified options across multiple asset classes to accommodate various trading strategies and portfolio requirements.

Cost Structure and Fees

Specific information regarding spreads, commissions, and other trading costs was not detailed in the available source materials for this swiss markets review.

Account Features

Detailed information about account types, minimum deposit requirements, and specific account features was not provided in the source materials.

Specific trading platform information and technological infrastructure details were not specified in the available documentation.

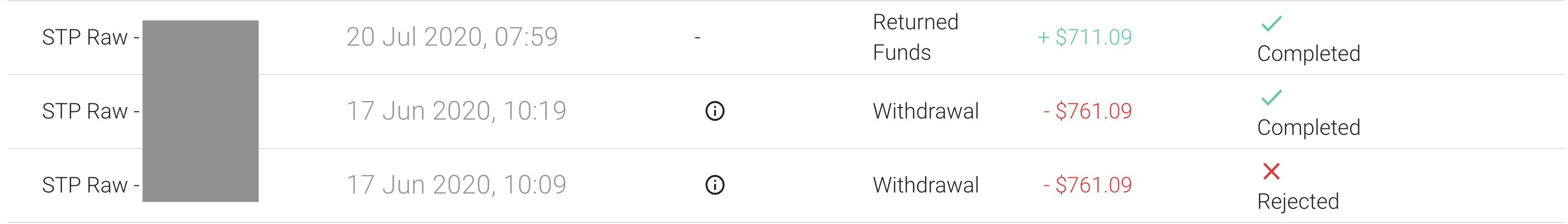

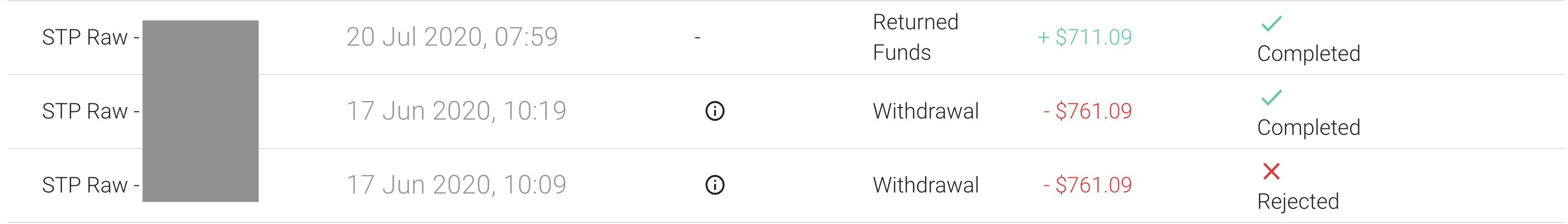

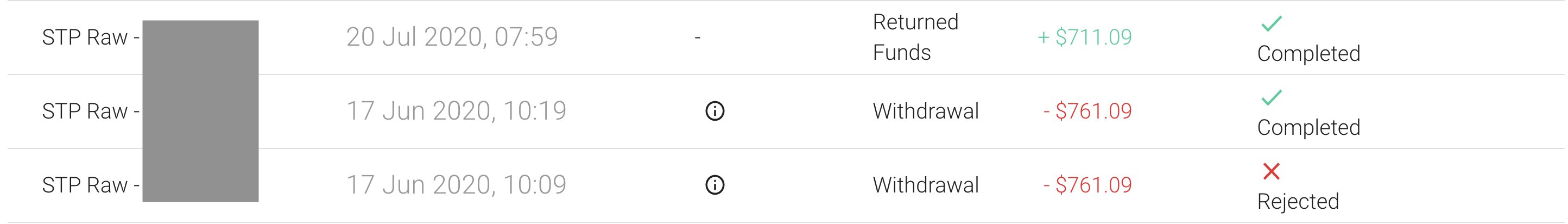

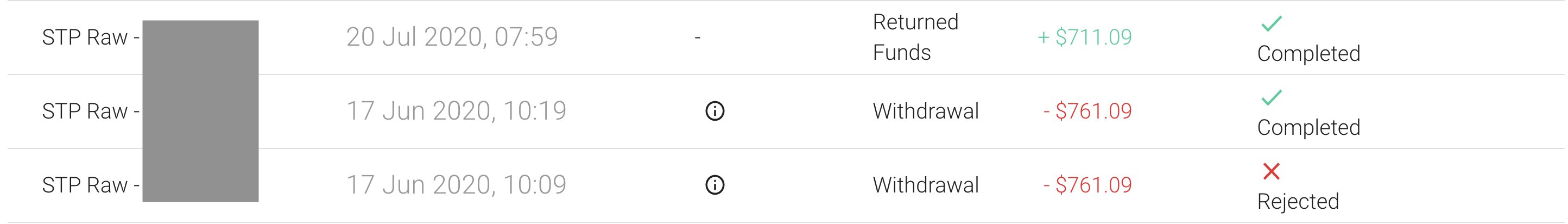

Payment Methods

Information regarding deposit and withdrawal methods, processing times, and associated fees was not included in the source materials.

Details about bonus programs, promotional campaigns, or special offers were not mentioned in the available information.

Geographic Restrictions

Specific information about regional limitations or restricted territories was not provided in the source documentation.

Detailed Analysis

Account Conditions Analysis

Based on the available information for this swiss markets review, specific details regarding account types, minimum deposit requirements, and account opening procedures were not provided in the source materials. The lack of detailed account condition information makes it challenging to provide a comprehensive assessment of this crucial aspect of the broker's offering.

Without access to specific account tier structures, minimum funding requirements, or special account features such as Islamic accounts, traders would need to contact Swiss Markets directly. They must obtain detailed information about available account options. This information gap represents a significant limitation in evaluating the broker's accessibility to different types of traders.

The absence of clear account condition details in publicly available information suggests that prospective clients should engage directly with the broker. They need to understand the specific terms and conditions that would apply to their trading activities. This direct communication approach may actually benefit traders by ensuring they receive the most current and applicable information for their specific circumstances.

Swiss Markets provides access to forex and CFD trading opportunities. This indicates a foundation for diverse trading activities. However, the specific details regarding trading tools, analytical resources, and educational materials were not elaborated upon in the available source information.

The platform's focus on forex and CFD trading suggests that traders can access multiple asset classes. This provides opportunities for portfolio diversification and various trading strategies. The asset variety represents a positive aspect of the broker's offering, though the specific range and depth of available instruments require further investigation.

Without detailed information about research capabilities, market analysis tools, or educational resources, it becomes difficult to assess how well Swiss Markets supports trader development and decision-making processes. The absence of information about automated trading support or advanced analytical tools also limits the ability to evaluate the platform's suitability for more sophisticated trading approaches.

Traders considering Swiss Markets would benefit from directly exploring the platform. They need to understand the full scope of available tools and resources that support their specific trading requirements and strategies.

Customer Service and Support Analysis

The available source materials for this swiss markets review did not include specific information about customer service channels, availability hours, response times, or service quality metrics. This information gap makes it challenging to assess one of the most critical aspects of broker operations.

Without details about available communication methods such as live chat, phone support, email systems, or help desk arrangements, prospective clients cannot evaluate how accessible support will be when needed. The absence of information about multilingual support capabilities also limits understanding of the broker's ability to serve international clients effectively.

Response time expectations, service quality standards, and problem resolution procedures are essential factors that traders consider when selecting a broker. Yet these details were not provided in the available documentation. The lack of customer service information suggests that interested traders should directly contact Swiss Markets to understand their support infrastructure.

Given the broker's multi-jurisdictional presence across Cyprus, Mauritius, and Seychelles, understanding the customer service framework becomes particularly important. It ensures adequate support across different time zones and regional requirements.

Trading Experience Analysis

Specific information regarding platform stability, execution speed, order processing quality, and overall trading environment was not detailed in the available source materials. This swiss markets review cannot provide comprehensive insights into the actual trading experience without access to performance metrics and user experience data.

Platform functionality, mobile trading capabilities, and trading environment characteristics are crucial factors. They significantly impact trader satisfaction and success. However, the absence of detailed technical specifications and performance data limits the ability to evaluate these important aspects of the broker's service delivery.

Without information about order execution policies, slippage rates, platform uptime statistics, or mobile application features, traders cannot make informed decisions. They need to know whether Swiss Markets' trading infrastructure meets their specific requirements and expectations.

The lack of detailed trading experience information suggests that prospective clients should consider requesting demo access or conducting thorough testing. They must evaluate platform performance and functionality before committing to live trading activities.

Trust and Reliability Analysis

Swiss Markets operates under CySEC regulation, which provides a solid foundation for regulatory compliance and client protection. CySEC is recognized as one of Europe's respected financial regulatory bodies, known for maintaining stringent standards that ensure broker transparency and proper client fund handling.

The broker's establishment in 2016 and continued operation under CySEC oversight indicates a track record of regulatory compliance and operational stability. This regulatory framework provides important protections for client funds and ensures adherence to European financial service standards.

Swiss Markets has been recognized within the trading community as a reliable platform. This suggests positive industry perception and operational credibility. However, specific information about fund segregation practices, insurance coverage, or additional security measures was not detailed in the available source materials.

The multi-jurisdictional presence across Cyprus, Mauritius, and Seychelles demonstrates operational scale and regulatory diversity. Traders should verify which specific entity serves their region and understand the applicable regulatory protections for their particular circumstances.

User Experience Analysis

The available information indicates that Swiss Markets targets traders seeking reliable and efficient trading experiences. This suggests a focus on user satisfaction and operational effectiveness. However, specific user satisfaction metrics, interface design details, and usability assessments were not provided in the source materials.

Without access to information about registration processes, account verification procedures, fund management experiences, or common user feedback, it becomes challenging to evaluate the overall user experience comprehensively. The absence of detailed user journey information limits understanding of how smooth and efficient the broker's operational processes actually are.

The broker's positioning as suitable for traders seeking reliable trading experiences suggests attention to user needs. However, specific evidence supporting this positioning was not detailed in the available documentation. Prospective users would benefit from directly experiencing the platform to evaluate whether it meets their specific usability and functionality expectations.

Given the lack of detailed user experience information, interested traders should consider utilizing demo accounts or conducting thorough platform testing. They need to assess whether Swiss Markets' user interface and operational processes align with their preferences and requirements.

Conclusion

Swiss Markets presents itself as a CySEC-regulated forex and CFD trading platform with a solid regulatory foundation and multi-jurisdictional presence. The broker's establishment in 2016 and continued operation under stringent European regulatory oversight indicates operational stability and compliance credibility.

This platform appears most suitable for traders who prioritize regulatory oversight and seek a reliable trading environment for forex and CFD activities. The CySEC regulation provides important client protections and ensures adherence to established financial service standards.

However, this evaluation reveals significant information gaps regarding specific account conditions, trading costs, platform features, and user experience details. While the regulatory foundation and asset diversity represent positive aspects, the limited availability of detailed operational information suggests that prospective traders should conduct thorough direct research before making decisions about this broker.