Is RG Group safe?

Pros

Cons

Is Rich Gold Safe or Scam?

Introduction

Rich Gold positions itself as a global player in the foreign exchange market, offering a range of trading services to both retail and institutional clients. Established in 2010, it claims to provide innovative trading solutions and access to various financial markets, including forex, commodities, and cryptocurrencies. However, the rise in online trading has also led to an increase in fraudulent schemes, making it essential for traders to carefully evaluate the legitimacy of brokers like Rich Gold. This article aims to investigate the safety and credibility of Rich Gold by examining its regulatory compliance, company background, trading conditions, customer experiences, and overall risk factors.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety. A regulated broker is subject to strict oversight, which can protect traders' interests. Unfortunately, Rich Gold has come under scrutiny for lacking credible regulatory oversight. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of a valid license from a recognized financial authority raises significant concerns about the broker's legitimacy. Regulatory bodies such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus) enforce strict rules to ensure brokers operate fairly and transparently. Rich Gold's lack of registration with any of these authorities suggests it may operate outside the law, exposing traders to heightened risks. Furthermore, a review of its compliance history reveals no substantial evidence of adherence to industry standards, which further questions its reliability.

Company Background Investigation

Rich Gold claims to have been operational since 2010, but details about its ownership and management team remain vague. The company's website offers limited information about its history, which is a red flag for potential clients. A transparent broker typically provides insights into its founders and management, along with their professional backgrounds. In Rich Gold's case, the lack of such disclosure raises questions about its operational integrity and accountability.

The management team's experience is a crucial component of a broker's credibility. Experienced professionals with a track record in finance and trading are likely to run a more reliable operation. However, Rich Gold does not provide sufficient information to assess the qualifications of its team. This opacity is concerning, as it may indicate a lack of accountability and transparency, two essential qualities for a trustworthy broker.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for evaluating its overall value. Rich Gold advertises competitive spreads and a variety of account types. However, the absence of clear information on fees and trading costs can be misleading. Below is a comparison of core trading costs:

| Fee Type | Rich Gold | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific figures for trading costs is troubling. Traders typically expect transparent fee structures, including spreads, commissions, and overnight fees. Without this information, it becomes challenging to assess whether Rich Gold's trading conditions are competitive or fair. Additionally, reports from users indicate potential hidden fees, which could significantly impact profitability.

Client Funds Security

The safety of client funds is paramount in the trading industry. Regulated brokers are required to keep client funds in segregated accounts, ensuring that traders' money is protected in case of insolvency. Rich Gold's lack of regulation raises serious concerns about its fund security measures.

The broker does not provide clear information regarding its policies on fund segregation, investor protection, or negative balance protection. These factors are crucial for safeguarding traders' investments. Furthermore, there are no documented incidents from Rich Gold's past regarding fund security issues, but the absence of transparency makes it difficult to trust that client funds are adequately protected.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Rich Gold reveal a pattern of negative experiences from clients, primarily concerning withdrawal issues and poor customer support. Below is a summary of common complaints:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | High | Poor |

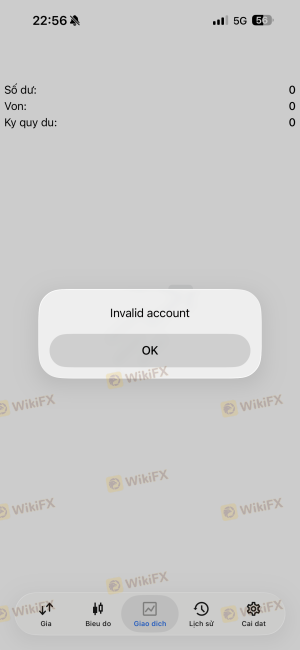

Many users report difficulty in withdrawing funds, a common issue with unregulated brokers. Clients often express frustration over unresponsive customer service, which exacerbates their challenges in resolving issues. A few case studies illustrate these complaints: one trader reported waiting weeks for a withdrawal to process, while another cited a lack of communication from the support team when seeking assistance with account issues.

These patterns indicate a concerning trend that could deter potential clients from trusting Rich Gold with their investments.

Platform and Execution

Assessing the trading platform's performance is crucial for any trader. Rich Gold claims to offer a robust trading platform with advanced features. However, user reviews suggest that the platform's execution quality may not be as reliable as advertised. Traders have reported instances of slippage and order rejections, which can significantly affect trading outcomes.

Furthermore, any signs of platform manipulation, such as sudden price movements or technical glitches during critical trading periods, should be taken seriously. While there is no direct evidence of manipulation, the overall user experience indicates that the platform may not be as stable as required for serious trading.

Risk Assessment

Using Rich Gold for trading carries inherent risks, primarily due to its unregulated status and lack of transparency. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight. |

| Fund Security Risk | High | Lack of clear fund protection measures. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, potential traders should conduct thorough research and consider using regulated brokers with established reputations.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rich Gold is not a safe trading option. Its lack of regulation, transparency, and poor customer feedback raises significant red flags. Traders should exercise caution and consider alternative brokers that are regulated and have a proven track record of reliability.

For those looking for safer trading options, reputable alternatives include brokers like IG, OANDA, and Forex.com, which are known for their regulatory compliance and strong customer support. Always prioritize safety and due diligence when selecting a trading partner.

Is RG Group a scam, or is it legit?

The latest exposure and evaluation content of RG Group brokers.

RG Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RG Group latest industry rating score is 5.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.