Is Barclays safe?

Pros

Cons

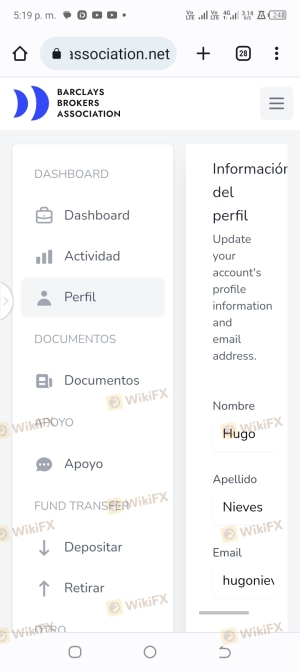

Is Barclays A Scam?

Introduction

Barclays is a prominent name in the global financial landscape, particularly recognized for its extensive offerings in the foreign exchange (Forex) market. Established in the United Kingdom, Barclays has positioned itself as a reputable broker, providing a range of services to both retail and institutional clients. However, with the proliferation of online trading platforms and the increasing number of scams in the financial sector, traders must exercise caution when selecting a broker. It is crucial to evaluate the legitimacy and safety of a trading platform before committing any funds. This article aims to provide an in-depth analysis of whether Barclays is a scam or a safe trading option. Our investigation draws on a comprehensive review of regulatory information, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is essential for assessing its legitimacy. Barclays operates under the oversight of several reputable regulatory bodies, which enforce strict guidelines to protect investors. Regulatory compliance is a significant indicator of a broker's reliability, as it ensures that the broker adheres to high standards of conduct, including the segregation of client funds and transparent trading practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 122702 | United Kingdom | Verified |

| Prudential Regulation Authority (PRA) | 122702 | United Kingdom | Verified |

| Securities and Futures Commission (SFC) | AYK 346 | Hong Kong | Verified |

Barclays is regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) in the UK, as well as the Securities and Futures Commission (SFC) in Hong Kong. These regulatory bodies are known for their rigorous oversight, which includes regular audits and compliance checks. The FCA, for instance, mandates that brokers maintain a high level of transparency and protect client funds through segregation. This regulatory framework significantly reduces the likelihood of fraudulent activities, thereby enhancing the safety profile of Barclays.

Company Background Investigation

Barclays has a rich history dating back to its founding in 1690, making it one of the oldest financial institutions in the world. Over the centuries, the company has evolved from a small bank in London to a global financial powerhouse, with operations in various sectors, including investment banking, retail banking, and wealth management. The ownership structure of Barclays is publicly traded, which adds a layer of transparency to its operations.

The management team at Barclays comprises experienced professionals from diverse backgrounds in finance and banking. Their collective expertise helps ensure that the company adheres to best practices in governance and compliance. Furthermore, Barclays maintains a high level of transparency in its operations, regularly disclosing financial performance and operational metrics to the public. This commitment to transparency is a positive indicator of its legitimacy and reliability as a broker.

Trading Conditions Analysis

When evaluating a broker, it is essential to consider the trading conditions they offer, including fees and spreads. Barclays employs a competitive pricing model that is generally in line with industry standards. However, traders should be aware of any unusual or hidden fees that may affect their trading costs.

| Fee Type | Barclays | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.2 pips | 1.5 pips |

| Commission Model | No commission on trades | Varies by broker |

| Overnight Interest Range | 0.5% to 1.5% | 0.5% to 2% |

Barclays offers a spread of approximately 1.2 pips on major currency pairs, which is competitive compared to the industry average of 1.5 pips. Additionally, there are no commissions on trades, which is a significant advantage for traders looking to minimize costs. However, traders should be mindful of the overnight interest rates that can vary based on market conditions. Overall, the trading conditions at Barclays appear favorable, suggesting that it is a safe option for Forex trading.

Customer Fund Safety

One of the primary concerns for traders is the safety of their funds. Barclays implements robust measures to ensure the security of client funds. The company segregates client funds from its operational funds, which means that even in the unlikely event of insolvency, clients' funds remain protected. Additionally, Barclays is a member of the Financial Services Compensation Scheme (FSCS), which provides further protection to clients in the UK.

Barclays does not offer negative balance protection, which means that traders could theoretically lose more than their initial investment during extreme market conditions. However, the broker's strong regulatory framework and commitment to client safety mitigate this risk. Historically, Barclays has not faced any significant issues related to fund safety, reinforcing its reputation as a secure trading platform.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. Overall, Barclays has received a mix of positive and negative reviews from its users. Many traders appreciate the broker's user-friendly platform, efficient execution, and responsive customer service. However, some common complaints include the lack of advanced trading features and occasional delays in withdrawal processing.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Generally responsive |

| Platform Stability | Low | Addressed in updates |

| Lack of Advanced Features | Medium | No immediate plans for enhancement |

One notable case involved a trader who reported delays in withdrawing funds during a period of high market volatility. Although Barclays addressed the issue promptly, it highlighted the importance of having clear communication regarding withdrawal processes. Overall, while there are some areas for improvement, the majority of customer experiences indicate that Barclays operates as a legitimate broker.

Platform and Trade Execution

The performance and reliability of a trading platform are critical factors for traders. Barclays offers a proprietary trading platform that is known for its stability and user-friendly interface. Traders have reported that order execution is generally efficient, with minimal slippage and a low rate of rejected orders.

However, it is essential to remain vigilant for any signs of platform manipulation. While there have been no substantial allegations against Barclays regarding this issue, traders should always monitor their trading activities closely. The platform's design allows for easy navigation, making it accessible for both novice and experienced traders.

Risk Assessment

Engaging with any broker involves inherent risks. In the case of Barclays, the overall risk profile can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight |

| Operational Risk | Medium | Occasional withdrawal delays |

| Market Risk | High | Potential for significant losses |

To mitigate these risks, traders should conduct thorough research, utilize risk management strategies, and remain informed about market conditions. It is advisable to start with a demo account to familiarize oneself with the platform before committing real funds.

Conclusion and Recommendations

In conclusion, based on the evidence presented, Barclays does not exhibit any signs of being a scam. The broker is regulated by reputable authorities, has a long-standing history, and offers competitive trading conditions. While there are areas for improvement, particularly regarding advanced trading features and withdrawal processes, Barclays is generally considered a safe option for Forex trading.

For traders seeking a reliable broker, Barclays is a commendable choice. However, it is essential to remain cautious and conduct ongoing evaluations of any broker's performance. If you are looking for alternatives, consider brokers that offer more advanced trading features or additional regulatory protections. Ultimately, the key to successful trading lies in thorough research and prudent risk management practices.

Is Barclays a scam, or is it legit?

The latest exposure and evaluation content of Barclays brokers.

Barclays Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Barclays latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.