Regarding the legitimacy of NPBFX forex brokers, it provides MISA and WikiBit, .

Is NPBFX safe?

Pros

Cons

Is NPBFX markets regulated?

The regulatory license is the strongest proof.

MISA Forex Trading License (EP)

Mwali International Services Authority

Mwali International Services Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

NMarkets Limited

Effective Date:

2024-09-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://nmarkets.org/Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is NPBFX A Scam?

Introduction

NPBFX, operating since 1996, positions itself as a forex broker catering to a global clientele. With claims of offering competitive spreads and high leverage, it attracts both novice and experienced traders. However, the forex market is rife with brokers, and not all are trustworthy. Traders need to exercise caution when selecting a broker, as the risks of fraud, poor customer service, and financial loss are prevalent. This article aims to provide a comprehensive analysis of NPBFX, focusing on its regulatory status, company background, trading conditions, customer safety, and overall reputation. The investigation is based on various online reviews, regulatory information, and user experiences, structured to offer a balanced view of whether NPBFX is a legitimate broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its trustworthiness. NPBFX claims to be regulated by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines and is a member of the Financial Commission, which provides some level of dispute resolution and deposit insurance. However, it does not hold licenses from major financial regulators such as the FCA (UK) or ASIC (Australia), which raises concerns about the robustness of its regulatory framework.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| SVG FSA | 24454 IBC 2018 | Saint Vincent | Unregulated |

| Financial Commission | N/A | International | Member |

The lack of stringent regulation is a significant red flag for potential investors. While the Financial Commission offers some protection, it does not have the authority to enforce penalties on brokers, which limits its effectiveness. Additionally, the offshore nature of NPBFX's regulation often correlates with higher risks, as these jurisdictions typically have less oversight and fewer investor protections.

Company Background Investigation

NPBFX, originally known as Nefte Prombank, has a long history in the forex industry. The company operates under the ownership of NMarkets Limited, which is incorporated in the Comoros Islands. This offshore registration is often associated with less stringent regulatory practices, which can lead to concerns regarding transparency and accountability.

The management team of NPBFX is not widely publicized, which raises questions about their qualifications and experience in the financial sector. A broker's leadership plays a crucial role in its operational integrity, and the lack of accessible information can deter potential clients. Transparency in operations and management is essential for building trust with clients, and NPBFX appears to fall short in this regard.

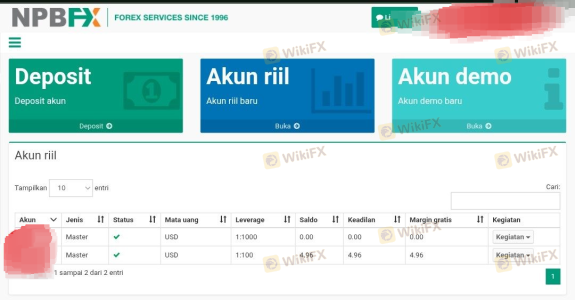

Trading Conditions Analysis

NPBFX offers a variety of trading conditions, including competitive spreads and high leverage, which can be appealing to traders. However, the overall fee structure requires careful consideration. The broker claims to offer spreads starting from 0.4 pips, but actual trading conditions may vary significantly based on market conditions and account types.

| Fee Type | NPBFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 - 1.2 pips | 0.1 - 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While NPBFX does not charge commissions, the spreads can be higher than industry averages, particularly during volatile market conditions. Additionally, the broker's commission structure and potential hidden fees should be scrutinized, as these can significantly impact trading profitability.

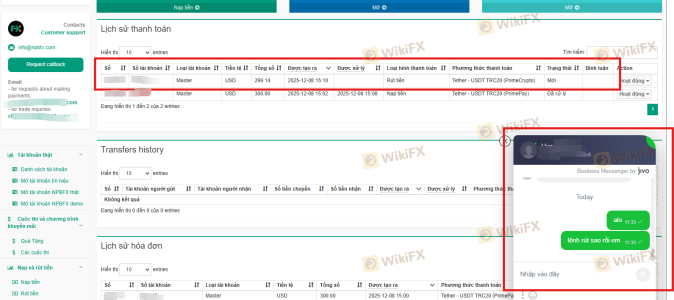

Customer Fund Safety

Customer fund safety is paramount when choosing a broker. NPBFX claims to implement several safety measures, including segregated accounts to protect client funds. However, the effectiveness of these measures is questionable, especially considering the broker's offshore registration.

The absence of a robust regulatory framework raises concerns about the security of client funds. Historical complaints regarding withdrawal issues and customer service responsiveness further exacerbate these concerns. Traders should be aware of the potential risks associated with depositing funds with NPBFX, given the lack of stringent oversight.

Customer Experience and Complaints

Customer feedback on NPBFX is mixed, with many users reporting difficulties in withdrawing funds and poor customer service. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or No Response |

| Customer Support Quality | Medium | Inconsistent |

| Trading Execution Problems | High | Limited Transparency |

Numerous users have reported delays in withdrawal processing, with some claiming that their requests were ignored. Such issues can severely impact a trader's experience and trust in the broker. For instance, one user reported waiting weeks for a withdrawal, only to receive no communication from customer support. These types of complaints are concerning, particularly for a broker that operates in a highly regulated environment.

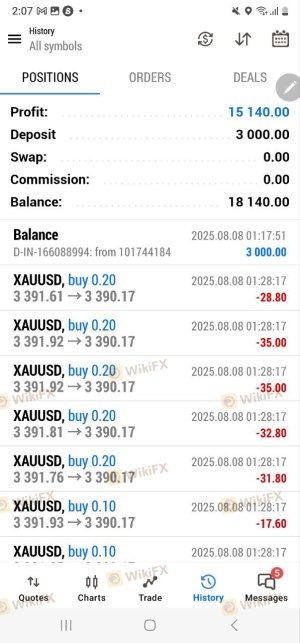

Platform and Trade Execution

The trading platform offered by NPBFX is MetaTrader 4, a widely used platform known for its user-friendliness and advanced trading features. However, the performance and reliability of the platform have been questioned by some users, particularly regarding order execution quality and slippage.

Slippage can occur during volatile market conditions, leading to traders executing orders at less favorable prices. Reports of high slippage and rejected orders raise concerns about the broker's execution quality, which can directly affect trading outcomes.

Risk Assessment

Engaging with NPBFX presents several risks, primarily due to its unregulated status and mixed customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of stringent oversight. |

| Withdrawal Risk | High | Numerous complaints about withdrawal delays. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

To mitigate these risks, traders should consider starting with a small deposit, thoroughly researching the broker's practices, and being prepared for potential withdrawal issues.

Conclusion and Recommendations

Based on the evidence presented, NPBFX exhibits several red flags that warrant caution. The lack of robust regulation, mixed customer feedback, and reported withdrawal issues suggest that potential investors should approach this broker with skepticism. While NPBFX offers competitive trading conditions, the risks associated with its unregulated status may outweigh the benefits.

For traders seeking a more secure trading environment, it is advisable to consider alternative brokers that are regulated by reputable authorities such as the FCA, ASIC, or CySEC. Brokers like FP Markets, Eightcap, and others provide a more trustworthy trading experience with enhanced safety measures for client funds.

Is NPBFX a scam, or is it legit?

The latest exposure and evaluation content of NPBFX brokers.

NPBFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NPBFX latest industry rating score is 5.10, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.10 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.